Professional Documents

Culture Documents

Mock SFM Answer March

Uploaded by

Menuka Siwa0 ratings0% found this document useful (0 votes)

25 views12 pagesOriginal Title

mock sfm answer march

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views12 pagesMock SFM Answer March

Uploaded by

Menuka SiwaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

Test Series: March 2021

MOCK TEST PAPER 1

FINAL (OLD) COURSE: GROUP – I

PAPER – 2: STRATEGIC FINANCIAL MANAGEMENT (NEW COURSE)

SUGGESTED ANSWERS/HINTS

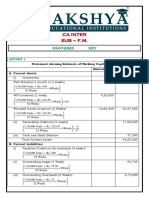

1. (a) Working Notes:

1. Computation of Annual Depreciation-

Particulars Rs.

Purchase Price 26,00,000

Add:1. Installation Charges 9,000

2. Fees Paid to Consultant for Advice 6,000

Total Cost of New Machine 26,15,000

Useful Life 8 Years

Annual Depreciation (Total Cost/ No. of Years) 3,26,875

2. Computation of Annual Cash Savings-

Particulars Rs.

Annual Earnings 3,15,000

Less-Tax @35% 1,10,250

Earning after Tax 2,04,750

Add-Depreciation on New Machine 3,26,875

Annual Cash Savings 5,31,625

3. Tax effect on sale of Old Machine-

Particulars Rs.

Proceeds of Sale 12,500

Less- Cost of Removal 4,500

Net Proceeds 8,000

Less: WDV 76,000

Net Loss due to Sale 68,000

Tax savings due to Loss on Sale @35% 23,800

Total Cash Inflow due to Sale (Rs. 8,000+Rs. 23,800) 31,800

4. Computation of Net Present Value

Particulars Period Cash Flow PVF PV

(Rs.)

@13% (Rs.)

(a) Annual Cash inflow after Tax 1-8 5,31,625 4.8 25,51,800

© The Institute of Chartered Accountants of India

(b) Net Salvage Value of 0 31,800 1.0 31,800

Existing Machine

(c) Working Capital Realized 8 17,000 0.376 6,392

Present Value of Cash Inflows 25,89,992

Less: 1. Initial Investment 0 26,15,000 1.0 26,15,000

2. Initial Working Capital 0 17,000 1.0 17,000

NPV of the Proposal (42,008)

Decision: Since NPV of the project is negative it is not viable.

(b) (i) Future Price = Spot + Cost of Carry – Dividend

= Rs. 125 + (Rs. 125 x 0.08) – 4 = Rs. 131

Price of one future contract = 1000 share x Rs. 131 = Rs. 1,31,000

(ii) Price decrease by 6 %

Market Price = 125 x 94% = 117.50

Then, price of one future contract

= Rs. 117.50 + (Rs. 117.50 x 0.08) – 4 = Rs. 122.90

= Rs. 122.90 x 1000 = Rs. 1,22,900

(iii) If the investor has taken a long position, decrease in price will result in loss for the investor.

Amount of loss will be:

Rs. 1, 31,000 - Rs. 1,22,900 = Rs. 8,100

(c) (i) Estimation of P/E Ratio using Gordon Growth Model

D

ke = 1 + g

P

1(1.02)

0.14 = + 0.02

P

P = Rs. 8.50

Rs. 8.50

PE Ratio = = 3.40

Rs. 2.50

(ii) Long Term Growth Rate implied

Based on Current PE Ratio, the price per share = Rs. 2.50 x 7 Times = Rs. 17.50

We know that

P = D0(1+g)/ (k e – g)

Rs. 17.50 = Rs. 1(1+g)/ (0.14 – g)

17.50 x 0.14 – 17.50g = 1 + g

g = 0.0784 i.e. 7.84%

(d) (i) Dirty Price

= Clean Price + Interest Accrued

© The Institute of Chartered Accountants of India

10 262

= 99.42 + 100 × × = 106.70

100 360

(ii) First Leg (Start Proceed)

Dirty Price 100 - Initial Margin

= Nominal Value x ×

100 100

106.70 100 - 2

= Rs.8,00,00,000 x × = Rs.8,36,52,800

100 100

No. of days

Second Leg (Repayment at Maturity) = Start Proceed x (1+ Repo rate × )

360

14

= Rs. 8,36,52,800 x (1+ 0.0565 × ) = Rs. 8,38,36,604

360

2. (a) (i) If company borrows in $ then outflow would be as follows:

Let company borrows $ 100 $ 100.00

Add: Interest for 6 months @ 5.5% $ 2.75

Amount Repayable after 6 months $ 102.75

Applicable 6 month forward rate 36.40

Amount of Cash outflow in Indian Rupees Rs. 3,740.10

If company borrows equivalent amount in Indian Rupee, then outflow would be as follows:

Equivalent Rs. amount Rs. 36.10 x 100 Rs. 3,610.00

Add: Interest @11.50% Rs. 207.58

Rs. 3817.58

Since cash outflow is more in Rs. borrowing then borrowing should be made in $.

(ii) (a) Let ‘ir’ be the interest rate of Rs. borrowing make indifferent between 3 months

borrowings and 6 months borrowing then

(1 + 0.03) (1 + ir) = (1 + 0.0575)

ir = 2.67% or 10.68% (on annualized basis)

(b) Let ‘id’ be the interest rate of $ borrowing after 3 months to make indifference between 3

months borrowings and 6 months borrowings. Then,

(1 + 0.015) (1 + id) = (1 + 0.0275)

id = 1.232% or 4.93% (on annualized basis)

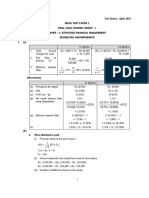

(b)

CALCULATION OF COST OF THE MACHINE

Beginning Cl. Balance Installment Interest Principal

of Year at the beginning component

4 0 1,68,589 23,254 1,45,335

3 1,45,335 1,68,589 43,300 1,25,289

2 2,70,624 1,68,589 60,581 1,08,008

1 3,78,632 1,68,589 0 1,68,589

Total 5,47,221

© The Institute of Chartered Accountants of India

Cost of the machine is Rs. 5,47,221

Alternatively, it can be computed as follows:

Cost of Machine

Annual Payment =

PVAF(16%,0 - 3)

Cost of Machine

1,68,589 =

3.245

Cost of Machine = Rs. 5,47,071

Computation of Interest

Year Total Payment Interest Principal component Principal

Outstanding

0 1,68,589 0 1,68,589 3,78,482

1 1,68,589 60,557 1,08,032 2,70,450

2 1,68,589 43,272 1,25,317 1,45,133

3 1,68,589 23,456* 1,45,133 --

Total 5,47,071

* Balancing Figure

Buying Option

Depreciation p.a. = Rs. 5,47,071− Rs. 12,412 = Rs. 5,34,659

4 4

Depreciation p.a. = Rs. 1,33,665

Tax Saving on interest & Depreciation

Year Interest (Rs.) Dep. (Rs.) Total (Rs.) Tax Saving (Rs.)

1 60,557 1,33,665 1,94,222 87,400

2 43,272 1,33,665 1,76,937 79,622

3 23,456 1,33,665 1,57,121 70,704

4 0 1,33,665 1,33,665 60,149

P.V. of Outflow

Year Installment (Rs.) Tax Saving Net outflow (Rs.) PV @ 8.4% P.V. (Rs.)

(Rs.)

0 1,68,589 0 1,68,589 1.000 1,68,589

1 1,68,589 87,400 81,189 0.919 74,613

2 1,68,589 79,622 88,967 0.845 75,177

3 1,68,589 70,704 97,885 0.776 75,959

4 -- 60,149 (60,149) 0.714 (42,946)

Salvage Value (12,412) 0.714 (8,862)

P.V. of Outflow 3,42,530

Leasing Option

Lease Rent 30% of Rs. 5,47,071 i.e. Rs. 1,64,121

Lease Rent payable at the end of the year

© The Institute of Chartered Accountants of India

Year Lease Rental Tax Saving Net outflow PV @ 8.4% PV (Rs.)

(Rs.) (Rs.) (Rs.)

1-4 1,64,121 73,855 90,266 3.254 2,93,726

Decision – The company is advised to opt for leasing as the total PV of cash outflow is lower in

this option.

3. (a) (i) Maximum exchange ratio acceptable to the shareholders of C Ltd.

Market Price of share of C Ltd. (Rs. 4.8 x 8) Rs. 38.40

No. of Equity Shares 20 Million

Market Capitalisation of C Ltd. (Rs. 38.40 x 20 Million) Rs. 768 Million

Combined Earnings (Rs. 96 + Rs. 30) Million Rs. 126 Million

Combined Market Capitalisation (Rs. 126 Million x 7) Rs. 882 Million

Market Capitalisation of C Ltd. (Rs. 38.40 x 20 Million) Rs. 768 Million

Balance for D Ltd. Rs. 114 Million

Let D be the no. of equity shares to be issued to D Ltd. then,

Rs. 114 Million

=D

126Million

×7

D + 20

D = 2.96875 Million Shares

Exchange Ratio = 2.96875 / 14 = 0.212:1

(ii) Minimum exchange ratio acceptable to the shareholders of D Ltd.

Market Price of share of D Ltd. Rs. 15.00

No. of Equity Shares 14 Million

Market Capitalisation of D Ltd. (Rs. 15.00 x 14 Million) Rs. 210

Million

Combined Earnings (Rs. 96 + Rs. 30) Million Rs. 126

Million

Combined Market Capitalisation (Rs. 126 Million x 9) Rs. 1134

Million

Balance for C Ltd. Rs. 924

Million

Let D be the no. of equity shares to be issued to D Ltd. then,

Rs. 210 Million

=D

126Million

D + 20 × 9

D = 4.54545 Million Shares

Exchange Ratio = 4.54545 / 14 = 0.325:1

(b) (i) Semi-annual fixed payment

= (N) (AIC) (Period)

© The Institute of Chartered Accountants of India

Where N = Notional Principal amount = Rs.8,00,000

AIC = All-in-cost = 6% = 0.06

180

= 8,00,000 × 0.06

360

= 8,00,000 × 0.06 (0.5)

= Rs.24,000

(ii) Floating Rate Payment

dt

= N (LIBOR)

360

181

= 8,00,000 × 0.05 ×

360

= Rs.20,111 or Rs. 20,120

(iii) Net Amount

= (i) – (ii)

= Rs.24,000 – Rs.20,111 = Rs.3889

Or = Rs.24,000 – Rs.20,120 = Rs.3880

4. (a)

Amount in Amount in Amount in

Rs. lakhs Rs. lakhs Rs. lakhs

Opening Bank (150 - 140 - 8) 2.00

Add: Proceeds from sale of securities 47.00

Add: Dividend received 1.50 50.50

Deduct:

Cost of securities purchased 41.60

Fund management expenses paid 5.50

Capital gains distributed = 80% of (47 – 44.75) 1.80

Dividend distributed =80% of 1.50 1.20 50.10

Closing Bank 0.40

Closing market value of portfolio 147.85

148.25

Less: Arrears of expenses 0.50

Closing Net Assets 147.75

Number of units (Lakhs) 15

Closing NAV per unit (147.75/15) 9.85

Rate of Earning (Per Unit)

Amount

Income received (Rs. 1.20 + Rs. 1.80)/15 Rs. 0.20

Loss: Loss on disposal (Rs. 150 - Rs. 147.75)/15 Rs. 0.15

Net earning Rs. 0.05

© The Institute of Chartered Accountants of India

Initial investment Rs. 10.00

Rate of earning (monthly) 0.5%

Rate of earning (Annual) 6.00%

(b) (a) Working Notes- (Rs. in Lakhs)

Reduction in Trade Receivable under Factoring Agreement

Current Trade Receivable 35.00

Revised Receivable (210 x 30/360) 17.50

17.50

(i) Calculation of Benefit with Recourse Factoring

Finance cost saving = 17.50 x 0.07 1.2250

Bad Debt Saving 0.6300

Administration Cost Saving 0.4000

Total Saving 2.2550

Less: Factoring Fee 1.2600

Additional Interest in Advance

(17.50 x 0.80 x 2%) 0.2800

0.7150

(ii) Calculation of Benefit with Non-Recourse Factoring

Finance cost saving = 17.50 x 0.07 1.2250

Bad Debt Saving 1.8900

Administration Cost Saving 0.4000

Total Saving 3.5150

Less: Factoring Fee 2.6250

Additional Interest in Advance

(17.50 x 0.80 x 2%) 0.2800

0.6100

Decision: It is viable to accept the Recourse Factoring proposal.

5. (a) (i) Calculation of Bond Duration

Bond A

Year Cash flow P.V. @ 9% Proportion of Proportion of bond

bond value value x time (years)

1 10 0.917 9.17 0.086 0.086

2 10 0.842 8.42 0.079 0.158

3 10 0.772 7.72 0.073 0.219

4 10 0.708 7.08 0.067 0.268

5 10 0.650 6.50 0.061 0.305

6 10 0.596 5.96 0.056 0.336

© The Institute of Chartered Accountants of India

7 10 0.547 5.47 0.051 0.357

8 10 0.502 5.02 0.047 0.376

9 10 0.460 4.60 0.043 0.387

10 110 0.4224 46.46 0.437 4.370

106.40 1.000 6.862

Duration of the bond is 6.862 years or 6.86 year

Bond B

Year Cash flow P.V. @ 9% Proportion of Proportion of bond

bond value value x time (years)

1 11 0.917 10.087 0.091 0.091

2 11 0.842 9.262 0.083 0.166

3 11 0.772 8.492 0.076 0.228

4 11 0.708 7.788 0.070 0.280

5 11 0.650 7.150 0.064 0.320

6 11 0.596 6.556 0.059 0.354

7 11 0.547 6.017 0.054 0.378

8 111 0.502 55.772 0.502 4.016

111.224 1.000 5.833

Duration of the bond B is 5.833 years or 5.84 years

Bond C

Year Cash flow P.V. @ 9% Proportion of Proportion of bond

bond value value x time (years)

1 9 0.917 8.253 0.082 0.082

2 9 0.842 7.578 0.076 0.152

3 9 0.772 6.948 0.069 0.207

4 9 0.708 6.372 0.064 0.256

5 109 0.650 70.850 0.709 3.545

100.00 1.000 4.242

Duration of the bond C is 4.242 years or 4.24 years

(ii) Amount of Investment required in Bond B and C

Period required to be immunized 6.000 Year

Less: Period covered from Bond A 3.087 Year

To be immunized from B and C 2.913 Year

Let proportion of investment in Bond B and C is b and c respectively then

b + c = 0.55 (1)

5.883b + 4.242c = 2.913 (2)

On solving these equations, the value of b and c comes 0.3534 or 0.3621 and 0.1966 or

0.1879 respectively and accordingly, the % of investment of B and C is 35.34% or 36.21%

and 19.66 % or 18.79% respectively.

© The Institute of Chartered Accountants of India

(iii) With revised yield the Revised Duration of Bond stands

0.45 x 7.15 + 0.36 x 6.03 + 0.19 x 4.27 = 6.20 year

No portfolio is not immunized as the duration of the portfolio has been increased from 6 years

to 6.20 years.

(iv) New percentage of B and C bonds that are needed to immunize the portfolio.

Period required to be immunized 6.0000 Year

Less: Period covered from Bond A 3.2175 Year

To be immunized from B and C 2.7825 Year

Let proportion of investment in Bond B and C is b and c respectively, then

b + c = 0.55

6.03b + 4.27c = 2.7825

b = 0.2466

On solving these equations, the value of b and c comes 0.2466 and 0.3034 respectively and

accordingly, the % of investment of B and C is 24.66% or 25% and 30.34 % or 30.00%

respectively.

Rs. 1500 crore

(b) Existing No. of Equity Shares = = 1 Crore

Rs. 1,500

No. of shares to be bought back = 1 Crore x 0.20 = 20 Lakh

Price at which share to be bought back = Rs. 1,500 + 10% of Rs. 1,500 = Rs. 1,650

Amount required for Buyback of Shares = Rs. 1,650 x 20 Lakh = Rs. 330 Crore

Amount of Loan @ 16% = Rs. 330 Crore

Statement showing Post Buyback EPS

Profit before tax (Rs. 200 crore/ 0.70) Rs. 285.7143 crore

Less: Interest on Loan (Rs. 330 Crore x 16%) Rs. 52.8000 crore

Profit before Tax Rs. 232.9143 crore

Tax Rs. 69.8743 crore

Profit after Tax (PAT) Rs. 163.0400 crore

No. of Shares Post buyback 80 Lakh

EPS (Post Buyback) (Rs. 163.0400 Crore/ 80.00 Lakh) Rs. 203.80

6. (a) (1) Yield from Investment in Equity Trading Index in Japan

Conversion of GBP 200 million in JPY (148.0002) JPY 29600.04 Million

Dividend Income JPY 1182.00 Million

Stock Lending JPY 10.00 Million

Investment Value at End JPY 29008.0392 Million

Amount available at End JPY 30200.0392 Million

Forward Rate of 30.06.2019 JPY 150/ GBP

Amount to be Remitted back to London GBP 201.3336 Million

Gain = GBP 201.3336 – GBP 200 GBP 1.3336 Million

© The Institute of Chartered Accountants of India

(2) Fixed Income Desk of US

Conversion of GBP 200 million in USD (1.28000) USD 256.00 Million

Add: Interest @ 5% p.a. for 6 months USD 6.40 Million

Amount available at End USD 262.40 Million

Forward Rate of 30.06.2019 USD 1.30331/ GBP

Amount to be Remitted back to London GBP 201.3335 Million

Gain = GBP 201.3335 – GBP 200 GBP 1.3335 Million

Decision:

The equivalent amount at the end of 6 months shall be almost same in both the options. The bank

can go for any of the options.

However, from risk perspective, the investment in fixed income desk of US is more beneficial as

the chance of variation in fixed income securities is less as compared to Equity Desk.

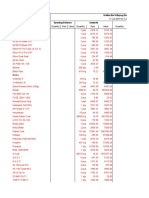

(b)

Security No. of shares Market Price of (1) × (2) % to total (w) ß (x) wx

(1)

Per Share (2)

ABC 1000 50 50000 0.4167 0.9 0.375

DEF 500 20 10000 0.0833 1 0.083

GHI 800 25 20000 0.1667 1.5 0.250

JKL 200 200 40000 0.3333 1.2 0.400

120000 1 1.108

(i) Portfolio beta 1.108

(ii) Required Beta 0.8

It should become (0.8 / 1.108) 72.2 % of present portfolio

If Rs. 1,20,000 is 72.20%, the total portfolio should be

Rs. 1,20,000 × 100/72.20 or Rs. 1,66,205

Additional investment in zero risk should be (Rs. 1,66,205 – Rs. 1,20,000) = Rs. 46,205

Revised Portfolio will be

Security No. of Market Price of (1) × (2) % to total ß (x) wx

shares (1) Per Share (2) (w)

ABC 1000 50 50000 0.3008 0.9 0.271

DEF 500 20 10000 0.0602 1 0.060

GHI 800 25 20000 0.1203 1.5 0.180

JKL 200 200 40000 0.2407 1.2 0.289

Risk free -- -- 46205 0.2780 0 0

asset

166205 1 0.800

10

© The Institute of Chartered Accountants of India

7. (a) The concept of sustainable growth can be helpful for planning healthy corporate growth. This

concept forces managers to consider the financial consequences of sales increases and to set

sales growth goals that are consistent with the operating and financial policies of the firm. Often, a

conflict can arise if growth objectives are not consistent with the value of the organization's

sustainable growth. Question concerning right distribution of resources may take a difficult shape

if we take into consideration the rightness not for the current stakeholders but for the future

stakeholders also.

Sustainable growth is important to enterprise long-term development. Too fast or too slow growth

will go against enterprise growth and development, so financial shoul d play important role in

enterprise development, adopt suitable financial policy initiative to make sure enterprise growth

speed close to sustainable growth ratio and have sustainable healthy development.

Sustainable growth models assume that the business wants to:

(1) maintain a target capital structure without issuing new equity;

(2) maintain a target dividend payment ratio; and

(3) increase sales as rapidly as market conditions allow.

Since the asset to beginning of period equity ratio is constant and the firm's only source of new

equity is retained earnings, sales and assets cannot grow any faster than the retained earnings

plus the additional debt that the retained earnings can support. The sus tainable growth rate is

consistent with the observed evidence that most corporations are reluctant to issue new equity. If,

however, the firm is willing to issue additional equity, there is in principle no financial constraint on

its growth rate.

(b) Equity Curve out can be defined as partial spin off in which a company creates its own new

subsidiary and subsequently bring out its IPO. It should be however noted that parent company

retains its control and only a part of new shares are issued to public.

On the other hand in Spin off parent company does not receive any cash as shares of subsidiary

company are issued to existing shareholder in the form of dividend. Thus, shareholders in new

company remain the same but not in case of Equity curve out.

(c) In a wider spectrum, a money market can be defined as a market for short-term money and financial

assets that are near substitutes for money with minimum transaction cost.

Features:

• The term short-term means generally a period upto one year and near substitutes to money

is used to denote any financial asset which can be quickly converted into money.

• Low cost.

• It provides an avenue for equilibrating the short-term surplus funds of lenders and the

requirements of borrower

• It, thus, provides a reasonable access to the users of short term money to meet their

requirements at realistic prices.

• The money market can also be defined as a centre in which financial institutions congregate

for the purpose of dealing impersonally in monetary assets.

(d) The Modigliani & Miller hypothesis is based on the following assumptions:

(i) The firm operates in perfect capital markets in which all investors are rational and information

is freely available to all.

(ii) There are no taxes. Alternatively, there are no differences in the tax rates applicable to capital

gains and dividends.

11

© The Institute of Chartered Accountants of India

(iii) The firm has a fixed investment policy.

(iv) There are no floatation or transaction costs.

(v) Risk of uncertainty does not exist. Investors are able to forecast future prices and dividends

with certainty, and

(vi) one discount rate is appropriate for all securities and all time periods. Thus, r = k = k t for all

t.

(e) Around 80 per cent of private sector companies in India are family-managed companies. The

family-owned companies are, under extraordinary pressure to yield control to professional

managements, as, in the emerging scenario of a liberalised economy the capital markets are

broadening, with attendant incentives for growth. So, many of these companies are arranging to

hive off their unprofitable businesses or divisions with a view to meeting a variety of succession

problems.

Even otherwise, a group of such family-managed companies may undertake restructuring of its

operations with a view also to consolidating its core businesses. For this, the first step that may

need to be taken is to identify core and non-core operations within the group. The second step may

involve reducing interest burden through debt restructuring along with sale of surplus assets. The

proceeds from the sale of assets may be employed for expanding by acquisitions and rejuvenation

of its existing operations. The bottom line is that an acquisition must improve economies of scale,

lower the cost of production, and generate and promote synergies. Besides acquisitions, therefore,

the group may necessarily have to take steps to improve productivity of its existing operations.

12

© The Institute of Chartered Accountants of India

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Contract Risk AssessmentDocument39 pagesContract Risk Assessmentarkirthi1175No ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Formal Words For IELTS WritingDocument12 pagesFormal Words For IELTS Writingdw1919100% (39)

- Analysis of Expansion Project Cash FlowsDocument368 pagesAnalysis of Expansion Project Cash FlowsRoy HemenwayNo ratings yet

- Audit of BanksDocument59 pagesAudit of Bankskaran kapadiaNo ratings yet

- ISO9001 2015 Frequently Asked QuestionsDocument5 pagesISO9001 2015 Frequently Asked QuestionsJyoti Jeevan SharmaNo ratings yet

- Level II 2020 IFT Mock Exam SampleDocument12 pagesLevel II 2020 IFT Mock Exam SampleRuda Thales Lins MeirelesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Paper 3 Cost and Management Accounting PDFDocument700 pagesPaper 3 Cost and Management Accounting PDFartizutshiNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Case Study of Sunlight Industries LTD: SolutionDocument3 pagesCase Study of Sunlight Industries LTD: Solutionparv guptaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Treasury Enterprise Architecture Framework (TEAF)Document164 pagesTreasury Enterprise Architecture Framework (TEAF)sreeni1750% (2)

- Financial Management - Capital Budgeting Answer KeyDocument5 pagesFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- SAP ATTP OverviewDocument33 pagesSAP ATTP OverviewkrishnaNo ratings yet

- Liabilities of AuditorDocument39 pagesLiabilities of AuditorMenuka SiwaNo ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Document40 pagesCa Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Shashank SikarwarNo ratings yet

- MBA Mock Exam Guide to Investment ProjectsDocument7 pagesMBA Mock Exam Guide to Investment ProjectsK58 Hà Phương LinhNo ratings yet

- Finacial Management MockDocument12 pagesFinacial Management MockRomaric DjokoNo ratings yet

- Solution Test 1Document3 pagesSolution Test 1anis izzatiNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (25)

- Capital Budgeting Decisions for Machine ReplacementsDocument9 pagesCapital Budgeting Decisions for Machine ReplacementsFaizaNo ratings yet

- Ca Inter-F.m.03-07-2023-KeyDocument3 pagesCa Inter-F.m.03-07-2023-KeyChintuNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- 23 Nov 2018 Mixed Questions With Solutions PDFDocument9 pages23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Chapter 22 Impairment of AssetsDocument13 pagesChapter 22 Impairment of AssetsPacifico HernandezNo ratings yet

- MTP Oct. 2018 FM and Eco AnswerDocument16 pagesMTP Oct. 2018 FM and Eco AnswerAisha MalhotraNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- Chapter 14 LEASINGDocument17 pagesChapter 14 LEASINGKaran KashyapNo ratings yet

- Advance Accounts Suggested Answer May2022Document13 pagesAdvance Accounts Suggested Answer May2022rajuNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions ManualDocument26 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (16)

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- P1. PRO O.L Solution CMA September 2022 ExaminationDocument6 pagesP1. PRO O.L Solution CMA September 2022 ExaminationAwal ShekNo ratings yet

- DPS Calculation and Preferred Stock ValuationDocument7 pagesDPS Calculation and Preferred Stock ValuationStoryKingNo ratings yet

- 6 - Capital Budgeting in PracticeDocument21 pages6 - Capital Budgeting in PracticeJosh AckmanNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Isna Wirda Lutfiyah - 17 - 4-17Document10 pagesIsna Wirda Lutfiyah - 17 - 4-17DewaSatriaNo ratings yet

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocument85 pagesGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesNo ratings yet

- Financial Management Assignment NotesDocument3 pagesFinancial Management Assignment NotesDaniyal AliNo ratings yet

- Brealey 5CE Ch09 SolutionsDocument27 pagesBrealey 5CE Ch09 SolutionsToby Tobes TobezNo ratings yet

- RadheDocument11 pagesRadheApoorv GUPTANo ratings yet

- Analyze costs and profitability of a companyDocument5 pagesAnalyze costs and profitability of a companyMd AlimNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Strategic Cost Management NMIMS AssignmentDocument7 pagesStrategic Cost Management NMIMS AssignmentN. Karthik UdupaNo ratings yet

- Analyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsDocument45 pagesAnalyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsStevin GeorgeNo ratings yet

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Document7 pagesLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaNo ratings yet

- Ratio Analysis: Solutions To Assignment ProblemsDocument16 pagesRatio Analysis: Solutions To Assignment Problemsmd fahadNo ratings yet

- Assignment NewDocument19 pagesAssignment Newيوسف سعيد العنزيNo ratings yet

- Polenar Budgeting-AssignmentDocument4 pagesPolenar Budgeting-AssignmentRyhanna Lou ReyesNo ratings yet

- Receivables Bad Debt Journal EntriesDocument7 pagesReceivables Bad Debt Journal EntriesTAWHID ARMANNo ratings yet

- Solution to Capital Investment ExercisesDocument7 pagesSolution to Capital Investment ExercisesMaria ClaraNo ratings yet

- Master Question, Additional Questions-2Document4 pagesMaster Question, Additional Questions-2anshikajain3474No ratings yet

- Afm New Topic CompiledDocument59 pagesAfm New Topic Compiledganesh bhaiNo ratings yet

- FM II Assignment 3 Solution W22Document3 pagesFM II Assignment 3 Solution W22Farah ImamiNo ratings yet

- Final Exam Answer Scheme A141Document9 pagesFinal Exam Answer Scheme A141Hooi CheeNo ratings yet

- Discussion:: 1. Explain How Capital Budgeting Can Impact On A Firm's Competitiveness 2Document4 pagesDiscussion:: 1. Explain How Capital Budgeting Can Impact On A Firm's Competitiveness 2Nishika KaranNo ratings yet

- Support-Department Cost AllocationDocument5 pagesSupport-Department Cost AllocationNABILA SARINo ratings yet

- Less: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaDocument11 pagesLess: Municipal Taxes Paid by Mr. Raj: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- MODERNARTS-334811: The Brief Introduction and Analysis. Date-2021/10/7Document1 pageMODERNARTS-334811: The Brief Introduction and Analysis. Date-2021/10/7Menuka SiwaNo ratings yet

- Fundamental of Applied Chemistry AllDocument6 pagesFundamental of Applied Chemistry AllMenuka SiwaNo ratings yet

- Major Changes in Labour ActDocument1 pageMajor Changes in Labour ActMenuka SiwaNo ratings yet

- 5 6194814846383424312Document212 pages5 6194814846383424312Menuka SiwaNo ratings yet

- MODERNARTS-33489: The Brief Introduction and Analysis. Date-2021/10/6Document1 pageMODERNARTS-33489: The Brief Introduction and Analysis. Date-2021/10/6Menuka SiwaNo ratings yet

- MODERNARTS-334812: The Brief Introduction and Analysis. Date-2021/10/8Document1 pageMODERNARTS-334812: The Brief Introduction and Analysis. Date-2021/10/8Menuka SiwaNo ratings yet

- Synonyms List: Sam Ielts Telegram @ieltsielts @asksamDocument6 pagesSynonyms List: Sam Ielts Telegram @ieltsielts @asksamMenuka SiwaNo ratings yet

- MODERNARTS-334810: The Brief Introduction and Analysis. Date-2021/10/6Document1 pageMODERNARTS-334810: The Brief Introduction and Analysis. Date-2021/10/6Menuka SiwaNo ratings yet

- Audit OF Public Sector Undertakings: Learning OutcomesDocument36 pagesAudit OF Public Sector Undertakings: Learning OutcomesMenuka SiwaNo ratings yet

- Audit Committee AND Corporate Governance: Learning OutcomesDocument47 pagesAudit Committee AND Corporate Governance: Learning OutcomesMenuka SiwaNo ratings yet

- Audit of Non-Banking Financial Companies: After Studying This Chapter, You Will Be Able ToDocument40 pagesAudit of Non-Banking Financial Companies: After Studying This Chapter, You Will Be Able ToSaumya RanjanNo ratings yet

- Engineering Exam Syllabus for Mechanical Engineering PostsDocument7 pagesEngineering Exam Syllabus for Mechanical Engineering PostsMenuka SiwaNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Document12 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Menuka SiwaNo ratings yet

- Kalika Itta Udhyog (Vat) 2076/2077 Particulars Opening Balance Inwards OutwardsDocument5 pagesKalika Itta Udhyog (Vat) 2076/2077 Particulars Opening Balance Inwards OutwardsMenuka SiwaNo ratings yet

- LawDocument65 pagesLawV. R. Saboo Chartered AccontantsNo ratings yet

- Cover LetterDocument1 pageCover LetterMenuka SiwaNo ratings yet

- Cover LetterDocument1 pageCover LetterMenuka SiwaNo ratings yet

- Key Qms 07 - F 01 Ncar FormDocument1 pageKey Qms 07 - F 01 Ncar FormMenuka SiwaNo ratings yet

- KEY-QMS-09 - F-03 Audit ReportDocument1 pageKEY-QMS-09 - F-03 Audit ReportMenuka SiwaNo ratings yet

- KEY-QMS-02 - F01 Risk AssessmentDocument4 pagesKEY-QMS-02 - F01 Risk AssessmentMenuka SiwaNo ratings yet

- Jan 21Document87 pagesJan 21Menuka SiwaNo ratings yet

- Key Solutions Pte LTD Procedures: Document TitleDocument5 pagesKey Solutions Pte LTD Procedures: Document TitleMenuka SiwaNo ratings yet

- Product Development: MBS-2 Semester (Evening Shift) Group-ADocument11 pagesProduct Development: MBS-2 Semester (Evening Shift) Group-AMenuka SiwaNo ratings yet

- Business Plan For Workshop (Key Solutions PTE LTD)Document35 pagesBusiness Plan For Workshop (Key Solutions PTE LTD)Ashimolowo BabatundeNo ratings yet

- Professional Ethics: After Studying This Chapter, You Will Be Able ToDocument161 pagesProfessional Ethics: After Studying This Chapter, You Will Be Able ToMenuka SiwaNo ratings yet

- CA Final Law May 21 Amendment NotesDocument7 pagesCA Final Law May 21 Amendment NotesMenuka SiwaNo ratings yet

- ACFrOgAw0q9lIKvxcNk06fKcl-Ih3ndL8dKic4mqAZh CJzn-cAPHRuSJiFWVRH9BS8nL fOeQ-a5 X0tckM4cGFf04kNRjeXR40U79i9m46WlLgTAOEskpFqVQB7NgDocument6 pagesACFrOgAw0q9lIKvxcNk06fKcl-Ih3ndL8dKic4mqAZh CJzn-cAPHRuSJiFWVRH9BS8nL fOeQ-a5 X0tckM4cGFf04kNRjeXR40U79i9m46WlLgTAOEskpFqVQB7NgdelightplasticsNo ratings yet

- In House PitchDocument10 pagesIn House Pitchniels koizumiNo ratings yet

- MB20202 Corporate Finance Unit IIDocument10 pagesMB20202 Corporate Finance Unit IISarath kumar CNo ratings yet

- Questions About The Case Study: ELE PLCDocument2 pagesQuestions About The Case Study: ELE PLCMicaela Hidalgo RamírezNo ratings yet

- Qualifying Exam Taxation SET ADocument11 pagesQualifying Exam Taxation SET AChina ReyesNo ratings yet

- Export Proforma Invoice Assaraya Libya L20Document1 pageExport Proforma Invoice Assaraya Libya L20ALRAYAN GOLDNo ratings yet

- Chapter 1 - Understanding Business EthicsDocument23 pagesChapter 1 - Understanding Business EthicsJihan RafiqaNo ratings yet

- The Value of Organizational ReputationDocument23 pagesThe Value of Organizational ReputationM Iqbal RamadhanNo ratings yet

- BMW-GB19 en FinanzberichtDocument262 pagesBMW-GB19 en FinanzberichtEsplanadeNo ratings yet

- Njau - Challenges Facing Human Resource Management Function at Kenyatta National HospitalDocument64 pagesNjau - Challenges Facing Human Resource Management Function at Kenyatta National HospitalAdrahNo ratings yet

- Ihe680 053111Document21 pagesIhe680 053111cecsdistancelabNo ratings yet

- Organizational Behavior EssentialsDocument32 pagesOrganizational Behavior EssentialsShuja IlyasNo ratings yet

- Opinion: CrisilDocument12 pagesOpinion: CrisilarvindNo ratings yet

- Chapter 1 - Meaning and ScopeDocument9 pagesChapter 1 - Meaning and ScopeAlphonse Raj DavidNo ratings yet

- Asset Inventory Management TemplateDocument85 pagesAsset Inventory Management TemplateM Monjur MobinNo ratings yet

- Solution Manual For Strategic Management 3rd EditionDocument9 pagesSolution Manual For Strategic Management 3rd Editionelfledadylanb11la100% (21)

- Data AnalysisDocument5 pagesData AnalysisMagical MakeoversNo ratings yet

- NCERT Class XII Business Studies - Chapter 2 - Principles of ManagementDocument29 pagesNCERT Class XII Business Studies - Chapter 2 - Principles of ManagementNaveen Jacob John0% (1)

- Activity No. 2Document2 pagesActivity No. 2Sophia Anne MonillasNo ratings yet

- 27 DT Case LawsDocument26 pages27 DT Case LawsVishakha MangtaniNo ratings yet

- Post Appiled DetailsDocument3 pagesPost Appiled DetailsDeepak JainNo ratings yet

- Marketing Essentials - Chapter 2 Basic Marketing ConceptsDocument16 pagesMarketing Essentials - Chapter 2 Basic Marketing ConceptsrahulxtcNo ratings yet

- Kantar Media Factoid Crisps and Potato Chips 13 12 12Document3 pagesKantar Media Factoid Crisps and Potato Chips 13 12 12Kantar MediaNo ratings yet

- (International Series in Operations Research & Management Science 139) Evangelos Grigoroudis, Yannis Siskos (Auth.) - Customer Satisfaction Evaluation - MethodsDocument318 pages(International Series in Operations Research & Management Science 139) Evangelos Grigoroudis, Yannis Siskos (Auth.) - Customer Satisfaction Evaluation - MethodsMarsha Aulia HakimNo ratings yet