Professional Documents

Culture Documents

MARCH 2020 Answer

Uploaded by

XianFa WongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MARCH 2020 Answer

Uploaded by

XianFa WongCopyright:

Available Formats

Professional Level – Financial Accounting and Reporting - March 2020

MARK PLAN AND EXAMINER’S COMMENTARY

The marking plan set out below was that used to mark this question. Markers were encouraged to use discretion

and to award partial marks where a point was either not explained fully or made by implication. More marks were

available than could be awarded for each requirement. This allowed credit to be given for a variety of valid points

which were made by candidates.

Question 1

General comments

Part 1.1 of this question tested the preparation of a statement of profit or loss and a statement of financial

position. Adjustments included deferred revenue, inventory calculation, an impairment and a right of use

asset with lease liability. Part 1.2 of the requirement asked for examples from the question of the IASB’s

Conceptual Framework’s elements and how they each meet the definition.

Bilberry Ltd – Statement of financial position as at 30 September 2019

£ £

ASSETS

Non-current assets

Property, plant and equipment

(159,250 + 392,490 + 230,000) (W5) 781,740

Right-of-use asset (W5) 15,000

796,740

Current assets

Inventories (W1) 59,980

Trade and other receivables 59,700

Cash and cash equivalents 3,700

123,380

Total assets 920,120

Equity

Ordinary share capital 480,000

Share premium account 120,000

Retained earnings (40,240 + 146,100) 186,340

Equity 786,340

Non-current liabilities

Lease liabilities (W6) 12,685

Current liabilities

Trade and other payables 78,300

Deferred income (W2) 3,060

Lease liabilities (15,420 – 12,685) (W6) 2,735

Taxation 37,000

121,095

Total equity and liabilities 920,120

Copyright © ICAEW 2020. All rights reserved. Page 1 of 16

Professional Level – Financial Accounting and Reporting - March 2020

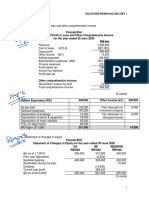

Bilberry Ltd – Statement of profit or loss for the year ended 30 September 2019

£

Revenue (1,264,780 – 3,060) (W2)) 1,261,720

Cost of sales (W1) (633,990)

Gross profit 627,730

Administrative expenses (W1) (249,860)

Operating costs (W1) (193,690)

Operating profit 184,180

Finance costs (W6) (1,080)

Profit before tax 183,100

Income tax (37,000)

Profit for the year 146,100

Workings

W1 Expenses

Cost of Admin Operating

sales expenses costs

£ £ £

Nominal ledger b/fwd 567,300 249,860 197,350

Opening inventories 61,320

Closing inventories (40,900 + 19,080 (W3)) (59,980)

Depreciation charges

(24,500 + 17,850 + 3,000) (W5) 45,350

Impairment (W4) 20,000

Reverse lease payment (W6) (3,660)

633,990 249,860 193,690

W2 Revenue

Discount

applied of 15%

£ £

Sale of goods 30,600 26,010

Normal cost of after sales support 5,400 4,590

36,000

Discount (5,400 / 36,000) 15%

Deferred revenue (4,590 x 8/12) 3,060

W3 Closing inventory

£ £

Per count at 30 September 2019 11,800

Less: delivery 1 October 2019 (1,600)

Add: sales (2,500 / 1.25) 2,000

12,200

£

Variable cost per unit ((16,020 + 4,700) / 2,800) 7.40

Fixed cost per unit (3,600 / 3,000) 1.20

8.60

800 x £8.60 6,880

Inventory at 30 September 2019 19,080

W4 Impairment

Land

£

Land & building – cost 150,000

Copyright © ICAEW 2020. All rights reserved. Page 2 of 16

Professional Level – Financial Accounting and Reporting - March 2020

Recoverable amount 130,000

Impairment 20,000

W5 Property, plant & equipment

Plant & equipment Buildings Land

£ £ £

Buildings

Cost b/fwd 245,000 714,000 250,000

Less: accumulated depreciation (61,250) (303,660)

183,750 410,340

Impairment (W4) (20,000)

Depreciation for year

(714,000 / 40yrs) (17,850)

245,000 / 10yrs (24,500)

159,250 392,490 230,000

Leased machine

Cost 18,000

Depreciation (18,000 / 6yrs) (3,000)

15,000

W6 Lease

1 October 2018 Interest (6%) Payment 30 September 2019

£ £ £ £

18,000 1,080 (3,660) 15,420

15,420 925 (3,660) 12,685

Presentation of the statement of profit or loss and the statement of financial position was generally good,

and certainly better than in some recent sessions. A very small number of candidates are still not following

the instructions to make sure all text is visible and some narrative in columns was partially cut off. These

candidates lost marks as text could not be read in its entirety.

There were some very high marks on this question. Almost all candidates dealt correctly with the tax charge

and liability, the trial balance figures for costs, property, plant and equipment, opening inventories, current

assets and liabilities and the equity figures. A good majority of candidates showed a working for their

closing retained earnings figure, which is not always the case.

Clear workings were usually given in the form of a costs matrix and workings for property, plant and

equipment. However, the audit trail was not always clear from the latter to the figure on the statement of

financial position. As is often the case, directional errors were sometimes made in the costs matrix, most

commonly with the depreciation charges for the year. These usually occur when candidates start with a

negative balance.

Many candidates arrived at the correct figure for closing inventories and workings were usually clear.

However, a number of candidates included a different figure in their costs matrix to the one shown in their

working, or omitted to include the unadjusted figure for closing inventories. The most common errors in the

calculations for the adjustment were:

for the inventories in the holding area, not dividing the correct costs by the correct production figures

(planned or actual) and/or multiplying the resultant cost per unit by actual production instead of by the

number of units left in inventory at the year end; and

for the warehouse not counted at the year-end, backing out the cost of the post year-end delivery, but

not adding in the cost of the goods despatched, and/or failing to add in the unadjusted figure.

Many candidates arrived at the correct figure for property, plant and equipment, although they did not

always show the right-of-use asset separately on the face of the statement of financial position. Where

errors were made the most common were:

Copyright © ICAEW 2020. All rights reserved. Page 3 of 16

Professional Level – Financial Accounting and Reporting - March 2020

Depreciating the right-of-use asset over ten instead of six years.

Omitting the depreciation on the right-of-use asset from costs.

Calculating depreciation for plant and equipment on a reducing balance basis instead of on a straight-

line basis.

Calculating the impairment as cost less recoverable amount (instead of using the higher value in use),

with costs to sell sometimes adjusted for in the wrong direction.

Including the impairment as an adjustment in retained earnings.

The lease table was often completely correct although some candidates wasted time calculating the present

value of minimum lease payments when it was stated in the question that this equated to the cash price, or

extended the table beyond the necessary two years. A minority treated the payments as in advance instead

of arrears and others failed to split the year-end liability or split it incorrectly. Most candidates took their

correct own figure for interest to the statement of profit or loss but a few showed the annual lease payment

here.

The adjustment for deferred revenue probably caused the most issues, although a good number of

candidates did arrive at the correct figure, and correctly adjusted revenue and showed the figure in current

liabilities. Others arrived at a figure and adjusted revenue but failed to show it also in current liabilities or

quite frequently adjusted trade receivables instead. The most common incorrect figures were £5,400 (the

whole of the after-sales support package) or £3,600 (eight-twelfths of that figure). A number of candidates

failed to show an audit trail for their revenue figure.

Total possible marks 23

Maximum full marks 22

(1.2) Elements of the financial statements

Asset – Bilberry Ltd’s head office building is recognised as an asset. The building is a resource controlled

by Bilberry Ltd as a result of a past event, which was the acquisition of the building. Bilberry Ltd’s expects

the business to generate future economic benefits and hence the head office function (and therefore the

building itself) will contribute to the smooth running of the business.

Liability – The lease is recognised as a liability. There needs to be a present obligation which is Bilberry

Ltd’s obligation to pay annual lease payments over a contracted six years as a result of a past event which

was the entering into the lease contract. The contracted annual lease payments are the future outflow of

resources.

Income – Revenue from sales is a form of income as it brings cash inflows or enhancement of assets in the

form of trade receivables.

Expenses – Depreciation is an expense as it reduces the carrying amount of property, plant

and equipment (ie, depletes an asset).

Equity – Equity is Bilberry Ltd's ordinary share capital and retained earnings. The sum of these are equal to

total assets minus total liabilities/is the residual interest in the assets of the entity after deducting all its

liabilities.

Copyright © ICAEW 2020. All rights reserved. Page 4 of 16

Professional Level – Financial Accounting and Reporting - March 2020

There were some excellent answers to this part, with many candidates scoring maximum marks. Almost all

candidates correctly defined assets and liabilities, although fewer gave an appropriate definition for the

other three elements. Almost all candidates gave a suitable example for all five elements, although

explanations as to how the example met the definition was much better, again, for assets and liabilities.

Total possible marks 9

Maximum full marks 5

Copyright © ICAEW 2020. All rights reserved. Page 5 of 16

Professional Level – Financial Accounting and Reporting - March 2020

Question 2

General comments

Part 2.1 of this question required candidates to explain the financial reporting treatment of three

accounting matters, given in the scenario. The matters covered a convertible bond, a government grant

and a provision. Part 2.2 required a revised profit calculation along with an EPS calculation following a

rights issue. Part 2.3 asked for an explanation of the impact on the financial statements of presenting

expenses by nature rather than function. Part 2.4 asked for the UK GAAP differences in relation to

government grants.

(2.1)

(1) Convertible bond

The convertible bonds are compound financial instruments per IAS 32 Financial Instruments:

Presentation. They have both an equity and a liability component which should be presented separately at

the time of issue. IAS 32 requires that the substance of such an instrument should be reflected, focusing

on the economic reality that in effect two financial instruments have been issued, rather than the one

instrument.

The liability component should be measured first at the present value of the capital and interest payments.

The discount rate used should be the effective rate for an instrument with the same terms and conditions

except without the ability to convert it into shares, here the market rate of interest for similar bonds without

the conversion option is 8%.

Cash flow Discount factor Present value

£ @ 8% £

1 October 2019 24,000 1/1.08 22,222

1 October 2020 24,000 1/1.082 20,576

1 October 2021 424,000 1/1.083 336,585

Liability component 379,383

Equity component (bal fig) 20,617

Total 400,000

The liability should initially be measured at £379,383 and the equity component is the residual amount of

£20,617.

Once recognised the equity element remains unchanged. However, the liability element should be shown

at amortised cost at the end of each year.

1 Oct 2018 Interest (8%) Payment (6%) 30 September 2019

£ £ £ £

379,383 30,351 (24,000) 385,734

At the year end an adjustment to reduce non-current liabilities of £14,266 (400,000 – 385,734) should be

made and an additional £6,351 (30,351 – 24,000) recognised as finance costs as part of profit or loss.

(2) Government grant

IAS 20, Accounting for Government Grants and Disclosure of Government Assistance requires grants to

be recognised when there is reasonable assurance that:

The entity will comply with the relevant conditions, here there are no conditions; and

The entity will receive the grant, Jonica plc is already in receipt of the grant.

Therefore, Jonica plc complies with both conditions and the grant should be recognised.

Copyright © ICAEW 2020. All rights reserved. Page 6 of 16

Professional Level – Financial Accounting and Reporting - March 2020

Government grants should be recognised in profit and loss over the periods in which the entity recognises

as expenses the costs which the grant are intended to compensate. It is against the accrual principle to

recognise the grant in profit or loss on a cash receipts basis as Jonica plc currently has.

Jonica plc’s accounting policy is to recognise government grants using the netting-off method. Under this

method the grant is deducted from the carrying amount of the related asset. The grant will then be

recognised over the life of the related asset, here by way of a reduced depreciation charge.

Income should be reduced by £150,000 which should instead be credited to non-current assets giving a

revised figure of £175,000. As it is assumed that depreciation has already been charged for the year on

the full asset cost of £325,000 an adjustment will need to be made for this. £24,375 was recognised by the

financial controller, although only £13,125 should have been recognised, being depreciation on £175,000

rather than £325,000. £11,250 (24,375 – 13,125) should be credited to profit for the period and debited to

non-current assets to adjust for this.

At 30 September 2019 the carrying amount of the asset should have been £161,875

(175,000 – 13,125) reducing non-current assets by £138,750 ((325,000 – 24,375) – 161,875).

(£325,000/10 years) x 9/12 = £24,375

(£175,000/10 years) x 9/12 = £13,125

(3) Provision – legal claim

Per IAS 37 Provisions, Contingent Liabilities and Contingent Assets, a provision should be recognised

where:

there is a present obligation, which may be a legal or constructive one, as a result of a past event (the

claim arising from the sale of faulty goods);

it is probable that an outflow of resources will be required to settle the obligation (payment of the

claim); and

the amount can be estimated reliably (being the estimate made by the lawyers).

Therefore, a provision should be recognised at 30 September 2019. This is a single obligation so the

provision should be based on the most likely outcome. Therefore, recognise a provision for £21,000. Since

the lawyers have recommended that the claim is settled out of court as soon as possible the provision has

not been discounted. Therefore, a provision of £21,000 should be recognised as part of current liabilities

and debited to profit or loss for the period.

This explain question covered three issues – convertible debt, a government grant to be accounted for

using the netting off method and a provision for the supply of faulty goods. Generally, answers to this part

of the question were good with nearly every candidate addressing all three issues and including both

narrative explanations and revised figures in their answers.

Convertible debt - The majority of candidates correctly identified the financial instrument as a compound

financial instrument and stated that it needed to separated out between its debt and equity elements. It

was common to see the numbers correctly calculated and split between equity and debt. Most candidates

also realised that the finance charge in the statement of profit or loss should be based on the interest rate

of 8%. Generally, candidates also went on to use amortised cost, although calculations were not always

correct. A common mistake was to split the liability between current and non-current. Only a significant

minority of candidates realised that the adjustment needed to the finance cost was the difference between

the figure calculated using the 8% and the actual amount paid. Only a minority of candidates also stated

that the equity figure did not subsequently change.

Government grant – Answers to this issue were a little more mixed with a significant number of

candidates wasting time discussing the deferred income approach when the question clearly stated that

the company’s policy was to use the netting off method. However, most candidates did realise that the

entry to income needed to be reversed out and instead netted off against the cost of the asset. A majority

of candidates attempted to calculate a revised depreciation figure although many forgot to time apportion

it. A minority of candidates calculated numbers using the deferred income approach.

Provision – The majority of candidates applied the IAS 37 criteria to the scenario and correctly concluded

that a provision was necessary. A majority of candidates stated that as a single obligation the most likely

outcome gave the amount to be recognised although a minority incorrectly used an expected value

Copyright © ICAEW 2020. All rights reserved. Page 7 of 16

Professional Level – Financial Accounting and Reporting - March 2020

approach or calculated both figures. Almost all candidates referred to the impact on profit and a

reasonable number stated it should be recognised as a current liability. Only a minority of candidates

linked this to the fact that discounting was not necessary.

Total possible marks 32½

Maximum full marks 18

(2.2)

Profit for the

period

£

Brought forward 1,035,000

(1) Convertible bond – finance costs (6,351)

(2) Government grant – income (150,000)

– depreciation 11,250

(3) Provision (21,000)

Revised 868,899

Dates No. of shares Bonus factor Weighting Total

in issue

1 Oct 2018 – 600,000 380 / 365 4/12 208,219

31 Jan 2019

Rights issue 200,000

1 for 3

1 Feb – 30 Sept 2019 800,000 8/12 533,333

741,552

Working

Bonus adjustment factor £

Theoretical ex-rights price:

3 shares @ £3.80 11.40

1 share @ £3.20 3.20

4 shares 14.60

Theoretical ex-rights price per share £14.60 / 4 = £3.65

Bonus fraction 380 / 365

Basic earnings per share £886,899 / 741,552 = £1.17

Most candidates attempted to calculate a revised profit figure but the requirement to calculate basic

earnings per share proved more challenging. The most common mistake in the adjustment to profits was

to simply put the correct accounting adjustment through rather than reversing out what had actually been

recognised first.

Most candidates made errors in the weighted average share capital table and in particular relatively few

managed to arrive at the correct bonus fraction for use in the table. Other common mistakes included:

Miscounting the number of months before and after the issue of shares.

Basing the table on the individual share issues rather than using the cumulative total.

Applying the bonus fraction to all periods in the table.

Applying the bonus fraction upside down.

Total possible marks 6½

Maximum full marks 6

Copyright © ICAEW 2020. All rights reserved. Page 8 of 16

Professional Level – Financial Accounting and Reporting - March 2020

(2.3) Presentation of the statement of profit or loss

IAS 1 allows expenses in the statement of profit or loss to be presented in one of two ways – by function

or by nature. It is a freely available choice to companies.

Expense items are accumulated according to the function they serve in the business - under the headings

of cost of sales, distribution costs and administrative expenses, which is the format used by Jonica plc.

Presentation by nature is particularly suitable for a manufacturing organisation and is often used by

smaller entities. It groups expenses under categories such as work capitalised, cost of raw materials,

employee costs and depreciation/amortisation. If this is the presentation used by many of your competitors

it may be that it is considered more appropriate and therefore would allow users of the financial

statements to make better and easier comparisons.

Whichever presentation is adopted there is no overall impact on net profit.

Answers to this part were very mixed although most candidates at least understood the difference

between presenting expenses by function or nature. Most candidates did try to arrive at a conclusion

although fewer considered that a change in format would allow better comparison with competitors.

Total possible marks 6

Maximum full marks 3

(2.4) IFRS vs UK GAAP

Jonica plc has used the netting off method to recognise the government grant. It has netted off the

£150,000 government grant against the cost of the asset. IAS 20 allows this treatment but also permits the

government grant to be separately reported as deferred

income.

Under FRS 102 Jonica plc does not have the option to use the netting off method. Instead an entity has

the choice to use the performance model or the accrual model. Under the performance model, as there

are no performance conditions attached to the government grant, the grant would be recognised as

income when it is received.

Under the accrual model the grant would instead be recognised as deferred income of £150,000, hence

showing the government grant as part of liabilities and then releasing it over the ten year useful life of the

asset. The overall impact on profit is the same as under IAS 20, as instead of reduced depreciation a

deferred income release is made of £11,250 (£150,000/10yrs x 9/12). Net assets would also be the same,

however property, plant and

equipment would be higher (initially recorded at £325,000) and there would be a balance on deferred

income instead. This would be £138,750 (150,000 – 11,250) of which £15,000 would be current and

£123,750 non-current.

Answers to this part of the question were a little disappointing and many candidates got no further than

stating that IFRS allowed both the netting off and deferred income approaches while UK GAAP only

allowed the latter. It was rare to see any reference to the performance or accruals model. However, where

candidates did attempt calculations most arrived at the correct figure for the release of deferred income

and recognised that the balance should be split between current and non-current liabilities.

Total possible marks 9½

Maximum full marks 4

Copyright © ICAEW 2020. All rights reserved. Page 9 of 16

Professional Level – Financial Accounting and Reporting - March 2020

Question 3

General comments

Part 3.1 of this question required the preparation of extracts from the statement of cash flows for investing

and financing activities, as well as calculating a revised figure for “Net cash from operating activities”. Part

3.2 required an explanation of the financial reporting treatment for a joint venture. Part 3.3 required the

preparation of a checklist covering the fundamental principles of the ICAEW’s Code of Ethics.

(3.1)

Cash from operations

£

Draft figure 37,420

Add back sale proceeds of disposal 31,000

Deduct profit on disposal (31,000 – 24,900) (6,100)

Scrapped machine 4,500

Depreciation 63,600

Impairment 3,550

Adjustment to movement of trade and other payables (10,000)

Net cash flow from operations 123,970

Statement of cash flows for year ended 30 September 2019 (extract)

Cash flows from investing activities

Purchase of property, plant and equipment (W1) (72,250)

Proceeds from sale of property, plant and equipment 31,000

Cash flows from financing activities

Proceeds from issue of ordinary shares 58,000

Dividends paid (W3) (108,000)

Workings

(1) Property, plant and equipment

£ £

B/d 512,700

Additions on credit 10,000 Disposal 24,900

Scrapped item 4,500

Additions – cash (β) 72,250 Depreciation 63,600

Impairment (11,800 – 8,250) 3,550

C/d 498,400

594,950 594,950

(2) Share capital and premium

£ £

B/d (200,000 + 50,000) 250,000

Share issue for cash

(40,000 x £1.45) 58,000

C/d (270,000 + 68,000) 338,000 Bonus issue (β) 30,000

338,000 338,000

(3) Retained earnings

£ £

Dividends (β) 108,000 B/d 239,600

Bonus issue (W2) 30,000 Profit or loss 132,100

C/d 233,700

371,700 371,700

Copyright © ICAEW 2020. All rights reserved. Page 10 of 16

Professional Level – Financial Accounting and Reporting - March 2020

Attempts at this part were generally good, with a significant number of candidates achieving maximum

marks.

Some presentation marks were lost due to the use of abbreviations, most commonly “PPE” and for not

heading up each section in full as, for example, “Cash flows from investing activities”. However, it was rare

to see a cash flow in the wrong section, although candidates continue to lose marks due to the use of

incorrect bracket conventions on the face of the extracts – most commonly failing to put brackets around

the outflows from the purchase of property, plant and equipment.

Most candidates did their workings in the form of T-accounts, with a columnar working for the revised

figure for net cash from operating activities. Where columnar workings were used instead of T-accounts,

directional errors were more common. A worrying number of candidates had all the entries on the wrong

sides of their T-accounts for the share accounts and retained earnings.

Most candidates correctly adjusted for the depreciation, the impaired item of plant and the scrapped

machine when calculating a revised figure for net cash from operating activities. Fewer correctly adjusted

for the plant disposed of.

Many candidates arrived at the correct figure for the bonus issue, but few then completed the double entry

by debiting that to retained earnings. The profit for the year was often also omitted from the retained

earnings working, or an incorrect figure was used.

Total possible marks 11

Maximum full marks 9

(3.2)

Poitou Ltd should recognise its investment in Chigu Ltd as a joint venture. Four companies have joint

control over Chigu Ltd, as unanimous consent is required by all four parties for all key operating decisions

and there is a contractual arrangement in place to share profits and losses equally. As Chigu Ltd is a

separate legal entity it is classified as a joint venture rather than a joint arrangement.

IFRS 11 Joint Arrangements requires the use of the equity method for joint ventures. The investment should

initially therefore be recognised at cost of £80,000 plus Poitou Ltd’s share of Chigu Ltd's post acquisition

increase in net assets. As Poitou Ltd was acquired part way through the year the share of post-acquisition

profits should be pro-rated by 7 months, £15,750 (£108,000 x 25% x 7/12).

The investment in Chigu Ltd will be shown as a separate line as part of non-current asset in the

consolidated statement of financial position. The share of post-acquisition profit of £15,750 should be added

to non-current assets, giving a carrying amount of £95,750 and the £15,750 recognised in consolidated

profit or loss as a separate line.

Again, there were some very good attempts at this part. The most common error was concluding that this

was an associate, although marks could then still be gained for explaining the accounting treatment. Even

those who concluded that this was a joint venture then went on to describe the separate lines in the

statements as “Investment in associate” and “Income from associate”. A minority hedged their bets and

concluded that it could be either. Not all candidates gained all the marks available by referencing the facts

in the scenario that supported their conclusion. Fewer candidates than might have been expected named

the accounting method used as the “equity method”.

The correct figures for inclusion in the statement of profit or loss and the statement of financial position were

often seen. The most common error was to fail to time-apportion the profit figure so that only the post-

acquisition portion was included.

Total possible marks 9

Maximum full marks 5

Copyright © ICAEW 2020. All rights reserved. Page 11 of 16

Professional Level – Financial Accounting and Reporting - March 2020

(3.3)

Five fundamental principles – Ethics checklist

Integrity

Are you honest at all times?

Are you open with your colleagues and clients? Providing access to all the information available and being

cooperative in any decision making.

Are you transparent in your work? Do you invite trust by others showing that you do not have anything to

hide?

Objectivity

Do you have any conflicts of interest? Are you going to derive a personal benefit from your actions / work

that you are undertaking?

Are you unbiased in your approach to work? Do you approach work with a non-prejudiced attitude and

show no preference for one particular solution?

Are you influenced by your colleagues or clients’ opinions before gaining all of the facts?

Professional competence and due care

Are you suitably qualified to undertake the work? Do you have the right level of supervision?

Have you completed relevant continuing professional development? Is your knowledge up to date?

Are you acting in accordance with the requirements of the assignment?

Do you have sufficient time to complete the assignment?

Confidentiality

Have you ever used information gained through work related activities for a personal advantage or for the

benefit of a family member or friend?

Have you ever discussed a client’s confidential activities, financial or internal reporting to someone outside

of the organisation?

Has the correct level of confidential information been disclosed appropriately?

Professional behaviour

Are you acting within the constraints of the law?

Would any of your activities be seen as inappropriate in the work environment?

Would any of your activities discredit the profession?

Have you overexaggerated your experience to clients?

Do you believe that money laundering activities have taken place which have not been appropriately

reported?

Answers to this part were mixed. At one end of the scale were those candidates who explained the meaning

of the five fundamental principles without giving any questions suitable for a checklist.

At the other end of the scale were those who turned their understanding into appropriate questions, and

scored maximum marks. The occasional candidate designed a checklist based around the qualitative

characteristics instead of the fundamental principles and scored zero.

The majority of candidates correctly named the five fundamental principles. Those candidates who failed to

link their questions to the correct fundamental principle were penalised accordingly.

A number of candidates wasted time by rewriting what was essentially the same question in a slightly

different way. Such questions were only awarded marks once.

Total possible marks 12½

Maximum full marks 5

Copyright © ICAEW 2020. All rights reserved. Page 12 of 16

Professional Level – Financial Accounting and Reporting - March 2020

Question 4

General comments

Part 4.1 of this question required the preparation of a consolidated statement of financial position for a

parent and two subsidiaries one of which was acquired in the year. Consolidation adjustments included

unrealised profit on the transfer of an asset, impairment of goodwill and a fair value adjustment on

acquisition, resulting in additional amortisation. Consideration on the acquisition of one of the subsidiaries

consisted of a deferred cash element. Part 4.2 required the preparation of the journal entries on

consolidation to recognise goodwill. Part 4.3 required the calculation of the profit or loss on disposal of one

of the subsidiary’s one month after the year end.

4.1 Chamba Ltd

Consolidated statement of financial position as at 30 September 2019

£ £

Assets

Non-current assets

Property, plant and equipment

(562,000 + 374,000 + 235,000 – 12,500 (W9)) 1,158,500

Intangibles (40,000 – 6,000) (W4) 34,000

Goodwill (61,440 (W2) + 20,000 (W5)) 81,440

Investments (W10) 25,000

1,298,940

Current assets

Inventories (72,000 + 59,400 + 35,300) 166,700

Trade and other receivables (47,800 + 31,000 + 29,400) 108,200

Cash and cash equivalents (7,100 + 3,200 + 1,800) 12,100

287,000

Total assets 1,585,940

Equity and liabilities

Equity attributable to owners of Chamba Ltd

Ordinary share capital 600,000

Share premium account 200,000

Retained earnings (W8) 281,625

1,081,625

Non-controlling interest (136,395 (W3) + 61,120 (W6)) 197,515

Total equity 1,279,140

Current liabilities

Trade and other payables (93,000 + 40,900 + 31,900) 165,800

Taxation (80,000 + 37,000 + 24,000) 141,000

306,800

Total equity and liabilities 1,585,940

Workings

(1) Net assets – Hejazi Ltd

Year end Acquisition Post acq

£ £ £

Share capital 300,000 300,000

Retained earnings 89,700 42,400

389,700 342,400 47,300

Copyright © ICAEW 2020. All rights reserved. Page 13 of 16

Professional Level – Financial Accounting and Reporting - March 2020

(2) Goodwill – Hejazi Ltd

£

Consideration transferred – cash 190,000

Deferred consideration (105,000 / 1.05) 100,000

290,000

Non-controlling interest at acquisition (342,400 (W1) x 35%) 119,840

409,840

Net assets at acquisition (W1) (342,400)

67,440

Impairments to date (6,000)

61,440

(3) Non-controlling interest – Hejazi Ltd

£

NCI at acquisition date (W2) 119,840

Share of post-acquisition reserves (47,300 (W1) x 35%) 16,555

136,395

(4) Net assets – Surati Ltd

Year end Acquisition Post acq

£ £ £

Share capital 200,000 200,000

Retained earnings 45,600 51,000

Intangibles – brands 40,000 40,000

Amortisation of brands ((40,000 / 5yrs) x 9/12) (6,000) –

279,600 291,000 (11,400)

(5) Goodwill – Surati Ltd

£

Consideration transferred 250,000

Non-controlling interest at acquisition (FV) 64,000

314,000

Net assets at acquisition (W4) (291,000)

23,000

Impairments to date (3,000)

20,000

(6) Non-controlling interest – Surati Ltd

£

NCI at acquisition date – FV (W5) 64,000

Share of post-acquisition reserves ((11,400) (W4) x 20%) (2,280)

61,720

Impairment (3,000 x 20%) (600)

61,120

(8) Retained earnings

£

Chamba Ltd 280,900

Hejazi Ltd (47,300 (W1) x 65%) 30,745

Surati Ltd ((11,400) (W4) x 80%) (9,120)

PPE Unrealised profit (W9) (12,500)

Impairment – Surati Ltd (3,000 x 80%) (W5) (2,400)

Impairment – Hejazi Ltd (W2) (6,000)

281,625

Copyright © ICAEW 2020. All rights reserved. Page 14 of 16

Professional Level – Financial Accounting and Reporting - March 2020

(9) PPE Unrealised profit

£

Asset now in Hejazi Ltd books at 63,000 x 5/6 52,500

Asset now in Chamba Ltd books at 48,000 x 5/6 (40,000)

12,500

(10) Investments

£

Per draft 565,000

Less Hejazi Ltd consideration (W2) (290,000)

Less Surati Ltd consideration (W5) (250,000)

25,000

Answers to this question were excellent with many candidates getting the correct figures for goodwill and the

non-controlling interest. This was particularly pleasing as both methods of calculating goodwill were tested

and there was an impairment that needed to be split between the non-controlling interest and retained

earnings.

Where mistakes were made they commonly included:

Calculating the PPE unrealised profit incorrectly. Many candidates only calculated the profit on transfer

or the impact on the subsequent depreciation. When both were calculated they were frequently added

together rather than netted off or one element was ignored when making the adjustment to property,

plant and equipment and retained earnings. Candidates who did one calculation by comparing carrying

amounts were most likely to get the adjustment correct.

Making unnecessary adjustments in the net assets table particularly for Hejazi Ltd eg including the PPE

unrealised profit and / or goodwill impairments.

Only deducting the parent’s share of the impairment when calculating goodwill.

Failing to split the impairment between the NCI and retained earnings (when the fair value method was

being used).

Making unnecessary adjustments to retained earnings for deferred consideration (where the question

stated that this had been accounted for correctly).

Calculating the NCI using the proportionate method for both subsidiaries.

As is common with this type of question some candidates lost marks for not including an “audit trail” to their

adjustments particularly relating to post acquisition profits.

Total possible marks 20

Maximum full marks 19

4.2 Goodwill journal entries

DR: Intangibles – goodwill (23,000 – 3,000) 20,000

DR: Intangibles – brand (40,000 – 6,000) 34,000

DR: Net assets 251,000

DR: Consolidated profit or loss for the period –

amortisation/impairment (3,000 + 6,000) 9,000

CR: Investments 250,000

CR: Non-controlling interest (FV) 64,000

Answers were disappointing with many candidates unable to go further than to show the debit to goodwill or

missing out this requirement completely. Where journal entries were broken down further full marks were still

available.

Total possible marks 3

Maximum full marks 2

Copyright © ICAEW 2020. All rights reserved. Page 15 of 16

Professional Level – Financial Accounting and Reporting - March 2020

4.3

£

Sale proceeds 346,000

Less: carrying amount of goodwill at disposal (4.1) (61,440)

Carrying amount of net assets at disposal

Net assets at 30 September 2019 (4.1) 389,700

Profit for the period 18,900

(408,600)

Add back: Attributable to non-controlling interest (408,600 x 35%) 143,010

Profit on disposal 18,970

Answers to this part of the question were very disappointing especially as part 4.1 was so well answered.

Most candidates simply did not appear to know the “formula” for calculating the profit or loss on disposal

and on many scripts the only correct figure was the sale proceeds. Some wasted time re-calculating

figures such as goodwill which they had already calculated in 4.1.

Total possible marks 2½

Maximum full marks 2

Copyright © ICAEW 2020. All rights reserved. Page 16 of 16

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Financial Accounting IFRS Student Mark Plan June 2019Document16 pagesFinancial Accounting IFRS Student Mark Plan June 2019scottNo ratings yet

- Financial Accounting and Reporting: IFRS - 2015 December MSDocument18 pagesFinancial Accounting and Reporting: IFRS - 2015 December MSMarchella LukitoNo ratings yet

- Financial Accounting and Reporting: IFRS - 2016 June MSDocument17 pagesFinancial Accounting and Reporting: IFRS - 2016 June MSMarchella LukitoNo ratings yet

- T12 - ABFA1153 (Extra)Document2 pagesT12 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Financial Accounting and Reporting: IFRS - 2021 December AKDocument15 pagesFinancial Accounting and Reporting: IFRS - 2021 December AKMarchella LukitoNo ratings yet

- Kunci Jawaban ICAEW Part 2Document4 pagesKunci Jawaban ICAEW Part 2Dendi RiskiNo ratings yet

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- Hullmark's Profit and LossDocument13 pagesHullmark's Profit and LossLoh Jin WenNo ratings yet

- Caput Plc Financial StatementsDocument6 pagesCaput Plc Financial StatementsLaud ListowellNo ratings yet

- Solution of Trial Balance Problem - Exam MEM-3 PDFDocument4 pagesSolution of Trial Balance Problem - Exam MEM-3 PDFEltayeb ElhigziNo ratings yet

- 15 Sole Trader - 2020Document34 pages15 Sole Trader - 2020Philile NkwanyanaNo ratings yet

- Ap Solutions 2016Document15 pagesAp Solutions 2016Shariefia MagondacanNo ratings yet

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanNo ratings yet

- Yongnam Holdings Limited: Financial Statements Announcement For The Year Ended 31 December 2019Document8 pagesYongnam Holdings Limited: Financial Statements Announcement For The Year Ended 31 December 2019Batu GajahNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- Project 2 FAR270 SummaryDocument6 pagesProject 2 FAR270 SummaryHaru BiruNo ratings yet

- Financial Statement Analysis of Tie Beauty EnterpriseDocument15 pagesFinancial Statement Analysis of Tie Beauty Enterprisenur anisNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Golden Ltd's Profit and Loss AnalysisDocument10 pagesGolden Ltd's Profit and Loss AnalysisSheilla BonsuNo ratings yet

- Jimmy Lim - Perbaikan UAS ICAEWDocument9 pagesJimmy Lim - Perbaikan UAS ICAEWJimmy LimNo ratings yet

- Gilbert Manufacturing Company Budgets for 2019 and 2020Document69 pagesGilbert Manufacturing Company Budgets for 2019 and 2020lov3m3100% (2)

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- b2 AnsDocument13 pagesb2 AnsRashid AbeidNo ratings yet

- Income StatementDocument4 pagesIncome Statementl201046No ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Far160 Dec 2018 Q4 PublishDocument5 pagesFar160 Dec 2018 Q4 PublishNur Anis AqilahNo ratings yet

- HKEX Interim ResultsDocument39 pagesHKEX Interim Resultsin resNo ratings yet

- 20solution Far460 - Jun 2020 - StudentDocument10 pages20solution Far460 - Jun 2020 - StudentRuzaikha razaliNo ratings yet

- Solution Far410 Dec - 2019 - 1 - PDFDocument8 pagesSolution Far410 Dec - 2019 - 1 - PDF2022478048No ratings yet

- Financial Ratio Analysis TutorialDocument6 pagesFinancial Ratio Analysis TutorialWEI QUAN LEENo ratings yet

- PYQ January 2018Document4 pagesPYQ January 2018Nur Amira NadiaNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Facn311 Test 1 Solution 2019Document10 pagesFacn311 Test 1 Solution 20196lackzamokuhleNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- 1Q 20 - Bursa (PMMA) FinalDocument12 pages1Q 20 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- Solution AP Test Bank 1Document8 pagesSolution AP Test Bank 1ima100% (1)

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- Accounting Assignments Financial StatementsDocument5 pagesAccounting Assignments Financial StatementsTendai MakosaNo ratings yet

- Solution - Auditing Problems Test Bank 1: Problem 1 - Tanying CorpDocument3 pagesSolution - Auditing Problems Test Bank 1: Problem 1 - Tanying CorpJayvee BalinoNo ratings yet

- Assignment 5 - Statement of Cash FlowsDocument2 pagesAssignment 5 - Statement of Cash FlowsJezza Mae Gomba RegidorNo ratings yet

- SOlution File For FRDocument38 pagesSOlution File For FRMonirul Islam MoniirrNo ratings yet

- Final IFRS For SMEs Illustrator ExampleDocument30 pagesFinal IFRS For SMEs Illustrator ExampleleekosalNo ratings yet

- Eva Trading Group AssignmentDocument8 pagesEva Trading Group AssignmentDoreen OngNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- 3. BT IAS1 (SV)Document3 pages3. BT IAS1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Notes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1Document2 pagesNotes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1JonellNo ratings yet

- Mavesto LTD and Its SubsidiaryDocument4 pagesMavesto LTD and Its SubsidiaryTawanda Tatenda HerbertNo ratings yet

- CR - MA-2023 - Suggested - AnswersDocument15 pagesCR - MA-2023 - Suggested - AnswersfahadsarkerNo ratings yet

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- Madaraka Ltd. income statement and financialsDocument17 pagesMadaraka Ltd. income statement and financialsMaryjoy KilonzoNo ratings yet

- Kingdom Ltd Group's Profit and Financial PositionDocument6 pagesKingdom Ltd Group's Profit and Financial PositionLaud ListowellNo ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sept Q2 2020Document8 pagesSept Q2 2020XianFa WongNo ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- Dublin LTDDocument4 pagesDublin LTDXianFa WongNo ratings yet

- FZ9 - Universiti Malaya 2024Document2 pagesFZ9 - Universiti Malaya 2024XianFa WongNo ratings yet

- AAIS Group A DiscussionDocument5 pagesAAIS Group A DiscussionXianFa WongNo ratings yet

- CH09 PPT MLDocument127 pagesCH09 PPT MLXianFa WongNo ratings yet

- Chapter 14 AnsDocument8 pagesChapter 14 AnsXianFa WongNo ratings yet

- Week 3 Capital Budgeting Cash Flows 2 - Replacement Project (Group 2, Slot 1)Document40 pagesWeek 3 Capital Budgeting Cash Flows 2 - Replacement Project (Group 2, Slot 1)XianFa WongNo ratings yet

- Chapter 15 AnsDocument7 pagesChapter 15 AnsXianFa WongNo ratings yet

- Jawaban Grand JeanDocument7 pagesJawaban Grand JeanSariIsmanengsihNo ratings yet

- CVP AnalysisDocument36 pagesCVP AnalysisNadian100% (1)

- Trendsetter Term Sheet Comparison - YulinDocument3 pagesTrendsetter Term Sheet Comparison - YulinYulin ChenNo ratings yet

- 7 May Adidas AnalysisDocument11 pages7 May Adidas Analysissardar hussain0% (1)

- Assignment 2 - Operating Segment 10 Items TestDocument4 pagesAssignment 2 - Operating Segment 10 Items TestJeane Mae BooNo ratings yet

- Case StudyDocument7 pagesCase Studycristinejoy.mendez17No ratings yet

- Fractional Ownership - Main BodyDocument15 pagesFractional Ownership - Main BodyJustin BettsNo ratings yet

- Chapter 8. Sales QuotaDocument12 pagesChapter 8. Sales QuotaRahul upadhaya100% (1)

- CH 13Document98 pagesCH 13reza agustinNo ratings yet

- T3 EmployeeDocument4 pagesT3 EmployeeLe YenNo ratings yet

- Ocean Carriers Case: Executive SummaryDocument5 pagesOcean Carriers Case: Executive SummarykokoNo ratings yet

- Kpi Dashboard TemplateDocument15 pagesKpi Dashboard TemplateADINo ratings yet

- PDF 881342290291222Document1 pagePDF 881342290291222Udayakumar KannanNo ratings yet

- Chapter 12 Pure Monopoly: Numbers Above Do Not Correspond To The Following GraphDocument6 pagesChapter 12 Pure Monopoly: Numbers Above Do Not Correspond To The Following GraphTesfayé HailuNo ratings yet

- Managerial Accounting 08Document55 pagesManagerial Accounting 08Dheeraj SunthaNo ratings yet

- Psa MathsDocument11 pagesPsa MathsUtsav SrivastavaNo ratings yet

- CH 14Document2 pagesCH 14tigger5191100% (1)

- Kannipayoor Rou CompensationDocument4 pagesKannipayoor Rou CompensationsebincherianNo ratings yet

- Management Accounting Session 2 Cost Terms & Purposes: Indian Institute of Management RohtakDocument58 pagesManagement Accounting Session 2 Cost Terms & Purposes: Indian Institute of Management RohtakSiddharthNo ratings yet

- Product Cannibalization: Business Accounting and Finance IiDocument18 pagesProduct Cannibalization: Business Accounting and Finance IiAmulya MantenaNo ratings yet

- Tybcom - Share NotesDocument749 pagesTybcom - Share NotesManojj21No ratings yet

- Break-even Analysis for Eat and Be Well CafeDocument1 pageBreak-even Analysis for Eat and Be Well CafeRikki Mae TeofistoNo ratings yet

- Real Estate Business Plan SummaryDocument3 pagesReal Estate Business Plan SummaryJio Victorino100% (2)

- 4.2 Capital InvestmentDocument22 pages4.2 Capital InvestmentIshaNo ratings yet

- Spokane Humane Society BackgrounderDocument5 pagesSpokane Humane Society Backgrounderapi-376436821No ratings yet

- Using Budgets to Achieve Organizational ObjectivesDocument88 pagesUsing Budgets to Achieve Organizational ObjectivesGks06No ratings yet

- Question Bank MbaDocument173 pagesQuestion Bank MbanamrataNo ratings yet

- Fee Concessions 060417Document3 pagesFee Concessions 060417anandsonachalamNo ratings yet

- Pilgreen Joshua Model CFI FinMoDocument217 pagesPilgreen Joshua Model CFI FinMoGargNo ratings yet

- Frequent Flyer ProgramDocument12 pagesFrequent Flyer ProgramAnonymous PKVCsGNo ratings yet