Professional Documents

Culture Documents

Chapter 3-LPG (Sandeep Garg)

Chapter 3-LPG (Sandeep Garg)

Uploaded by

Ashley Noel100%(1)100% found this document useful (1 vote)

1K views26 pagesOriginal Title

Chapter 3-LPG(Sandeep Garg)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(1)100% found this document useful (1 vote)

1K views26 pagesChapter 3-LPG (Sandeep Garg)

Chapter 3-LPG (Sandeep Garg)

Uploaded by

Ashley NoelCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

o

LIBERALISATION, PRIVATISATION AND

GLOBALISATION: AN APPRAISAL

LEARNING OBJECTIVES

INTRODUCTION

9.2 REASONS FOR ECONOMIC REFORMS

3.3 THE NEW ECONOMIC POLICY

3.4 LIBERALISATION

3.5 PRIVATISATION

9.6 GLOBALISATION

3.7 AN APPRAISAL OF LPG POLICIES (ECONOMIC REFORMS) |

3.8 DEMONETISATION i

3.9 GOODS AND SERVICES TAX (GST)

3.1 INTRODUCTION ieee

Since independence, India followed the mixed economic system, by combining the advantages

of the market economic system (capitalist economy) with those of the planned economic system

(socialist economy).

But, in reality, the public sector dominated the control and regulation of our economy and private

sector was ignored. There was a huge investment in the public sector and very low investment

in the private sector. The dominance of public sector for about 4 decades led to establishment

of various rules and laws, which hampered the process of growth and development.

According to some scholars, the increasing role of public sector has helped Indian economy to:

(i) Achieve growth in savings; (ii) Develop a diversified industrial sector; and (iii) Achieve food security

through sustained expansion of agricultural output.

3.2 REASONS FOR ECONOMIC REFORMS

The economic condition of India in the year 1991 was very miserable. It was due to the cumulative

affect of number of reasons. Let us discuss the various reasons, which aroused the need for making

‘major economic reforms in the country:

1. Poor Performance of Public Sector In the 40 years period (1951-90), public sector was

assigned an important role to work for the economic development of India. However, except

for few public enterprises, the overall performance was very disappointing. Considering

34

the huge losses incurred by a good number of public Cana

30vel ognised the

sector enterprises, the G jovernment recog! Poor Perlormance of Public Seta

need for making necessary reforms.

Deficit in Balance of Payments

. Deficit in Balance of Payments (BOP): Deficit in BOP

arises when foreign payments for imports exceed

foreign receipts from exports. Even after imposing | Fall in Foreign Exchange Reserye,

heavy tariffs and fixing quotas, there was a sharp rise |

in imports. On the other hand, there was slow growth

of exports due to low quality and high prices of Indian Inefficient Management

goods in the international market.

Inflationary Pressures

Huge Burden of Debts

. Inflationary Pressures: There was a consistent rise in the general price level in the economy

due to increase in money supply and shortage of essential goods.

. Fall in foreign exchange reserves: Foreign Exchange Reserve (also termed 45 Forex

Reserves or FX Reserves) are external assets (like convertible foreign currencies, Gold, Special

Drawing Rights, etc.) held by the Central Bank for direct financing of external payments

imbalances. In 1991, foreign exchange reserves fell to the lowest level and it led to the foreign

exchange crisis in the country. Foreign exchange reserves declined to a level that was not

adequate:

* To finance imports for more than two weeks; and

« To pay the interest that needs to be paid to international lenders.

Moreover, no country or international funder was willing to lend to India.

Huge burden of debts: The expenditure of the government was much higher than revenue.

Asa result, government had to borrow money from banks, public and from international

financial institutions.

. Inefficient Management: The origin of the financial crisis can be traced from the inefficient

management of the Indian economy.

» The government had to generate surplus revenue to meet challenges like unemployment,

poverty and population explosion. However, there was no additional revenue due to

continuous spending on development programmes by the government. Moreover,

government was not able to generate sufficient revenue from internal sources such as

taxation, running of public sector enterprises, etc.

* Government expenditure began to exceed its revenue by such large margins that it

became unsustainable.

* At times, the foreign exchange borrowed from other countries and international financial

institutions was spent on meeting consumption needs. Moreover, neither any attempt

was made to reduce such profligate or reckless spending nor sufficient attention was

given to boost exports to pay for growing imports.

a9

Liberalisation, Privatisation and Globalisation An Appraisal

Crisis of 1991 Forced India for Financial help from (ME and World Bank

fo manage the economic crisis of 199L, Indian Government approached for loan fren!

© International Bank for Reconstruction and Development (IBRD), popularly kaw!

World Bank (to facilitate lending, for reconstruction and development); and

© International Monetary Bund (IMB) (to avail short-term loans to solve Balance of Pay vl

problem)

India availed $7 billion loan from these agencies as loan, Dr. Manmohan Singh was the Indian

Finance Minister in 1991 and he was greatly acknowledged for his capabilities to steer away

the economic crisis looming large on the Indian Economy,

For availing the loan, these international agencies expected India to liberalise and open up the econonty bY:

pelor;

© Removing re

rictions on the private s

* Reducing the role of the government in many areas; and

* Removing trade restrictions.

anomic Policy.

India agreed to the conditions of World Bank and IMF and announced the New F

3.3 THE NEW ECONOMIC POLICY __

The New Economic Policy (NEP) was announced in July 1991, It consisted of wide range of

economic reforms. The main aim of the policy was to create a more competitive environment

in the economy and remove the barriers to entry and growth of firms.

The New Economic Policy can be broadly classified into two kinds of measures:

1, Stabilisation Measures: They refer to short-term measures which aim at:

(i) Correcting weaknesses of the balance of payments by maintaining sufficient fore

exchange reserves; and

(ii) Controlling inflation by keeping the rising prices under control.

2. Structural Reform Measures: They refer to long-term measures which aim at:

(i) Improving the efficiency of the economy; and

(ii) Increasing international competitiveness by removing the rigidities in various

segments of the Indian economy.

Main Policies of New Economic Policy

The government initiated a variety of policies which fall under three heads:

1. Liberalisation

2. Privatisation

3. Globalisation

Liberalisation, Privatisation and Globalisation or ‘LPG’ are the supporting pillars, on which

the structure of new economic policy of our Government has been erected and implemented

since 1991.

a indian Economic Developing

. i

Globalisation

Liberalisation Privatisation

(Refers to removal of Entry (Refers to transfer of ownership, (Refers to integrating the

and Growth restrictions on —_-—-management and contro! of Public National Economy wih

the Private Sector) Sector to Private Sector) World Economy)

Let us discuss them one by one.

3.4 LIBERALISATION ——

Prior to 1991, there were large number of government restrictions in India in the areas of

licensing, import and export trade, dealings in foreign exchange, etc. In July 1991, a package of

economic reforms was announced, which marked the beginning of process of ‘Liberalisation’

in India. Liberalisation means removal of entry and growth restrictions on the private sector

© Liberalisation involves deregulation and reduction of government controls and greater

autonomy (freedom) of private investment, to make economy more competitive.

° Under this process, business is given free hand and is allowed to run on commercial lines.

© The purpose of liberalisation was:

° To unlock the economic potential of the country by encouraging private sector and

multinational corporations to invest and expand; and

> To introduce much more competition into the economy and creating incentives for

increasing efficiency of operations.

* The economic reforms taken by the Government under liberalisation include the following

(i) Industrial Sector Reforms

(ii) Financial Sector Reforms

(iii) Tax Reforms

(iv) Foreign Exchange Reforms

(v) Trade and Investment Policy Reforms

Let us now discuss each reform in detail.

Monopolies:

Industrial Sector Reforms Porat

In order to make necessary reforms in the (MTP) Act

industrial sector, the Government introduced its

new industrial policy on July 24, 1991. The various

Se policy reforms include: ype aiaterd

1. Reduction in Industrial Licensing: The new eensing prep

policy abolished industrial licensing for all

the projects, except for 18 industries, This

number was further reduced to 5 industries. Decrease in

They are: (i) Distillation and brewing of Mba

sation and Globalisation An Appraisal

stitutes’

alcoholic drinks; (i) Cigars and cigarettes of tobacco and manufactured tobacco substi

(iii) Electronic Aerospace and defense equipments; (iv) Industrial explosives; (v) Spe

Hazardous chemicals. ;

© No licences were needed (i) To set up new units; or (ii) Expand or diversify the existing

line of manufacture.

© However, compulsory licensing is required for the above mentioned 5 industries on

account of environmental, safety and strategic considerations.

1 Docie sein voleoF Public Sectors One of the striking features was the substantive reduction

in the role of the public sector in the future industrial development of the country. The

number of industries, exclusively reserved for the public sector, reduced from 17 to

following 8 industries: (3) Arms and ammunition and allied items of defence equipments

(ii) Defence aircraft and warships; (iii) Atomic Energy; (iv) Coal and lignite; (v) Mineral

oils; (vi) Mining of iron ore, manganese ore, chrome ore, gypsum, sulphur, gold, diamond,

copper, lead, zinc, tin, molybdenum and wolfram; (vii) Minerals specified in the Schedule

to the Atomic Energy (Control of production and use) Order, 1953; (viii) Railway transport.

3, De-reservation under small-scale industries: Many goods produced by small scale industries

have now been de-reserved.

© The investment ceiling on plant and machinery for small undertakings enhanced to

rupees one crore.

© In many industries, the market was allowed to determine the prices through forces of

the market (and not by directive policy of the government).

4, Monopolies and Restrictive Trade Practices (MRTP) Act: With the introduction of

liberalisation and expansion schemes, the requirement for large companies, to seek prior

approval for expansion, establishment of new undertakings, merger, amalgamations, etc.

were eliminated. MRTP Act has been replaced by Competition Act, 2002, which is more

liberal. The Competition Act, 2002 was amended by the Competition (Amendment) Act,

2007 and again by the Competition (Amendment) Act, 2009.

inancial Sector Reforms | —

Hinancial sector includes financial institutions like commercial banks, investment banks, stock

»xchange operations and foreign exchange market. The financial sector in India is controlled

by the Central Bank - Reserve Bank of India (RBI). RBI is known as the apex (supreme) body

as it occupies the top most position in the monetary and banking system of the country. RBI

decides the amount of money (i.e. deposits) that the banks can keep with themselves, fixes

interest rates and nature of lending to various sectors.

The reforms introduced under financial sector are:

4, Change Role of RB The role of RBI was reduced from regulator to facilitator of financial

sector. As a result, financial sector was allowed to take decisions on many matters, without

consulting the RBI.

Inaian Economic Prveion.

3.6 :

ature fo! Comn |

Asa regulator (prior to liberalisation), RBI used to fix interest rate a panes tree ae

Affer changing the ole as a faciitator(post-iberalisation), RBINOW NET. ptt

to act accoraingly. in the post liberalisation era, greater autonomy wea

institutions tor their functioning.

2. Origin of Private Banks: The reform policies led to the esa?

Indian as well as foreign. For example, Indian banks like rac sea intent

increased the competition and benefitted the consumers through I< States

better services.

3. Increase in limit of Foreign investment: The limit of foreign &

around 51%. Foreign oe eruae Investors (FII) such as — bankers mutual fang

and pension funds were now allowed to invest in Indian financial markets.

Though banks have been given permission to generate resources from India and abroad, cena,

aspects have been retained with the RBI to safeguard the interests of the account-holders ang tne

nation.

abl

ment of private sector

ment OF Sector hay

and foreign banks like ee

stiment in bani

4. Ease in Expansion Process: Banks were given freedom to set up new branches (after fulfillmen,

of certain conditions) without the approval of the RBI.

‘Change in Role of a Origin of Private

RBI Financial ‘Banks

Sector

Reforms

increase in Limit of Ease in Expansion

Foreign Investment Process

Tax Reforms

Tax reforms refer to reforms in government's taxation and public expenditure policies, which av

collectively known as its ‘Fiscal Policy’. Taxes are of two types:

* Direct Taxes consist of taxes on incomes of individuals as well as profits of busines

enterprises. For example, Income tax (taxes on individual incomes) and Corporate tay (tae

on profits of companies).

* Indirect Taxes refer to those taxes which affect the income and property of persons through

their consumption expenditure. Indirect taxes are generally imposed on goods and services

For example, Goods and Services Tax (GST).

The major Tax Reforms made are:

1, Reduction in Taxes: Since 1991, there has been a continuous reduction in income and corporat

tax as high tax rates were an important reason for tax evasion. It is now widely accepted

that moderate rates of income tax encourage savings and voluntary disclosure of income

2. Reforms in Indirect Taxes: Considerable reform have been made in indirect taxes to facilitate

establishment of common national market for goods and commodities.

3. Simplification of Process: In order to encourage better compliance on the part of taxpayes

many procedures have been simplified.

7a

37

iberalisation, Privat

Jin tho Parlaonton 20! March, 2017 to simpily a4

july, 2007, This I

9 one

The Goods and Service Tax Act was pai

introduce a unified indirect tax system in India. The Act camo into affect on

expected to generate additional revenue for the government, reduce tax evasion and create

nation, one tax and one market’

Foreign Exchange Retorms

The important reforms made in the foreign exchange market are:

1. Devaluation of Rupee: Devaluation refers to deliberate reduction it the value of domestic curren y

vis-a-vis any foreign currency by the goverment ofa country, To overcome Balance of Payments

crisis, the rupee was devalued against foreign currencies. This led to an increase in the

inflow of foreign exchange.

2. Market Determination of Exchange Rate; The Government allowed rupee value to be free

from its control. Asa result, market forces of demand and supply determine the exchange

value of the Indian rupee in terms of foreign currency.

[rade and Investment Policy Reforms

3efore 1991, a lot of restrictions (high tariffs and quotas) were imposed on imports to protect

he domestic industries. However, this protection reduced the efficiency and competitiveness

of domestic industries and led to their slow growth. So, the reforms in the trade and investment

solicy were initiated:

© To increase the international competitiveness of industrial production

© To promote foreign investments and technology into the economy.

© To promote efficiency of local industries and adoption of modern technologies.

The important trade and investment policy reforms include:

1. Removal of Quantitative restrictions on Imports and Exports: Under the New Economic

Policy, quantitative restrictions on imports and exports were greatly reduced. For example,

quantitative restrictions on imports of manufactured consumer goods and agricultural

products were fully removed from April 2001.

Removal of Export Duties: Export duties were removed to increase the competitive position

of Indian goods in the international markets.

3. Reduction in Import Duties: Import duties were considerably reduced, which improved

the competitiveness of domestic industries as it enabled them to import raw materials at

better prices.

4. Relaxation in Import Licensing System: The Import licensing was abolished, except in

case of hazardous and environmentally sensitive industries. This encouraged domestic

tries to import raw materials at better prices, which raised their efficiency and made

indus!

them more competitive.

‘Another important feature of new economic policy was the promotion of the policy of “Privatisation”.

38

3.5 PRIVATISATION

and control of public seetorenten,

Privatisation means transfer of ownership, managerten is,

to the entrepreneurs in the private sect

i » economic activities of the

Privatisation implies greater role of the private sector in the econo the Coun,

Over the years, Indian Government has diluted its stake in several public enterprises, ingly,”

IPCL, IBP, Maruti U

Privatisation can be done in tivo wavs

1. Transfer of ownership and management of public sector companies 1FOM the BOV eT,

to the Private Sector:

2. Privatisation of the public sector undertakings (PSU) by selling off part of the equity 9,

PSUs to the public. This process is known as disinvestment.

dyog, ete

The purpose of privatisation was mainly to improve financial discipline and facilitay

modernisation, It was also believed that private capital and managerial capabilities will help

in improving performance of the PSUs

For “Arguments in Favour of Privatisation” and “Arguments Against Privatisation’, refer Power Boosey

Section.

Lhd Me ee aie

by giving them autonomy in taking managerial decisions. '

~ Forinstance, some PSUs have been granted special status as navaratnas and mini rainas,

In order to infuse professionalism and enable PSU's to compete more effectively in the

liberalised global environment, government started granting ‘Navarainas’ status to PSUs.

They were given greater managerial and operational autonomy in taking various decisions.

to run the company efficiently and to increase their profits

The granting of navaratna status resulted in better performance of these companies.

~ Apart from this, other profit-making enterprises were granted greater operational, financial

and managerial autonomy and they were referred as ‘Mini Ratnas’. As on 1" January

2020, there are:

10 Maharatnas (like indian Oil Corporation Limited, Stee! Authority of india Ltd, ete};

14 Navratnas {like Bharat Electronics Limited, Container Corporation of india Limited, etc. J

74 Miniratnas (Like Airports Authonty of India , Antrix Corporation, etc.)

3.6 GLOBALISATION .

Globalisation means integrating the national economy with the world economy through

removal of barriers on international trade and capital movements,

~ Globalisation is generally understood to mean integration of the economy of the count)

with the world economy.

» However, itis a complex phenomenon. It is an outcome of the set of various pol

aim to transform the world towards greater interdependence and integration.

ss that

i derais, Prvatisabon and Giobaisabon An Appraisal 39

* It involves creation of networks and activities tr 4

nscending economic, social a

geographical boundaries. In short, globalisation aims to create a borderless world

Ovanges made by the Globalisation of the Indian Feonomy

1 The New Economie Policy prepared a specified list of high technology and high investment

poority industries, in which automatic permission will be available tor foreign direct

Investment up to 51 per cent of foreign

juity

ion is provided in high

2 In respect of foreign technology agreements, automatic perm

nis now required for hiring,

priority industry upto a sum of rupees L crore. No permis:

foreign technicians or for testing, indigenously developed technology abroad,

Inorder to make international adjustment of Indian currency, rupee was devalued in July

1991 by nearly 20 percent. It stimulated exports, discouraged imports and raised the influx

of foreign capital

4. To integrate Indian economy with world, the Union Budget 1992-93 made Indian rup

rtible and then the rupee was made fully convertible in 1993-94 budget

partially conv

5. A new five year export-import policy (1992-97) was announced by the Government to

establish the framework of globalisation of India’s toreign trade. The policy removed all

restrictions and controls on the external trade and allowed market forces to play a greater

role in respect of exports and imports,

©. In order to bring the Indian economy within the ambit of global competition, the

government has modified the customs duty to a considerable extent. Accordingly, the

peak rate of customs duty has been reduced from 250 per cent to 10 per cent in 2007-2008

budget

Positive and Negative Traits of Globalisation

The process of globalisation through liberalisation and privatisation policies, has produced

positive as well as negative results, both for India and other countries

In Favour of Globalisation

Globalisation resulted in:

© Greater access to global markets;

© Advanced technology;

» Better future prospeets for large industries of developing countries to become important

players in the international arena

© Better prospects for skilled people across the globe to increase their earnings by utilising

their skills.

Against Globalisation

Globalisation has been criticized by some scholars because according to them:

© Benefits of globalisation accrue more to developed countries as they are able to expand

their markets in other countries.

te _

Inaian Economic Developmen

) 3.10 ~

risation compromises the welfare and identity of people belonging '© poor countrieg

jobalisation co :

«Gh ies among nations and pe,

Market-driven globalisation increases the economic disparities among, id People

@ Market ais

Jobalisation, MNCs have gained strong position in the developing countrieg,

. aresult of GI ae

if jomestic companies are forced to face stiff competition

due to which di

Outsourcing — | - /

Outsourcing refers to contracting out some of its activities to a third party which were earlie,

performed by the organisation. For example, many companies have started outsourcing security

service to outside agencies on a contractual basis.

* Outsourcing is one of the important outcomes of the

globalisation process.

© It has intensified in recent times because of the growth of

fast modes of communication, particularly the growth of

Information Technology (IT).

© With the help of modern telecommunication links, the text,

voice and visual data in respect of these services is digitised

and transmitted in real time over continents and national

boundaries

* India has become a favourable destination of outsourcing

for most of the MNC’s because c

» Availability of Skilled Manpower: India has vast skilled

manpower which enhances the faith of MNCs for

investment in India

» Favourable Government Policies: MNCs get various types

of lucrative offers from the Indian Government such as

tax holidays, tax concessions, etc

» Low Wage Rates and availability of cheap labour in India

for skilled work.

Considerable growth of Indian IT industry, which has

proved its competitive strength in the world.

For example, Indian Business Process Outsourcing (BPO) companies

Prominence and earning precious foreign exchange.

World Trade Organisation (WTO)

Origin of World Trade Organisation (WTO)

are already gaining

Prior to WTO, General Agreement on Trade and Tariff (GATT) w

organisation, in 1948 with 23 countries. GATT was se

agreements by providing equal opportunities to

founded in 1995 as the

as established as global trade

up to administer all multilateral trade

all countries in the international market. WIO

successor organisation to the GAT:

Liberalisation, Privatisation and Globalisation, An Appraisal

an

* The WTO agreements cover trade in goods as well as services, to facilitate international

trade.

EO,

© At present, there are 164 member countries of WTO and aQnvl ORG,

all the members are required to abide by laws and policies

framed under WTO rules.

As an important member of WTO, India has been in the

forefront of framing fair global rules, regulations and

advocating the interests of the developing world

India has kept its commitments made to the WTO, India

has taken reasonable steps to liberalise trade by removing,

‘The World Trade Organization

quantitative restrictions on imports and reducing, tariff rates. (WTO) intend to eupervien sn

* Some Major Functions of WTO:

(i) To facilitate international trade (both bilateral and multi-lateral trade) through removal

of tariff as well as non-taritt barriers

(1) To establish a rule-based trading regime, in which nations cannot place arbitrary

restrictions on trade

(iii) To enlarge production and trade of services;

(iv) To ensure optimum utilisation of world resources; and

(v) To protect the environment

Should India be

ber of WTO?

Some scholars are of the view that there is no use for a developing country like India to be a

member of the WTO. According to them

Major volume of international trade occurs among the developed nations; and

Developing countries are being

cheated as they are forced to open up their markets for

developed countries and are not allowed access to markets of developed countries

Bilateral Trade: Trade (export and import) between two countries is known as Bilateral Trade

Multi-lateral Trade: Trade between more than two countries is known as Multi-lateral Trade

Tariff Barriers: The barners which are imposed on imports of goods and services to make

them relatively costier and to protect the domestic producers trom the stitt international

competition are known as Tant Baers. For example, Import Duties.

Non-Taritt Barriers: The barriers which are imposed on quantity of import and export of goods

and services. For example, Quota and Import Licensing

3.7 AN APPRAISAL OF LPG POLICIES (ECONOMIC REFORMS)

Economic retorms created mixed reactions at ditterent

and negative aspects of econ.

vels. Let us discuss some of the pest

1 reforms

guments in Favour ot Foonomic Reforms.

The following are some of the important arguments advanced in favour of economic reforms

13

Liberalisation, Privatisation and Globalisation An Appraisal 3

Gi) Removal of subsidy: Removal of fertilizer subsidy inc reased the cost of production,

which adversely affected the small and marginal fara}

(in) Liberalisation and reduction in import duties: This sector has been experiencing, a number

of policy changes such as: (a) Reduction in import duties on agricultural product

(b) Removal of minimum support price; and (c) Lifting of quantitative restrichons

on agricultural products. All these policies adversely affected the Indian farmers a»

they now have to face increased international competition

(iv) Shift towards cash crops: Due to Export-oriented policy strategies in agriculture, the

production shifted from food grains to cash crops for the export market. It led to rise

in the prices of food grains.

3. Low level of Industrial Growth: Industrial growth recorded a slowdown due to the

following reasons:

(i) Cheaper Imported Goods: Due to globalisation, there was a greater flow of goods and

capital from developed countries and as a result, domestic industries were exposed

to imported goods. Cheaper imports replaced the demand for domestic goods and

domestic manufacturers started facing competition from imports. For example, € heaper

Chinese goods pose a big threat to Indian manufacturers

(ii) Lack of infrastructure facilities: The infrastructure facilities, including power supply,

have remained inadequate due to lack of investment.

(iii) Non-Tariff Barriers by Developed countries: All quota restrictions on exports of textiles

and clothing have been removed from India. But some developed countries, like USA

have not removed their quota restrictions on import of textiles from India

4, Ineffective Disinvestment Policy: The government has always fixed a target for

disinvestment of Public Sector Enterprises (PSEs). For instance, in 2014-15, the target was

% 56,000 crore, whereas, the achievement was about & 34,500 crore.

However, according to some scholars, the disinvestment policy of government was not

successful because:

¢ The assets of PSEs were undervalued and sold to the private sector.

* Moreover, such proceeds from disinvestment were used to compensate shortage of

government revenues rather than using it for the development of PSEs and building,

social infrastructure in the country.

5. Ineffective Tax Policy: The tax reduction in the reform period was done to generate larger

revenue and to curb tax evasion. But, it did not result in increase in tax revenue for the

government.

* Tariff reduction decreased the scope for raising revenue through customs duties.

* Tax incentives provided to foreign investors to attract foreign investment further

reduced the scope for raising tax revenues.

6. Spread of Consumerism: The new policy has been encouraging a dangerous trend of

consumerism by encouraging the production of luxuries and items of superior consumption.

Inchan Economic Developmen

3.14

.d only in some select areas in the servicy,

7, Unbalanced Grow tly Growth has been concentrates

hnology, finance, entertainment, tray,

sector, such as telecommunication, information te |

and hospitality services, real estate and trade, rather than vital sectors, such as agricultury

and industry, which provide livelihood to millions of people in the country

oe DaMONETIOATION 000000 __se

On the 8" of November, 2016, the Government of India made an announcement with profound

implications for the Indian economy. It was decided to demonetise high value currency notes

of denomination of @ 500 and % 1,000 with immediate effect, ceasing to be legal tender, excep

for a few specified purposes. Demonetisation is the act of removing a currency unit of its status as

Legal Tender.

These notes accounted for almost 86% of the country’s cash supply. As per the scheme, people

had to deposit the invalid currency in the banks and restrictions were also placed on cash

withdrawals. In other words, restrictions were placed on the convertibility of domestic money

and bank deposits.

The aim of demonetisation was to curb corruption, counterfeiting the use of high denomination

notes for illegal activities and especially the accumulation of ‘black money’ generated by income

that has not been declared to the tax authorities.

Features of Demonetisation

1, Demonetisation is viewed as a ‘Tax Administration Measure’. Cash holdings arising from

declared income was readily deposited in banks and exchanged for new notes. However,

people holding black money had to declare their unaccounted wealth and pay taxes ata

penalty rate.

2. Demonetisation is also interpreted as a shift on the part of government indicating that Tax

Evasion will no longer be tolerated or accepted.

3. Demonetisation also led to channelizing savings into the formal financial system. Though,

much of the cash deposited in the banking system is bound to be withdrawn. But, some

of the new deposits schemes offered by the banks will continue to provide a base loans,

at lower interest rates.

4. Demonetisation also aims to create a less-cash or cash-lite economy, i. channeling more

savings through the formal financial system and improving tax compliance

* However, digital transactions require internet connectivity as they need cell phones for

customers and Point-of-Sale (PoS) machines for merchants.

* On the contrary, these disadvantages are counterbalanced by an understanding that it

helps people into the formal economy, thereby increasing financial saving and reducing

tax evasion.

PANN? BAY DEORE? A> Anvatine 318

NAS DOOR MAREE RE SACTHONS OF SOIR

TPE A WHO al IVAN CUESTE the digtal enaNOMY

2 Thales at¥ent who aie Danny Ait of the digital annnomy who have been covered

wersier day Dinan Agcounts ant RuPay oars and

The ativent who ae f

\

SOVRIRANL WAN cVHal Hansactons.

| Rank ceoosits Hommased

NNRASE HN ANAM SAVINGS

2 Pevate weath | Desines shoe some Nigh demonetised notes were not retumed and real

2 DOORS te

het.

achons AMO ST New users and use of RuPay Canis and Aadhar

2X) Payment S\stem (AEPS) increased,

Prices dectined

Rise in Moome tax collection decause of increased disclosure

3.9 GOODS AND SERVICES TAX (GST)

GST of “Gots and Services Tan’ is a comprehensive Indirect Tay which has replaced many

erent Tanes it

sand Service Tay Act was passed in the Parliament an 29%

March, OU, The Act came inte effect on TY July, 2017, It is a comprehensive, multi-stage,

i mhasAt tar th every Value addition, GST has been identified as one of

portant pWebindependence

is levie

ta uNplemental GST tollowing the crado of One Nation and One

av onder to ensure the smouth flow of goods and services

cross,

‘being 2 SOURS Of FEVER for growth also plays a key role in making the

Apavers: Patective taxation ensures that public funds are effectively

1g Social objectives for sustainable development

ner Henetits GST is expectad to improve the ease of doing business in tar

oe eARuee the tay burton by eliminating tacon-tay, improve tay administration

mitigate fa evasion, broaden the onganisal segmentot the economy and boost tay revenues,

Value Added Tay, Service Tay, Excise Duty, Sales

ete) and 23 cesses of the Centre and the States, thereby eliminating the need for filing

ultiple returns and assessments [thas rational

# GST has replaced (7 indirect taves (5

m Ni the tay troatment of goods and services

along the supply chain tram prakucers to consumers.

# GST ischarged at each stage of Value addition and the supplier ott-sets the levy on iputs

in the previous stages of Value chain through the tay erat mechanism

indian Economic Deve,

Phen

3.16 added GST to the consumer, Making gg

sses on the

© The last dealer in the supply chain passes

a destination-based consumption tax

helps in avoig,

f value chain iding 4

i ‘h stage O} e

credit at ead)

acted to reduce prices of commog,."

s

* The provision of availing input cope

5} ich i

cascading effect (tax on tax) under GST, whi

and benefit the consumers.

‘ypes of Taxes under GST

‘he types of taxes levied under GST are:

It is the GST Je’

(0) Central Goods and Services Tax (CGST): It is the

of goods or services by the Centre ; ‘he ‘Intra-State’

(ii) State Goods and Services Tax (SGST): It is the GST Ievied on the ‘in © SUPPLy of

i ith legislature).

goods or services by the State (including Union Territories ~ ve Sheen ;

(iii) Integrated Goods and Services Tax IGST):Itis the GST lev) pene papas . Supply

of goods or services and is collected by the Centre. IGST is eq} "UM toa)

of CGST and SGST.

vied on the ‘Intra-State’ pp

ome Facts about GST . .

1. Single Tax Structure: GST aims to subsume a multiple taxes into one single tax across the

country and make goods uniformly priced across India. Though, in this process, some

goods become costly and some become cheaper.

2. Effect on Prices: With the implementation of GST, luxury goods have become costlier,

while items of mass consumption have become cheaper.

3. Consumption Based Tax: GST is a ‘Consumption Based Tax’, i.e. the tax is received by

the state in which the goods or services are consumed and not by the state in which such

goods are manufactured. For example, if a product is manufactured in Tamil Nadu and

travels through the country before it reaches Delhi, where the buyer or consumer pays tat

for it. Both the Centre and the State have their share in this tax.

4. Invoice Matching: The Indian GST will have a mechanism of matching of invoices. Input

Tax Credit of purchased services and goods will be available only when the inward supply

details filed in by buyer matches the outward supplies details filed in by supplier. GST

network is a self-regulating mechanism, which not only checks tax frauds and tax evasion

but also brings in more and more businesses into the formal economy.

5. Anti-Profiteering Measure: It is one of the key features of the recently implemented GST haw.

‘These measures prevent entities from making excessive Profits. As per the Anti-Profiteeti"g

rules, the benefit of reduced GST tax rates and increased input tax credit should be passed

on to the consumer in the form of reduced price. A National Anti-Profiteering Authority

(NAA) has been constituted for efficient administration of these provisions. °

. Registration under GST: A business whose a

% 20 lakhs has to compulsorily register und

% 10 lakhs for North Eastern and hilly state:

Seregate turnover in a financial year excee!!

&r Goods and Services Tax, This limit is

S flagged as special category states.

37

es to be paid on

GST charg

Tax. The

supplier at each e is permitted to avail credit of G

PI F

services and

T paid on the purchase of goods and or

an set off this credit against the GST payable on the supply of goods and services

to be made by him. Thus, the final consumer bears the

SST charged by the last supplier in the

supply chain, with set-off benefits at all the previous stages. Hence, the tay will be levied only

on the value added, which results in avoiding double taxation.

if tay payable by a manufacturer on the output, Le. final product is € 450 and he

= already paid tax of € 300 on input. Le. purchases, then he can claim ‘Input Cradit’ of £300

and he needs to deposit only & 150 in taves.

INPUTS

A BandC)

GST paid on purchase of

input A= 70 . OUTPUT

GST paid on purchase of eect cetscc ote GST on

input B = 2130 Output = 7450

GST to be paid by Manufacturer = GST on Output ~ GST on Inputs = £450 - (#70 + € 130 + € 100) = 7 150

GST wall benefit in the following ways

Reduction in overall tax burden

No hidden taxes

Development of a harmonised national market for goods and services.

4 Higher disposable income in hand, education and essential needs.

Customers to have wider choice.

© Increased economic actwity

More employment opportunities

Key Features of GST

1. Apy | 5) The terntorial spread of GST is the whole country

2 AF Sur

py of Conds and Scnices GST is applicable on the ‘supply of goods

or services as against the earlier concept of tax on the manutacture or sale of goods OF On

the provision of services

nanan eewrnensie EVE Ope,

3.18 ple of destination-based CONSUMption

ci

yn the princip

-based taxation. '

in-bas treated as inter-State supplies and Woulq

srvices iS

3. Consumption Based Tax: It is based e

tax against the earlier principle of origi

C s and se eee

GST on Imports: Import of goods ani ustoms duties

be subject to IGST in addition to the applicable ¢ tually agreed upon by the Cen,

GST Rates: CGST, SGST and IGST are levied at eee are four tax slabs namely 5

2 7 oa nc. baad

the aegis of the GST Cour ies to SEZ are zevo-rated

regenera Eo on

%, 18% Yo

. nt of t

Payment of GST: There are various modes of Peete

including Internet banking, debit/credit card an

(NEFT)/Real Time Gross Settlement (RTGS).

T Council :

balboa Services Tax Council is a constitutional body for making recommendations to the

Union and State Government on issues related to Goods and Service Tax.

1. Constitution: As per Article 279A of the amended Constitution, the GST Council which

will be a joint forum of the Centre and the States, shall consist of the following members.

© Chairperson: Finance Minister.

® Vice Chairperson: Chosen amongst the Ministers of State Government.

° Members: MoS (Finance) and all Ministers of Finance / Taxation of each State.

2. Quorum. 50% of the total number of Members of the Goods and Services Tax Council shall

constitute the quorum at its meetings.

=

s

ax available to the taxpaye

1 Electronic Funds Transfer

a

3. Majority required for taking Decisions: Every decision of the GST Council shall be taken

at a meeting, by a majority of not less than 75% of the weighted votes of the members

Present and voting, in accordance with the following principles,

* Vote of the Central Government shall hav

cast, and

* Votes of all the State Governments taken together shall have a weightage of two-thirds

of the total votes cast, in that meeting,

namely:

© a weightage of one-third of the total votes

Indan ECONOMIC Develoany,

9.2

~ Features of Demonetisation

1 Itis viewed as a Taw Administration Measure. potatoes

© Ithas indicated that Tax Evasion will no 1onge" raver

2 ited to channelizing savings into the formal finan

. 7 nlite economy.

‘ax on the supply

i tax levied on

4. Itaims to create a less-cash or cas!

* Goods and Services Tax (GST)is & a

manufacturer to the consumer. It is a value a

of goods and services, right trom

manufacture, sale and consump,

of goods and services,

important Dates Relevant to this Chapter a,

1948

Establishment of General Agreement on Trade and Tariff Z

(GATT) with 23 countries as the global trade organisation

Economie Crisis in india — _————

New Economic Policy (NEP) or Economic Reforms:

Liberalisation, Privatisation and Globalisation (LPG) Policy was

announced by Indian Government

World Trade Organisation (WTO) was founded as successor | 1995

to GATT

Removal of quantitative restrictions on imports of manufac- April, 2001

tured consumer goods and agricultural products

Launch of Make initiative September, 2014

Demonetisation of Currency by indian Government [8 November, 2016

Goods and Services Tax (GST) Act passed in the Parliament | 29" March, 2017

Goods and Services Tax (GST) Act came into Effect 1" July, 2017

[HOTS] REMEMBERING + UNDERSTANDING « APPLICATION BASED QUESTIONS

Q.1. Outof Liberalisation, Privatisation and Globalisation, which term matches the best from the following

statements:

\) involves deregulation and reduction of government controls and greater autonomy of private

investment.

(1), Itmeans integration of economy of the country with the world economy.

(1) implies greater role of private sector in the economic activities of the country.

(wv) Itaims to remove entry and growth restrictions on the Private Sector.

(v)_Itinvolves selling off part of the equity of public se :

ctor undertaki i

(vi). Itaims to create a borderless world, ngs to the public.

Ans. (i) Liberalisation

(ii) Globalisation

(iii) Privatisation

(iv) Liberalisation

(v) Privatisation

(vi) Globalisation

“iperaiisation, Privatisation and Globalisation: An Appraisal 3.23

Q.2. Match the items given under‘A’ with the suitable statements under ‘B'

(A) (B)

(i) Reforms in Indirect Taxes (a) Industrial Sector Reforms.

(ii) Devaluation of Rupee (b) Financial Sector Reforms

(ili) Decrease in role of Public Sector | (c) Tax Reforms

(iv) Removal of Export Duties (d) Foreign Exchange Reforms

(v) Origin of Private Banks L(e) Trade and Investment Policy Reforms

Ans. (i) (i) d; (il) a; (iv) @; (v) b.

Q.3. "Process of Globalisation has produced only positive results for India and other countries.” Comment

Ans. The given statement is incorrect. Process of globalisation has produced positive as well as negative

results. Globalisation has been criticized because.

* Benefits of globalisation accrue more to developed countries as they are able fo expand their markets

in other countries,

* Globalisation compromises the welfare and identity of people belonging to poor countries,

+ Market-driven globalisation increases the economic disparities among nations and people.

Q.4, Economic Reforms were widely criticized because it neglected agricultural sector. Do you agree?

Ans. Yes, |agree with the given statement. New Economic Policy neglected the agricultural sector as compared

{0 industry, trade and services sector,

() Public investment in agriculture sector was reduced in the reform period.

(i) Removal of fertilizer subsidy increased the cost of production, which adversely affected the small

and marginal mers.

(iil) After commencement of WTO, a number of policy changes were made: (a) Reduction in import

uties on agricultural products; (b) Removal of minimum support price; and (c) Lifting of quantitative

restrictions on agricultural products. All these policies adversely affected the Indian farmers as they

now have to face increased international competition.

(iv) Due to Export-oriented policy strategies in agriculture, the production shifted from food grains to

cash crops for the export market It led to rise in the prices of food grains.

Q.5. ‘The opening up of the Indian Economy has led to a rapid increase in Foreign Direct Investments.

and Foreign Exchange Reserves of the country’. Defend or refute the given statement.

(CBSE, Sample Paper 2020}

The given statement is true to its character. The foreign investments, both Foreign Direct Investment

(FDI) and Foreign institutional Investment (Fil), have increased trom about US $100 million in 1990-91

fo US$ 73.5 billion in 2014-15. This has changed the status of India from a ‘begging bow!’ in 1990's toa

‘self-dependent’ economy in the present ages

Ans.

Due to the opening up of the Indian Economy, she has become one of the largest foreign exchange

reserve holders in the world. India been able to register an increase in the foreign exchange reserves

from about US S$ 6 billion in 1990-91 to about US $ 321 billion in 2014-15.

Q.6. “Recently the Government of India has decided to merge MTNL and BSNL on account of rising

losses.” Justify the steps taken by the Government of India (CBSE, 2020 (58/2/1)}

The decision taken by the Government of India to merge BSNL and MTNL is quite appropriate. The

Government has merged the two loss incurring businesses, with a motive to

(0) Achieve higher economic and functional efficiency,

(i) Minimise possible losses.

Ans.

walisation, Privatisation and Globalisation. An Appraisal 3.27

(iv) Shift towards cash crops: Due to export-oriented policy strategies in agriculture, the production

Shifted from food grains to cash crops for the export market. It led to rise in the prices of food grains.

15. Why has the industrial sector performed poorly in the reform period?

ns. The industrial sector performed poorly in the reform period because of following reasons:

() Cheaper Imported Goods: Due to globalisation, there was a greater flow of goods and capital from

developed countries. As a result, domestic industries were exposed to imported goods. Cheaper

Imports replaced the demand for domestic goods and domestic manufacturers started facing

competition from imports.

(ii) Lack of infrastructure facilities: The infrastructure facilities, including power supply, have remained

inadequate due to lack of investment.

(ii) Non-Tariff Barriers by Developed countries: All quota restrictions on exports of textiles and clothing

have been removed from India. But some developed countries, like USA have not removed their

quota restrictions on import of textiles from India.

16. Discuss economic reforms in India in the light of social justice and welfare.

\ns. The economic reforms have been criticized in the light of social justice and welfare due to following

reasons:

() Growing Unemployment: Though the GOP growth rate has increased in the reform period, but such

growth failed to generate sufficient employment opportunities in the country.

Removal of subsidy: Removal of fertilizer subsidy increased the cost of production, which adversely

affected the small and marginal farmers.

oD

(ii) Rise in the prices of Food grains: Due to export-oriented policy strategies in agriculture, the production

shifted from food grains to cash crops for the export market. It led to rise in the prices of food grains.

(iv) Cheaper Imported Goods: Due to globalisation, there was a greater flow of goods and capital from

developed countries and as a result, domestic industries were exposed to imported goods.

(v) Spread of Consumerism: The new policy has been encouraging a dangerous trend of consumerism

by encouraging the production of luxuries and items of superior consumption.

(vi) Unbalanced Growth: Growth has been concentrated only in some select areas in the services sector,

‘such as telecommunication, information technology, finance, entertainment, travel and hospitality

services, real estate and trade, rather than vital sectors, such as agriculture and industry, which

provide livelihood to millions of people in the country.

1. Deficit in Balance of Payments arises when foreign payments for

____ exceed foreign receipts

trom

2. Economic reforms have _ __ (Increased/ Reduced) the role of the public sector.

_ means removal of entry and growth restrictions on the private sector.

_______ is one of the taxes eliminated after implementation of Goods and Services Tax

(GST) {CBSE, 2020 (58/31)

5. As per Financial Sector Reforms, the role of RBI was reduced from ___ to facilitator of

financial sector.

6. The aim of

world economy.

_ (Liberalisation / Globalisation) is to integrate the Indian economy with the

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Book Applied Mathematics Class XIIDocument382 pagesBook Applied Mathematics Class XIIAshley Noel83% (6)

- Management BST PDF NotesDocument12 pagesManagement BST PDF NotesAshley NoelNo ratings yet

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Document12 pagesStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Ashley NoelNo ratings yet

- The Struggle You'Re in Today Is Developing The Strength You Need For TomorrowDocument1 pageThe Struggle You'Re in Today Is Developing The Strength You Need For TomorrowAshley NoelNo ratings yet

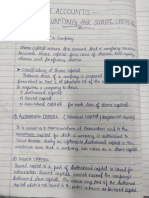

- Accounting 1or Siiure Cat: Company AccountsDocument6 pagesAccounting 1or Siiure Cat: Company AccountsAshley NoelNo ratings yet

- PT2 Applied Class 12Document6 pagesPT2 Applied Class 12Ashley NoelNo ratings yet

- Xii Acc Kvs Ro Agra 2021-22 Term 1Document98 pagesXii Acc Kvs Ro Agra 2021-22 Term 1Ashley NoelNo ratings yet

- Chapter 3-LPG (Sandeep Garg)Document26 pagesChapter 3-LPG (Sandeep Garg)Ashley Noel43% (7)

- Xii Acc Kvs Ro Agra 2021-22 Term 1Document98 pagesXii Acc Kvs Ro Agra 2021-22 Term 1Ashley NoelNo ratings yet