Professional Documents

Culture Documents

Acc9 Accounting For Special Transactions University of Batangas

Uploaded by

Hannahbea Lindo0 ratings0% found this document useful (0 votes)

134 views2 pagesThis document provides guidance and examples for accounting for various partnership transactions including:

1) The admission of a new partner through purchasing existing partners' interests and determining new capital balances and profit/loss ratios.

2) The withdrawal, retirement, or death of an existing partner through another partner purchasing their interest or the partnership settling the interest, and recalculating remaining partners' capital balances and ratios.

3) The incorporation of an existing partnership where partners receive preference and ordinary shares based on their capital balances at time of incorporation. Worked problems are provided to illustrate journal entries and calculations for each transaction type.

Original Description:

Original Title

Guided_Exercises_-_3_(Partnership_Dissolution)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides guidance and examples for accounting for various partnership transactions including:

1) The admission of a new partner through purchasing existing partners' interests and determining new capital balances and profit/loss ratios.

2) The withdrawal, retirement, or death of an existing partner through another partner purchasing their interest or the partnership settling the interest, and recalculating remaining partners' capital balances and ratios.

3) The incorporation of an existing partnership where partners receive preference and ordinary shares based on their capital balances at time of incorporation. Worked problems are provided to illustrate journal entries and calculations for each transaction type.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

134 views2 pagesAcc9 Accounting For Special Transactions University of Batangas

Uploaded by

Hannahbea LindoThis document provides guidance and examples for accounting for various partnership transactions including:

1) The admission of a new partner through purchasing existing partners' interests and determining new capital balances and profit/loss ratios.

2) The withdrawal, retirement, or death of an existing partner through another partner purchasing their interest or the partnership settling the interest, and recalculating remaining partners' capital balances and ratios.

3) The incorporation of an existing partnership where partners receive preference and ordinary shares based on their capital balances at time of incorporation. Worked problems are provided to illustrate journal entries and calculations for each transaction type.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

ACC9

Accounting for Special Transactions

University of Batangas

PARTNERSHIP DISSOLUTION

GUIDED EXERCISES

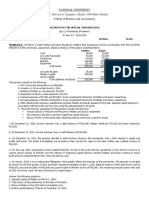

PROBLEM 1 (Admission of a new partner)

Molave joins the partnership of Narra and Mahogany. The partnership’s statement of financial position

before Molave’s admission is as follows:

Cash 30,000 Accounts payable 80,000

Accounts Receivable 140,000 Narra, Capital (60%) 515,000

Inventory 200,000 Mahogany, Capital (40%) 275,000

Equipment 500,000

Total Assets 870,000 Total liabilities and equity 870,000

The following adjustments are determined:

a. The recoverable amount of the accounts receivable is P120,000

b. The inventory has a net realizable value of P160,000

c. The equipment has a fair value of P450,000

d. Unrecorded liabilities amount to P20,000

Case 1: Purchase of interest from one partner

Molave acquires half of Mahogany’s capital interest for P800,000. Provide the entry and the capital

balance and P/L ratio of the partners after Molave’s admission.

Case 2: Purchase of interest from more than one partner

Molave purchases 20% of Narra and Mahogany’s capital interest for P800,000. Provide the entry

and the capital balance of the partners after Molave’s admission.

Case 3: Amount of investment

Molave wants to invest for a 20% in the net assets and profits of the partnership. If not bonus is

allowed, how much should Molave invest and what would be the new P/L ratio of the partners

after Molave’s admission?

Case 4: Investment in the partnership – bonus to new partner

Molave invests P100,000 for a 20% interest in the net assets and profits of the partnership. No

goodwill is recognized. Provide the entry and compute for the capital balances of the partners

after Molave’s admission.

Case 5: Investment in partnership – bonus to old partners

Molave invests P180,000 for a 20% interest in the net assets and profits of the partnership. No

goodwill is recognized. Provide the entry and compute for the capital balances of the partners

after Molave’s admission.

PROBLEM 2 (Withdrawal, retirement or death of a partner)

Partners A, B and C had the following capital balances on January 1, 20x1: A, Capital (50%) P320,000;

B, Capital (30%) P192,000; and C, Capital (20%) P128,000. Partner A decided to retire on Sept. 1, 20x1.

The partnership earned profit of P800,000 from Jan. 1 to Aug. 31, 20x1 and the partners had the following

capital withdrawals during that period: A, P40,000; B, P60,000; and C, P30,000.

Case 1: Purchase of interest by remaining partner

Partner B purchases Partner A’s interest for P700,000. Provide the entry and compute for the

capital balances and P/L ratio of the partners after A’s retirement.

Case 2: Settlement of interest by partnership

ACC9

Accounting for Special Transactions

University of Batangas

The partnership pays Partner A P700,000 for his interest. Provide the entry and compute for the

capital balances and P/L ratio of the partners after A’s retirement.

Case 3: Settlement of interest by partnership

The partnership pays Partner A P650,000 for his capital. Provide the entry and compute for the

capital balances of the partners after A’s retirement.

PROBLEM 3 - Incorporation of a Partnership

Use the information in Problem 2 above. However, instead of Partner A retiring, the partnership is

converted into a corporation on August 31, 20x1. The corporation issued 1,000 preference shares with

par value of P200 per share to each of the partners and even multiples of ordinary shares with par value

of P50 per share for their remaining interests. Compute for the number of shares issued to each of the

partners.

You might also like

- Assignment03 PDFDocument2 pagesAssignment03 PDFAilene MendozaNo ratings yet

- Accounting 2 (Admission &withdrawal of Partners)Document6 pagesAccounting 2 (Admission &withdrawal of Partners)Zyka SinoyNo ratings yet

- Prelims - P2 MockboardsDocument15 pagesPrelims - P2 MockboardsRommel RoyceNo ratings yet

- Module 4Document7 pagesModule 4trixie maeNo ratings yet

- Financial Accounting and ReportingDocument8 pagesFinancial Accounting and ReportingPauline Idra100% (1)

- Quiz Partn OerationDocument6 pagesQuiz Partn OerationTommy OngNo ratings yet

- Accounting 111E Quiz 5Document3 pagesAccounting 111E Quiz 5Khim NaulNo ratings yet

- Problem On AdmissionDocument2 pagesProblem On AdmissionSam Rae LimNo ratings yet

- Partnership DissolutionDocument19 pagesPartnership DissolutionRujean Salar Altejar100% (1)

- 01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 OperationsDocument5 pages01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 Operationsjohn francisNo ratings yet

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Ae100 Partnership Operations Notes and Sample ProblemsDocument3 pagesAe100 Partnership Operations Notes and Sample ProblemsJrm mendesNo ratings yet

- Partnership HCC CttoDocument7 pagesPartnership HCC CttoKenncy100% (1)

- Assignment02 PDFDocument2 pagesAssignment02 PDFAilene MendozaNo ratings yet

- Partnership Formation ActivityDocument8 pagesPartnership Formation ActivityShaira UntalanNo ratings yet

- Partnership Dissolution - Practice ExercisesDocument5 pagesPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- Practice Sets 3 & 4: Accounting For PartnershipDocument4 pagesPractice Sets 3 & 4: Accounting For PartnershipRey Joyce AbuelNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- 1st Evals p2Document10 pages1st Evals p2Shiela MayNo ratings yet

- Afar 1 Sw3 Mle01 PDF FreeDocument9 pagesAfar 1 Sw3 Mle01 PDF FreeBrian TorresNo ratings yet

- 1 Partnership AccountingDocument10 pages1 Partnership AccountingMarynelle Labrador SevillaNo ratings yet

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Document10 pagesP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonNo ratings yet

- CH 010Document2 pagesCH 010Joana TrinidadNo ratings yet

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Drill 11272019Document1 pageDrill 11272019Mike MikeNo ratings yet

- Parcor CaseletsDocument13 pagesParcor CaseletsErika delos Santos100% (2)

- 03 - Handout - Partnership DissolutionDocument4 pages03 - Handout - Partnership DissolutionJanysse CalderonNo ratings yet

- Dissolution ActivityDocument5 pagesDissolution ActivitymariashekinahdNo ratings yet

- QUIZ 02: Partnership Operations Name: - ID No.Document6 pagesQUIZ 02: Partnership Operations Name: - ID No.yoj cepilloNo ratings yet

- 2nd Assign Topic2 AdvaccDocument2 pages2nd Assign Topic2 AdvaccStella SabaoanNo ratings yet

- Premidterm ExaminationDocument5 pagesPremidterm ExaminationAnne Camille AlfonsoNo ratings yet

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- ADFINA 1 - Partnerhip - Luidation - Quizzer - 2016NDocument3 pagesADFINA 1 - Partnerhip - Luidation - Quizzer - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- CMPC 131 2-Partneship-OperationsDocument4 pagesCMPC 131 2-Partneship-OperationsGab IgnacioNo ratings yet

- Partnership Dissolution & LiquidationDocument15 pagesPartnership Dissolution & LiquidationJean Ysrael Marquez50% (4)

- Afar TestbankDocument13 pagesAfar TestbankRanie MonteclaroNo ratings yet

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- Partnership Dissolution QuestionsDocument3 pagesPartnership Dissolution QuestionsArkkkNo ratings yet

- Session 2 On Partnership: OPERATIONS Prepared By: Rañer S. Arañez, CPA Problem 1Document3 pagesSession 2 On Partnership: OPERATIONS Prepared By: Rañer S. Arañez, CPA Problem 1Cyra JimenezNo ratings yet

- AST Discussion 3 - PARTNERSHIP DISSOLUTIONDocument5 pagesAST Discussion 3 - PARTNERSHIP DISSOLUTIONCHRISTINE TABULOGNo ratings yet

- 1st Pre-Board - P2 October 2011 BatchDocument8 pages1st Pre-Board - P2 October 2011 BatchKim Cristian MaañoNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- EvalsDocument11 pagesEvalsPaul Adriel Balmes50% (2)

- Partnership OPERATIONS Handout PDFDocument3 pagesPartnership OPERATIONS Handout PDFRayne Andreana YuNo ratings yet

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Document21 pagesAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Stella SabaoanNo ratings yet

- Integ02 ADocument2 pagesInteg02 ARonald CorunoNo ratings yet

- Final Term Assignment 2 On Financial Accounting and Reporting - Partnership OperationsDocument2 pagesFinal Term Assignment 2 On Financial Accounting and Reporting - Partnership OperationsAnne AlagNo ratings yet

- Partnership Operations 2Document2 pagesPartnership Operations 2Anne AlagNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- Partnership Additional ProbsDocument9 pagesPartnership Additional ProbsJoy LagtoNo ratings yet

- Advacc Preboard QuestionsDocument9 pagesAdvacc Preboard QuestionsJefferson ArayNo ratings yet

- Partcorp. LiquidDocument8 pagesPartcorp. LiquidMark Dave Yu100% (1)

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- ACC 1802 Partneship OperationsDocument3 pagesACC 1802 Partneship OperationsronnelNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Chrisimm Sentimo Kumon Accounting and Bookkeeping ServicesDocument7 pagesChrisimm Sentimo Kumon Accounting and Bookkeeping ServicesHannahbea LindoNo ratings yet

- Lent Holy Week 2023Document7 pagesLent Holy Week 2023Hannahbea LindoNo ratings yet

- Drill-Receivables CompressDocument7 pagesDrill-Receivables CompressHannahbea LindoNo ratings yet

- SOP and Proposed QuestionnaireDocument7 pagesSOP and Proposed QuestionnaireHannahbea LindoNo ratings yet

- G GefevaluationDocument89 pagesG GefevaluationHannahbea LindoNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingHannahbea LindoNo ratings yet

- Updated Saro DBM2022Document102 pagesUpdated Saro DBM2022Hannahbea LindoNo ratings yet

- Certificate of Research Instrument ValidationDocument1 pageCertificate of Research Instrument ValidationHannahbea LindoNo ratings yet

- Module 1: Nature of StatisticsDocument47 pagesModule 1: Nature of StatisticsHannahbea LindoNo ratings yet

- Short-Term DecisionsDocument11 pagesShort-Term DecisionsHannahbea LindoNo ratings yet

- 5strategic Analysis ContDocument21 pages5strategic Analysis ContHannahbea LindoNo ratings yet

- Strat Bus Analysis Lecture2Document15 pagesStrat Bus Analysis Lecture2Hannahbea LindoNo ratings yet

- 66Document1 page66Hannahbea LindoNo ratings yet

- Module 1: Nature of StatisticsDocument29 pagesModule 1: Nature of StatisticsHannahbea LindoNo ratings yet

- Physical Education 4: Official Volleyball Rules Learning OutcomesDocument18 pagesPhysical Education 4: Official Volleyball Rules Learning OutcomesHannahbea LindoNo ratings yet

- Partnershi P Formation: (A Review) : Kim Nicole M. Reyes, Cpa, MBMDocument23 pagesPartnershi P Formation: (A Review) : Kim Nicole M. Reyes, Cpa, MBMHannahbea LindoNo ratings yet

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoNo ratings yet

- 4strategic Analysis ToolsDocument14 pages4strategic Analysis ToolsHannahbea LindoNo ratings yet

- Taxation 1 - Estate Tax: A. Format of Computation (Bir Form 1801)Document15 pagesTaxation 1 - Estate Tax: A. Format of Computation (Bir Form 1801)Hannahbea LindoNo ratings yet

- Physical Education 4: Volleyball Attack Hit and BlockingDocument11 pagesPhysical Education 4: Volleyball Attack Hit and BlockingHannahbea LindoNo ratings yet

- ldcr2013 ch3 enDocument48 pagesldcr2013 ch3 enHannahbea LindoNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasHannahbea LindoNo ratings yet

- 03 CH03Document41 pages03 CH03Walid Mohamed AnwarNo ratings yet

- Solar Plus Business PlanDocument23 pagesSolar Plus Business PlanMichael GregoryNo ratings yet

- Cash Flow Statement For AAPLDocument2 pagesCash Flow Statement For AAPLEzequiel FriossoNo ratings yet

- Management Representation Letter (Standalone Financial Statements - Companies Act 2013)Document16 pagesManagement Representation Letter (Standalone Financial Statements - Companies Act 2013)Rahul Laddha100% (1)

- Computing Loans Involving Partial Payments Before MaturityDocument2 pagesComputing Loans Involving Partial Payments Before MaturityIcekwim05No ratings yet

- CH 14Document95 pagesCH 14Carlene JanettaNo ratings yet

- ch15 MCDocument26 pagesch15 MCWed CornelNo ratings yet

- Exercise 5-9 (Part Level Submission) : Allessandro Scarlatti Company Balance Sheet (Partial) DECEMBER 31, 2014Document3 pagesExercise 5-9 (Part Level Submission) : Allessandro Scarlatti Company Balance Sheet (Partial) DECEMBER 31, 2014Tntnntnt ntntNo ratings yet

- ACFrOgAMXLJQ31ib6NhLGI0LJ g6GJ517KX03aMrtqxVEqeGBZVYeNyhJHHN9 NBC Vi fXXpyOSGJRyPbtkRLA5DID6 - WJh7xyy7T4 - lcWF9qvk7GWZbEblGKEapUTdWZQyBqXGaUpCDjeEy - FVDocument6 pagesACFrOgAMXLJQ31ib6NhLGI0LJ g6GJ517KX03aMrtqxVEqeGBZVYeNyhJHHN9 NBC Vi fXXpyOSGJRyPbtkRLA5DID6 - WJh7xyy7T4 - lcWF9qvk7GWZbEblGKEapUTdWZQyBqXGaUpCDjeEy - FVmy VinayNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set3Document42 pages12 Accountancy Lyp 2017 Outside Delhi Set3Ramprasad Sarkar100% (1)

- Develop A Business PlanDocument12 pagesDevelop A Business PlanAllyza Krizchelle Rosales BukidNo ratings yet

- Equivalent Annual AnnuityDocument3 pagesEquivalent Annual AnnuityMaximusNo ratings yet

- Corporate Valuation Revision Copy Main FileDocument63 pagesCorporate Valuation Revision Copy Main FileRajalakshmi SNo ratings yet

- 1 ACCOUNTEAM Exercises 1 3 PDFDocument3 pages1 ACCOUNTEAM Exercises 1 3 PDFMelyssa Dawn GullonNo ratings yet

- Ratio Analysis of BMWDocument16 pagesRatio Analysis of BMWRashidsarwar01No ratings yet

- A Brief Study On The Peformance of HDFC Bank KohimaDocument27 pagesA Brief Study On The Peformance of HDFC Bank KohimaShraddha PotdarNo ratings yet

- Income Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Document2 pagesIncome Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Jasmine ActaNo ratings yet

- The Mainsail Capital Group MBADocument148 pagesThe Mainsail Capital Group MBANabile AnzNo ratings yet

- Class Xii 2021-2022 HHWDocument17 pagesClass Xii 2021-2022 HHWPRATHAM JAINNo ratings yet

- Financial Statements & Analysis of NalcoDocument57 pagesFinancial Statements & Analysis of Nalcosrinibashb554678% (9)

- PDF Projected Income Statement and Balance SheetDocument4 pagesPDF Projected Income Statement and Balance Sheetnavie VNo ratings yet

- Anantha PVC LTDDocument58 pagesAnantha PVC LTDMaheshSrikakulam50% (2)

- 4 Internal Rate of ReturnDocument25 pages4 Internal Rate of ReturnAngel NaldoNo ratings yet

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- FM Varsity Main-Model Chapter-4Document8 pagesFM Varsity Main-Model Chapter-4AnasNo ratings yet

- Exam Finals Manon-OgDocument14 pagesExam Finals Manon-OgJM RoxasNo ratings yet

- Financial Report For The Year 2020-21Document280 pagesFinancial Report For The Year 2020-21Amanuel TewoldeNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Oracle Financials Cloud Intro For CFOs and System IntegratorsDocument76 pagesOracle Financials Cloud Intro For CFOs and System IntegratorsMiguel Felicio100% (1)

- UzAuto Motors IFRS Report FY2022Document41 pagesUzAuto Motors IFRS Report FY2022id00001875No ratings yet