0% found this document useful (0 votes)

4K views6 pagesTally Module 1 Assignment Solution

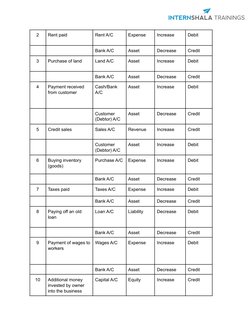

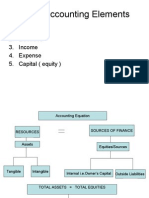

The document provides examples of classifying different types of business transactions as assets, liabilities, revenues, expenses or equity. It also provides examples of journal entries for common business transactions like cash sales, purchases, payments, and additional investments. The document aims to help students understand how to properly classify accounts and record basic accounting journal entries.

Uploaded by

charu bishtCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

4K views6 pagesTally Module 1 Assignment Solution

The document provides examples of classifying different types of business transactions as assets, liabilities, revenues, expenses or equity. It also provides examples of journal entries for common business transactions like cash sales, purchases, payments, and additional investments. The document aims to help students understand how to properly classify accounts and record basic accounting journal entries.

Uploaded by

charu bishtCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Topic 1: Classification of Financial Accounts

- Topic 2: Impact of Transactions on Accounts

- Topic 3: Transaction Recording