Professional Documents

Culture Documents

X 100 Price of Basket Goods & Services in Current Year Price of Basket in Base Year

Uploaded by

rez dianne evidaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

X 100 Price of Basket Goods & Services in Current Year Price of Basket in Base Year

Uploaded by

rez dianne evidaCopyright:

Available Formats

1ST PILLAR: PRICE STABILITY we compute for the consumer price index

(Through the conduct of monetary policy) and those are included in the standard

basket of goods and services we consume.

The BSP’s primary mandate is to maintain price

stability conducive to a balanced and sustainable Inflation Rate

economic growth of the Philippine economy. - Annual percentage change in consumer

price index

- When you talk about price stability, BSP

must make sure that prices are stable. What Inflation

happens if there is no price stability? With - Sustained/continuous increase in the

the same amount of money that you have average prices of goods and services

today is no longer the same 10 years ago typically purchased by consumers

because of inflation. Meaning to say, you - We say ‘continuous” because the increase

will be able to buy fewer goods or services must be sustained. It’s not only for a day or

with your money today than 5 years or 10 a week, but it’s continuous.

years ago.

What is PRICE STABILITY?

HOW THE CONSUMER PRICE INDEX IS

- price stability when the general price level of

CALCULATED

goods and services moves at a low and

- It’s the responsibility of the PSA (Philippines

predictable rate thereby maintaining the

Statistics Authority) to compute for the

value of our Philippine Peso. When the

Consumer Price Index. It was used to be

prices increase unpredictably, our money

NSO (National Statistics Office) but now the

will no longer buy the same quantity of

agency is called the PSA.

goods and services.

- refers to low and stable inflation

5 Steps That PSA Follows in Computing CPI:

- preserves purchasing power

1. Fix the basket

- If there is a continuous increase in the - prices that are most important to the typical

prices of goods and services, then we tend Filipino family are determined. If more

to become poorer. We will not be able to hotdogs are bought than hamburgers, then

buy the same quantity of goods or services the price of hotdogs is more important than

with the same amount of money that we the price of hamburgers.

have today and 5 or 10 years ago. 2. Fix the price

- It is the responsibility of the BSP through - find the prices of each of the goods and

the conduct of monetary policy to ensure services in the basket at each point in time.

that prices are stable. 3. Compute the basket’s cost

4. Choose a base year and compute the index

HOW ARE PRICES MEASURED?

CONSUMER PRICE INDEX FORMULA

Consumer Price Index Price of basket goods & services in current year

x 100

- Represents the average price of a standard Price of basket in base year

CPI =

basket of goods and services consumed by

a typical Filipino family for a given period.

- When we talk about the expenses, what do

we consume every month? Those are food

INFLATION RATE FORMULA

and rent, we avail the services of the CPI in year 2 – CPI in year 1

x 100

transportation (we commute), education is CPI in year 1

Inflation Rate =

part of the basket, electric and water bills.

These are the things that we consider when

pesos, the inflation rate in Year 3 is 9.1% so there

CALCULATING CONSUMER PRICE INDEX AND is a decrease.

INFLATION RATE: AN EXAMPLE

- Prices increased but inflation slowed down

- This table shows how to calculate the CPI - But consumers will usually fixate on the rise

and Inflation Rate for a hypothetical in prices rather than on the slowdown in

economy in which consumers buy only inflation.

hotdogs and hamburgers.

HOW ARE PRICES DETERMINED?

- Prices are determined by the interaction of

Supply and Demand

- When Demand falls and supply rises, price

falls

- When Demand rises, Supply falls, price

rises

- In determining the price, why price will

increase and decrease, we have to know

the different factors that affect the demand

PRICE LEVEL vs INFLATION and supply.

- The only factor that affects quantity

YEAR 1 YEAR 2 YEAR 3

demanded is the price of the goods itself.

Price Level P100 P110 P120

Increase in prices P10 P10 Ex: the price of gasoline per liter will

Inflation (rate of increases in prices) 10.0% 9.1% increase. The quantity that buyers will

purchase will going to decrease during a

There is a 10% increase in year 2. In year 3 it’s given period of time at a particular price.

already 120 pesos so the difference is 10 pesos. - With the same amount of money, holding all

But it doesn’t mean that 10% also is the increase. things the same (Ceteris paribus), you can

So how did we compute the 9.1%? no longer buy the same quantity of gasoline

**120-110/110 x 100** per liter with the same amount of money

now that prices increase

The inflation rate here is lower. You will notice that - If income will increase, demand for some

the increase in prices is the same, which is 10 goods will increase but not the demand for

pesos. But it doesn’t mean that 10% is the inflation all goods. Normal goods vs Inferior goods

rate. From 100 pesos to 110 pesos, the inflation - But there are several factors that affects

rate in Year 2 is 10%. But from 110 pesos to 120 demand.

- Quantity demanded is the amount of deducted with expenses. That will be

goods and services that buyers are willing your basis on how much you will be

and able to buy at a particular price during a spending for the month. At low

period of time prices savings and investments are

- Demand is the willingness and the ability of encourages

buyers to purchase goods or services at a Greater productive activities are promoted

particular price during a period of time Job opportunities are increased

Purchasing power specially of the poor is

preserved

WHY IS IT IMPORTANT TO KEEP INFLATION

Price stability enables consumers and firms to

LOW AND STABLE?

effectively decide on economic and financial

- price stability is felt if inflation is low and matters. If inflation is not kept at a minimum, there

stable. Keeping inflation low and stable is will be a tremendous increase in prices of goods

the primary goal of the BSP. This promotes and services. We become poorer and poorer as our

economic efficiency thereby improving the money will not allow us to buy enough goods and

well-being of the Filipino people. There are services.

a number of benefits of price stability

Preventing erratic changes in the inflation rate has HOW DOES THE BSP KEEP INFLATION LOW

several benefits: AND STABLE?

It enables households and firms to make - It is the BSP’s task to ensure that Money

better and informed decisions on Supply is neither too much nor too little.

consumption, investment, savings and

production Too Much Money Too Little Money

Higher inflation Deflation

When prices are stable, manufacturers are

Increased Demand for Reduced Demand for

protected against the increase in the prices Goods & Services Goods & Services

of raw materials. manufacturers can Productive and

therefore price their products at a Prices are Pushed

Economic Activities are

Upward

competitive price or at a price cheaper than Reduced

competitors. When people save more, more

funds are available for loans and greater - If there is too much money, inflation will

productive activities are promoted which will tend to increase

result to more job opportunities. This in turn - If there is too little money, there will be

will allow more Filipinos to get employed deflation

allowing them to have money to buy and - Inflation is not bad at all if production will

increase

satisfy their needs and wants.

- One of the reasons why that price will

Price stability preserves the value of our

increase because there are too few goods

money. If the value of our money is available while there is too much money in

preserved, we can buy the same amount of circulation.

goods and services with the same amount - Money has a price or cost as expressed in

of money. the interest rate.

Price stability is important in order to keep

With managed inflation,

a higher level of savings and investments is the purchasing power of our peso stable.

encouraged Ideally, inflation must be kept at 2%. The

- Because when you are working, take higher the inflation rate the more dramatic is

home pay, is different from your its impact on prices.

gross pay. What is left is your take Recipients of fixed income like

home pay after your gross pay is salaries/wages, pensions and social

benefits (PPPP) are the groups particularly after. If he paid you only 6% interest, your

hard hit by inflation as often because these income was not even big enough to cover

forms of income do not go up for a while the more than 10% increase in prices.

despite inflation.

The outcome of this is that because of rising Inflation gainers include speculators, people

prices, people can afford to buy less and of flexible income, and debtors. Speculators

less for their money. High inflation hurt consist of luck or skilled individuals who are

savers too. Their investments progressively able to buy the goods that enjoy the

lose buying power. For example, money sharpest price increases. Among these

saved in several years for retirement might goods are land, house, gold, jewelry, etc.

not be enough to live on. People of flexible income are those which

are able to increase their income faster than

There are inflation losers and inflation the inflation rate. Usually, people in this

gainers. Those people with fixed incomes group have a monopoly situation or have

are losers during inflationary situation. market power that enables them to "get

Among the fixed income earners are the away" with increasing their prices faster

retirees who are living on pensions because than the average. These usually are the

unless some adjustments are provided entrepreneurs, property owners, managers,

during times of inflation, they will surely etc. The debtors or borrowers gain during

suffer from inflation. It is only during the inflation because they need to pay off their

presidency of Rodrigo Duterte that benefits loans and interest in less-valued money.

from SSS have increased by P2000.00. The longer the term of the loan, the higher

Also, fixed salaried employees such as the gain. That is why those who built houses

government employees, teachers, industrial 10 years or more ago gained considerably

workers, etc. are also inflation losers. In because their housing loans were charged

Silliman University for example, teachers do very low interest than today.

not receive salary increase unless the

members of the Silliman University Faculty

Association (SUFA) demand for salary Two types of inflation

increase.

It is a fact that the CBA (Collective 1. Demand-Pull Inflation - Inflation is said to

Bargaining Agreement) of 2018 has not yet be of Demand-Pull variety when buyers of

been settled. It is a sad fact that members goods and services (households, firms,

of SUFA have no salary increase since government, and foreigners) desire to

2018. Another group that suffered during purchase quantities of output greater than

inflation are the creditors or savers. They what our economy can produce. In

lose during inflation because they will economics, this is called a state of excess

receive less-valued fixed amount of interest aggregate demand.

and principal. For example, if you lent

P10,000 to a friend in December 2019 2. Cost-Push Inflation - the continued

payable in December 2020, the 10,000 you increase in some costs of production (labor,

would get in 2020 could have allowed you to raw materials, profits). An increase in any of

purchase P9,000 worth of goods and these factors of production would cause an

services in earlier years. Your borrower increase in prices of goods and services

actually realized a profit from the transaction and a reduction in output and employment.

because in 2019 he was able to buy more This ability of certain factors of production to

goods and services from the money he increase prices can be attributed to

borrowed than what you could have bought monopolistic powers of firms (profits),

with the amount he paid back to you a year

external suppliers (raw materials) and checks. That includes your notes and coins,

unions (wages). and traveler’s check

M2 or Broad Money – consists of M1 +

peso savings deposits and time or term

BSP is able to address demand-pull inflation thru

deposits

Monetary Policy (will be discussed later) but it

M3 or Broad Money Liabilities – consists

cannot solve cost-push inflation which needs non-

of M2 + peso deposit substitutes such as

monetary measures such as lowering down prices

promissory notes, commercial papers and

of raw materials and bringing down the cost of

government securities.

business.

M4 or Near Money –consists of M3 +

Deflation is also harmful to the economy. Although transferable and other deposits in foreign

people can buy more when prices fall on the currency.

average, a general decline in prices also has a

negative effect. POSSIBILE EFFECTS OF CHANGES IN MONEY

- It means that businesses make less profit or SUPPLY

maybe incur a loss. Some will even lay-off

employees. The people who have lost their

jobs can no longer afford to buy as much as

before and downward pressure on prices

continues to build up.

- Furthermore, people delay buying decisions

or postpone their purchases because they

are hoping that prices will drop even further

(meaning decrease in sales).

- This create a dangerous downward spiral of

profits and investments, tax revenues fall,

the debt burden increases, the government

spends more on social benefits and less

capital is invested.

-

Price stability is also important for companies' DEFINITION OF TERMS

planning as it allows them to identify price Market Interest Rate – is the prevailing

fluctuations of individual goods. They can more interest rate offered on cash deposits that is

precisely assess supply and demand and set driven by factors such as BSP interest

production and investment accordingly. rates, the duration of the deposits, and the

size of the deposits.

Real Interest Rate – is the rate of interest an

HOW DOES BSP KEEP INFLATION LOW AND investor, saver or lender receives after

STABLE? allowing for inflation adjustment or nominal

- The BSP maintains stable prices by interest rate minus inflation rate.

influencing the cost or volume of money

Real Interest Rate = Nominal Interest Rate – Inflation Rate

circulating in the economy (Money Supply).

Money Supply consists of: Nominal Interest Rate – is the interest rate

M1 or Narrow Money – consists of before taking inflation into account.

currency in circulation (or currency outside

Nominal Interest Rate – Interest Rate + Inflation Rate

depository corporations), peso demand

deposits or checkable deposits, traveler’s

You might also like

- Economics for CFA level 1 in just one week: CFA level 1, #4From EverandEconomics for CFA level 1 in just one week: CFA level 1, #4Rating: 4.5 out of 5 stars4.5/5 (2)

- Accounting Policy Procedure ManualDocument40 pagesAccounting Policy Procedure ManualImee100% (4)

- IB Economics - Microeconomics NotesDocument15 pagesIB Economics - Microeconomics NotesMICHELLE KARTIKA HS STUDENT100% (1)

- The Toroidal Economy-2Document18 pagesThe Toroidal Economy-2Cam Beers100% (1)

- Consumer Surplus:: at K Chabveka Economics NotesDocument28 pagesConsumer Surplus:: at K Chabveka Economics NotesShawn DzingayiNo ratings yet

- Economics Explorer 2 InflationDocument20 pagesEconomics Explorer 2 InflationCecilia Elizabeth100% (1)

- The Cost of Living: The Consumer Price Index andDocument21 pagesThe Cost of Living: The Consumer Price Index andWan Nursyafiqah Wan RusliNo ratings yet

- Buisness Plan: Bahria UniversityDocument18 pagesBuisness Plan: Bahria UniversityMehwish AbbasNo ratings yet

- Cost Benefit Analysis AllDocument17 pagesCost Benefit Analysis AllmohamedhudaifNo ratings yet

- Applied Economics Chapter 2-3Document6 pagesApplied Economics Chapter 2-3Joan Mae Angot - Villegas100% (1)

- Lecture 4 Notes Econ1020Document10 pagesLecture 4 Notes Econ1020Farah Abdel AzizNo ratings yet

- Chapter 11Document16 pagesChapter 11frozenstreetcollectivebdNo ratings yet

- Final Paper PDFDocument25 pagesFinal Paper PDFRuth SyNo ratings yet

- What is Inflation? Understanding Causes, Effects and Measures to Curb InflationDocument19 pagesWhat is Inflation? Understanding Causes, Effects and Measures to Curb InflationZusane Dian TabladaNo ratings yet

- Applied Economics PrelimDocument8 pagesApplied Economics PrelimRylyn IsabelNo ratings yet

- PED!Document6 pagesPED!Sparsh BothraNo ratings yet

- WhereDocument3 pagesWhereRexi Chynna Maning - AlcalaNo ratings yet

- Managerial Economics Lesson 2Document2 pagesManagerial Economics Lesson 2Seth F. DonatoNo ratings yet

- Macro ReviewerDocument6 pagesMacro Reviewerbeavalencia20No ratings yet

- InflationDocument3 pagesInflationSherika Milky StevensNo ratings yet

- Economics Lesson 14-Measuring InflationDocument26 pagesEconomics Lesson 14-Measuring InflationBecky GalanoNo ratings yet

- 2 Price Elasticity of DemandDocument6 pages2 Price Elasticity of DemandProwess ChiromboNo ratings yet

- Inflation: Why A Dollar Is Not Worth A Dollar Any MoreDocument29 pagesInflation: Why A Dollar Is Not Worth A Dollar Any MoreHelen WillsNo ratings yet

- Cost of LivingDocument4 pagesCost of LivingDhruv ThakkarNo ratings yet

- Taste AND PreferencesDocument5 pagesTaste AND PreferencesPauline BiancaNo ratings yet

- Political Examen 3-5Document5 pagesPolitical Examen 3-5Felicitas MNo ratings yet

- Script in ReportingDocument3 pagesScript in Reportingvevien abarcaNo ratings yet

- ECO G12&13 Notes 05 InflationDocument8 pagesECO G12&13 Notes 05 InflationtobaronNo ratings yet

- Inflation: Prices On The RiseDocument1 pageInflation: Prices On The RiseMicheleFontanaNo ratings yet

- Economics Duran and LachicaDocument1 pageEconomics Duran and LachicaAaron Daniel DuranNo ratings yet

- Before Revision - Theme 2 Economic Growth and InflationDocument3 pagesBefore Revision - Theme 2 Economic Growth and InflationUrvi BhudiaNo ratings yet

- Summary Chapter 4Document5 pagesSummary Chapter 4Lalit SoniNo ratings yet

- Econ Review ProjectDocument5 pagesEcon Review ProjectNing GuangNo ratings yet

- Pricing Decisions and Target CostingDocument52 pagesPricing Decisions and Target CostingIman Nessa100% (1)

- INTERMEDIATE MACROECONOMICS NOTESDocument22 pagesINTERMEDIATE MACROECONOMICS NOTESYande ZuluNo ratings yet

- Macroeconomics: Lecture 11: Inflation-Effects & Corrective MeasuresDocument11 pagesMacroeconomics: Lecture 11: Inflation-Effects & Corrective MeasuresBakchodi NhiNo ratings yet

- Macroeconomics Lecture 11: Inflation Effects & Corrective MeasuresDocument11 pagesMacroeconomics Lecture 11: Inflation Effects & Corrective MeasuresBakchodi NhiNo ratings yet

- Macroeconomics Study of Overall Economy Output Price LevelDocument6 pagesMacroeconomics Study of Overall Economy Output Price LevelchanyeolololNo ratings yet

- Market Forces 1Document27 pagesMarket Forces 1Andrea Marie CalmaNo ratings yet

- Unit 6Document15 pagesUnit 6openedwithedgeNo ratings yet

- Chapter Summary: 21.1 Business CycleDocument6 pagesChapter Summary: 21.1 Business CycleAntoniaNo ratings yet

- Stu-Tutorial 9 - NewDocument13 pagesStu-Tutorial 9 - Newnguyendat03042004No ratings yet

- Basic Microeconomics Context Diminishing ReturnsDocument6 pagesBasic Microeconomics Context Diminishing ReturnsBryant Daniel Arguelles GacusNo ratings yet

- Principle of Economics Notes of Inflation and Price Index (Chapter 6)Document4 pagesPrinciple of Economics Notes of Inflation and Price Index (Chapter 6)ng boon janeNo ratings yet

- Compilation in Aplied EconomicsDocument11 pagesCompilation in Aplied EconomicsSha BasaNo ratings yet

- Applied Economics Module4Document24 pagesApplied Economics Module4Janice Arlos SevetseNo ratings yet

- Microeconomics Chapter 2 5Document13 pagesMicroeconomics Chapter 2 5Shesheng ComendadorNo ratings yet

- Chapter 2.1 SupplyandDemand - #2Document9 pagesChapter 2.1 SupplyandDemand - #2Mark Ogie PasionNo ratings yet

- GDP Deflator Nominal GDP Real GDP 100: CPI in Year 2 CPI in Year 1 Inflation Rate in Year 2 100 CPI in Year 1Document2 pagesGDP Deflator Nominal GDP Real GDP 100: CPI in Year 2 CPI in Year 1 Inflation Rate in Year 2 100 CPI in Year 1andyNo ratings yet

- Inflation: - Change in Price/original Price X 100%Document2 pagesInflation: - Change in Price/original Price X 100%minhaxxNo ratings yet

- A.E Second GradingDocument12 pagesA.E Second GradingJereline OlivarNo ratings yet

- Inflation & The Cost of Living: T P T Is CalculatedDocument6 pagesInflation & The Cost of Living: T P T Is CalculatedAbhinay SaiNo ratings yet

- InflationDocument11 pagesInflationAnup AgarwalNo ratings yet

- Becc-134 emDocument32 pagesBecc-134 emnavneetNo ratings yet

- InflationDocument3 pagesInflationbrazzaq_2No ratings yet

- Comprehensive Outline For Economic Concepts and TheoryDocument9 pagesComprehensive Outline For Economic Concepts and TheorycerapyaNo ratings yet

- ECO 415 Chapter 2 Demand and SupplyDocument39 pagesECO 415 Chapter 2 Demand and SupplyMuhammad TarmiziNo ratings yet

- EC205 - Handout - 2 - Elasticities - and - Revenue ANSDocument6 pagesEC205 - Handout - 2 - Elasticities - and - Revenue ANSMumtaj MNo ratings yet

- Measuring Cost of Living Index and Inflation RatesDocument21 pagesMeasuring Cost of Living Index and Inflation RatesHardip MaradiaNo ratings yet

- Economics BYJU Notes PDFDocument66 pagesEconomics BYJU Notes PDFManoj Kumar100% (1)

- Applied Econ FinalsDocument5 pagesApplied Econ FinalsKrysha FloresNo ratings yet

- PriceIndices ISDA PDFDocument23 pagesPriceIndices ISDA PDFmazamniaziNo ratings yet

- Real Vs Nominal - (Gross National Product)Document1 pageReal Vs Nominal - (Gross National Product)Mohammad MujahidNo ratings yet

- APPLIED ECON WEEK 1 4THDocument4 pagesAPPLIED ECON WEEK 1 4THjgpanizales03No ratings yet

- 2 Pillar: Financial Stability (Through Banking Supervision and Regulation)Document7 pages2 Pillar: Financial Stability (Through Banking Supervision and Regulation)rez dianne evidaNo ratings yet

- Understanding Organizational Behavior and Its Key ConceptsDocument3 pagesUnderstanding Organizational Behavior and Its Key Conceptsrez dianne evidaNo ratings yet

- International Business - Chapter 1 and 2Document12 pagesInternational Business - Chapter 1 and 2rez dianne evidaNo ratings yet

- HBO Chapter 2 NotesDocument3 pagesHBO Chapter 2 Notesrez dianne evidaNo ratings yet

- Traditional Games in The PhilippinesDocument13 pagesTraditional Games in The Philippinesrez dianne evidaNo ratings yet

- Psycholometrician NewsDocument2 pagesPsycholometrician Newsrez dianne evidaNo ratings yet

- Happy New Year, With A Sad Tone. in The Morning, The Doctor Claimed That There Was A Miracle. AllDocument1 pageHappy New Year, With A Sad Tone. in The Morning, The Doctor Claimed That There Was A Miracle. Allrez dianne evidaNo ratings yet

- FAR1 ASN01 Balance Sheet and Income Statement PDFDocument1 pageFAR1 ASN01 Balance Sheet and Income Statement PDFira concepcionNo ratings yet

- Ch.7 FinanceDocument18 pagesCh.7 FinanceJohnCharles ShawNo ratings yet

- Original For Recipient: SHIPMENT NO: DI101642751Document1 pageOriginal For Recipient: SHIPMENT NO: DI101642751Shah BrothersNo ratings yet

- Managerial Report On WaltonDocument15 pagesManagerial Report On WaltonSalauddin SifatNo ratings yet

- CHPT 7 in Class ExercisesDocument3 pagesCHPT 7 in Class ExercisesKaran Pahwa0% (1)

- Economic EssayDocument2 pagesEconomic EssayPasinda PiyumalNo ratings yet

- Dokumen - Tips - 12 Factory Overhead Planned Actual AppliedDocument13 pagesDokumen - Tips - 12 Factory Overhead Planned Actual AppliedDenny Kridex OmolonNo ratings yet

- Patanjali Dant KantiDocument21 pagesPatanjali Dant KantisonaalNo ratings yet

- What Is GDP and Why Is It So Important To Economists and InvestorsDocument2 pagesWhat Is GDP and Why Is It So Important To Economists and InvestorsDomshell CahilesNo ratings yet

- Retail SupplyDocument14 pagesRetail Supplylaikhan_marketerNo ratings yet

- FL Sprinter Brochure 2012Document26 pagesFL Sprinter Brochure 2012amos_evaNo ratings yet

- AP Microeconomics: Free-Response Questions Set 1Document4 pagesAP Microeconomics: Free-Response Questions Set 1KayNo ratings yet

- Assignment CFM (RUCHIT GUPTA) PDFDocument11 pagesAssignment CFM (RUCHIT GUPTA) PDFruchit gupta50% (2)

- Nepal Plastic Pvt Ltd price list under 40 charactersDocument4 pagesNepal Plastic Pvt Ltd price list under 40 charactersbuntyNo ratings yet

- Why CommunismDocument47 pagesWhy CommunismAva SchneiderNo ratings yet

- FIM-Module V-Foreign Exchange Market and The International Financial SystemDocument23 pagesFIM-Module V-Foreign Exchange Market and The International Financial SystemAmarendra Pattnaik0% (1)

- MCS 035 NotesDocument7 pagesMCS 035 NotesAshikNo ratings yet

- Republic Act 8479 IrrDocument27 pagesRepublic Act 8479 IrrcelinekdeguzmanNo ratings yet

- PercentagesDocument4 pagesPercentagesjacknotfound78No ratings yet

- Ch. 18: Elasticity: Del Mar College John DalyDocument24 pagesCh. 18: Elasticity: Del Mar College John DalyManthan PatelNo ratings yet

- Group Assignment AccountingDocument3 pagesGroup Assignment Accountingkow kai lynnNo ratings yet

- Notes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Document21 pagesNotes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Aayushi AroraNo ratings yet

- Understanding Demand, Supply and EquilibriumDocument5 pagesUnderstanding Demand, Supply and EquilibriumKiarra Nicel De TorresNo ratings yet

- Deco504 Statistical Methods in Economics EnglishDocument397 pagesDeco504 Statistical Methods in Economics EnglishBipasha TalukdarNo ratings yet

- Monopoly: Prepared By: Jamal HuseinDocument26 pagesMonopoly: Prepared By: Jamal Huseinsaad_hjNo ratings yet

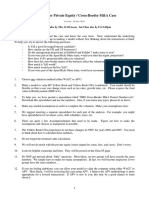

- Questions For Private Equity / Cross-Border M&A Case: Thu Class Due by Thu 12:00 Noon Sat Class Due by Fri 9:00pmDocument2 pagesQuestions For Private Equity / Cross-Border M&A Case: Thu Class Due by Thu 12:00 Noon Sat Class Due by Fri 9:00pmvencentNo ratings yet