Professional Documents

Culture Documents

Module 3 - The Professional Standards

Uploaded by

MAG MAGOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 3 - The Professional Standards

Uploaded by

MAG MAGCopyright:

Available Formats

MODULE 3: THE PROFESSIONAL STANDARDS

I. Description

This module discusses on the professional standards governing the audit of the financial

statements.

II. Objectives

After completing the module, the students are expected to:

Define and comply with the standards

III. Duration

Start: Week 4

End: Week 4

IV. Learning Contents

A. GENERALLY ACCEPTED AUDITING STANDARDS (GAAS)

GAAS represent measures of the quality of the auditor’s performance. These standards

are the minimum standard of performance that auditors should follow.

1. General Standards (TIP)

a. Technical training and proficiency

The examination should be performed by person/s having adequate technical

training and proficiency as auditor.

b. Independence

In all matters relating to an engagement, independence in mental attitude is

to be maintained by an auditor.

c. Professional Care

Due professional care is to be exercised in the performance of audit and in

preparation of the report.

2. Standards of Fieldwork (PIE)

a. Planning

The work is to be adequately planned and assistants if any are to be properly

supervised.

b. Internal Control consideration

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 1

Desiree D. Cemefrania, CPA

Proper study and evaluation of existing internal control as a basis for the

reliance thereon and for the determination of the resultant extent of the tests

to which auditing procedures are to be restricted.

c. Evidential matter

Sufficient competent evidential matter is to be obtained through inspection,

observation, inquiries and confirmations to afford a reasonable basis for an

opinion regarding the financial statements under examination.

3. Standards of Reporting (GIDO)

a. Generally Accepted Accounting Principles (GAAP)

The report shall state whether the financial statements are presented in all

material respects with the GAAP.

b. Inconsistency

The report shall identify circumstances in which principles have not been

consistently observed in the current period in relation to the preceding report.

c. Disclosure

Informative disclosures are to be regarded adequate unless otherwise stated

in the report.

d. Opinion

The report shall contain an expression of the opinion regarding the financial

statements, taken as a whole, or an assertion to the effect that an opinion

cannot be expressed, the reasons should be stated.

B. PHILIPPINE STANDARDS ON AUDITING

Auditing and Assurance Standards Council (AASC)

The Auditing and Assurance Standards Council (AASC) was created in December 2005,

under the Philippine Accountancy Act of 2004, by the Professional Regulation

Commission upon the recommendation of the Board of Accountancy (BOA). The AASC

is tasked to assist the BOA to establish and promulgate auditing standards in the

Philippines.

The AASC replaced the Auditing Standards and Practices Council (ASPC), which was

previously responsible for the promulgation of auditing standards, practices and

procedures, considered as generally accepted auditing standards in the Philippines.

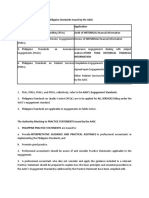

The AASC shall have 18 regular members with a term of three years, renewable for

another term, coming from the following:

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 2

Desiree D. Cemefrania, CPA

The structure of AASC pronouncements are as follows:

Framework for Assurance Engagements:

1. Audit – PHILIPPINE STANDARDS ON AUDITING (PSA)

2. Review

3. Other Assurance Engagements

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 3

Desiree D. Cemefrania, CPA

Related Services – Philippine Standards on Related Engagements

4. Agreed Upon Procedures

5. Compilation Services

The International Auditing and Assurance Standards Board (IAASB) is an independent

standard-setting body that serves the public interest by setting high-quality international

standards for auditing, quality control, review, other assurance, and related services, and by

facilitating the convergence of international and national standards. In doing so, the IAASB

enhances the quality and uniformity of practice throughout the world and strengthens public

confidence in the global auditing and assurance profession.

They were founded in March 1978 and were previously known as International Auditing

Practices Committee (IAPC). In 1991, the IAPC’s guidelines were recodified as International

Standards on Auditing (ISAs). In 2001, a comprehensive review of the IAPC was

undertaken, and in 2002, the IAPC was reconstituted as the International Auditing and

Assurance Standards Board (IAASB).

International Federation of Accountants (IFAC) a global organization for the accountancy

profession created the IAPC.

At present, AASC pronouncements are mainly adopted from the standards and practice

statements issued by the IAASB.

International Standards on Auditing (ISAs)

International Standards on Assurance Engagements (ISAEs)

International Standards on Review Engagements (ISREs)

International Standards on Related Services (ISRSs)

The AASC undertakes a review of the standards and practices statements issued by the

IAASB to determine if these can be adopted in the Philippines with or without changes, after

considering any local requirements imposed by the law or practice.

C. SYSTEM OF QUALITY CONTROL

Quality controls are policies and procedures adopted by CPAs to provide reasonable

assurance of conforming to professional standards in performing audit and related

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 4

Desiree D. Cemefrania, CPA

services. Quality Controls ensure that all members of the audit team perform the same

level of quality of work.

Under the Philippine Standards on Quality Control (PSQCs) 1 (Quality Controls for

Firms that Perform Audits and Reviews of Financial Statements, and Other Assurance

and Related Services Engagements) that:

A firm has an obligation to establish a system of quality control to provide reasonable

assurance that the firm and its personnel

comply with the professional standards and regulatory and legal requirements

that proper report issued by the firm are appropriate in the circumstances.

Elements of Quality Control Policies and Procedures

PSA 220 identified the following quality control policies that may serve as a guide to audit

firms in establishing their own system of quality control.

1. Leadership Responsibilities for Quality on Audits

The engagement partner shall take responsibility for the overall quality on each audit

engagement to which that partner is assigned.

The actions of the engagement partner and appropriate messages to the other

members of the engagement team, in taking responsibility for the overall quality on

each audit engagement, emphasize:

a. The importance to audit quality of performing work that complies with

professional standards and regulatory and legal requirements;

b. The importance to audit quality of complying with the firm’s quality control

policies and procedures as applicable;

c. The importance to audit quality of issuing auditor’s reports that are

appropriate in the circumstances

d. The importance to audit quality of the engagement team’s ability to raise

concerns without fear of reprisals

e. The fact that quality is essential in performing audit engagements.

2. Relevant Ethical Requirements

Throughout the audit engagement, the engagement partner shall remain alert,

through observation and making inquiries as necessary, for evidence of

noncompliance with relevant ethical requirements by members of the engagement

team. Such noncompliance should be documented and appropriate actions should

be determined.

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 5

Desiree D. Cemefrania, CPA

The Philippine Ethics Code establishes the fundamental principles of professional ethics,

which include:

a. Integrity

b. Objectivity;

c. Professional competence and due care;

d. Confidentiality; and

e. Professional behavior.

3. Independence

The engagement partner shall form a conclusion on compliance with independence

requirements that apply to the audit engagement. In doing so, the engagement

partner shall:

a. Obtain relevant information from the firm and, where applicable, network

firms, to identify and evaluate circumstances and relationships that create

threats to independence;

b. Evaluate information on identified breaches, if any, of the firm’s

independence policies and procedures to determine whether they create a

threat to independence for the audit engagement; and

c. Take appropriate action to eliminate such threats or reduce them to an

acceptable level by applying safeguards, or, if considered appropriate, to

withdraw from the audit engagement, where withdrawal is permitted by law or

regulation. The engagement partner shall promptly report to the firm any

inability to resolve the matter for appropriate action.

4. Acceptance and Continuance of Client Relationships and Audit Engagements

The engagement partner shall be satisfied that appropriate procedures regarding the

acceptance and continuance of client relationships and audit engagements have

been followed, and shall determine that conclusions reached in this regard are

appropriate.

If the engagement partner obtained information that would have caused the firm to

decline the audit engagement had that information been available earlier, the

engagement partner shall communicate that information promptly to the firm, so that

the firm and the engagement partner can take the necessary action

PSQC 1 (Redrafted) requires the firm to obtain information considered necessary in

the circumstances before accepting an engagement with a new client, when deciding

whether to continue an existing engagement, and when considering acceptance of a

new engagement with an existing client. Such information in determining the

conclusions are as follows:

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 6

Desiree D. Cemefrania, CPA

a. The integrity of the principal owners, key management and those charged with

governance of the entity;

b. Whether the engagement team is competent to perform the audit engagement

and has the necessary capabilities, including time and resources;

c. Whether the firm and the engagement team can comply with relevant ethical

requirements; and

d. Significant matters that have arisen during the current or previous audit

engagement, and their implications for continuing the relationship

5. Assignment of Engagement Teams

The engagement partner shall be satisfied that the engagement team, and any

auditor’s experts who are not part of the engagement team, collectively have the

appropriate competence and capabilities to:

a. Perform the audit engagement in accordance with professional standards and

regulatory and legal requirements; and

b. Enable an auditor’s report that is appropriate in the circumstances to be

issued.

The firm should establish policies and procedures on this matter. Such should

include, but are not limited:

a. Recruitment

b. Performance evaluation, compensation and promotion

c. Capabilities and competence

d. Career development

e. Assignment of engagement teams

6. Engagement Performance

The engagement partner shall take responsibility for:

a. The direction, supervision and performance of the audit engagement in

compliance with professional standards and regulatory and legal

requirements; and

Direction of the engagement team involves informing the members of the

engagement team of matters such as:

Their Responsibilities and the need to comply with relevant ethical

requirements

Objectives of the work to be performed

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 7

Desiree D. Cemefrania, CPA

The nature of the business

Risk-related issues

Problems that may arise

The detailed approach of the engagement

Discussion among members of the engagement team allows less experienced

members to raise questions with more experienced members so that appropriate

communication can occur within the engagement team. Appropriate teamwork

and training assist less experienced members of the engagement team to clearly

understand the objectives of the assigned work.

Supervision - The engagement partner should monitor the progress of the audit,

resolve audit issues and consider level of consultation appropriate for the

engagement.

The engagement partner shall take responsibility for reviews being performed in

accordance with the firm’s review policies and procedures.

Consultation - the firm should establish policies and procedures in encouraging

firm personnel to seek assistance from authoritative sources within or outside the

firm.

b. The auditor’s report being appropriate in the circumstances.

V. References

Auditing Theory by J. Salosagcol, Tiu and Hermosilla

Philippine Standards on Quality Control 1 (PSQC 1) - Quality Controls for Firms that

Perform Audits and Reviews of Financial Statements, and Other Assurance and

Related Services Engagements

ifac.org

aasc.org.ph

https://www.iaasb.org/

PSA 220 - QUALITY CONTROL FOR AN AUDIT OF FINANCIAL STATEMENTS

ACCTG 109 – AUDITING AND ASSURANCE PRINCIPLES 8

Desiree D. Cemefrania, CPA

You might also like

- Audit ReportsDocument64 pagesAudit ReportsNatali SanchezNo ratings yet

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- Software Developement Life CycleDocument21 pagesSoftware Developement Life CycleJAI THAPANo ratings yet

- (Roncal) at Midterms 2Document5 pages(Roncal) at Midterms 2Lorie RoncalNo ratings yet

- H3 Quality ControlDocument7 pagesH3 Quality ControlTrek ApostolNo ratings yet

- Module 5 - Audit Process, Accepting An EngagementDocument9 pagesModule 5 - Audit Process, Accepting An EngagementMAG MAGNo ratings yet

- Summary of Standards of AuditingDocument23 pagesSummary of Standards of AuditingMary Grace FajardoNo ratings yet

- FAM Reviewer by NANDocument86 pagesFAM Reviewer by NANshane natividadNo ratings yet

- Introduction To Financial Statement AuditDocument28 pagesIntroduction To Financial Statement AuditJnn CycNo ratings yet

- Chapter 5.0 HALAL INTERNAL AUDIT FACILITATIONDocument88 pagesChapter 5.0 HALAL INTERNAL AUDIT FACILITATIONprincess sabbyNo ratings yet

- Swot San Miguel CorporationDocument26 pagesSwot San Miguel CorporationMAG MAGNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Risk Based AuditDocument67 pagesRisk Based Auditkevin carmeloNo ratings yet

- Work Breakdown StructureDocument3 pagesWork Breakdown StructureEllie Annelle LazaroNo ratings yet

- Chapter 2-The Auditing ProfessionDocument53 pagesChapter 2-The Auditing Professionyebegashet100% (2)

- Script Elevator PitchDocument4 pagesScript Elevator PitchNoveliaNo ratings yet

- Quality of Work LifeDocument85 pagesQuality of Work Lifeparsh4u91% (11)

- QE Short QuestionsDocument5 pagesQE Short QuestionsPrashant27992No ratings yet

- Module 1.2 Introduction To AuditingDocument13 pagesModule 1.2 Introduction To AuditingMary Grace Dela CruzNo ratings yet

- IPA Institute-Integration of Turnarounds and Capital ProjectsDocument31 pagesIPA Institute-Integration of Turnarounds and Capital ProjectsLuiz EduardoNo ratings yet

- Auditing Theory: C. Both I and IIDocument8 pagesAuditing Theory: C. Both I and IIKIM RAGANo ratings yet

- The Professional StandardsDocument6 pagesThe Professional StandardsJBNo ratings yet

- Chapter 2 THE PROFESSIONAL STANDARDSDocument5 pagesChapter 2 THE PROFESSIONAL STANDARDSNicole Anne M. ManansalaNo ratings yet

- 5b. QUALITY CONTROL POLICIES AND PROCEDURESDocument6 pages5b. QUALITY CONTROL POLICIES AND PROCEDURESSumbul SammoNo ratings yet

- AT-9002 CparDocument6 pagesAT-9002 CparSirNo ratings yet

- The Professional Standards: Kalven Perry T. AgustinDocument23 pagesThe Professional Standards: Kalven Perry T. AgustinANGELA THEA BUENVENIDANo ratings yet

- Lesson 2 - The Professional StandardsDocument9 pagesLesson 2 - The Professional StandardsJoe P PokaranNo ratings yet

- WV&PE Lesson 2Document5 pagesWV&PE Lesson 2Daniel S. GonzalesNo ratings yet

- Module 3 Professional StandardDocument4 pagesModule 3 Professional StandardCharlize Natalie ReodicaNo ratings yet

- Module 2 - Audit, An OverviewDocument8 pagesModule 2 - Audit, An OverviewMAG MAGNo ratings yet

- PSA220Document3 pagesPSA220StephannieArreolaNo ratings yet

- Lesson 4 Professional StandardsDocument8 pagesLesson 4 Professional StandardsMark TaysonNo ratings yet

- Module 1Document8 pagesModule 1JayaAntolinAyusteNo ratings yet

- FAM Reviewer by NAN For Further EditDocument86 pagesFAM Reviewer by NAN For Further Editshane natividadNo ratings yet

- The Professional StandardsDocument1 pageThe Professional StandardsPau SantosNo ratings yet

- Auditing and Assurance Principles: Chapter Two: The Professional StandardsDocument25 pagesAuditing and Assurance Principles: Chapter Two: The Professional StandardsMark Domingo MendozaNo ratings yet

- Last Name Prelims Seatwork No. 1Document14 pagesLast Name Prelims Seatwork No. 1Shiela Marie GadayosNo ratings yet

- Chapter02 SMDocument4 pagesChapter02 SMDivashiniNo ratings yet

- Best Summary Notes of All The SADocument40 pagesBest Summary Notes of All The SAalpha bravoNo ratings yet

- Standards, Laws, and RegulationDocument35 pagesStandards, Laws, and RegulationKezNo ratings yet

- Auditing Theory Reviewer Part 1Document3 pagesAuditing Theory Reviewer Part 1Sheena ClataNo ratings yet

- Related Philippine Standards in Auditing (Psas) : November 16, 2020Document30 pagesRelated Philippine Standards in Auditing (Psas) : November 16, 2020Aki StephyNo ratings yet

- Seatwork For Professional Standards MCDocument5 pagesSeatwork For Professional Standards MCJoyce Ann CortezNo ratings yet

- Summary of Standards of AuditingDocument41 pagesSummary of Standards of AuditingKIM RODANo ratings yet

- BY A.Amogh: Summary of Standards of Auditing (Sa) Applicable For The Fy 2011-12Document32 pagesBY A.Amogh: Summary of Standards of Auditing (Sa) Applicable For The Fy 2011-12V.Naveen kumarNo ratings yet

- DYBSAAap313 - Auditing & Assurance Principles (MIDTERM MODULE)Document24 pagesDYBSAAap313 - Auditing & Assurance Principles (MIDTERM MODULE)Jonnafe Almendralejo IntanoNo ratings yet

- Auditing Arens CH 2Document5 pagesAuditing Arens CH 2John Rey Batandolo ManatadNo ratings yet

- Summary of Standards of Auditing (SA) Issued by Institute of Chartered Accountants of IndiaDocument43 pagesSummary of Standards of Auditing (SA) Issued by Institute of Chartered Accountants of IndiaParthasarathi MishraNo ratings yet

- Acaud NotesDocument41 pagesAcaud NotesAltessa Lyn ContigaNo ratings yet

- Audit Process - Risk Assesment Kel 4Document33 pagesAudit Process - Risk Assesment Kel 4MylaNo ratings yet

- Espinoza, Audit Quiz 1Document5 pagesEspinoza, Audit Quiz 1Daenielle EspinozaNo ratings yet

- Ac19 Module 4 - DGCDocument19 pagesAc19 Module 4 - DGCMaricar PinedaNo ratings yet

- Session 2 For SBAC2B AUDITING AND ASSURANCE PRINCIPLESDocument43 pagesSession 2 For SBAC2B AUDITING AND ASSURANCE PRINCIPLESagent2100100% (1)

- CHAPTER 4 - Quality ControlDocument10 pagesCHAPTER 4 - Quality ControlLaura CarverNo ratings yet

- C. A System of Quality ControlsDocument11 pagesC. A System of Quality ControlsMC ExtNo ratings yet

- Chapter TwoDocument38 pagesChapter TwoGemechu GuduNo ratings yet

- Montalbo, Klouie C. Philippine Standard On Quality Control ScopeDocument14 pagesMontalbo, Klouie C. Philippine Standard On Quality Control ScopeKlo MonNo ratings yet

- Module 001 Overview of The Risk-Based AuditDocument12 pagesModule 001 Overview of The Risk-Based AuditCherwin bentulan100% (1)

- Molar, Ela GDocument28 pagesMolar, Ela GEla Gloria MolarNo ratings yet

- Auditing Reviewer 3Document3 pagesAuditing Reviewer 3Sheena ClataNo ratings yet

- Auditing in CIS Environment: Chool of Usiness and CcountancyDocument6 pagesAuditing in CIS Environment: Chool of Usiness and Ccountancycha11No ratings yet

- PSBA - GAAS and System of Quality ControlDocument10 pagesPSBA - GAAS and System of Quality ControlephraimNo ratings yet

- Unit II Professioinal StandardsDocument14 pagesUnit II Professioinal StandardsMark GerwinNo ratings yet

- Chapter 1 Assurance Services, Auditing and Related ServicesDocument9 pagesChapter 1 Assurance Services, Auditing and Related ServicesSteffany RoqueNo ratings yet

- AuditmidtermsDocument26 pagesAuditmidtermsLana sereneNo ratings yet

- Gaap PDFDocument4 pagesGaap PDFY.h. TariqNo ratings yet

- AT 02 Intro To AuditingDocument5 pagesAT 02 Intro To AuditingPrincess Mary Joy LadagaNo ratings yet

- Chapter 2 - Pre1Document21 pagesChapter 2 - Pre1MAG MAGNo ratings yet

- Consideration of Internal ControlDocument10 pagesConsideration of Internal ControlMAG MAGNo ratings yet

- Objectives: Measures of Correlation and Regression AnalysisDocument16 pagesObjectives: Measures of Correlation and Regression AnalysisMAG MAGNo ratings yet

- Independe NT T-Test: - The Independent T-Test Compares Two Means Have Come From Different GroupsDocument23 pagesIndepende NT T-Test: - The Independent T-Test Compares Two Means Have Come From Different GroupsMAG MAGNo ratings yet

- Chapter 9 Audit SamplingDocument17 pagesChapter 9 Audit SamplingMAG MAGNo ratings yet

- Nego Quiz 1Document3 pagesNego Quiz 1MAG MAGNo ratings yet

- Assignment in Internal ControlDocument2 pagesAssignment in Internal ControlMAG MAGNo ratings yet

- MidtermDocument11 pagesMidtermMAG MAGNo ratings yet

- Chapter - 1Document5 pagesChapter - 1MAG MAGNo ratings yet

- Strama Strategic Plangroup 5Document28 pagesStrama Strategic Plangroup 5MAG MAGNo ratings yet

- Module 4 - Auditor's ResponsibilityDocument28 pagesModule 4 - Auditor's ResponsibilityMAG MAG100% (1)

- Module 4 - Auditors ResponsibilityDocument10 pagesModule 4 - Auditors ResponsibilityMAG MAGNo ratings yet

- Module 6 - Audit PlanningDocument15 pagesModule 6 - Audit PlanningMAG MAGNo ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Digital Mckinsey: LeadershipDocument2 pagesDigital Mckinsey: LeadershipGiovanni AmansureNo ratings yet

- 1.5 Extreme ProgrammingDocument12 pages1.5 Extreme ProgrammingMohamed BilalNo ratings yet

- Assignment On Sarbanes Oaxley Act 10Document5 pagesAssignment On Sarbanes Oaxley Act 10Haris MunirNo ratings yet

- New Resume 1040Document2 pagesNew Resume 1040Jaya SinghNo ratings yet

- PM ASSIGNMENT (Group-6)Document6 pagesPM ASSIGNMENT (Group-6)Roop NarayanNo ratings yet

- Chapter One EnterpreneurshipDocument20 pagesChapter One EnterpreneurshipSomanath BilihalNo ratings yet

- Case Chapter 8Document11 pagesCase Chapter 8jeremyNo ratings yet

- Co Cs Genl Updts Signed Bse Nse Filing Dt190523Document28 pagesCo Cs Genl Updts Signed Bse Nse Filing Dt190523akashNo ratings yet

- DAQ PackagingDocument15 pagesDAQ PackagingPavan SamudralaNo ratings yet

- Hira's Project Front PageDocument9 pagesHira's Project Front PageJehan MahmudNo ratings yet

- CT SS For Student Apr2019Document5 pagesCT SS For Student Apr2019Nabila RosmizaNo ratings yet

- SAP TCodeDocument2 pagesSAP TCodeAman Singh KauravNo ratings yet

- Concept Inventory ControlDocument6 pagesConcept Inventory ControlSabir AliNo ratings yet

- Dell Case StudyDocument4 pagesDell Case StudyRashik AnzumNo ratings yet

- Improving Performance of District MGT Teams in Tanzania Aug2016 Ada PDFDocument40 pagesImproving Performance of District MGT Teams in Tanzania Aug2016 Ada PDFtapales jamesNo ratings yet

- Diagram ADocument1 pageDiagram ARosendo RizoNo ratings yet

- CV TemplateDocument2 pagesCV TemplateKamran AhmadXaiNo ratings yet

- Implementation Plan For Third Party Logistics Providers (3Pls)Document2 pagesImplementation Plan For Third Party Logistics Providers (3Pls)Robby Setiabudi TjangNo ratings yet

- IT Governance On One Page Peter Weill Jeanne W. RossDocument18 pagesIT Governance On One Page Peter Weill Jeanne W. RossDouglas SouzaNo ratings yet

- Methods To Initiate Ventures From Idea To ActionDocument2 pagesMethods To Initiate Ventures From Idea To ActionEC Virtual DeskNo ratings yet

- Job Vacancy - Rusumo - Power - CompanyDocument3 pagesJob Vacancy - Rusumo - Power - CompanyRashid BumarwaNo ratings yet

- Fostering A Culture of Innovation: The Role of Leadership: Jaideep Prabhu October 2018Document90 pagesFostering A Culture of Innovation: The Role of Leadership: Jaideep Prabhu October 2018shanikaNo ratings yet

- Final HRM Project Sem 2Document47 pagesFinal HRM Project Sem 2Anita HatnolkarNo ratings yet

- The Digital FirmDocument4 pagesThe Digital FirmeldociNo ratings yet