Professional Documents

Culture Documents

Depletion For 2019 8,100,000.00

Uploaded by

Paula Mae DacanayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depletion For 2019 8,100,000.00

Uploaded by

Paula Mae DacanayCopyright:

Available Formats

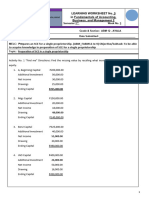

In 2018, Lepanto Mining Company purchased property with natural resources for P28, 000,000.

The

property had a residual value of P5, 000,000.

However, the entity is required to restore the property to the original condition at a discounted amount

of P2, 000,000.

In 2018, the entity spent P1, 000,000 in development cost and P3, 000,000 in building on the property.

The entity does not anticipate that the building will have utility after the natural resources are removed.

In 2019, an amount of P1, 000,000 was spent for additional development on the mine.

The tonnage mined and estimated remaining tons are:

Tons extracted Tons remaining

2018 0 10,000,000

2019 3,000,000 7,000,000

2020 3,500,000 2,500,000

1. What amount should be recognized as depletion 2019?

Natural resources 28,000,000.00

Development cpst 2018 1,000,000.00

Restoration 2,000,000.00

Development cpst2019 1,000,000.00

total 32,000,000.00

Less: residual value 5,000,000.00

Depletable amount 27,000,000.00

divided by : est. extraction 10,000,000.00

Rate 2.70

Mined 2019 3,000,000

Depletion for 2019 8,100,000.00

2. What amount should be recognized as depletion 2020?

Depletable amount 27,000,000.00

less: Depletion (8,100,000.00)

Depletable amount 18,900,000.00

divided by : est.

extraction 6,000,000.00

Rate 3.15

Mined 2019 3,500,000

Depletion for 2020 11,025,000.00

You might also like

- Depletion 2Document2 pagesDepletion 2Paula Mae Dacanay100% (2)

- Depletion For 2019 1,200,000.00Document2 pagesDepletion For 2019 1,200,000.00Paula Mae DacanayNo ratings yet

- Depletion 3Document2 pagesDepletion 3Paula Mae DacanayNo ratings yet

- Intermediate Accounting 1 Problems and SolutionDocument26 pagesIntermediate Accounting 1 Problems and SolutionRAFALLO, ABMYR ROSE R.No ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- A6 Audit of Ppe Part 2Document5 pagesA6 Audit of Ppe Part 2KezNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Quiz Midterm - Answer KeyDocument11 pagesQuiz Midterm - Answer KeyGloria BeltranNo ratings yet

- Financial Accounting Reviewer - Chapter 59Document10 pagesFinancial Accounting Reviewer - Chapter 59Coursehero PremiumNo ratings yet

- DEPLETION and DEPRECIATIONDocument1 pageDEPLETION and DEPRECIATIONNykee PenNo ratings yet

- NOTES-Auditing and Assurance Specialized Industries p5Document4 pagesNOTES-Auditing and Assurance Specialized Industries p5Lovers Mae BasergoNo ratings yet

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- ACTIVITY For Sales Budget, Production Budget, FS ProjectionDocument2 pagesACTIVITY For Sales Budget, Production Budget, FS ProjectionJasmine UndecimoNo ratings yet

- Problem 12 27Document4 pagesProblem 12 27Bella RonahNo ratings yet

- M2 Q Cfs and FinplnDocument7 pagesM2 Q Cfs and FinplnLeane MarcoletaNo ratings yet

- Solutions - Long-Term Construction ContractsDocument19 pagesSolutions - Long-Term Construction Contractskaren perrerasNo ratings yet

- Assignment Ch.5 SolutionsDocument4 pagesAssignment Ch.5 SolutionsstoryNo ratings yet

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- Andiam: January 2, 2019Document5 pagesAndiam: January 2, 2019Avox EverdeenNo ratings yet

- Depletion ProblemsDocument3 pagesDepletion ProblemsSharon LotinoNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Fin Activity For Sales Budget EtcDocument3 pagesFin Activity For Sales Budget EtcMariz TimarioNo ratings yet

- Installment ExercisesDocument2 pagesInstallment ExercisesalyssaNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- Act1104 Quiz No. 3 Problem 1Document6 pagesAct1104 Quiz No. 3 Problem 1DyenNo ratings yet

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Angela MartiresNo ratings yet

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Erika Larinay100% (1)

- Chapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Document6 pagesChapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Jue WernNo ratings yet

- 1909 Gross Profit and Retail MethodDocument3 pages1909 Gross Profit and Retail MethodCykee Hanna Quizo Lumongsod50% (4)

- Jan-01 Cost 10,000,000 Useful Life 10 Annual Depreciation 1,000,000.00 Accumulated Depreciation Carrying Amount 8,000,000Document10 pagesJan-01 Cost 10,000,000 Useful Life 10 Annual Depreciation 1,000,000.00 Accumulated Depreciation Carrying Amount 8,000,000Marjon Godfrey Dojillo CaveNo ratings yet

- Ratio Analysis (Divya Jadi Booti)Document85 pagesRatio Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Instructions: Choose The BEST Answer For Each of The Following ItemsDocument18 pagesInstructions: Choose The BEST Answer For Each of The Following ItemsVaughn TheoNo ratings yet

- I. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 7, 2020. (2pts Each)Document9 pagesI. MULTIPLE CHOICE. Select The Best Answer. Write The LETTER of Your Answer On A Sheet of Paper. Deadline Is On or Before June 7, 2020. (2pts Each)Hazel Seguerra BicadaNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- CRC ACE Final PreboardDocument10 pagesCRC ACE Final PreboardrochielanciolaNo ratings yet

- Partnership Operation Quiz 2Document2 pagesPartnership Operation Quiz 2cabbigatcrisanta04No ratings yet

- Financial Accounting Paper1.1Document20 pagesFinancial Accounting Paper1.1MahediNo ratings yet

- Pre Finals Manacc 1Document8 pagesPre Finals Manacc 1Gesselle Acebedo0% (1)

- IA Quiz ImadeDocument4 pagesIA Quiz ImadeKuro ZetsuNo ratings yet

- Afar 104 Installment SalesDocument3 pagesAfar 104 Installment SalesReyn Saplad PeralesNo ratings yet

- Inventory Valuation and Gross Profit MethodDocument3 pagesInventory Valuation and Gross Profit MethodLuiNo ratings yet

- Error Correction SolutionDocument3 pagesError Correction SolutionMary Grace Garcia VergaraNo ratings yet

- 20th Regional Mid Year Convention Cup 6 Easy RoundDocument18 pages20th Regional Mid Year Convention Cup 6 Easy RoundSophia De GuzmanNo ratings yet

- Q1. ProblemsDocument9 pagesQ1. ProblemsAldrin ZolinaNo ratings yet

- ACCT 4410 Depreciation Allowance Illustration (DA) (2023S)Document2 pagesACCT 4410 Depreciation Allowance Illustration (DA) (2023S)何健珩No ratings yet

- Instalment DISDocument4 pagesInstalment DISRenelyn David100% (1)

- Forda Reviewer IA - MidtermDocument18 pagesForda Reviewer IA - MidtermAltessa Lyn ContigaNo ratings yet

- Financial Analysis For WorlducationDocument2 pagesFinancial Analysis For WorlducationParth PrajapatiNo ratings yet

- FAB2 W3 No Answer KeyDocument3 pagesFAB2 W3 No Answer KeyClintwest Caliste Autida BartinaNo ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Final Quiz 1 Set A With AnswerDocument9 pagesFinal Quiz 1 Set A With Answer11mahogany.hazelnicoletiticNo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- The Changing Wealth of Nations 2021: Managing Assets for the FutureFrom EverandThe Changing Wealth of Nations 2021: Managing Assets for the FutureNo ratings yet

- 9ATDocument2 pages9ATPaula Mae DacanayNo ratings yet

- F1Document3 pagesF1Paula Mae DacanayNo ratings yet

- 3ATDocument3 pages3ATPaula Mae Dacanay0% (1)

- 1GDocument2 pages1GPaula Mae DacanayNo ratings yet

- 1ADocument8 pages1APaula Mae DacanayNo ratings yet

- AT - RA 9298 Red Sirug Page 5Document2 pagesAT - RA 9298 Red Sirug Page 5Paula Mae DacanayNo ratings yet

- AT - RA 9298 Red Sirug Page 3: D. Pending Case Involving Moral TurpitudeDocument2 pagesAT - RA 9298 Red Sirug Page 3: D. Pending Case Involving Moral TurpitudePaula Mae DacanayNo ratings yet

- AT - RA 9298 Red Sirug Page 2Document2 pagesAT - RA 9298 Red Sirug Page 2Paula Mae DacanayNo ratings yet

- AT - RA 9298 Red Sirug Page 8Document2 pagesAT - RA 9298 Red Sirug Page 8Paula Mae DacanayNo ratings yet

- 1FDocument2 pages1FPaula Mae DacanayNo ratings yet

- Compensation IncomeDocument5 pagesCompensation IncomePaula Mae Dacanay100% (1)

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Auditor's ResponsibilityDocument3 pagesAuditor's ResponsibilityPaula Mae DacanayNo ratings yet

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDocument5 pagesExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayNo ratings yet

- Depletion 5Document1 pageDepletion 5Paula Mae DacanayNo ratings yet