Professional Documents

Culture Documents

Abc FR162

Uploaded by

Prashant SachanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abc FR162

Uploaded by

Prashant SachanCopyright:

Available Formats

Daffodil Limited - Marks 11

ICAP Spring 2018 (FR162) IAS 33 Earnings per Share

Answer to Q1 has already been covered in separate

video with IAS 8 topic.

Answer to Q1: (already covered in separate video)

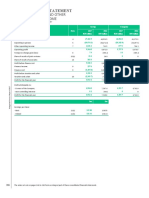

Daffodil Limited Share Share General Revaluation Retained

Total

Statement of changes in equity Capital premium Reserves Surplus Earnings

For the year ended 31 December 2017 Rs. m

As at 31 December 2015 1,600 1,850 49 1,430 4,929

Effect of correction of error W1 (54.69) (54.69)

As at 31 December 2015 (restated) 1,600 0 1,850 49 1,375.31 4,874.31

Final Dividend N1 (120) (120)

Right Issue N2 400 320 720

Net Profit (restated) N3 331.67 331.67

Transfer on realisation (49) 49 0

As at 31 December 2016 2,000 320 1,850 0 1,635.98 5,805.98

Final Bonus issue N4 200 (200) 0

Right Issue N5 500 250 750

Interim Bonus issue N6 405 (405) 0

Net Profit N7 660.25 660.25

Transfer to general reserves 112 (112) 0

Balance as at 31 December 2017 3,105 570 1,962 0 1,579.23 7,216.23

Notes on Calculations Rs. m

1. Final Cash Dividend 2015 Rs. 1,600m x 7.5% 120

2. Right issue @ 25%

Share Capital Rs. 1,600m / Rs. 10 = 160m x 25% x Rs. 10 400

Share premium Rs. 1,600m / Rs. 10 = 160m x 25% x Rs. 8 320

3. Net Profit 2016 [Rs. 318m given + Rs. 13.67m correction] 331.67

4. Final Bonus Dividend 2016 Rs. 2,000m x 10% 200

5. Right issue 50m shares

Share Capital 50m shares x Rs. 10 500

Share premium 50m shares x Rs. 5 250

6. Interim Bonus Dividend 2017 Rs. 2,000m + 200m + 500m = Rs. 2,700m x 15% 405

7. Net Profit 2017 [Rs. 650m given + Rs. 10.25m correction] 660.25

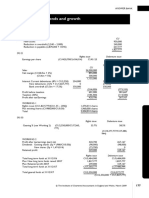

Correct Incorrect Profit

W1 Correction of error depreciation depreciation correction

Rs. m Rs. m Rs. m

Cost 700.00 700.00

Depreciation 2014 [700 x 25% x 11/12] (160.42)

[700 x 25% x 6/12] (87.50) (72.92)

539.58 612.50

Depreciation 2015 @25% (134.90) (153.13) 18.23

404.68 459.37 (54.69)

Depreciation 2016 @25% (101.17) (114.84) 13.67

303.51 344.53

Depreciation 2017 @25% (75.88) (86.13) 10.25

Answer to Question 2: Part (a)

Rs. 660.25m (from Ans 1) Rs. 2.26 per

Basic EPS (2017) = =

291.87m shares share

Rs. 331.67m (from Ans 1) Rs. 1.30 per

Basic EPS (2016) - restated = =

255.02m shares share

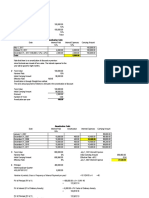

Workings

Number of Time Weighted

Period Fraction(s)

shares (m) factor average (m)

Jan to Apr 2016 [Rs. 1600m/10] 160 x 4/12 x1 x 1.10 x 1.08 x 1.15 = 72.86

Right issue 1 May 2016 [25%] 40

May to Dec 2016 200 x 8/12 x 1.10 x 1.08 x 1.15 = 182.16

Weighted average shares 2016 255.02

Jan to Mar 2017 200 x 3/12 x 1.10 x 1.08 x 1.15 = 68.31

Bonus issue 1 Apr 2017 [10%] 20

Apr to Jun 2017 220 x 3/12 x 1.08 x 1.15 = 68.31

Right issue 1 Jul 2017 50

Jul to Aug 2017 270 x 2/12 x 1.15 = 51.75

Bonus issue 1 Sep 2017 [15%] 40.5

Sep to Dec 2017 310.5 x 4/12 = 103.5

Weighted average shares 2017 291.87

Fractions

Right issue 1 May 2016 [25%] Issued at fair market price =1

Bonus issue 1 Apr 2017 [10%] 110 after / 100 before = 1.10

Right issue 1 Jul 2017 25 AcRP / 23.15 TeRP = 1.08

Bonus issue 1 Sep 2017 [15%]

115 after / 100 before = 1.15

(220m x Rs. 25) + (50m x Rs. 15) Rs. 23.15 per

Theoretical ex-right price = =

220m + 50m shares share

Answer to Question 2: Part (b)

If a class of preference shares is classified as liability (redeemable), any dividend relating to that share is

recognised as a finance cost in the statement of profit or loss.

Since it is already deducted from the profit or loss and so no further adjustment needs to be made.

If a class of preference shares is classified as equity (irredeemable), dividend must be deducted from the

profit or loss.

- For cumulative preference shares, above treatment shall be followed irrespective of declaration of

dividend.

- For non-cumulative preference shares, above treatment shall be followed only if dividend is declared.

You might also like

- Answers For Problems On Financial Leverage - 1-4Document4 pagesAnswers For Problems On Financial Leverage - 1-4jeganrajraj67% (3)

- Practice Problem On Capital BudgetingDocument29 pagesPractice Problem On Capital BudgetingPadyala Sriram90% (10)

- Exercises and Answers Chapter 5Document8 pagesExercises and Answers Chapter 5MerleNo ratings yet

- Approaches To Measure Cost of Quality: C 0revention-Appraisal-Failure ,-+ "! & .& /01 2 && 3Document6 pagesApproaches To Measure Cost of Quality: C 0revention-Appraisal-Failure ,-+ "! & .& /01 2 && 3sanyasamNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- New Heritage DoolDocument9 pagesNew Heritage DoolVidya Sagar KonaNo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- Spare Parts Management - Intro Levels Notes PDFDocument6 pagesSpare Parts Management - Intro Levels Notes PDFEslam MansourNo ratings yet

- COBIT 2019 Foundation ExamDocument28 pagesCOBIT 2019 Foundation ExamVitor Suzarte100% (1)

- PROBLEM 2 - Two Sole Proprietors Form A Partnership PROBLEM 2 - Two Sole Proprietors Form A PartnershipDocument7 pagesPROBLEM 2 - Two Sole Proprietors Form A Partnership PROBLEM 2 - Two Sole Proprietors Form A PartnershipRudy LugasNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- Finacial Management MockDocument12 pagesFinacial Management MockRomaric DjokoNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- 23 Nov 2018 Mixed Questions With Solutions PDFDocument9 pages23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziNo ratings yet

- Exhibit 10 Payback Period: Year Annual Cash Inflow Unrecovered Cost SolutionDocument3 pagesExhibit 10 Payback Period: Year Annual Cash Inflow Unrecovered Cost SolutionSenku ishigamiNo ratings yet

- Strategic Cost Management NMIMS AssignmentDocument7 pagesStrategic Cost Management NMIMS AssignmentN. Karthik UdupaNo ratings yet

- Chapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. BDocument7 pagesChapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. Bmarriette joy abadNo ratings yet

- United Metal: Initial Outlay (IO) CalculationDocument3 pagesUnited Metal: Initial Outlay (IO) CalculationMarjina Binte Abbas BrishtiNo ratings yet

- Valuations - Awethu - SolutionDocument2 pagesValuations - Awethu - SolutionTNNo ratings yet

- Ias 38, 10, 37 Ifrs 15Document83 pagesIas 38, 10, 37 Ifrs 15Mehedi Hasan MunnaNo ratings yet

- Investment Appraisal and Analysis Ide 2018Document4 pagesInvestment Appraisal and Analysis Ide 2018vincentNo ratings yet

- Example 21.19 Text BookDocument4 pagesExample 21.19 Text BookNUR DARWISYAH KAMARUDINNo ratings yet

- SOCIE Format (CAF Level)Document1 pageSOCIE Format (CAF Level)kashan.ahmed1985No ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- CFAP 1 AAFR Summer 2017Document10 pagesCFAP 1 AAFR Summer 2017Aqib SheikhNo ratings yet

- 9706 s12 Ms 22 PDFDocument6 pages9706 s12 Ms 22 PDFmarryNo ratings yet

- Solution Far610 - Jan 2018Document10 pagesSolution Far610 - Jan 2018E-cHa PineappleNo ratings yet

- Tax 3702 Assignment 2Document3 pagesTax 3702 Assignment 2ngoloyintomboxoloNo ratings yet

- Accounts AssignmentDocument17 pagesAccounts AssignmentApoorvNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- Solution Aassignments CH 12Document7 pagesSolution Aassignments CH 12RuturajPatilNo ratings yet

- Qualitative BasicsDocument17 pagesQualitative BasicsJosé Manuel EstebanNo ratings yet

- Suggested Answers Final Examination - Winter 2015: Management AccounitngDocument7 pagesSuggested Answers Final Examination - Winter 2015: Management AccounitngAbdulAzeemNo ratings yet

- Workbook 6 Capital Budgeting/Making Capital Investment Decisions/ Estimation of Project Cash FlowsDocument9 pagesWorkbook 6 Capital Budgeting/Making Capital Investment Decisions/ Estimation of Project Cash FlowsFaizaNo ratings yet

- Q Test FAR570 Jan 2022Document6 pagesQ Test FAR570 Jan 2022fareen faridNo ratings yet

- Solutions (Chapter17)Document5 pagesSolutions (Chapter17)James Domini Lopez LabianoNo ratings yet

- November 2019 Exam Solution Final PaperDocument7 pagesNovember 2019 Exam Solution Final Paper2603803No ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Document12 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Menuka SiwaNo ratings yet

- Of Profit or Loss and Other Comprehensive Income: Consolidated StatementDocument11 pagesOf Profit or Loss and Other Comprehensive Income: Consolidated Statementaslanalan0101No ratings yet

- 3.business Plan Divident and Grought ABDocument26 pages3.business Plan Divident and Grought ABmiradvance studyNo ratings yet

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocument85 pagesGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesNo ratings yet

- Notes CA Int GMDocument51 pagesNotes CA Int GMDharmateja ChakriNo ratings yet

- FINANCIAL RESULTS FOR THE QUARTER ENDED DECEMBER 31, 2016 (Company Update)Document4 pagesFINANCIAL RESULTS FOR THE QUARTER ENDED DECEMBER 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Year 0 1 2 3 4 - Rs. in MillionDocument6 pagesYear 0 1 2 3 4 - Rs. in MillionShehrozSTNo ratings yet

- S-2022 SolDocument9 pagesS-2022 SolMuhammad NawazNo ratings yet

- Ca Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Document40 pagesCa Inter Accounting Full Test 1 Nov 2022 Unschedule Solution 1658223005Shashank SikarwarNo ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- FM II Assignment 3 SolutionDocument2 pagesFM II Assignment 3 SolutionSheryar NaeemNo ratings yet

- MTP Oct. 2018 FM and Eco AnswerDocument16 pagesMTP Oct. 2018 FM and Eco AnswerAisha MalhotraNo ratings yet

- Cases 3 - Berlin Novanolo G (29123112)Document4 pagesCases 3 - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Accounting and Financial ManagementDocument7 pagesAccounting and Financial ManagementMelokuhle MhlongoNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Intermediate Accounting 2Document4 pagesIntermediate Accounting 2MARRIETTE JOY ABADNo ratings yet

- 9 BBDocument5 pages9 BBIlesh DinyaNo ratings yet

- Accounting NSC P1 MG Sept 2022 Eng GautengDocument13 pagesAccounting NSC P1 MG Sept 2022 Eng GautengSweetness MakaLuthando LeocardiaNo ratings yet

- Answer Key Quiz 5 Actbas2 T3 PDFDocument5 pagesAnswer Key Quiz 5 Actbas2 T3 PDFCharles TuazonNo ratings yet

- CH SolutionsDocument6 pagesCH SolutionsPink MagentaNo ratings yet

- Practice Set (Solutions) - IAS 19 PDFDocument4 pagesPractice Set (Solutions) - IAS 19 PDFAli HaiderNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- Compilation First Prelim Period SolutionDocument12 pagesCompilation First Prelim Period SolutionHarvyn Kuster AcedilloNo ratings yet

- Coco Cola Ratio Analysis Final (II)Document20 pagesCoco Cola Ratio Analysis Final (II)Adeel Shah100% (2)

- Suggested Answers Assignment Notes PayableDocument4 pagesSuggested Answers Assignment Notes PayableKeikoNo ratings yet

- Notification LetterDocument2 pagesNotification LetterALNo ratings yet

- Aug 1G Ehealthcare: 5 10 (K) Premnarkct Notification SubmissionDocument8 pagesAug 1G Ehealthcare: 5 10 (K) Premnarkct Notification SubmissionrafikNo ratings yet

- CASE STUDY OF RMC PLANT Report 1Document3 pagesCASE STUDY OF RMC PLANT Report 1Radha AgarwalNo ratings yet

- Paige Begody Resume 11 2 23Document1 pagePaige Begody Resume 11 2 23api-700591109No ratings yet

- Opportunity Recognition & Generation of IdeasDocument13 pagesOpportunity Recognition & Generation of IdeasSiddhi PatilNo ratings yet

- Unit 2Document17 pagesUnit 2DeepakNo ratings yet

- BCom - SEM 4 2024 - UDocument9 pagesBCom - SEM 4 2024 - UarunvklplmNo ratings yet

- Examination Paper Question 1: Charter Engineer Using Suitable Examples Discuss: (A) The Benefits For Employees To Be Chartered EngineersDocument9 pagesExamination Paper Question 1: Charter Engineer Using Suitable Examples Discuss: (A) The Benefits For Employees To Be Chartered EngineerscharlesNo ratings yet

- Audit Mock Q. A PDFDocument11 pagesAudit Mock Q. A PDFANo ratings yet

- Hesham Saafan - MSC - CPL - Othm: ContactDocument3 pagesHesham Saafan - MSC - CPL - Othm: Contactnemoo80 nemoo90No ratings yet

- Manage Security Agency Within Legal Framework - Rev.1Document44 pagesManage Security Agency Within Legal Framework - Rev.1Vksathiamoorthy KrishnanNo ratings yet

- Job Description - Ops StratDocument3 pagesJob Description - Ops StratchengadNo ratings yet

- Apprentice Act 1961Document2 pagesApprentice Act 1961Narendra ParmarNo ratings yet

- R3 PT Canggu International-1 PDFDocument2 pagesR3 PT Canggu International-1 PDFkarina MEPNo ratings yet

- Bill Statement 01 2024Document2 pagesBill Statement 01 2024AbhinavNo ratings yet

- 1.5.6 Resultados Del Test de Estilo de EmprendedorDocument5 pages1.5.6 Resultados Del Test de Estilo de EmprendedorGFranco BlancasNo ratings yet

- Farhana SultanaDocument37 pagesFarhana Sultanakazi mahmudurNo ratings yet

- Data Analytics: This Study Resource Was Shared ViaDocument5 pagesData Analytics: This Study Resource Was Shared ViaAmeya SakpalNo ratings yet

- Afm Module 3 - IDocument26 pagesAfm Module 3 - IABOOBAKKERNo ratings yet

- April 7, 2022Document12 pagesApril 7, 2022Rina EscaladaNo ratings yet

- Title Business Partner Number Bus Part Cat Business Partner Role Category Business Partner GroupingDocument16 pagesTitle Business Partner Number Bus Part Cat Business Partner Role Category Business Partner GroupingRanjeet KumarNo ratings yet

- Skin Care in GermanyDocument4 pagesSkin Care in Germanynguyen minhanhNo ratings yet

- Design and Construction of Offshore Concrete Structures: February 2017Document18 pagesDesign and Construction of Offshore Concrete Structures: February 2017Suraj PandeyNo ratings yet

- 10 Golden Rules of Pricing ConversationsDocument3 pages10 Golden Rules of Pricing ConversationsPete Majkowski100% (1)

- Children Should Earn Their Pocket MoneyDocument5 pagesChildren Should Earn Their Pocket MoneyGabiNo ratings yet