Professional Documents

Culture Documents

Respectivetyi (A) (B) (D) : Rrrr"rtluli

Respectivetyi (A) (B) (D) : Rrrr"rtluli

Uploaded by

S M Thouhiqul Islam0 ratings0% found this document useful (0 votes)

1 views1 pageOriginal Title

NI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views1 pageRespectivetyi (A) (B) (D) : Rrrr"rtluli

Respectivetyi (A) (B) (D) : Rrrr"rtluli

Uploaded by

S M Thouhiqul IslamCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

84 CHAPTER 7

27. Nominal GDp was $3774 billion

GDP deftator was 108 and nominat

in year i theand

year 2 and the GDp deflator

GDd;;" $3989 in Allocations:

that year was t f i. What was lncome approach

,..'] real GDp in years 1 and Z, respectivetyi - Item Amount

lli

(a) $g+g+ billion and $3562 biltion $--

(b) $gg3g biilion and $3695 biilion $_

(c) $gsgS bittion and $0725 biltion $_-- $.--.-

(d) $s0+s biilion and $3854 binio; $__- $_

year was 148, and rhe next year $=_- $_

31.-tg,::..,ndex,one

was "167. What it

is the approximate percentaje cnange

the price level from one year to the in $_-

neX as [reasured by

that index? $_-

(a) 1z::/" $_

(b) 13% National

(c) 14% income $

(d) 15%

s-_-

29. GDp accounting includes

(a) the goods and services produced $_.--

in the under- $_

ground economy Gross domestic

(b) Gross domestic

expenditures for equipment to reduce product

product

the pollution $

of the environment

n"

(c) the value of the leisure enjoyed b. Use the other national accounts to find

by citizens

(d) the goods and services pioOr.jnui-n-ot

and sold in the markets of tfre oought (1) Net domestic pioduct is Jr

economl-

30. Whjch is a major reason why (2) Nationalincome is s

index of society,s economic wetibeing?- '-'- accurate

GDp is nof an

(3) Personal income is s

(a) lt includes changes in the valLie

(b) lt excludes many- improrern"nt" ofp[ir",

leisure. (4) Disposable income is s

i" quatily.

(c) lt includes transactions from tne

:

unOurgrounO 2. A larmer owns a plot of ground and

,l: economy. sells the right to

ll

(d) pump crude oil from his land to a crude oil proJucer.

It excludes transactions from the

i buying and sell- crude oil producer agrees to pay the The

i;

ii

ing of stocks. furruislo a barrel

for every barrel pumped from tn"

i)

rrrr"rtluli.

a. During one year 10,000 barrels urrprrp"O.

ii, r PROBLEMS

(1) The farmer receives a payment

of :b

from the crude oil producer.

1- Following are national income accounting

the figures for (2) The value added by the

United States. farmer is

b. The crude oil producer sells

the 10,000 barrels

pumped to a petroleum refiner

Billions at a price of $25 a

of dollars barrel.

r Exports (1) The crude oil producer receives

r Dividends $ 367 a payment of

r Consumption of fixed

,

capital

60

tl07

$ from the refiner.

Compensation of employees (2) The value added by the

- Government purchases 17?-2 crude oil producer is

, Rents 57'/

- lndirect business taxes i]3

refiner employs a pipeline company

', Gross private domestic investment :?5t,

4:)/

l.

portIl,"

the crude oil from the farmer,s funJ

to trans_

Corporate income taxes io tne retin_

Ai;7:::y

pavments

I

utJ

|;r( ) :II."r9 pays the pipetine company a fee of g.t a bar_

rel for the oil transported.

. Proprietors, income jro I

(1) The pipeline company receives

. Personal consumption expenditures l:1') a payment of

I810 6

r lmports

')'t() from the refiner,

Social Security contributions

,/( Undistributed corporate prof its I /18 (2) The value added by the com pany

is

I Personal taxes

Net foreign factor income earned

in the U.S.

:) /'/,

0

d. From the 10,000 barrels of crude

duces 315,000 gallons of gasoline

oil, the refiner

and various by-

pro_ \

products which are sold to distributors

a. ln the following table, use any of and gaso line

thesc fir;tircs Ir.r service stations at an average price gl per gallon

prepare an income statement of

for the econonty similar (1) The total payment received

to the one found in Table 7.3 of by the refiner from its

the text. customers is

You might also like

- Computing Per Capita Gross Domestic ProductDocument2 pagesComputing Per Capita Gross Domestic Productbustiman200% (2)

- April 2022Document2 pagesApril 2022abul hasan nayemNo ratings yet

- 7.basic Income TaxationDocument4 pages7.basic Income TaxationMerlajoy VillanuevaNo ratings yet

- TAX Preweek Lecture (B42)Document24 pagesTAX Preweek Lecture (B42)Bernadette Panican100% (1)

- CH 4 AssignmentDocument3 pagesCH 4 AssignmentMikulas HarvankaNo ratings yet

- Questions For Review: Multiple Choice Questions With AnswerDocument3 pagesQuestions For Review: Multiple Choice Questions With AnswermahamnadirminhasNo ratings yet

- Objective Type Questions SAPMDocument15 pagesObjective Type Questions SAPMSaravananSrvn77% (31)

- Namma Kalvi 12th Economics Chapter 2 Sura English Medium GuideDocument11 pagesNamma Kalvi 12th Economics Chapter 2 Sura English Medium GuideAakaash C.K.100% (3)

- CSEC Economics Paper 1 Booklet (2013 - 2021)Document40 pagesCSEC Economics Paper 1 Booklet (2013 - 2021)BriannaNo ratings yet

- CSEC Economics June 2015 P1Document9 pagesCSEC Economics June 2015 P1Sachin Bahadoorsingh100% (1)

- Namma Kalvi 12th Economics Unit 2 Surya Economics Guide emDocument28 pagesNamma Kalvi 12th Economics Unit 2 Surya Economics Guide emAakaash C.K.No ratings yet

- National Income.Document18 pagesNational Income.doshifamily.raahilNo ratings yet

- CV6216 2123 S2 TPwwf1B-After-tax AnalysisDocument12 pagesCV6216 2123 S2 TPwwf1B-After-tax AnalysisZJ XNo ratings yet

- Answers To Online Review Questions: The Classical Long-Run ModelDocument6 pagesAnswers To Online Review Questions: The Classical Long-Run ModelannfaiNo ratings yet

- Quiz 1 Macro Sample With Answers Spring 18Document4 pagesQuiz 1 Macro Sample With Answers Spring 18shamsaNo ratings yet

- Homework1 解答Document6 pagesHomework1 解答9pxxp7pp6sNo ratings yet

- Ned University of Engineering & Technology: Principles of Economics - MT-153Document2 pagesNed University of Engineering & Technology: Principles of Economics - MT-153Syed AliainNo ratings yet

- MS 3412-8Document1 pageMS 3412-8CPANo ratings yet

- Mcom Sem 2 Macro Economics Objective AnswersDocument9 pagesMcom Sem 2 Macro Economics Objective Answerssaurabh deshmukhNo ratings yet

- TNPSC TEST 2 AnswerDocument10 pagesTNPSC TEST 2 AnswerDheekshith KumarNo ratings yet

- REIT NAV Model ExamplesDocument5 pagesREIT NAV Model Examplesmerag76668No ratings yet

- Business Environment: Multiple Choice Questions (MCQS)Document17 pagesBusiness Environment: Multiple Choice Questions (MCQS)Amita ManojNo ratings yet

- Q4 BUSINESS FINANCE Modified Assessment Weeks 1 4Document4 pagesQ4 BUSINESS FINANCE Modified Assessment Weeks 1 4Jade MasiragNo ratings yet

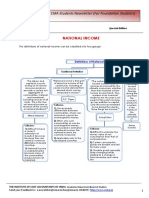

- CMA Students Newsletter (For Foundation Students) : National IncomeDocument25 pagesCMA Students Newsletter (For Foundation Students) : National IncomeOkyere Justice OjNo ratings yet

- N2020 Paper 3 Model AnswersDocument10 pagesN2020 Paper 3 Model Answersangeleschang99No ratings yet

- Smart Farms Small Grants Round 4 Budget Template: (Leave Blank - This Will Auto Populate)Document1 pageSmart Farms Small Grants Round 4 Budget Template: (Leave Blank - This Will Auto Populate)testing.testNo ratings yet

- 04 - Preguntas Costos 1Document2 pages04 - Preguntas Costos 1jjimenezgNo ratings yet

- Chapter 1Document26 pagesChapter 1humaidjahangirNo ratings yet

- Class 12th: EconomicsDocument6 pagesClass 12th: EconomicsPuneet GeraNo ratings yet

- BOP & Parity ConditionsDocument61 pagesBOP & Parity ConditionsZeusNo ratings yet

- MEFA BitsDocument5 pagesMEFA BitsShaik Mohammad MujeebNo ratings yet

- What Do You Mean by Cost Accounting?Document3 pagesWhat Do You Mean by Cost Accounting?Adib Mahmud ZiadNo ratings yet

- National Income Imp QDocument4 pagesNational Income Imp QamulyavatsNo ratings yet

- Final Exam Correction 2020-2021Document8 pagesFinal Exam Correction 2020-2021Ahmed KharratNo ratings yet

- L 3 Formulasheetjune 2016 SampleDocument6 pagesL 3 Formulasheetjune 2016 Samplepier AcostaNo ratings yet

- Eco SS2 WK 3 NoteDocument7 pagesEco SS2 WK 3 NotekumoyejoyNo ratings yet

- Mid Term Cheat SheetDocument2 pagesMid Term Cheat SheetnupurNo ratings yet

- ITL Paper Feb 2023Document2 pagesITL Paper Feb 2023Harnoor SinghNo ratings yet

- RKG Institute: B - 193, Sector - 52, NoidaDocument5 pagesRKG Institute: B - 193, Sector - 52, NoidaTanishq TayalNo ratings yet

- American Economic AssociationDocument18 pagesAmerican Economic AssociationAdrian MartinezNo ratings yet

- HKALE Economics Past Examination Papers Multiple-Choice Questions (HKCEE) Chapter 1: National Income AccountingDocument23 pagesHKALE Economics Past Examination Papers Multiple-Choice Questions (HKCEE) Chapter 1: National Income AccountingMuhammad Sanawar ChaudharyNo ratings yet

- What Do You Mean by Cost Accounting?: AnswerDocument3 pagesWhat Do You Mean by Cost Accounting?: AnswerAdib Mahmud ZiadNo ratings yet

- EConomics 4thfnrom Exam 20223Document10 pagesEConomics 4thfnrom Exam 20223Dellon-Dale BennettNo ratings yet

- D01 DocxDocument15 pagesD01 DocxPham Hong Chau Anh QP2629No ratings yet

- HPAS-2023-24 Answer Key Economy Test-6Document20 pagesHPAS-2023-24 Answer Key Economy Test-6kaushalankushNo ratings yet

- Macro - PGP 36Document12 pagesMacro - PGP 36Aravali KhandelwalNo ratings yet

- Macro - PGP 36Document12 pagesMacro - PGP 36Rajan sharmaNo ratings yet

- National Income: Learning ObjectivesDocument30 pagesNational Income: Learning Objectivesmuhammedsadiq abdullaNo ratings yet

- National Income AccountingDocument3 pagesNational Income AccountingTRIZIE CHENGNo ratings yet

- FY2022 WeaponsDocument103 pagesFY2022 Weaponsluqiya123456No ratings yet

- Ias 36Document21 pagesIas 36f9vertexlearningsolutionsNo ratings yet

- Quiz 5 Equity Valuation M7 AnswerDocument63 pagesQuiz 5 Equity Valuation M7 AnswerPrabu PrabaNo ratings yet

- 311FA07 Midterm 1Document13 pages311FA07 Midterm 1Akshay AgarwalNo ratings yet

- Executive SummaryDocument6 pagesExecutive SummaryGoldram LaceNo ratings yet

- Is-Lm and Fiscal & Monetary Policies: Session 11 - 15Document34 pagesIs-Lm and Fiscal & Monetary Policies: Session 11 - 15Raj PatelNo ratings yet

- Chapter 2 QuestionsDocument16 pagesChapter 2 QuestionsAmalin IlyanaNo ratings yet

- Long-Answer Questions: Explain of DomesticDocument6 pagesLong-Answer Questions: Explain of DomesticSITAKSH KUMAR TIWARINo ratings yet

- Microeconomics - Previous Years MCQsDocument12 pagesMicroeconomics - Previous Years MCQsArpan CHATTERJEENo ratings yet

- Final SolDocument14 pagesFinal Solbadhasagezali670No ratings yet

- Sec-B2 2022Document3 pagesSec-B2 2022Sanchari DasNo ratings yet

- 7 Aggregate Supply and Aggregate DemandDocument32 pages7 Aggregate Supply and Aggregate DemandMILON KUMAR HORENo ratings yet

- A02Document16 pagesA02Vũ Hồng NhungNo ratings yet

- 122 1004Document32 pages122 1004api-275486640% (1)

- World Development: Caio Torres Mazzi, Neil Foster-Mcgregor, Glaucia Estefânia de Sousa FerreiraDocument24 pagesWorld Development: Caio Torres Mazzi, Neil Foster-Mcgregor, Glaucia Estefânia de Sousa FerreiraS M Thouhiqul IslamNo ratings yet

- World Development: Ranjula Bali Swain, Shyam RanganathanDocument14 pagesWorld Development: Ranjula Bali Swain, Shyam RanganathanS M Thouhiqul IslamNo ratings yet

- HW 2Document4 pagesHW 2S M Thouhiqul IslamNo ratings yet

- HW 1Document5 pagesHW 1S M Thouhiqul IslamNo ratings yet

- World Development: Orlando J. SotomayorDocument14 pagesWorld Development: Orlando J. SotomayorS M Thouhiqul IslamNo ratings yet

- World Development: Pierre André, Esther Delesalle, Christelle DumasDocument24 pagesWorld Development: Pierre André, Esther Delesalle, Christelle DumasS M Thouhiqul IslamNo ratings yet

- Opt 1Document5 pagesOpt 1Bridget Zoe Lopez BatoonNo ratings yet

- Applied Taxation ACCT 370: Rabia SaleemDocument23 pagesApplied Taxation ACCT 370: Rabia Saleemsultan siddiquiNo ratings yet

- Theory of Accounts 1. Which Is Not The Characteristic of Using IFRS?Document5 pagesTheory of Accounts 1. Which Is Not The Characteristic of Using IFRS?Frc BayogNo ratings yet

- Reserve and ProvisionDocument19 pagesReserve and ProvisionRojesh BasnetNo ratings yet

- Guarantee Check - Employment - Clickable For E-ViewingDocument16 pagesGuarantee Check - Employment - Clickable For E-ViewingTaniya RoyNo ratings yet

- Pas 20 Government Grants: Nature: Government Grant Government AssistanceDocument2 pagesPas 20 Government Grants: Nature: Government Grant Government AssistanceKristalen ArmandoNo ratings yet

- VIP HandoutsDocument131 pagesVIP Handoutsestihdaf استهدافNo ratings yet

- Marathon HotelDocument5 pagesMarathon HotelKaylee SteinNo ratings yet

- FMA - Tute 10 - Dividend PolicyDocument3 pagesFMA - Tute 10 - Dividend PolicyPhuong VuongNo ratings yet

- Chapter 5 Consolidated FS - Part 2Document13 pagesChapter 5 Consolidated FS - Part 2Geraldine Mae DamoslogNo ratings yet

- Gr11 Acc P1 (English) June 2019 Question PaperDocument12 pagesGr11 Acc P1 (English) June 2019 Question PaperShriddhi MaharajNo ratings yet

- Partnership Agreement Between Two Limited CompaniesDocument5 pagesPartnership Agreement Between Two Limited CompaniesmshehriyarNo ratings yet

- Quiz 1Document8 pagesQuiz 1Kurt dela TorreNo ratings yet

- Regular Income Tax: Bacc8 TaxationDocument18 pagesRegular Income Tax: Bacc8 TaxationsoonsNo ratings yet

- Cfas - Midterm Exam GuideDocument9 pagesCfas - Midterm Exam GuideAngel Madelene BernardoNo ratings yet

- Payslip 3 2023Document1 pagePayslip 3 2023Saurabh DugarNo ratings yet

- 3SM With Iterations Model 1 Model IntroDocument5 pages3SM With Iterations Model 1 Model IntroEmperor OverwatchNo ratings yet

- Exercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioDocument6 pagesExercise 5-11: B/E Analysis Target Profit Margin of Safety C/M RatioMaryane AngelaNo ratings yet

- Activity 06 - Financial Statement PreparationDocument4 pagesActivity 06 - Financial Statement PreparationMariz TiuNo ratings yet

- WIPRO 2021-22 Annual Report AnalysisDocument60 pagesWIPRO 2021-22 Annual Report AnalysisShanmuganayagam RNo ratings yet

- ANSWER TO AGEC 562 Lab #2Document6 pagesANSWER TO AGEC 562 Lab #2wondater MulunehNo ratings yet

- Tax Table Corporations 2022Document4 pagesTax Table Corporations 2022Xandredg Sumpt LatogNo ratings yet

- Annual Report Analysis On ACCDocument42 pagesAnnual Report Analysis On ACCShiVâ SãiNo ratings yet

- Ask Our Experts Philippines Tax Annualization Year End ReportingDocument5 pagesAsk Our Experts Philippines Tax Annualization Year End ReportingMItch BermeoNo ratings yet

- 2607y Maliyyə Hesabatı SABAH (En)Document34 pages2607y Maliyyə Hesabatı SABAH (En)leylaNo ratings yet

- Seatwork - FS Analysis QDocument4 pagesSeatwork - FS Analysis QHannah JoyNo ratings yet