Professional Documents

Culture Documents

Revised Corporation Code

Uploaded by

jenelyn laygo0 ratings0% found this document useful (0 votes)

55 views32 pageshistory

Original Title

CORPORATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthistory

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

55 views32 pagesRevised Corporation Code

Uploaded by

jenelyn laygohistory

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 32

MODULE 3 o Explained the o Case digest/research

difference of (Supreme Court

CORPORATIONS corporation and decisions relevant to

partnership; topics)

TITLE OF THE General provisions of o Illustrated a o Drafting of articles of

MODULE corporations corporate principle in incorporation

law;

LEANING o To describe corporate o Outlined the

OBJECTIVES firm; incorporation process ASSESSMENT

o To explain the ; o Formative evaluation

difference of o Explained the need of through quiz via

corporation and being registered; goggle classroom

partnership; o Analyzed the o Major examination

o To illustrate a organization of TIME NEEDED Five (5) hours

corporate principle in corporation;

law; o Explained the

o To summarize the composition of

incorporation process corporate officers;

; o Compared board of

o To explain the need directors and board

of being registered; of trustees

o To analyze the

organization of

corporation; STRUCTURE o General provisions;

o To explain the MODULE 3

o Incorporation and

composition of organization of REVISED CORPORATION CODE

corporate officers; private corporations;

o To compare board of R. A NO. 11232

o Board of

directors and board directors/trustees

of trustees and officers TITLE I

GENERAL PROVISIONS

DEFINITION AND CLASSIFICATIONS

LEARNING o described corporate EXERCISES/ACTIVITIE o Lecture/interactive

OUTCOMES firm; S discussion via zoom

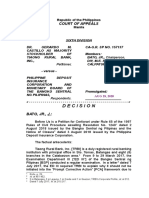

Section 1. Title of the Code. - This Code shall be corporation, nor is the debt or credit of the latter

known as the "Revised Corporation Code of the that of the former.

Philippines". What is meant by “Piercing the Veil of Corporate

It has a personality separate and distinct from Entity”?

The present Revised Corporation Code (r. a. 11232), the persons composing it, as well as from any other That the separate juridical personality of the

took effect on February 23, 2019. legal entity to which it may be related. corporation may be disregarded, where such

separate personality is availed:

Section 2. Corporation Defined. - A corporation is an As a consequence of this legal concept of separate a. To defeat public convenience;

artificial being created by operation of law, having personality of a corporation: b. To justify wrong;

the right of succession and the powers, attributes, 1. LIABILITY FOR DEBT/ OWNERSHIP OF c. To protect fraud;

and properties expressly authorized by law or CREDIT – the corporation is not liable for the d. To defend crime, in which case or cases, the

incidental to its existence. debts of its stockholders and vice versa. law would regard the corporation a mere

2. RIGHT TO BRING ACTIONS – A corp. may association of persons thus hold the latter

ATTRIBUTES OF A CORPORATION incur obligations and bring civil or criminal jointly liable.

1. It is an artificial being; actions in its own name in the same manner

2. It is created by operation of law; as a natural person. CORPORATION as a CREATION OF LAW or BY

3. It has the right of succession; and 3. RIGHT TO ACQUIRE AND POSSESS PROPERTY OPERATION OF LAW

4. It has only the powers, attributes, and – property conveyed to or acquired by the 1. Special authority or grant by the State

properties expressly authorized by law or corporation is in law the property of the required – a corporation is created by law or

incident to its existence. corporation itself as a distinct legal entity and by operation of law. This means that

not that of the stockholders or members as corporation cannot come into existence by

CORPORATION as an ARTIFICIAL BEING such. mere agreement of the parties as in the case

A corporation is a juridical entity vested with 4. LIABILITY FOR CONTRACTS – All contracts of business partnership. They require special

legal personality SEPARATE and DISTINCT from its entered into in its name by its regular authority or grant from the State. This power

stockholders (Stock Corporation) or individual appointed officers and agents are the exercise by the State through the legislative

members (non-stock corporations) who, as natural contract of the corporation and not those of department either by a special incorporation

persons, are merged in the corporate body. It is not, the stockholders or members. law which directly creates the corporation or

in fact, and in reality, a person but the law treats it as 5. TAX EXEMPTION /LIABILITY – Tax exemption by means of a general incorporation law

though it is a person. The stockholders or members granted to corporation cannot be extended under which, by operation of said law, person

compose the corporation but they are not the to include its stockholders.

desiring to be and act as a corporation may 2. Corporation created by special laws have the CLASSIFICATION OF PRIVATE CORPORATIONS

incorporate. right of succession for the term provided in 1. STOCK CORPORATION - are those which

2. Governing general law/special laws – in the the laws creating them. have capital stock divided into shares and are

Philippines, the general law which govern the authorized to distribute to the holders of

creation of PRIVATE CORPORATIONS is Batas POWERS OF A CORPORATION such shares, dividends, or allotments of the

Pambansa Blg. 68, NOW R. A 11232 REVISED A corporation has no power EXCEPT those surplus profits on the basis of the shares

CORPORATION CODE OF THE PHILIPPINES. a. EXPRESSLY conferred on it by the: held.

Private corporations owned and 1. Corporation Code 2. NON-STOCK CORPORATION – Do not issue

controlled by the government or any 2. or special laws stock and are created not for profit but for

subdivision or instrumentality thereof are b. and those that are IMPLIED or INCIDENTAL the public good and welfare. Non-stock

created by SPECIAL LAWS. (Constitution of to its existence. corporation:

the Philippines, Art. XII, Sec. 16.) In turn, a corporation exercise said powers a. have no capital stock which can be

3. EXCEPTION – Legislative grant or authority is through its: subscribed by their members;

not necessary – corporation by prescription. 1. BOARD OF DIRECTORS b. their capital are sourced from

Ex. Roman Catholic Church 2. Duly authorized officers and agents contributions and donations.

Example:

RIGHT OF SUCCESSION OF A CORPORATION RIGHT OF A CORPORATION TO OWN PROPERTY Religious, social, literary, scientific, civic

A corporation has a capacity of continuous Property acquire by the corporation is the and political organizations and societies.

existence irrespective of the: property of the corporation and not the property of

a. DEATH, WITHDRAWAL, INSOLVENCY, or stockholders or members, being a separate legal OTHER CLASSES OF CORPORATION

INCAPACITY of the individual members or personality or entity from persons composing it AS TO PURPOSE

stockholders; and Section 3. Classes of Corporations. - Corporations Public Corporation Private Corporation

b. Regardless of the TRANSFER of their interest formed or organized under this Code may be stock A corporation for the A corporation

or shares of stock. But the corporation is by or non-stock corporations. Stock corporations are government of a portion formed for some private

of the State for the purpose, benefit or end.

no means immortal those which have capital stock divided into shares

general good and welfare.

1. Under B. P. 68 – the life of the corporation is and are authorized to distribute to the holders of Government-owned and Quasi-public

limited to up to 50 years but NOW under R. such shares, dividends, or allotments of the surplus controlled corporation corporation

A. NO. 11232 – REVISED Corporation Code - profits on the basis of the shares held. All other (GOCC) A private

The life is now “ PERPETUAL EXISTENCE”. corporations are non-stock corporations. A corporation owned corporation which has

by the Government accepted from the

directly or through its STATE the grant of in relation to those only the sovereign power

instrumentalities either franchise or contract who, by reason of their and which by fiction of As to Number of Persons who Compose them

wholly, or; where involving the acts or admissions are law, is given the status Corporation Aggregate Corporation Sole

applicable as in the case performance of public precluded from asserting of a corporation. A corporation of more A corporation

of stock corporations, to duties but which is that it is not a Ex. Roman Catholic than one member consisting of only one

the extent at least 51 % of organized for profit. corporation. Church member for the purpose

its capita stock. Ex.: electric, water, and (Barlin v. Ramirez, 7 Phil. administering and

transportation 41) managing, as trustee,

companies. the affairs, property and

AS TO LEGAL RIGHT TO CORPORATE EXISTENCE temporalities of any

De Jure Corporation De Facto Corporation As To Laws of Incorporation religious denomination,

A corporation created A corporation Domestic Corporation Foreign Corporation sect or church.

in strict or substantial existing in in fact but not A corporation One formed,

conformity with the in law (Sec. 21) incorporated under organized, or existing As to whether They are for Charitable or Not

mandatory statutory Philippine laws under any laws other Ecclesiastical Corporation Lay Corporation

requirements for than those of the A corporation A corporation

incorporation and the Philippines. organized for religious organized for a purpose

right of which to exist as a purposes other than for religion.

corporation cannot be As to whether they are open to the public or not

successfully attacked or Open Corporation Close Corporation As to whether They are for Charitable Purposes or

questioned by any party Open to any person Limited to selected Not

even in a direct who may wish to become persons or members of Eleemosynary Civil Corporation

proceeding for that a stockholder or member a family. Corporation A corporation

purpose by the State. thereto. A corporation organized for business

(Corporation existing in As to Relationship of Management and Control organized for charitable purposes.

fact and in law) Parent or Holding Subsidiary Corporation purposes.

Corporation A corporation more

Corporation by Estoppel Corporation by A corporation that than 50 % of the voting

One which in reality is Prescription hold stocks in another stock of which is Section 4. Corporations Created by Special Laws or

not a corporation, either One which has corporation for purposes controlled directly or

De Jure or De Facto, exercised corporate Charters. - Corporations created by special laws or

of control. indirectly by another

because it is so powers for an indefinite corporation, which charters shall be governed primarily by the

defectively formed, but is period without thereby becomes its provisions of the special law or charter creating

considered a corporation inference on the part of parent corporation. them or applicable to them, supplemented by the

provisions of this Code, insofar as they are who compose a corporation, whether as - A person or entity, especially an

applicable. stockholders or shareholders in a stock corporation investment banker, who guarantees the

or as members in non-stock corporations. sale of newly issued securities by

INCORPORATION OF PRIVATE CORPORATION BY A Incorporators are those stockholders or members purchasing all or part of the shares for

SPECIAL ACT mentioned in the articles of incorporation as resale to the public.

originally forming and composing the corporation 3. Promoter – A person who brings about or

SECTION 4 authorizes the creation of PRIVATE and who are signatories thereof. cause to bring about the formation and

CORPORATION by SPECIAL LAWS or CHARTERS. The organization of a corporation by;

enactment of a special act creating a private COMPONENTS OF A CORPORATION 1. Bringing together the incorporators or

corporation is subject to constitutional limitation that 1. Corporators – those who compose the the persons interested in the enterprise;

such corporation shall be OWNED and CONTROLLED corporation, whether as stockholders or 2. Procuring subscriptions or capital for the

by the: members. corporation;

1. Government; or 2. Incorporators – the stockholders or 3. Setting in motion the machinery which

2. Any subdivision or instrumentality thereof. members mentioned in the Articles of leads to the incorporation of the

(Art. XII, Sec. 16, 1987 Constitution) Incorporation as originally forming and corporation itself.

composing the corporation and who are A founder or organizer of a corporation

Reason for the limitation: signatories in the Articles of Incorporation. or business venture; one who takes the

1. To prevent the granting of special privileges 3. Stockholders (Shareholders) – the owners of entrepreneurial initiative in funding or

to one body of men without giving all others shares of stock in a stock corporation. organizing a business enterprise.

the right to obtain them in the same 4. Members – the corporators of a non-stock

conditions; corporation.

2. Partly to prevent bribery and corruptions of Section 6. Classification of Shares. - The

the legislature. (Clark on Corporations, p. 45) Three other classes classification of shares, their corresponding rights,

1. Subscribers – persons who agreed to take privileges, restrictions, and their stated par value, if

Example of corporation created by special act and pay for original, unissued shares of a any, must be indicated in the articles of

1. DBP, 2. Land Bank, 3. Veterans Bank corporation formed or to be formed. incorporations. Each share shall be equal in all

2. Underwriter- a person who guarantees on a respects to every other share, except as otherwise

firm commitment and/or declared best effort provided in the articles of incorporation. Each share

Section 5. Corporators and Incorporators, basis the distribution and sale of securities of shall be equal in all respects to every other share,

Stockholders and Members. - Corporators are those any kind by another company.

except as otherwise provided in the articles of approve a particular corporate act shall be deemed share: Provided, further, That the entire

incorporation and in the certificate of stock. to refer only to stocks with voting rights. consideration received by the corporation for its no-

The shares or series of shares may or may not have par value shares shall be treated as capital and shall

The share stock corporations may be divided into a par value: Provided, That banks, trust, insurance, not be available for distribution as dividends.

classes or series of shares, or both. No share may be and preneed companies, public utilities, building

deprived of voting rights except those classified and and loan associations, and other corporations A corporation may further classify its shares for the

issued as "preferred" or "redeemable" shares, authorized to obtain or access funds from the public purpose of ensuring compliance with constitutional

unless otherwise provided in this Code: Provided whether publicly listed or not, shall not be or legal requirements. (Change in corporations not

that there shall be a class or series of shares with permitted to issue no-par value shares of stock. permitted to no par shares)

complete voting rights.

Preferred shares of stock issued by a corporation

Holders of nonvoting shares shall nevertheless be may be given preference in the distribution of A corporation may further classify its shares

entitled to vote on the following matters; dividends and in the distribution of corporate assets for the purpose of ensuring compliance with

(a) Amendment of the articles of incorporation; in case of liquidation, or such other preferences: constitutional or legal requirements.

(b) Adoption and amendment of bylaws; Provided, That preferred shares of stock may be

(c) Sale, lease, exchange, mortgage, pledge, or other issued only with a stated par value. The board of DOCTRINE OF EQUALITY OF SHARES

disposition of all or substantially all of the corporate directors, where authorized in the articles of Each share shall be equal in all respects

property; incorporation, may fix the terms and conditions of (rights and liabilities) to every other share

(d) Incurring, creating, or increasing bonded preferred shares of stock or any series thereof: except as otherwise provided in the articles

indebtedness; Provided, further, That such terms and conditions of incorporation stated in the certificate of

(e) Increase or decrease of authorized capital stock; shall be effective upon filing of a certificate thereof stock.

(f) Merger or consolidation of the corporation with with the Securities and Exchange Commission,

another corporation or other corporations; hereinafter referred to as the "Commission". WHO MAY CLASSIFY SHARES?

(g) Investment of corporate funds in another 1. Incorporators

corporation or business in accordance with this Shares of capital stock issued without par value It is to be determined by the

Code; and shall be deemed fully paid and non-assessable and incorporators by stating it in their articles of

(h) Dissolution of the corporation. the holder of such shares shall not be liable to the Incorporation which will be filed in the S. E.

corporation or to its creditors in respect thereto: C.

Except as provided in the immediately preceding Provided, That no-par value shares must be issued 2. Board of Directors and stockholders

paragraph, the vote required under this Code to for a consideration of at least Five pesos (₱5.00) per

The original classification of shares made A preferred share of stock is one which entitles INSTANCES WHEN HOLDERS OF NON-VOTING

by the incorporators which was stated in the the holder thereof to certain preferences over the SHARES ARE ALLOWED

articles of incorporation can be amended by holders of common stock. The preferences are 1. Amendment of the articles of incorporation;

a majority vote of the BOD and the vote or designed to INDUCE persons to subscribe for shares 2. Adoption and amendment of by-laws;

written assent of the stockholders of a corporation. 3. Sale, lease, exchange, mortgage, pledge or

representing at least 2/3 of the outstanding CLASSES OF PREFERRED SHARE OF STOCK: other disposition of all or substantially all of

capital stock. 1. Preferred share as to assets – a share which the corporate property;

gives the holder thereof preference in the 4. Incurring, creating or increasing bonded

WHAT ARE VOTING SHARES? distribution of the assets of the corporation indebtedness;

Shares with a right to vote. There shall always be in case of liquidation. 5. Increase or decrease of authorized capital

a class or series of shares which have complete 2. Preferred share as to dividends – a share the stock;

voting rights. of which is entitled to receive dividend on 6. Merger or consolidation of the corporation

said share to the extent agreed upon before with another corporation or other

WHAT ARE NON-VOTING SHARES? any dividends at all are paid to the holders of corporations;

Shares without right to vote. common stock. 7. Investment of corporate funds in another

The law provides that shares classified and issued as corporation or business in accordance with

preferred or redeemable shares may be deprived of WHAT ARE REDEEMABLE SHARES? this Code; and

voting right. REDEEMABLE SHARES may be issued by the 8. Dissolution of the corporation.

corporation when expressly so provided in the Note: shares classified both as voting and

WHAT IS A COMMON SHARE OF STOCK? articles of Incorporation. They may be purchased or non-voting shares are entitled to vote in 8

A class of stock entitling the holder to vote on taken up by the corporation upon the expiration of a instances above.

corporate matters, to receive dividends after other fixed period, regardless of the existence of

claims and dividends have been paid (specially to unrestricted retained earnings in the books of the WHAT ARE PAR VALUE SHARES?

preferred shareholders), and to share in the assets corporation, and upon such other terms and Shares with a value fixed in the articles of

upon liquidation. Common stock is often called conditions as may be stated in the articles of incorporation and the certificates of stock.

capital stock IF it is the corporation’s only class of incorporation, which terms and conditions must also

stock outstanding. Also termed ordinary shares. be stated in the certificate of stock representing said WHAT ARE NO PAR VALUE SHARES?

shares. Share with no par value

WHAT IS PREFERRED SHARE OF STOCK?

Note: Stocks shall not be issued for a A share subject to an agreement by virtue of otherwise known as "Foreign Investments Act of

consideration less than the par or issued price which the share is deposited by the grantor or his 1991"; and other pertinent laws. (New rules under

thereof. agent with a third person to be kept by the RCC)

depositary until the performance of certain condition

or the happening of a certain event contained in the

LIMITATION ON NO PAR VALUE SHARES FOUNDER’S SHARES

agreement.

1. It cannot have an issued price of less than Shares classified as such in the articles of

P5.00 WHAT IS FRACTIONAL SHARE? incorporation which may be given certain rights and

2. It is deemed fully paid and non-assessable A share that is less than one full share. privileges (e.g. dividend payment) not enjoyed by the

3. The entire consideration for its issuance owners of other stocks.

constitutes capital so that no part of it should WHAT IS OVER-ISSUED STOCK?

It is a stock or share issued in excess of the

be distributed as dividends; LIMITATION ON FOUNDER’S SHARES

authorized capital stock. Such issuance is null and

4. It cannot issued as preferred shares void. The exclusive right to vote and be voted for in the

5. It cannot be issued by banks, trust, election of directors, if granted, it must be for a

insurance, and preneed companies, public WHAT IS CONVERTIBLE SHARE? limited period not to exceed 5 years from the date of

utilities, building and loan associations, and A share that is convertible by the stockholder incorporation.

other corporations authorized to obtain or from one class to another class at a certain price and

access funds from the public whether within a certain period.

publicly listed or not; Section 8. Redeemable Shares. - Redeemable shares

6. The articles of incorporation must state the may be issued by the corporation when expressly

Section 7. Founders' Shares. - Founders' shares may

fact that it is issued no par value shares as provided in the articles of incorporation. They are

be given certain rights and privileges not enjoyed by

well as the number of said shares. shares which may be purchased by the corporation.

the owners of other stock. Where the exclusive right

They are shares which may be purchased by the

WHAT IS PROMOTION SHARE? to vote and be voted for in the election of directors

corporation from the holders of such shares upon

is granted, it must be for a limited period not to

A share issued to promoter or those in some way the expiration of a fixed period, regardless of the

exceed five (5) years from the date of incorporation:

interested in the company, for incorporating the existence of unrestricted retained earnings in the

Provided, That such exclusive right shall not be

company, or for services rendered in launching or books of the corporation, and upon such other

allowed if its exercise will violate Commonwealth

promoting the welfare of the company. terms and conditions stated in the articles of

Act No. 108, otherwise known as the "Anti-Dummy

incorporation and the certificate of stock

Law"; Republic Act No. 7042, otherwise known as

WHAT IS SHARE IN ESCROW? representing the shares, subject to rules and

the "Foreign Investments Act of 1991"; and

regulations issued by the Commission.

2. The terms and conditions affecting said This doctrine is the underlying principle in the

WHAT ARE THE REDEEMABLE SHARES? shares must be stated both in the articles of procedure for the distribution of capital assets,

REDEEMABLE SHARES are shares usually incorporation and in the certificate of stock; embodied in the Corporation Code, which allows the

preferred, which by their terms are redeemable at a 3. It may be deprived of voting rights in the distribution of corporate capital only in the three

fixed date, or at the option of either issuing article of incorporation; instances:

corporation, or the stockholder, or both at a certain 4. Redemption cannot be made if it will cause 1. Amendment of the Articles of Incorporation

redemption price. A redemption by the corporation insolvency of the corporation. to reduce the authorized capital stock;

of its stocks is, in a sense, a repurchase of it for 2. Purchase of redeemable shares by the

cancellation. What is RETAINED EARNINGS? corporation, regardless of of the existence of

The present Code allows redemption of shares A corporation’s accumulated income after unrestricted retained earnings;

even if there are no unrestricted retained earnings dividends have been distributed. Also termed earned 3. Dissolution and eventual liquidation of the

on the books of the corporation. This is a new surplus; undistributed profit. corporation.

provision which in effect qualifies the general rule

that the corporation cannot purchase its own shares KINDS OF REDEEMABLE SHARES

except out of current retained earnings. However, 1. Compulsory – The Corporation is required to Section 9. Treasury Shares. - Treasury shares are

while redeemable shares may be redeemed redeem the shares. shares of stock which have been issued and fully

regardless of the existence of unrestricted retained 2. Optional – The Corporation is not mandated paid for, but subsequently reacquired by the issuing

earnings, this is subject to the condition that the to redeem the shares. corporation through purchase, redemption,

corporation has, after such redemption, assets in its donation, or some other lawful means. Such shares

books to cover debts and liabilities inclusive of capital CAN REDEEMABLE SHARES BE REISSUED? may again be disposed of for a reasonable price

stock. Redemption, therefore, may not be made Redeemable shares, once redeemed are retired fixed by the board of directors.

where the corporation is insolvent or if such unless reissuance is expressly allowed in the articles

redemption will cause insolvency or inability of the of incorporation. WHAT ARE TREASURY SHARES?

corporation to meet its debts as they mature. Treasury shares are shares of stock which have

WHAT IS TRUST FUND DOCTRINE? been issued and fully paid for, but subsequently

LIMITATIONS ON REDEEMABLE SHARES The Trust Fund Doctrine provides that reacquired by the issuing corporation by purchase,

1. It must be expressly provided in the articles subscriptions to the capital stock of a corporation redemption, donation or through some other lawful

of incorporation; constitute a fund to which the creditors have a right means.

to look for the satisfaction of their claims.

RIGHTS THAT ARE DENIED TO THE TREASURY are licensed to practice a profession, and 1. Banks and quasi-banks, Preneed, trust,

SHARES partnerships or associations organized for the insurance, public and publicly-listed

1. Voting rights purpose of practicing a profession, shall not be companies, and non- chartered GOCC

2. Right to dividends allowed to organize as a corporation unless 2. Natural person who is licensed to exercise a

Note: otherwise provided under special laws. profession for the purpose of exercising such

Treasury shares sold below par value are not Incorporators who are natural persons must be of profession except as otherwise provided

watered stock because watered stock contemplates legal age. under special laws.

an original issuance of shares.

Each incorporator of a stock corporation must own QUALIFICATION OF INCORPORATORS

WHAT ARE WATERED STOCKS? or be a subscriber to at least one (1) share of the 1. Those stockholders or members mentioned

Stocks issued for a consideration less than the capital stock. in the Articles of Incorporation;

par or issued price therof or in any other than cash 2. A signatory of the Articles of Incorporation;

valued in excess of its fair value. A corporation with a single stockholder is 3. Must own or be a subscriber to at least one

Note: considered a One Person Corporation as described (1) share of capital stock

Watered stock refers only to original issue of in Title XIII, Chapter III of this Code. 4. Not more than 15 in numbers

shares but not to a subsequent transfer of such 5. Does not cease to be an incorporator upon

shares by the corporation. Thus, treasury shares may sale of his shares;

be sold for less than par or issued value for they have (Note: ONE PERSON CORPORATION – is a

already been issued and paid for. corporation with single stockholder. STEPS IN THE CREATION OF A CORPORATION

NOTE: Only a natural person, trust or an estate 1. Promotion

TITLE II may form a One Person Corporation (OPC) The formation or organization

INCORPORATION AND ORGANIZATION OF PRIVATE corporations are brought about at the

CORPORATIONS WHO MAY INCORPORATE OPC? instance and under supervision of one or

1. Any person (Natural Person) must be of legal more promoters.

Section 10. Number and Qualifications of age;

Incorporators. - Any person, partnership, 2. Partnership, association or corporation, 2. Incorporation

association or corporation, singly or jointly with singly or jointly with others. Steps of incorporation

others but not more than fifteen (15) in number, a. Drafting and execution of the Articles of

may organize a corporation for any lawful purpose WHO MAY NOT INCORPORATE AS OPC Incorporation and other documents

or purposes: Provided, That natural persons who

required for registration of a corporation Corporations with certificates of incorporation No application for revival of certificate of

by the incorporators. issued prior to the effectivity of this Code and which incorporation of banks, banking and quasi-banking

b. Filing of the Articles of Incorporation continue to exist shall have perpetual existence, institutions, preneed, insurance and trust

with the Securities and Exchange unless the corporation, upon a vote of its companies, non-stock savings and loan associations

Commission together with the: stockholders representing a majority of its articles (NSSLAs), pawnshops, corporations engaged in

1. Treasurer’s Affidavit of incorporation: Provided, That any change in the money service business, and other financial

2. In case the corporation is governed corporate right of dissenting stockholders in intermediaries shall be approved by the

by special law (e.g. educational accordance with the provisions of this Code. Commission unless accompanied by a favorable

institution), a favorable recommendation of the appropriate government

recommendation of the appropriate A corporate term for a specific period may be agency. (Note: Perpetual existence substantial

government agency (e.g. CHED or extended or shortened by amending the articles of changes)

DepEd) that such articles of incorporation: Provided, That no extension may be

incorporation and by-laws is in made earlier than three (3) years prior to the

accordance with law. original or subsequent expiry date(s) unless there CORPORATE TERM

are justifiable reasons for an earlier extension as GENERAL RULE:

3. Formal organization and commencement of may be determined by the Commission: Provided, A corporation shall have perpetual existence.

business transactions further, That such extension of the corporate term EXCEPTION:

Examples: shall take effect only on the day following the If the articles of incorporation provides

1. adoption of by-laws and filing the original or subsequent expiry date(s). otherwise or if it provides for a specific period.

same with the SEC

2. election of Board of Directors or A corporation whose term has expired may apply Note: A corporate term for a specific period may be

Board of Trustees and officers for revival of its corporate existence, together with extended or shortened by amending the articles of

3. payment of shares all the rights and privileges under its certificate of incorporation.

incorporation and subject to all of its duties, debts

and liabilities existing prior to its revival. Upon Note: a corporation for a specific period ceases to

Section 11. Corporate Term. - A corporation shall approval by the Commission, the corporation shall exist and is dissolved ipso facto upon the expiration

have perpetual existence unless its articles of be deemed revived and a certificate of revival of of the period fixed in the original articles of

incorporation provides otherwise. corporate existence shall be issued, giving it incorporation in the absence of compliance with the

perpetual existence, unless its application for legal requisites of extension of period.

revival provides otherwise.

REVIVAL OF CORPORATE EXISTENCE allowed by the Commission, containing substantially nationalities, and subscribers, amount subscribed

A corporation whose term has expired may apply the following matters, except as otherwise and paid by each on the subscription, and a

for a revival of its corporate existence. prescribed by this Code or by special law: statement that some or all of the shares are without

(a) The name of corporation; par value, if applicable;

GENERAL RULE: (b) The specific purpose or purposes for which the (i) If it be a nonstock corporation, the amount of its

Upon approval by the SEC, the corporation shall corporation is being formed. Where a corporation capital, the names, nationalities, and residence

be deemed revived and a certificate of revival of has more than one stated purpose, the articles of addresses of the contributors, and amount

corporate existence shall be issued, giving it incorporation shall indicate the primary purpose contributed by each; and

perpetual existence. and the secondary purpose or purposes: Provided, (j) Such other matters consistent with law and

That a nonstock corporation may not include a which the incorporators may deem necessary and

EXCEPTION: if its application for revival provides purpose which would change or contradict its convenient.

otherwise or provides for specific period. nature as such;

(c) The place where the principal office of the An arbitration agreement may be provided in the

corporation is to be located, which must be within articles of incorporation pursuant to Section 181 of

Section 12. Minimum Capital Stock Not Required of the Philippines; this Code.1âwphi1

Stock Corporations. - Stock corporations shall not be (d) The term for which the corporation is to exist, if

required to have minimum capital stock, except as the corporation has not elected perpetual existence; The Articles of incorporation and applications for

otherwise specially provided by special law. (e) The names, nationalities, and residence amendments thereto may be filed with the

addresses of the incorporators; Commission in the form of an electronic document,

GENERAL RULE: (f) The number of directors, which shall not be more in accordance with the Commission's rule and

NO Minimum Authorized Capital Stock. than fifteen (15) or the number of trustees which regulations on electronic filing.

EXCEPTION: may be more than fifteen (15);

If provided by special law. (g) The names, nationalities, and residence

addresses of persons who shall act as directors or Section 14. Form of Articles of Incorporation. -

trustees until the first regular directors or trustees Unless otherwise prescribed by special law, the

Section 13. Contents of the Articles of are duly elected and qualified in accordance with articles of incorporation of all domestic corporations

Incorporation. - All corporations shall file with the this Code; shall comply substantially with the following form:

Commission articles of incorporation in any of the (h) If it be a stock corporation, the amount of its

official languages, duly signed and acknowledged or authorized capital stock, number of shares into Articles of Incorporation

authenticated, in such form and manner as may be which it is divided, the par value of each, names, Of

_____________________ ________________________ ________________________

(Name of Corporation) ________________________ ________________________

________________________ ________________________

The undersigned incorporators, all of legal age, have ________________________

voluntarily agreed to form a (stock) (non-stock) ________________________ Seventh: That the authorized capital stock of the

corporation under the laws of the Republic of the ________________________ corporation is ____________________ PESOS

Philippines and certify the following: ________________________ (₱______), divided into ____ shares with the par

________________________ value of ___________________ PESOS

First: That the name of said corporation shall be ________________________ (₱_____________) per share. (In case all the shares

"_________________", Inc. Corporation or OPC"; ________________________ are without par value): That the capital stock of the

________________________ corporation is __________________ shares without

Second: That the purpose or purposes for which ________________________ par value.

such corporation is incorporated are: (If there is ________________________

more than one purpose, indicate primary and ________________________ (In case some shares have par value and some are

secondary purposes); ________________________ without par value): That the capital stock of said

Sixth: That the number if directors or trustees of the corporation consists of

Third: That the principal office of the corporation is corporation shall be ___________________; and the ________________________________ shares, of

located in the City/Municipality of names, nationalities, and residence addresses of the which _______________________ shares have a par

_______________, Province of first directors or trustees of the corporation are as value of ___________________________PESOS

______________________, Philippines; follows: (₱_______) each, and of which

1âwphi1 ____________________ shares are without par

Fourth: That the corporation shall have perpetual Name Nationality Residence value.

existence or a term of ___________ years from the ________________________

date of issuance of the certificate of incorporation; ________________________ Eight: That the number of shares of the authorized

________________________ capital stock-stated has been subscribed as follows:

Fifth: That the names, nationalities, and residence ________________________ Name of Subscriber Nationality No. of

addresses of the incorporators of the corporation ________________________ Shares Subscribed Amount Subscribed

are as follows: ________________________ Amount Paid

Name Nationality Residence

(Modify No. 8 if shares are with no-par value. In has been declared not distinguishable from a (Name and signature of Treasurer)

case the corporation is nonstock, Nos. 7 and 8 of the corporation, or that it is contrary to law, public

above articles may be modified accordingly, and it is morals, good customs or public policy. Meaning of Articles of Incorporation

sufficient if the articles may be modified Eleventh: (Corporations which will engage in any

accordingly, and it is sufficient if the articles state business or activity reserved for Filipino citizens ARTICLES OF INCORPORATION is a document

the amount of capital or money contributed or shall provide the following): prepared by the persons establishing a corporation

donated by specified persons, stating the names, and filed with the Securities and Exchange

nationalities, and residence addresses of the "No transfer of stock or interest which shall reduce Commission containing the matters required by the

contributors or donors and the respective amount the ownership of Filipino citizens to less than the Code.

given by each.) required percentage of capital stock as provided by

existing laws shall be allowed or permitted to be THREE-FOLD NATURE OF THE ARTICLES OF

Ninth: That _______________________ has been recorder in the proper books of the corporation, and INCORPORATION

elected by the subscribers as Treasurer of the this restriction shall be indicated in all stock 1. a contract between the State and the

Corporation to act as such until after the successor certificates issued by the corporation." corporation

is duly elected and qualified in accordance with the 2. a contract between the corporation and its

bylaws, that as Treasurer, authority has been given IN WITNESS WHEREOF, we have hereunto signed stockholders;

to receive in the name and for the benefit of the these Articles of Incorporation, this ______ day of 3. a contract between stockholders inter se.

corporation, all subscriptions, contributions or _____, 20___ in the City/Municipality of

donations paid or given by the subscribers or _________________, Province of SUBSCRIPTION

members, who certifies the information set forth in ________________, Republic of the Philippines. A written contract to purchase newly issued

the seventh and eighth clauses above, and that the _____________________________ shares of stock or bonds. Also termed stock

paid-up portion of the subscription in cash and/or _____________________________ subscription.

property for the benefit and credit of the _____________________________

corporation has been duly received. _____________________________ WHAT IS PAID-UP CAPITAL?

_____________________________ PAID-UP CAPITAL is that portion of the

Tenth: That the incorporators undertake to change _____________________________ authorized capital stock which has been both

the name of the corporation immediately upon _____________________________ subscribed and paid. Such must form part of the

receipt of notice from the Commission that another _____________________________ authorized capital stock of the corporation,

corporation, partnership or person has acquired a (Names and signatures of the incorporators) subscribed and then actually paid.

prior right to the use of such name, that the name ____________________________

CONTENTS AND FORM OF ARTICLES OF whether the acts performed by the 6. Authorized Capital stock

INCORPORATION corporation are authorized (intra The maximum amount fixed in the

1. Name of the corporation vires acts) or beyond its power- ultra articles of incorporation that must

The corporation acquires juridical vires acts. be:

personality under the name stated in a. SUBSCRIBED CAPITAL– 25 % of

the certificate of incorporation. 3. Principal office of the corporation the Authorized Capital must be

A corporation has the power of Purpose: subscribed;

succession by its corporate name. To fix the residence of the b. PAID UP CAPITAL – 25 %

It is the name of the corporation corporation in a definite place; subscribed capital must be paid

which identifies and distinguishes it To determine the venue of court in.

from other corporations, firms or cases involving corporation;

entities. For purposes of stockholders or

By that name it is authorized to members meeting; Section 15. Amendment of Articles of Incorporation.

transact business. To determine the place where the - Unless otherwise prescribed by this Code or by

The name of a corporation is, books and records of the corporation special law, and for legitimate purposes, any

therefore, peculiarly essential to its are ordinarily kept. provision or matter stated in the articles of

existence. incorporation may be amended by a majority vote

4. Term of existence of the board of directors or trustees and the vote or

2. Purpose or purposes of the corporation A corporation shall have PERPETUAL written assent of the stockholders representing at

Purpose or purposes must be lawful EXISTENCE unless its Articles of least two-thirds (2/3) of the outstanding capital

It must be stated with sufficient Incorporation provides otherwise. stock, without prejudice to the appraisal right of

clarity dissenting stockholders in accordance with the

Primary purpose must be stated, 5. Number of Board of Directors or Trustees provisions of this Code. The articles of incorporation

where it has more one stated The number of Directors shall not be of a nonstock corporation may be amended by the

purposes, shall state which is primary more than fifteen (15). – Stock vote or written assent of majority of the trustees

or main purpose and which is/are corporation and at least two-thirds (2/3) of the members.

secondary purpose or purposes. The number of Trustees may be The original and amended articles together shall

Purpose must be lawfully combined. more than fifteen (15). – Non-stock contain all provisions required by law to be set out

Main reason in stating the purpose of corporation in the articles of incorporation. Amendments to the

the corporation is to determine articles shall be indicated by underscoring the

change or changes made, and a copy thereof duly amended, shall be indicated by underscoring same is not compliant with the requirements of this

certified under oath by the corporate secretary and the changes made; Code: Provided, That the Commission shall give the

a majority of the directors or trustees, with a incorporators, directors, trustees, or officers as

statement that the amendments have been duly 5. Certification under oath by the corporate reasonable time from receipt of the disapproval

approved by the required vote of the stockholders secretary and a majority of the board of within which to modify the objectionable portions

or members, shall be submitted to the Commission. directors or board of trustees stating the fact of the articles or amendment. The following are

The amendments shall take effect upon their that said amendments have been duly ground for such disapproval:

approval by the Commission or from the date of approved by the required vote of the

filing with the said Commission if not acted upon stockholders or members or members, shall (a) The articles of incorporation or any amendment

within six (6) months from the date of filing for a be submitted to SEC; thereto is not substantially in accordance with the

cause not attributable to the corporation. form prescribed herein;

6. The amendment must be approved by the (b) The purpose or purposes of the corporation are

LIMITATIONS IN THE AMENDMENT OF THE ARTICLES SEC; patently unconstitutional, illegal, immoral or

OF INCORPORATION contrary to government rules and regulations;

1. The amendment must be for legitimate 7. 7.The amendment must be accompanied by (c) The certification concerning the amount of

purposes and must not be contrary to a favorable recommendation of the capital stock subscribed and/or paid is false; and

Corporation Code and special laws; appropriate government agency in cases of: (d) The required percentage of Filipino ownership of

a. Banks; the capital stock under existing laws or the

2. The amendment must be approved by a

b. Banking and quasi-banking institution; Constitution has not been complied with.

majority of the board of directors or board of

trustees c. Preneed; No articles of incorporation or amendment to

d. Insurance and trust companies; articles of incorporation of banks, banking and

3. The amendment requires the vote or written e. Non-stock saving and loan association; quasi-banking institutions, preneed, insurance and

assent of stockholders representing 2/3 of f. Pawnshops; and trust companies, NSSLAs, pawnshops and other

the outstanding capital stock or 2/3 g. Other financial intermediaries. financial intermediaries shall be approved by the

members if it be a non-stock corporation; Commission unless accompanied by a favorable

recommendation of the appropriate government

4. The original and amended articles of Section 16. Grounds When Articles of Incorporation agency to the effect that such articles or

incorporation together shall contain all or Amendment May be disapproved. The amendment is in accordance with law.

provisions required by law to be set out in Commission may disapprove the articles of

the articles of incorporation. Such articles, as incorporation or any amendment thereto if the

This enumerates GROUNDS when articles of or (3) contrary to law, rules and regulations, may shall submit the intended corporate name to the

incorporation or its amendment may be disapproved summarily order the corporation to immediately Commission for verification. If the Commission finds

cease and desist from using such name and require that the name is distinguishable from a name

Note: before disapproving the AOI or its the corporation to register a new one. The already reserved or registered for the use of

amendments, the SEC should give the incorporators, Commission shall also cause the removal of all another corporation, not protected by law and is

directors, trustees, or officers, a reasonable time visible signages, marks, advertisements, labels not contrary to law, rules and regulation, the name

within which to correct or modify the objectionable prints and other effects bearing such corporate shall be reserved in favor of the incorporators. The

portions of the AOI or its amendment. name. Upon the approval of the new corporate incorporators shall then submit their articles of

name, the Commission shall issue a certificate of incorporation and bylaws to the Commission.

Section 17. Corporation Name. - No corporate name incorporation under the amended name.

shall be allowed by the Commission if it is not If the Commission finds that the submitted

distinguishable from that already reserved or If the corporation fails to comply with the documents and information are fully compliant with

registered for the use if another corporation, or if Commission's order, the Commission may hold the the requirements of this Code, other relevant laws,

such name is already protected by law, rules and corporation and its responsible directors or officers rules and regulations, the Commission shall issue

regulations. in contempt and/or hold them administratively, the certificate of incorporation.

civilly and/or criminally liable under this Code and

A name is not distinguishable even if it contains one other applicable laws and/or revoke the registration A private corporation organized under this Code

or more of the following: of the corporation. commences its corporate existence and juridical

(a) The word "corporation", "company", personality from the date the Commission issues

incorporated", "limited", "limited liability", or an NOTE: the certificate of incorporation under its official seal

abbreviation of one if such words; and No corporate name shall be allowed by the thereupon the incorporators,

(b) Punctuations, articles, conjunctions, Commission if it is not distinguishable from that stockholders/members and their successors shall

contractions, prepositions, abbreviations, different already reserved or registered for the use if another constitute a body corporate under the name stated

tenses, spacing, or number of the same word or corporation, or if such name is already protected by in the articles of incorporation for the period of time

phrase. law, rules and regulations. mentioned therein, unless said period is extended

or the corporation is sooner dissolved in accordance

The Commission upon determination that the with law.

corporate name is: (1) not distinguishable from a Section 18. Registration, Incorporation and

name already reserved or registered for the use of Commencement of Corporation Existence. - A

another corporation; (2) already protected by law; person or group of persons desiring to incorporate

REQUIREMENTS FOR REGISTRATION AND Exchange Commission issues CERTIFICATE OF corporate status as against third parties although not

INCORPORATION OF A CORPORATION INCORPORATION under its official seal. against the State.

1. Submission of intended CORPORATE NAME

to SEC for verification; REQUISITES OF A DE FACTO CORPORATION

Section 19. De facto Corporations. - The due 1. The existence of a valid law under which it

2. If the Commission finds that the name is incorporation of any corporation claiming in good may be incorporated;

distinguishable from a name already faith to be a corporation under this Code, and its 2. An attempt in good faith incorporate under

reserved or registered for the use of another right to exercise corporate powers, shall not be such law; and

corporation, not protected by law and is not required into collaterally in any private suit to which 3. Actual use in good faith of corporate powers.

contrary to law, rules and regulation, the such corporation may be a party. Such inquiry may

name shall be reserved in favor of the be made by the Solicitor General in a quo warranto

incorporators. proceeding. Section 20. Corporation by Estoppel. - All persons

who assume to act as a corporation knowing it to be

3. The incorporators shall then submit their DEFINITION: without the authority to do so shall be liable as

Articles of Incorporation and By-laws to the DE JURE CORPORATION – is one created in strict general partners for all debts, liabilities and

Commission. or substantial conformity with the statutory damages incurred or arising as a result thereof:

requirements for incorporation and the right of Provided, however, That when any such ostensible

4. The Commission shall issue the Certificate of which to exist as a corporation cannot be successfully corporation is sued on any transaction entered by

Incorporation, if the submitted documents or attacked even in a direct proceeding for that purpose its as a corporation or on any tort committed by it

information are fully compliant with the by the State. as such, it shall not be allowed to use on any its lack

requirements of this Code, other relevant of corporate personality as a defense. Anyone who

laws, rules and regulations. DE FACTO CORPORATION – is one actually exist assumes an obligation to an ostensible corporation

for all practical purposes as a corporation but which as such cannot resist performance thereof on the

WHEN A CORPORATION DOES COMMENCE TO HAVE has no legal right to corporate existence as against ground that there was in fact no corporation.

CORPORATE EXISTENCE AND JURIDICAL the State. It is a corporation from the fact of its acting

PERSONALITY? as such, though not in law or right a corporation.

A corporation commences its corporate It is one which had not complied with all the ESTOPPEL TO DENY CORPORATE EXISTENCE

existence and juridical personality and is deemed requirements necessary to be a de jure corporation The stockholders or members of a

incorporated from the DATE the Securities and BUT has complied sufficiently to be accorded pretended or ostensible corporation who

participated in holding it as a corporation

are generally estopped or precluded to deny It exists only between the persons who The Commission shall give reasonable notice to, and

its existence against creditors for the misrepresented their status and the parties who coordinate with the appropriate regulatory agency

purpose of escaping liability for corporate relied on the misrepresentation. prior to the suspension or revocation of the

debts or for unpaid part of a subscription to certificate of incorporation of companies under

stock. their special regulatory jurisdiction.

Third persons, who deal with such a Section 21. Effects of Non-Use of Corporate Charter

corporation recognizing it as such and and Continuous Inoperation. - If a corporation does

pretended corporation itself , estopped from not formally organize and commence its business 1. FAILURE TO FORMALLY ORGANIZE AND

denying its corporate existence and raising within five (5) year from the date of its COMMENCE ITS BUSINESS WITHIN 5 YEARS

the defense of its lack of corporate incorporation, its certificate of incorporation shall FROM THE DATE OF ITS INCORPORATION

personality for the purpose of defeating a be deemed revoked as of the day following the end The certificate of incorporation shall

liability growing out of a contract between of the five (5)-year period. be deemed revoked as of the day

them and such entity. following the end of the five (5) years

Persons not stockholders or members who However, if a corporation has commenced its period.

assume to act as a corporation knowing it to business but subsequently becomes inoperative for Example of acts constituting formal

be without authority to do so shall be a period of at least five (5) consecutive years, the organization

solidarily liable as general partners with all Commission may, after due notice and hearing, 1. Adoption of by-laws and filing of the

their property with all debts, liabilities and place the corporation under delinquent status. same with the SEC.

damages incurred or arising as a result 2. Election of board of directors or

thereof. A delinquent corporation shall have a period of two board of trustees as well as officers

(2) years to resume operations and comply with all like the president, secretary,

requirements that the Commission shall prescribed. treasurer and other officers as

CORPORATION BY ESTOPPEL WITHOUT DE FACTO Upon the compliance by the corporation, the stated in its by-laws.

EXISTENCE Commission shall issue an order lifting the 3. Establishment of the principal office.

A Corporation by Estoppel has no real existence delinquent status. Failure to comply with the 4. Providing for the subscription and

in law. It is neither De Jure nor De Facto Corporation, requirements and resume operations within the payment of its shares of stock.

but a mere “fiction existing for a particular case” period given by the Commission shall cause the 5. Other acts necessary to enable the

where the element of estoppel present. revocation of the corporation's certificate of corporation to transact business or

incorporation. accomplish the purpose for which it

was created.

TITLE III must seek approval of the stockholders or

2. CONTINUOUS INOPERATION FOR AT LEAST BOARD OF DIRECTORS/TRUSTEE AND OFFICERS members.

5 CONSECUTIVE YEARS

The SEC may, after due notice and CORRELATION OF THE BOARD OF WHERE DO CORPORATE POWERS RESIDE?

hearing, place the corporation DIRECTORS/TRUSTEES, OFFICERS AND One of the most important rights of a

delinquent status. STOCKHOLDERS UNDER THE CODE: 1. Qualified shareholder or member:

A delinquent corporation shall have a The Stockholders Or Members periodically o Right to vote – either personally

period of two (2) years to resume elect the board of board of or by proxy.

operations and comply with all directors/trustees;

requirements that the Commission The Board Of Directors Or Trustees are 2. Board of Directors/Trustees:

shall prescribed. charged with the management of the o To manage the corporate affairs

Upon the compliance by the corporation;

corporation, the Commission shall The Board Of Directors/Trustees, in turn, Once the board of directors or trustees is

issue an order lifting the delinquent periodically elects officers to carry out elected, the stockholders or members

status. management functions on day - to- day basis; relinquish corporate powers to the board in

Failure to comply with the The Stockholders or Members, as owners, accordance with law.

requirements and resume operations have residual powers over the fundamental

within the period given by the and major corporate changes. WHAT IS BUSINESS JUDGMENT RULE?

Commission shall cause the Contracts Intra Vires entered into by the Board

revocation of the corporation's WHAT ARE ACTS OF MANAGEMENT (ACTS OF of Directors are binding upon the corporation and

certificate of incorporation. ADMINISTRATION) AND ACTS OF OWNERSHIP? courts will not interfere unless such contracts are so

The Commission shall give While stockholders and members (in some unconscionable and oppressive as to amount to

reasonable notice to, and coordinate instances) are entitled to received profits, the wanton destruction to the rights of the minority, as

with the appropriate regulatory management and direction of the when plaintiffs aver that defendants (members of the

agency prior to the suspension or corporation are lodge with their board), have concluded a transaction among

revocation of the certificate of representatives and agents – BOARD OF themselves as will result in serious injury to the

incorporation of companies under DIRECTORS/TRUSTESS – ACTS OF plaintiffs stockholders.

their special regulatory jurisdiction. MANAGEMENT pertains to the Board;

Those of OWNERSHIP, to the Stockholders or Section 22. The Board of Directors or Trustees of a

Members. The board cannot act alone, but Corporation; Qualification and Term. - Unless

otherwise provided in this Code, the board of limit, maximum number of board membership and

directors or trustees shall exercise the corporate (b) Banks and quasi-banks, NSSLAs, pawnshops, other requirements that the Commission will

powers, conduct all business, and control all corporations engaged in money service business, prescribed to strengthen their independence and

properties of the corporation. preneed, trust and insurance companies and other align with international best practices.

financial intermediaries; and

Directors shall be elected for a term of one (10 Year GOVERNING BODY OF A CORPORATION

from among the holders of stocks registered in the (c) Other corporations engaged in businesses vested Board of Directors – The governing body of a

corporation's book while trustees shall be elected with public interest similar to the above, as may be corporation – a creation of the stockholders.

for a term not exceeding three (3) years from determined by the Commission, after taking into The board of directors or the majority

among the members of the corporation. Each account relevant factors which are germane to the thereof, controls and directs the affairs of the

director and trustee shall hold office until the objective and purpose of requiring the election of corporation.

successor is elected and qualified. A director who an independent director, such as the extent of It occupies a position of trusteeship in

ceases to own at least one (1) share of stock or a minority ownership, type of financial products or relation to the minority of the stock.

trustee who ceases to be a member of the securities issued or offered to investors, public The board shall exercise good faith, care, and

corporation shall cease to be such. interest involved in the nature of business diligence in the administration of the affairs

operations, and other analogous factors. of the corporation, and protect not only the

The board of the following corporations vested with interest of the majority but also that of the

public interest shall have independent directors An independent director is a person who apart from minority of the stock.

constituting at least twenty percent (20%) of such shareholdings and fees received from any business

board: or other relationship which could, or could AUTHORITY OF THE BOARD OF DIRECTORS OR

reasonable be received to materially interfere with TRUSTEES

(a) Corporations covered by Section 17.2 of Republic the exercise of independent judgment in carrying With the exception only of some powers

Act No. 8799, otherwise known as "The Securities out the responsibilities as a director. expressly granted by law to Stockholders or

Regulation Code", namely those whose securities members:

are registered with the Commission, corporations Independent directors must be elected by the The board of directors or trustees has

listed with an exchange or with assets of at least shareholders present or entitled to vote in absentia the sole authority to determine policies,

Fifty million pesos (50,000,000.00) and having two during the election of directors. Independent enter into contracts, and conduct the

hundred (200) or more holders of shares, each directors shall be subject to rules and regulations ordinary business of the corporation

holding at least one hundred (100) shares of a class governing their qualifications, disqualifications, within the scope of its charter, i.e.

of its equity shares; voting requirements, duration of term and term

articles of incorporation, by-laws and appointment, they may discharge those 3. The stockholders

relevant provision of law. appointed. They have the residual power over

The property of the corporation is not the fundamental corporate changes, like

The authority of the board of directors is property of its stockholders or members and amendments of articles of

restricted to the management of the may not be sold by the stockholders or incorporation.

regular business affairs of the members WITHOUT EXPRESS

corporation, UNLESS, more extensive AUTHORIZATION from the Board. NOTE: As a general rule, all corporate

power is expressly conferred. Unless duly authorized, a Treasurer, whose powers are to be exercised by the Board of Directors,

powers are limited, cannot bind the exceptions are made where the Code

CORPORATION EXERCISES ITS POWERS THROUGH corporation in a sale of its assets. provides otherwise.

ITS BOARD OF DIRECTORS

A corporation exercises its powers through THREE LEVELS OF CONTROL QUALIFICATIONS OF A BOARD OF DIRECTORS

its Board of Directors and/or its duly 1. The board of directors OR TRUSTEES

authorized officers and agents, EXCEPT in They are responsible for corporate 1. For stock corporation:

instances where the Corporation Code policies and the general Ownership of at least 1 share of the

requires stockholders’ approval for certain management of the business affairs capital stock of the corporation in his

specifics acts. of the corporation; own name.

A corporation’s Board of Directors is Just as a natural person may For non-stock corporation:

understood to be that BODY which: authorize another to do certain acts Only members of the corporation can

1. Exercise all powers provided for under in his behalf, so may the board of be elected.

the Corporation Code directors of a corporation validly 2. The director or trustee must be capacitated.

2. Conducts all business of the corporation; delegate some of its functions to 3. The director or trustee must be of legal age.

and individual officers or agents 4. Other qualifications as may be prescribed in

3. Controls and holds all property of the appointed by it. the by-laws of the corporation

corporation. 2. The officers INDEPENDENT DIRECTOR

Its members have been characterized as They, in theory, execute the policies An independent Director is a person who, apart

trustees or directors clothed with FIDUCIARY laid down by the board, but in from shareholdings and fees received from the

CHARACTER. practice often have wide latitude in corporation, is independent of management and free

The directors may appoint officers and determining the course of business from any business or other relationship which could,

agents and as incident to this power of operations. or could reasonably be perceived to materially

interfere with the exercise of independent judgment disqualifications and none of the disqualifications such number of shares for as many persons as there

in carrying out the responsibilities as a director. set forth in this Code. are directors to be elected; (b) cumulate said shares

and give one (1) candidate as many votes as the

Independent director must be elected by the At all elections of directors or trustees, there must number of directors to be elected multiplied by the

shareholders present or entitled to vote in be present, either in person or through a number of shares owned; or (c) distribute them on

absentia during the election. representative authorized to act by written proxy, the same principle among as many candidates as

The Board of the following corporations the owners of majority of the outstanding capital may be seen fit: Provided, That the total number of

vested with PUBLIC INTEREST shall have stock, or if there be no capital stock, a majority of votes cast shall not exceed the number of shares

INDEPENDENT DIRECTORS constituting at the members entitled to vote. When so authorized owned by the stockholders as shown in the books of

least 20 % of such board: in the bylaws or by a majority of the board of the corporation multiplied by the whole number of

1. Corporation covered by Section 17.2, The directors, the stockholders or members may also directors to be elected: Provided, however, That no

Securities Regulation Code; vote through remote communication or in absentia: delinquent stock shall be voted. Unless otherwise

2. Banks and quasi-banks, non-stock savings Provided, That the right to vote through such modes provided in the articles of incorporation or in the

and loan associations, pawnshop, may be exercised in corporations vested with public bylaws, members of non-stock corporations may

corporations engage in money service interest, notwithstanding the absence of a provision cast as many votes as there are trustees to be

business, preneed, trust and insurance in the bylaws of such corporations. elected by may not cast more than one (1) vote for

companies, and other financial one (1) candidate. Nominees for directors or

intermediaries; and A stockholder or member, who participates through trustees receiving the highest number of votes shall

3. Other corporations engaged in business remote communication or in absentia, shall be be declared elected.

vested with public interest similar to the deemed present for purposes of quorum.

above, as may be determined by the If no election is held, or the owners of majority of

commission (SEC). The election must be by ballot if requested by any the outstanding capital stock or majority of the

voting stockholder or member. members entitled to vote are not present in person,

by proxy, or through remote communication or not

Section 23. Election of Directors or Trustees. - In stock corporations, stockholders entitled to vote voting in absentia at the meeting, such meeting may

Except when the exclusive right is reserved for shall have the right to vote the number of shares of be adjourned and the corporation shall proceed in

holders of founders' shares under Section 7 of this stock standing in their own names in the stock accordance with Section 25 of this Code.

Code, each stockholder or member shall have the books of the corporation at the time fixed in the

right to nominate any director or trustee who bylaws or where the bylaws are silent at the time of

possesses all of the qualifications and none of the the election. The said stockholder may: (a) vote

The directors or trustees elected shall perform their may not cast more than one (1) vote for one corporation. But when these officers exceed their

duties as prescribed by law, rules of good corporate (1) candidate. authority, their actions “cannot bind the corporation,

governance, and bylaws of the corporation. 6. Nominees for directors or trustees receiving unless it has ratified such acts or is estopped from

the highest number of votes shall be disclaiming them”

declared elected.

WHAT ARE THE REQUIREMENTS FOR THE ELECTION CORPORATE OFFICERS AND AGENTS

OF DIRECTORS OR TRUSTEES? Officer Requiremen Citizenshi Residency

1. the owners of majority of the outstanding Section 24. Corporate Officers. - Immediately after t p

capital stock, or if there be no capital stock, a their election, the directors of a corporation must President Must be a Need not Need not

majority of the members entitled to vote of formally organize an elect: (a) a president, who director; be a be a

Must be a Filipino resident

the corporation must be present, either in must be a director; (b) a treasurer, who must be a

stockholder citizen of the

person or through a representative resident of the Philippines; and (d) such other on record of Philippine

authorized to act by written proxy. officers as may be provided in the bylaws. If the at least 1 s

2. When so authorized in the bylaws or by a corporation is vested with public interest, the board share

majority of the board of directors, the shall also elect compliance officer. The same person Secretary May or may Must be a Must be a

stockholders or members may also vote may hold two (2) or more positions concurrently, not be a Filipino resident

through remote communication or in except that no one shall act as president and director citizen of the

Philippine

absentia. secretary or as president and treasurer at the same

s

3. The election must be by ballot if requested time, unless otherwise allowed in this Code. Treasurer May or may Need not Must be a

by any voting stockholder or member. not be a be a resident

4. In Stock Corporation the total number of The officers shall manage the corporation and director Filipino of the

votes cast shall not exceed the number of perform such duties as may be provided in the citizen Philippine

shares owned by the stockholder as shown in bylaws and/or as resolved by the board of directors. s

the books of the corporation multiplied by

Complianc If the corporation is vested with public

the whole number of directors to be elected. CORPORATE OFFICER

e officer interest.

Provided, that no delinquent sock shall be The position must be expressly mentioned in the

voted. by-laws in order be considered as a corporate office. Other Qualification may be provided for in

5. In non-stock corporations, the members of officers the by-laws.

non-stock corporations may cast as many GENERAL RULE: The acts of corporate officers

votes as there are trustees to be elected but within the scope of their authority are binding on the NOTE:

Any two (2) or more positions may be held The non-holding of elections and the reasons director, trustee or officer of the corporation, shall,

concurrently by the same person, except, that no therefor shall be reported to the Commission within within seven (7) days form knowledge thereof,

one shall act as president and secretary or as thirty (30) days from the date of the scheduled report in writing such fact to the Commission.

president and treasurer at the same time. election. The report shall specify a new date for the

election, which shall not be later than sixty (60) days

Corporate Officer – the position is provided from the scheduled date. WHO HAS THE RESPONSIBILITY TO REPORT THE

under the Corporation Code or in the By-laws ELECTION AND VACANCY?

of the corporation. If no new date has been designated, or if the The SECRETARY, or ANY OTHER OFFICER of the

Corporate employee – employed by the rescheduled election is likewise not held, the corporation, shall submit to the Commission, the

action of the managing officer of the Commission may, upon the application of a names, nationalities, shareholdings, and residence