Professional Documents

Culture Documents

Fundamentals of Accountancy, Business and Management

Uploaded by

charles harvey ablitasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Accountancy, Business and Management

Uploaded by

charles harvey ablitasCopyright:

Available Formats

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

Name: KEIR EDUARD S. DE GUZMAN Section: DAH Module # 4

Subject Teacher Rosal C. Arche Parent’s Signature ____________________

Independent Activity 1. What’s My Net Income?

Learning is Fun Company generated revenues amounting to Php 100,000. Expenses for the year

totaled Php 76,000. How much is the company’s net income for the year?

Answer: 24,000

Independent Assessment 1. Juan’s Net Income

At the end of the first month of operations for Juan’s Service Company, the business had the

following accounts: Cash, Php19,000; Prepaid Rent, Php500; Equipment, Php5,000 and Accounts

Payable Php2,000. By the end of the month, Jackson's had earned Php20,000 of Revenues,

Php1,000 of Utilities Expenses and Php1,500 of Salaries Expenses. Calculate the net income to be

reported by the company for this first month.

Answer: 17,500

Independent Activity 2. How much did I sell?

Compute for the Cost of Goods Sold using the following:

Sales P 15,000

Purchases P 2,000

Purchase returns P 200

Purchase discounts P 200

Freight-in P 100

Beginning inventory P 1,000

Ending inventory P 500

Answer: 2,100

Independent Assessment 2. Loss or Gain?

During October, a sari-sari store had the following transactions involving revenue and expenses.

Did the firm earn a net income or incur a net loss for the period? What was the amount?

Paid Php1,200 for rent

Provided services for Php2,750 in cash

Paid Php250 for telephone service

Provided services for Php1,900 on credit

Paid salaries of Php1,675 to employees

Paid Php350 for office cleaning service

Answer: 1,175

Independent Activity 3. How Much Did You Gain?

Direction: Answer the question below.

You are an owner of a small barber shop in your barangay and you wish to know how much

your business has earned for the past year. To do so, you gathered the following records of all your

previous transactions. How much net income did you gain?

Total revenue P 176,000.00

Salaries expense P 49,600.00

Rent expense P 36,000.00

Depreciation expense P 5,000.00

Utilities expense P 7,450.00

Miscellaneous P 4,850.00

Answer:82,800

ASSESSMENT:

C. Prepare SCI using the data in your module.

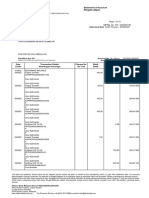

DRIP UKAY UKAY

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED DECEMBER 31, 2020

NET SALES P 560,000.00

COST OF GOOD SOLD P 385,000.00

GROSS PROFIT P 175,000.00

P 50,000.00

GENERAL AND ADMINISTRATION EXPENESE

SALARIES EXPENSES P 30,000.00

RENT EXPENSES P 25,000.00

DEPRECIATION EXPENSE P 20,000.00

UTILITIES P 8,000.00

MISCELLEANUOS P 7,000.00 P 90,000.00

SELLING EXPENSE

SHARE EXPENSES P 20,000.00

RENT EXPENSE P 13,000.00

DEPRECIATION EXPENSE P 9,000.00

ADVERTIZING P 8,000.00 P 50,000.00

NET INCOME P 35,000.00

You might also like

- Cash FlowDocument15 pagesCash FlowCandy BayonaNo ratings yet

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- OilGas DCF NAV ModelDocument22 pagesOilGas DCF NAV ModelJack JacintoNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- Audit Investments ChapterDocument34 pagesAudit Investments ChapterMr.AccntngNo ratings yet

- ACT #4 - Jewel Ann C. Penaranda - ACT213Document20 pagesACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- ACCCOB1 Module 3Document19 pagesACCCOB1 Module 3Ayanna CameroNo ratings yet

- BITONG V CADocument1 pageBITONG V CAihartjass07No ratings yet

- MODULE Midterm FAR 3 Income Tax2Document12 pagesMODULE Midterm FAR 3 Income Tax2francis dungcaNo ratings yet

- Role of Regulators in Achieving Corporate Integrity /TITLEDocument23 pagesRole of Regulators in Achieving Corporate Integrity /TITLEsana khanNo ratings yet

- FABM 2 Practice Problems SCIDocument3 pagesFABM 2 Practice Problems SCIMounicha Ambayec100% (4)

- Syllabus 4 - Financial Management - Spring 2020Document6 pagesSyllabus 4 - Financial Management - Spring 2020Hayden Rutledge Earle100% (1)

- Accounts Receivables Interview Questions - GeekInterviewDocument20 pagesAccounts Receivables Interview Questions - GeekInterviewManish VermaNo ratings yet

- Chapter 4 SOLUTIONDocument18 pagesChapter 4 SOLUTIONEarl Joseph ColloNo ratings yet

- Business Mathematics: Quarter 1, Week 7 - Module 12 ABM - BM11BS-Ii-7Document12 pagesBusiness Mathematics: Quarter 1, Week 7 - Module 12 ABM - BM11BS-Ii-7Dave Sulam100% (1)

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- Statement Request.6Document13 pagesStatement Request.6Aisyah Memey100% (1)

- Name: Grade and Section:: S A L G L O S R E VDocument5 pagesName: Grade and Section:: S A L G L O S R E VPaul Robert DonacaoNo ratings yet

- FBGGBDocument5 pagesFBGGBPaul Robert DonacaoNo ratings yet

- Review Problems With AnswersDocument5 pagesReview Problems With AnswersGelai BatadNo ratings yet

- Robyn Company Financial AnalysisDocument2 pagesRobyn Company Financial AnalysisRandy ManzanoNo ratings yet

- Activity 7Document16 pagesActivity 7JEWELL ANN PENARANDANo ratings yet

- Pateros Catholic SchoolDocument4 pagesPateros Catholic Schooljohn nathanNo ratings yet

- Chapter Four Problem P4-8 Part B Adjusted Without VoiceDocument13 pagesChapter Four Problem P4-8 Part B Adjusted Without Voicehassan nassereddineNo ratings yet

- Chapter 2 Comprehensive IncomeDocument34 pagesChapter 2 Comprehensive IncomeKyla DizonNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeMarie FeNo ratings yet

- Chapter 4 Review Principles of Accounting AnswersDocument3 pagesChapter 4 Review Principles of Accounting AnswersChien Phuong ThanhNo ratings yet

- Name: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingDocument2 pagesName: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingIrish C. BamuyaNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Toaz - Info Joint Venture Quizzers PRDocument4 pagesToaz - Info Joint Venture Quizzers PRMark Anthony BabaoNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Audit adjustments uncover financial reporting errorsDocument9 pagesAudit adjustments uncover financial reporting errorsAldrin ZolinaNo ratings yet

- Cash To Accrual ProblemsDocument10 pagesCash To Accrual ProblemsAmethystNo ratings yet

- Problem Cash FlowDocument3 pagesProblem Cash FlowKimberly AnneNo ratings yet

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- Agency and BranchDocument25 pagesAgency and BranchChelsea VisperasNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- AA COMPANY FINANCIAL REVIEWDocument3 pagesAA COMPANY FINANCIAL REVIEWNeil John Santos ParasNo ratings yet

- Problem Solving 1: RequirementsDocument4 pagesProblem Solving 1: RequirementsMariz TimarioNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- EL201 Accounting Learning Module Lessons 3Document4 pagesEL201 Accounting Learning Module Lessons 3Code BoredNo ratings yet

- Advanced Accounting Chapter 22Document9 pagesAdvanced Accounting Chapter 22LJ AggabaoNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Far Assessment Test Part 2 4302020Document2 pagesFar Assessment Test Part 2 4302020Juliana IpoNo ratings yet

- Quiz 2 Financial ManagementDocument6 pagesQuiz 2 Financial ManagementMARVIE JUNE CARBONNo ratings yet

- Account Title Amount (PHP) Bs/IsDocument14 pagesAccount Title Amount (PHP) Bs/IsAlthea Marie LazoNo ratings yet

- Sue Feria Travel AgencyDocument5 pagesSue Feria Travel AgencyMa Sophia Mikaela Erece100% (1)

- ST ND RD THDocument4 pagesST ND RD THStefany ApaitanNo ratings yet

- Quiz Ins Sales Oct5Document6 pagesQuiz Ins Sales Oct5AlexNo ratings yet

- Long Quiz P1Document2 pagesLong Quiz P1chonana0408No ratings yet

- Class Participation 7 Q 1: (3 Marks) : Trout Company Is Considering Introducing A New Line of Pagers Targeting The PreteenDocument5 pagesClass Participation 7 Q 1: (3 Marks) : Trout Company Is Considering Introducing A New Line of Pagers Targeting The Preteenaj singhNo ratings yet

- Prepare The Report Form of Balance Sheet 2. Compute The Results of Operation 3. Explain The Effect of Net Income/loss On Owner's EquityDocument4 pagesPrepare The Report Form of Balance Sheet 2. Compute The Results of Operation 3. Explain The Effect of Net Income/loss On Owner's EquityRevise PastralisNo ratings yet

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- Deductions ExamplesDocument25 pagesDeductions ExamplesKezNo ratings yet

- Sample Problem Accounting Taxation 1Document4 pagesSample Problem Accounting Taxation 1carl patNo ratings yet

- Activity 19. in This Activity You Will Assemble The Data in Order For You To PrepareDocument2 pagesActivity 19. in This Activity You Will Assemble The Data in Order For You To PrepareVibe VreeNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- For DefenseDocument64 pagesFor DefenseShairine ReyesNo ratings yet

- Document 1 Hoem BranchDocument38 pagesDocument 1 Hoem BranchNadi HoodNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- PL FA&R Class SummaryDocument12 pagesPL FA&R Class SummaryRazib DasNo ratings yet

- FM QuizDocument34 pagesFM QuizChristopher C ChekaNo ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- Module 2.1-Cost of CapitalDocument12 pagesModule 2.1-Cost of CapitalBheemeswar ReddyNo ratings yet

- Jurnal Okta PDFDocument10 pagesJurnal Okta PDFJason JenalNo ratings yet

- Advanced Accounting Test Bank Questions Chapter 13Document21 pagesAdvanced Accounting Test Bank Questions Chapter 13Ahmed Al EkamNo ratings yet

- List of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationDocument2 pagesList of Case Questions: Case #1 Oracle Systems Corporation Questions For Case PreparationArnold TampubolonNo ratings yet

- CiMB Research Report On REITDocument6 pagesCiMB Research Report On REITAnonymous DJrec2No ratings yet

- 20210226AR 2020 BCAInggris Medium ResDocument740 pages20210226AR 2020 BCAInggris Medium ResAhmad100% (1)

- BEC Study NotesDocument4 pagesBEC Study NotesCPA ChessNo ratings yet

- Change in Designated Directors (For Corporates)Document32 pagesChange in Designated Directors (For Corporates)Sãmpãth Kûmãř kNo ratings yet

- SFP- key financial statementsDocument14 pagesSFP- key financial statementsJuvie Rose BuenaventeNo ratings yet

- FM Final Project Amreli Steels SarimDocument33 pagesFM Final Project Amreli Steels SarimimbisatNo ratings yet

- Seasons Construction estimates and costs for building projectDocument5 pagesSeasons Construction estimates and costs for building projectCarlo ParasNo ratings yet

- GWEGWEDocument10 pagesGWEGWECarlos AlphonceNo ratings yet

- AFA Full Question Bank - ANKDocument121 pagesAFA Full Question Bank - ANKknpramodaffiliateNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet

- Corporate Finance - Mock ExamDocument5 pagesCorporate Finance - Mock ExamMinh Hạnh NguyễnNo ratings yet

- Final Exam/2: Multiple ChoiceDocument4 pagesFinal Exam/2: Multiple ChoiceJing SongNo ratings yet

- Capital BudgetingDocument87 pagesCapital BudgetingCBSE UGC NET EXAMNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- Summary of Corporate Time PeriodsDocument2 pagesSummary of Corporate Time PeriodsElla LuceroNo ratings yet