Professional Documents

Culture Documents

Impairment of Goodwill

Uploaded by

Zes OOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impairment of Goodwill

Uploaded by

Zes OCopyright:

Available Formats

Impairment of goodwill

Goodwill should be tested for impairment annually. [IAS 36.96]

To test for impairment, goodwill must be allocated to each of the acquirer's cash-generating units, or

groups of cash-generating units, that are expected to benefit from the synergies of the combination,

irrespective of whether other assets or liabilities of the acquiree are assigned to those units or groups of

units. Each unit or group of units to which the goodwill is so allocated shall: [IAS 36.80]

represent the lowest level within the entity at which the goodwill is monitored for internal management

purposes; and not be larger than an operating segment determined in accordance with IFRS 8 Operating

Segments.

A cash-generating unit to which goodwill has been allocated shall be tested for impairment at least

annually by comparing the carrying amount of the unit, including the goodwill, with the recoverable

amount of the unit: [IAS 36.90]

If the recoverable amount of the unit exceeds the carrying amount of the unit, the unit and the goodwill

allocated to that unit is not impaired If the carrying amount of the unit exceeds the recoverable amount

of the unit, the entity must recognise an impairment loss.

The impairment loss is allocated to reduce the carrying amount of the assets of the unit (group of units)

in the following order: [IAS 36.104]

first, reduce the carrying amount of any goodwill allocated to the cash-generating unit (group of units);

and then, reduce the carrying amounts of the other assets of the unit (group of units) pro rata on the

basis.

The carrying amount of an asset should not be reduced below the highest of: [IAS 36.105]

its fair value less costs of disposal (if measurable) its value in use (if measurable) zero.

If the preceding rule is applied, further allocation of the impairment loss is made pro rata to the other

assets of the unit (group of units).

Reversal of an impairment loss

Same approach as for the identification of impaired assets: assess at each balance sheet date whether

there is an indication that an impairment loss may have decreased. If so, calculate recoverable amount.

[IAS 36.110] No reversal for unwinding of discount. [IAS 36.116] The increased carrying amount due to

reversal should not be more than what the depreciated historical cost would have been if the

impairment had not been recognised. [IAS 36.117] Reversal of an impairment loss is recognised in the

profit or loss unless it relates to a revalued asset [IAS 36.119] Adjust depreciation for future periods. [IAS

36.121] Reversal of an impairment loss for goodwill is prohibited. [IAS 36.124]

You might also like

- Ias 36Document2 pagesIas 36Baqar BaigNo ratings yet

- Chapter 11 Pas 36 Impairment of AssetsDocument7 pagesChapter 11 Pas 36 Impairment of AssetsJoelyn Grace MontajesNo ratings yet

- Summary of IAS 36-Impairment of AssetsDocument4 pagesSummary of IAS 36-Impairment of AssetsVikash HurrydossNo ratings yet

- Lecture 12 Impairment of Non-Current Assets and GoodwillDocument23 pagesLecture 12 Impairment of Non-Current Assets and GoodwillWinston 葉永隆 DiepNo ratings yet

- IAS 36 - ImpairmentDocument4 pagesIAS 36 - ImpairmentAiman TuhaNo ratings yet

- IAS 36 - ImpairmentDocument4 pagesIAS 36 - ImpairmentAiman TuhaNo ratings yet

- Impairment of AssetDocument6 pagesImpairment of AssetOLAWALE AFOLABI TIMOTHYNo ratings yet

- Ent - of - Assets/$FILE/Impairment - Accounting - IAS - 36.pdf: Fasb Asc and Iasb Research CaseDocument2 pagesEnt - of - Assets/$FILE/Impairment - Accounting - IAS - 36.pdf: Fasb Asc and Iasb Research CaseJoey LessardNo ratings yet

- Lecture Notes For IAS 36Document9 pagesLecture Notes For IAS 36dương nguyễn vũ thùyNo ratings yet

- Umst MBA (B7) Finance IAS 36: Asset ImpairmentDocument27 pagesUmst MBA (B7) Finance IAS 36: Asset ImpairmentHadina SafiNo ratings yet

- Summary of Pas 36Document5 pagesSummary of Pas 36Elijah MontefalcoNo ratings yet

- Accounting GuidanceDocument5 pagesAccounting GuidanceVibha MittalNo ratings yet

- MODULE 4: Impairment of AssetsDocument3 pagesMODULE 4: Impairment of AssetsPauline Joy GenalagonNo ratings yet

- Impairment LossDocument3 pagesImpairment LossZes ONo ratings yet

- Handout - Impairment of Assets - SCDocument10 pagesHandout - Impairment of Assets - SCRenz Francis LimNo ratings yet

- IAS 36 Impairment of Assets PDFDocument9 pagesIAS 36 Impairment of Assets PDFAmenyo GodknowsNo ratings yet

- Impairment of AssetsDocument6 pagesImpairment of AssetsMendoza KlariseNo ratings yet

- Theory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesDocument5 pagesTheory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesPia DagmanNo ratings yet

- 49 Pdfsam IASDocument1 page49 Pdfsam IASdskrishnaNo ratings yet

- Fair ValueDocument3 pagesFair ValueHisham MalikNo ratings yet

- Ias 36 PDFDocument4 pagesIas 36 PDFCarmela Joaquin Valbuena-PaañoNo ratings yet

- Module 4 - ImpairmentDocument5 pagesModule 4 - ImpairmentLuiNo ratings yet

- Oracle Fusion Assets Asset Impairment: Oracle White Paper - March 2018Document27 pagesOracle Fusion Assets Asset Impairment: Oracle White Paper - March 2018satyaNo ratings yet

- IAS 36 Impairment of Assets: Technical SummaryDocument4 pagesIAS 36 Impairment of Assets: Technical SummaryFoititika.net100% (2)

- ImpairmentDocument45 pagesImpairmentnati100% (1)

- Impairment of Assets - IAS 36Document17 pagesImpairment of Assets - IAS 36charanteja9No ratings yet

- Acc201-Ias 36 SlidesDocument15 pagesAcc201-Ias 36 SlidesBilliee ButccherNo ratings yet

- Cash-Generating Unit (CGU) : Definition and ScopeDocument6 pagesCash-Generating Unit (CGU) : Definition and ScopeAnonymous QEcQfTeHlNo ratings yet

- Ch9 Impairment of AssetsDocument20 pagesCh9 Impairment of AssetsiKarloNo ratings yet

- IAS16 Defines Property, Plant and Equipment As "Tangible Items ThatDocument35 pagesIAS16 Defines Property, Plant and Equipment As "Tangible Items ThatMo HachimNo ratings yet

- IAS 16 SummaryDocument7 pagesIAS 16 SummaryCharmaine LogaNo ratings yet

- FR 01 Impairment of Assets - IAS36 - Part 1 NotesDocument2 pagesFR 01 Impairment of Assets - IAS36 - Part 1 NotesUser Upload and downloadNo ratings yet

- As-28 Impairment of AssetDocument22 pagesAs-28 Impairment of AssetPankajRateriaNo ratings yet

- IND AS-36 Impairment of AssetsDocument3 pagesIND AS-36 Impairment of AssetsaaosarlbNo ratings yet

- As 28Document14 pagesAs 28Harsh PatelNo ratings yet

- Ias 36 - Impairment of Assets ObjectiveDocument9 pagesIas 36 - Impairment of Assets ObjectiveAbdullah Al Amin MubinNo ratings yet

- IAS#36Document31 pagesIAS#36Shah KamalNo ratings yet

- Accounting Standard-28 Impairment of Assets: Presented By:-Dr. Raj K. AgarwalDocument23 pagesAccounting Standard-28 Impairment of Assets: Presented By:-Dr. Raj K. AgarwalSanchita GuptaNo ratings yet

- HSBC0469, D, Priyansh - Group D11Document14 pagesHSBC0469, D, Priyansh - Group D11Priyansh KhatriNo ratings yet

- Ias 16Document7 pagesIas 16Baqar BaigNo ratings yet

- Home Site Map Standards Interpretations Agenda StructureDocument6 pagesHome Site Map Standards Interpretations Agenda StructurehelperforeuNo ratings yet

- IAS 1 Presentation of Financial StatementsDocument74 pagesIAS 1 Presentation of Financial StatementsCandyNo ratings yet

- Summary of IAS 16Document5 pagesSummary of IAS 16Laskar REAZNo ratings yet

- Property, Plant and EquipmentDocument8 pagesProperty, Plant and EquipmentMark John Malazo RiveraNo ratings yet

- Accounting Standard - 28 Impairment of Assets: Generally Follows IAS-36 (Differs From SFAS - 144 of US GAAP)Document45 pagesAccounting Standard - 28 Impairment of Assets: Generally Follows IAS-36 (Differs From SFAS - 144 of US GAAP)Ranga NayakuluNo ratings yet

- P7 - IAS's Summary (June 2015)Document12 pagesP7 - IAS's Summary (June 2015)Hamza Abdul Haq83% (6)

- IAS#36 ImpairmentDocument37 pagesIAS#36 ImpairmentSyed SadmanNo ratings yet

- Ias 36Document8 pagesIas 36Muhammad MoizNo ratings yet

- Impairment of AssetsDocument9 pagesImpairment of AssetsLatria.T. ZvousheNo ratings yet

- Property, Plant and Equipment Are Tangible Items ThatDocument2 pagesProperty, Plant and Equipment Are Tangible Items ThatnasirNo ratings yet

- IAS#16Document17 pagesIAS#16Shah KamalNo ratings yet

- Chapter 20 Impairment of AssetsDocument10 pagesChapter 20 Impairment of AssetsEllen MaskariñoNo ratings yet

- Noncurrent Asset Held For SaleDocument3 pagesNoncurrent Asset Held For SalePaula De RuedaNo ratings yet

- Discussion ProblemsDocument15 pagesDiscussion ProblemsAliah Jane PalomadoNo ratings yet

- Impairment Accounting IAS 36 0810Document12 pagesImpairment Accounting IAS 36 0810Eynar MahmudovNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- The Sheer Cost of Producing His Book Meant That The Final Two Parts Were Never Completed and It Was A Financial FailureDocument4 pagesThe Sheer Cost of Producing His Book Meant That The Final Two Parts Were Never Completed and It Was A Financial FailureZes ONo ratings yet

- The Original 7 Has Been Really Wonderful IndeedDocument2 pagesThe Original 7 Has Been Really Wonderful IndeedZes ONo ratings yet

- The Following Are Deemed Not To Be RelatedDocument2 pagesThe Following Are Deemed Not To Be RelatedZes ONo ratings yet

- 7 World Trade CenterDocument2 pages7 World Trade CenterZes ONo ratings yet

- Objective of IAS 24Document2 pagesObjective of IAS 24Zes ONo ratings yet

- In June 1986 The 7 Towers ChurvanesDocument2 pagesIn June 1986 The 7 Towers ChurvanesZes ONo ratings yet

- Research About The Parrot The BirdDocument3 pagesResearch About The Parrot The BirdZes ONo ratings yet

- Summary of IAS 40Document2 pagesSummary of IAS 40Zes ONo ratings yet

- Objective of IAS 24Document2 pagesObjective of IAS 24Zes ONo ratings yet

- Related Party TransactionsDocument1 pageRelated Party TransactionsZes ONo ratings yet

- Initial Recognition An Entity Recognises A Biological Asset or Agriculture Produce Only When The Entity Controls The Asset As A Result of Past EventsDocument3 pagesInitial Recognition An Entity Recognises A Biological Asset or Agriculture Produce Only When The Entity Controls The Asset As A Result of Past EventsZes ONo ratings yet

- Summary of IAS 40Document2 pagesSummary of IAS 40Zes ONo ratings yet

- Related Party TransactionsDocument1 pageRelated Party TransactionsZes ONo ratings yet

- Initial Recognition An Entity Recognises A Biological Asset or Agriculture Produce Only When The Entity Controls The Asset As A Result of Past EventsDocument3 pagesInitial Recognition An Entity Recognises A Biological Asset or Agriculture Produce Only When The Entity Controls The Asset As A Result of Past EventsZes ONo ratings yet

- DisclosureDocument2 pagesDisclosureZes ONo ratings yet

- The Following Are Deemed Not To Be RelatedDocument2 pagesThe Following Are Deemed Not To Be RelatedZes ONo ratings yet

- IAS 21 The Effects of Changes in Foreign Exchange Rates Outlines How To Account For Foreign Currency Transactions and Operations in Financial StatementsDocument3 pagesIAS 21 The Effects of Changes in Foreign Exchange Rates Outlines How To Account For Foreign Currency Transactions and Operations in Financial StatementsZes ONo ratings yet

- IAS 41 Agriculture Sets Out The Accounting For Agricultural ActivityDocument3 pagesIAS 41 Agriculture Sets Out The Accounting For Agricultural ActivityZes ONo ratings yet

- DisclosureDocument2 pagesDisclosureZes ONo ratings yet

- IAS 40 Investment Property Applies To The Accounting For PropertyDocument2 pagesIAS 40 Investment Property Applies To The Accounting For PropertyZes ONo ratings yet

- Government GrantsDocument2 pagesGovernment GrantsZes ONo ratings yet

- Fair Value ModelDocument2 pagesFair Value ModelZes ONo ratings yet

- Functional CurrencyDocument3 pagesFunctional CurrencyZes ONo ratings yet

- Ancillary Services If The Entity Provides Ancillary Services To The Occupants of A Property Held by The EntityDocument2 pagesAncillary Services If The Entity Provides Ancillary Services To The Occupants of A Property Held by The EntityZes ONo ratings yet

- Fair Value ModelDocument2 pagesFair Value ModelZes ONo ratings yet

- Ancillary Services If The Entity Provides Ancillary Services To The Occupants of A Property Held by The EntityDocument2 pagesAncillary Services If The Entity Provides Ancillary Services To The Occupants of A Property Held by The EntityZes ONo ratings yet

- Ancillary Services If The Entity Provides Ancillary Services To The Occupants of A Property Held by The EntityDocument2 pagesAncillary Services If The Entity Provides Ancillary Services To The Occupants of A Property Held by The EntityZes ONo ratings yet

- Fair Value ModelDocument2 pagesFair Value ModelZes ONo ratings yet

- DisclosureDocument2 pagesDisclosureZes ONo ratings yet

- What Is The Foundation of The Agrarian Reform Program Under The 1987Document2 pagesWhat Is The Foundation of The Agrarian Reform Program Under The 1987Zes ONo ratings yet

- JMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesDocument50 pagesJMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesSagar PatelNo ratings yet

- Correcting The Trial Balance 2022Document3 pagesCorrecting The Trial Balance 2022Charlemagne Jared RobielosNo ratings yet

- Second PreboardDocument6 pagesSecond PreboardBella AyabNo ratings yet

- Journal of Applied Corporate Finance Volume 19 Issue 2 2007 (Doi 10.1111/j.1745-6622.2007.00137.x) Javier Estrada - Discount Rates in Emerging Markets - Four Models and An ApplicationDocument8 pagesJournal of Applied Corporate Finance Volume 19 Issue 2 2007 (Doi 10.1111/j.1745-6622.2007.00137.x) Javier Estrada - Discount Rates in Emerging Markets - Four Models and An ApplicationJose Francisco TorresNo ratings yet

- Options Strategies For A Range Bound ViewDocument11 pagesOptions Strategies For A Range Bound ViewAshutosh ChauhanNo ratings yet

- Tugas Pertemuan 12Document9 pagesTugas Pertemuan 12Pejantan TangguhNo ratings yet

- PNB Vs AndradaDocument3 pagesPNB Vs AndradaMigen SandicoNo ratings yet

- Dividen 1Document3 pagesDividen 1Lucyana Maria MagdalenaNo ratings yet

- Finance E2-E3-Financial ManagementDocument39 pagesFinance E2-E3-Financial Managementpintu_dyNo ratings yet

- DCF Model TemplateDocument6 pagesDCF Model TemplateHamda AkbarNo ratings yet

- A-Financial Accounting - Midterm Exam QuestionsDocument8 pagesA-Financial Accounting - Midterm Exam QuestionsAmbra KoraNo ratings yet

- Gross Profit: Income Statement For The Year Ended December 31Document3 pagesGross Profit: Income Statement For The Year Ended December 31Jane VillanuevaNo ratings yet

- Comparison Between Investment in Equity and Mutual Fund - Dissertation Ideas or Thesis Topics PDFDocument4 pagesComparison Between Investment in Equity and Mutual Fund - Dissertation Ideas or Thesis Topics PDFPuneet AgarwalNo ratings yet

- Itc Clsa Oct2020Document100 pagesItc Clsa Oct2020ksatishbabuNo ratings yet

- Proof of Cash Problems 4 PDF FreeDocument9 pagesProof of Cash Problems 4 PDF FreeAngieNo ratings yet

- Dec 2009 IcwaDocument8 pagesDec 2009 Icwamknatoo1963No ratings yet

- Itc FinalDocument32 pagesItc FinalbuntysaunakNo ratings yet

- Partnership Accounting Sample QuestionsDocument14 pagesPartnership Accounting Sample QuestionsKibedi Kennedy J88% (51)

- FINANCIAL-MARKETS Prelims RevDocument13 pagesFINANCIAL-MARKETS Prelims RevJasmine TamayoNo ratings yet

- TIAA-CREF Lifecycle FundsDocument135 pagesTIAA-CREF Lifecycle FundsDiarmadhim MoresbyNo ratings yet

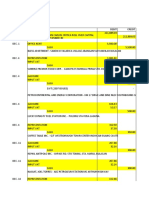

- 12linsteel Book of Account DecemberDocument54 pages12linsteel Book of Account DecemberCarlos_CriticaNo ratings yet

- CHAP - 5 - Measuring and Evaluating The Performance of BanksDocument7 pagesCHAP - 5 - Measuring and Evaluating The Performance of BanksNgoc AnhNo ratings yet

- Capital MarketsDocument17 pagesCapital MarketsSHEILA LUMAYGAY100% (1)

- sd13 Using Income Tax InformationDocument9 pagessd13 Using Income Tax InformationAngela JoyceNo ratings yet

- Challenge Tree Comparative Form: Date: Company Held Challenging CompanyDocument2 pagesChallenge Tree Comparative Form: Date: Company Held Challenging CompanyJAMILALKHATIBNo ratings yet

- MA REV 1 MIDTERM EXAMINATION Wit Ans Key 1Document18 pagesMA REV 1 MIDTERM EXAMINATION Wit Ans Key 1Erin CruzNo ratings yet

- Dr. Adukia Valuation 09032018Document366 pagesDr. Adukia Valuation 09032018Venkat Deepak SarmaNo ratings yet

- Due Diligence QuestionnaireDocument5 pagesDue Diligence QuestionnairetestnationNo ratings yet

- Ch20 InvestmentAppraisalDocument32 pagesCh20 InvestmentAppraisalsohail merchantNo ratings yet

- Adams Inc Acquires Clay Corporation On January 1 2012 inDocument1 pageAdams Inc Acquires Clay Corporation On January 1 2012 inMiroslav GegoskiNo ratings yet