Professional Documents

Culture Documents

A Company Decided To Go Public

A Company Decided To Go Public

Uploaded by

kris mOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Company Decided To Go Public

A Company Decided To Go Public

Uploaded by

kris mCopyright:

Available Formats

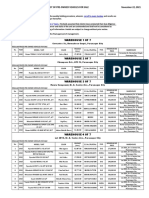

A company decided to go public.

At that time, net income available to common shareholders amounted

to P300,000. The number of common shares issued and outstanding is 125,000.

1. Assume that the pay-out ratio is 60%, how much of the total dividends shall a shareholder owning

10,000 common shares receive? Total dividends= (DPR)(Net income) Total dividends= (.60)(300,000)

Total dividends=P180,000 =(10,000/125,000)(180,000) The amount of total dividends that the

shareholder owning 10,000 common shares shall receive=P14,400

2. Assume that the pay-out ratio is 60% and the price per share is P20, what is the dividend yield?

Dividends yield=annual dividends per share/Price per share Dividends per share=Total dividends paid

out/Total outstanding shares Dividends per share=180,000/125,000 Dividends per share=P1.44

Dividends yield=1.44/20 Dividends yield=7.2%

3. Assume that the price-earnings ratio will be set 12 times and 25,000 new shares will be issued: 3a.

How much is the initial public offering per share of the 25,000 new shares? Price per share=(price-

earnings ratio)(earnings per share) Earnings per share=Net income-Preferred Dividends/End of Period

Common Shares Outstanding Earnings per share=300,000-0/125,000 Earnings per share=P2.4 Price per

share=(12)(2.4) Price per share/Initial public offering per share=P28.8

3b. How much is the net proceeds from the issuance if underwriter spread is 2%? =(25,000)(28.8)

=(720,000 )(1.02) =P734,400

You might also like

- Modigliani and Miller ApproachDocument12 pagesModigliani and Miller Approachishuch24100% (1)

- Chapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelDocument3 pagesChapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelJedediah Samuel Marato0% (1)

- Home Office and Branch Accounting Testbankpdf PDF FreeDocument18 pagesHome Office and Branch Accounting Testbankpdf PDF Freekris mNo ratings yet

- Earnings Per ShareDocument30 pagesEarnings Per ShareTanka P Chettri100% (1)

- 1) Important Terms: Earning MoneyDocument9 pages1) Important Terms: Earning MoneyMaria DeeTee NguyenNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Lec8.Cost of CapitalDocument52 pagesLec8.Cost of Capitalvivek patelNo ratings yet

- Swap RatioDocument24 pagesSwap RatioRajesh SharmaNo ratings yet

- IFRS Chapter 18 Earnings Per ShareDocument30 pagesIFRS Chapter 18 Earnings Per ShareHamis Rabiam Magunda100% (2)

- Problems On Cost of CapitalDocument4 pagesProblems On Cost of CapitalAshutosh Biswal100% (1)

- PW Cost Chapter05Document14 pagesPW Cost Chapter05abd_hafidz_1100% (1)

- Chapter 11 ExerciseDocument5 pagesChapter 11 ExerciseJoe DicksonNo ratings yet

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavNo ratings yet

- Solution - Problems and Solutions Chap 8Document8 pagesSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- AveDocument3 pagesAveJessaNo ratings yet

- My Think, Feel and Do ProfileDocument29 pagesMy Think, Feel and Do ProfileCherie Lee100% (1)

- Business Applications FOR BASE, RATE, PERCENTAGEDocument36 pagesBusiness Applications FOR BASE, RATE, PERCENTAGEVevianJavierCervantesNo ratings yet

- Final Requirement ProblemsDocument5 pagesFinal Requirement ProblemsYoite MiharuNo ratings yet

- Stocks, Bonds and Mutual BondsDocument4 pagesStocks, Bonds and Mutual BondsChrisNo ratings yet

- Financial Management: Unit 3Document47 pagesFinancial Management: Unit 3muralikarthik31No ratings yet

- Gen Math q2 Week 5 PDFDocument27 pagesGen Math q2 Week 5 PDFlucban.136550100297No ratings yet

- FM PFDocument12 pagesFM PFJenelle ReyesNo ratings yet

- Distribution To Shareholders ProblemsDocument4 pagesDistribution To Shareholders ProblemsTrisha Janella CabralNo ratings yet

- Ave 4Document3 pagesAve 4Jessa0% (1)

- Cosido Jeiza May Insight FinalDocument15 pagesCosido Jeiza May Insight FinalJannine AvilaNo ratings yet

- Shares and Dividends PDFDocument14 pagesShares and Dividends PDFVenu GopalNo ratings yet

- Profitability RatiosDocument9 pagesProfitability RatiosfasmekbakerNo ratings yet

- Profitability: Income Revenue Expenses Income StatementDocument14 pagesProfitability: Income Revenue Expenses Income StatementElisha Lois ManluluNo ratings yet

- Business ApplicationsDocument19 pagesBusiness ApplicationsAdair VinNo ratings yet

- Stocks and BondsDocument46 pagesStocks and BondsAlaissaNo ratings yet

- Goodwill 01Document4 pagesGoodwill 01Chanderprakash GuptaNo ratings yet

- Fitriyanto - Financial Management Asignment - CH 14 15Document6 pagesFitriyanto - Financial Management Asignment - CH 14 15iyanNo ratings yet

- Finman - Ytm & Stock ValuationDocument5 pagesFinman - Ytm & Stock ValuationnettenolascoNo ratings yet

- 21 CorfinExerciseDocument21 pages21 CorfinExerciseAaryn KasoduNo ratings yet

- Shares and Dividends: 3.1 ShareDocument13 pagesShares and Dividends: 3.1 ShareUs ManNo ratings yet

- Selected QuestionsDocument5 pagesSelected QuestionsMazhar AliNo ratings yet

- 4 Basic Concepts of Stocks and Bonds 1Document70 pages4 Basic Concepts of Stocks and Bonds 1Lukas AlexanderNo ratings yet

- In BusinessDocument6 pagesIn BusinessPhoebe LlameloNo ratings yet

- Quiz Week 5Document2 pagesQuiz Week 5marzenap2No ratings yet

- Corporate Finance: Dividend Theory and PolicyDocument26 pagesCorporate Finance: Dividend Theory and PolicyFaisal IslamNo ratings yet

- Module 9 Stocks Bonds Mutual FundsDocument7 pagesModule 9 Stocks Bonds Mutual FundsKristine MartinezNo ratings yet

- Stock Dividend: Date of PaymentDocument6 pagesStock Dividend: Date of PaymentmercyvienhoNo ratings yet

- Chapter 4 (Ratio Analysis)Document20 pagesChapter 4 (Ratio Analysis)Brylle LeynesNo ratings yet

- Businees Math ReviewerDocument4 pagesBusinees Math ReviewerZhynna SanchezNo ratings yet

- LeveragingDocument2 pagesLeveragingChelsea DizonNo ratings yet

- Stocks & SharesDocument2 pagesStocks & SharesAnu AmruthNo ratings yet

- Solutions (Chapter14)Document7 pagesSolutions (Chapter14)Engr Fizza AkbarNo ratings yet

- Practice ProblemsDocument12 pagesPractice ProblemsJonathan BohbotNo ratings yet

- Types of Dividend PoliciesDocument4 pagesTypes of Dividend PoliciesJo Che RenceNo ratings yet

- Fundamentals of Financial Management (Brigham Houston-13 Edition)Document6 pagesFundamentals of Financial Management (Brigham Houston-13 Edition)samaraNo ratings yet

- Final Output FinanmaDocument12 pagesFinal Output FinanmaJoy Dela TorreNo ratings yet

- Mod5Act1 - Distribution To ShareholdersDocument12 pagesMod5Act1 - Distribution To ShareholdersArnelli Marie Asher GregorioNo ratings yet

- Dividend PolicyDocument9 pagesDividend Policymhshasan7No ratings yet

- Oria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?Document52 pagesOria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?May OriaNo ratings yet

- FINA5311 Ch8 NotesDocument12 pagesFINA5311 Ch8 NotesaleuvoNo ratings yet

- Far Ii Finals ProblemDocument17 pagesFar Ii Finals ProblemSaeym SegoviaNo ratings yet

- 06 Sharing Firm Wealth Dividends Share Repurchases and Other Payouts AnswersDocument6 pages06 Sharing Firm Wealth Dividends Share Repurchases and Other Payouts AnswersErica DizonNo ratings yet

- Shares and Mutual FundDocument21 pagesShares and Mutual FundHumouRaaj100% (1)

- FM UNIT-IV Dividend DecisionDocument47 pagesFM UNIT-IV Dividend DecisionVinay VinnuNo ratings yet

- FM II Assignment 7 Solution W22Document2 pagesFM II Assignment 7 Solution W22Farah ImamiNo ratings yet

- Chap 1 TAX TheoriesDocument16 pagesChap 1 TAX Theorieskris mNo ratings yet

- Construction Contract Notes (Ast)Document1 pageConstruction Contract Notes (Ast)kris mNo ratings yet

- AdequancyDocument3 pagesAdequancykris mNo ratings yet

- November 22, 2021 List of Pre-Owned Vehicles For Sale: Cut-Off Is Every SundayDocument3 pagesNovember 22, 2021 List of Pre-Owned Vehicles For Sale: Cut-Off Is Every Sundaykris mNo ratings yet

- Taxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's ObjectiveDocument3 pagesTaxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's Objectivekris mNo ratings yet

- Dokumen - Tips - Branch Accounting TestbankDocument6 pagesDokumen - Tips - Branch Accounting Testbankkris mNo ratings yet

- 12 Capital Budgeting v2Document3 pages12 Capital Budgeting v2kris mNo ratings yet

- Psa 315 RedraftedDocument4 pagesPsa 315 Redraftedkris mNo ratings yet

- (H) Revenue Cycle - SAP Business One (H) Revenue Cycle - SAP Business OneDocument9 pages(H) Revenue Cycle - SAP Business One (H) Revenue Cycle - SAP Business Onekris mNo ratings yet

- All About DataDocument2 pagesAll About Datakris mNo ratings yet

- Psa 315Document5 pagesPsa 315kris mNo ratings yet

- MCQDocument6 pagesMCQkris mNo ratings yet

- Responsibility Acctg 2Document5 pagesResponsibility Acctg 2kris mNo ratings yet

- Cost DivisionDocument4 pagesCost Divisionkris mNo ratings yet

- Shareholder's EquityDocument3 pagesShareholder's Equitykris mNo ratings yet

- Controls AuditingDocument4 pagesControls Auditingkris mNo ratings yet

- CommsDocument3 pagesCommskris mNo ratings yet

- Psa 320Document2 pagesPsa 320kris mNo ratings yet