Professional Documents

Culture Documents

Case 18-1 Huron Automotive Company Study

Uploaded by

Empress CarrotOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 18-1 Huron Automotive Company Study

Uploaded by

Empress CarrotCopyright:

Available Formats

Case 18-1

Huron Automotive Company*

Sandy Bond, a recent business school graduate who had recently been employed by Huron automotive

Company, was asked by Huron’s president to review the company’s present cost accounting procedures.

In outlining this project to Bond, the president had expressed three concerns about the present system: (1)

its adequacy for purposes of cost control, (2) its accuracy in arriving at the true cost of products, and (3) its

usefulness in providing data to judge supervisor’s performance.

Huron Automotive was a relatively small supplier of selected vehicle parts to the large automobile and truck

companies. Huron competed on a price basis with larger suppliers that were long-established in the

market. Huron had competed successfully in the past by focusing on parts that, relative to the industry,

were of small volume and hence did not permit Huron’s competitors to take advantage of economics of

scale. For example, Huron produced certain parts required only by “off-the-road” equipment such as front

loaders.

Bond began the cost accounting study in Huron’s carburetor and fuel injector (CFI) division, which

accounted for about 40 percent of Huron’s sales. This division contained five production departments:

casting and stamping, grinding, machining, custom work, and assembly. The casting and stamping

department produced cases, valves, and certain other parts. The grinding department prepared these

parts for further machining and precision ground those parts requiring close tolerances. The machining

department performed all necessary machining operations on standard products, whereas the custom work

department performed part of the machining and certain other operations on custom products, which

usually were replacement carburetors for antique cars or other highly specialized applications. The

assembly department assembled and tested all products, both standard and custom.

Thus, custom products passed through all five departments and standard products passed through

departments except custom work. Spare parts produced for inventory went through only the first three

departments. Both standard and custom products were produced to order; there were no inventories of

completed carburetors or fuel injectors.

Bond’s investigation showed that with the exception of materials costs, all product costing was done based

on a single, plantwide, direct labor hourly rate. This rate included both direct labor and factory overhead

costs. Each batch of products was assigned its labor and overhead cost by having workers charge their

time to the job number assigned to the batch, and then multiplying the total hours charged to the job

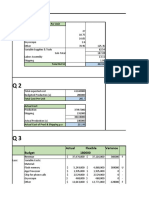

number by the hourly rate. Exhibit 1 shows how the July hourly rate of $55.96 was calculated.

It seemed to Bond that because the average labor skill level varied from department to department, each

department should have its own hourly costing rate. With this approach, time would be charged to each

batch by department; then the hours charged by a department would be multiplied by that department’s

costing rate to arrive at a departmental labor and over-head cost for the batch; and finally these

departmental labor and overhead costs would be added (along with materials cost) to obtain the cost of a

batch.

ACCOUNTING TEXT AND CASES, 13TH Edition

Robert N. Anthony, David F. Hawkins, Kenneth A. Merchant

* Copyright by James S. Reece.

Bond decided to see what impact this approach would have on product costs. The division’s accountant

pointed out to Bond that labor hours and payroll costs were already traceable to departments. Also, some

overhead items, such as departmental supervisors’ salaries and equipment depreciation, could be charged

directly to the relevant department. However, many other overhead items, including heat, electricity,

property taxes, and insurance, would need to be allocated to each department if the new approach were

implemented. Accordingly, Bond determined a reasonable allocation basis for each of these joint costs

(e.g., cubic feet of space occupied as the basis of allocating heating costs), and then used these bases to

recast July’s costs on a departmental basis. Bond then calculated hourly rates for each department, as

shown in Exhibit 2.

In order to have some concrete number to show the president, Bond decided to apply the proposed

approach to three CFI division activities: production of model CS-29 fuel injectors (CFI’s best-selling

product), production of spare parts for inventory, and work done by the division for other Huron divisions .

Exhibit 3 summarizes the hourly requirements of these activities by department. Bond then costed these

three activities using both the July plantwide rate and the proforma July departmental rates.

Upon seeing Bond’s numbers, the president noted that there was a large difference in the indicated cost of

CS-29 injectors as calculated under the present and proposed methods. The present method was

therefore probably leading to incorrect inferences about the profitability of each product, the president

surmised. The impact of the proposed method on spare parts inventory valuation was similarly noted. the

president therefore was leaning toward adopting the new method, but told Bond that the departmental

supervisors should be consulted before any change was made.

Bond’s explanation of the proposal to the supervisor’s prompted strong opposition from some of them. The

supervisors of the outside departments for which the CFI division did work each month felt it would be

unfair to increase their costs by increasing charges from the CFI division. One of them stated:

The CFI division handles our department’s overflow machining work when we’re at

capacity. I can’t control costs in the CFI division, but if they increase their charges, I’ll

never be able to meet my department’s cost budget. They’re already charging us more

than we can do the work for in our own department, if we had enough capacity, and you’re

proposing to charge us still more!

Also opposed was the production manager of the CFI division:

I’ve got enough to do getting good quality output to our customers on time, without getting

involved in more paperwork! What’s more, my department supervisors haven’t got time to

become bookkeepers, either. We’re already charging all of the division’s production costs

to products and work for other departments; why do we need this extra complication?

The company’s sales manager also did not favor the proposal, telling Bond:

We already have trouble being competitive with the big companies in our industry. If we

start playing games with our costing system, then we’ll have to start changing our prices.

ACCOUNTING TEXT AND CASES, 13TH Edition

Robert N. Anthony, David F. Hawkins, Kenneth A. Merchant

* Copyright by James S. Reece.

You’re new here, so perhaps you don’t realize that we have to carry some low-profit-or

even loss-items in order to sell the more profitable ones. As far as I’m concerned, if a

product line is showing an adequate profit, I’m not hung up about cost variations among

items within the line.

The strongest criticism of Bond’s proposed new system came from Huron’s director of financial planning:

Departmentalizing the costing rate may be a good idea, but I’m not sure you’re attacking

the main problem. How can we do anything with these cost estimates when you change

the rates every month? When volume is rising, all of our product make money, no matter

which system you use. But when overall volume is falling, some products begin to show

losses even though their own sales continue to hold up. I don’t know whether they’re

really losing money or whether they just can’t carry a full share of the costs of idle capacity.

I don’t see how your system is going to help me answer that question.

Faced with all these arguments, Bond decided to make some more calculations before going back to the

president. First, bond asked the industrial engineering department to estimate the monthly volume at which

each of the five production departments typically operated over the course of a year (normal volume).

Then Bond assembled a new set of overhead cost estimates and recalculated the proposed overhead

rates, as shown in Exhibit 4. Finally, Bond recalculated the labor and overhead costs of a 100-unit lot of

model CS-29 injectors and of a typical month’s spare parts production and work for other divisions, based

on the “normalized” departmental rates.

When Bond circulated these new calculations, the production manager of the CFI division was even more

perturbed than before:

That’s even worse! Now you’re piling paperwork on paperwork! And on top of everything,

we won’t be able to charge out all of our costs. What am I supposed to do with the costs in

machining and assembly if I can’t charge them to products or spare parts or the work we

do for other divisions?

When Bond reported the various managers’ opposition to the president, the president replied:

You’re not telling me anything that I haven’t already heard from unsolicited phone calls

from several supervisors the last few days. I don’t want to cram anything down their

throats – but I’m still not satisfied our current system is adequate. Sandy, what do you

think we should do?

Questions

1. Using the data in the exhibits, determine the cost of a 100-unit batch of model CS-29, a month’s

spare parts, and a month’s work done for other divisions under the present method, Bond’s first

proposal, and Bond’s revised proposal.

2. Are the cost differences among the methods significant? What causes these differences?

ACCOUNTING TEXT AND CASES, 13TH Edition

Robert N. Anthony, David F. Hawkins, Kenneth A. Merchant

* Copyright by James S. Reece.

3. Suppose that Huron purchased a new machine costing $400,000 for the custom work department.

Its expected useful life is five years. This machine would reduce machining time and result in

higher quality custom carburetors. As a result, the department’s direct labor-hours would be

reduced by 30 percent, and this extra labor would be transferred to departments outside the

carburetor division. About 10 percent of the custom work department’s overhead is variable with

respect to direct labor-hours. Using July’s data:

a. Calculate the plantwide hourly rate (present method) if the new machine were acquired.

Then calculate indicated costs for the custom work department in July, using both this new

plantwide rate and the former $55.96 rate.

b. Calculate the hourly rate for the custom work department only (first proposed method),

assuming the machine was acquired and the first proposed costing procedure was

adopted. Then calculate indicated costs for the custom work department in July, using

both this new rate and the former $55.96 rate.

c. Under the present costing procedures, what is the impact on the indicated costs of custom

products if the new machine is acquired? What is this impact if the first proposed costing

procedure is used? What inference do you then draw concerning the usefulness of the

present and proposed methods?

4. Assume that producing a batch of 100 model CS-29 injectors requires 126 hours, distributed by

department as shown in Exhibit 3, and $4,200 worth of materials. Huron sells these carburetors

$113 each. Should the CS-29 price be increased? Should the CS-29 be dropped from the product

line? (Answer using both the present and the first proposed costing methods.)

5. What benefits, if any, do you see to Huron if either proposed costing method is adopted? Consider

this question from the standpoint of (a) product pricing, (b) cost control, (c) inventory valuation, (d)

charges to outside departments, ( e) judging departmental performance, and ( f) diagnostic uses of

cost data. What do you conclude Huron should do regarding its costing procedures?

ACCOUNTING TEXT AND CASES, 13TH Edition

Robert N. Anthony, David F. Hawkins, Kenneth A. Merchant

* Copyright by James S. Reece.

You might also like

- Bridgeton HWDocument3 pagesBridgeton HWravNo ratings yet

- Prestige Telephone Company SlidesDocument13 pagesPrestige Telephone Company SlidesHarsh MaheshwariNo ratings yet

- This Study Resource Was: Forner CarpetDocument4 pagesThis Study Resource Was: Forner CarpetLi CarinaNo ratings yet

- Variable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesDocument6 pagesVariable Cost Structure and Budget AnalysisTITLECost Variance Analysis for Phone ProductionTITLECalculation of Material and Labor VariancesArindam MandalNo ratings yet

- Frequent FliersDocument4 pagesFrequent Fliersarchit_shrivast908467% (3)

- Huron Automotive Company ExcelllDocument6 pagesHuron Automotive Company Excelllmaximus0903No ratings yet

- Case Study - Destin Brass Products CoDocument6 pagesCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- Outsourcing Manifold ProductionDocument8 pagesOutsourcing Manifold Productionaliraza100% (2)

- Costing analysis of carburator batch shows higher costs under proposed methodsDocument13 pagesCosting analysis of carburator batch shows higher costs under proposed methodsshreyansh1200% (1)

- SUBJECT: Analyses and Recommendations For The Different Cost AccountingDocument4 pagesSUBJECT: Analyses and Recommendations For The Different Cost AccountinglddNo ratings yet

- Cost Accounting ReportDocument12 pagesCost Accounting ReportSYED WAFINo ratings yet

- Danshui PlantDocument2 pagesDanshui PlantYAKSH DODIANo ratings yet

- Selligram Case Answer KeyDocument3 pagesSelligram Case Answer Keysharkss521No ratings yet

- Group 7 - Excel - Destin BrassDocument9 pagesGroup 7 - Excel - Destin BrassSaumya SahaNo ratings yet

- Management 122 Course XXXXZAXReader - Rev J - SolutionsDocument43 pagesManagement 122 Course XXXXZAXReader - Rev J - SolutionsWOw WongNo ratings yet

- Baldwin Bicycle Company Considers Private Label DealDocument5 pagesBaldwin Bicycle Company Considers Private Label DealPremal Gangar0% (1)

- Ajax Manufacturing Cost AnalysisDocument7 pagesAjax Manufacturing Cost Analysisreva_radhakrish1834No ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- PRESTIGE TELEPHONE COMPANY BREAK EVEN ANALYSISDocument10 pagesPRESTIGE TELEPHONE COMPANY BREAK EVEN ANALYSISSumit ChandraNo ratings yet

- O.M Scott and Sons Case SummaryDocument2 pagesO.M Scott and Sons Case SummarySUSHMITA SHUBHAMNo ratings yet

- Destin BrassDocument5 pagesDestin Brassdamanfromiran100% (1)

- PIA Breakeven Analysis and Financial Performance ReportDocument3 pagesPIA Breakeven Analysis and Financial Performance ReportsaadsahilNo ratings yet

- Compagnie Du Froid PDFDocument18 pagesCompagnie Du Froid PDFGunjanNo ratings yet

- A Note On Leveraged RecapitalizationDocument5 pagesA Note On Leveraged Recapitalizationkuch bhiNo ratings yet

- Miles High Cycles Katherine Roland and John ConnorsDocument4 pagesMiles High Cycles Katherine Roland and John ConnorsvivekNo ratings yet

- FMG Comsat FCCDocument18 pagesFMG Comsat FCCMuhammad Rizwan AsimNo ratings yet

- Soal Capital Budgeting Chapter 11Document1 pageSoal Capital Budgeting Chapter 11febrythiodorNo ratings yet

- WalthamMotors CaseAnalysisDocument9 pagesWalthamMotors CaseAnalysisabeeju100% (5)

- Daud Engine Parts CompanyDocument3 pagesDaud Engine Parts CompanyJawadNo ratings yet

- Pradeep MA3 SirDocument6 pagesPradeep MA3 SirPradeep Elavarasan0% (1)

- Hallstead Jewelers Breakeven AnalysisDocument7 pagesHallstead Jewelers Breakeven Analysisanon_839867152No ratings yet

- Merrimack Tractors and MowersDocument10 pagesMerrimack Tractors and MowersAtul Bhatia0% (1)

- Case - SunAir Boat Builders Part - 2Document3 pagesCase - SunAir Boat Builders Part - 2dhakar_ravi1No ratings yet

- Integrated Siting SystemDocument8 pagesIntegrated Siting SystemSahrish Jaleel Shaikh100% (4)

- Siemens ElectricDocument6 pagesSiemens ElectricUtsavNo ratings yet

- Catawba Industrial Company-Case QuestionsDocument1 pageCatawba Industrial Company-Case QuestionsSumit Kulkarni0% (3)

- CASE SUMMARY Waltham Oil and LubesDocument2 pagesCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNo ratings yet

- Seligram 2Document4 pagesSeligram 2Yvette YuanNo ratings yet

- Reichard Maschinen DocumentDocument5 pagesReichard Maschinen DocumentLucille Ausborn100% (1)

- Case Study South Dakota MicrobreweryDocument1 pageCase Study South Dakota Microbreweryjman02120No ratings yet

- Unitron CorporationDocument7 pagesUnitron CorporationERika PratiwiNo ratings yet

- EX 1 - WilkersonDocument8 pagesEX 1 - WilkersonDror PazNo ratings yet

- Kanthal Activity-Based CostingDocument13 pagesKanthal Activity-Based CostingRaymon AquinoNo ratings yet

- Dakota Office ProductsDocument10 pagesDakota Office ProductsMithun KarthikeyanNo ratings yet

- Seimens Electric Motor WorksDocument5 pagesSeimens Electric Motor WorksShrey BhalaNo ratings yet

- Precision Motors Division CaseDocument9 pagesPrecision Motors Division CaseAliza Rizvi50% (2)

- MBA – Management Accounting Problem ValencianoDocument5 pagesMBA – Management Accounting Problem ValencianoalexsophieNo ratings yet

- Dan ShuiDocument12 pagesDan ShuiSai KiranNo ratings yet

- ARS Waltham Case TransactionsDocument2 pagesARS Waltham Case TransactionsRajnikaanth SteamNo ratings yet

- John Deere Component WorkDocument6 pagesJohn Deere Component WorkandresugiNo ratings yet

- Lipman Bottle CompanyDocument20 pagesLipman Bottle CompanySaswata BanerjeeNo ratings yet

- Huron AutomotiveDocument8 pagesHuron Automotiveanubhav1109No ratings yet

- Baguette Galore International Ppts FinalDocument23 pagesBaguette Galore International Ppts FinalSadaf KazmiNo ratings yet

- Case ReichardDocument23 pagesCase ReichardDesiSelviaNo ratings yet

- ETO cost system analysis and overhead ratesDocument34 pagesETO cost system analysis and overhead ratesKirtiKishanNo ratings yet

- Stuart Daw CoffeeDocument8 pagesStuart Daw CoffeeZarith Akhma100% (1)

- Huron Automotive Company: The Crimson Press Curriculum Center The Crimson Group, IncDocument4 pagesHuron Automotive Company: The Crimson Press Curriculum Center The Crimson Group, IncJeremy DuxNo ratings yet

- Target Costing Approach To PricingDocument11 pagesTarget Costing Approach To Pricingarch1491No ratings yet

- Assignment Problems WK 1-Adnan-N0033642335Document5 pagesAssignment Problems WK 1-Adnan-N0033642335Mohammad AdnanNo ratings yet

- Break of Dawn A Briefer On The Case of The University of The East Dawn CegpcordilleraDocument5 pagesBreak of Dawn A Briefer On The Case of The University of The East Dawn CegpcordilleraEmpress CarrotNo ratings yet

- CEGP - UPHL SupportDocument7 pagesCEGP - UPHL SupportEmpress CarrotNo ratings yet

- READ ME - Stopped HereDocument1 pageREAD ME - Stopped HereEmpress CarrotNo ratings yet

- Outcrop's Editorial Board, The Satirical Article Did Not Contain The Professor's Name and Was NotDocument1 pageOutcrop's Editorial Board, The Satirical Article Did Not Contain The Professor's Name and Was NotEmpress CarrotNo ratings yet

- Bulacan Campus Journalists Decry Closure of School PaperDocument1 pageBulacan Campus Journalists Decry Closure of School PaperEmpress CarrotNo ratings yet

- Bulacan State UniversityDocument1 pageBulacan State UniversityEmpress CarrotNo ratings yet

- Working GirlDocument2 pagesWorking GirlEmpress CarrotNo ratings yet

- Wag The Dog - Reflection PaperDocument2 pagesWag The Dog - Reflection PaperEmpress CarrotNo ratings yet

- Case16 1 HospitalSupplyDocument1 pageCase16 1 HospitalSupplyChristine Joy RoxasNo ratings yet

- Voice SynthesisDocument3 pagesVoice SynthesisEmpress CarrotNo ratings yet

- NSTP2 Part 7 Emperor Story For Children FinaleDocument4 pagesNSTP2 Part 7 Emperor Story For Children FinaleEmpress CarrotNo ratings yet

- Understanding Prefixes and Suffixes in a StoryDocument2 pagesUnderstanding Prefixes and Suffixes in a StoryEmpress CarrotNo ratings yet

- Pronoun Lesson for Grade 4Document3 pagesPronoun Lesson for Grade 4Empress CarrotNo ratings yet

- NSTP2 Part 6 Story For ChildrenDocument2 pagesNSTP2 Part 6 Story For ChildrenEmpress CarrotNo ratings yet

- NSTP2 Part 7 Emperor Story For ChildrenDocument2 pagesNSTP2 Part 7 Emperor Story For ChildrenEmpress CarrotNo ratings yet

- Reading 1 - Monastic SpiritualityDocument7 pagesReading 1 - Monastic SpiritualityEmpress CarrotNo ratings yet

- Supplement To Reading 1 - A Hidden Gem in TodayDocument3 pagesSupplement To Reading 1 - A Hidden Gem in TodayEmpress CarrotNo ratings yet

- Supplement To Reading 1 - TranscendenceDocument2 pagesSupplement To Reading 1 - TranscendenceEmpress CarrotNo ratings yet

- Product Costing Analysis ReportDocument9 pagesProduct Costing Analysis ReportDeepti TripathiNo ratings yet

- ch22 (Pricing and Profitability Analysis)Document36 pagesch22 (Pricing and Profitability Analysis)Ogie WijayaNo ratings yet

- Marginal Cosing Practice ManualDocument18 pagesMarginal Cosing Practice ManualNimesh GoyalNo ratings yet

- Short-Term DecisionsDocument11 pagesShort-Term DecisionsHannahbea LindoNo ratings yet

- Production and Operational PlanDocument5 pagesProduction and Operational PlanKiwoolNo ratings yet

- Lyceum of The Philippines - Laguna: Assembly of Bundle Bytes: Tear and Share Flash Drive PackDocument52 pagesLyceum of The Philippines - Laguna: Assembly of Bundle Bytes: Tear and Share Flash Drive PackPY HipolitoNo ratings yet

- Accounting 202 Exam 1 Study Guide: Chapter 1: Managerial Accounting and Cost Concepts (12 Questions)Document4 pagesAccounting 202 Exam 1 Study Guide: Chapter 1: Managerial Accounting and Cost Concepts (12 Questions)zoedmoleNo ratings yet

- Cost Chapter 1-5Document302 pagesCost Chapter 1-5chingNo ratings yet

- Unit 6-1Document14 pagesUnit 6-1Abel ZegeyeNo ratings yet

- Absorption and Variable Costing MethodsDocument7 pagesAbsorption and Variable Costing MethodsJoneric RamosNo ratings yet

- F5-03 Relevant Cost AnalysisDocument24 pagesF5-03 Relevant Cost AnalysisBin SaadunNo ratings yet

- Cost Accounting FundamentalsDocument6 pagesCost Accounting FundamentalsLourdes Sabuero TampusNo ratings yet

- AB CA 20-1 Kuis - 4 PDFDocument1 pageAB CA 20-1 Kuis - 4 PDFYogie YaditraNo ratings yet

- Management Accounting 2021Document107 pagesManagement Accounting 2021JojoNo ratings yet

- TWO WHEELER REPAIR SERVICEDocument8 pagesTWO WHEELER REPAIR SERVICEparth sarthyNo ratings yet

- 01d MCQ and A Intro To Man Acc and Cost ConceptsDocument8 pages01d MCQ and A Intro To Man Acc and Cost ConceptsK Lam LamNo ratings yet

- Quiz Assignment 4 Costing ProblemsDocument2 pagesQuiz Assignment 4 Costing ProblemsRocel Domingo0% (1)

- Activity Based Costing PractiseDocument23 pagesActivity Based Costing PractiseAR KuvadiyaNo ratings yet

- The Bidii Plumbing and Electronics TradersDocument41 pagesThe Bidii Plumbing and Electronics TraderstajiricyberNo ratings yet

- Chapter 5 SummaryDocument6 pagesChapter 5 SummaryDiana Mark AndrewNo ratings yet

- Cost Accounting 15th Edition Horngren Solutions ManualDocument26 pagesCost Accounting 15th Edition Horngren Solutions ManualMelissaBakerijgd100% (61)

- Solution To Quiz 2Document4 pagesSolution To Quiz 2GianJoshuaDayritNo ratings yet

- Predetermined Overhead Rates, Flexible Budgets, And: True/FalseDocument52 pagesPredetermined Overhead Rates, Flexible Budgets, And: True/FalseJohnnoff BagacinaNo ratings yet

- Variable Costing and Segment Reporting: Tools For Management Reporting: Tools For ManagementDocument14 pagesVariable Costing and Segment Reporting: Tools For Management Reporting: Tools For Managementemadhamdy2002No ratings yet

- Chapter 7 Overheads CostDocument12 pagesChapter 7 Overheads CostFaina NaqviNo ratings yet

- Activity-Based Costing Analysis for Coffee ProductsDocument2 pagesActivity-Based Costing Analysis for Coffee ProductsRae Allen De Castro0% (1)

- Quiz CostDocument4 pagesQuiz CostMikee MellaNo ratings yet

- Workshop 6 AnsDocument5 pagesWorkshop 6 AnsSAMUEL THOMASNo ratings yet

- Factor Kappa (198058)Document16 pagesFactor Kappa (198058)fdorojrNo ratings yet

- True/False QuestionsDocument168 pagesTrue/False QuestionsLara FloresNo ratings yet