Professional Documents

Culture Documents

Scrap 1

Uploaded by

Bryent GawOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scrap 1

Uploaded by

Bryent GawCopyright:

Available Formats

Recently, I watch a video in YouTube called Philippine Value added tax.

First, it talks about the VAT

applies to all persons who sells, barter exchange or lease goods, properties and render services. Second,

it defines the meaning of VAT.

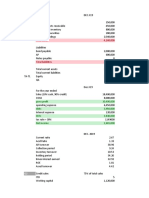

There are 2 kinds of VAT: one is Input VAT, refers to the VAT the buyer pays on purchase from VAT –

register entities, and only VAT – register ed buyers are allowed to claim input VAT. Second would be

output VAT refers to the VAT the seller passed on to the buyer.

Third, 3 VAT:

1.) 12% for non-exempt domestic and imported goods and services.

2.) 0% for exports and export-related transactions.

3.) Exempt for selected goods and services.

Fourth, Exempt transactions and services. Sale or importation of: a. Agricultural and marine food

products in their original state, livestock and poultry. B. Fertilizers; seeds, seedlings and fingerlings; fish,

prawn, livestock and poultry feeds, including ingredients. Importation of: Personal and household

effects belonging to the residents of the Philippines returning from abroad and nonresident citizens

coming to resettle in the Philippines. B. Professional instruments and implements, wearing apparel,

domestic animals, and personal household effects. Service rendered by: Medical, dental, hospital and

veterinary services. Transactions which are exempt under international agreements to which the

Philippines is a signatory or under special laws. Gross receipts from lending activities. Lease of a

residential unit with a monthly rental not exceeding PhP12,800. Sale of real properties not primarily held

for sale to customers or held for lease in the ordinary course of trade or business.

Fifth. 0% for exports and export- related transactions. sales of goods - Sales to persons or

entities whose exemption under special laws or international agreements to which the Philippines is a

signatory effectively subjects such sales to zero-rate. Sale of services - Processing, manufacturing or

repacking goods for other persons doing business outside the Philippines.

Sixth, 12% for non-exempt domestic and imported goods and services. Sale of Goods or

Properties - All goods and properties (except those specifically exempt), including those subject to excise

tax, sold, bartered or exchanged are subject to a 12% VAT based on the gross selling price or gross value

in money. Importation of Goods - Importation of goods is subject to a 12% VAT based on the total value

used by the Bureau of Customs in determining tariff and customs duties, plus excise taxes, if any, and

other charges which shall be paid prior to the release of the goods from customs custody: Provided, that

where the customs duties are determined on the basis of the quantity or volume of the goods, the VAT

shall be based on the landed cost-plus excise tax, if any.

After I watch the video. I learn that everything we buy or use is taxed by the government which

is the 12% VAT. But the purpose of us paying the VAT is for the Government and to gain revenue and

rebuild the infrastructures, road etc. to make our country better, “cough for a while”. I hope those VAT

that we are paying is for rebuilding our country a better place not for those government to buy luxury

cars and watches for their own interest.

You might also like

- Bookbind HRMDocument132 pagesBookbind HRMBryent GawNo ratings yet

- Working CapsDocument2 pagesWorking CapsBryent GawNo ratings yet

- Chiang Kai Shek College Assessment No. 3Document6 pagesChiang Kai Shek College Assessment No. 3Bryent GawNo ratings yet

- MT Act 2-GEGRBK: Types of Literature Direction: Based On The Local Tradition and Culture of The Philippines, Supply The FollowingDocument1 pageMT Act 2-GEGRBK: Types of Literature Direction: Based On The Local Tradition and Culture of The Philippines, Supply The FollowingBryent GawNo ratings yet

- Chiang Kai Shek College: A Documentary Requirement For Work-Integrated Learning at Ollopa CompanyDocument3 pagesChiang Kai Shek College: A Documentary Requirement For Work-Integrated Learning at Ollopa CompanyBryent GawNo ratings yet

- Human Resource Management AssignmentDocument2 pagesHuman Resource Management AssignmentBryent GawNo ratings yet

- Assignment 2Document14 pagesAssignment 2Bryent GawNo ratings yet

- Umayyad Caliphate 661 To 750 Abu Sufyan Ibn HarbDocument4 pagesUmayyad Caliphate 661 To 750 Abu Sufyan Ibn HarbBryent GawNo ratings yet

- Jms Student Organization Treasurer Jma Student Organization Treasurer Jms Student Organization Adviser Jma Student Organization AdviserDocument2 pagesJms Student Organization Treasurer Jma Student Organization Treasurer Jms Student Organization Adviser Jma Student Organization AdviserBryent GawNo ratings yet

- Scrap 5Document14 pagesScrap 5Bryent GawNo ratings yet

- Donkey's Dick For DinnerDocument3 pagesDonkey's Dick For DinnerBryent GawNo ratings yet

- Gelato: Not Quite The SameDocument1 pageGelato: Not Quite The SameBryent GawNo ratings yet

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocument7 pages2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawNo ratings yet

- De La Salle Araneta UniversityDocument7 pagesDe La Salle Araneta UniversityBryent GawNo ratings yet

- Titi Ni Manoy SauceDocument6 pagesTiti Ni Manoy SauceBryent GawNo ratings yet

- VAT Exempt Exercise TBPDocument3 pagesVAT Exempt Exercise TBPBryent GawNo ratings yet

- Donkey's Dick For DinnerDocument3 pagesDonkey's Dick For DinnerBryent GawNo ratings yet

- 91 Aloo Gobi: Northern India, IndiaDocument5 pages91 Aloo Gobi: Northern India, IndiaBryent GawNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Economie - Assignment 4 - Group 30Document3 pagesEconomie - Assignment 4 - Group 30NickNo ratings yet

- Industry Profile TanishqDocument2 pagesIndustry Profile TanishqRaghav JakhetiyaNo ratings yet

- FX MKT Insights Jun2010 Rosenberg PDFDocument27 pagesFX MKT Insights Jun2010 Rosenberg PDFsuksesNo ratings yet

- Export Promotion and Import Substitution StrategyDocument19 pagesExport Promotion and Import Substitution StrategyTaiyaba100% (3)

- Routing Details To Remit Funds To Punjab National BankDocument2 pagesRouting Details To Remit Funds To Punjab National Bankdorje@blueyonder.co.ukNo ratings yet

- New Economic Policy of 1991 - ImportantDocument6 pagesNew Economic Policy of 1991 - ImportantSpammer OpNo ratings yet

- Lesson 3 Introduction To Market Integration Module 3Document5 pagesLesson 3 Introduction To Market Integration Module 3rose belle garciaNo ratings yet

- New Small Scale Industrial PolicyDocument1 pageNew Small Scale Industrial PolicyPrachi BharadwajNo ratings yet

- International Business AssignmentDocument5 pagesInternational Business AssignmentCeline cheahNo ratings yet

- WS 16 GRAND Strategy MatrixDocument6 pagesWS 16 GRAND Strategy MatrixTherese PascuaNo ratings yet

- BS Logos & IndiciesDocument11 pagesBS Logos & IndiciesJunkoNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablemanuela sotoNo ratings yet

- ATP - Premium For Additional FSI For Plots in IT Parks in MIDC Area - 21-10-15Document2 pagesATP - Premium For Additional FSI For Plots in IT Parks in MIDC Area - 21-10-15worksprogressive1 architectsNo ratings yet

- Pesco Online BillDocument2 pagesPesco Online Billahad shahNo ratings yet

- Classification of Commercial BanksDocument2 pagesClassification of Commercial BanksPrakash KrishnanNo ratings yet

- Canada's Balance of International Payments: Fourth Quarter 2010Document145 pagesCanada's Balance of International Payments: Fourth Quarter 2010defacto77No ratings yet

- OutsourcingDocument8 pagesOutsourcingLokesh PalaparthiNo ratings yet

- BanksDocument1,822 pagesBanksgrooveit_adiNo ratings yet

- ExportDecDoc E6RB000010EDocument2 pagesExportDecDoc E6RB000010ENaj MusorNo ratings yet

- Mepco Online BillDocument2 pagesMepco Online BillAltaf SiddiqiNo ratings yet

- LTCM Final PresentationDocument16 pagesLTCM Final PresentationAtul JainNo ratings yet

- Impact of Covid-19 On FMCG IndustryDocument1 pageImpact of Covid-19 On FMCG IndustryBhumika JainNo ratings yet

- © Pearson Education Limited 2015.: All Rights Reserved. 1-1Document20 pages© Pearson Education Limited 2015.: All Rights Reserved. 1-1Vu Van CuongNo ratings yet

- Q. 18. Differences Between Fixed & Floating Exchange RatesDocument1 pageQ. 18. Differences Between Fixed & Floating Exchange RatesMAHENDRA SHIVAJI DHENAKNo ratings yet

- About Attock Cement Pakistan LimitedDocument8 pagesAbout Attock Cement Pakistan LimitedSaif RahmanNo ratings yet

- What Is A Sez?Document13 pagesWhat Is A Sez?Anurag SharmaNo ratings yet

- Calculating GDP-Practice Problems 19-20Document3 pagesCalculating GDP-Practice Problems 19-20Jill C100% (1)

- Kyrgyzstan During The Years of Developed Stalinism and Khrushchev's Thaw (1945-1964)Document11 pagesKyrgyzstan During The Years of Developed Stalinism and Khrushchev's Thaw (1945-1964)raushanbaktybekovaNo ratings yet

- Impact of Goods and Service Tax On The Indian Economy: Dr. (SMT.) Rajeshwari M. ShettarDocument5 pagesImpact of Goods and Service Tax On The Indian Economy: Dr. (SMT.) Rajeshwari M. ShettarSanjog DewanNo ratings yet

- Pros and Cons of Globalization DebateDocument5 pagesPros and Cons of Globalization DebateRukaiya Ahsan FarahNo ratings yet