Professional Documents

Culture Documents

Partnership Classification

Uploaded by

jenelyn laygo0 ratings0% found this document useful (0 votes)

25 views16 pagesOriginal Title

Partnership

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views16 pagesPartnership Classification

Uploaded by

jenelyn laygoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 16

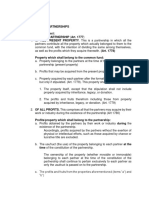

PARTNERSHIP

[Part 2]

Art. 1776 – Classification of Partnership

a. as to object/subject matter

1. Universal Partnership

- may refer to all the present

property or to all the profits

a. universal of all present property

- that which the partners contribute all the property which actually belongs to them to a common

b. universal of profits

- comprises all that the partners may acquire by their industry or work during the existence of the partnership

2. Particular Partnership

- object are determinate things, their use or fruits; a specific undertaking or the exercise of a profession or occupation

b. as to liability of partners

1. General

- they are liable even with respect to their individual properties, in pro rata after the assets of the partnership have

been exhausted, for the contracts which may be entered into in the name and for the account of the partnership, under its

signature and by a person authorized to act for the partnership

2. Limited

- formed by two or more persons having as members one or more general partners and one or more limited

partners.

The limited partners as such shall not be bound by the obligations of the partnership

A limited partner is one whose liability is limited only up to the extent of his contribution

c. as to duration

1. at will

2. at a fixed term

- the term of existence has been agreed upon expressly or impliedly

- the expiration of the term thus fixed or the accomplishment of the particular undertaking specified will cause the

automatic dissolution of the partnership

d. as to legality of existence

1. de jure –

2. de facto

e. as to representation

1. ordinary/real

2. ostensible/ partnership by estoppel

f. as to publicity

1. secret

2. open or notorious

g. as to purpose

1. commercial

2. professional

Kinds of Partners

1. Capitalist Partners

- one who furnishes capital;

- not exempted from losses; can engage in other business provided there is no competition between the partner

and his business

2. Industrial

- one who furnishes industry or labor;

- can be a general partner but never a limited partner;

- exempted from losses as between the partner; cannot engage in any other business without express consent of

the partners, otherwise

- he can be excluded from the firm (plus damage)

- or the benefits he obtains from the other business can be availed of by the other partners (plus damages)

3. General/Real

- one who is liable beyond the extent of his contribution

4. Managing

- one who manages actively the firm’s affairs

5. Liquidating

- one who liquidates or winds up the affairs of the firm after it has been dishonored

6. Partner by estoppel/Quasi-partner

- one who is not really a partner but who may become liable as such insofar as third persons are concerned

7. Continuing

8. Surviving

9. Subpartner

Other classifications

a. ostensible partner

- one whose connection with the firm is public and open

b. secret

- one whose connection with the firm is concealed or kept a secret

c. silent

- one who does not participate in the management, though he shares in the profits or losses

d. dormant/sleeping

- one who is both a secret and silent partner (not managing)

e. original

f. incoming

g. retiring

Arts. 1778-80 – Universal Partnership

2 kinds of Universal Partnership

A. Universal property of all present property

- one which comprises all that the partners may acquire by their industry or work during the existence of the

partnership and the usufruct of movable or immovable property which each of the partners may possess at the time

of the celebration of the contract.

The following become common property of all the partners:

1. property which belonged to each of them at the time of the construction of the partnership

2. profits which they may acquire from the property contributed

Property which the partners may acquire subsequently by inheritance, legacy or donation cannot be included for

the stipulation for common enjoyment

Fruits thereof may be included

B. All profits

- comprises all that the partners may acquire by their industry or work during the existence of the partnership

Distinction between all profits and all present property

All profits

- only the usufruct of the properties of the partners become common property; naked ownership is retained by each

of the partners

- all profits required by the industry or work of the partners become common property

All present property

- all the property actually belonging to the partners are contributed- and said properties become common properties

- as a rule, aside from the properties, only the profits of the said contributed common property

Note:

- profits from other sources may become common, but only if there is a stipulation to such effect.

- Properties subsequently acquired by inheritance, legacy or donation, cannot be included in the stipulation, but the

fruits thereof can be included in the stipulation

Art. 1781 – Presumption in favor of partnership of profits

- applicable only when a universal partnership has been entered into

note:

- future property cannot be included in the stipulation regarding universal partnership of all present property

Reasons:

1. contracts regarding successions rights cannot be made;

2. partnership demands that the contributed things be determinate, known and certain;

3. universal partnership of all present properties really implies a donation and future property cannot be donated

Art. 1782 – Persons prohibited by law to give donation- cannot enter into Universal Partnership

Reason: they should not be allowed to do indirectly what the law forbids directly

Art. 1783 – Particular Partnership

- it has for its object determinate things, their use of fruits, or specific undertaking, or the exercise of a profession or

vocation

Doctrine:

If two (2) individuals form a particular partnership for a deal in reality, it does not necessarily follow that all deals are for

the benefit of the partnership. In the absence of agreement, each particular deal results in a particular partnership. If one

of them, on his account, and using his own funds, should make transactions in the same business, it is his own

undertaking

II. Obligations of the Partners among themselves

Art. 1784 – When partnership begins

General Rule:

- begins from the moment of the execution of the contract

Exception:

- unless it is otherwise stipulated

Intent to create a future partnership

Art 1784 presupposes that there can be a future partnership which at the moment has no juridical existence

yet

The agreement for a future partnership does not itself result in a partnership. The intent must be later on

actualized by the formation of the intended partnership

Rule if contributions have not yet been actually made

- generally, even if contributions have not yet been made, the firm already exists, for partnership is a consensual contract

(all requisites for such consent must be present)

Art. 1785 – Duration of Partnership

Duration: unlimited in the sense that no time limit is fixed by law; may be agreed upon (expressly or impliedly)

Partnership “at will”

- 2 kinds

a. when there is no term, express or implied

b. when continued by habitual managers

- note:

It is called “at will” because its continued existence really depends upon the will of the partners or even on the will of

any of them.

Art. 1786 – Duties of Parties

3 Important Duties of a partner

1. to contribute what has been promised;

2. to deliver the fruits of what should have been delivered; and

3. to warrant

Obligations with respect to contribution of property

1. to contribute at the beginning of the partnership or at the stipulated time the money, property or industry which he

may have promised to contribute;

2. to answer for eviction in case the partnership is deprived of the determinate property contributed; and

3. to answer to the partnership for the fruits of the property the contribution of which he delayed, from the date they

should have been contributed up to the time of actual delivery

in addition, the partner has the obligation:

4. to preserve said property with the diligence of a good father of a family pending delivery to the partnership; and

5. to indemnify the partnership for any damage caused to it by the retention of the sane or by the delay in its

contribution

Effects of failure to contribute property promised

The mutual contribution to a common fund being of the essence of the contract of partnership, for without the

contributions the partnership is useless, it is but logical that the failure to contribute is to make the partner ipso jure a

debtor of the partnership even in the absence of any demand.

The remedy of the partner is not rescission but an action for specific performance with damages and interest from

the defaulting partner from the time he should have complied with his obligation.

Art. 1787 – Appraisal of Goods

- manner prescribed by the contract of partnership in the absence of stipulation, appraisal shall be made by

experts chosen by the partners and according to current prices

A. When contribution consist of goods

- appraisal of value is needed to determine how much has been contributed

B. How appraisal is made

- as prescribed by the contract

- in default of the first, experts chosen by the partners, and at current prices

C. Necessity of the Inventory Appraisal

- proof is needed to determine how much goods or money had been contributed. An inventory is useful

D. Risk of loss

- after goods have been contributed, the partnership bears the risk of subsequent changes in their value

Art. 1788- Obligations with respect to contribution of money

1. to contribute on the date due the amount he has undertaken to contribute to the partnership;

2. to reimburse any amount he may have taken from the partnership coffers and converted to his own use;

3. to pay the agreed or legal interest, if he fails to pay his contribution on time or in case he takes any amount

from the common fund and converts it for his own use; and

4. to indemnify the partnership for the damages caused to it by the delay in the contribution or the conversion of

any sum for his personal benefit

Liability of guilty partner for interest and damages

- the guilty partner is liable for interest and damages not from the time judicial or extrajudicial demand is made but

from the time he should have complied with his obligation or from the time he converted the amount to his own use,

as the case may be.

- Unless there is a stipulation fixing a different time, this obligation of a partner to give his promised contribution

arises from the commencement of the partnership, that is, upon perfection of the contract.

Cases covered by the article:

a. when money promised is not given on time;

b. when partnership money is converted to the personal use of the partner

Coverage of liability

a. interest at the agreed rate (if none, the legal interest)

b. damages that may be suffered by the partnership

Why no demand is needed to put partners in default:

a. contribution

- a partnership is formed precisely to make use of contributions, and this use should start from its formation, unless

a different period has been set; otherwise the firm is necessarily deprived of the benefits thereof

- injury is constant

- time is of the essence

b. conversion

- the form is deprived of the

benefits of the money, from the very moment of conversion

note: even if no actual injury results, the liability exists because Art. 1788 is absolute

Art. 1789 – Obligations of an Industrial Partner

Remedies where industrial partner engages in business

- if the industrial partner engages in business for himself, without the express permission of the partnership, the

capitalist partners have the right to exclude him from the firm or to avail themselves of the benefits which he may

have obtained. In either case, the capitalist partners have the right to damages

note: the permission given must be express; hence, mere toleration by the partnership will not exempt the industrial

partner from liability

Distinction between Capitalist Partner and Industrial Partner

a. as to contribution

CP – contributes money or property

IP – contributes industry (mental or physical)

b. as to prohibition to engage in other business

CP – cannot generally engage in the same or similar enterprise as that of his firm (possibility of unfair competition)

IP – cannot engage in any business for himself (all his industry is supposed to be contributed to the firm)

c. as to profits

CP – shares in the profits according to the agreement thereon; if none, pro rata to his contribution

IP – receives a just and equitable share

d. as to losses

CP – stipulation; if no stipulation, the agreement as to the profits; if none, pro rata contribution

IP – exempted as to losses (as between the partners0; but is liable to strangers without prejudice to reimbursement

from capitalist partners

Art. 1790 - Contribution

General Rule: Partner shall contribute equal shares to the capital of the partnership

Exception: stipulation to the contrary

Amount of contribution

- it is permissible to contribute unequal shares, if there is a stipulation to that effect

To whom applicable

- both to industrial as well as to capital partners undoubtedly

Art. 1791 – Obligation of Capitalist Partner

General Rule:

- a capitalist partner is not bound to contribute to the partnership more than what he agreed to contribute but in

case of imminent loss of the business, and there is no agreement to the contrary, he is under obligation to contribute

an additional share to save the venture.

- if he refuses to contribute, he shall be obliged to sell his interest to the other partners

Requisites when a capitalist partner is obliged to sell his interest to the other partners:

1. if there is imminent loss of the partnership;

2. he refuses to contribute an additional share to the capital; and

3. there is no agreement to the contrary

note: industrial partner is exempted for he is already giving his entire industry

Art. 1792 – Obligations of Managing Partner who collects debt

Requisites:

a. existence of at least two debts;

b. both sums are demandable; and

c. collecting partner is authorized to manage and actually manages the partnership

when not applicable

- if the partner collecting is not a managing partner

- here, there is no basis for the suspicion that the partner is in BAD FAITH

Art. 1793 – Obligation of Partner who receives share of partnership credit

- to bring such to the partnership capital in case of insolvency of the debtor and other partners have not yet

collected their share

as compared to Art. 1792

a. one debt only (firm credit)

b. applies to any partner

Art. 1794 – Obligation of partner for damages to partnership

Why General Damages cannot be offset by benefits:

a. the partner has the duty to secure benefits for the partnership; on the other hand, he has the duty also not to be at

fault

b. since both are duties, compensation should not take place, the partner being the debtor in both instances

- compensation requires 2 persons who are reciprocally debtors and creditors of each other

Mitigation of Liability

- equity may mitigate liability if there are “extraordinary efforts” resulting in unusual “profits”

Need for Liquidation

- before a partner sues another for alleged fraudulent management and resultant damages, a liquidation must first

be effected to know the extent of damages

Effect of Death of the negligent Partner

- suit for recovery may be had against his estate

Art. 1795 – Risk of Loss of things contributed

Cases contemplated:

1. Specific and determinate things which are not fungible where only the use is contributed

- the risk of loss is borne by the partner because he remains the owner of the things

2. Specific and determinate things the ownership of which is transferred to the partnership

- the risk of loss is for the account of the partnership, being the owner

3. Fungible things or things which cannot be kept without deteriorating even if they are contributed only for the use of the

partnership

- the risk of loss is borne by the partnership for evidently the ownership was being transferred since use is

impossible without the things being consumed or impaired

4. Things contributed to be sold

- the partnership bears risk of loss for there cannot be any doubt that the partnership was intended to be the owner;

otherwise’ the partnership could not effect the sale

5. Things brought and appraised in the inventory

- the partnership bears the risk of loss because the intention of the parties was to contribute to the partnership the

price of the things contributed with an appraisal in the inventory. There is thus an implied sale making the

partnership owner of the said things, the price being represented by their appraised value.

Art. 1796 – Responsibility of the Firm

Obligation of the partnership to the partners:

1. refund amounts disbursed by the partner in behalf of the partnership plus the corresponding interest from the time

the expenses are made;

2. to answer for the obligations the partner may have contracted in good faith in the interest of the partnership

business; and

3. answer for risk in consequence of its management

Art. 1797 – Rules for Distribution of Profits and Losses

Distribution of Profits

a. partners share the profits according to their agreement subject to Art. 1799

b. if there is no such agreement:

1. the share of each capitalist partner shall be in proportion to his capital contribution (this rule is based on the

presumed will of the partners)

2. the industrial partner shall receive such share, which must be satisfied first before the capitalist partners shall

divide the profits, as may be just and equitable under the circumstances.

- the share of the industrial partner in the profits is not fixed, as in the case of the capitalist partners, as it is

very difficult to ascertain the value of the services of a person

Distribution of Losses

a. the losses shall be distributed according to their agreement subject to Art. 1799

b. if there is no such agreement, but the contract provides for the share of the partners in the profits, the share of

each in the losses shall be in accordance with the profit-sharing ratio, but the industrial partner shall not be liable

for losses. The profits or losses of the partnership cannot be determined by taking into account the result of one

particular transaction but of all the transactions had.

c. If there is also no profit-sharing stipulated in the contract, then losses shall be born by the partners in

proportion to their capital contributions, but the purely industrial partner shall not be liable for the losses.

Industrial Partner’s Profit

- a just and equitable share

Industrial Partner’s Losses

- while he may be held liable by third persons, still he can recover whatever he is made to give them, from the other

partners, for he is exempted from losses, with or without stipulation to this effect

Non-applicability to Strangers

- Art. 1797 applies only to the partners, not when liability in favor of strangers are concerned, particularly with

reference to the industrial partner

Art. 1798 – Designation by Third Persons

a. third person

- in the article, not a partner; to avoid partiality

b. when designation by the 3rd party may be impugned

- when it is manifestly inequitable

c. when designation cannot be impugned even if manifestly inequitable:

- if the aggrieved partner has already begun to execute the decision

- if he has not impugned the same within 3 months from the time he had knowledge thereof

Art. 1799 – (1) Stipulation excluding a partner from any share in profits or losses

General Rule:

- a stipulation excluding one or more partners from any share in the profits or losses is void

Reason: partnership is for COMMON BENEFIT

Exception:

- in the case of the industrial partner whom the law itself excludes from losses

note: stipulation exempting a partner from losses should be allowed

Reason why industrial partner is generally exempted from losses

- the industrial partner cannot withdraw any labor or industry he had already exerted.

Art.1800 - Rights and Obligations of a Managing Partner

Modes of Appointing a Manager

1. appointment as manager in the articles of partnership

2. appointment as manager made in an instrument other than the articles of partnership or made orally

Distinction between Appointment in Articles of Partnership and Appointment from other Source (other than the articles

of partnership)

a. as to power

Partnership – power is irrevocable without just or lawful cause

- to justify removal for just cause: controlling partners should vote to oust him

- without just cause: there must be unanimity

other source - power to act may be revoked at any time, with or without just cause

- such appointment is a mere delegation of power; revocable at any time

- removal shall also be done by the controlling interest

b. as to extent of power

Partnership

good faith – he may do all acts of administration (not ownership) despite the opposition of his partners

bad faith – he cannot

other source – as long as he remains manager, he can perform all acts of administration, but of course, if the others

oppose and he persists, he can be removed

Scope of the Powers of the Manager

Unless specifically restricted:

- he has the powers of a general agent;

- as well as the incidental powers needed to carry out the objectives of the partnership

Rules as to Compensation

General Rule:

- in the absence of an agreement to the contrary, each member of the partnership assumes the duty to give his

time, attention, and skill to the management of its affairs, so far at least, as may be reasonable necessary to the

success of the common enterprise; and for this service a share of the profits is only his compensation.

Exception:

a. a partner engaged by his co-partners to perform services not required of him in fulfillment of the duties which the

partnership relation imposes and in a capacity other than that of a partner is entitled to receive the compensation

agreed upon therefor;

b. a contract for compensation may be implied where there is extraordinary neglect on the part of one partner to

perform his duties toward the firm’s business, thereby imposing the entire burden on the remaining partner;

c. one partner may employ his co-partner to do work for him outside of and independent of the co-partnership, and

become personally liable therefor;

d. partners exempted by the terms of partnership from rendering services to the firm may demand pay for services

rendered;

e. where one partner is entrusted with the management of the partnership business and devotes his whole time and

attention thereto, at the instance of the other partners who are attending to their individual business and giving no

time or attention to the business of the firm, the case presents unusual conditions, is taken out of the general rule as

to compensation and warrants the implication of an agreement to make compensation, In such cases, the amount of

compensation depends, of course, upon the agreement of the parties, express or implied, as well as upon the

particular circumstances of the case; and

f. by the contract of partnership, one partner is exempted from the duty of rendering personal services to the

concerned, if he afterwards does render such service at the instance and request of his co-partners, or where the

services rendered are extraordinary.

Art. 1801 – Rule where there are 2 or more Managers

Applicability of the Article

1. there are two or more managers;

2. there is no specification of respective duties; and

3. there is no stipulation requiring unanimity

Specific Rules:

1. Each may separately execute all acts of administration;

2. except if any of the managers should oppose (division of the majority of the managers shall prevail)

- if there is a tie, the partners owning the controlling interest prevail; provided they are also managers

when opposition may be made

- before the acts produce legal effects insofar as third persons are concerned

Art. 1802 – Unanimity of Action

When Unanimity is Required

a. applies when there must be unanimity in the actuations of the managers

b. absence or incapacity of one of the managers still requires unanimity

except:

- when there is imminent danger of grave or irreparable injury to the partnership

Duty of third persons

RULE:

Third persons are not required to inquire as to whether or not a partner with whom he transacts has the consent of

all the managers, for the presumption is that he acts with due authority and can bind the partnership.

APPLICABILITY:

When they innocently deal with a partner apparently carrying on in the usual way the business, it is imperative that if

unanimity is required it is essential that there be unanimity; otherwise the act shall not be valid, that is the partnership is

not bound.

Art. 1803 – Rule when manner of management has not been agreed upon

a. Generally, each partner is an agent

b. Although each is an agent, still if the acts are opposed by the rest, the majority should prevail for the

presumed intent is for all the partners to manage as in Art. 1801;

c. When a partner acts as an agent, it is understood that he acts in behalf of the firm; therefor when he acts in

his own name, he does not bind the partnership generally

d. On the other hand, the authority to bind the firm does not apply if somebody else had been given authority to

manage in the articles of organization or thru other means.

Rule on Alterations

a. “important alterations”

- deals with immovable property because of their greater importance than personality. Also, in proper cases,

they should be returned to the partners in the same condition as when they were delivered to the partnership

b. “alteration”

- contemplates useful expenses

c. consent of the others may be express or implied

Art. 1804 – Contract of Subpartnership

Subpartnership – partnership formed between a member of a partnership and a third person for a division of the profits coming

to him from the partnership enterprise

- partnership within a partnership and is distinct and separate from the main or principal partnership

Right of person associated with partner share

- subpartnership agreements do not in any wise affect the composition, existence, or operations of the firm. The

partners are partners inter se, but, in the absence of the mutual assent of all the parties, the subpartner does not

become a member of the partnership, even the agreement is known to the other members of the firm.

Associate of Partner

a. for a partner to have an associate in his share, consent of the other partners is not required;

b. for the associate to become a partner, all must consent

Art. 1805 – Partnership Books

a. such a right is granted to enable the partner to obtain true and fuel information of the partnership affairs

b. the article presupposes an “ongoing partnership”

c. “reasonable hour”

- contemplates business days throughout the year

Value of Partnership Books of Account as Evidence

- they constitute an admission of the facts stated therein, an admission that can be introduced on evidence as

against the keeper or maker thereof.

Art. 1806 – Duty of Partner to render Information

Duty to give information

- there must be no concealment between partners in all matters affecting the firm’s interest

- requires good faith

- duty to give on demand “true and full information”

Errors in the Book

- if partnership books contain error, but said errors have not been alleged, the books must be considered entirely

correct insofar as the keeper of said books of account is concerned

Who can demand information

a. any partner;

b. legitimate representative of dead partner;

c. legitimate representative of any partner under any legal disability

Art. 1807 – Duty to Account

Partner accountable as fiduciary

- the relation between the partners is essentially fiduciary involving trust and confidence, each partner being

considered in law, as he is, the confidential agent of the others

Duties of a partner

1. Duty to act for common benefit

2. Duty begins during the formation of partnership

3. Duty continues even after dissolution of partnership

4. Duty to account for secret and similar profits

5. Duty to account for earnings accruing even after termination of partnership

6. Duty to make full disclosure of information belonging to partnership

7. Duty not to acquire interest or right adverse to partnership

Duty to Account

REASON:

- the fiduciary relation between the partners are relationships of trust and confidence which must not be abused or

used to personal advantage

- trust relations exists only during the life of the partnership, not before nor after

Art. 1808 – Prohibition against a Capitalist Partner

Business Prohibition on Capitalist Partner

- prohibited from engaging for his own account in any operation which is the kind of business in which the

partnership is engaged

Instances where there is no prohibition

a. when there is an express stipulation allowing the capitalist partner to engage himself;

b. when the other partners expressly allow him to do so;

c. when the other partners impliedly allowed him to do so;

d. when the company ceases to be engaged in business during the period of liquidation and winding up; and

e. when the general-capitalist partner becomes merely a limited partner in a competitive enterprise

Effect of Violation

a. the violator shall bring the partner shall of the profits illegally obtained;

b. he shall personally bear all the losses

Art. 1809 – Right of Partner to a Formal Account

Right to demand a formal account

a. generally, no formal accounting is demandable until after dissolution

b. however, under Art. 1809, formal accounting may be properly asked for

Estoppel

- cannot be questioned anymore if it was accepted without objection for this would now be a case of estoppel,

unless fraud and error are alleged and proved

Stipulation and Continuing Share

- valid and proper accounting must be made

III. Property Rights of a Partner

Art. 1810 – Property Rights of a Partner

Principal Rights:

a. specific partnership

b. interest in the partnership

c. right to participate in the management

Related Rights:

a. the right to reimbursement for amounts advanced to the partnership and to indemnification for risks in

consequence of management;

b. the right to access the inspection of partnership books;

c. the right to true and full information of all things affecting the partnership;

d. the right to formal account of partnership affairs under certain circumstances; and

e. the right to have the partnership dissolved also under certain conditions

Distinction between Partnership Property and Partnership Capital

a. as to changes in value

PP – variable; its value may vary from day to day with changes in the market value of the partnership assets

PC – constant; remains unchanged as the amount fixed by agreement of partners, and is not affected by fluctuations

in the value of partnership property, although it may be increased or diminished by unanimous consent of the

partners

b. as to assets included

PP – includes not only the original capital contributions of the partners, but all property subsequently acquired on

account of the partnership or with partnership funds, including partnership name and the good will of the partnership

PC – represents the aggregate of the individual contributions made by the partners in establishing or continuing the

partnership

Art. 1811 – Partnership in Specific Partnership Property

Co-ownership in Specific Partnership Property

- partners are co-owners but rules on co-ownership does not necessarily apply

Rights of a partner in specific partnership property

1. in general, he has an equal right with his partners to posses, but only for partnership purposes;

2. he cannot assign his right;

3. his right is not subject to attachment or execution; and

4. his rights is not subject to legal support

Art. 1812 – Partner’s Interest in the Partnership is his share of the profits and surplus

In general., a partner’s interest in the partnership (his share in the profits and surplus) may be assigned, attached or

be subject to legal support

Art. 1813 – Conveyance of Interest

Effects of conveyance by partner of his Interest in the Partnership

1. Partnership may still remain; partnership may be dissolved

2. Assignee does not necessarily become a partner

3. Assignee cannot even interfere in the management or administration of the partnership business or affairs

4. Assignee cannot demand information, accounting or inspection of the partnership books

Rights of Assignee

1. to get whatever profits the assignor-partner would have obtained;

2. to avail himself of the usual remedies in case of fraud in the management;

3. to ask for annulment of the contract of assignment if there was fraud, error, intimidation, force, undue influence;

4. to demand an accounting

Art. 1814 –

Charging Interest of a Partner

- while a partner’s interest in the partnership may be charged or levied upon, his interest in a specific firm property

cannot as a rule be attached.

Preferential Rights of Partnership Creditors

- preference is given to partnership creditors in the partnership assets;

- separate or individual creditors have preference in separate or individual properties

Remedies of separate Judgment Creditor of a Partner

1. Application for the “charging order” after securing judgment on his credit

2. Availability of other remedies

Receivership

a. when the charging order is applied for and granted, the court may at the same time or later appoint a receiver of

the partner’s share in the profits or money due him

b. the receiver appointed is entitled to any relief necessary to conserve the partnership assets for partnership

purposes

Redemption of the Interest Charged

a. redemption- means the extinguishment of the charge or attachment on the partner’s interest in the profits;

b. when redemption is made

- any time before closure;

- after closure, it may still be bought with separate property or with partnership property

IV. Obligation of the Partners with regard to Third Persons

Art. 1815 – Firm Name

Firm Name

- name, title or style under which a company transacts business; a partnership of two or more persons; a

commercial house

Purpose

- necessary to distinguish the partnership which has a distinct and separate juridical personality from the individuals

composing the partnership and from other partnerships and entities.

Liability of strangers who include their name

- liability as partners because of estoppel, but do not have the rights as partners

Art. 1816 – Liability for Contractual Obligations of Partners

Partnership Liability

Individual Liability

Liability Distinguished from Losses

- an industrial partner is exempted by law for losses’ but not from liability;

- third persons may sue the firm and the partners, including the industrial partners;

- partners will be personally liable only after the assets of the partnership have been exhausted

Stipulations such as those exempting all the industrial partners and some of the capitalist partners, insofar as third

persons are concerned, would be null and void

Art 1817 – Stipulations Eliminating Liability

Art. 1799 and 1817 reconciled:

- it is permissible to stipulate among them that a capitalist partner will be exempted from liability in excess of the

original capital contributed; but will not be exempted insofar as his capital is concerned

Liability vs. Losses

Liability – refers to responsibility towards third persons

Losses – refers to responsibility as among partners

Art. 1818 – Partner as an Agent of Partnership

When a partner can bind or cannot bind the firm

a. Art. 1818 speaks of an instance when the partner is an agent; and

b. when he can and cannot bind as agent

Agency of a partner

- partnership is a contract of mutual agency

- each partner acting as a principal on his own behalf and as an agent for his co-partners or the firm

When can a partner bind the partnership

Requisites:

a. when he is expressly authorized or impliedly authorized; and

b. when he acts in behalf and in the name of the partnership

When will act not bind the partnership

A. when, although for apparently carrying on in the usual way the business of the partnership,” still the partner

has in fact NO AUTHORITY, and the third party knows that the partner has no authority;

B. when the act is not for apparently carrying on in the usual way of the partnership and the partner has no

authority

NOTE: The 7 kinds of acts enumerated in Art. 1818 are instances of acts which are NOT for apparently carrying on

in the usual way the business of the partnership.

In the 7 instances, the authority must be unanimous except if the business has been abandoned.

Reasons why 7 acts are “unusual”

a. assign the firm property – firm will virtually be dishonored

b. dispose of the goodwill – good will is valuable property

c. do any other act which would make it impossible to carry on – this is evidently prejudicial

d. confers a judgment – if done before a case is filed, this is null and void; if done later, the firm would be jeopardized

e. compromise – an act of ownership and may be said to be equivalent to alienation

f. arbitration – an act of ownership which may not be justified

g. renounce a claim – why should a partner renounce a claim that does not belong to him but to the partnership?

Art. 1819 – Conveyance of Real Property

the article speaks of “:to convey” or a conveyance

real property may be registered or owned in the name of

- the partnership

- all the partners

- one, some or not all the partners in trust for the partnership

Art. 1920 – Admission or representation made by a partner

Conditions:

- admission must concern partnership affairs;

- within the scope of the authority

Restrictions on the rule:

a. admission made BEFORE dissolution are binding only when the partners has authority to act on the

particular matter

b. admissions made AFTER dissolution are binding only if the admissions were necessary to wind up the

business

note: a previous admission of a partner is admissible in evidence against the partnership when it is made within the

scope of the partnership, and during the existence, provided of course that the existence of the partnership is first

proved by evidence other than such act or declaration

Art. 1821 – Notice to a Partner

Cases of Knowledge of a Partner

1. knowledge of a partner acting in a particular matter acquired while a partner;

2. knowledge of a partner acting in a particular matter then present to his mind; and

3. knowledge of any partner who reasonably could and should have communicated it to the acting partner

Effect of Notice to a Partner

a. in general, notice to a partner is notice to the partnership, that is, a partnership cannot claim ignorance if a partner

knew (but this is with restriction)

b. notice to a partner, given while already a partner, is a notice to the partnership provided it relates to partnership

affairs

Effect of knowledge although no notice was given

- notice of the partner is also knowledge of the firm provided:

a. the knowledge was acquired by a partner who is acting in the particular matter involved;

b. the knowledge may have been acquired by a partner not acting in the particular matter involved

Art. 1822 – Liability of Partnership

Requisites for Liability

a. the partner must be guilty of a wrongful act or omission; and

b. he must be acting in the ordinary course of business, or with the authority of his co-partners even if the act is

unconnected with the business

note: partnership liability does not extend to criminal liability

Instances when the firm and other partners are not liable:

a. if the wrongful act or omission was not done within the scope of the partnership business and for its benefit;

b. if the act or omission was not wrongful;

c. if the act or omission, although wrongful, did not make the partner concerned liable himself; and

d. if the wrongful act or omission was committed after the firm had been dissolved and the same was not in

connection with the process of winding up

Art. 1823 – Liability for Misappropriation

Liability of partnership for misappropriation

- the difference between par. 1 and par. 2 is that in the former misappropriation is made by the receiving partner,

while in the latter, the culprit may be any partner. The effect however is the same in both cases

Art. 1824 – Solidary Liability of partners

- not only the partners that are liable in solidum; it is also the partnership

Art. 1825 – Partner by Estoppel and Partnership by Estoppel

Estoppel

- a bar which precludes a person from denying or asserting anything contrary to that which has been established as

the truth by his own deed or representation, either express or implied

When Partnership Liability Results:

- if all the actual partners consented to the representation, then the liability of the person who represented himself

to be a partner or who consented to such representation and the actual partners is considered a partnership liability.

Elements to establish liability as a partner on ground of estoppel:

1. proof by plaintiff that he was individually aware of the defendant’s representations as to his being a partner or

that such representations were made by others and not denied or refuted by the defendant;

2. reliance on such representations by the plaintiff; and

3. lack of denial or refutation of the statements by the defendants; such denial need not precede plaintiff’s acting

thereon if the denial was forthcoming promptly upon hearing of the representations, and if, by prudence and

diligence the plaintiff might have learned the truth or untruth of the representations.

When the problem may arise:

A person may:

a. represent himself as a partner of an existing partnership with or without the consent of the partnership;

b. represent himself as a partner of a non-consent partnership

When estoppel does not apply:

- when although there is misrepresentation, the third party is not deceived, the doctrine of estoppel does not apply

Burden of Proof

- the creditor, or whoever alleges the existence of a partner or partnership by estoppel has the burden of proving

the existence of the misrepresentation and the innocent reliance on it

Art. 1826 – Entry of a New Partner

Entry of a new partner into an existing partnership

- the newly admitted partner would be liable as an ordinary original partner for all partnership obligations incurred

after his admission to the firm

Creation of a new partnership in view of the entry

- the admission of a new partner dissolves the old firm and creates a new one;

- since the old firm is dissolved, the original creditors would not be the creditors of the new firm, but only of the

original partners; hence, they may lose their preference;

- under the civil code, they are considered creditors of the new firm

Liability of incoming partner for partnership obligations

1. limited to his share in partnership property for existing obligations, unless there is stipulation to the contrary;

2. extends to his separate property for subsequent obligations

Liability of an Outgoing Partner

- where a partner gives notice of his retirement or withdrawal from the partnership, he is freed from any liability on

contracts entered into thereafter, but his liability on existing incomplete contract continues.

the rule of holding the new partner liable for previous obligations of the firm is not harsh on the said new partner.

After all the incoming partner partakes of the benefit of the partnership, property and an established business

Art. 1827 – Creditors of Partnership

Reason for the Preference of Partnership Creditors

- after all, the partnership is a juridical person with whom the creditors have contracted; moreover the assets of the

partnership must first be executed

Reason why industrial creditors may still attach the partner’s share

- after all, remainder belongs to the partner

Sale by a partner of his share to a third party

- if a partner sells his share to a third party, but the firm itself still remains solvent, creditors of the partnership

cannot assail the validity of the sale by alleging that it is made in fraud of them, since they have not really been

prejudiced

You might also like

- Law On Partnerships (General Provisions)Document3 pagesLaw On Partnerships (General Provisions)Citoy LabadanNo ratings yet

- Art. 1776. Kinds of PartnershipsDocument4 pagesArt. 1776. Kinds of PartnershipsJoe P PokaranNo ratings yet

- Real Rights Are Contributed Thereto, in Which Case A Public Instrument Shall Be NecessaryDocument6 pagesReal Rights Are Contributed Thereto, in Which Case A Public Instrument Shall Be NecessaryCyrus DaitNo ratings yet

- Law On Partnership and CorporationDocument8 pagesLaw On Partnership and CorporationClarence ClaunaNo ratings yet

- PartnershipReportGroup2Document10 pagesPartnershipReportGroup2Dan LocsinNo ratings yet

- Kinds of PartnersDocument15 pagesKinds of PartnersGenievive AbuboNo ratings yet

- Characteristics of A Contract of Partnership: I. Effect If The Above Requirements Are Not Complied WithDocument10 pagesCharacteristics of A Contract of Partnership: I. Effect If The Above Requirements Are Not Complied WithJay jacinto100% (2)

- The Law On Partnerships and Private CorporationsDocument32 pagesThe Law On Partnerships and Private CorporationsFluffy SnowbearNo ratings yet

- Characteristics of A Contract of Partnership: I. Effect If The Above Requirements Are Not Complied WithDocument6 pagesCharacteristics of A Contract of Partnership: I. Effect If The Above Requirements Are Not Complied WithMyla Rose BornalesNo ratings yet

- Law ReviewerDocument5 pagesLaw Revieweralbert cumabigNo ratings yet

- Law On Partnership and Corporation Discussion Material A: Christian Colleges of Southeast AsiaDocument2 pagesLaw On Partnership and Corporation Discussion Material A: Christian Colleges of Southeast AsiaMary Joyce GarciaNo ratings yet

- PARTNERSHIPS General ProvisionsDocument28 pagesPARTNERSHIPS General ProvisionsjetotheloNo ratings yet

- Law on Partnership and Corporation DiscussionDocument2 pagesLaw on Partnership and Corporation DiscussionJeane BongalanNo ratings yet

- Assignment#2Document14 pagesAssignment#2alexandra nuñezNo ratings yet

- Partnership-3 0Document5 pagesPartnership-3 0Rhea Jane ParconNo ratings yet

- Partnership LawDocument14 pagesPartnership LawTerstine Ayesha LadinesNo ratings yet

- Bus Org ReviewerDocument4 pagesBus Org ReviewerPatricia RodriguezNo ratings yet

- Ae3 Laws of Sale and PartnershipDocument2 pagesAe3 Laws of Sale and PartnershipQueeny Mae Cantre ReutaNo ratings yet

- Law2 NotesDocument12 pagesLaw2 NotesApril Jane AndresNo ratings yet

- Law On Partnership Special ProjectDocument7 pagesLaw On Partnership Special ProjectMamabetNo ratings yet

- BL2 - Partnership ReviewerDocument4 pagesBL2 - Partnership ReviewerKlang B.No ratings yet

- PARTNERSHIPDocument22 pagesPARTNERSHIPJames RemigioNo ratings yet

- Bl2-Partnership NotesDocument4 pagesBl2-Partnership NotesMaria RosetaNo ratings yet

- Forming Partnerships and Partner ObligationsDocument4 pagesForming Partnerships and Partner ObligationsKristan EstebanNo ratings yet

- NaurtsDocument7 pagesNaurtsa jNo ratings yet

- Real Rights Are Contributed Thereto, in Which Case - Shall Be NecessaryDocument4 pagesReal Rights Are Contributed Thereto, in Which Case - Shall Be Necessaryyurineo losisNo ratings yet

- Law On Parcor Study GuideDocument16 pagesLaw On Parcor Study GuideMariel DimaculanganNo ratings yet

- Law On Partnership (NOTES)Document35 pagesLaw On Partnership (NOTES)monsta x noona-yaNo ratings yet

- Business Law and RegulationsDocument5 pagesBusiness Law and RegulationsLoida Joy AvellanaNo ratings yet

- Partnership Obligations and DutiesDocument3 pagesPartnership Obligations and DutiesKat AntonioNo ratings yet

- Understanding Partnership Types and CharacteristicsDocument5 pagesUnderstanding Partnership Types and CharacteristicsLovesickbut PrettysavageNo ratings yet

- A PARTNERSHIP Is A Contract of Two or More Persons Who Contribute MoneyDocument2 pagesA PARTNERSHIP Is A Contract of Two or More Persons Who Contribute MoneyLoise MorenoNo ratings yet

- Salient Points To Remember: ReviewDocument13 pagesSalient Points To Remember: ReviewYan V BeeNo ratings yet

- Obligations-of-Partners Art 1784-1796Document6 pagesObligations-of-Partners Art 1784-1796Aysayah JeanNo ratings yet

- General ProvisionsDocument39 pagesGeneral ProvisionshwhwhwhjiiiNo ratings yet

- Forda ReviewDocument9 pagesForda ReviewMekaella Reu HermosoNo ratings yet

- Partnership Review NotesDocument3 pagesPartnership Review NotesNoel Krish ZacalNo ratings yet

- (Partnerships) Post-Midterms ReviewerDocument34 pages(Partnerships) Post-Midterms ReviewerAlecParafinaNo ratings yet

- Partnership Formation OperationDocument23 pagesPartnership Formation OperationJonh Carlo ManalansanNo ratings yet

- Classifications of PartnershipDocument18 pagesClassifications of PartnershipkennethpenusNo ratings yet

- Laws (Week 1&2)Document15 pagesLaws (Week 1&2)Monica MonicaNo ratings yet

- Essential requisites of contract partnershipDocument5 pagesEssential requisites of contract partnershipJoraldine BatoctoyNo ratings yet

- Partnership: The Civil Code of The Philippines Articles 1767-1867Document29 pagesPartnership: The Civil Code of The Philippines Articles 1767-1867MyunimintNo ratings yet

- Exception: Partnership by EstoppelDocument10 pagesException: Partnership by EstoppelJefNo ratings yet

- Law On PartnershipDocument15 pagesLaw On PartnershipJustine Paul Pangasi-anNo ratings yet

- Assignment #2: 1. What Is The Principle of Delectus Personae? ExplainDocument7 pagesAssignment #2: 1. What Is The Principle of Delectus Personae? ExplainKristan John ZernaNo ratings yet

- Coblaw2 Finals ReviewerDocument7 pagesCoblaw2 Finals ReviewerluisamariepandoNo ratings yet

- Characteristics and Types of PartnershipDocument14 pagesCharacteristics and Types of Partnershipjeo beduaNo ratings yet

- Partnerships Chapter 1 General ProvisionsDocument14 pagesPartnerships Chapter 1 General ProvisionsCristina Gutierrez Acosta100% (1)

- Classification of PartnershipDocument3 pagesClassification of PartnershipLight StormNo ratings yet

- PartnershipDocument17 pagesPartnershipJanelle TabuzoNo ratings yet

- Partnership Requirements and TypesDocument7 pagesPartnership Requirements and TypesYeontanNo ratings yet

- Classes of Partners and PartnerhsipDocument5 pagesClasses of Partners and PartnerhsipKyser JalandoniNo ratings yet

- Study Guide 1Document7 pagesStudy Guide 1Marie Frances SaysonNo ratings yet

- Partnership ReviewerDocument7 pagesPartnership ReviewershelNo ratings yet

- Law On Business Organizations ReviewerDocument2 pagesLaw On Business Organizations ReviewerDianne Mae LeysonNo ratings yet

- Partnerships: (Arts. 1767-1867 of The Civil Code of The Philippines)Document11 pagesPartnerships: (Arts. 1767-1867 of The Civil Code of The Philippines)kemeeNo ratings yet

- Prelim Rev Law 1Document25 pagesPrelim Rev Law 1Angela 18 PhotosNo ratings yet

- RFBT 2 Partnership Midterm ReviewerDocument6 pagesRFBT 2 Partnership Midterm ReviewerJamaica DavidNo ratings yet

- Parntnership and CorporationDocument3 pagesParntnership and Corporationjenelyn laygoNo ratings yet

- Assumption of ArtsDocument5 pagesAssumption of Artsjenelyn laygoNo ratings yet

- Partnership ClassificationDocument16 pagesPartnership Classificationjenelyn laygoNo ratings yet

- Ae2107 - Business Laws and Regulations: Amending B. P. No. 68 - Corporation Code of The PhilippinesDocument16 pagesAe2107 - Business Laws and Regulations: Amending B. P. No. 68 - Corporation Code of The Philippinesjenelyn laygoNo ratings yet

- Module 2a Dissolution PartnershipDocument15 pagesModule 2a Dissolution PartnershipjoooNo ratings yet

- Revised Corporation CodeDocument32 pagesRevised Corporation Codejenelyn laygoNo ratings yet

- The Federal Reserve ActDocument121 pagesThe Federal Reserve Actjram64100% (2)

- Thesis Part 2Document73 pagesThesis Part 2Tamahome TakaNo ratings yet

- Assignment Chapter 14Document8 pagesAssignment Chapter 14Nicolas ErnestoNo ratings yet

- S.C Economics (2281) Dec 2013 Paper 12 13 22 23Document59 pagesS.C Economics (2281) Dec 2013 Paper 12 13 22 23Ansha GunessNo ratings yet

- THE ROLE OF FINANCIAL SYSTEMS IN ECONOMIC DEVELOPMENTDocument5 pagesTHE ROLE OF FINANCIAL SYSTEMS IN ECONOMIC DEVELOPMENTCritical ThinkerNo ratings yet

- IKEA Brochure Bath enDocument19 pagesIKEA Brochure Bath endivxnsNo ratings yet

- Transfer To Benefit of Unborn Child Section 13-20: Submitted To: D.R. Nisha JindalDocument25 pagesTransfer To Benefit of Unborn Child Section 13-20: Submitted To: D.R. Nisha JindalriyaNo ratings yet

- Solutions To Tutorial 5Document2 pagesSolutions To Tutorial 5Yuki TanNo ratings yet

- Owner Finance Addendum FormDocument2 pagesOwner Finance Addendum FormNathan Ibale100% (1)

- Monetary PolicyDocument34 pagesMonetary PolicyYogesh Kende89% (9)

- Alfred C. Morley-The Financial Services Industry - Banks, Thrifts, Insurance Companies, and Securities Firms-AIMR (CFA Institute) (1992) PDFDocument148 pagesAlfred C. Morley-The Financial Services Industry - Banks, Thrifts, Insurance Companies, and Securities Firms-AIMR (CFA Institute) (1992) PDFtariqul21No ratings yet

- Insolvency T2 Full AnswerDocument10 pagesInsolvency T2 Full AnswerSI LI YEENo ratings yet

- Tutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862Document112 pagesTutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862THABO CLARENCE MohleleNo ratings yet

- Cash Management ModelsDocument2 pagesCash Management ModelsyukesrajaNo ratings yet

- Rubina ShaikhDocument100 pagesRubina ShaikhNehaNo ratings yet

- Loan AgreementDocument9 pagesLoan AgreementLeboNo ratings yet

- Quantitative Aptitude Old Questions: WWW - Recruitment.guruDocument6 pagesQuantitative Aptitude Old Questions: WWW - Recruitment.guruPudeti RaghusreenivasNo ratings yet

- Financial MathematicsDocument20 pagesFinancial MathematicsabdullahiismailisaNo ratings yet

- Income Tax On CorporationsDocument8 pagesIncome Tax On CorporationsDevonNo ratings yet

- PERSONAL-FINANCE-PRELIMS-REVIEWER FinalllllDocument47 pagesPERSONAL-FINANCE-PRELIMS-REVIEWER FinalllllStephanie Andal0% (1)

- CIVIL LIABILITY OF DISHONORED CHECKDocument17 pagesCIVIL LIABILITY OF DISHONORED CHECKjackyNo ratings yet

- Calculate interest earned on depositDocument5 pagesCalculate interest earned on depositMhelveneNo ratings yet

- Loan Agreement Lender Loan NumberDocument6 pagesLoan Agreement Lender Loan Numbermr_3647839No ratings yet

- PWC Worldwide Tax Summaries Corporate Taxes 2018 19 2 PDFDocument2,839 pagesPWC Worldwide Tax Summaries Corporate Taxes 2018 19 2 PDFJansen SinagaNo ratings yet

- G. Edward Griffin: A Second Look at The Federal ReserveDocument11 pagesG. Edward Griffin: A Second Look at The Federal ReserveKirsten NicoleNo ratings yet

- Baroda Home LoanDocument31 pagesBaroda Home LoanRajkot academyNo ratings yet

- Letter To Congressman Pingree Re. Student Loan Interest RatesDocument2 pagesLetter To Congressman Pingree Re. Student Loan Interest RatesBowdoin Student GovernmentNo ratings yet

- CBSE Class 12 Accountancy Important FormulasDocument3 pagesCBSE Class 12 Accountancy Important Formulasrio_harcan100% (2)

- Brave New World: Future of Jobs and OpportunityDocument68 pagesBrave New World: Future of Jobs and OpportunityVdasilva83No ratings yet

- YEAR 2013: Zapatoes, Inc. Collects Receivables About 1.18 Times A YearDocument10 pagesYEAR 2013: Zapatoes, Inc. Collects Receivables About 1.18 Times A YearJessica Khristel DumayNo ratings yet