Professional Documents

Culture Documents

3 Adjusting Entries Handouts

Uploaded by

Juan Dela CruzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Adjusting Entries Handouts

Uploaded by

Juan Dela CruzCopyright:

Available Formats

UNIVERSITY OF SANTO TOMAS 1

AMV COLLEGE OF ACCOUNTANCY

NAME:_____________________________________ GRADE/SECTION_______

ACCOUNTING PROCESS

Adjusting entries.

Data relating to the balances of various accounts affected by adjusting or closing entries appear

below. (The entries which caused the changes in the balances are not given.) You are asked to

supply the missing journal entries which would logically account for the changes in the account

balances.

1. Interest receivable at 1/1/18 was P1,000. During 2018 cash received from debtors for

interest on outstanding notes receivable amounted to P5,000. The 2018 income statement

showed interest revenue in the amount of P4,900. You are to provide the missing adjusting

entry that must have been made, assuming reversing entries are not made.

2.

Unearned rent at 1/1/18 was P5,300 and at 12/31/18 was P6,000. The records indicate

cash receipts from rental sources during 2018 amounted to P40,000, all of which was

credited to the Unearned

Rent Account. You are to prepare the missing adjusting entry.

3. Accumulated depreciation—equipment at 1/1/18 was P230,000. At 12/31/18 the balance

of the account was P280,000. During 2018, one piece of equipment was sold. The

equipment had an original cost of P40,000 and was 3/4 depreciated when sold. You are to

prepare the missing adjusting entry.

4.

Allowance for doubtful accounts on 1/1/18 was P50,000. The balance in the allowance

account on 12/31/18 after making the annual adjusting entry was P60,000 and during 2018

bad debts written off amounted to P30,000. You are to provide the missing adjusting entry.

5. Prepaid rent at 1/1/18 was P9,000. During 2018 rent payments of P110,000 were made

and charged to "rent expense." The 2018 income statement shows as a general expense

the item "rent expense" in the amount of P125,000. You are to prepare the missing adjusting

entry that must have been made, assuming reversing entries are not made.

6. On December 31, two notes are on hand:

P 1,500 for 60days dated December 16, 2013 @ 14% was received froma customer.

P1,800, 90days, issued to Bank of P.I on December 1, 2013 discounted @ 18%.(use

asset method)

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 1 of 10

7. The Unexpired Insurance account balance of P23,000 represents two year insurance taken

on December 1, 2012. The expired portion for the year 2012 has been already adjusted.

8. The business has Accounts Receivable of P14,500 as at the end of 2013. It is estimated

that only 90% of this is collectible. Allowance for Doubtful Accounts has a balance of

P750.

9. A six month advertising contract was entered to by the business which required an

advance payment on P2,400 on November 2, 2013 and was debited to Advertising

Expense.

10. Rent income was credited for P18,000 represent 3 months rent received from lesee on

October 15, 2013.

11. Office equipment costing P75,000 was purchased on October 1, 2013 and estimated to

have a useful life of five years which a scrap value of P5,000.

12. Supplies Expense has balance of P9,500 representing supplies purchased during the

year of which only P4,500 has been taken out from the stockroom.

LONG PROBLEM:

The Righter Shoe Store Company prepares monthly financial statements for its bank. The

November 30 and December 31, 2018, trial balances contained the following information:

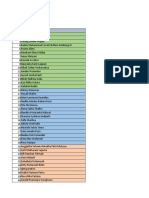

Nov. 30 Dec. 31

Dr. Cr. Dr. Cr.

Supplies 1,000 3,000

Prepaid insurance 6,000 4,250

Wages payable 10,000 15,000

Unearned rent revenue 2,000 1,000

The following information also is known:

a. The December income statement (accrual basis) reported P2,000 in supplies expense.

b. No insurance payments were made in December.

c. P10,000 was paid to employees during December for wages.

d. On November 1, 2018, a tenant paid Righter P3,000 in advance rent for the period November

through January. Unearned revenue was credited.

Questions

1. What was the cost of supplies purchased during December?

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 2 of 10

2. What was the adjusting entry recorded at the end of December for prepaid insurance?

3. What was the adjusting entry recorded at the end of December for accrued wages?

4. What was the amount of rent revenue earned in December?

5. What adjusting entry was recorded at the end of December for unearned rent?

MULTIPLE CHOICE PROBLEM

6.

Beginning and ending Accounts Receivable balances were P28,000 and

P24,000, respectively. If collections from clients during the period were P80,000, then total

services rendered on account were apparently

a. P76,000.

b. P84,000.

c. P118,000.

d. P108,000.

7. The Supplies on Hand account balance at the beginning of the period was P6,600.

Supplies totaling P12,825 were purchased during the period and debited to Supplies

on Hand. A physical count shows P3,825 of Supplies on Hand at the end of the period.

The proper journal entry at the end of the period

a. debits Supplies on Hand and credits Supplies Expense for P9,000.

b. debits Supplies Expense and credits Supplies on Hand for P12,825.

c. debits Supplies on Hand and credits Supplies Expense for P15,600.

d. debits Supplies Expense and credits Supplies on Hand for P15,600.

8. Arid Company paid P1,718 on June 1, 2018, for a two-year insurance policy

and recorded the entire amount as Insurance Expense. The December 31, 2018, adjusting entry

is

a. debit Prepaid Insurance and credit Insurance Expense, P497.

b. debit Insurance Expense and credit Prepaid Insurance, P497.

c. debit Insurance Expense and credit Prepaid Insurance, P1,207.

d. debit Prepaid Insurance and credit Insurance Expense, P1,207.

9. Moon Company purchased equipment on November 1, 2018, by giving its

supplier a 12-month, 9 percent note with a face value of P48,000. The December 31, 2018,

adjusting entry is

a. debit Interest Expense and credit Cash, P720.

b. debit Interest Expense and credit Interest Payable, P720.

c. debit Interest Expense and credit Interest Payable, P1,080.

d. debit Interest Expense and credit Interest Payable, P4,320.

10.

In November and December 2018, Bee Company, a newly organized

newspaper publisher, received P72,000 for 1,000 three-year subscriptions at P24 per year,

starting with the January 2, 2019, issue of the newspaper. How much should Bee report in its

2018 income statement for subscription revenue?

a. P0

b. P12,000

c. P24,000

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 3 of 10

d. P72,000

11.

The following errors were made in preparing a trial balance: the P1,350

balance of Inventory was omitted; the P450 balance of Prepaid Insurance was listed as a credit;

and the P300 balance of Salaries Expense was listed as Utilities Expense. The debit and credit

totals of the trial balance would differ by

a. P1,350.

b. P1,800.

c. P2,100.

d. P2,250.

12.

Crescent Company's interest revenue for 2018 was P13,100. Accrued

interest receivable on December 31, 2018, was P2,275 and P1,875 on December 31, 2017. The

cash received for interest during 2018 was

a. P1,350.

b. P10,825.

c. P12,700.

d. P13,100.

13.

Sky Company's salaries expense for 2018 was P136,000. Accrued salaries

payable on December 31, 2018, was P17,800 and P8,400 on December 31, 2017. The cash

paid for salaries during 2018 was

a. P126,600.

b. P127,600.

c. P145,400.

d. P153,800.

14.

Gomez Company received P9,600 on April 1, 2018 for one year's rent in advance and

recorded the transaction with a credit to a nominal account. The December 31, 2018

adjusting entry is

a. debit Rent Revenue and credit Unearned Rent, P2,400.

b. debit Rent Revenue and credit Unearned Rent, P7,200.

c. debit Unearned Rent and credit Rent Revenue, P2,400.

d. debit Unearned Rent and credit Rent Revenue, P7,200.

15.

Forbes Company paid P7,200 on June 1, 2018 for a two-year insurance policy

and recorded the entire amount as Insurance Expense. The December 31, 2018

adjusting entry is

a. debit Insurance Expense and credit Prepaid Insurance, P2,100.

b. debit Insurance Expense and credit Prepaid Insurance, P5,100.

c. debit Prepaid Insurance and credit Insurance Expense, P2,100

d. debit Prepaid Insurance and credit Insurance Expense, P5,100.

16.

Lane Company purchased equipment on November 1, 2018 and gave a 3-

month, 9% note with a face value of P50,000. The December 31, 2018 adjusting entry is

a. debit Interest Expense and credit Interest Payable, P4,500.

b. debit Interest Expense and credit Interest Payable, P1,125.

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 4 of 10

c. debit Interest Expense and credit Cash, P750.

d. debit Interest Expense and credit Interest Payable, P750.

17.

Green Company's account balances at December 31, 2018 for Accounts

Receivable and the related Allowance for Doubtful Accounts are P460,000 debit and

P700 credit, respectively. From an aging of accounts receivable, it is estimated that

P18,000 of the December 31 receivables will be uncollectible. The necessary adjusting

entry would include a credit to the allowance account for

a. P18,000.

b. P18,700.

c. P17,300.

d. P700.

18.

Chen Company's account balances at December 31, 2018 for Accounts

Receivable and the Allowance for Doubtful Accounts are P640,000 debit and P1,200

credit. Sales during 2018 were P1,800,000. It is estimated that 1% of sales will be

uncollectible. The adjusting entry would include a credit to the allowance account for

a. P19,200.

b. P18,000.

c. P16,800.

d. P6,400.

19.

Perez Corporation received cash of P9,000 on August 1, 2018 for one year's

rent in advance and recorded the transaction with a credit to Rent Revenue. The

December 31, 2018 adjusting entry is

a. debit Rent Revenue and credit Unearned Rent, P3,750.

b. debit Rent Revenue and credit Unearned Rent, P5,250.

c. debit Unearned Rent and credit Rent Revenue, P3,750.

d. debit Cash and credit Unearned Rent, P5,250.

20.

Lane Corporation has an incentive commission plan for its salesmen, entitling

them to an additional sales commission when actual quarterly sales exceed budgeted

estimates. An analysis of the account "incentive commission expense" for the year

ended December 31, 2018, follows:

Amount For Quarter Ended Date Paid

P42,000 December 31, 2017 January 23, 2018

36,000 M arch 31, 2018 April 24, 2018

39,000 J une 30, 2018 July 19, 2018

43,000 S eptember 30, 2018 October 22, 2018

The incentive commission for the quarter ended

December 31, 2018, was

P45,000. This amount was recorded and paid in January 2019. What amount should

Lane report as incentive commission expense for 2018?

a. P160,000.

b. P118,000.

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 5 of 10

c. P163,000.

d. P205,000.

21.

On September 1, 2017, Kile Co. issued a note payable to National

Bank in the amount of P900,000, bearing interest at 12%, and payable in three equal

annual principal payments of P300,000. On this date, the bank's prime rate was 11%.

The first payment for interest and principal was made on September 1, 2018. At

December 31, 2018, Kile should record accrued interest payable of

a. P36,000.

b. P33,000.

c. P24,000.

d. P22,000.

22.

Eaton Co. sells major household appliance service contracts for cash. The

service contracts are for a one-year, two-year, or three-year period. Cash receipts from

contracts are credited to Unearned Service Revenues. This account had a balance of

P900,000 at December 31, 2018 before year-end adjustment. Service contract costs are

charged as incurred to the Service Contract Expense account, which had a balance of

P225,000 at December 31, 2018.

Service contracts still outstanding at December 31, 2018 expire as follows:

uring 2019

D 190,000

P

uring 2020

D 85,000

2

uring 2021

D 75,000

1

What amount should be reported as Unearned Service Revenues in Eaton's

December 31, 2018 balance sheet?

a. P675,000.

b. P650,000.

c. P425,000.

d. P250,000.

23.

In November and December 2018, Mann Co., a newly organized magazine

publisher, received P75,000 for 1,000 three-year subscriptions at P25 per year, starting

with the January 2019 issue. Mann included the entire P75,000 in its 2018 income tax

return. What amount should Mann report in its 2018 income statement for subscriptions

revenue?

a. P0.

b. P4,167.

c. P25,000.

d. P75,000.

24.

On June 1, 2018, Nott Corp. loaned Gore P600,000 on a 12% note, payable in

five annual installments of P120,000 beginning January 2, 2019. In connection with this

loan, Gore was required to deposit P6,000 in a noninterest-bearing escrow account. The

amount held in escrow is to be returned to Gore after all principal and interest payments

have been made. Interest on the note is payable on the first day of each month

beginning July 1, 2018. Gore made timely payments through November 1, 2018. On

January 2, 2019, Nott received payment of the first principal installment plus all interest

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 6 of 10

due. At December 31, 2018, Nott's interest receivable on the loan to Gore should be

a. P0.

b. P6,000.

c. P12,000.

d. P18,000.

25.

Allen Corp.'s liability account balances at June 30, 2018 included a 10% note

payable in the amount of P1,800,000. The note is dated October 1, 2016 and is payable

in three equal annual payments of P600,000 plus interest. The first interest and principal

payment was made on October 1, 2017. In Allen's June 30, 2018 balance sheet, what

amount should be reported as accrued interest payable for this note?

a. P135,000.

b. P90,000.

c. P45,000.

d. P30,000.

26.

Dolan Co. pays all salaried employees on a biweekly basis. Overtime pay,

however, is paid in the next biweekly period. Dolan accrues salaries expense only at its

December 31 year end. Data relating to salaries earned in December 2018 are as

follows:

Last payroll was paid on 12/26/18, for the 2-week period ended 12/26/18.

Overtime pay earned in the 2-week period ended 12/26/18 was P5,000.

Remaining work days in 2018 were December 29, 30, 31, on which days there

was no overtime.

The recurring biweekly salaries total P90,000.

Assuming a five-day work week, Dolan should record a liability at December 31,

2018 for accrued salaries of

a. P27,000.

b. P32,000.

c. P54,000.

d. P59,000.

27.

Unruh Corp.'s trademark was licensed to Eddy Co. for royalties of 15% of

sales of the trademarked items. Royalties are payable semiannually on March 15 for

sales in July through December of the prior year, and on September 15 for sales in

January through June of the same year. Unruh received the following royalties from

Eddy:

March 15 September 15

2017 P5,000 P7,500

2018 6,000 8,500

Eddy estimated that sales of the trademarked items would total P80,000 for July

through December 2018. In Unruh's 2018 income statement, the royalty revenue should

be

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 7 of 10

a. P20,500.

b. P22,000.

c. P26,500.

d. P28,000.

28.

Winston Company sells magazine subscriptions for one- to three-year

subscription periods. Cash receipts from subscribers are credited to Magazine Subscriptions

Collected in Advance, and this account had a balance of P9,600,000 at December 31, 2018,

before year-end adjustment. Outstanding subscriptions at December 31, 2018, expire as

follows:

During 2019 .................. P2,600,000

During 2020 .................. 3,200,000

During 2021 .................. 1,800,000

In its December 31, 2018, balance sheet, what amount should Winston report as the balance for

magazine subscriptions collected in advance?

a. P2,000,000

b. P3,800,000

c. P7,600,000

d. P9,600,000

29. L. Lane received P12,000 from a tenant on December 1 for four months' rent of an office.

This rent was for December, January, February, and March. If Lane debited Cash and credited

Unearned Rental Income for P12,000 on December 1, what necessary adjustment would be

made on December 31?

a. Unearned Rental Income ............. 3,000

Rental Income .................... 3,000

b. Rental Income ...................... 3,000

Unearned Rental Income ........... 3,000

c. Unearned Rental Income ............. 9,000

Rental Income .................... 9,000

d. Rental Income ...................... 9,000

Unearned Rental Income ........... 9,000

30.

Ingle Company paid P12,960 for a four-year insurance policy on September

1 and recorded the P12,960 as a debit to Prepaid Insurance and a credit to Cash. What

adjusting entry should Ingle make on December 31, the end of the accounting period?

a. Prepaid Insurance .................. 810

Insurance Expense ................ 810

b. Insurance Expense .................. 1,080

Prepaid Insurance ................ 1,080

c. Insurance Expense .................. 3,240

Prepaid Insurance ................ 3,240

d. Prepaid Insurance .................. 11,880

Insurance Expense ................ 11,880

31. Bannister Inc.'s fiscal year ended on November 30, 2018. The balance in

the prepaid insurance account as of November 30, 2018, was P35,200 (before adjustment) and

consisted of the following policies:

Policy Date of Date of Balance in

Number Purchase Expiration Account

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 8 of 10

279248 7/1/2018 6/30/2019 P14,400

694421 12/1/2016 11/30/2018 9,600

800616 4/1/2017 3/31/2019 11,200

P35,200

The adjusting entry required on November 30, 2018, would be

a. Insurance Expense ................... 24,000

Prepaid Insurance ................. 24,000

b. Insurance Expense ................... 9,600

Prepaid Insurance ................. 9,600

c. Insurance Expense ................... 11,200

Prepaid Insurance ................. 11,200

d. Insurance Expense ................... 16,400

Prepaid Insurance ................. 16,400

32.

Kite Company paid P24,900 in insurance premiums during 2018. Kite

showed P3,600 in prepaid insurance on its December 31, 2018, balance sheet and P4,500 on

December 31, 2017. The insurance expense on the income statement for 2018 was

a. P16,800.

b. P24,000.

c. P25,800.

d. P33,000.

33. The work sheet of PSI Company shows Income Tax Expense of P9,000 and

Income Tax Payable of P9,000 in the Adjustments columns. What will be the ultimate disposition

of these items on the work sheet?

a. Income Tax Expense will appear as a debit of P9,000 and Income Tax Payable as

credit in the Balance Sheet columns.

b. Income Tax Expense will appear as a debit of P9,000 and Income Tax Payable as

credit in the Income Statement columns.

c. Income Tax Expense will appear as a debit of P9,000 in the Balance Sheet

columns and Income Tax Payable as credit in the Income Statement columns.

d. Income Tax Expense will appear as a debit of P9,000 in the Income Statement

columns and Income Tax Payable as credit in the Balance Sheet columns.

34. Teller Inc. reported an allowance for doubtful accounts of P30,000 (credit) at

December 31, 2018, before performing an aging of accounts receivable. As a result of the

aging, Teller Inc. determined that an estimated P52,000 of the December 31, 2018, accounts

receivable would prove uncollectible. The adjusting entry required at December 31, 2018, would

be

a. Doubtful Accounts Expense ........... 22,000

Allowance for Doubtful Accounts ... 22,000

b. Allowance for Doubtful Accounts ..... 22,000

Accounts Receivable ............... 22,000

c. Doubtful Accounts Expense ........... 52,000

Allowance for Doubtful Accounts ... 52,000

d. Allowance for Doubtful Accounts ..... 52,000

Doubtful Accounts Expense ......... 52,000

35. Comet Corporation's liability account balances at June 30, 2018, included a

10 percent note payable. The note is dated October 1, 2016, and carried an original principal

amount of P600,000. The note is payable in three equal annual payments of P200,000 plus

interest. The first interest and principal payment was made on October 1, 2017. In Comet's June

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 9 of 10

30, 2018, balance sheet, what amount should be reported as Interest Payable for this note?

a. P10,000

b. P15,000

c. P30,000

d. P45,000

ACCOUNTING PROCESS HANDOUTS

https://cdn.fbsbx.com/v/t59.2708-21/40461728_53282499716…=04742d84283a1fcae43782ec6d728b66&oe=5B9E33EC&dl=1 14/09/2018, 4H23 PM

Page 10 of 10

You might also like

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- Practice Questions: Adjusting EntriesDocument5 pagesPractice Questions: Adjusting EntriesRize Takatsuki100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument13 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionMarielle Mae BurbosNo ratings yet

- ACCT101 - Prelim - THEORY (25 PTS)Document3 pagesACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- Fabm 1 Quiz TheoriesDocument4 pagesFabm 1 Quiz TheoriesJanafaye Krisha100% (1)

- Financial Accounting & Reporting ReviewerDocument21 pagesFinancial Accounting & Reporting ReviewerRosemarie GoNo ratings yet

- Acc ActivityDocument6 pagesAcc ActivityJoyce Eguia100% (1)

- Quizzes - Chapter 4 - Types of Major Accounts.Document3 pagesQuizzes - Chapter 4 - Types of Major Accounts.Mechaella Shella Ningal ApolinarioNo ratings yet

- Far Reviewer 1Document4 pagesFar Reviewer 1MARK JAYSON MANABATNo ratings yet

- Merchandising BusinessDocument31 pagesMerchandising BusinessAngelo ReyesNo ratings yet

- ABM 1 Diagnostic Test AnalysisDocument2 pagesABM 1 Diagnostic Test AnalysisMarjorie BadiolaNo ratings yet

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- Quiz 2 Accounting Principles Without AnswerDocument4 pagesQuiz 2 Accounting Principles Without AnswerJazzy MercadoNo ratings yet

- FABM2 Module - 1Document3 pagesFABM2 Module - 1Jennifer NayveNo ratings yet

- Detailed Lesson Plan Acctg 3docxDocument4 pagesDetailed Lesson Plan Acctg 3docxXyrah Yvette PelayoNo ratings yet

- Recording Business TransactionsDocument11 pagesRecording Business TransactionsKristine Lou BaddongNo ratings yet

- FAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018Document5 pagesFAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018kai luvNo ratings yet

- Midterms Q3 FABM1Document10 pagesMidterms Q3 FABM1Emerita MercadoNo ratings yet

- Users of Accounting InfoDocument5 pagesUsers of Accounting InfoGheGhe AvilaNo ratings yet

- 4th FABM 2Document2 pages4th FABM 2Keisha MarieNo ratings yet

- Accounting Cycle: 4. Preparation of The Trial BalanceDocument8 pagesAccounting Cycle: 4. Preparation of The Trial BalanceAda Janelle Manzano0% (1)

- June 3-7 2019 BNHSDocument45 pagesJune 3-7 2019 BNHSKRISTINE MAE A. RIVERANo ratings yet

- Comprehensive Prob Bank Recon - Sample ProblemDocument2 pagesComprehensive Prob Bank Recon - Sample ProblemKez MaxNo ratings yet

- Financial Statement Analysis Part 2Document10 pagesFinancial Statement Analysis Part 2Kim Patrick VictoriaNo ratings yet

- RJDAMA CHRISTIAN ACADEMY INC. 2nd SUMMATIVE TESTDocument3 pagesRJDAMA CHRISTIAN ACADEMY INC. 2nd SUMMATIVE TESTjelay agresorNo ratings yet

- Quiz Bee Final 2Document101 pagesQuiz Bee Final 2joshNo ratings yet

- Module 9 - Merchandising Accounting CycleDocument62 pagesModule 9 - Merchandising Accounting CycleRandolph Collado100% (1)

- Xy95lywmi - Midterm Exam FarDocument12 pagesXy95lywmi - Midterm Exam FarLyra Mae De BotonNo ratings yet

- BA256 Final Exam Review CH 1 Through 7Document19 pagesBA256 Final Exam Review CH 1 Through 7Joey MannNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyNo ratings yet

- Group Activity 1 Aec 217Document5 pagesGroup Activity 1 Aec 217Enitsuj Eam EugarbalNo ratings yet

- Cash Flow Statement for Joshtine CompanyDocument3 pagesCash Flow Statement for Joshtine CompanyTshina Jill BranzuelaNo ratings yet

- Quiz Bee Problems Version 1Document68 pagesQuiz Bee Problems Version 1Lalaine De JesusNo ratings yet

- Financial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreDocument15 pagesFinancial Accounting & Reporting First Grading Examination: Name: Date: Professor: Section: ScoreCUSTODIO, JUSTINE A.No ratings yet

- Accounts Notes For BCA - IncompleteDocument56 pagesAccounts Notes For BCA - IncompleteSahil Kumar Gupta100% (1)

- Accounting Concepts and PrinciplesDocument26 pagesAccounting Concepts and PrinciplesWindelyn Iligan100% (2)

- FY 2019-2020 adjusting entries quizDocument7 pagesFY 2019-2020 adjusting entries quizAngelieNo ratings yet

- QUIZ - FS - SolutionDocument3 pagesQUIZ - FS - SolutionRichelle ManocayNo ratings yet

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaNo ratings yet

- Drills on Accounting ConceptsDocument5 pagesDrills on Accounting ConceptsAnne AlagNo ratings yet

- Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesAssets Liabilities Owner'S Equity Income ExpensesRalph Christer Maderazo0% (1)

- Fabm1 Assmnt Q2 WK1-2 FinalDocument9 pagesFabm1 Assmnt Q2 WK1-2 FinalIrish D. CudalNo ratings yet

- Exams BookkeepigDocument5 pagesExams BookkeepigRosita Aquino PacibeNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument31 pagesAccounting Cycle of A Merchandising BusinessAresta, Novie Mae100% (1)

- Accounting1 Midterm Exam 1st Sem Ay2017-18Document13 pagesAccounting1 Midterm Exam 1st Sem Ay2017-18Uy SamuelNo ratings yet

- Acchievement Test Fabm2Document5 pagesAcchievement Test Fabm2Carmelo John Delacruz100% (1)

- Cpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessDocument5 pagesCpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessJane ValenciaNo ratings yet

- Accounting1s IstqtrexamDocument3 pagesAccounting1s IstqtrexamJessa BeloyNo ratings yet

- Fabm 1 Lesson 4Document3 pagesFabm 1 Lesson 4Joey Agnas67% (3)

- 04 PRE-TEST OR POST-TEST Jeremy OrtegaDocument14 pages04 PRE-TEST OR POST-TEST Jeremy OrtegaJeremy OrtegaNo ratings yet

- FAR 1st Monthly AssessmentDocument5 pagesFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- Book of Accounts Part 1. JournalDocument12 pagesBook of Accounts Part 1. JournalJace AbeNo ratings yet

- Statement of Cost of Goods SoldDocument3 pagesStatement of Cost of Goods SoldMARIA67% (3)

- Quizbee QuestionsDocument19 pagesQuizbee QuestionsLalaine De JesusNo ratings yet

- Math 11 Fabm1 Abm q2 Week 7Document14 pagesMath 11 Fabm1 Abm q2 Week 7Marchyrella Uoiea Olin JovenirNo ratings yet

- Quiz JournalizingDocument13 pagesQuiz JournalizingEron Roi Centina-gacutanNo ratings yet

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessAngel TumamaoNo ratings yet

- The Adjusting Process: Prepared By: C. Douglas Cloud Professor Emeritus of Accounting Pepperdine UniversityDocument52 pagesThe Adjusting Process: Prepared By: C. Douglas Cloud Professor Emeritus of Accounting Pepperdine UniversityJuan Dela CruzNo ratings yet

- 2 E Mabilis Trucking Service KP Golf Range HandoutsDocument3 pages2 E Mabilis Trucking Service KP Golf Range HandoutsJuan Dela Cruz0% (1)

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- 3 Completing The Accounting CycleDocument6 pages3 Completing The Accounting CycleJuan Dela CruzNo ratings yet

- Fundamentals of Accounting I: Conceptual Framework (ACCT 1A&BDocument12 pagesFundamentals of Accounting I: Conceptual Framework (ACCT 1A&BericacadagoNo ratings yet

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- ACCT 1A&B: Fundamentals of Accounting BCSVDocument17 pagesACCT 1A&B: Fundamentals of Accounting BCSVRyan CapiliNo ratings yet

- MANUFACTURING COST REVIEWDocument12 pagesMANUFACTURING COST REVIEWJuan Dela CruzNo ratings yet

- Accounting For Manufacturing Concern UST-AMV College of Accountancy Financial Accounting and ReportingDocument3 pagesAccounting For Manufacturing Concern UST-AMV College of Accountancy Financial Accounting and ReportingJuan Dela CruzNo ratings yet

- Accounting For Corporation: Learning OutcomesDocument39 pagesAccounting For Corporation: Learning OutcomesElla Mae SaludoNo ratings yet

- Actual Costing Illustrative ProblemDocument5 pagesActual Costing Illustrative ProblemJuan Dela CruzNo ratings yet

- Accounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesDocument7 pagesAccounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesRio GardoceNo ratings yet

- Basic Accounting Review: Unearned Revenue, Notes Receivable, and MoreDocument6 pagesBasic Accounting Review: Unearned Revenue, Notes Receivable, and MoreJuan Dela CruzNo ratings yet

- Accounting Cycle Steps ExplainedDocument13 pagesAccounting Cycle Steps ExplainedJuan Dela CruzNo ratings yet

- Accounting 101 MerchandisingDocument7 pagesAccounting 101 Merchandisingchristian talosig100% (2)

- Accounting for Merchandising BusinessesDocument15 pagesAccounting for Merchandising BusinessesJuan Dela Cruz100% (1)

- Problem 1-1: End BalDocument2 pagesProblem 1-1: End BalJuan Dela CruzNo ratings yet

- Accounting 1 Conceptual Framework and PrinciplesDocument13 pagesAccounting 1 Conceptual Framework and PrinciplesTatyanna Kaliah0% (1)

- Accounting 1: Recognition PrinciplesDocument8 pagesAccounting 1: Recognition PrinciplesJuan Dela CruzNo ratings yet

- Accounting EquationDocument11 pagesAccounting EquationNacelle SayaNo ratings yet

- Module 5 - Substantive Test of CashDocument6 pagesModule 5 - Substantive Test of CashJesievelle Villafuerte NapaoNo ratings yet

- Fin722 Papers Solved Finals Numerical Type: Find Stock Out CostDocument20 pagesFin722 Papers Solved Finals Numerical Type: Find Stock Out CostShrgeel HussainNo ratings yet

- Finance Headlines from July 2020 to November 2020Document55 pagesFinance Headlines from July 2020 to November 2020ShivamNo ratings yet

- Worksheet To Assess Your SelfDocument7 pagesWorksheet To Assess Your SelfBUSHRA ILYASNo ratings yet

- Chap 009Document20 pagesChap 009delosreyesmartinNo ratings yet

- Supply Chain ManagementDocument15 pagesSupply Chain Managementgabriel jimenezNo ratings yet

- Project Management Assignment: Analyzing Software ProjectsDocument9 pagesProject Management Assignment: Analyzing Software ProjectssizzlacalunjiNo ratings yet

- (FM02) - Chapter 1 The Role and Environment of Financial ManagementDocument12 pages(FM02) - Chapter 1 The Role and Environment of Financial ManagementKenneth John TomasNo ratings yet

- Financial Management 1. Cash Management (Cash Conversion Cycle) ProblemDocument4 pagesFinancial Management 1. Cash Management (Cash Conversion Cycle) ProblemVivian SantosNo ratings yet

- Wacc NTDocument41 pagesWacc NTsachin2727No ratings yet

- Accounting assignment - Income statements and discontinued operationsDocument7 pagesAccounting assignment - Income statements and discontinued operationshananNo ratings yet

- Market Makers' Methods of Stock ManipulationDocument4 pagesMarket Makers' Methods of Stock Manipulationhkless100% (3)

- Caf All Subjects Updated Topicwise Grid Prepared by Fahad IrfanDocument8 pagesCaf All Subjects Updated Topicwise Grid Prepared by Fahad IrfanAbubakar PalhNo ratings yet

- Abm1 Learning Module Quarter 1Document71 pagesAbm1 Learning Module Quarter 1LANY T. CATAMINNo ratings yet

- Indonesian Financial Statements TranslationDocument48 pagesIndonesian Financial Statements TranslationJeri HorisonNo ratings yet

- ReSA B44 AUD First PB Exam No AnswerDocument35 pagesReSA B44 AUD First PB Exam No AnswerAlliah Mae AcostaNo ratings yet

- Company Nature Characteristics Separate Legal Entity Limited LiabilityDocument20 pagesCompany Nature Characteristics Separate Legal Entity Limited Liabilitykanakapdurga60% (5)

- Sources of Funding For MNC'sDocument22 pagesSources of Funding For MNC'sNeeraj Kumar80% (5)

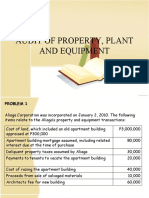

- Audit of Property, Plant and Equipment CostsDocument26 pagesAudit of Property, Plant and Equipment CostsJoseph SalidoNo ratings yet

- Balance Sheet of State Bank of India: - in Rs. Cr.Document17 pagesBalance Sheet of State Bank of India: - in Rs. Cr.Sunil KumarNo ratings yet

- Partnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 10 (Of Lecture 12) - (Kautilya)Shreyash JhaNo ratings yet

- Mutual FundsDocument14 pagesMutual FundsSiddharthNo ratings yet

- BEC Study NotesDocument4 pagesBEC Study NotesCPA ChessNo ratings yet

- IPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr IssueDocument4 pagesIPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr Issuechinna rao100% (1)

- Nigerian Stock Recommendation For August 7th 2023Document4 pagesNigerian Stock Recommendation For August 7th 2023DMAN1982No ratings yet

- III Year QuestionBankDocument113 pagesIII Year QuestionBankercis6421100% (1)

- Jadwal Wawancara Chapter 2 Day 1 Dan 2Document15 pagesJadwal Wawancara Chapter 2 Day 1 Dan 2Rafly athaya LubisNo ratings yet

- Income From House Property: Solution To Assignment SolutionsDocument4 pagesIncome From House Property: Solution To Assignment SolutionsAsar QabeelNo ratings yet

- Acct Statement - XX4920 - 02022023Document4 pagesAcct Statement - XX4920 - 02022023Popi BhowmikNo ratings yet