Professional Documents

Culture Documents

CPA 1 Financial Accounting-1 2019

CPA 1 Financial Accounting-1 2019

Uploaded by

LYNETTE NYAKAISIKICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CPA 1 Financial Accounting-1 2019

CPA 1 Financial Accounting-1 2019

Uploaded by

LYNETTE NYAKAISIKICopyright:

Available Formats

THE PUBLIC ACCOUNTANTS EXAMINATIONS BOARD

A Committee of the Council of ICPAU

CPA (U) EXAMINATIONS

LEVEL ONE

FINANCIAL ACCOUNTING – PAPER 1

MONDAY 27 MAY, 2019

INSTRUCTIONS TO CANDIDATES:

1. Time allowed: 3 hours 15 minutes.

The first 15 minutes of this examination have been designated for reading

time. You may not start to write your answer during this time.

2. This examination contains Sections A and B.

3. Section A is bound separately from Section B.

4. Attempt all the 20 multiple–choice questions in Section A. Each question

carries 1 mark.

5. Attempt four of the five questions in Section B. Each question carries 20

marks.

6. Write your answer to each question on a fresh page in your answer

booklet.

7. Please, read further instructions on the answer booklet, before attempting

any question.

2019 Public Accountants Examinations Board

Financial Accounting - Paper 1

SECTION B

Attempt four of the five questions in this section.

Question 2

The following information relates to Kibuga Women’s Group (KWG) whose aim is

to impart women with entrepreneurial skills to enhance their household incomes.

KWG also operates a bakery to raise money to finance the activities of the group.

Their receipts and payments account for the year ended 31 December, 2018 is

as follows:

Details Shs ‘000’ Details Shs ‘000’

Balance b/ d (1 January,

2018) 32,000 Balance b/ d (1 January, 2018) 2,000

Donations 60,000 Bakery material purchases 18,450

Fundraising income 15,520 Utilities 10,050

Membership income 11,250 Salaries 8,000

Confectionaries sales 54,000 Repairs and maintenance 1,560

Training costs 2,112

Motivational speaker allowances 1,200

Motivational visits 1,480

Storage costs (bakery) 870

- Balance c/d 127,048

172,770 172,770

Additional information:

1. The following balances were available in 2018:

1 January 31 December

Shs ‘000’ Shs ‘000’

Bakery delivery van (cost Shs 16 million) 12,800 ?

Baking equipment (cost Shs 36 million) 28,800 ?

Buildings (cost Shs 52.5 million) 50,400 ?

Furniture (cost Shs 8.4 million) 6,720 ?

Confectionary inventory 1,400 1,100

Prepaid utilities 2,000 3,000

2. Baking flour of Shs 540,000 expired and this has not been accounted for in

the books.

3. Apportionment of costs to be as follows:

Item Bakery KWG

Utilities 60% ?

Salaries ? 1⁄5

Repair & maintenance 70% ?

Depreciation of furniture ¼ ?

Depreciation of buildings 50% 50%

27 May, 2019 Page 2 of 8

Financial Accounting - Paper 1

4. The bakery paid Shs 250,000 to deliver confectionaries to customers and

Shs 315,000 to transport baking flour to the bakery. These costs were

omitted in the books of account.

5. Membership fee is paid by women to join the group.

6. Motivational costs and training costs relate to KWG.

7. Depreciation is provided for, on cost per annum, as follows:

Asset Rate (%)

Delivery van 10

Baking equipment 10

Furniture 10

Building 2

Required:

Prepare for KWG a statement of:

(a) affairs as at 1 January, 2018. (3 marks)

(b) profit or loss for the year ended 31 December, 2018. (7 marks)

(c) income and expenditure for the year ended 31 December, 2018.

(5 marks)

(d) financial position as at 31 December, 2018. (5 marks)

(Total 20 marks)

27 May, 2019 Page 3 of 8

Financial Accounting - Paper 1

Question 3

The following trial balance was extracted from the books of JITO Ltd, a

manufacturer of textile materials, for the year ended 31 December, 2018.

Shs ‘000’ Shs ‘000’

Share capital 1,096,800

Inventory 1 January, 2018

Raw materials 50,400

Work in progress 33,600

Rolls of finished textile materials 55,200

Plant & machinery at cost 700,000

Delivery truck at cost 60000

Accumulated depreciation 1 January, 2018:

Plant & machinery 19,200

Delivery truck 15,000

Bank balance 6,000

Purchase of raw materials 915,800

Utilities 50,400

Salaries 40,800

Factory labour 141,600

Trade show exhibition expenses 3,400

Rent & rates 120,000

Sales 1,030,000

General office expenses 21,600

Trade receivables & payables 63,000 88,800

Total 2,255,800 2,255,800

Additional information:

1. Rent and rates had been paid for the period 1 January, 2018 to 31 March,

2019 while utilities Shs 4.8 million was outstanding by the year end. Rent

and rates accrue evenly throughout the year.

2. Cotton bales bought at Shs 25.6 million (included in purchases) were

stained by smoke during a fire outbreak and subsequently sold for Shs 10

million. This entire transaction has not been recorded in the books of

account.

3. Included in factory labour is Shs 21.6 million in wages advanced to 10

factory workers during the year. This amount had not been recovered by

the year end. 5⁄6 of the factory labour relates to direct costs and the

balance relates to factory overheads. The company apportions other costs

as follows:

27 May, 2019 Page 4 of 8

Financial Accounting - Paper 1

Cost Factory Office & Selling &

administration distribution

Utilities 0.7 ? 0.15

Rent and rates 60% 20% 20%

Salaries 10% 70% 20%

4. Inventories as at 31 December, 2018 were as follows:

Shs ‘000’

Raw materials 30,000

Work in progress 13,200

Rolls of finished textile materials 25,200

5. The company’s depreciation policy is:

Asset Rate

Plant & machinery 10% on cost

Delivery truck 25% on reducing balance

Required:

Prepare for JITO Ltd for the year ended 31 December, 2018 a statement

of:

(a) manufacturing cost. (6 marks)

(b) profit or loss. (8 marks)

(c) financial position as at 31 December (6 marks)

(Total 20 marks)

Question 4

(a) ‘The business environment in Uganda is tough’ said one participant in a

training organised by Uganda Entrepreneurs Association.

Required:

As an expert in entrepreneurship, advise entrepreneurs on how best their

businesses can survive in such an environment.

(5 marks)

(b) Explain five purposes of the International Accounting Standards Board

(IASB’s) conceptual framework for financial reporting.

(5 marks)

(c) Jonathan operates a general merchandise shop in Kalembe market. On 18

June, 2018 the market was gutted by fire and three quarters of his

merchandise was lost. The remaining inventory was partially destroyed.

On 1 March, 2018 the stock taking exercise valued inventory at Shs 12.5

million. Purchases from 1 March, 2018 to 18 June, 2018 amounted to Shs

85 million while the sales for the same period were Shs 96 million. Goods

are sold at a markup of 20%. The inventory which was partially destroyed

27 May, 2019 Page 5 of 8

Financial Accounting - Paper 1

by fire can be sold for Shs 1.8 million. Costs expected to be incurred to

sale the partially destroyed inventory include delivery costs Shs 120,000

and repackaging costs Shs 180,000.

Required:

Determine the:

(i) cost of inventory completely destroyed by fire. (5 marks)

(ii) cost of inventory partially destroyed by fire. (1 marks)

(iii) value at which inventory partially destroyed by fire should be

recognised following the requirements of IAS 2: Inventory.

(4 marks)

(Total 20 marks)

Question 5

(a) Explain the qualitative characteristics that enhance the usefulness of

financial information.

(6 marks)

(b) The Accounts Clerk of Mule Traders extracted a trial balance as at 31

December, 2018 but it failed to agree with debits being more than credit

by Shs 22,410,000. On further scrutiny, the following errors were

discovered.

1. Repairs of machinery, Shs 4.5 million had been charged to

machinery account.

2. Sales journal had been under cast by Shs 6.5 million.

3. Purchase of a motor vehicle Shs 15 million was entered in the

purchases account.

4. Payment Shs 7,877,000 to Mwamba, a supplier was properly

recorded in Mwamba’s account but was wrongly recorded in the

cash book as Shs 7,787,000.

5. An incoming credit note Shs 8.8 million was properly recorded in the

supplier’s account but wrongly recorded in the purchases returns

account as credit Shs 9.8 million.

6. Opening inventory was under cast by Shs 4.5 million.

7. Dividends received Shs 9 million were debited to directors’ salaries.

This transaction was recorded correctly in the cash book.

8. Purchase of land Shs 9 million cash was omitted from the books.

9. Discounts received Shs 660,000 were debited to discounts allowed

account.

27 May, 2019 Page 6 of 8

Financial Accounting - Paper 1

10. Disposal proceeds from sale of machinery Shs 4.25 million were

debited in the disposal account. A correct entry was passed in the

corresponding account.

11. Purchases Shs 9.7 million on credit from John Mwase were credited

to Paul Mwase account.

Required:

(i) Prepare journal entries necessary to correct the above errors.

(ignore narrations).

(10 marks)

(ii) Prepare a suspense account duly balanced. (4 marks)

(Total 20 marks)

Question 6

Abillinga, Bonny and Charlotte are architects in A, B & C Consulting, sharing

profits or losses equally. The following information was extracted from the

partnership’s books as at 31 December, 2018.

Non-current assets: Shs '000' Shs '000'

Motor vehicles 25,000

Furniture and fittings (book value) 24,000

Laptops (book value) 5,400

Xerox digital copier and printer (book value) 20,000 74,400

Current assets:

Prepaid license 3,300

Accounts receivable 5,900 9,200

Total assets 83,600

Capital and liabilities:

Capital accounts 1 January 2018:

Abillinga 8,000

Bonny 10,000

Charlotte 5,000 23,000

Current accounts 1 January 2018:

Abillinga (800)

Bonny -

Charlotte 1,000 200

Non-current liabilities:

Bank loan 50,000

Current liabilities:

Bills payable 9,200

Bank overdraft 1,200 10,400

Total capital & liabilities 83,600

27 May, 2019 Page 7 of 8

Financial Accounting - Paper 1

Additional information:

On 31 December, 2018, Abillinga retired, the remaining partners decided to

admit David on the same date. David was to contribute cash Shs 12 million as

capital. Bonny, Charlotte and David (B, C & D) agreed as follows:

1. Share profit or losses in the ratio of 2:3:5 respectively.

2. Maintain fluctuating capital accounts.

3. Bonny and Charlotte to increase their capital contribution by 20% and

50% of initial capital contribution respectively.

4. Value goodwill at Shs 4.2 million and account for it using the revaluation

method.

5. Revalue assets as follows:

Asset: Shs ‘000’

Xerox digital copier and printer 18,000

Furniture and fittings 26,000

Motor vehicles 21,700

6. Abillinga took one of the laptops whose book value was Shs 1.8 million.

He took it over at the same amount.

7. Settle liabilities before David joins. Bonny takes over bills payable in full

and 60% of the bank loan. Charlotte takes over the bank overdraft and

40% of the bank loan.

8. Pay off Abillinga’s balance by cheque.

Required:

Prepare for B, C & D partnership:

(a) a revaluation account. (2 marks)

(b) partner’s capital accounts. (6 marks)

(c) bank account. (2 marks)

(d) individual asset accounts. (4 marks)

(e) goodwill account. (2 marks)

(f) statement of financial position for B, C & D partnership as at 31

December, 2018.

(4 marks)

(Total 20 marks)

27 May, 2019 Page 8 of 8

You might also like

- The Finance Director of Stenigot Is Concerned About The LaxDocument1 pageThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNo ratings yet

- History of The DDR German ShepherdsDocument7 pagesHistory of The DDR German ShepherdsIvan RogachevNo ratings yet

- Index To Study Materials: Uol: Ac2097 - Management Accounting-2021 Lecturer: Balwant SinghDocument100 pagesIndex To Study Materials: Uol: Ac2097 - Management Accounting-2021 Lecturer: Balwant SinghDương DươngNo ratings yet

- AU Section 350 - Audit SamplingDocument5 pagesAU Section 350 - Audit SamplingnatiNo ratings yet

- JB Limited Is A Small Specialist Manufacturer of Electronic ComponentsDocument2 pagesJB Limited Is A Small Specialist Manufacturer of Electronic ComponentsAmit PandeyNo ratings yet

- Saqib M26 - MISH1520 - 06 - PPW - C25Document40 pagesSaqib M26 - MISH1520 - 06 - PPW - C25Tariq MahmoodNo ratings yet

- Week 1 - Problem SetDocument3 pagesWeek 1 - Problem SetIlpram YTNo ratings yet

- Great Zimbabwe University Faculty of CommerceDocument6 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- Review Questions Final Accounts For A Sole TraderDocument3 pagesReview Questions Final Accounts For A Sole TraderdhanyasugukumarNo ratings yet

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Document8 pagesMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNo ratings yet

- P2 November 2010 Answers PDFDocument13 pagesP2 November 2010 Answers PDFjoelvalentinorNo ratings yet

- Past Paper IIDocument16 pagesPast Paper IIWasim OmarshahNo ratings yet

- Practice Questions # 4 Internal Control and Cash With AnswersDocument9 pagesPractice Questions # 4 Internal Control and Cash With AnswersIzzahIkramIllahiNo ratings yet

- FADocument3 pagesFAYukta GoelNo ratings yet

- Midterm 5101Document4 pagesMidterm 5101MD Hafizul Islam HafizNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Business Mangement (3.4 Final Accounts)Document35 pagesBusiness Mangement (3.4 Final Accounts)Yatharth SejpalNo ratings yet

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- BA3 Mock Exam 01 - PILOT PAPER Nov 2020Document8 pagesBA3 Mock Exam 01 - PILOT PAPER Nov 2020Sanjeev JayaratnaNo ratings yet

- Course Outline Advnced Business TaxationDocument4 pagesCourse Outline Advnced Business TaxationjohnNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- 20190831041657SLCHIA005FR1 Intro To FRDocument113 pages20190831041657SLCHIA005FR1 Intro To FRNadiaIssabellaNo ratings yet

- Chap 1Document22 pagesChap 1Zara Sikander33% (3)

- Law II R. Kit Final As at 3 July 2006Document248 pagesLaw II R. Kit Final As at 3 July 2006kevoh1No ratings yet

- Job, Batch and Service CostingDocument22 pagesJob, Batch and Service CostingSanjeev JayaratnaNo ratings yet

- Chapter 10 - Fixed Assets and Intangible AssetsDocument94 pagesChapter 10 - Fixed Assets and Intangible AssetsAsti RahmadaniaNo ratings yet

- 7 2006 Dec QDocument6 pages7 2006 Dec Qapi-19836745No ratings yet

- Soal P 7.2, 7.3, 7.5Document3 pagesSoal P 7.2, 7.3, 7.5boba milkNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Ias 16Document31 pagesIas 16Reever RiverNo ratings yet

- Torrington, Hall & Taylor, Human Resource Management 6e, © Pearson Education Limited 2005Document27 pagesTorrington, Hall & Taylor, Human Resource Management 6e, © Pearson Education Limited 2005adil0% (1)

- CMA Inventory Management New HandoutDocument10 pagesCMA Inventory Management New HandoutahmedNo ratings yet

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocument17 pagesACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNo ratings yet

- CAF 1 IA Autumn 2020Document5 pagesCAF 1 IA Autumn 2020Qasim Hafeez KhokharNo ratings yet

- Fin Accounting 3-A1-12-2022Document4 pagesFin Accounting 3-A1-12-2022Benjamin Banda100% (1)

- Model Answers For Extra Practicing Problems in Financial Statement AnalysisDocument12 pagesModel Answers For Extra Practicing Problems in Financial Statement AnalysisAhmad Osama MashalyNo ratings yet

- Week1c.introduction - Exercises WithoutAnswersDocument8 pagesWeek1c.introduction - Exercises WithoutAnswersyow jing peiNo ratings yet

- MGT705 - Advanced Cost and Management Accounting Midterm 2013Document1 pageMGT705 - Advanced Cost and Management Accounting Midterm 2013sweet haniaNo ratings yet

- IAS 02: Inventories: Requirement: SolutionDocument2 pagesIAS 02: Inventories: Requirement: SolutionMD Hafizul Islam Hafiz100% (1)

- Cash Flow StatementsDocument19 pagesCash Flow Statementsyow jing peiNo ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- Accounting GuessDocument5 pagesAccounting GuessjhouvanNo ratings yet

- Measuring Business Income CH 3Document37 pagesMeasuring Business Income CH 3eater PeopleNo ratings yet

- 17 H F6 Vietnam Tax PIT Answers For Multiple Choice Questions 2015 Exam enDocument8 pages17 H F6 Vietnam Tax PIT Answers For Multiple Choice Questions 2015 Exam endomNo ratings yet

- Chapter Two Investment Allowances NotesDocument12 pagesChapter Two Investment Allowances NotesTriila manillaNo ratings yet

- When A Steel Company Goes Bankrupt, Other Companies in The Same Industry Benefit Because They Have One Less Competitor. But When A Bank Goes Bankrupt Other Banks Do Not Necessarily Benefit.Document5 pagesWhen A Steel Company Goes Bankrupt, Other Companies in The Same Industry Benefit Because They Have One Less Competitor. But When A Bank Goes Bankrupt Other Banks Do Not Necessarily Benefit.alka murarka100% (3)

- Cost 2021-MayDocument8 pagesCost 2021-MayDAVID I MUSHINo ratings yet

- Ch13. Flexible BudgetDocument36 pagesCh13. Flexible Budgetnicero555No ratings yet

- Accounting 1 FinalDocument2 pagesAccounting 1 FinalchiknaaaNo ratings yet

- Tutorial 1 - PointersDocument30 pagesTutorial 1 - PointersSheany LinNo ratings yet

- Calculation of Maturity DateDocument4 pagesCalculation of Maturity Dateyogeshdhuri22No ratings yet

- Ratios - Profitability, Market &Document46 pagesRatios - Profitability, Market &Jess AlexNo ratings yet

- 13 Standard CostingDocument32 pages13 Standard CostingMusthari KhanNo ratings yet

- 7e Extra QDocument72 pages7e Extra QNur AimyNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Inventory valuation Complete Self-Assessment GuideFrom EverandInventory valuation Complete Self-Assessment GuideRating: 4 out of 5 stars4/5 (1)

- Nov 19 Q PDFDocument9 pagesNov 19 Q PDFTenywa SalimNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- Malto v. PeopleDocument5 pagesMalto v. PeoplePaolo BañaderaNo ratings yet

- MFC - Central Agreement - WealthjoyDocument10 pagesMFC - Central Agreement - WealthjoyManish ReddyNo ratings yet

- Pa1000 Om deDocument65 pagesPa1000 Om deAnonymous PL3wzykNo ratings yet

- Tacas v. Tobon (When Possession in Good Faith Ceases, Fruits) - LoraDocument2 pagesTacas v. Tobon (When Possession in Good Faith Ceases, Fruits) - Lorakjhenyo218502100% (1)

- Ch04 - Property, Plant and Equipment - v2Document38 pagesCh04 - Property, Plant and Equipment - v2Davy KHSCNo ratings yet

- Sim900 DatasheetDocument4 pagesSim900 DatasheetNatasha AgarwalNo ratings yet

- 4.2 Group Situations: Will An Incremental Borrowing Rate Based On A Property Yield Be Higher?Document3 pages4.2 Group Situations: Will An Incremental Borrowing Rate Based On A Property Yield Be Higher?hur hussainNo ratings yet

- Chapter 13 TEST ANSWERS 1.) Spam Is Used Only To Deliver Harmful Worms and Other Malware. - False 2.) 3.)Document4 pagesChapter 13 TEST ANSWERS 1.) Spam Is Used Only To Deliver Harmful Worms and Other Malware. - False 2.) 3.)Isabel ObordoNo ratings yet

- Works Contract Service and Construction ServiceDocument17 pagesWorks Contract Service and Construction Serviceavinash rai100% (1)

- Ched Memo PDFDocument1 pageChed Memo PDFElizar Vince CruzNo ratings yet

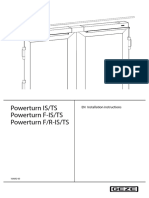

- GEZE Installation Instructions en 741721Document24 pagesGEZE Installation Instructions en 741721PiotrNo ratings yet

- Hebron Messenger For December 2002Document15 pagesHebron Messenger For December 2002hebronmumbaiNo ratings yet

- Feedback On Meeting With Sheikh Ninowy and Sunni UlamaDocument8 pagesFeedback On Meeting With Sheikh Ninowy and Sunni UlamazubairmbbsNo ratings yet

- Assessment-3 V 1.6Document18 pagesAssessment-3 V 1.6nehaNo ratings yet

- Supervisor HandbookDocument11 pagesSupervisor HandbookMike RossNo ratings yet

- Unimasters ConglomerationDocument2 pagesUnimasters ConglomerationTrexPutiNo ratings yet

- Republic of The Philippines v. Bantigue Point Development Corporation, GR 162322, 14 March 2012Document2 pagesRepublic of The Philippines v. Bantigue Point Development Corporation, GR 162322, 14 March 2012Joseph DimalantaNo ratings yet

- Affidavit-Of Desistance (Civil)Document2 pagesAffidavit-Of Desistance (Civil)Judilyn RavilasNo ratings yet

- Biographical MethodDocument18 pagesBiographical MethodStephen Waddell100% (1)

- ch07 Internal Control CashDocument60 pagesch07 Internal Control CashMinh Duy HoàngNo ratings yet

- Suite of The Day - 5. Evening at The DiscoDocument16 pagesSuite of The Day - 5. Evening at The Discojosenet02No ratings yet

- تمارين +الحل اداريةDocument14 pagesتمارين +الحل اداريةaec216320136No ratings yet

- Chin Lin SouDocument2 pagesChin Lin Souapi-28395916No ratings yet

- Full Cases 3.3Document117 pagesFull Cases 3.3James San DiegoNo ratings yet

- The Worlds Great Thinkers, Ed. by Saxe Commins & Robert N. LinscDocument542 pagesThe Worlds Great Thinkers, Ed. by Saxe Commins & Robert N. LinscjulianbreNo ratings yet

- Employee Disciplinary MeasuresDocument16 pagesEmployee Disciplinary MeasuresSweet Miranda100% (2)

- PC-PNDT ActDocument34 pagesPC-PNDT ActDr. Rakshit SolankiNo ratings yet

- Alphabet Coloring PagesDocument27 pagesAlphabet Coloring PagesYuyu MomokoNo ratings yet

- Step 4 Understans IT NegotiationsDocument17 pagesStep 4 Understans IT NegotiationsMaikol Sdvsf75% (4)