Professional Documents

Culture Documents

Corona Kavach Policy-Oriental Insurance - Rate Chart

Uploaded by

Anand KesarkarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corona Kavach Policy-Oriental Insurance - Rate Chart

Uploaded by

Anand KesarkarCopyright:

Available Formats

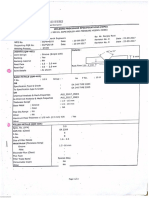

THE ORIENTAL INSURANCE COMPANY LIMITED

Regd.Office: Oriental House,P.B.No.7037,A-25/27,Asaf Ali Road, New Delhi-110 002

CIN No. U66010DL1947GOI007158

CORONA KAVACH POLICY- ORIENTAL INSURANCE

PREMIUM CHART

INDIVIDUAL PLAN : BASE COVER (INR)

S.No. Sum For 9,1/2 Months For 6,1/2 Months For 3,1/2 Months

Insured Age in completed

(INR) years* Age in completed years* Age in completed years*

Upto Above Above Above

40 41-60 60 Upto 40 41-60 60 Upto 40 41-60 60

1 50,000 257 343 514 208 277 416 127 170 254

2 1,00,000 434 579 868 351 468 701 215 286 429

3 1,50,000 595 793 1189 481 641 961 294 392 588

4 2,00,000 743 990 1485 600 800 1200 367 490 735

5 2,50,000 876 1168 1752 708 944 1416 433 578 867

6 3,00,000 932 1243 1864 753 1005 1507 461 615 923

7 3,50,000 1061 1414 2122 857 1143 1715 525 700 1050

8 4,00,000 1125 1500 2250 909 1212 1819 557 742 1113

9 4,50,000 1246 1661 2491 1007 1342 2013 616 822 1233

10 5,00,000 1286 1714 2572 1039 1386 2078 636 848 1272

Taxes as applicable shall be extra.

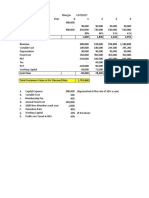

INDIVIDUAL PLAN : ADD-ON DAILY HOSPITAL CASH (INR)

S.No. Sum For 9,1/2 Months For 6,1/2 Months For 3,1/2 Months

Insured Age in completed

(INR) years* Age in completed years* Age in completed years*

Upto Above Above Above

40 41-60 60 Upto 40 41-60 60 Upto 40 41-60 60

1 50,000 12 16 23 9 13 19 6 8 12

2 1,00,000 23 31 47 19 25 38 12 15 23

3 1,50,000 35 47 70 28 38 57 17 23 35

4 2,00,000 47 62 93 38 50 75 23 31 46

5 2,50,000 58 78 117 47 63 94 29 38 58

6 3,00,000 70 93 140 57 75 113 35 46 69

7 3,50,000 82 109 163 66 88 132 40 54 81

8 4,00,000 93 124 186 75 100 151 46 61 92

9 4,50,000 105 140 210 85 113 170 52 69 104

1

Page

10 5,00,000 117 155 233 94 126 188 58 77 115

The Oriental Insurance Company Ltd. Corona Kavach Policy-Oriental Insurance

UIN: OICHLIP21063V012021

Premium Chart

Taxes as applicable shall be extra.

*Means the age completed as on the date of the policy inception/renewal. So, for a person aged 40 years

and 364 days , completed age would be charged on the age of 40 years, not that of 41 years.

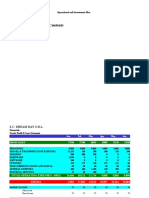

PREMIUM CALCULATION FOR FAMILY FLOATER PLAN:

A sum insured wise floater discount will be provided to opt the covers under family floater plan.

The defined range of floater discounts is tabulated below:

Table A: Sum Insured wise floater discount:

Sum Insured (INR) Discount

50000 90%

100000 90%

150000 85%

200000 80%

250000 75%

300000 75%

350000 75%

400000 60%

450000 60%

500000 60%

Office premium for the family floater plan is calculated by considering a member as ‘primary

member’ – one with the highest age-wise premium (Even when more than one person in a

family is eligible as a primary member, only one will be considered as primary member)

Premium for the Floater cover = 100% of Applicable premium for one primary member +

(applicable discount % for Floater SI defined in Table-A) * (Sum of applicable premium for

other members of the family (other than primary member))

An Illustrative Example for floater premium calculation is cited below for understanding:

Let a family of 6 members want to insure under the proposed product with the following details:

Opted SI 5,00,000

Opted Add On Daily Hospital Cash

Term of policy opted 9 ½ months

Family Composition Age category No of members

Lower Category 2

Base Category 2

2

Higher Category 2

Page

The Oriental Insurance Company Ltd. Corona Kavach Policy-Oriental Insurance

UIN: OICHLIP21063V012021

Premium Chart

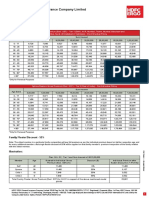

Then, the applicable Sum Insured Floater Discount = 60%; and the per person premium rate is

calculated as shown under in the table:

Table: B

Age Category Age Wise Base Cover Hospital Daily Total

Discount(A) (A*Base Premium of cash (A*Base Premium Premium

Individual plan Base of Individual plan Per

Cover for 9 1/2 Hospital Daily cash for 9

Months) 1/2 Months) Person

Applicable Lower Category 75% 1286 117 1402

premium Base Category 100% 1714 155 1870

Higher Category 150% 2572 233 2805

(In INR)

From the above table, we can see that the premium for primary member = INR 2,805 Premium

for members other than primary member is done in the following table:

Table: C

Premium for No of persons Applicable Applicable Premium after

other members (A) premium Per Premium discount (60%

(other than Person(B) (A*B) discount)

primary member)

Lower Category 2 1402 2805 1122

Base Category 2 1870 3740 1496

Higher Category 1 2805 2805 1122

Total 3740

So, the total floater premium for 285 days tenure = Primary member premium + premium for other

member = Rs. 2,805+ Rs.3,740 = Rs. 6,544/-

DISCOUNTS:

1. Health Care Worker Discount: A flat discount of 5% in premium for health care workers

as defined in the product wordings.

2. Digital Discount: 5 % Discount If policy taken Online where no intermediary is involved.

3. TPA Service Discount: 5.5% if TPA services not opted for.

******************************

3

Page

The Oriental Insurance Company Ltd. Corona Kavach Policy-Oriental Insurance

UIN: OICHLIP21063V012021

Premium Chart

You might also like

- Jnri Credit 127 Corporation: Promissory NoteDocument3 pagesJnri Credit 127 Corporation: Promissory NoteEra gasperNo ratings yet

- Process Flow Chart - Heat ExchangerDocument7 pagesProcess Flow Chart - Heat ExchangerAnand KesarkarNo ratings yet

- Pressure Testing Safety EssentialsDocument7 pagesPressure Testing Safety EssentialsSuleyman HaliciogluNo ratings yet

- The Truth About Fibonacci TradingDocument34 pagesThe Truth About Fibonacci TradingAnand KesarkarNo ratings yet

- The Complete Guide To Trading PDFDocument116 pagesThe Complete Guide To Trading PDFvkverma352No ratings yet

- Basic Accounting ProblemsDocument6 pagesBasic Accounting ProblemsDalia ElarabyNo ratings yet

- Hydrostatic Testing Procedures for FacilitiesDocument17 pagesHydrostatic Testing Procedures for Facilitiesprakash07343No ratings yet

- Profit & Loss StatementDocument16 pagesProfit & Loss StatementtaolaNo ratings yet

- Buczek 20081130 Bonded Promissory Note HSBC & BESTBUYDocument1 pageBuczek 20081130 Bonded Promissory Note HSBC & BESTBUYBob HurtNo ratings yet

- Extensive Budget Set UpDocument1 pageExtensive Budget Set Uporientalhospitality100% (1)

- Symbol of Weld PDFDocument28 pagesSymbol of Weld PDFSyarif IrwantoNo ratings yet

- Symbol of Weld PDFDocument28 pagesSymbol of Weld PDFSyarif IrwantoNo ratings yet

- Symbol of Weld PDFDocument28 pagesSymbol of Weld PDFSyarif IrwantoNo ratings yet

- Standard Operation ProcedureDocument3 pagesStandard Operation ProcedureAnand KesarkarNo ratings yet

- Candlestick Patterns Every Trader Should KnowDocument65 pagesCandlestick Patterns Every Trader Should KnowDxtr V Drn100% (1)

- Forecast May 03Document3 pagesForecast May 03Anonymous geItmk3No ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideAnand Kesarkar100% (1)

- Performance TaskDocument3 pagesPerformance TaskAnne Esguerra80% (5)

- A270Document6 pagesA270Anonymous O39pjWNo ratings yet

- 2021 SBU Red Book Volume 2 - Commercial LawDocument123 pages2021 SBU Red Book Volume 2 - Commercial LawJong CjaNo ratings yet

- Dss 2205 Wps PQR WPQDocument8 pagesDss 2205 Wps PQR WPQAnand KesarkarNo ratings yet

- Corona Kavach Policy-Oriental Insurance - Rate Chart - RRDocument2 pagesCorona Kavach Policy-Oriental Insurance - Rate Chart - RRNagaraj BVNo ratings yet

- MLHUILLIER COMMISSIONS FinalDocument2 pagesMLHUILLIER COMMISSIONS FinalabtNo ratings yet

- Kindly Change The GREEN Cells Only Kindly Change The GREEN Cells OnlyDocument14 pagesKindly Change The GREEN Cells Only Kindly Change The GREEN Cells Onlyfaizahamed111No ratings yet

- Target PPSMDocument94 pagesTarget PPSMLucan MusicNo ratings yet

- Revised-Installment-of-all-Scheme - 14-05-2020Document3 pagesRevised-Installment-of-all-Scheme - 14-05-2020Toufiqur Rahman SiamNo ratings yet

- CGT21027 30APR HomeworkDocument7 pagesCGT21027 30APR HomeworkBhargav D.S.No ratings yet

- BookDocument9 pagesBookURK20CM3005 M CATHRINENo ratings yet

- Time schedule and cost analysis of building construction projectDocument24 pagesTime schedule and cost analysis of building construction projectAgie Ramdiansyah NurrahmanNo ratings yet

- Kindly Change The GREEN Cells Only Kindly Change The GREEN Cells OnlyDocument14 pagesKindly Change The GREEN Cells Only Kindly Change The GREEN Cells OnlyKannammal SampathkumarNo ratings yet

- Numeric Model MetricsDocument5 pagesNumeric Model MetricsAnkit NarulaNo ratings yet

- Single Item Expected Profit AnalysisDocument16 pagesSingle Item Expected Profit Analysisvaibhav kumar KhokharNo ratings yet

- Report Mr. A 945 70 20 Age 30 SA 2000000Document6 pagesReport Mr. A 945 70 20 Age 30 SA 2000000Sai VkcNo ratings yet

- Leveling Dragon Mania LegendsDocument22 pagesLeveling Dragon Mania LegendsWendi SurdinalNo ratings yet

- Rekayasa HiDocument110 pagesRekayasa HiFitria FitriNo ratings yet

- MID DAY REPORT (Daily) (Autosaved) Latest 5 AprilDocument35 pagesMID DAY REPORT (Daily) (Autosaved) Latest 5 AprilSing IskingaNo ratings yet

- Premium Chart New India Floater Mediclaim PolicyDocument1 pagePremium Chart New India Floater Mediclaim PolicyDeepan ManojNo ratings yet

- Reduced Mean and Reduced Standard Deviation TablesDocument58 pagesReduced Mean and Reduced Standard Deviation TablesRiskiawan ErtantoNo ratings yet

- QC Rincian Polsus Cowok - Before WPFKDocument23 pagesQC Rincian Polsus Cowok - Before WPFKAji NugrohoNo ratings yet

- Airlines Katar Airlines Lusiana Airlines Go-Indio Spice Jet Indiana Airlines East-West Airlines Ethihad Emiritus Air MalayaDocument24 pagesAirlines Katar Airlines Lusiana Airlines Go-Indio Spice Jet Indiana Airlines East-West Airlines Ethihad Emiritus Air Malayamahesh kumarNo ratings yet

- CGT21010 HomeworkDocument5 pagesCGT21010 HomeworkBhargav D.S.No ratings yet

- PDF Reduced Mean Yn Dan Reduced Standard Deviation SN N Yn SN N Yn SN N Yn SN CompressDocument20 pagesPDF Reduced Mean Yn Dan Reduced Standard Deviation SN N Yn SN N Yn SN N Yn SN CompressAnisa KamilaNo ratings yet

- Azucena MBCPayroll CalculatorDocument14 pagesAzucena MBCPayroll Calculatoracctg2012No ratings yet

- Itk - Tugas 3Document12 pagesItk - Tugas 3Riski Lya AmaliaNo ratings yet

- Honkai Star Rail - Trailblazer Level CalculatorDocument6 pagesHonkai Star Rail - Trailblazer Level CalculatorScarlet ZeonNo ratings yet

- Cuentas X Cobrar Caribbean 2017Document8 pagesCuentas X Cobrar Caribbean 2017ajvlNo ratings yet

- Laboratorio 5Document9 pagesLaboratorio 5Brajham Felix Alberto GarayNo ratings yet

- Quiz 2 TableDocument5 pagesQuiz 2 TableSathish BNo ratings yet

- Navi Cure premium rates chartDocument21 pagesNavi Cure premium rates chartAnkit UjjwalNo ratings yet

- Airlines Katar Airlines Lusiana Airlines Go-Indio Spice Jet Indiana Airlines East-West Airlines Ethihad Emiritus Air MalayaDocument24 pagesAirlines Katar Airlines Lusiana Airlines Go-Indio Spice Jet Indiana Airlines East-West Airlines Ethihad Emiritus Air Malayamahesh kumarNo ratings yet

- Load Security Rate 01-04-2022Document1 pageLoad Security Rate 01-04-2022Simanta DuttaNo ratings yet

- RT Safe Distance CalculationDocument4 pagesRT Safe Distance CalculationBilal Tahir100% (1)

- St. Vincent College: Tuition Fee Per Unit at P400 Miscellaneous FeesDocument3 pagesSt. Vincent College: Tuition Fee Per Unit at P400 Miscellaneous FeesYlor NoniuqNo ratings yet

- Bank A Bank B Bank C P.V P.V P.V Year: Question No # 1Document4 pagesBank A Bank B Bank C P.V P.V P.V Year: Question No # 1AsadvirkNo ratings yet

- Investment Analysis ExercisesDocument4 pagesInvestment Analysis ExercisesAnurag SharmaNo ratings yet

- Proposed Oxymon Solution Limited Financial ProjectionsDocument104 pagesProposed Oxymon Solution Limited Financial ProjectionsBABAN JUNIORNo ratings yet

- Diag. InteraccionDocument32 pagesDiag. InteraccionMauricio CalderonestelaNo ratings yet

- Rekapitulasi Bulanan Puskesmas Jatirokeh Feb-18Document4 pagesRekapitulasi Bulanan Puskesmas Jatirokeh Feb-18puskesmas jatirokehNo ratings yet

- Monthly Basic Pay Table: Effective 1 January 2022Document3 pagesMonthly Basic Pay Table: Effective 1 January 2022j bloneyNo ratings yet

- Auro Chit New Payment ChartDocument1 pageAuro Chit New Payment Chartbest southNo ratings yet

- Book1 (AutoRecovered)Document22 pagesBook1 (AutoRecovered)raihanrobin2002No ratings yet

- Andan-Queen-Zhien-A.-CE-4B-Assignment-1Document10 pagesAndan-Queen-Zhien-A.-CE-4B-Assignment-1EmmanNo ratings yet

- Calculation For Accounting Level 2Document6 pagesCalculation For Accounting Level 2Marc WrightNo ratings yet

- Mes Error CFE Error Abs MAD Pronostico de Demanda Ventas Reales Error Abs AcumDocument8 pagesMes Error CFE Error Abs MAD Pronostico de Demanda Ventas Reales Error Abs AcumcarlosNo ratings yet

- Plan Presentation UlsavDocument7 pagesPlan Presentation UlsavAswathy GopinathNo ratings yet

- Plan Afaceri-Mirică Irina-MariaDocument83 pagesPlan Afaceri-Mirică Irina-MariaTheodor BondocNo ratings yet

- Cap Bud SolutionsDocument17 pagesCap Bud SolutionsSwati PorwalNo ratings yet

- Engine Controls and Fuel - 1.6L (LXV) PDFDocument81 pagesEngine Controls and Fuel - 1.6L (LXV) PDFBenz Aio Calachua AraujoNo ratings yet

- Capital Investment Decisions Answers To End of Chapter ExercisesDocument3 pagesCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Creditnote - VIZAG 30.09.2023Document6 pagesCreditnote - VIZAG 30.09.2023Raja chNo ratings yet

- Or Rate Chart Excluding STDocument2 pagesOr Rate Chart Excluding STRatzNo ratings yet

- Data HidrologiDocument36 pagesData HidrologiMuhammad NaquibNo ratings yet

- New India Floater Mediclaim Policy Premium ChartDocument2 pagesNew India Floater Mediclaim Policy Premium ChartSnehaAnilSurveNo ratings yet

- Solutions Chapter 7Document6 pagesSolutions Chapter 7houssamNo ratings yet

- Book 7Document3 pagesBook 7Vigash DharrsanNo ratings yet

- Assignmen3 (Mahmoud Abd El Aziz)Document5 pagesAssignmen3 (Mahmoud Abd El Aziz)Mahmoud ZizoNo ratings yet

- Cash Flow WaterfallDocument8 pagesCash Flow WaterfallEmmanuelDasiNo ratings yet

- Name Contact No. Location DOB Age SR No. Employee CodeDocument5 pagesName Contact No. Location DOB Age SR No. Employee CodeAnand KesarkarNo ratings yet

- ANUGRAHA TEJAS Automatic power loom for Coir Geo TextilesDocument16 pagesANUGRAHA TEJAS Automatic power loom for Coir Geo TextilesAnand KesarkarNo ratings yet

- The Truth About Fibonacci TradingDocument34 pagesThe Truth About Fibonacci TradingAnand KesarkarNo ratings yet

- Dynamic Print Solution: D P E PDocument8 pagesDynamic Print Solution: D P E PAnand KesarkarNo ratings yet

- Manufacturing Processes UNIT Test-I - Series A With SolutionsDocument1 pageManufacturing Processes UNIT Test-I - Series A With SolutionsAnand KesarkarNo ratings yet

- Unit 8 - Week 7: Assignment 07Document3 pagesUnit 8 - Week 7: Assignment 07Anand KesarkarNo ratings yet

- Astm A70Document1 pageAstm A70Anand KesarkarNo ratings yet

- Let's Discuss Your Next Project.: Contact USDocument8 pagesLet's Discuss Your Next Project.: Contact USAnand KesarkarNo ratings yet

- Cap 3 Dse CutoffDocument614 pagesCap 3 Dse CutoffAnand KesarkarNo ratings yet

- 1.4 BG00381946 - ADocument1 page1.4 BG00381946 - AAnand KesarkarNo ratings yet

- Maharashtra State Road Transport Corporation Public Online Reservation System TicketDocument1 pageMaharashtra State Road Transport Corporation Public Online Reservation System TicketAnand KesarkarNo ratings yet

- Change Address Contact Details Email IdDocument1 pageChange Address Contact Details Email IdAnand KesarkarNo ratings yet

- M CR 601r1Document14 pagesM CR 601r1nazari123No ratings yet

- WPQ Is 2062 Haresh Shah W1Document1 pageWPQ Is 2062 Haresh Shah W1Anand KesarkarNo ratings yet

- Wps Is 2062 GR B Butt-OkDocument2 pagesWps Is 2062 GR B Butt-OkAnand Kesarkar33% (3)

- Cr10830005 - 3 Heat Exchanger 01Document1 pageCr10830005 - 3 Heat Exchanger 01Anand KesarkarNo ratings yet

- Coc Level 3 4TH RoundDocument15 pagesCoc Level 3 4TH Roundsolomon asfawNo ratings yet

- Project Report On "To Study The Strength of Using CAMELS Framework As A Tool of Performance Evaluation For Banking Institutions '' Bank of Kathmandu Everest Bank NIC BankDocument81 pagesProject Report On "To Study The Strength of Using CAMELS Framework As A Tool of Performance Evaluation For Banking Institutions '' Bank of Kathmandu Everest Bank NIC Bankshyamranger100% (1)

- Mock Test – 2 Accountancy Class XII ComDocument5 pagesMock Test – 2 Accountancy Class XII ComprakharNo ratings yet

- Amendments To Regulations On Electronic Banking Services and Other Electronic OperationsDocument13 pagesAmendments To Regulations On Electronic Banking Services and Other Electronic OperationsKat GuiangNo ratings yet

- Gweyi, Moses Ochieng PHD BA, (Finance), 2018Document159 pagesGweyi, Moses Ochieng PHD BA, (Finance), 2018Moses GweyiNo ratings yet

- CB1 - April23 - EXAM - Clean ProofDocument7 pagesCB1 - April23 - EXAM - Clean ProofAdvay GuglianiNo ratings yet

- Certificate of Liability Insurance: 17w045 Hodges Road Oakbrook Terrace, IL-60181 PH: 630-786-9971 Fax: 630-495-6039Document1 pageCertificate of Liability Insurance: 17w045 Hodges Road Oakbrook Terrace, IL-60181 PH: 630-786-9971 Fax: 630-495-6039arnur.toksanbay24No ratings yet

- PPE ProblemDocument3 pagesPPE ProblemChristy HabelNo ratings yet

- Working GroupDocument16 pagesWorking GrouppvaibhyNo ratings yet

- Operating Activities:: What Are The Classification of Cash Flow?Document5 pagesOperating Activities:: What Are The Classification of Cash Flow?samm yuuNo ratings yet

- AKL1 Imam (Pertemuan 6)Document2 pagesAKL1 Imam (Pertemuan 6)Clarissa HalimNo ratings yet

- BNK 214: Commercial Banking Operations: (Focus Area III)Document2 pagesBNK 214: Commercial Banking Operations: (Focus Area III)Suvash KhanalNo ratings yet

- CIBIL Loan Details Format AnalysisDocument11 pagesCIBIL Loan Details Format AnalysisPrince CharliNo ratings yet

- Review Engineering Economics Bsce 2022 Sem2Document11 pagesReview Engineering Economics Bsce 2022 Sem2Angelica PanganibanNo ratings yet

- Differenfce Between Various Types of AuditDocument3 pagesDifferenfce Between Various Types of AuditGhalib HussainNo ratings yet

- BPI Philippine High Dividend Equity Fund - November 2023 v2Document3 pagesBPI Philippine High Dividend Equity Fund - November 2023 v2Gabrielle De VeraNo ratings yet

- Franklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Document45 pagesFranklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Ghanshyam Kumar PandeyNo ratings yet

- The Mpassbook Statement Is Generated For Selected Date Range Between 14-07-2022 TO 12-10-2022. Customer DetailsDocument5 pagesThe Mpassbook Statement Is Generated For Selected Date Range Between 14-07-2022 TO 12-10-2022. Customer DetailsPraveen kumarNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)ShreyaNo ratings yet

- Loan Recovery Policy - StatebankoftravancoreDocument2 pagesLoan Recovery Policy - StatebankoftravancoreBhagyanath MenonNo ratings yet

- Assignment 6 1 Warm-Up Exercises Chapter 12Document4 pagesAssignment 6 1 Warm-Up Exercises Chapter 12Irene ApriliaNo ratings yet

- Indus Bank - Report On Summer TrainingDocument34 pagesIndus Bank - Report On Summer TrainingZahid Bhat100% (1)

- Auditor report typesDocument10 pagesAuditor report typesNirjalamani KannanNo ratings yet

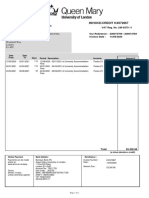

- Queen Mary University of London residence invoice summaryDocument1 pageQueen Mary University of London residence invoice summaryMarita PantelNo ratings yet

- 811 Banking SQP T1Document7 pages811 Banking SQP T1nirmalabehera8No ratings yet