Professional Documents

Culture Documents

PDF 431051120260712

PDF 431051120260712

Uploaded by

Laxman DuggiralaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 431051120260712

PDF 431051120260712

Uploaded by

Laxman DuggiralaCopyright:

Available Formats

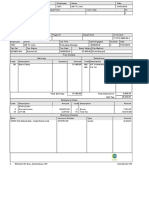

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM ITR-V [Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature] . 2012 - 13

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

LAKSHMANA MURTHY DUGGIRALA

AOYPD3923R

PERSONAL INFORMATION AND THE

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

# 11-5-26/F has been ITR-1

TRANSMISSION

electronically

transmitted

Road/Street/Post Office Area/Locality

SRINIVASAPURAM KOVVUR

Town/City/District State Pin Status

Individual

W.G.DT.

534350

Designation of AO (Ward / Circle) DELHI Original or Revised ORIGINAL

E-filing Acknowledgement Number 431051120260712 Date(DD-MM-YYYY) 26-07-2012

1 Gross Total Income 1 708972

2 Deductions under Chapter-VI-A 2 99860

3 Total Income 3 609112

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 55437

5 Interest Payable 5 0

6 Total Tax and Interest Payable 6 55437

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 55437

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 55437

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

VERIFICATION

I, LAKSHMANA MURTHY DUGGIRALA

son/ daughter of SESHAGIRI RAO D , holding permanent account number AOYPD3923R

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income/ fringe benefits

and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income and

fringe benefits chargeable to income-tax for the previous year relevant to the assessment year 2012-13. I further declare that I am making this return

in my capacity as and I am also competent to make this return and verify it.

Sign here Date 26-07-2012 Place NAYUDUPETA

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Filed from IP address 115.249.171.74

Receipt No

Date

Seal and signature of

AOYPD3923R01431051120260712924B6756BD1BBC5B8B8979ABC1C88A8526BA5694

receiving official

Please furnish Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY POST OR

SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other office of

the Income-tax Department or in any other manner. The receipt of this ITR-V at ITD-CPC will be sent to you at e-mail address

LAKSHMAN_DUGGIRALA@YAHOO.CO.IN

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Introduction To Financial ManagementDocument9 pagesIntroduction To Financial ManagementRitesh ShreshthaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mech GS 2019R2 EN WS13Document11 pagesMech GS 2019R2 EN WS13Laxman DuggiralaNo ratings yet

- Mech GS 2019R2 EN RF13Document6 pagesMech GS 2019R2 EN RF13Laxman DuggiralaNo ratings yet

- Mech GS 2019R2 EN WS15Document16 pagesMech GS 2019R2 EN WS15Laxman DuggiralaNo ratings yet

- Standards Spec Brochure ME WEBDocument44 pagesStandards Spec Brochure ME WEBLaxman Duggirala100% (1)

- Hot Dip Galvanizing and Corrosion CategoriesDocument2 pagesHot Dip Galvanizing and Corrosion CategoriesLaxman DuggiralaNo ratings yet

- HV-CONNEX Pluggable Connection System-Size 5SDocument15 pagesHV-CONNEX Pluggable Connection System-Size 5SLaxman DuggiralaNo ratings yet

- Dehonit ElektroDocument6 pagesDehonit ElektroLaxman DuggiralaNo ratings yet

- Guide To Netaji MysteryDocument6 pagesGuide To Netaji MysteryLaxman DuggiralaNo ratings yet

- Presentation On Taxation of The Microfinance IndustryDocument23 pagesPresentation On Taxation of The Microfinance IndustryFranco DurantNo ratings yet

- Corporate Tax QuestionnairesDocument12 pagesCorporate Tax QuestionnairesvanNo ratings yet

- Nova Scotia Tax and Credits: Form NS428 2021Document4 pagesNova Scotia Tax and Credits: Form NS428 2021Greg KnightNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- 62294bos50449 Mod2 cp9Document17 pages62294bos50449 Mod2 cp9monicabhat96No ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- Forms - Australian Taxation OfficeDocument6 pagesForms - Australian Taxation OfficeadFWSVNo ratings yet

- Note 1-Estate Under AdministrationDocument8 pagesNote 1-Estate Under AdministrationNur Dina AbsbNo ratings yet

- Transfer Tax Quiz QuestionsDocument5 pagesTransfer Tax Quiz QuestionsKyasiah Mae AragonesNo ratings yet

- SOL MAN CHAPTER 15 PPE PART 1 IA PART 1B 2020ed1 DocxDocument21 pagesSOL MAN CHAPTER 15 PPE PART 1 IA PART 1B 2020ed1 DocxVkyla BataoelNo ratings yet

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-11 PDFDocument11 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-11 PDFaemanNo ratings yet

- Acfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxDocument1 pageAcfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxHarpreetNo ratings yet

- Paystub 2019 05 31 PDFDocument1 pagePaystub 2019 05 31 PDFAnonymous wkIlICXmQfNo ratings yet

- Pay Details: 250655 First National Bank - Central Branch Code 62757691160 Current 29,444.07Document1 pagePay Details: 250655 First National Bank - Central Branch Code 62757691160 Current 29,444.07Tyelovuyo Charles JahoNo ratings yet

- Act370 Final - AssignmentDocument12 pagesAct370 Final - AssignmentAnkan Saha 1711046030No ratings yet

- Short Term: Applicant InformationDocument3 pagesShort Term: Applicant InformationAnahit Yakubovich100% (1)

- SK-PST FormDocument1 pageSK-PST FormOsama JavaidNo ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)Ciarie SalgadoNo ratings yet

- Rev 5 Zimbabwe Revenue Authority Return For The Remittance of Withholding TaxesDocument2 pagesRev 5 Zimbabwe Revenue Authority Return For The Remittance of Withholding TaxesZIMWASENo ratings yet

- Garima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265Document3 pagesGarima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265The Cultural CommitteeNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 525402640240619 Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 525402640240619 Assessment Year: 2019-20రాకేష్ బాబు చట్టిNo ratings yet

- File ITR-2 Online User Manual - Income Tax DepartmentDocument62 pagesFile ITR-2 Online User Manual - Income Tax DepartmentHelp Tubestar CrewNo ratings yet

- DCapsule 46 - 27 July 2023Document20 pagesDCapsule 46 - 27 July 2023naveen.mNo ratings yet

- Sasha CompanyDocument3 pagesSasha CompanyVivienne Lei BolosNo ratings yet

- Post Task 3, Question 1Document4 pagesPost Task 3, Question 1SHARMAINE CORPUZ MIRANDANo ratings yet

- IOS Sums PDFDocument2 pagesIOS Sums PDFBeing HumaneNo ratings yet

- 5334 Apr-2021Document1 page5334 Apr-2021Hadi Ul HassanNo ratings yet

- Post 714Document1 pagePost 714VyakulShahNo ratings yet

- 2020 12 12 23 10 30 664 - 1607794830664 - XXXPR2886X - Acknowledgement PDFDocument1 page2020 12 12 23 10 30 664 - 1607794830664 - XXXPR2886X - Acknowledgement PDFJagesh RanjanNo ratings yet