Professional Documents

Culture Documents

Finacial Management Mock

Uploaded by

Romaric DjokoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finacial Management Mock

Uploaded by

Romaric DjokoCopyright:

Available Formats

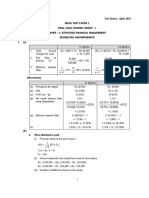

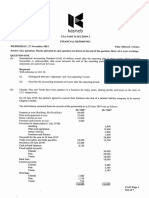

Test Series: October, 2018

MOCK TEST PAPER –2

FINAL COURSE: GROUP – I

PAPER – 2: STRATEGIC FINANCIAL MANAGEMENT (OLD)

SUGGESTED ANSWER / HINTS

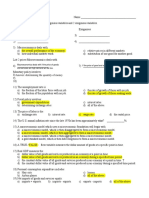

1. (a) Number of index future to be sold by the Fund Manager is:

1.1 90,00,00,000

= 4,605

4,300 50

Justification of the answer:

11

Loss in the value of the portfolio if the index falls by 10% is Rs. x90 Crore = Rs. 9.90 Crore.

100

0.1 4,300 50 4,605

Gain by short covering of index future is: = 9.90 Crore

1,00,00,000

This justifies the answer cash is not part of the portfolio.

4

(b) βp = xβ

i1

i i

= 1.60 x 0.25 + 1.15 x 0.30 + 1.40 x 0.25 + 1.00 x 0.20

= 0.4 + 0.345 + 0.35 + 0.20 = 1.295

The Standard Deviation (Risk) of the portfolio is

= [(1.295) 2(18)2+(0.25)2(7)2+(0.30)2(11)2+(0.25)2(3)2+(0.20)2(9)2)]

= [543.36 + 3.0625 + 10.89 + 0.5625 + 3.24] = [561.115] ½ = 23.69%

Alternative Answer

The variance of Security’s Return

2 = i2 2m + 2εi

Accordingly, variance of various securities

2 Weight(w) 2Xw

L (1.60)2 (18)2 + 72 = 878.44 0.25 219.61

M (1.15)2 (18)2 + 112 = 549.49 0.30 164.85

N (1.40)2 (18)2 + 32 = 644.04 0.25 161.01

K (1.00)2 (18)2 + 92 = 405.00 0.20 81

Variance 626.47

SD = 626.47 = 25.03

(c) (i) Returns for the year

(All changes on a Per -Unit Basis)

Change in Price: Rs.48 – Rs.45 = Rs. 3.00

Dividends received: Rs. 1.00

1

© The Institute of Chartered Accountants of India

Capital gains distribution Rs. 2.00

Total reward Rs. 6.00

` 6.00

Holding period reward: 100 13.33%

` 45

(ii) When all dividends and capital gains distributions are re-invested into additional units of the

fund @ (Rs. 46/unit)

Dividend + Capital Gains per unit = Rs. 1.00 + Rs. 2.00 = Rs. 3.00

Total received from 200 units = Rs. 3.00 x 200 = Rs. 600/-.

Additional Units Acquired = Rs. 600/Rs. 46 = 13.04 Units.

Total No. of Units = 200 units + 13.04 units = 213.04 units.

Value of 213.04 units held at the end of the year

= 213.04 units x Rs.48 = Rs. 10225.92

Price Paid for 200 Units at the beginning of the year = 200 units x Rs. 45 = Rs. 9000.00

Holding Period Reward Rs. (10225.92 – 9000.00) = Rs.1225.92

`1225 .92

Holding Period Reward = 100 13.62%

` 9000

(d) Here we can assume two cases (i) If investor is US investor then there will be no impact of

appreciation in $. (ii) If investor is from any other nation other than US say Indian then there will

be impact of $ appreciation on his returns.

First we shall compute return on bond which will be common for both investors.

(Price at end - Price at begining)+Interest

Return =

Price at begining

(5250 5000) 350

=

5000

250 350

= =0.12 say 12%

5000

(i) For US investor the return shall be 12% and there will be no impact of appreciation in $.

(ii) If $ appreciate by 2% then return for non-US investor shall be:

Return x 1.02 = 0.12 x 1.02=0.1224 i.e. 12.24%

Alternatively it can also be considered that $ appreciation will be applicable to the amount of

principal as well. The answer therefore could also be

(1+0.12)(1+0.02) -1 =1.12X1.02 - 1 = 0.1424 i.e. 14.24%

2. (a) Computation of initial cash outlay

(Rs. in lakhs)

Equipment Cost (0) 120

Working Capital (0) 15

135

2

© The Institute of Chartered Accountants of India

Calculation of Cash Inflows:

Year 1 2 3-5 6-8

Sales in units 80,000 1,20,000 3,00,000 2,00,000

Rs. Rs. Rs. Rs.

Contribution @ Rs. 60 p.u. 48,00,000 72,00,000 1,80,00,000 1,20,00,000

Fixed cost 16,00,000 16,00,000 16,00,000 16,00,000

Advertisement 30,00,000 15,00,000 10,00,000 4,00,000

Depreciation 15,00,000 15,00,000 16,50,000 16,50,000

Profit/(loss) (13,00,000) 26,00,000 1,37,50,000 83,50,000

Tax @ 50% (6,50,000)* 13,00,000 68,75,000 41,75,000

Profit/(loss) after tax (6,50,000) 13,00,000 68,75,000 41,75,000

Add: Depreciation 15,00,000 15,00,000 16,50,000 16,50,000

Cash Inflow 8,50,000 28,00,000 85,25,000 58,25,000

* Tax Benefit as loss shall be adjusted against taxable profit.

Computation of PV of CIF

Year CIF PV Factor @ 12%

Rs. Rs.

1 8,50,000 0.893 7,59,050

2 28,00,000 0.797 22,31,600

3 85,25,000 0.712 60,69,800

4 85,25,000 0.636 54,21,900

5 85,25,000 0.567 48,33,675

6 58,25,000 0.507 29,53,275

7 58,25,000 0.452 26,32,900

8 58,25,000 0.404 23,53,300

WC 15,00,000 0.404 6,06,000

SV 1,00,000 0.404 40,400

2,79,01,900

PV of COF 1,35,00,000

Additional Investment = Rs. 10,00,000 0.797 7,97,000

1,42,97,000

NPV 1,36,04,900

Recommendation: Accept the project in view of positive NPV.

(b) The expected rate of return on equity after 2008 = 0.0625 + 1.10(0.055) = 12.3%

The dividends from 2003 onwards can be estimated as:

Year 2003 2004 2005 2006 2007 2008 2009

Earnings Per Share (€) 2.1 2.415 2.78 3.19 3.67 4.22 4.48

Dividends Per Share (€) 0.69 0.794 0.913 1.048 1.206 1.387 2.91

a. The price as of 2008 = €2.91/(0.123- 0.06) = €46.19

b. The required rate of return upto 2008 = 0.0625 + 1.4(0.055) = 13.95%. Th e dividends upto

3

© The Institute of Chartered Accountants of India

2008 are discounted using this rate as follow:

Year PV of Dividend

2004 0.794/1.1395 = 0.70

2005 0.913/(1.1395)2 = 0.70

2006 1.048/(1.1395)3 = 0.70

2007 1.206/(1.1395)4 = 0.72

2008 1.387/(1.1395)5 = 0.72

Total 3.54

The current price = €3.54 + €46.19/(1.1395) 5 = €27.58.

* Values have been rounded off.

3. (a) Initial amount borrowed = Rs. 5,00,000 – Rs. 50,000 = Rs. 4,50,000

This amount of Rs.4,50,000 is the amount which together with interest at the rate of 10% on

outstanding amount is repayable in equal installments i.e., annuities in the beginning of each of

10 years. The PVAF at the rate of 10% for 9 years is 5.759 and for the year 0 it is 1.000. So, the

annuity amount may be ascertained by dividing Rs.4,50,000 by (5.759 + 1.000).

So Annual payment = Rs.4,50,000/6.759 = Rs. 66,578

Amount owed at time 0 = Rs.4,50,000 – Rs. 66,578 = Rs.3,83,422.

Schedule of Debt Payment

End of Year Total Payment Interest Principal Amount Outstanding

Rs. Rs. Rs.

0 66,578 0 3,83,422

1 66,578 38,342 3,55,186

2 66,578 35,519 3,24,127

3 66,578 32,413 2,89,962

4 66,578 28,996 2,52,380

5 66,578 25,238 2,11,040

6 66,578 21,104 1,65,566

7 66,578 16,557 1,15,545

8 66,578 11,555 60,522

9 66,578 6,056* NIL

* Balancing Figure

Schedule of Cash Outflows: Debt Alternative

(Amount in Rs.)

(1) (2) (3) (4) (5) (6) (7) (8)

End of Debt Interest Dep Tax Shield Cash outflows PV factors PV

year Payment [(3)+(4)]0.5 (2) – (5) @ 5%

0 66,578 0 0 0 66,578 1.000 66,578

1 66,578 38,342 50,000 44,171 22,407 0.952 21,331

© The Institute of Chartered Accountants of India

2 66,578 35,519 50,000 42,759 23,819 0.907 21,604

3. 66,578 32,413 50,000 41,206 25,372 0.864 21,921

4 66,578 28,996 50,000 39,498 27,080 0.823 22,287

5 66,578 25,238 50,000 37,619 28,959 0.784 22,704

6 66,578 21,104 50,000 35,552 31,026 0.746 23,145

7 66,578 16,557 50,000 33,279 33,299 0.711 23,676

8 66,578 11,555 50,000 30,777 35,801 0.677 24,237

9 66,578 6,056 50,000 28,028 38,550 0.645 24,865

10 - 0 50,000 25,000 (-25,000) 0.614 (-15,350)

Total present value of Outflows 2,56,998

Schedule of Cash Outflows: Leasing Alternative

(Amount in Rs.)

End of Lease Payment Tax Shield Cash Outflow PVIFA @ 5% PV

year

0 55,000 0 55,000 1.000 55,000

1-9 55,000 27,500 27,500 7.109 1,95,498

10 0 27,500 -27,500 0.614 (-16,885)

Total Present value of Outflows 2,33,613

The present values of cash outflow are Rs.2,56,998 and Rs.2,33,613 respectively under debt and

lease alternatives. As under debt alternatives the cash outflow would be more, the lease is

preferred.

Note: (i) The repayment of loan as well as payment of lease rental is made in the beginning of

the years. So, at the end of year 10, there will not be any payment in either option, but the tax

benefit of depreciation for the year 10 as well as of lease rentals paid in the beginning of year 10,

will be available only a the end of year 10.

(ii) Students may also calculate depreciation after subtracting the amount of subsidy from

original cost, however, even in this situation, lease alternative is preferable.

(b) Market price per share (MPS) = EPS X P/E ratio or P/E ratio = MPS/EPS

(i) Determination of EPS, P/E ratio, ROE and BVPS of BA Ltd. and DA Ltd.

BA Ltd. DA Ltd.

Earnings After Tax (EAT) Rs. 2,10,000 Rs. 99,000

No. of Shares (N) 100000 80000

EPS (EAT/N) Rs. 2.10 Rs. 1.2375

Market price per share (MPS) 40 15

P/E Ratio (MPS/EPS) 19.05 12.12

Equity Funds (EF) Rs. 12,00,000 Rs. 8,00,000

BVPS (EF/N) 12 10

ROE (EAT/EF) × 100 17.50% 12.37%

(ii) Estimation of growth rates in EPS for BA Ltd. and DA Ltd.

Retention Ratio (1-D/P ratio) 0.6 0.4

Growth Rate (ROE × Retention Ratio) 10.50% 4.95%

© The Institute of Chartered Accountants of India

(iii) Justifiable equity shares exchange ratio

(a) Intrinsic value based = Rs.20 / Rs.40 = 0.5:1 (upper limit)

(b) Market price based = MPSDA/MPSBA = Rs.15 / Rs.40 = 0.375:1(lower limit)

Since, BA Ltd. has a higher EPS, ROE, P/E ratio and even higher EPS growth expectations,

the negotiable terms would be expected to be closer to the lower limit, based on the existing

share prices.

(iv) Calculation of post merger EPS and its effects

Particulars BA Ltd. DA Ltd. Combined

EAT (Rs.) (i) 2,10,000 99,000 3,09,000

Share outstanding (ii) 100000 80000 132000*

EPS (Rs.) (i) / (ii) 2.1 1.2375 2.341

EPS Accretion (Dilution) (Re.) 0.241 (0.301***)

(v) Estimation of Post merger Market price and other effects

Particulars BA Ltd. DA Ltd. Combined

EPS (Rs.) (i) 2.1 1.2375 2.341

P/E Ratio (ii) 19.05 12.12 19.05

MPS (Rs.) (i) / (ii) 40 15 44.6

MPS Accretion (Rs.) 4.6 2.84***

* Shares outstanding (combined) = 100000 shares + (.40 × 80000) = 132000 shares

** EPS claim per old share = Rs.2.34 × 0.4 Rs. 0.936

EPS dilution = Rs.1.2375 – Rs. 0.936 Rs. 0.3015

***S claim per old share (Rs. 44.60 × 0.4) Rs. 17.84

Less: MPS per old share Rs. 15.00

Rs. 2.84

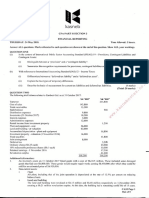

4. (a) (i) Beta of the Portfolio

Security Market No. of Value β Value x β

Price Shares

A 29.40 400 11760 0.59 6938.40

B 318.70 800 254960 1.32 336547.20

C 660.20 150 99030 0.87 86156.10

D 5.20 300 1560 0.35 546.00

E 281.90 400 112760 1.16 130801.60

F 275.40 750 206550 1.24 256122.00

G 514.60 300 154380 1.05 162099.00

H 170.50 900 153450 0.76 116622.00

994450 1095832.30

10,95,832.30

Portfolio Beta = = 1.102

9,94,450

© The Institute of Chartered Accountants of India

(ii) Theoretical Value of Future Contract Expiring in May and June

F = Sert

FMay= 8500 x e 0.20 x (2/12) = 8500 x e 0.0333

e0.0333 shall be computed using Interpolation Formula as follows:

e0.03 = 1.03045

e0.04 = 1.04081

e0.01 = 0.01036

e0.0033 = 0.00342

e0.0067 = 0.00694

e0.0333 = 1.03045 + 0.00342 = 1.03387 or 1.04081 – 0.00694 = 1.03387

According the price of the May Contract

8500 X 1.03387 = Rs. 8788

Price of the June Contract

FMay= 8500 x e 0.20 x (3/12) = 8500 x e 0.05= 8500 x 1.05127 = 8935.80

(iii) No. of NIFTY Contracts required to sell to hedge until June

Value of Position to be hedged

=

Value of Future Contract

(A) Total portfolio

994450

1.102 = 4.953 say 5 contracts

8850 25

(B) 50% of Portfolio

994450 0.50

1.102 = 2.47 say 3 contracts

8850 25

(C) 120% of Portfolio

994450 1.20

1.102 = 5.94 say 6 contracts

8850 25

(b) Market Risk Premium (A) = 14% – 7% = 7%

Share Beta Risk Premium Risk Free Return Return

(Beta x A) % Return % % Rs.

Oxy Rin Ltd. 0.45 3.15 7 10.15 8,120

Boxed Ltd. 0.35 2.45 7 9.45 14,175

Square Ltd. 1.15 8.05 7 15.05 33,863

Ellipse Ltd. 1.85 12.95 7 19.95 89,775

Total Return 1,45,933

Total Investment Rs. 9,05,000

` 1,45,933

(i) Portfolio Return = 100 = 16.13%

` 9,05,000

© The Institute of Chartered Accountants of India

(ii) Portfolio Beta

Portfolio Return = Risk Free Rate + Risk Premium х β = 16.13%

7% + 7 = 16.13%

β = 1.30

Alternative Approach

First we shall compute Portfolio Beta using the weighted average method as follows:

0.80 1.50 2.25 4.50

BetaP = 0.45X + 0.35X + 1.15X + 1.85X

9.05 9.05 9.05 9.05

= 0.45x0.0884+ 0.35X0.1657+ 1.15X0.2486+ 1.85X0.4972 = 0.0398+ 0.058 + 0.2859 +

0.9198 = 1.3035

Accordingly,

(i) Portfolio Return using CAPM formula will be as follows:

RP= RF + BetaP(RM – RF)

= 7% + 1.3035(14% - 7%) = 7% + 1.3035(7%)

= 7% + 9.1245% = 16.1245%

(ii) Portfolio Beta

As calculated above 1.3035

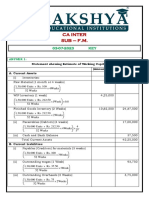

5. (a)

Particulars Rs.

Estimated Receivables 46,00,000

30

Estimated Receivables under Factor 3,74,00,000 30,73,973

365

Reduction in Receivables (Rs. 46,00,000 – Rs. 30,73,973) 15,26,027

Total Savings (A)

Reduction in finance costs Rs. 15,26,027 @ 5% 76,301

Saving of Administration costs 1,00,000

Saving of Bad debts 3,50,000

Total 5,26,301

Total Cost of Factoring (B)

Interest on advances by Factor

Advances 30,73,973 @ 80% Rs. 24,59,178

Interest on Rs. 24,59,178 @ 7% Rs. 1,72,142

Overdraft Interest rate 5% (Rs. 1,22,959) 49,183

Charges payable to Factor (Rs. 3,74,00,000 @ 3%) 11,22,000

Total 11,71,183

Net Saving (A) – (B) (6,44,882)

Since Net Saving is negative the proposal is not viable and cannot be accepted

© The Institute of Chartered Accountants of India

(b) (i) US $ required to get Rs. 25 lakhs after 2 months at the Rate of Rs. 47/$

` 25,00,000

∴ = US $ 53191.489

` 47

(ii) Rs. required to get US$ 2,00,000 now at the rate of Rs. 46.25/$

US $ 200,000 × Rs. 46.25 = Rs. 92,50,000

(iii) Encashing US $ 69000 Now Vs 2 month later

Proceed if we can encash in open mkt $ 69000 × Rs.46 = Rs. 31,74,000

Opportunity gain

10 2

= 31,74,000 Rs. 52,900

100 12

Likely sum at end of 2 months 32,26,900

Proceeds if we can encash by forward rate:

$ 69000 × Rs.47.00 32,43,000

It is better to encash the proceeds after 2 months and get opportunity gain.

6. (a) (i) Calculation of maximum price per share at which PQR Ltd. can offer to pay for XYZ Ltd.’s

share

Market Value (10,00,000 x Rs. 24) Rs. 2,40,00,000

Synergy Gain Rs. 80,00,000

Saving of Overpayment Rs. 30,00,000

Rs. 3,50,00,000

Maximum Price (Rs. 3,50,00,000/10,00,000) Rs. 35

Alternatively, it can also be computed as follows:

Let ER be the swap ratio then,

24×10,00,000+40×15,00,000+ 80,00,000+30,00,000

40=

15,00,000+10,00,000×ER

ER = 0.875

40

MP = PE x EPS x ER = x Rs. 4 x 0.875 = Rs. 35

4

(ii) Calculation of minimum price per share at which the management of XYZ Ltd.’s will be

willing to offer their controlling interest

Value of XYZ Ltd.’s Management Holding Rs. 96,00,000

(40% of 10,00,000 x Rs. 24)

Add: PV of loss of remuneration to top management Rs. 30,00,000

Rs. 1,26,00,000

No. of Shares 4,00,000

Minimum Price (Rs. 1,26,00,000/4,00,000) Rs. 31.50

© The Institute of Chartered Accountants of India

(b) (i) According to Dividend Discount Model approach the firm’s expected or required return on

equity is computed as follows:

D1

e

K g

P0

Where,

Ke = Cost of equity share capital

D1 = Expected dividend at the end of year 1

P0 = Current market price of the share.

g = Expected growth rate of dividend.

3.36

Therefore, K e 7.5%

146

= 0.0230 +0.075 = 0.098

Or, Ke = 9.80%

(ii) With rate of return on retained earnings (r) 10% and retention ratio (b) 60%, new growth rate

will be as follows:

g= br i.e.

= 0.10 X 0.60 = 0.06

Accordingly dividend will also get changed and to calculate this, first we shall calculate

previous retention ratio (b1) and then EPS assuming that rate of return on retained earnings

(r) is same.

With previous Growth Rate of 7.5% and r =10% the retention ratio comes out to be:

0.075 =b 1 X 0.10

b1 = 0.75 and payout ratio = 0.25

With 0.25 payout ratio the EPS will be as follows:

3.36

= 13.44

0.25

With new 0.40 (1 – 0.60) payout ratio the new dividend will be

D1 = 13.44 X 0.40 = 5.376

Accordingly new Ke will be

5.376

Ke 6.0%

146

or, Ke = 9.68%

Alternatively

EPS with 6% growth rate instead of 7.5%.

1.06

13.44× = 13.25

1.075

With new 0.40 (1 – 0.60) payout ratio the new dividend will be

D1 = 13.25 X 0.40 = 5.30

10

© The Institute of Chartered Accountants of India

Accordingly new Ke will be

5.30

Ke 6.0%

146

or, Ke = 9.63%

7. (a) Advantages of Holding Securities in ‘Demat’ Form: The Depositories Act, 1996 provides the

framework for the establishment and working of depositories enabling transactions in securities in

scripless (or demat) form. With the arrival of depositories on the scene, many of the problems

previously encountered in the market due to physical handling of securities have been to a great

extent minimized. In a broad sense, therefore, it can be said that ‘dematting’ has helped to

broaden the market and make it smoother and more efficient.

From an individual investor point of view, the following are important advantages of holding

securities in demat form:

• It is speedier and avoids delay in transfer

• It avoids lot of paper work.

• It saves on stamp duty.

From the issuer-company point of view also, there are significant advantages due to dematting,

some of which are:

• Savings in printing certificates, postage expenses.

• Stamp duty waiver.

• Easy monitoring of buying/selling patterns in securities, increasing ability to spot takeover

attempts and attempts at price rigging.

(b) The following factors may particularly be kept in mind while assessing the factors relating to an

industry :

(a) Product Life-Cycle;

(b) Demand Supply Gap;

(c) Barriers to Entry;

(d) Government Attitude;

(e) State of Competition in the Industry;

(f) Cost Conditions and Profitability and

(g) Technology and Research.

(c) Inefficiencies of Money Market:

(i) Markets not integrated,

(ii) High volatility,

(iii) Interest rates not properly aligned,

(iv) Players restricted,

(v) Supply based-sources influence uses,

(vi) Not many instruments,

(vii) Players do not alternate between borrowing and lending,

(viii) Reserve requirements,

11

© The Institute of Chartered Accountants of India

(ix) Lack of transparency,

(x) Inefficient Payment Systems,

(xi) Seasonal shortage of funds,

(xii) Commercial transactions are mainly in cash, and

(xiii) Heavy Stamp duty limiting use of exchange bills

(d) The various financial instruments dealt with in the international market are briefly described

below :

• Euro Bonds: Denominated in a currency issued outside the country of that currency.

• Foreign Bonds: Example a British firm placing dollar denominated bonds in U.S.A.

• Fully Hedged Bonds: Currency risk eliminated by selling in forward market entire stream of

interest and principal payments.

• Floating Rate Notes: Interests are adjusted to reflect the prevailing exchange rate, Not so

popular.

• Euro Commercial Papers: Designated in US Dollar, they are short-term instruments.

• Foreign Currency Options: Provide hedge against financial and economic risk.

• Foreign Currency Futures: Obligation to buy or sell a specified currency in the present for

settlement at a future dates.

(e) Due to the prevailing guidelines, the target company without the approval of the shareholder

cannot resort to any issuance of fresh capital or sale of assets etc., and also due to the necessity

of getting approvals from various authorities. Thus, the target company cannot refuse transfer of

shares without the consent of shareholders in a general meeting.

A target company can adopt a number of tactics to defend itself from hostile takeover through a

tender offer.

• Divestiture;

• Crown jewels;

• Poison pill;

• Poison Put;

• Greenmail;

• White knight;

• White squire;

• Golden parachutes; and

• Pac-man defense.

12

© The Institute of Chartered Accountants of India

You might also like

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Document40 pagesCa Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Shashank SikarwarNo ratings yet

- Test - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswersDocument10 pagesTest - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswerswinNo ratings yet

- AnswersDocument34 pagesAnswerssathvik.g.m.s.saiNo ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- Master Question, Additional Questions-2Document4 pagesMaster Question, Additional Questions-2anshikajain3474No ratings yet

- Paper14 SolutionDocument21 pagesPaper14 SolutionJabir AghadiNo ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 2 PDFDocument56 pagesGroup - I Paper - 1 Accounting V2 Chapter 2 PDFShrinivas GirnarNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Document12 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Menuka SiwaNo ratings yet

- Nov 12 SuggestedDocument18 pagesNov 12 SuggestedRaul KarkyNo ratings yet

- Chapter 4 Practice SolutionsDocument24 pagesChapter 4 Practice SolutionstolatillerNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- Portfolio management techniques and constant ratio planDocument15 pagesPortfolio management techniques and constant ratio planMr. Shopper NepalNo ratings yet

- SFM MTP 1 May 18 ADocument12 pagesSFM MTP 1 May 18 ASampath KumarNo ratings yet

- SFM Book 3 Merger Mutual and TheoryDocument380 pagesSFM Book 3 Merger Mutual and TheorySagar singlaNo ratings yet

- Ca Inter-F.m.03-07-2023-KeyDocument3 pagesCa Inter-F.m.03-07-2023-KeyChintuNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingDocument16 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingPraveen Reddy DevanapalleNo ratings yet

- Paper - 2: Strategic Financial Management: PV of Interest + PV of Maturity Value of BondDocument17 pagesPaper - 2: Strategic Financial Management: PV of Interest + PV of Maturity Value of BondAkshay NagarNo ratings yet

- Corporate FinanceDocument8 pagesCorporate Financedivyakashyapbharat1No ratings yet

- DPS Calculation and Preferred Stock ValuationDocument7 pagesDPS Calculation and Preferred Stock ValuationStoryKingNo ratings yet

- FM DJB - ICAI Mat Additional QuestionsDocument69 pagesFM DJB - ICAI Mat Additional QuestionsRoshan KumarNo ratings yet

- Shri Guru Kripa Learning Centre, Chennai 600 024. PhoneDocument16 pagesShri Guru Kripa Learning Centre, Chennai 600 024. PhoneCAclubindiaNo ratings yet

- MTP 1 Suggested Answers AADocument9 pagesMTP 1 Suggested Answers AAYash RankaNo ratings yet

- Strategic Cost Management NMIMS AssignmentDocument7 pagesStrategic Cost Management NMIMS AssignmentN. Karthik UdupaNo ratings yet

- SFM Answers 1Document10 pagesSFM Answers 1riyaNo ratings yet

- 67229bos54127 Inter P8aDocument16 pages67229bos54127 Inter P8aSANDEEP MADANNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- Managerial Economics (Chapter 14)Document28 pagesManagerial Economics (Chapter 14)api-3703724100% (1)

- Efficient market insider dealing regulationsDocument9 pagesEfficient market insider dealing regulationsBadihah Mat SaudNo ratings yet

- AC2105 Seminar 3 Group 3Document37 pagesAC2105 Seminar 3 Group 3Kwang Yi JuinNo ratings yet

- Final Exam Answer Scheme A141Document9 pagesFinal Exam Answer Scheme A141Hooi CheeNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocument9 pagesSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (26)

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- 73300bos58129 Final P2aDocument14 pages73300bos58129 Final P2aPrasanni RaoNo ratings yet

- Solution FM GMDocument11 pagesSolution FM GMDharmateja ChakriNo ratings yet

- Receivables Bad Debt Journal EntriesDocument7 pagesReceivables Bad Debt Journal EntriesTAWHID ARMANNo ratings yet

- Answers To Questions Answers To Exercises Exercise 1-1 Part A Normal Earnings For Similar Firms ($15,000,000 - $8,800,000) X 15% $930,000Document2 pagesAnswers To Questions Answers To Exercises Exercise 1-1 Part A Normal Earnings For Similar Firms ($15,000,000 - $8,800,000) X 15% $930,000sameerNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- FM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Document34 pagesFM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Srushti AgarwalNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- ABC FR162Document3 pagesABC FR162Prashant SachanNo ratings yet

- I Teach Like This... : "FM Rocks"Document24 pagesI Teach Like This... : "FM Rocks"Saksham TehriNo ratings yet

- MTP Oct. 2018 FM and Eco AnswerDocument16 pagesMTP Oct. 2018 FM and Eco AnswerAisha MalhotraNo ratings yet

- Tutorial 3 AnswersDocument7 pagesTutorial 3 AnswersFEI FEINo ratings yet

- Short-term examDocument6 pagesShort-term examymkuzangwe16No ratings yet

- Answers To Week 1 HomeworkDocument6 pagesAnswers To Week 1 Homeworkmzvette234No ratings yet

- Advance Accounts Suggested Answer May2022Document13 pagesAdvance Accounts Suggested Answer May2022rajuNo ratings yet

- Cpa 8Document13 pagesCpa 8justinorchidsNo ratings yet

- Practice Problem On Capital BudgetingDocument29 pagesPractice Problem On Capital BudgetingPadyala Sriram89% (9)

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- SFM DJB - Nov20 Suggested Answers PDFDocument22 pagesSFM DJB - Nov20 Suggested Answers PDFJash BhagatNo ratings yet

- By: Vinit Mishra SirDocument109 pagesBy: Vinit Mishra SirgimNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (25)

- Chapter 14 LEASINGDocument17 pagesChapter 14 LEASINGKaran KashyapNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- Financial Reporting November 2017 Past PaperDocument5 pagesFinancial Reporting November 2017 Past PaperRomaric DjokoNo ratings yet

- Management AccountingDocument223 pagesManagement Accountingcyrus100% (2)

- Financial Reporting May 2018 Past PaperDocument5 pagesFinancial Reporting May 2018 Past PaperRomaric DjokoNo ratings yet

- CA33 Financial ReportingDocument7 pagesCA33 Financial ReportingRomaric DjokoNo ratings yet

- CA Final SFM Very Short Formula Book Nov 2020Document36 pagesCA Final SFM Very Short Formula Book Nov 2020Romaric DjokoNo ratings yet

- COMPANY LAW KEY TERMSDocument11 pagesCOMPANY LAW KEY TERMSRomaric DjokoNo ratings yet

- Financial Management May 2018 Past PaperDocument5 pagesFinancial Management May 2018 Past PaperRomaric DjokoNo ratings yet

- ICWAI Final - Financial AccountingDocument568 pagesICWAI Final - Financial AccountingMM_AKSI100% (3)

- COMPANY LAW KEY TERMSDocument11 pagesCOMPANY LAW KEY TERMSRomaric DjokoNo ratings yet

- CPA Exam: Company Law Revision GuideDocument26 pagesCPA Exam: Company Law Revision GuideRomaric DjokoNo ratings yet

- Handout - Company Law - Lecture Notes WS 14-15Document84 pagesHandout - Company Law - Lecture Notes WS 14-15Amitav Talukdar100% (1)

- COMPANY LAW KEY TERMSDocument11 pagesCOMPANY LAW KEY TERMSRomaric DjokoNo ratings yet

- ICWAI Final - Financial AccountingDocument568 pagesICWAI Final - Financial AccountingMM_AKSI100% (3)

- PEPSI. Project Report On HR PEPSICODocument98 pagesPEPSI. Project Report On HR PEPSICOMahi Khatri100% (1)

- Logistics Project FinalDocument27 pagesLogistics Project FinalDhaval ThackerNo ratings yet

- Economic Analysis for Business Decisions QuizDocument22 pagesEconomic Analysis for Business Decisions Quizravi kangneNo ratings yet

- Putting A Price Tag On LifeDocument4 pagesPutting A Price Tag On LifeKenji LogieNo ratings yet

- Homework 1 PDFDocument6 pagesHomework 1 PDFjnm,No ratings yet

- Why Bresler ice cream failed in the Peruvian marketDocument3 pagesWhy Bresler ice cream failed in the Peruvian marketRosaACHNo ratings yet

- Marketing ManagementDocument130 pagesMarketing ManagementGuruKPO88% (25)

- Case StudyDocument9 pagesCase StudyParth SharmaNo ratings yet

- Avida Towers Aspira: An Exciting New Addition To Your Everyday AspirationDocument18 pagesAvida Towers Aspira: An Exciting New Addition To Your Everyday Aspirationkenneth MagarinNo ratings yet

- Ventura, Mary Mickaella R - Chapter8p.255-256Document3 pagesVentura, Mary Mickaella R - Chapter8p.255-256Mary VenturaNo ratings yet

- Project PresentationDocument17 pagesProject PresentationSaran M KumarNo ratings yet

- Cake - Extra - James - SukreeDocument72 pagesCake - Extra - James - SukreevaibhavdschoolNo ratings yet

- Price Skimming - Wikipedia, The Free EncyclopediaDocument3 pagesPrice Skimming - Wikipedia, The Free Encyclopedia92SgopeNo ratings yet

- AcknowledgementDocument14 pagesAcknowledgementHanisah JamaludinNo ratings yet

- Ecommerce Handbook: Growth Outlook and Competitive LandscapeDocument43 pagesEcommerce Handbook: Growth Outlook and Competitive LandscapeTiago SoaresNo ratings yet

- 0450 s04 Ms 1+2Document15 pages0450 s04 Ms 1+2miroslav79No ratings yet

- CFAP 3 SPM Complete Summary With Mind Maps - by Muzzammil Munaf (IQSF)Document45 pagesCFAP 3 SPM Complete Summary With Mind Maps - by Muzzammil Munaf (IQSF)Mateen Ahmed100% (1)

- Chapter 3Document37 pagesChapter 3ENG ZI QINGNo ratings yet

- BBQfun Sales Data Worksheet - ASSESSMENT TASK 2 Part ADocument4 pagesBBQfun Sales Data Worksheet - ASSESSMENT TASK 2 Part AbabluanandNo ratings yet

- PO Painting ServicesDocument2 pagesPO Painting ServicessuntoroboyNo ratings yet

- Dr. Duffy Microeconomics: The End of CHAPTER 3 Frank and Bernanke With Supplemental MaterialDocument43 pagesDr. Duffy Microeconomics: The End of CHAPTER 3 Frank and Bernanke With Supplemental MaterialMariNo ratings yet

- Right to Fair Land AcquisitionDocument21 pagesRight to Fair Land AcquisitionShruti Sinha100% (2)

- ProcurementGuidelines Sri Lanka 12juneDocument79 pagesProcurementGuidelines Sri Lanka 12juneChinthaka SomaratnaNo ratings yet

- Internal and External Factors Analysis of IKEADocument18 pagesInternal and External Factors Analysis of IKEABoy BearishNo ratings yet

- Specialists Control Over Market Openings and Closings by Richard NeyDocument3 pagesSpecialists Control Over Market Openings and Closings by Richard NeyaddqdaddqdNo ratings yet

- The Symphonie Trader System GuideDocument71 pagesThe Symphonie Trader System GuideAdil BensellamNo ratings yet

- Port Man Quiz Stuff PDFDocument53 pagesPort Man Quiz Stuff PDFHein BreunissenNo ratings yet

- HEWLETT PACKARD - Computer Systems Organization: Selling To Enterprise CustomersDocument16 pagesHEWLETT PACKARD - Computer Systems Organization: Selling To Enterprise CustomersAbhishek GaikwadNo ratings yet

- Maf253 GP Ia No6 QDocument2 pagesMaf253 GP Ia No6 QNik Syarizal Nik MahadhirNo ratings yet

- Sales Contract Annulment Due to FraudDocument5 pagesSales Contract Annulment Due to FraudRamz JayNo ratings yet