Professional Documents

Culture Documents

1+r + (1+r) + .. .+ (1+r) + (1+r) : P Div Div Div P

Uploaded by

AnnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1+r + (1+r) + .. .+ (1+r) + (1+r) : P Div Div Div P

Uploaded by

AnnCopyright:

Available Formats

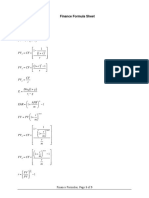

Formulas BUS241

Div 1 +P1 −P 0

r E=

Stocks: Holding Period Yield (Return): P0

Discounted dividend model (DDM, also applies for the two stage DDM model:

Div 1 Div 2 Div N PN

P0 = + 2

+ .. .+ N

+

1+r E ( 1+ r E ) (1+ r E ) ( 1+r E ) N

Div 1

P0 =

Constant Growth DDM model r E −g

Earnings Growth Rate = Retention Rate X Return on New Investment (ROE)

Where Retention Rate = 1 – Payout rate

If earnings growth rate is the same as the dividend growth rate, then

G = Retention Rate X Return on New Investment

Project Evaluation: NPV = PV(Benefits) – PV(Costs). This is the most accurate method

IRR is the discount rate that sets NPV = 0

Profitability index = Value Created/Resource Consumed = NPV/Resource consumed

Payback period is the number of periods to pay back the initial investment

Capital Budgeting

Incremental Earnings = (Incremental Revenues – Incremental Cost – Depreciation) X (1-Tax Rate)

Free Cash Flow = (Revenues – Costs – Depreciation) X (1 – Tax Rate) + Depreciation – CapEx –

Change in NWC

After-Tax Cash Flow from Asset Sale = Sale Price – (Tax Rate X Capital Gain)

NPV of the project is the Discounted Cash Flow of the projects.

Accounting breakeven: set EBIT=0 to calculate the parameter value interested

NPV breakeven: set NPV=0 to calculate the parameter value interested

Scenario analysis vs Sensitivity analysis

Discounted Cash Flow (DCF) Model for Stock Valuation

Enterprise Value (Vo) = Market Value of Equity + Debt – Cash = PV(Future Free Cash Flow of Firm)

V 0 +Cash0 −Debt 0

P0 =

Share Price: Shares Outstanding

FCF 1 FCF 2 FCF N VN

V 0= + 2

+. . .+ N

+

DCF Intrinsic Value of the Firm:

1+ r WACC (1+ r WACC ) (1+ r WACC ) ( 1+ r WACC )N

FCF N+1 1+g FCF

Constant growth model of DCF:

VN= =

(

r WACC −g FCF r WACC−g FCF

×FCF N

)

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Finalexam - Financial Management FicheDocument6 pagesFinalexam - Financial Management FicheLouis BarbierNo ratings yet

- Selection of Useful FormulasDocument3 pagesSelection of Useful FormulasМаша СкрипченкоNo ratings yet

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Formula Sheet FinanceDocument2 pagesFormula Sheet Financemostafa daherNo ratings yet

- Finance 430 Executive SummaryDocument31 pagesFinance 430 Executive SummaryEin LuckyNo ratings yet

- List of Corporate Finance FormulasDocument9 pagesList of Corporate Finance FormulasYoungRedNo ratings yet

- Formula Sheet Short-Term Solvency RatiosDocument2 pagesFormula Sheet Short-Term Solvency RatiosNguyễn Ngọc Phương LinhNo ratings yet

- Exam Cheat Sheet VSJDocument3 pagesExam Cheat Sheet VSJMinh ANhNo ratings yet

- 26 - Summary of MafaDocument3 pages26 - Summary of Mafahina1234No ratings yet

- Profit Margin Total Assets Turnover Equity Multiplier: Formula AFDocument4 pagesProfit Margin Total Assets Turnover Equity Multiplier: Formula AFDiva Tertia AlmiraNo ratings yet

- 395 Midterm 1 Cheat SheetDocument2 pages395 Midterm 1 Cheat Sheetchrisjames20036No ratings yet

- MAF302 Formula Sheet: Key Financial ConceptsDocument2 pagesMAF302 Formula Sheet: Key Financial ConceptsWill LeeNo ratings yet

- Principles of Finance Formulae SheetDocument4 pagesPrinciples of Finance Formulae SheetAmina SultangaliyevaNo ratings yet

- Formulas Bonds: Cpn Income+ price change APY(Approximate Yield to MaturityDocument1 pageFormulas Bonds: Cpn Income+ price change APY(Approximate Yield to MaturityGhitaNo ratings yet

- PAK CFE Supplemental Formula Sheet (Spring 2023)Document49 pagesPAK CFE Supplemental Formula Sheet (Spring 2023)CalvinNo ratings yet

- 2022 Level I Key Facts and Formulas SheetDocument13 pages2022 Level I Key Facts and Formulas Sheetayesha ansari100% (2)

- Present Value and Future Value: Finance: Time Value of MoneyDocument11 pagesPresent Value and Future Value: Finance: Time Value of MoneyTes DudteNo ratings yet

- Formula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NDocument5 pagesFormula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NrohansahniNo ratings yet

- Formula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NDocument5 pagesFormula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NrohansahniNo ratings yet

- PRINCIPLES OF FINANCE FORMULA SHEETDocument3 pagesPRINCIPLES OF FINANCE FORMULA SHEETDawid HamerNo ratings yet

- Lecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALDocument49 pagesLecture 4 INVESTMENT CRITERIA FOR PROJECT APPRAISALANH VÕ TỪNo ratings yet

- 24 Top Financial FormulasDocument1 page24 Top Financial FormulasNgọc Linh NguyễnNo ratings yet

- FINA 1310 - Lecture 3 NotesDocument6 pagesFINA 1310 - Lecture 3 NotesAayushi ReddyNo ratings yet

- Sample Level 1 Wiley Formula Sheets PDFDocument10 pagesSample Level 1 Wiley Formula Sheets PDFMuhammed RafiudeenNo ratings yet

- Định Giá DN Khi Thực Hiện M&ADocument45 pagesĐịnh Giá DN Khi Thực Hiện M&ABlatta OrientalisNo ratings yet

- Financial Management Equations Korea UniversityDocument2 pagesFinancial Management Equations Korea UniversityTom DNo ratings yet

- Formula Sheet Midterm2021Document5 pagesFormula Sheet Midterm2021Derin OlenikNo ratings yet

- FormulasDocument2 pagesFormulasKalid JCNo ratings yet

- FM Formula Sheet - Not GivenDocument4 pagesFM Formula Sheet - Not GivenSophie ChopraNo ratings yet

- Chap 2: 1. CF (A) OCF - Capital Spending - 2. CF (B) Debt Service - Long-Term DebtDocument5 pagesChap 2: 1. CF (A) OCF - Capital Spending - 2. CF (B) Debt Service - Long-Term DebtTRANG NGUYỄN LÊ QUỲNHNo ratings yet

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolDocument6 pagesFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenNo ratings yet

- Formula SheetDocument4 pagesFormula Sheetinspiredbysims4No ratings yet

- Corporate Finance Sam en VattingDocument11 pagesCorporate Finance Sam en VattingVincent van MeeuwenNo ratings yet

- FINA2222 Formula SheetDocument6 pagesFINA2222 Formula SheetDaksh ParasharNo ratings yet

- FIN222 Equations NotesDocument49 pagesFIN222 Equations NotesSotiris HarisNo ratings yet

- Finance - Time Value of MoneyDocument2 pagesFinance - Time Value of MoneyMaria Inês AzevedoNo ratings yet

- Corporate Finance Equations NotesDocument4 pagesCorporate Finance Equations NotesSotiris HarisNo ratings yet

- CH 2Document6 pagesCH 2Hemant GoyalNo ratings yet

- Test 2 Formula SheetDocument1 pageTest 2 Formula Sheetgabriella portelliNo ratings yet

- CH 6 Slides 1kua58iDocument29 pagesCH 6 Slides 1kua58iTaa AngieNo ratings yet

- BF - Fourmulae - 2013Document3 pagesBF - Fourmulae - 2013AmiteshNo ratings yet

- Formula Sheet: Short-Term Solvency RatiosDocument2 pagesFormula Sheet: Short-Term Solvency RatiosNgô Hoàng Bích Kha100% (1)

- Ee Cash Flows and Capital BudgetingDocument33 pagesEe Cash Flows and Capital Budgetingdwi suhartantoNo ratings yet

- Adms3530f18 Final Exam Formula Sheet PDFDocument6 pagesAdms3530f18 Final Exam Formula Sheet PDFSandy SandNo ratings yet

- FM Shot NotesDocument25 pagesFM Shot NotesragefolioNo ratings yet

- Mock Final 2021 - 2Document5 pagesMock Final 2021 - 2anthony.schzNo ratings yet

- General Notes FIN 412Document16 pagesGeneral Notes FIN 412Christian Leth-KjaerNo ratings yet

- Investment Project Analysis & EvaluationDocument15 pagesInvestment Project Analysis & EvaluationdavidNo ratings yet

- Manajemen Keuangan RangkumanDocument6 pagesManajemen Keuangan RangkumanDanty Christina SitalaksmiNo ratings yet

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- Công thức IM tự luận- cho finalDocument6 pagesCông thức IM tự luận- cho finalTuấn NguyễnNo ratings yet

- Unit 3Document71 pagesUnit 3martaNo ratings yet

- Formulas Öecture SlidesDocument2 pagesFormulas Öecture SlidesChristine KwanNo ratings yet

- Corporate Finance Formula SheetDocument5 pagesCorporate Finance Formula SheetChan Jun LiangNo ratings yet

- Bond Valuation and Stocks Acquisition of CapitalDocument7 pagesBond Valuation and Stocks Acquisition of CapitalKizzandria BayotNo ratings yet

- Interest Rates That Vary With Time: I A I CWDocument3 pagesInterest Rates That Vary With Time: I A I CWTepe HolmNo ratings yet

- Cost of Capital and Capital Budgeting FormulasDocument4 pagesCost of Capital and Capital Budgeting FormulasMaha Bianca Charisma CastroNo ratings yet

- Finance Formulas Cheat SheetDocument3 pagesFinance Formulas Cheat Sheetkfir goldburdNo ratings yet

- Econ 215-Ch.4-hwSMDocument12 pagesEcon 215-Ch.4-hwSMAnnNo ratings yet

- In The Balance Sheet Above, The Excess Reserve Ratio of ABC Bank Is - and Its Excess Reserves AreDocument5 pagesIn The Balance Sheet Above, The Excess Reserve Ratio of ABC Bank Is - and Its Excess Reserves AreAnnNo ratings yet

- BUS 241 Chapter 2 Sample QuizDocument1 pageBUS 241 Chapter 2 Sample QuizAnnNo ratings yet

- Chapter 10 HWDocument1 pageChapter 10 HWAnnNo ratings yet

- Key Symbols and Their Meaning in SocietyDocument2 pagesKey Symbols and Their Meaning in SocietyAnnNo ratings yet

- Asian Paints PLDocument2 pagesAsian Paints PLPriyalNo ratings yet

- Equity Research Summer ProjectDocument66 pagesEquity Research Summer Projectpajhaveri4009No ratings yet

- The Cost of Capital: Assets DebtDocument22 pagesThe Cost of Capital: Assets Debtaku kamuNo ratings yet

- Case 11 Horniman Horticulture 20170504Document16 pagesCase 11 Horniman Horticulture 20170504Chittisa Charoenpanich100% (4)

- Principles of Accounting Needles 12th Edition Test BankDocument70 pagesPrinciples of Accounting Needles 12th Edition Test BankCharles Lussier100% (31)

- Aspire Global Q2-21-ReportDocument25 pagesAspire Global Q2-21-Reportl chanNo ratings yet

- Test Bank Advanced Accounting Part 2 Millan PDFDocument433 pagesTest Bank Advanced Accounting Part 2 Millan PDFAmie Jane MirandaNo ratings yet

- Job Order Costing HandoutsDocument8 pagesJob Order Costing HandoutsHannah Jane Arevalo LafuenteNo ratings yet

- ch05 Accounting For Merchandising Operations Test BankDocument58 pagesch05 Accounting For Merchandising Operations Test BankSTEM1 LOPEZNo ratings yet

- Chapter One Introduction To Financial Modeling and ValuationDocument6 pagesChapter One Introduction To Financial Modeling and ValuationBobasa S AhmedNo ratings yet

- Auditing and Consulting Business PlanDocument40 pagesAuditing and Consulting Business Plandabatamene50% (2)

- Diamond Energy ResourcesDocument3 pagesDiamond Energy ResourcesMuhammad FikryNo ratings yet

- Account StructureDocument20 pagesAccount StructureKrisdayanti BrchimbolonNo ratings yet

- Instructions For A Classified Balance SheetDocument5 pagesInstructions For A Classified Balance SheetMary91% (11)

- Session 7 Valuation of ITC Using DDMDocument24 pagesSession 7 Valuation of ITC Using DDMSnehil BajpaiNo ratings yet

- Cost II AssignmentDocument4 pagesCost II AssignmentmeazadgafuNo ratings yet

- COST VOLUME PROFIT ANALYSIS ExercisesDocument5 pagesCOST VOLUME PROFIT ANALYSIS ExercisesjenieNo ratings yet

- SOL. MAN. CHAPTER 5 CORPORATE LIQUIDATION REORGANIZATION 2020 EDITION - Docx 070455Document24 pagesSOL. MAN. CHAPTER 5 CORPORATE LIQUIDATION REORGANIZATION 2020 EDITION - Docx 070455ChristianNo ratings yet

- Blcok-4 MCO-7 Unit-1 PDFDocument24 pagesBlcok-4 MCO-7 Unit-1 PDFSoitda BcmNo ratings yet

- 3185 ch04Document48 pages3185 ch04mkam212No ratings yet

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- Emperador Vertical AnalysisDocument3 pagesEmperador Vertical AnalysisDiane Isogon Lorenzo100% (2)

- MBA Question PapersDocument36 pagesMBA Question PapersVaidehi JoshiNo ratings yet

- Class - Marginal CostingDocument45 pagesClass - Marginal CostingAMBIKA MALIKNo ratings yet

- Week 1 - Accounting EquationDocument23 pagesWeek 1 - Accounting EquationJannyfaye RallecaNo ratings yet

- Prade Case StudyDocument12 pagesPrade Case StudyTrump Papers100% (1)

- COST ANALYSIS - 62 Questions With AnswersDocument6 pagesCOST ANALYSIS - 62 Questions With Answersmehdi everythingNo ratings yet

- Postal Test Papers_P10_Intermediate_Syllabus 2012 Cost & Management Accountancy Test Paper—II/10/CMA/2012/T-1 ueDocument22 pagesPostal Test Papers_P10_Intermediate_Syllabus 2012 Cost & Management Accountancy Test Paper—II/10/CMA/2012/T-1 ueGajju ChautalaNo ratings yet

- Activity 6B CapStructure FinmaDocument4 pagesActivity 6B CapStructure FinmaDiomela BionganNo ratings yet

- MasterpadDocument1 pageMasterpadnoursfoodforthoughtNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet