Professional Documents

Culture Documents

Brief History of Taxation in The Phillipines

Uploaded by

Mica BarrunOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brief History of Taxation in The Phillipines

Uploaded by

Mica BarrunCopyright:

Available Formats

BRIEF HISTORY OF TAXATION IN THE PHILLIPINES

It all started from the Ancient Filipinos, where they pay their taxes to their Datu or the

Chiefs for the protection they gave to them, the tax was termed buwis. Everyone is required to

pay their taxes, except for the Datu/Chieftain’s household. Punishment for not paying taxes was

also implemented on this period.

The arrival or invasion of the Spanish People from 1521 to 1898 gave the Filipinos

modern concepts of taxation, wherein 16 years old to 60 years old were forced to pay tributes

or tributo to the King of Spain through the Colonial Government worth 8 reales or 1 peso per

year, but there are also other forms of payment like gold, chickens, textile, rice and forced labor

or Polo Y Servicio.

In 1884, the tribute was abolished and was replaced by the cedula or sedula, a certificate

identifying the tax payer that needs to be carried all the time. If someone is not able to present

their cedula to a guardia civil they will be imprisoned for being “indocumentado”, which means

that they lack valid document or legal personal identification necessary to prove their identity.

It was followed by the 1987 Philippine Constitution, stating that it “sets limitations on the

exercise of the power to tax. The rule of taxation shall be uniform and equitable. The congress

shall evolve a progressive system of taxation”, wherein the Philippines covers both national and

local. National Taxes refer to national internal revenue taxes imposed and collected by the

national government through the BIR or Bureau of Internal Revenue, while the Local Taxes is

those imposed and collected by the local government.

Lately the current President of the Philippines, President Rodrigo Duterte, implemented

the TRAIN Law or Tax Reform for Acceleration and Inclusion which was signed last January

01, 2018, which seeks to correct a number of deficiencies in the tax system to make it simpler,

fairer, and more efficient. Wherein the rich will have a bigger contribution and the poor will

benefit more from the government’s program and services.

You might also like

- Evolution of Philippine TaxationDocument26 pagesEvolution of Philippine TaxationAliza MorallosNo ratings yet

- Evolution of Philippine TaxationDocument6 pagesEvolution of Philippine TaxationGuki Suzuki0% (1)

- Evolution of Philippine TaxationDocument4 pagesEvolution of Philippine TaxationMay MayNo ratings yet

- Evolution of Philippine TaxationDocument22 pagesEvolution of Philippine TaxationRaymart OsiaNo ratings yet

- 13 PDFDocument9 pages13 PDFJhona NinalgaNo ratings yet

- Taxation FinalDocument16 pagesTaxation FinalGhetto Spider100% (1)

- Evolution of The Philippine Taxation, Taxation in Spanish PhilippinesDocument12 pagesEvolution of The Philippine Taxation, Taxation in Spanish PhilippinesAnge Napalia100% (2)

- Evolution of Philippine TaxationDocument11 pagesEvolution of Philippine TaxationJosh Lozada100% (4)

- RPH 2Document13 pagesRPH 2BJ AmbatNo ratings yet

- Philippine Taxation History and SystemDocument58 pagesPhilippine Taxation History and SystemThea MallariNo ratings yet

- Fiscal Policy From 1946 To PresentDocument7 pagesFiscal Policy From 1946 To PresentRhoxane Santos100% (1)

- Philippine Tax History and ConceptsDocument22 pagesPhilippine Tax History and ConceptsBJ Ambat100% (1)

- Fiscal Policy From 1946 To PresentDocument17 pagesFiscal Policy From 1946 To PresentJerlyn Loto100% (1)

- The Philippine Reform and Taxation in The PhilippinesDocument24 pagesThe Philippine Reform and Taxation in The PhilippinesBrylle Angelo PolintanNo ratings yet

- Philippine Taxation Under American Period (1898-1935)Document3 pagesPhilippine Taxation Under American Period (1898-1935)Christopher TorcelinoNo ratings yet

- Taxation During Spanish ColonizationDocument44 pagesTaxation During Spanish Colonizationgladyl bermioNo ratings yet

- Readings in Philippine History Evolution of Philippine TaxationDocument4 pagesReadings in Philippine History Evolution of Philippine TaxationAngel Joseph Tejada100% (1)

- Cédula Tax and Residence Certificate in the Philippines 1898-1946Document8 pagesCédula Tax and Residence Certificate in the Philippines 1898-1946Geansylle BollenaNo ratings yet

- Pre-Hispanic Period: Evolution of Philippine TaxationDocument8 pagesPre-Hispanic Period: Evolution of Philippine TaxationAlias SimounNo ratings yet

- Taxation During Commonwealth PeriodDocument18 pagesTaxation During Commonwealth PeriodLEIAN ROSE GAMBOA100% (2)

- 8 Carper-And-The-Future-Of-Agrarian-Reform-In-The-Philippines-Group-8Document5 pages8 Carper-And-The-Future-Of-Agrarian-Reform-In-The-Philippines-Group-8Random internet person100% (1)

- Pre-Colonial Philippine Taxation EvolutionDocument23 pagesPre-Colonial Philippine Taxation EvolutionMarc Edouard100% (1)

- Lesson 3 Evolution of Philippine TaxationDocument8 pagesLesson 3 Evolution of Philippine TaxationZendee Jade MaderaNo ratings yet

- Landownership in the Philippines under Spanish ruleDocument1 pageLandownership in the Philippines under Spanish ruleツBienNo ratings yet

- The Two Faces of The 1872 Cavite MunityDocument9 pagesThe Two Faces of The 1872 Cavite Munityjefferson paculbaNo ratings yet

- Evolution of The Taxation in The Philippines Post War Marcos Aquino Ramos AdministrationDocument4 pagesEvolution of The Taxation in The Philippines Post War Marcos Aquino Ramos AdministrationSairah Camille ArandiaNo ratings yet

- The First CaricatureDocument4 pagesThe First CaricatureJunayla Estares AzcarragaNo ratings yet

- MacroEconomics - EstradaDocument4 pagesMacroEconomics - EstradaDahzle Kaye100% (1)

- Group 2 - Agrarian ReformDocument2 pagesGroup 2 - Agrarian ReformMarco RegunayanNo ratings yet

- Negative Effects of TRAIN LAW: Increase Inflation, Worsen Poverty, Income Inequality and Higher Revenue LossesDocument9 pagesNegative Effects of TRAIN LAW: Increase Inflation, Worsen Poverty, Income Inequality and Higher Revenue LossesChristine NolascoNo ratings yet

- Taxation During The Commonwealth Period (1935-1945Document2 pagesTaxation During The Commonwealth Period (1935-1945VALENCIA, JR. ANGELITONo ratings yet

- Taxation during the Commonwealth PeriodDocument2 pagesTaxation during the Commonwealth PeriodRhoxane SantosNo ratings yet

- José Basco y Vargas' Reforms in the PhilippinesDocument3 pagesJosé Basco y Vargas' Reforms in the PhilippinesJoe Ronnie TorresNo ratings yet

- Tax Reform Package Biggest Christmas and New Year'S Gift': - Dof ChiefDocument4 pagesTax Reform Package Biggest Christmas and New Year'S Gift': - Dof ChiefShane Nicole Delacruz100% (3)

- Agrarian Reform DuringDocument5 pagesAgrarian Reform DuringBryne BoishNo ratings yet

- Agrarian Reform Policies in the PhilippinesDocument68 pagesAgrarian Reform Policies in the PhilippinesLonelyn LatumboNo ratings yet

- RizalDocument1 pageRizalAudzkieNo ratings yet

- Module 12: Taxation During The SpanishperiodDocument3 pagesModule 12: Taxation During The SpanishperiodAMORA ANTHONETHNo ratings yet

- The Magna Carta of Social Justice and Economic Freedom - An Unapplied Policy - 1Document7 pagesThe Magna Carta of Social Justice and Economic Freedom - An Unapplied Policy - 1vinlava100% (1)

- Antonio Pigaffeta and Cavite Mutiny ReflectionDocument2 pagesAntonio Pigaffeta and Cavite Mutiny ReflectionCriszia May MallariNo ratings yet

- Pos Cavite MutinyDocument3 pagesPos Cavite MutinyDianne BalagsoNo ratings yet

- Section 3: The Tax System and The Philippines Development ExperienceDocument13 pagesSection 3: The Tax System and The Philippines Development ExperiencePearl ArcamoNo ratings yet

- Philippine Tax System Changes Under RA 10963Document17 pagesPhilippine Tax System Changes Under RA 10963franz mallariNo ratings yet

- Rizal's 19th Century Philippines: Political, Social and Economic Aspects of Spanish Colonial RuleDocument3 pagesRizal's 19th Century Philippines: Political, Social and Economic Aspects of Spanish Colonial RuleMichelle Gutierrez SibayanNo ratings yet

- Difference Between Malolos Constitution and The Present Constitution of The Philippines Malolos Constitution (1899)Document2 pagesDifference Between Malolos Constitution and The Present Constitution of The Philippines Malolos Constitution (1899)Jhoyvhie Nolasco100% (1)

- TAXATION With ActivityDocument14 pagesTAXATION With ActivityAriel Rashid Castardo BalioNo ratings yet

- Evolution of Philippine TaxationDocument8 pagesEvolution of Philippine TaxationMae Niverba67% (3)

- Pre-Colonial EraDocument126 pagesPre-Colonial Era1400440% (5)

- LESSON 6 The Political Structure in The 19th Century in The PhilippinesDocument7 pagesLESSON 6 The Political Structure in The 19th Century in The PhilippinesIan DenverNo ratings yet

- The Indolence of The Filipinos by Jose RizalDocument2 pagesThe Indolence of The Filipinos by Jose RizalTami DizonNo ratings yet

- Kartilya NG KatipunanDocument7 pagesKartilya NG KatipunanEloisa Espino GabonNo ratings yet

- SYNTHESIS AnsongDocument6 pagesSYNTHESIS Ansongrowena veruasaNo ratings yet

- Garcia, Rochene I - Reaction Paper For Group 1's PresentationDocument4 pagesGarcia, Rochene I - Reaction Paper For Group 1's PresentationRochene GarciaNo ratings yet

- 01 Handout 1 HistoryDocument4 pages01 Handout 1 HistoryVilma Cardoza100% (1)

- Readings 2: (Proclamation) Act of Proclamation of Independence of The Filipino People Pre-Reading Activity Background of The AuthorDocument4 pagesReadings 2: (Proclamation) Act of Proclamation of Independence of The Filipino People Pre-Reading Activity Background of The AuthorChristine EvangelistaNo ratings yet

- Agrarian Reform G3 FinalDocument38 pagesAgrarian Reform G3 FinalCRISTY LOU SAMSON BSED-1No ratings yet

- Post-War Agrarian Reforms in the PhilippinesDocument3 pagesPost-War Agrarian Reforms in the Philippineskimboy bolañosNo ratings yet

- Role of Katipunan LeadersDocument4 pagesRole of Katipunan Leadersmikol vegaNo ratings yet

- UntitledDocument2 pagesUntitledErirose ApolinarioNo ratings yet

- Taxation 101: Basic Rules and Principles in Philippine TaxationDocument8 pagesTaxation 101: Basic Rules and Principles in Philippine TaxationZamZamieNo ratings yet

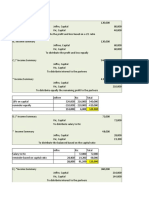

- Adobas Auditing FinalsDocument10 pagesAdobas Auditing FinalsMica BarrunNo ratings yet

- Dagcasin Denric Partnership SeatworkDocument4 pagesDagcasin Denric Partnership SeatworkMica BarrunNo ratings yet

- Rosete Thesis Printing EditedDocument90 pagesRosete Thesis Printing EditedMica BarrunNo ratings yet

- Dagcasin Denric Partnership SeatworkDocument4 pagesDagcasin Denric Partnership SeatworkMica BarrunNo ratings yet