Professional Documents

Culture Documents

Fedelin Fiscal 2

Fedelin Fiscal 2

Uploaded by

Carina Avila CorroOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fedelin Fiscal 2

Fedelin Fiscal 2

Uploaded by

Carina Avila CorroCopyright:

Available Formats

Fedelin, Nyna Micah C.

Sir Abvic Maghirang

MPA 618 Fiscal Policy and National Development

1. Does an increase in the IRA in your Local Government Unit actually increase its spending power?

IRA stands for Internal Revenue Allotment which was allocated to transfer to different

levels of local governments. It is distributed based on population and land area. Its purpose is

the decentralization of some fiscal decisions to LGU to efficiently deliver public services to the

local population. The local government of Naujan, Oriental Mindoro is a first-class municipality

and it also has the biggest land area in Oriental Mindoro. Having a large land area means Naujan

receives a large share of IRA, however, it is a first-class municipality that has various sources of

revenue. An increase in IRA will add to the other source of revenue of LGU thus results in

additional funds for spending. To answer the question, yes, an increase in the IRA in our LGU

increase our spending power. Due to our big land area and population, it does need support

from the national government to sustain the services to the local population.

2. What are the local sources of revenue of your LGU? How do they factor in the spending capacity

of the LGU in relation with the IRA?

The town of Naujan's revenues came from operations of slaughterhouse, cemetery,

public market, and Bahay Tuklasan Center aside from local taxes, permits and licenses, services,

and business incomes. Naujan achieved being the first-class municipality by promoting

investment in our town, however, Naujan’s sources of income are not enough to sustain due to

our large population and land area. For that same reason, Naujan receives a big amount of IRA,

which results in the IRA’s contribution being bigger than the local source fund. Hence, Naujan is

dependent on IRA. With a limited source of income, Naujan’s spending capacity is reliant on IRA.

3. What are the possible impact of the "Mandanas Ruling" as far as the revenue generation

capacity of your LGU?

Mandanas- Garcia's ruling resulted from the petition made by Batangas Governor

Mandanas and former Bataan Governor Garcia which appeals that LGU shares should include all

national taxes. At present, LGU’s IRA comes from 40% of national internal revenue taxes that are

collected by the Bureau of Internal Revenue. With the implementation of the Mandanas-Garcia

Ruling, the IRA that will be received by LGUs will increase. In my opinion, the increase of IRA will

result in, further dependency on IRA. Additionally, more LGUs will not address the need of

having their source of revenue besides IRA. On a positive point, an increase in IRA will help LGUs

who are dependent on IRA to increase their spending capacity to address the needs of the local

population.

You might also like

- The Barangay - Roles, Functions, Officials, Offices and BenefitsDocument64 pagesThe Barangay - Roles, Functions, Officials, Offices and Benefitskyla penaverdeNo ratings yet

- Approved Turkana County Budget FY 2020 - 21Document427 pagesApproved Turkana County Budget FY 2020 - 21James EkalNo ratings yet

- Philippine Christian University: Subject: Local Fiscal AdministrationDocument5 pagesPhilippine Christian University: Subject: Local Fiscal AdministrationMara AngeliNo ratings yet

- Valdoviezo, Jan Paul MPA 103 IRA Dependency of LGUsDocument4 pagesValdoviezo, Jan Paul MPA 103 IRA Dependency of LGUsJan Paul ValdoviezoNo ratings yet

- Ebuka OneDocument62 pagesEbuka OneIkenna OrjiNo ratings yet

- Module 2, Test 1, Test 3Document9 pagesModule 2, Test 1, Test 3Jigz GuzmanNo ratings yet

- Originally Submitted Fil Revenue Enhancement-Activities-Of-The-Barangays-In-The-City-Of-TanauanDocument101 pagesOriginally Submitted Fil Revenue Enhancement-Activities-Of-The-Barangays-In-The-City-Of-TanauanJonathan MontealtoNo ratings yet

- JURNAL SKRIPSI Analisis Potensi Pajak Reklame Terhadap Realisasi Penerimaan Pajak ReklameDocument14 pagesJURNAL SKRIPSI Analisis Potensi Pajak Reklame Terhadap Realisasi Penerimaan Pajak ReklameAntikasariNo ratings yet

- Analisis Tingkat Pengetahuan Pemahaman Dan Kesadaran Pemilik Usaha Kos Tentang Pajak Kos Di Kecamatan Lowokwaru Kota MalangDocument9 pagesAnalisis Tingkat Pengetahuan Pemahaman Dan Kesadaran Pemilik Usaha Kos Tentang Pajak Kos Di Kecamatan Lowokwaru Kota MalangHilmi IkhwanNo ratings yet

- Blessing Full ProjectDocument60 pagesBlessing Full ProjectTreasureNo ratings yet

- Land Use Management On Establishment of Local Economic EnterpriseDocument7 pagesLand Use Management On Establishment of Local Economic EnterpriseEfren Louie Olaño100% (1)

- FADocument7 pagesFAMariella AngobNo ratings yet

- Extent of Implementation of Revenue-Generation Strategies and Revenue-Generation Performance of The Municipalities in Ilocos NorteDocument27 pagesExtent of Implementation of Revenue-Generation Strategies and Revenue-Generation Performance of The Municipalities in Ilocos NorteLawrence Brian LabasanNo ratings yet

- West Visayas State University Luna ST., La Paz, Iloilo City: College of EducationDocument7 pagesWest Visayas State University Luna ST., La Paz, Iloilo City: College of EducationDarlene Rose Hofileña AlcaldeNo ratings yet

- Barangay Development CouncilDocument5 pagesBarangay Development CouncilJohny VillanuevaNo ratings yet

- Senator Ralph Recto's 12 Point Agenda For LGU'sDocument2 pagesSenator Ralph Recto's 12 Point Agenda For LGU'sRalph RectoNo ratings yet

- Mandanas Garcia Ruling Short PaperDocument2 pagesMandanas Garcia Ruling Short PaperMimiNo ratings yet

- Government of NagalandDocument13 pagesGovernment of NagalandKhupma HangsingNo ratings yet

- Liquidity Injection - A Real Solution To The Current Crisis in India?Document4 pagesLiquidity Injection - A Real Solution To The Current Crisis in India?CritiNo ratings yet

- 6606-Article Text-27458-1-10-20200323Document12 pages6606-Article Text-27458-1-10-20200323silvia wulandariNo ratings yet

- 2990 8662 1 PBDocument8 pages2990 8662 1 PBIron NuriNo ratings yet

- Charmagne E. Eclavea: Manuel S. Enverga University Foundation Inc. (MSEUF) Bachelor of Science in Public AdministrationDocument2 pagesCharmagne E. Eclavea: Manuel S. Enverga University Foundation Inc. (MSEUF) Bachelor of Science in Public AdministrationPrances PelobelloNo ratings yet

- Impact of Tax Policies On Small and Medium-Sized Enterprises (Smes) in Nigeria (A Case Study of Smes in Gwagwalada, Fct-Abuja)Document15 pagesImpact of Tax Policies On Small and Medium-Sized Enterprises (Smes) in Nigeria (A Case Study of Smes in Gwagwalada, Fct-Abuja)Osilama Vincent OmosimuaNo ratings yet

- Sales Strategy Competitor Analysis Market Growth Market Validation Target Customers Marketing StrategyDocument19 pagesSales Strategy Competitor Analysis Market Growth Market Validation Target Customers Marketing StrategyAvia Hidayatul filzahNo ratings yet

- Fiscal Deficit and Public Sector DebtDocument14 pagesFiscal Deficit and Public Sector DebtBettina OsterfasticsNo ratings yet

- Public Fiscal Administration TestDocument7 pagesPublic Fiscal Administration TestApril Dominguez-Benzon100% (2)

- Joi, Revised Title Proposal, 2Document47 pagesJoi, Revised Title Proposal, 2Jelie DomingoNo ratings yet

- Assignment SONADocument8 pagesAssignment SONAAbam AbamNo ratings yet

- Chapter OneDocument14 pagesChapter OneOsilama Vincent OmosimuaNo ratings yet

- Reflection 2 - Campos, Grace R.Document3 pagesReflection 2 - Campos, Grace R.Grace Revilla CamposNo ratings yet

- Public Fiscal Adminstration 2017Document18 pagesPublic Fiscal Adminstration 2017nitotalibNo ratings yet

- Factors Determinant Tax Revenue in India: - GROUP 14:-Vijay.A Vijay.G Vinuth.M.N Vikas Nag.VDocument12 pagesFactors Determinant Tax Revenue in India: - GROUP 14:-Vijay.A Vijay.G Vinuth.M.N Vikas Nag.Vbs_sharathNo ratings yet

- An Conradh Leis Na DaoineDocument6 pagesAn Conradh Leis Na DaoineMacroomFFNo ratings yet

- Student-Work-5-Term Paper - Ok PDFDocument28 pagesStudent-Work-5-Term Paper - Ok PDFPaul Laurence DocejoNo ratings yet

- Application of GIS in Improving Tax Revenue From The Informal Sector in Bayelsa State, NigeriaDocument13 pagesApplication of GIS in Improving Tax Revenue From The Informal Sector in Bayelsa State, NigeriaJASH MATHEWNo ratings yet

- DL PA 231-Public Fiscal AdministrationDocument7 pagesDL PA 231-Public Fiscal AdministrationYnohtna AsogadnabNo ratings yet

- Debate Speech DraftDocument7 pagesDebate Speech DraftAshmina JagooNo ratings yet

- Fiscal Sustainability, Equity, and Allocative Efficiency in The Light of The 2019 Supreme Court Ruling On The Lgus' Share in National TaxesDocument23 pagesFiscal Sustainability, Equity, and Allocative Efficiency in The Light of The 2019 Supreme Court Ruling On The Lgus' Share in National TaxesJS NazNo ratings yet

- 1.0 Introduction of StudyDocument23 pages1.0 Introduction of StudyUnit Audit DalamNo ratings yet

- Questions For Question & Answer SessionDocument12 pagesQuestions For Question & Answer Sessionapi-284426542No ratings yet

- Canned Goods RICEDocument7 pagesCanned Goods RICElordonorNo ratings yet

- County Executive Marc Elrich's Budget Message For FY21Document10 pagesCounty Executive Marc Elrich's Budget Message For FY21David LublinNo ratings yet

- Jurnal EkonomiDocument1 pageJurnal EkonomiRohot Jeki ManurungNo ratings yet

- Assingment Banker 4Document5 pagesAssingment Banker 4compzNo ratings yet

- Nrega ThesisDocument5 pagesNrega Thesisangelawilliamssavannah100% (2)

- Fiscal Administration Rich SchoolDocument8 pagesFiscal Administration Rich Schoolrich22No ratings yet

- 2410163218mizoram StateFocusPaper 2016 17.split and MergedDocument8 pages2410163218mizoram StateFocusPaper 2016 17.split and MergedAndrew 28No ratings yet

- Case Study Homework Income TaxDocument3 pagesCase Study Homework Income TaxJune Maylyn Marzo100% (2)

- Sponsorship Speech On GSIS Members Rights and Benefits Act of 2011Document10 pagesSponsorship Speech On GSIS Members Rights and Benefits Act of 2011Ralph RectoNo ratings yet

- Regional Economic Growth Effectiveness of Local Revenues and Equalization FundsDocument7 pagesRegional Economic Growth Effectiveness of Local Revenues and Equalization FundsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- State of State 2018 Final PrintDocument136 pagesState of State 2018 Final PrintmayorladNo ratings yet

- Interim Budget 2019Document8 pagesInterim Budget 2019Deepansh goyalNo ratings yet

- Classification Essay-Hendrocahyo-revDocument3 pagesClassification Essay-Hendrocahyo-revHendrocahyo HatsNo ratings yet

- ProposalDocument18 pagesProposalwedzeNo ratings yet

- The Village's Original Revenue Enhancement Strategy (PADes) Through The Management of The Village Owned Enterprises (BUMDes)Document10 pagesThe Village's Original Revenue Enhancement Strategy (PADes) Through The Management of The Village Owned Enterprises (BUMDes)198710072015032002 198710072015032002No ratings yet

- The 4 As' of Rural Marketing MixDocument8 pagesThe 4 As' of Rural Marketing MixKRook NitsNo ratings yet

- Relationship of Revenue Sharing With Regional Revenue and Poverty in East Kalimantan ProvinceDocument14 pagesRelationship of Revenue Sharing With Regional Revenue and Poverty in East Kalimantan Provincefitri adfirafikaNo ratings yet

- 08 Special CoverageDocument9 pages08 Special CoverageIwan SusantoNo ratings yet

- Balud Del Sur - DTP FinalDocument23 pagesBalud Del Sur - DTP FinalBarangay Balud del SurNo ratings yet

- Chapter 6 - Business Ethics & Social ResponsibilityDocument13 pagesChapter 6 - Business Ethics & Social ResponsibilityKenshin Zaide GutierrezNo ratings yet

- Ivy Jean A. Feliciano: What Are The Advantages?Document3 pagesIvy Jean A. Feliciano: What Are The Advantages?Vee FelicianoNo ratings yet

- Ethiopian Industry PolicyDocument37 pagesEthiopian Industry PolicyMequanent MengistuNo ratings yet

- Contemporary Trends in Social StudiesDocument103 pagesContemporary Trends in Social StudiesJuliux Solis GuzmoNo ratings yet

- CIV - Finnish Federation of Graduate - Women - FIDocument3 pagesCIV - Finnish Federation of Graduate - Women - FIPaula HultoanaNo ratings yet

- ADAM Et Al 2019 - Vertical CoordinationDocument25 pagesADAM Et Al 2019 - Vertical CoordinationEdward T MaiaNo ratings yet

- ATAF-FORM-1-FOR - Eng TEACHERSDocument39 pagesATAF-FORM-1-FOR - Eng TEACHERSnelson100% (4)

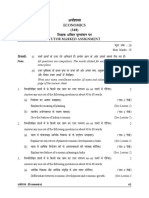

- Economics (318) : Tutor Marked AssignmentDocument2 pagesEconomics (318) : Tutor Marked AssignmentSatyam MishraNo ratings yet

- Andrews Powergrab Dictatorial Powers BillDocument116 pagesAndrews Powergrab Dictatorial Powers BillMichael SmithNo ratings yet

- Francisco M200 A54Document11 pagesFrancisco M200 A54Cassy ParkNo ratings yet

- Research Chapter 1 5Document50 pagesResearch Chapter 1 5katherine19nicerNo ratings yet

- Local Treasury ManualDocument2 pagesLocal Treasury ManualRaies JumawanNo ratings yet

- Participation of Shareholders in Corporate GovernanceDocument8 pagesParticipation of Shareholders in Corporate GovernanceTabokaNo ratings yet

- IMF and World Bank AssignmentDocument5 pagesIMF and World Bank AssignmentAmazing worldNo ratings yet

- Goverment and Politics in Public Administration - PresentationDocument83 pagesGoverment and Politics in Public Administration - PresentationDaisy DonatoNo ratings yet

- Iso 56005 2020Document13 pagesIso 56005 2020boroNo ratings yet

- Letter Response For Notice of Call For AccreditationDocument3 pagesLetter Response For Notice of Call For AccreditationReshel D. Bulcase100% (1)

- Origin of Customs DutyDocument45 pagesOrigin of Customs DutyJayagokul SaravananNo ratings yet

- Sifonios2018 PDFDocument342 pagesSifonios2018 PDFNawress Ben AissaNo ratings yet

- Aspirational Districts' Programme: Water Resources, Financial Inclusion & Skill Development, and Basic InfrastructureDocument3 pagesAspirational Districts' Programme: Water Resources, Financial Inclusion & Skill Development, and Basic Infrastructureankit_shakyawarNo ratings yet

- LC AgricultureDocument2 pagesLC AgricultureInterActionNo ratings yet

- Namma Kalvi 12th Commerce Loyola Guide em 219222Document52 pagesNamma Kalvi 12th Commerce Loyola Guide em 219222John100% (1)

- Hello Vishal, Here's Your Tax Invoice: Original For RecipientDocument1 pageHello Vishal, Here's Your Tax Invoice: Original For RecipientVishal SinghNo ratings yet

- Mankiew Chapter 10Document44 pagesMankiew Chapter 10Umesh SahNo ratings yet

- Conduct Risk - Delivering An Effective Framework - KPMG United Kingdom PDFDocument9 pagesConduct Risk - Delivering An Effective Framework - KPMG United Kingdom PDFsimha1177No ratings yet

- MEMORANDUM AND FORMAL OFFER OF EVIDENCE FOR PETITIONERS (SPA Case No. 21-156 - Buenafe, Et Al. v. Marcos, JR.) December 17, 2021Document100 pagesMEMORANDUM AND FORMAL OFFER OF EVIDENCE FOR PETITIONERS (SPA Case No. 21-156 - Buenafe, Et Al. v. Marcos, JR.) December 17, 2021Theodore TeNo ratings yet

- Chapter 3 Politics and The StateDocument12 pagesChapter 3 Politics and The StateDo KyungsoooooNo ratings yet

- Central Monetary Authority - PhilippinesDocument24 pagesCentral Monetary Authority - PhilippinesmercxNo ratings yet

- Chapter 11 Corporate GovernanceDocument27 pagesChapter 11 Corporate GovernanceJoselito S. MalaluanNo ratings yet

- Santiago Vs GuingonaDocument2 pagesSantiago Vs GuingonaSandy CelineNo ratings yet