Professional Documents

Culture Documents

FBGGB

Uploaded by

Paul Robert DonacaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FBGGB

Uploaded by

Paul Robert DonacaoCopyright:

Available Formats

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, AND MANAGEMENT 2

Name: DONACAO, PAUL ROBERT B. Grade and Section: 12- GALAO

S L R

I E A O E

N X L G S V

C O M P R E H E N S I V E

O E S N N

M N E U

E S R E

E A

M U L

T I P L E

S

LOOKING BACK TO YOUR LESSON

SOLUTION:

1. P 5,000

Income or Loss= Revenue minus Expense

2. (P 25,000)

3. P 20,000 1. 20,000 – 15,000 = 5,000

4. (P 44,000) 2. 75,000 – 100,000 = -25,000

5. (P112, 000) 3. 85,000 – 65,000 = 20,000

4. 56,000 – 100,000 = -44, 000

5. 88,000 – 200,000 = -112,000

ACTIVITY 1

1. GENERAL

2. GENERAL

3. SELLING

4. GENERAL

5. SELLING

6. GENERAL

7. SELLING

8. SELLING

9. SELLING

1|Quarter 1 Module 3 Week 3

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, AND MANAGEMENT 2

10. SELLING

ACTIVITY 2

1. P 20,000 since accountant is for operating and included in non-selling expenses.

2. COGAS= 250,000 + 70,000+ 15,000

= P 335,000

3. Net Purchase= 100,000 – (20,000+10,000)

= P 70,000

4. Ending Inventory= 250,000 + 85,000 – 235,000

= P 100,000

5. COGS= 300,000 – 175,000

= P 125,000

ACTIVITY 3

Tin’s Ready to Wear Company

Statement of Comprehensive Income

For the Year Ended December 31, 2019

Net Sales P 75, 000

Cost of Sales (30,000)

Gross Profit P 45,000

General and Administrative Expenses (12,000)

Selling Expenses (25, 000)

Net Income P 8,000

CHECK YOUR UNDERSTANDING

____________________

Statement of Comprehensive Income

For the Year Ended December 31, _____

Net Sales P 73, 000

Cost of Sales (20,000)

Gross Profit P 53,000

General and Administrative Expenses (12,000)

Selling Expenses (4, 000)

Net Income P 37,000

POST TEST

1. A

2. C

3. B

4. A

2|Quarter 1 Module 3 Week 3

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, AND MANAGEMENT 2

5. A

6. C

7. D

8. B

REFLECTIVE LEARNING SHEET

The merchandising or trading business that increased their sales during COVID-19: drugstore,

food businesses, gadget store, telecommunication, and supermarkets.

To increase our income yet: As a millennial, we can keep up with those online sellers. So, we

can generate another income besides our business. Since it is related to the agricultural industry, it

affects the flow of cash-in, which resulted in a lower income. We can take a gamble on the food business

and sell it online since it is in demand in our community. In that case, many consumers may buy and try

our products. Therefore, we can regain that income in our business, even amidst this pandemic.

WORKSHEET 3

1. Selling

2. General

3. Selling

4. Selling

5. General

6. Selling

7. Selling

8. General

9. Selling

10. General

3|Quarter 1 Module 3 Week 3

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, AND MANAGEMENT 2

ADDITIONAL ACTIVITY

1. Determine the following:

a. Net Sales

764, 985 –(13,300 + 5455)

= P 746,230

b. Net Purchases

459,990 –(8,200 + 5,465)

= P 446,325

c. Cost of Goods Sold

480,960 – 20,765

= P 460,195

d. Bad debts expense

746,230 * .04

= P 29,849.20

2. Nature of Expense

ABC Company

Statement of Comprehensive Income

For the Year Ended December 31, 2019

Net Sales P 746, 230.00

Expenses

Cost of Goods Sold 460,195.00

Amortization Expense 10,000.00

Depreciation Expense 25,000.00

Salaries Expense 80,000.00

Utilities Expense 55,000.00

Advertising Expense 35,000.00

Rent Expense 60,000.00

Interest Expense 5,677.00

Bad Debts Expense 29,849.20 (P760,721.20)

Other Income

Interest Income 5,444.00

Gain on Sale of PPE 5,465.00 P10,909.00

NET LOSS (P 3,582.20)

4|Quarter 1 Module 3 Week 3

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, AND MANAGEMENT 2

3. Function of Expense

a. G&A Depreciation Expense = 5,000

b. Amortization Expense to G&A

c. 80,000*.4 = 32,000 to selling

d. 55,000*.35 = 19,250 to selling

e. Rent Expense 20,000 for G&A

ABC Company

Statement of Comprehensive Income

For the Year Ended December 31, 2019

Net Sales P 746,230.00

Cost of Sales (460,195.00)

Gross Profit P 286, 035.00

Operating Expense

General and Administrative Expense

Bad Debts Expense 29, 849.20

Amortization Expense 10,000.00

Salaries Expense 48,000.00

Utilities Expense 35,750.00

Rent Expense 20,000.00

Depreciation Expense 5,000.00 (148,599.20)

Selling Expense

Advertising Expense 35,000.00

Depreciation Expense 20,000.00

Salaries Expense 32,000.00

Utilities Expense 19,250.00

Rent Expense 40,000.00 (146,250.00)

Total Operating Expense (294,849.20)

Operating Loss (P 8,814.20)

Non-operating or Others

Interest Income 5,444.00

Gain on Sale of PPE 5,465.00

Interest Expense (5,677.00)

Total Non-operating P 5,232.00

Net Loss (P 3,582.20)

5|Quarter 1 Module 3 Week 3

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Name: Grade and Section:: S A L G L O S R E VDocument5 pagesName: Grade and Section:: S A L G L O S R E VPaul Robert DonacaoNo ratings yet

- Intermediate Accounting Volume III 2012 Edition Suggested AnswersDocument3 pagesIntermediate Accounting Volume III 2012 Edition Suggested AnswersEuphoriaNo ratings yet

- Fundamentals of Accountancy, Business and ManagementDocument2 pagesFundamentals of Accountancy, Business and Managementcharles harvey ablitasNo ratings yet

- 2017 Vol 3 CH 9 AnsDocument3 pages2017 Vol 3 CH 9 AnsDiola QuilingNo ratings yet

- ABC CompanyDocument7 pagesABC CompanyLouise Kyla CabreraNo ratings yet

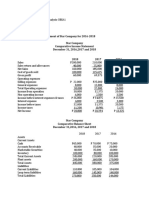

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- FinAcc3 Chap9 PDFDocument3 pagesFinAcc3 Chap9 PDFCindy BartolayNo ratings yet

- FinAcc3 Chap9 PDFDocument3 pagesFinAcc3 Chap9 PDFRenren FranciscoNo ratings yet

- FinAcc3 Chap9 PDFDocument3 pagesFinAcc3 Chap9 PDFReilpeterNo ratings yet

- Angel Company interim report and operating segmentsDocument3 pagesAngel Company interim report and operating segmentsJoana MagtuboNo ratings yet

- Solution Booklet 2 Installment LTCC, FranchiseDocument7 pagesSolution Booklet 2 Installment LTCC, Franchisemarcus yapNo ratings yet

- Answers in AbmDocument6 pagesAnswers in AbmJEANNE DENISSE MENDOZANo ratings yet

- Quiz Ins Sales Oct5Document6 pagesQuiz Ins Sales Oct5AlexNo ratings yet

- Financial Statment 12 JulyDocument13 pagesFinancial Statment 12 JulyMuhammad AshhadNo ratings yet

- Preparation of Financial StatementsDocument13 pagesPreparation of Financial StatementsSharina Mhyca SamonteNo ratings yet

- Accounting assignment - Income statements and discontinued operationsDocument7 pagesAccounting assignment - Income statements and discontinued operationshananNo ratings yet

- Pateros Catholic SchoolDocument4 pagesPateros Catholic Schooljohn nathanNo ratings yet

- Problem Solving 1: RequirementsDocument4 pagesProblem Solving 1: RequirementsMariz TimarioNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Statement of Comprehensive IncomeDocument14 pagesStatement of Comprehensive IncomeDanerish PabunanNo ratings yet

- Answer Key Midterm Tax ReviewDocument3 pagesAnswer Key Midterm Tax ReviewMerry AlqueroNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- 3. BT IAS1 (SV)Document3 pages3. BT IAS1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Quiz 3 ACC 211 SummaryDocument4 pagesQuiz 3 ACC 211 SummaryPatricia Camille Austria50% (2)

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Notes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1Document2 pagesNotes: Colleagues Company Statement of Comprehensive Income For The Year Ended December 31, 20x1JonellNo ratings yet

- Accounting Assignments Financial StatementsDocument5 pagesAccounting Assignments Financial StatementsTendai MakosaNo ratings yet

- DocumentDocument3 pagesDocumentPhantom LancerNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- FABM 2 Practice Problems SCIDocument3 pagesFABM 2 Practice Problems SCIMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Barayuga - Ecological - Fabm2 - Module 2Document5 pagesBarayuga - Ecological - Fabm2 - Module 2Lee Arne BarayugaNo ratings yet

- Common Size Statement AnalysisDocument2 pagesCommon Size Statement AnalysisRevati ShindeNo ratings yet

- Maria Beatrice N. Reynancia tax exam resultsDocument4 pagesMaria Beatrice N. Reynancia tax exam resultsBeatrice ReynanciaNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- FinAcc3 Chap4Document9 pagesFinAcc3 Chap4Iyah AmranNo ratings yet

- Classroom Exercises on Interim Reporting Key FinancialsDocument2 pagesClassroom Exercises on Interim Reporting Key FinancialsalyssaNo ratings yet

- Name: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingDocument2 pagesName: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingIrish C. BamuyaNo ratings yet

- ROCO - SCI Unit TestDocument9 pagesROCO - SCI Unit TestRaymond Roco100% (1)

- Problem 1 Dream Co. and Theater CoDocument4 pagesProblem 1 Dream Co. and Theater CoskyNo ratings yet

- FABM 2 3.ACT SCIdocxDocument10 pagesFABM 2 3.ACT SCIdocxMaryPher CadioganNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- 02 Financing Decisions - Leverages - Practice SheetDocument22 pages02 Financing Decisions - Leverages - Practice SheetPatrick LoboNo ratings yet

- 10 Answer PDFDocument17 pages10 Answer PDFagspurealNo ratings yet

- Multi-Step Income Statement - CRDocument16 pagesMulti-Step Income Statement - CRVivian BastoNo ratings yet

- Chapter 10Document5 pagesChapter 10Xynith Nicole RamosNo ratings yet

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyDocument6 pagesJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacNo ratings yet

- QUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEDocument6 pagesQUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEAllen Kate Malazarte0% (1)

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- Excercise Sheet Lecture 3Document30 pagesExcercise Sheet Lecture 3Mohamed ZaitoonNo ratings yet

- Multiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000Document26 pagesMultiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000ALEXANDRANICOLE OCTAVIANONo ratings yet

- Assignment 2Document6 pagesAssignment 2TAWHID ARMANNo ratings yet

- Gurukripa’s Guide Answers for May 2014 CA Inter ExamDocument12 pagesGurukripa’s Guide Answers for May 2014 CA Inter Examsantosh barkiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Proper Order:: Net Income CashDocument2 pagesProper Order:: Net Income CashPaul Robert DonacaoNo ratings yet

- Related LiteratureDocument2 pagesRelated LiteraturePaul Robert DonacaoNo ratings yet

- Donacao Activity 1Document1 pageDonacao Activity 1Paul Robert DonacaoNo ratings yet

- Midterm Reviewer MMW: An Ellipsis Not All Ellipsis Means Infinite Used To Indicate Pattern Ambiguity PreciseDocument4 pagesMidterm Reviewer MMW: An Ellipsis Not All Ellipsis Means Infinite Used To Indicate Pattern Ambiguity PrecisePaul Robert DonacaoNo ratings yet

- Balance Per Bank, April 30 1,000,000Document2 pagesBalance Per Bank, April 30 1,000,000Paul Robert DonacaoNo ratings yet

- Hope4 Las1 Q4week1 To Week2Document5 pagesHope4 Las1 Q4week1 To Week2Paul Robert DonacaoNo ratings yet

- Social Injustices: Natural Event or Accidental Deliberately ImposedDocument1 pageSocial Injustices: Natural Event or Accidental Deliberately ImposedPaul Robert DonacaoNo ratings yet

- CHAPTER 1: Introduction To Operations Management: Providing Services. Create Goods And/ or Provide ServicesDocument3 pagesCHAPTER 1: Introduction To Operations Management: Providing Services. Create Goods And/ or Provide ServicesPaul Robert DonacaoNo ratings yet

- What Is The Adjusted Cash in Bank On December 31?Document2 pagesWhat Is The Adjusted Cash in Bank On December 31?Paul Robert DonacaoNo ratings yet

- Bac 315Document11 pagesBac 315maisie laneNo ratings yet

- Afsm 2011Document4 pagesAfsm 2011Rakshit SehgalNo ratings yet

- CA Lesson 3 Relative VelocityDocument22 pagesCA Lesson 3 Relative VelocityShaimaa AbdulhamedNo ratings yet

- Principles of Accounting Chapter 1 SummaryDocument38 pagesPrinciples of Accounting Chapter 1 SummaryAfsar AhmedNo ratings yet

- Robotics SeminarDocument17 pagesRobotics SeminarTejasvi PalNo ratings yet

- FUZZY SYSTEMS SYLLABUS AND QUESTION BANKDocument13 pagesFUZZY SYSTEMS SYLLABUS AND QUESTION BANKSaurabh Rajput33% (3)

- The Chess Player's Quarterly Chronicle, 1869-X, 330pDocument330 pagesThe Chess Player's Quarterly Chronicle, 1869-X, 330pJacky JopheNo ratings yet

- Radar Clutter Types and Models ExplainedDocument63 pagesRadar Clutter Types and Models ExplainedWesley GeorgeNo ratings yet

- Warm-Ups 81-180Document60 pagesWarm-Ups 81-180api-272906033No ratings yet

- ABB - KPM - All - Products Eng v1.0 - FINALDocument12 pagesABB - KPM - All - Products Eng v1.0 - FINALJeff RobertNo ratings yet

- Chapter 1 & 2Document18 pagesChapter 1 & 2Bella Monica Montecino100% (3)

- Medium Term Plan On Teaching Scratch in Year 4Document5 pagesMedium Term Plan On Teaching Scratch in Year 4api-272550320No ratings yet

- Vaisnava Glossary PDFDocument24 pagesVaisnava Glossary PDFJulen OsorioNo ratings yet

- The Viewpoint of Iranian Traditional Medicine (Persian Medicine) On Obesity and Its Treatment MethodsDocument6 pagesThe Viewpoint of Iranian Traditional Medicine (Persian Medicine) On Obesity and Its Treatment MethodsBaru Chandrasekhar RaoNo ratings yet

- Qualiry Technical Rrequirement User S Handbook VW MexicoDocument23 pagesQualiry Technical Rrequirement User S Handbook VW MexicoOscar Javier Olivares Tronco0% (1)

- Leyte Edible Oil Supervisors and Confidential20170704-911-1fckbjxDocument12 pagesLeyte Edible Oil Supervisors and Confidential20170704-911-1fckbjxJustin ParasNo ratings yet

- Badass 3.5e Prestige ClassDocument4 pagesBadass 3.5e Prestige ClassTony HolcombNo ratings yet

- Chronicle of the Lodge Fraternitas SaturniDocument4 pagesChronicle of the Lodge Fraternitas SaturniCanKoris100% (1)

- Differentiation Between Complex Tic and Eyelid Myoclonia With Absences: Pediatric Case Report and Brief Review of The LiteratureDocument5 pagesDifferentiation Between Complex Tic and Eyelid Myoclonia With Absences: Pediatric Case Report and Brief Review of The LiteratureAperito InternationalNo ratings yet

- Australian Guidebook For Structural Engineers by Lonnie Pack 1138031852Document5 pagesAustralian Guidebook For Structural Engineers by Lonnie Pack 1138031852Frans ChandraNo ratings yet

- 3 Point ProblemDocument8 pages3 Point ProblemDhana Strata NNo ratings yet

- Change Management PresentationDocument15 pagesChange Management PresentationAshu AyshaNo ratings yet

- Fallacy of CompositionDocument3 pagesFallacy of CompositionKen ManeboNo ratings yet

- Daphnia Write UpDocument3 pagesDaphnia Write UpASDFGHJKL9571% (7)

- Is Umeme Worth 300 BillionsDocument5 pagesIs Umeme Worth 300 Billionsisaac setabiNo ratings yet

- Bully Kutta Price and DetailsDocument4 pagesBully Kutta Price and DetailsDr Dogs 4 UNo ratings yet

- Ephemeris 01012009 To 19022011Document15 pagesEphemeris 01012009 To 19022011prvnprvnNo ratings yet

- One Foot in The Grave - Copy For PlayersDocument76 pagesOne Foot in The Grave - Copy For Playerssveni meierNo ratings yet

- Respiratory and Circulatory Systems Working TogetherDocument4 pagesRespiratory and Circulatory Systems Working TogetherShellane Blanco Sardua100% (1)

- #0 - Volume 1 PrefaceDocument2 pages#0 - Volume 1 Prefaceitisme_angelaNo ratings yet

- CiviljointpdfDocument8 pagesCiviljointpdfAyashu PandeyNo ratings yet