Professional Documents

Culture Documents

SBM Errata Sheet 2020 - 080920

Uploaded by

Hamza AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBM Errata Sheet 2020 - 080920

Uploaded by

Hamza AliCopyright:

Available Formats

Strategic Business Management

errata sheet 2020

QUESTION BANK

(i) Errata and clarifications

Amended answer to Question 37 Gemstone Jewellery Ltd

SBM errata sheet 2020_080920.docx Page 1 of 11

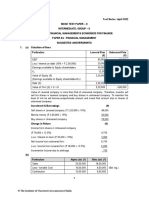

(1) Forecast value of the equity – Free cash flows

Current year

20X7 20X8 20X9 20Y0

£'000 £'000 £'000 £'000

Revenue 63,000 66,150 69,458

Operating costs (excluding depreciation)

(£53.58m – £3m) (50,580) (50,580) (50,580)

EBITDA 12,420 15,570 18,878

Depreciation [(500 15/20) + 300 +161*] (836) (836) (836)

EBIT 11,584 14,734 18,042

Tax at 20% (2,317) (2,947) (3,608)

Profit after tax 9,267 11,787 14,434

Add back depreciation 836 836 836

Less Capex (50) (50) (50)

At 1 January

20X8

Working capital saving 450

Leaseback proceeds 5,500

Deferred consideration (2,000)

Sale of workshop 3,000

Initial refurbishment (3,000)

Free cash flow 5,950 8,053 12,573 15,220

Bal b/f 0 5,950 14,003 26,576

Bal c/f (cash free acquisition for 20X7) 5,950 14,003 26,576 41,796

DF @10% 1.0 0.909 0.826 0.751

PV of free cash flow 5,950 7,320 10,385 11,430

Terminal value (15,220/0.1) 152,200

PV of TV (152,200 0.751) 114,302

Enterprise value at 31 Dec 20X7 149,387

Debt – existing (1,500)

Debt – Farmley (18,000)

Debt – ICF (10,000)

Debt - new lease liability (2,934)

Equity value at 31 Dec 20X7 116,953

*300 is additional depreciation on the refurbishment cost as per the question and 161 is depreciation on new

leased assets (see working below on sale and leaseback)

At 31 December 20X7, the enterprise value is £149.387 million and the value of the equity is £116.953 million.

The consideration therefore looks reasonable if the revenue growth and cost savings can be delivered.

The free cash flow valuation method

The valuation of an enterprise, based on discounting future free cash flows, determines a total value for equity

and debt (enterprise value). From a valuation perspective, the normalised cash flow and earnings figures are

used together to estimate the free cash flows of a business. It is the free cash flow that is discounted to deduce

an enterprise value for the business before deducting the value of debt to obtain an equity value.

The annual discount rate of 10% is the weighted average cost of capital which is appropriate to the enterprise

value as it considers the risk of all cash flows (ie, flows to equity and debt).

The free cash flow method of determining the value of the equity is sufficiently flexible to allow for a period of

temporary growth, followed by a perpetuity period of EBIT without growth. However, a concern is the

sustainability of the cash flows in perpetuity beyond 20Y0, or indeed beyond a reasonable time horizon where

markets may change.

SBM errata sheet 2020_080920.docx Page 2 of 11

In common with other valuation methods, it is dependent on the forecasts being reliable and the discount rate

being appropriate and stable over time. This means that the working assumptions need to be valid, which is

questioned further below.

Revenue

Revenue is assumed to grow at 5% per year. This is a fundamental assumption as it drives much of the increase in

value of the equity from the MBO.

The PV of the previous revenue stream (which is assumed to be constant) under Ultima is:

£60m/0.1 = £600m

The PV of the forecast revenue stream under the MBO (with 5% pa growth) is:

(£63m/1.1) + (£66.15m/1.12) + ((£69.458m/1.12)/0.1) = £685.97m

Thus, there is a very substantial increase of £85.97 million in the value of the enterprise arising from the forecast

increase in the revenue stream over the three-year time horizon.

Cost savings

The cash cost savings further add to the increased valuation at 31 December 20Y0.

These comprise:

Cost type Change pa

£

Staff costs 600,000

Purchases of jewellery 1,400,000

Central service payments to Ultima 1,000,000

Less

Increased lease payments (550,000)

Net annual cost savings 2,450,000

Therefore, annual operating costs fall by £2.45 million from £53.58 million in 20X7 to £51.13 million in 20X8 and

thereafter.

The PV of the costs savings before tax amounts to £24.5 million (£2.45m/0.1) according to the working

assumptions.

Enterprise value at 31 December 20Y0

The value of the enterprise at 31 December 20Y0 is the discounted sustainable free cash flow beyond 20Y0 which

amounts to:

£15.220m/0.1 = £152.2m

Equity value at 31 December 20Y0

Over the three-year period 20X8 to 20Y0, GJ has generated free cash flows of £41.796 million before interest (per

the above table) which is used to pay the interest and repay the Farmley Bank debt and ICF debt at 31 December

20Y0 as follows:

SBM errata sheet 2020_080920.docx Page 3 of 11

Annual interest Interest net of tax

£'000 Interest rate £'000 £'000 3 year CF

Original loan 1,500 0.05 75 60 180

Farmley Bank 18,000 0.06 1,080 864 2,592

ICF loan 10,000 0.09 900 720 2,160

4,932

Cash bal c/f 41,796

Cash c/f net of int 36,864

ICF debt 10,000

Farmley debt 18,000

28,000

Surplus cash balance 8,864

In addition to the debt noted above, the lease liability and interest over the three-year period 20X8 to 20Y0 will

also need to be paid.

3 annual payments of £550,000 = £1,650,000 leaving a net surplus cash balance of £7,214,000.

The equity value at 31 December 20Y0 can normally be determined by deducting the remaining net debt value at

that date.

However, the cash available of £7.214 million is greater than the Roatt Bank debt of

£1.5 million at that date giving a surplus of £5.714 million.

This gives an equity value of:

£

Enterprise value 152.20m

Surplus cash 5.714m

Equity value 157.914m

This assumes that the surplus cash can be distributed to shareholders and does not need to be retained for

investment to generate the future cash flows.

(2) Potential benefits and risks of the MBO for stakeholders

A key risk factor for all stakeholders is the reasonableness of the price paid to Ultima.

In terms of a 'safety net' the net asset value is:

Per SFP £8.7m

Fair value uplift (£4.3m – £3.2m) £1.1m

Net assets at fair value £9.8m

There may be some unrecognised asset value in intangibles (eg, brand name) but in the absence of this the £40

million valuation gives a high goodwill figure of £30.2 million

(£40m – £9.8m).

As a going concern, the continuing valuation to Ultima (ie, without the MBO induced changes) is:

(£5.186m/0.1) – £1.5 m = £50.36m

The price of £40 million therefore looks favourable compared to this figure of

£50.36 million.

With the MBO changes the above table shows PV of free cash flows to give an enterprise value of £149.387

million and after deducting debt of £32.434 million an equity value of £116.953 million. The suggested deal price

looks favourable compared to these values, but these are based on forecasts which may not be achieved. This is

considered further below.

SBM errata sheet 2020_080920.docx Page 4 of 11

Overall, subject to the sustainability and reliability of these forecasts, the £40 million sale price suggested seems

reasonable.

(a) ICF

If the forecasts and working assumptions are valid, then the value of the ICF share of equity at 31 December

20Y0 is (per workings in (1) above):

£157.914m 90% = £142.123m

ICF's initial equity investment (per the deal structure in Exhibit 4) is £9 million.

The compound annual return over the 3-year period is therefore (£142.123m /£9m)1/3 = 250.9%

While this is significantly in excess of the 35% annual return required by ICF, this is only the equity element

of the ICF investment. It also has £10 million of subordinated debt which is at risk if the MBO fails, and this

only earns an annual return of 9%.

The weighted average return is therefore:

[250.9% (9/19)] + [9% 10/19)] = 123.6% pa

Therefore, to the extent that the forecasts and working assumptions can be delivered by the management

team, the expected return is significantly above ICF's required annual rate of 35%.

In particular, the assumption that the cash flows are indefinite needs to be evaluated as much of the fair

value at the AIM flotation date at the end of 20Y0 depends on this long tail of cash flows which may not be

realistic given the short-termist strategy of reducing quality and increasing prices.

Risks

There are a number of key risks which may question the forecasts, the working assumptions and therefore

the valuations that can be achieved.

Management team

The GJ management team appears to possess the core skills required, have inside knowledge of the

business and hence are aware of the reliability of the forecasts. However, there are some concerns which

may cause risks for the MBO in general, and for ICF in particular.

Geoff Boyne appears to have some conflict of interest between the MBO and Ultima. This may mean there

is a risk he will not negotiate the most favourable terms with Ultima for the management team and for ICF

(eg, the total consideration). The fact that he intends to work part time after the MBO may be indicative of

low commitment to the MBO and the lack of suitable finance expertise for the MBO (see 5 below for further

consideration of this issue, including its ethical implications).

In addition, Sally Bothan is responsible for the workshop, but the MBO strategy intends to close this, so it is

not clear how a key member of the management team will contribute to the post-MBO operations and

whether she has a skill set that will then be required.

Governance

In order to be at less risk from the management team decisions, ICF may want to appoint at least one

member of the GJ board to represent its interests and have access to inside information.

Business strategy

The future business strategy of the management team appears to include reducing the actual quality of the

jewellery sold. This includes:

• lower cost precious metals and gem stones

• no longer manufacturing its own jewellery, which were: higher priced items; improved reputation; and

met 10% of customer needs

• fewer staff, so possibly a poorer service to customers.

In contrast GJ management appears to want to raise perceived quality through:

SBM errata sheet 2020_080920.docx Page 5 of 11

• refurbishment of stores to improve appearance

• increasing prices by 5% per annum, perhaps where price is signal of perceived quality when it is

difficult for customers, for example, to determine the quality of gem stones.

This is a risky policy, as offering customers less and charging a higher price in a competitive market is

unlikely to be sustainable. If customers perceive this and revenues fail to increase, or even fall, then, as

noted above, the valuations are extremely sensitive to the forecast growth rate and the entire MBO

financing structure could be at risk, affecting all stakeholders.

Financial gearing

Financial gearing is high with £28 million of the £40 million consideration being financed by debt, which is

67.5%. This is in addition to the £1.5 million debt already in the statement of financial position and the new

lease liability.

This means that any shortfall in operating profit is magnified significantly by the gearing effect.

In addition, annual interest on borrowings is £4.932 million (see above). This amount, along with the

interest on the new lease liability needs to be earned before any profit is made and before any cash flows

can be generated to repay debt. Failure to repay debt from operating cash flows leaves a major risk of GJ

not being able to repay the Farmley Bank debt or the ICF debt in 20Y0 as they fall due.

If this is the case, then ICF is at risk not just for its £9 million equity but also for its

£10 million subordinated debt.

(b) The MBO team

The management team is only investing £250,000 per person.

If the forecasts and working assumptions are valid, then the value of the management team share of equity

at 31 December 20Y0 is (per workings in 1 above):

£157.914m 10% = £15.7914m (ie, £3.948 million per manager)

The management team's initial total equity investment (per the deal structure in Exhibit 4) is £1 million.

The compound annual return over the 3-year period is therefore (£15.7914m /£1m)1/3 = 250.9%

ie, this is the same % return as ICF as the shareholdings are linear.

The low initial investment may question the incentives and commitment of the management team if they

do not have enough personal assets at risk if the MBO fails (ie, downside potential).

Also, as their share of equity is a fixed 10% it is questionable whether there are enough incentives for

upside potential (eg, share options, or increasing the management team equity share if a target valuation is

achieved in three years' time). Closer alignment of interests between ICF and the management team may

reduce the risks from lack of management commitment.

In essence, it is not the absolute amount of the investment of managers in the context of the MBO that

matters, but rather the significance to each individual's perception of risk. If, in order to raise the £250,000,

it has been necessary to engage in personal borrowing perhaps giving security on their houses, then this

may be a sufficient commitment to give reassurance to other investors taking risks with larger absolute

amounts.

(c) Farmley Bank

The bank has senior debt so is at less risk than the ICF debt.

However, if the MBO forecasts turn out to be optimistic then there is limited security available for the

Farmley loan to be repaid.

The fair value of the five properties in the sale and leaseback arrangement is

£4.3 million. These have been sold, but the fair value for the remaining 15 shops (given they are equal size

and value) is £12.9 million. This is insufficient to cover the Farmley debt and existing debt from Roatt Bank

totalling £19.5 million, so there is a significant risk if operating cash flows are not sufficient to draw down at

least some of this debt.

SBM errata sheet 2020_080920.docx Page 6 of 11

It is important to ICF therefore that Farmley commits to the MBO (notwithstanding these risks) before ICF

itself makes any firm commitment.

(3) Due diligence

Financial due diligence

The validity of GJ's free cash flow valuation model depends mainly on the revenue and cost cash flow forecasts

and the discount rate.

The forecast revenue growth rate is critical. The financial due diligence would need to validate the underlying

assumptions of price increases and cost savings to ascertain whether they are consistent with the forecasts and

sustainable. The credibility of achieving these sales also needs to be assessed under commercial due diligence

(see below).

The staff cost savings also need to be evidenced in terms of wage rates and the number of staff reductions

needed to achieve the total claimed savings. The impact on staffing for each shop would also need to be

considered under operational due diligence (see below). There is no mention of redundancy costs hence this

would also need to be investigated under financial due diligence.

Due diligence procedures would also need to attest the fair value of the shops under the proposed sale and

leaseback arrangement and for the 15 remaining shops as an assessment for the security for the loans.

This information would support the net asset valuation as a base line valuation, although as noted above this is

well below the sale price.

The appropriateness of the discount rate will need to be assessed from market interest rates. This can be

observed from listed companies by modelling share prices, but adjustment would need to be made for an

unlisted company such as GJ.

As the working assumption is for constant future cash flows indefinitely, the discount rate may be viewed as a

real rate, rather than a money rate (ie, it compensates for future inflation). The 10% should therefore be

evaluated against real market rates in this context.

While financial due diligence may provide limited assurance, typically it will not involve the detailed level of

testing that would be carried out in a statutory audit. Due diligence procedures could be extended to cover

detailed audit procedures, but this would inevitably cause a delay in completing the MBO. Even if audit

procedures were to be carried out, the key issue for valuation and risk is the validity of the forecasts, where only

limited assurance could ever be obtained.

Commercial due diligence

Commercial due diligence work complements that of financial due diligence by considering the markets and the

external economic environment. Information may come from the GJ management team but also other business

contacts. Alternatively, it may come from external information sources.

Such information is useful for ICF to understand the appropriate post-acquisition strategy.

Commercial due diligence work should be carried out to test the revenue growth assumption for future periods,

to enable ICF to assess whether the GJ growth being forecast by the management team is credible. The due

diligence team should look at likely changes in demand on a shop by shop basis considering: regional growth,

changes in local competition, and plans for future advertising.

Customer reactions to the 5% pa price increase should be considered, perhaps reviewing the response at each

shop to historic price changes.

Operational due diligence

Operational due diligence considers the operational risks and possible improvements which can be made in GJ. In

particular it will:

• validate the implications of assumed operational cost savings eg, with staff cost savings can a reasonable

service continue to be provided to customers.

• identify operational upsides that may increase the value of GJ (eg, the impact of the proposed refurbishing

on footfall).

SBM errata sheet 2020_080920.docx Page 7 of 11

(4) Financial reporting

Sale of workshop

Unless it had reached the end of its useful life, the workshop should not have been fully depreciated, as IAS 16

requires the useful life of PPE to be reviewed on a regular basis and adjusted as a change in an accounting

estimate in accordance with IAS 8 if the useful life has changed from previous expectations.

Given however that the workshop has been fully depreciated, then the proceeds of

£3 million should be recognised in full as a profit in the statement of profit or loss in the year of sale.

The workshop may be treated as a discontinued operation per IFRS 5 as it is a separate major line of business,

cash flows can be distinguished and it will be disposed as part of a single coordinated plan.

Refurbishment

To the extent that the refurbishment costs are repairs, these costs should be recognised in profit or loss as

incurred. Where the refurbishment is PPE or an improvement they should be capitalised and depreciated over

their useful lives in accordance with GJ's accounting policy on PPE.

Inventory management

Inventory should continue to be recognised in accordance with IAS 2 at the lower of cost and net realisable

value. The reduction in inventory levels has no direct effect on financial reporting but the process of reviewing

inventories may reveal slow moving items which should be written down to their net realisable value.

Sale and leaseback

The transfer is a sale in accordance with IFRS 15, Revenue from Contracts with Customers.

The fact that the lessor will retain the properties at the end of the lease period indicates that control has passed

to the lessor. The performance obligations of IFRS 15 have therefore been satisfied to make the assessment that

the transfer of the properties qualifies as a sale.

GJ should therefore measure the lease asset at an amount equal to the 'right of use' retained, ie, a proportion of

the previous carrying amount, and a gain or loss on disposal is calculated based only on the rights transferred to

the lessor.

As the transfer proceeds of £5.5 million exceed the £4.3 million fair value of the properties, there is £1.2 million

additional financing provided to GJ.

The interest rate implicit in the lease is 10%, so the present value of the 8 annual payments of £550,000 is

£550,000 5.335 = £2,934,250 (of which £1,200,000 relates to the additional financing, and £1,734,250 relates

to the lease). GJ will measure the right-of-use asset arising from the leaseback as the proportion of the previous

carrying amount of the asset that relates to the 'right of use' that it has retained. This is calculated as:

Carrying amount discounted lease payments

fair value

= (£3,200,000 £1,734,250)/£4,300,000 = £1,290,605

GJ should recognise only the amount of any gain or loss on the sale that relates to the rights transferred to the

lessor. This is calculated in three stages:

Stage 1: Calculate gain = £4.3m less £3.2m = £1.1m

Stage 2: Calculate gain that relates to rights retained:

Gain discounted lease payments

= Gain relating to rights retained

fair value

= (£1,100,000 £1,734,250)/£4,300,000 = £443,645

Stage 3: Gain relating to rights transferred is the balancing figure:

Gain on rights transferred = total gain (£1,100,000) less gain on rights retained (£443,645) = £656,355

In summary, at the start of the lease, GJ would account for the transactions as follows:

Dr Cr

SBM errata sheet 2020_080920.docx Page 8 of 11

Cash £5,500,000

'Right of use' asset £1,290,605

Properties £3,200,000

Financial liability for lease payments £2,934,250

Gain on rights transferred to lessor £656,355

The right-of-use asset is subsequently depreciated over the lease term of eight years, therefore in the each of the

years ended 31 December 20X8 to 20Y1 the depreciation charge will be:

DEBIT Depreciation expense (£1,290,605/8) £161,326

CREDIT Right-of-use asset £161,326

The lease liability is amortised in each of the three years as follows:

£

1 January 20X8 1,734,250

Interest at 10% 173,425

Lease payment 31 December 20X8 (550,000)

1 January 20X9 1,357,625

Interest at 10% 135,763

Lease payment 31 December 20X9 (550,000)

1 January 20Y0 943,388

Interest at 10% 94,339

Lease payment 31 December 20Y0 (550,000)

1 January 20Y1 487,727

Therefore the profit or loss charge relating to the lease in each of the three years (depreciation on right-of-use asset

plus interest on lease liability) is:

Y/e 31 December 20X8: £161,326 + £173,425 = £334,751

Y/e 31 December 20X9: £161,326 + £135,763 = £297,089

Y/e 31 December 20Y0: £161,326 + £94,339 = £255,665

(5) Ethical issue

Ethics pertains to whether a particular behaviour is deemed acceptable in the context under consideration. In

short, it is 'doing the right thing'.

In making any ethical evaluation, it is first necessary to establish the facts. In this case, it would seem that the

source of information is from the Ultima CEO. Given the current negotiations with Ultima its CEO may not be an

entirely reliable source of information.

Also, it would seem that 'Geoff is in the process of arranging a new contract with Ultima' so nothing appears to

be signed or finalised and there may be reasons for Geoff suggesting he might work as a consultant. These facts

need to be verified.

If, after investigation, it is true that Geoff intends to sign a consulting contract, then the primary ethical issues

appear to be transparency and conflict of interest.

It would appear that, although Geoff has disclosed to the GJ board that he wants to work only part time for GJ

after the MBO, he did not disclose the reasons. In particular, given that Ultima is in negotiations with the GJ

management team and other key stakeholders, it is a matter of significance that any dealings with Ultima should

be disclosed to the other three members of the GJ board, as a minimum. The question of disclosure to ICF is

more tenuous but, given the nature of the joint interests in the MBO deal with Ultima, then this disclosure to ICF

may also be expected as a matter of business trust.

A conflict of interest arises for Geoff in that his future income will come partly from the success of the GJ MBO,

but also partly from Ultima. If Geoff could negotiate a lower consideration than £40 million this would be

SBM errata sheet 2020_080920.docx Page 9 of 11

beneficial to the GJ management team but would harm Ultima. In so doing, Geoff may feel his future consulting

contract may be jeopardised, incentivising him not to push for the best deal for the GJ management team in

negotiating the amount of the consideration.

If the actions of Geoff are a deliberate attempt to reduce the consideration in return for payments from Ultima

then, if this is successfully carried through, this may be illegal and legal advice should be taken. However, given

that the other board members are now aware of the issues and nothing has yet been signed for Geoff's contract

and for the MBO then this now seems unlikely, even if originally intended by Geoff.

Other ethical issues are:

Effect – whom does the issue affect? If the terms of the MBO deal are unduly favourable to Ultima, then some

stakeholders may lose out (eg, other GJ directors, ICF and Farmley Bank who may earn lower returns and could

be at more risk).

Fairness – would the arrangement be considered fair by those affected? Clearly, if the negotiated MBO

agreement is influenced by the personal interests of Geoff, then those adversely affected may regard this as

unfair in not satisfying arm's length conditions. However, the greatest unfairness may be seen with respect to the

other three GJ directors who are entitled to trust Geoff as colleagues sharing investment interests. ICF and

Farmley Bank should have a degree of professional scepticism of other stakeholders as well as Ultima in

establishing the facts (eg, through due diligence) and need to make their own judgements, but nevertheless a

degree of business trust may be expected from Geoff.

Actions

As an ICAEW Chartered Accountant, Geoff is bound by the ICAEW ethical code. If there is a belief that the

transaction is illegal, ICF should obtain advice (eg, calling the ICAEW helpline). In this case, they should not speak

to Geoff as this may be tipping off.

If advice is received that this is not an illegal transaction, but it may be unethical, then Kevin should raise the

issue formally at a GJ board meeting and ask Geoff for an explanation. Geoff's response should be recorded in

the minutes.

It may be that the GJ board no longer wants Geoff to be part of the MBO team, but this would need to be agreed

with other stakeholders and Ultima, unless the three other GJ board members want to withdraw altogether from

the deal.

As part of business trust and transparency the GJ board should inform ICF and Farmley Bank of what has

occurred.

From ICF's perspective, business trust in one of the key MBO management team may be damaged. In the

extreme they could withdraw from the deal or only continue if Geoff is excluded from the deal.

As an ICAEW Chartered Accountant I should consider reporting Geoff to the ethics committee if on the basis of

the established facts there is a reasonable suspicion that there has been an ethical, legal or other disciplinary

breach by Geoff.

SBM errata sheet 2020_080920.docx Page 10 of 11

SBM errata sheet 2020_080920.docx Page 11 of 11

You might also like

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- 23 Nov 2018 Mixed Questions With Solutions PDFDocument9 pages23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- PYQ January 2018Document4 pagesPYQ January 2018Nur Amira NadiaNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- MARCH 2020 AnswerDocument16 pagesMARCH 2020 AnswerXianFa WongNo ratings yet

- Answer 1 - Blue Bill CorporationDocument2 pagesAnswer 1 - Blue Bill CorporationRheu ReyesNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- APT Tax AssignmentDocument11 pagesAPT Tax AssignmentMalik JavidNo ratings yet

- Ceci TEAMWORK HW - Case - New and Repaired FurnaceDocument14 pagesCeci TEAMWORK HW - Case - New and Repaired FurnaceMarcela GzaNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- Statement of Cash Flows Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNo ratings yet

- Accounting Assignment Q-4Document5 pagesAccounting Assignment Q-4Ueamraan MartNo ratings yet

- Financial Accounting 3a Assignment 2 2022Document9 pagesFinancial Accounting 3a Assignment 2 2022sartynaftalNo ratings yet

- Master Budgeting - Blades Pty LTDDocument14 pagesMaster Budgeting - Blades Pty LTDAdi KurniawanNo ratings yet

- Hullmark's Profit and LossDocument13 pagesHullmark's Profit and LossLoh Jin WenNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- CHAPTER 6 JOINT ARRANGEMENTS Soln 2AAC Mar 2023 Copy 2Document11 pagesCHAPTER 6 JOINT ARRANGEMENTS Soln 2AAC Mar 2023 Copy 2Lorifel Antonette Laoreno TejeroNo ratings yet

- PDE4232 Individual Coursework - 2023-24 UpdatedDocument5 pagesPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanNo ratings yet

- Less: Present value of expected cash flowsDocument8 pagesLess: Present value of expected cash flowsMaricar PinedaNo ratings yet

- Maximizing Market Value Through Equity FinancingDocument5 pagesMaximizing Market Value Through Equity FinancingNeelNo ratings yet

- BAF11Document3 pagesBAF11tembo groupNo ratings yet

- Analyze investment project cash flows and valuationDocument4 pagesAnalyze investment project cash flows and valuationabeer alamNo ratings yet

- Financial Statement Analysis of Tie Beauty EnterpriseDocument15 pagesFinancial Statement Analysis of Tie Beauty Enterprisenur anisNo ratings yet

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- c38fn2 - Revision Handout (2018)Document6 pagesc38fn2 - Revision Handout (2018)Syaimma Syed AliNo ratings yet

- Mavesto LTD and Its SubsidiaryDocument4 pagesMavesto LTD and Its SubsidiaryTawanda Tatenda HerbertNo ratings yet

- Mellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Document3 pagesMellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Debbie DebzNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Section A - CASE QUESTIONS (Total: 50 Marks) : PC - Taxation (June 2012 Session)Document12 pagesSection A - CASE QUESTIONS (Total: 50 Marks) : PC - Taxation (June 2012 Session)Steven LukNo ratings yet

- Case F&B: Income StatementDocument3 pagesCase F&B: Income StatementDIPESH KUNWARNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Problems On DepreciationDocument7 pagesProblems On DepreciationHarsha HarshaNo ratings yet

- Sage Onion Profit LossDocument3 pagesSage Onion Profit LossLee Li HengNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (60)

- Individual/Group Assignments (Optional) Assignment 1Document3 pagesIndividual/Group Assignments (Optional) Assignment 1Robin GhotiaNo ratings yet

- Past Exam QuestionDocument3 pagesPast Exam QuestionYến Hoàng HảiNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Madaraka Ltd. income statement and financialsDocument17 pagesMadaraka Ltd. income statement and financialsMaryjoy KilonzoNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- November 2019 Exam Solution Final PaperDocument7 pagesNovember 2019 Exam Solution Final Paper2603803No ratings yet

- Financial Accounting IFRS Student Mark Plan June 2019Document16 pagesFinancial Accounting IFRS Student Mark Plan June 2019scottNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Key Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceDocument15 pagesKey Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceRashan Jida ReshanNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Workshop 5 QsDocument7 pagesWorkshop 5 QsNaresh SehdevNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Strategic Business Leader (SBL) : March/June 2021 (20/21 Syllabus)Document17 pagesStrategic Business Leader (SBL) : March/June 2021 (20/21 Syllabus)Cheng Chin HwaNo ratings yet

- Ifrs at A Glance IFRS 15 Revenue From Contracts: With CustomersDocument11 pagesIfrs at A Glance IFRS 15 Revenue From Contracts: With CustomersMiruna CatalinaNo ratings yet

- Ifrs at A Glance IAS 19 Employee BenefitsDocument5 pagesIfrs at A Glance IAS 19 Employee BenefitsnanaNo ratings yet

- Ifrs at A Glance IFRS 2 Share-Based PaymentDocument5 pagesIfrs at A Glance IFRS 2 Share-Based PaymentNoor Ul Hussain MirzaNo ratings yet

- IAS 37 Short SummaryDocument5 pagesIAS 37 Short SummaryChandler BingNo ratings yet

- Strategic Business Management: The Institute of Chartered Accountants in England and WalesDocument76 pagesStrategic Business Management: The Institute of Chartered Accountants in England and WalesHamza Ali100% (1)

- How To Book A Remote Invigilation Exam FinalDocument5 pagesHow To Book A Remote Invigilation Exam FinalHamza AliNo ratings yet

- Ifrs at A Glance IFRS 9 Financial InstrumentsDocument13 pagesIfrs at A Glance IFRS 9 Financial InstrumentsGCNo ratings yet

- ACA Student JourneyDocument3 pagesACA Student Journeyshariq zafarNo ratings yet

- SBM Question Bank Practice Software Guidance 2021Document3 pagesSBM Question Bank Practice Software Guidance 2021Issa BoyNo ratings yet

- F3 Study NotesDocument251 pagesF3 Study NotesHamza AliNo ratings yet

- Strategic Business Leader (SBL) : March/June 2021 (20/21 Syllabus)Document17 pagesStrategic Business Leader (SBL) : March/June 2021 (20/21 Syllabus)Cheng Chin HwaNo ratings yet

- SBL 2020 Septdec QDocument11 pagesSBL 2020 Septdec QHamza AliNo ratings yet

- Strategic Business Management Practice Script BDocument11 pagesStrategic Business Management Practice Script BHamza AliNo ratings yet

- Strategic Business Management Syllabus and GridsDocument24 pagesStrategic Business Management Syllabus and GridsHamza AliNo ratings yet

- SBM Nov 17 Exam PaperDocument16 pagesSBM Nov 17 Exam PaperIsavic AlsinaNo ratings yet

- SBM J18 QuestionsDocument21 pagesSBM J18 QuestionsHamza AliNo ratings yet

- ScribdDocument1 pageScribdHamza AliNo ratings yet

- Audit and Assurance: March/June 2018 - Sample QuestionsDocument5 pagesAudit and Assurance: March/June 2018 - Sample QuestionsKubNo ratings yet

- 1Document48 pages1Hamza Ali100% (2)

- Agriculture (Ias 41) : OpentuitionDocument15 pagesAgriculture (Ias 41) : OpentuitionHamza AliNo ratings yet

- OpentuitionDocument21 pagesOpentuitionHamza AliNo ratings yet

- My FileDocument1 pageMy FileHamza AliNo ratings yet

- DNNFDocument1 pageDNNFHamza AliNo ratings yet

- My FileDocument1 pageMy FileHamza AliNo ratings yet

- DNNFDocument1 pageDNNFHamza AliNo ratings yet

- My FileDocument1 pageMy FileHamza AliNo ratings yet

- My FileDocument1 pageMy FileHamza AliNo ratings yet

- Engineering Economy 15th Edition Sullivan Test BankDocument25 pagesEngineering Economy 15th Edition Sullivan Test BankDannyStaffordctbi100% (53)

- Axix Bank Cash MangementDocument21 pagesAxix Bank Cash MangementMd WasimNo ratings yet

- Financial Performance Analysis of Jamuna Bank LimitedDocument53 pagesFinancial Performance Analysis of Jamuna Bank LimitedABC Computer R.SNo ratings yet

- Planning For Homeownership GuideDocument20 pagesPlanning For Homeownership Guideapi-295818061No ratings yet

- Advanced Financial Accounting 10th Edition Christensen Cottrell Baker Solutions Chapter 15Document56 pagesAdvanced Financial Accounting 10th Edition Christensen Cottrell Baker Solutions Chapter 15renyNo ratings yet

- Community Engagement, Solidarity, and Citizenship: Quarter 1-Week 6Document13 pagesCommunity Engagement, Solidarity, and Citizenship: Quarter 1-Week 6NarlieSilvaGaviaNo ratings yet

- Understanding Fraud Risks in Mobile FinanceDocument48 pagesUnderstanding Fraud Risks in Mobile FinancereemaNo ratings yet

- Income Tax Calculator FY 2015-16 InstructionsDocument15 pagesIncome Tax Calculator FY 2015-16 InstructionsIlayaraja ChinnasamyNo ratings yet

- Sanction LetterDocument23 pagesSanction LetterAYUSH MishraNo ratings yet

- Loan Shark CalculatorDocument18 pagesLoan Shark CalculatorTony MartinNo ratings yet

- KDDocument5 pagesKDRajeevi parsaNo ratings yet

- Auditing Problems Review: Key Equity and Bond CalculationsDocument2 pagesAuditing Problems Review: Key Equity and Bond CalculationsgbenjielizonNo ratings yet

- Bank Lending Channel of Monetary Policy Transmission Mechanism in NigeriaDocument14 pagesBank Lending Channel of Monetary Policy Transmission Mechanism in NigeriaKolawole EbireNo ratings yet

- International Financial ManagementDocument7 pagesInternational Financial ManagementShuvro RahmanNo ratings yet

- United States District CourtDocument58 pagesUnited States District CourtheatherNo ratings yet

- TermsDocument19 pagesTermshussain korirNo ratings yet

- EBA Recommendation On The Creation and Supervisory Oversight of Temporary Capital Buffers To Restore Market Confidence (EBA/REC/2011/1)Document22 pagesEBA Recommendation On The Creation and Supervisory Oversight of Temporary Capital Buffers To Restore Market Confidence (EBA/REC/2011/1)EKAI CenterNo ratings yet

- Session 2 - Modeling With VensimDocument28 pagesSession 2 - Modeling With Vensimyashashree barhateNo ratings yet

- MT PS With Solutions PDFDocument11 pagesMT PS With Solutions PDFWilmar AbriolNo ratings yet

- G.R. No. L-30187Document7 pagesG.R. No. L-30187HohenheimNo ratings yet

- Financial Management OptionsDocument17 pagesFinancial Management OptionsUsuf JabedNo ratings yet

- FM Unit 3Document9 pagesFM Unit 3ashraf hussainNo ratings yet

- 2023-2024-Class VIII-Mathematics-Part 2-AWDocument19 pages2023-2024-Class VIII-Mathematics-Part 2-AWSimrah shaikhNo ratings yet

- Divisibility of product of 4 consecutive even numbersDocument8 pagesDivisibility of product of 4 consecutive even numbersSANDEEP RANANo ratings yet

- Fin358 - Individual Assignment - Norsyafiqah - 2019250896 - Ba1115gDocument13 pagesFin358 - Individual Assignment - Norsyafiqah - 2019250896 - Ba1115gHafiz HafiziNo ratings yet

- Finacle FAQDocument38 pagesFinacle FAQArchana Pattnaik100% (1)

- A-LEVEL Accounting. ACCN3 - Further Aspects of Financial Accounting Mark Scheme June Version - Stage - 1.0 FinalDocument17 pagesA-LEVEL Accounting. ACCN3 - Further Aspects of Financial Accounting Mark Scheme June Version - Stage - 1.0 FinalKathy Froehlich100% (1)

- Term Sheet For Sacramento ArenaDocument45 pagesTerm Sheet For Sacramento ArenaIsaac GonzalezNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- Business Glossary (Shetu Ranjan Biswas) PDFDocument36 pagesBusiness Glossary (Shetu Ranjan Biswas) PDFMd. Erfan AhmedNo ratings yet