Professional Documents

Culture Documents

White Gold Marine vs. Pioneer Insurance (G.R. No. 154514. July 28, 2005) - 4

Uploaded by

eunice demaclid0 ratings0% found this document useful (0 votes)

6 views1 pageThe Supreme Court of the Philippines ruled that Steamship Mutual, a Protection and Indemnity Club, was engaged in the insurance business in the Philippines without proper licensing. As a mutual insurance association providing marine insurance, Steamship Mutual needed a certificate of authority from the country's Insurance Commission. The Court also ruled that Pioneer Insurance, as the agent of Steamship Mutual, required a separate license to act in that capacity, in addition to its existing license as an insurance company, in accordance with the Insurance Code. The Court affirmed the Commission's ruling that Steamship Mutual and Pioneer had violated the Code and needed to secure the proper licenses to continue operations in the Philippines.

Original Description:

Comrev cases

Original Title

1. White Gold Marine vs. Pioneer Insurance (G.R. No. 154514. July 28, 2005) - 4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Supreme Court of the Philippines ruled that Steamship Mutual, a Protection and Indemnity Club, was engaged in the insurance business in the Philippines without proper licensing. As a mutual insurance association providing marine insurance, Steamship Mutual needed a certificate of authority from the country's Insurance Commission. The Court also ruled that Pioneer Insurance, as the agent of Steamship Mutual, required a separate license to act in that capacity, in addition to its existing license as an insurance company, in accordance with the Insurance Code. The Court affirmed the Commission's ruling that Steamship Mutual and Pioneer had violated the Code and needed to secure the proper licenses to continue operations in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageWhite Gold Marine vs. Pioneer Insurance (G.R. No. 154514. July 28, 2005) - 4

Uploaded by

eunice demaclidThe Supreme Court of the Philippines ruled that Steamship Mutual, a Protection and Indemnity Club, was engaged in the insurance business in the Philippines without proper licensing. As a mutual insurance association providing marine insurance, Steamship Mutual needed a certificate of authority from the country's Insurance Commission. The Court also ruled that Pioneer Insurance, as the agent of Steamship Mutual, required a separate license to act in that capacity, in addition to its existing license as an insurance company, in accordance with the Insurance Code. The Court affirmed the Commission's ruling that Steamship Mutual and Pioneer had violated the Code and needed to secure the proper licenses to continue operations in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

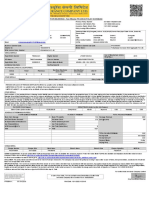

Republic of the Philippines Section 2(2) of the Insurance Code enumerates what constitutes "doing an insurance business" or "transacting

quot;doing an insurance business" or "transacting an insurance

SUPREME COURT business". These are:

FIRST DIVISION (a) making or proposing to make, as insurer, any insurance contract;

G.R. No. 154514. July 28, 2005 (b) making, or proposing to make, as surety, any contract of suretyship as a vocation and not as merely incidental to any

WHITE GOLD MARINE SERVICES, INC., Petitioners, other legitimate business or activity of the surety;

vs. PIONEER INSURANCE AND SURETY CORPORATION AND THE STEAMSHIP MUTUAL UNDERWRITING (c) doing any kind of business, including a reinsurance business, specifically recognized as constituting the doing of an

ASSOCIATION (BERMUDA) LTD., Respondents. insurance business within the meaning of this Code;

DECISION (d) doing or proposing to do any business in substance equivalent to any of the foregoing in a manner designed to evade the

QUISUMBING, J.: provisions of this Code.

This petition for review assails the Decision1 dated July 30, 2002 of the Court of Appeals in CA-G.R. SP No. 60144, affirming ...

the Decision2 dated May 3, 2000 of the Insurance Commission in I.C. Adm. Case No. RD-277. Both decisions held that there The same provision also provides, the fact that no profit is derived from the making of insurance contracts, agreements or

was no violation of the Insurance Code and the respondents do not need license as insurer and insurance agent/broker. transactions, or that no separate or direct consideration is received therefor, shall not preclude the existence of an insurance

The facts are undisputed. business.12

White Gold Marine Services, Inc. (White Gold) procured a protection and indemnity coverage for its vessels from The The test to determine if a contract is an insurance contract or not, depends on the nature of the promise, the act required to

Steamship Mutual Underwriting Association (Bermuda) Limited (Steamship Mutual) through Pioneer Insurance and Surety be performed, and the exact nature of the agreement in the light of the occurrence, contingency, or circumstances under

Corporation (Pioneer). Subsequently, White Gold was issued a Certificate of Entry and Acceptance. 3 Pioneer also issued which the performance becomes requisite. It is not by what it is called.13

receipts evidencing payments for the coverage. When White Gold failed to fully pay its accounts, Steamship Mutual refused to Basically, an insurance contract is a contract of indemnity. In it, one undertakes for a consideration to indemnify another

renew the coverage. against loss, damage or liability arising from an unknown or contingent event.14

Steamship Mutual thereafter filed a case against White Gold for collection of sum of money to recover the latter’s unpaid In particular, a marine insurance undertakes to indemnify the assured against marine losses, such as the losses incident to a

balance. White Gold on the other hand, filed a complaint before the Insurance Commission claiming that Steamship Mutual marine adventure.15 Section 9916 of the Insurance Code enumerates the coverage of marine insurance.

violated Sections 1864 and 1875 of the Insurance Code, while Pioneer violated Sections 299,6 3007 and 3018 in relation to Relatedly, a mutual insurance company is a cooperative enterprise where the members are both the insurer and insured. In it,

Sections 302 and 303, thereof. the members all contribute, by a system of premiums or assessments, to the creation of a fund from which all losses and

The Insurance Commission dismissed the complaint. It said that there was no need for Steamship Mutual to secure a license liabilities are paid, and where the profits are divided among themselves, in proportion to their interest. 17 Additionally, mutual

because it was not engaged in the insurance business. It explained that Steamship Mutual was a Protection and Indemnity insurance associations, or clubs, provide three types of coverage, namely, protection and indemnity, war risks, and defense

Club (P & I Club). Likewise, Pioneer need not obtain another license as insurance agent and/or a broker for Steamship Mutual costs.18

because Steamship Mutual was not engaged in the insurance business. Moreover, Pioneer was already licensed, hence, a A P & I Club is "a form of insurance against third party liability, where the third party is anyone other than the P & I Club and

separate license solely as agent/broker of Steamship Mutual was already superfluous. the members."19 By definition then, Steamship Mutual as a P & I Club is a mutual insurance association engaged in the

The Court of Appeals affirmed the decision of the Insurance Commissioner. In its decision, the appellate court distinguished marine insurance business.

between P & I Clubs vis-à-vis conventional insurance. The appellate court also held that Pioneer merely acted as a collection The records reveal Steamship Mutual is doing business in the country albeit without the requisite certificate of authority

agent of Steamship Mutual. mandated by Section 18720 of the Insurance Code. It maintains a resident agent in the Philippines to solicit insurance and to

In this petition, petitioner assigns the following errors allegedly committed by the appellate court, collect payments in its behalf. We note that Steamship Mutual even renewed its P & I Club cover until it was cancelled due to

non-payment of the calls. Thus, to continue doing business here, Steamship Mutual or through its agent Pioneer, must secure

FIRST ASSIGNMENT OF ERROR a license from the Insurance Commission.

THE COURT A QUO ERRED WHEN IT RULED THAT RESPONDENT STEAMSHIP IS NOT DOING BUSINESS IN THE Since a contract of insurance involves public interest, regulation by the State is necessary. Thus, no insurer or insurance

PHILIPPINES ON THE GROUND THAT IT COURSED . . . ITS TRANSACTIONS THROUGH ITS AGENT AND/OR BROKER company is allowed to engage in the insurance business without a license or a certificate of authority from the Insurance

HENCE AS AN INSURER IT NEED NOT SECURE A LICENSE TO ENGAGE IN INSURANCE BUSINESS IN THE Commission.21

PHILIPPINES. Does Pioneer, as agent/broker of Steamship Mutual, need a special license?

SECOND ASSIGNMENT OF ERROR Pioneer is the resident agent of Steamship Mutual as evidenced by the certificate of registration 22 issued by the Insurance

THE COURT A QUO ERRED WHEN IT RULED THAT THE RECORD IS BEREFT OF ANY EVIDENCE THAT Commission. It has been licensed to do or transact insurance business by virtue of the certificate of authority 23 issued by the

RESPONDENT STEAMSHIP IS ENGAGED IN INSURANCE BUSINESS. same agency. However, a Certification from the Commission states that Pioneer does not have a separate license to be an

THIRD ASSIGNMENT OF ERROR agent/broker of Steamship Mutual.24

THE COURT A QUO ERRED WHEN IT RULED, THAT RESPONDENT PIONEER NEED NOT SECURE A LICENSE WHEN Although Pioneer is already licensed as an insurance company, it needs a separate license to act as insurance agent for

CONDUCTING ITS AFFAIR AS AN AGENT/BROKER OF RESPONDENT STEAMSHIP. Steamship Mutual. Section 299 of the Insurance Code clearly states:

FOURTH ASSIGNMENT OF ERROR SEC. 299 . . .

THE COURT A QUO ERRED IN NOT REVOKING THE LICENSE OF RESPONDENT PIONEER AND [IN NOT REMOVING] No person shall act as an insurance agent or as an insurance broker in the solicitation or procurement of applications for

THE OFFICERS AND DIRECTORS OF RESPONDENT PIONEER.9 insurance, or receive for services in obtaining insurance, any commission or other compensation from any insurance

Simply, the basic issues before us are (1) Is Steamship Mutual, a P & I Club, engaged in the insurance business in the company doing business in the Philippines or any agent thereof, without first procuring a license so to act from the

Philippines? (2) Does Pioneer need a license as an insurance agent/broker for Steamship Mutual? Commissioner, which must be renewed annually on the first day of January, or within six months thereafter. . .

The parties admit that Steamship Mutual is a P & I Club. Steamship Mutual admits it does not have a license to do business Finally, White Gold seeks revocation of Pioneer’s certificate of authority and removal of its directors and officers. Regrettably,

in the Philippines although Pioneer is its resident agent. This relationship is reflected in the certifications issued by the we are not the forum for these issues.

Insurance Commission.

Petitioner insists that Steamship Mutual as a P & I Club is engaged in the insurance business. To buttress its assertion, it WHEREFORE, the petition is PARTIALLY GRANTED. The Decision dated July 30, 2002 of the Court of Appeals affirming the

cites the definition of a P & I Club in Hyopsung Maritime Co., Ltd. v. Court of Appeals10 as "an association composed of Decision dated May 3, 2000 of the Insurance Commission is hereby REVERSED AND SET ASIDE. The Steamship Mutual

shipowners in general who band together for the specific purpose of providing insurance cover on a mutual basis against Underwriting Association (Bermuda) Ltd., and Pioneer Insurance and Surety Corporation are ORDERED to obtain licenses

liabilities incidental to shipowning that the members incur in favor of third parties." It stresses that as a P & I Club, Steamship and to secure proper authorizations to do business as insurer and insurance agent, respectively. The petitioner’s prayer for

Mutual’s primary purpose is to solicit and provide protection and indemnity coverage and for this purpose, it has engaged the the revocation of Pioneer’s Certificate of Authority and removal of its directors and officers, is DENIED. Costs against

services of Pioneer to act as its agent. respondents.

Respondents contend that although Steamship Mutual is a P & I Club, it is not engaged in the insurance business in the SO ORDERED.

Philippines. It is merely an association of vessel owners who have come together to provide mutual protection against Davide, Jr., C.J., (Chairman), Ynares-Santiago, Carpio, and Azcuna, JJ., concur.

liabilities incidental to shipowning.11 Respondents aver Hyopsung is inapplicable in this case because the issue in Hyopsung

was the jurisdiction of the court over Hyopsung.

Is Steamship Mutual engaged in the insurance business?

You might also like

- Residential Construction AgreementDocument6 pagesResidential Construction AgreementJanice EstrelladoNo ratings yet

- Supreme Court: White Gold Marine Services, Inc. v. Bermuda G.R. No. 154514Document4 pagesSupreme Court: White Gold Marine Services, Inc. v. Bermuda G.R. No. 154514Jopan SJNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Marine AbreviationsDocument88 pagesMarine Abreviationsbernardinodino100% (2)

- White Gold Marine Vs Pioneer Insurance G.R. No. 154514 July 28, 2005Document2 pagesWhite Gold Marine Vs Pioneer Insurance G.R. No. 154514 July 28, 2005Emrico CabahugNo ratings yet

- White Gold Marine Services, Inc. vs. Pioneer Insurance and Surety Corporation DigestDocument2 pagesWhite Gold Marine Services, Inc. vs. Pioneer Insurance and Surety Corporation DigestAnnaNo ratings yet

- QUIZ 1 Risk Answers PDFDocument6 pagesQUIZ 1 Risk Answers PDFLandeelyn Godinez100% (1)

- SSS & GsisDocument6 pagesSSS & GsisNatsu DragneelNo ratings yet

- 1.WhiteGold V Pioneer Insurance DigestDocument2 pages1.WhiteGold V Pioneer Insurance Digestmb_estanislaoNo ratings yet

- Villacorta vs. Insurance Commission (G.R. No. L-54171 October 28, 1980) - 3Document1 pageVillacorta vs. Insurance Commission (G.R. No. L-54171 October 28, 1980) - 3eunice demaclidNo ratings yet

- Problems in CounsellingDocument15 pagesProblems in CounsellingVijay Siwach75% (4)

- Risk Allocations in Construction ContractsDocument10 pagesRisk Allocations in Construction ContractsMdms PayoeNo ratings yet

- White Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Document2 pagesWhite Gold Marine Services, Inc Vs Pioneer Insurance (Summary)Coyzz de Guzman100% (1)

- White Gold Marine Services Vs Pioneer InsuranceDocument2 pagesWhite Gold Marine Services Vs Pioneer InsuranceCarmii HoNo ratings yet

- Tio Khe Chio vs. CA (G.R. No. 76101-02 September 30, 1991) - 2Document2 pagesTio Khe Chio vs. CA (G.R. No. 76101-02 September 30, 1991) - 2eunice demaclidNo ratings yet

- White Gold Marine Services, Inc Vs Pioneer Insurance and Surety Corporation and The Steamship Mutual Underwriting Association (Bermuda) LTD DigestDocument2 pagesWhite Gold Marine Services, Inc Vs Pioneer Insurance and Surety Corporation and The Steamship Mutual Underwriting Association (Bermuda) LTD DigestAbilene Joy Dela CruzNo ratings yet

- White Gold Marine Services, Inc. v. Pioneer Insurance and Bermuda Ltd. Case DigestDocument2 pagesWhite Gold Marine Services, Inc. v. Pioneer Insurance and Bermuda Ltd. Case DigestKareen BaucanNo ratings yet

- Insurance Cases Batch 2Document20 pagesInsurance Cases Batch 2asdfghjkattNo ratings yet

- Insurance Cases Batch 2Document20 pagesInsurance Cases Batch 2asdfghjkattNo ratings yet

- Insurance Cases 1stDocument30 pagesInsurance Cases 1stElias BenderNo ratings yet

- Insurance-Rights of Subrogation - Full Text CasesDocument29 pagesInsurance-Rights of Subrogation - Full Text CasesAerylle GuraNo ratings yet

- 04-White Gold Marine Services Inc. v. Pioneer Insurance and Surety CorpDocument7 pages04-White Gold Marine Services Inc. v. Pioneer Insurance and Surety CorpJaymar DetoitoNo ratings yet

- 1 WhiteGold V Pioneer Insurance DigestDocument2 pages1 WhiteGold V Pioneer Insurance DigestMich FelloneNo ratings yet

- WhiteDocument9 pagesWhiteDennis VelasquezNo ratings yet

- White Gold Vs PioneerDocument5 pagesWhite Gold Vs PioneerArman DalisayNo ratings yet

- White Gold Marine Services Vs Pioneer InsuranceDocument6 pagesWhite Gold Marine Services Vs Pioneer InsurancezaneNo ratings yet

- Insurance Law CasesDocument54 pagesInsurance Law CasesJenNo ratings yet

- TOPIC: Sections 1-4 of The Insurance Code: Supreme CourtDocument61 pagesTOPIC: Sections 1-4 of The Insurance Code: Supreme CourtvivivioletteNo ratings yet

- Cases Sa InsuranceDocument32 pagesCases Sa InsuranceJosef FloresNo ratings yet

- WHITE GOLD MARINE SERVICES Vs PIONEER INSURANCEDocument5 pagesWHITE GOLD MARINE SERVICES Vs PIONEER INSURANCEYvon BaguioNo ratings yet

- White Gold Marine V Pioneer InsuranceDocument3 pagesWhite Gold Marine V Pioneer InsuranceMICAELA NIALANo ratings yet

- Full Text 1 ST Batch InsuranceDocument85 pagesFull Text 1 ST Batch InsuranceJayson CamasuraNo ratings yet

- 112632-2005-White Gold Marine Services Inc. v. Pioneer20180404-1159-1pzisprDocument7 pages112632-2005-White Gold Marine Services Inc. v. Pioneer20180404-1159-1pzisprKrizel BianoNo ratings yet

- White Gold Marine Services, Inc., vs. Pioneer Insurance and Surety Corporation PDFDocument7 pagesWhite Gold Marine Services, Inc., vs. Pioneer Insurance and Surety Corporation PDFFatima TumbaliNo ratings yet

- White Gold Marine Vs Pioneer Insurance GR 154514Document5 pagesWhite Gold Marine Vs Pioneer Insurance GR 154514VieNo ratings yet

- White Gold Marine Services V Pioneer InsuranceDocument5 pagesWhite Gold Marine Services V Pioneer InsuranceKitKat ZaidNo ratings yet

- White Gold v. Pioneer Insurance 464 SCRA 448 (2005)Document6 pagesWhite Gold v. Pioneer Insurance 464 SCRA 448 (2005)Joena GeNo ratings yet

- White Gold Services, Inc. vs. Pioneer Insurance Corporation. GR No 154514 July 28, 2005Document6 pagesWhite Gold Services, Inc. vs. Pioneer Insurance Corporation. GR No 154514 July 28, 2005Christopher ArellanoNo ratings yet

- Insurance 1st Recit Meeting DigestsDocument20 pagesInsurance 1st Recit Meeting DigestsIa HernandezNo ratings yet

- G.R. No. 154514Document5 pagesG.R. No. 154514Hanifa D. Al-ObinayNo ratings yet

- Insurance CasesDocument116 pagesInsurance CasesJames Mier VictorianoNo ratings yet

- Comm2 Insurance CasesDocument267 pagesComm2 Insurance Casesnice_stellarNo ratings yet

- Insurance Whitegold V PioneerDocument5 pagesInsurance Whitegold V PioneerAmicus CuriaeNo ratings yet

- Insurance Title I DigestsDocument7 pagesInsurance Title I DigestsJean Jamailah TomugdanNo ratings yet

- Whitegold CaseDocument5 pagesWhitegold CaseMaria Cristina MartinezNo ratings yet

- 01-White Gold Marine Services vs. Pioneer Insurance, Et Al. (GR No. 154514, 28 July 2005) - EscraDocument10 pages01-White Gold Marine Services vs. Pioneer Insurance, Et Al. (GR No. 154514, 28 July 2005) - EscraJ100% (1)

- Insurance Full TextDocument102 pagesInsurance Full TextRaymarc Elizer AsuncionNo ratings yet

- Week 4 InsuranceDocument9 pagesWeek 4 InsuranceAnne Sherly OdevilasNo ratings yet

- White Gold Marine Services Inc. vs. Pioneer Insurance & Surety CorpDocument5 pagesWhite Gold Marine Services Inc. vs. Pioneer Insurance & Surety Corptalla aldoverNo ratings yet

- Cases InsuranceDocument77 pagesCases InsuranceSychia AdamsNo ratings yet

- Insurance - Full Text (Sections 1-4) WordDocument31 pagesInsurance - Full Text (Sections 1-4) WordAnthony Angel TejaresNo ratings yet

- White Gold Marine Services, Inc. vs. Pioneer Insurance and Surety CorporationDocument10 pagesWhite Gold Marine Services, Inc. vs. Pioneer Insurance and Surety CorporationFD BalitaNo ratings yet

- White Gold Marine V Pioneer - Insurance - Case NoteDocument1 pageWhite Gold Marine V Pioneer - Insurance - Case NoteApril Gem BalucanagNo ratings yet

- Whitegold PDFDocument5 pagesWhitegold PDFRal CaldiNo ratings yet

- Concept of Insurance-GR 154514,125678,167330Document28 pagesConcept of Insurance-GR 154514,125678,167330zetsumikoNo ratings yet

- 5 CaseDocument4 pages5 CaseSuzette AbejuelaNo ratings yet

- White Gold Vs Pioneer InsuranceDocument2 pagesWhite Gold Vs Pioneer Insuranceanon_536827703No ratings yet

- White Gold Marine Services Inc Vs Pioneer Insurance and Surety Corporation Et Al 464 SCRA 448 154514Document5 pagesWhite Gold Marine Services Inc Vs Pioneer Insurance and Surety Corporation Et Al 464 SCRA 448 154514emmaniago08No ratings yet

- Cases in Insurance 3rd MeetingDocument21 pagesCases in Insurance 3rd Meetingjieun leeNo ratings yet

- Ins. Whitegold VspioneerDocument1 pageIns. Whitegold VspioneerLittle GirlblueNo ratings yet

- Insurance - Aug 20 DigestsDocument7 pagesInsurance - Aug 20 DigestsAnjNo ratings yet

- White Gold Marine Services v. PioneerDocument3 pagesWhite Gold Marine Services v. Pioneerkenn TenorioNo ratings yet

- Insurance Case Digests - ShayneDocument2 pagesInsurance Case Digests - ShayneFelipe, Shayne Anne I.No ratings yet

- 1 - White Gold Marine vs. PioneerDocument4 pages1 - White Gold Marine vs. PioneerMarioneMaeThiamNo ratings yet

- Insurance Week 1Document26 pagesInsurance Week 1Haze Q.No ratings yet

- White Gold v. PioneerDocument2 pagesWhite Gold v. PioneerWV Gamiz Jr.No ratings yet

- 1-White Gold MArine Services vs. Pioneer InsuranceDocument2 pages1-White Gold MArine Services vs. Pioneer InsuranceHeartHeartNo ratings yet

- Case Diget InsuranceDocument6 pagesCase Diget InsuranceQuinnee VallejosNo ratings yet

- Pioneer Insurance vs. Yap (G.R. No. L-36232 December 19, 1974) - 2Document2 pagesPioneer Insurance vs. Yap (G.R. No. L-36232 December 19, 1974) - 2eunice demaclidNo ratings yet

- Perla Compania de Seguros vs. Ramolete (G.R. No. L-60887 November 13, 1991) - 4Document2 pagesPerla Compania de Seguros vs. Ramolete (G.R. No. L-60887 November 13, 1991) - 4eunice demaclidNo ratings yet

- Prudential Guarantee vs. Trans-Asia Shipping (G.R. No. 151890 June 20, 2006) - 13Document6 pagesPrudential Guarantee vs. Trans-Asia Shipping (G.R. No. 151890 June 20, 2006) - 13eunice demaclidNo ratings yet

- Tiu vs. Arriesgado (G.R. No. 138060 September 1, 2004) - 12Document5 pagesTiu vs. Arriesgado (G.R. No. 138060 September 1, 2004) - 12eunice demaclidNo ratings yet

- 2 Philam Care Health vs. CA (G.R. No. 125678 March 18, 2002) - 4Document2 pages2 Philam Care Health vs. CA (G.R. No. 125678 March 18, 2002) - 4eunice demaclidNo ratings yet

- Palermo vs. Pyramid Insurance (G.R. No. L-36480 May 31, 1988) - 2Document1 pagePalermo vs. Pyramid Insurance (G.R. No. L-36480 May 31, 1988) - 2eunice demaclidNo ratings yet

- BPI vs. Posadas (G.R. No. L-34583 October 22, 1931) - 7Document4 pagesBPI vs. Posadas (G.R. No. L-34583 October 22, 1931) - 7eunice demaclidNo ratings yet

- Del Val vs. Del Val (G.R. No. L-9374 February 16, 1915) - 4Document2 pagesDel Val vs. Del Val (G.R. No. L-9374 February 16, 1915) - 4eunice demaclidNo ratings yet

- Magellan Manufacturing Corp vs. CA (G.R. No. 95529 August 22, 1991) - 10Document4 pagesMagellan Manufacturing Corp vs. CA (G.R. No. 95529 August 22, 1991) - 10eunice demaclidNo ratings yet

- 14 Geagonia vs. CA (G.R. No. 114427 February 6, 1995) - 3Document3 pages14 Geagonia vs. CA (G.R. No. 114427 February 6, 1995) - 3eunice demaclidNo ratings yet

- Delsan Transport Lines vs. CA (G.R. No. 127897 November 15, 2001) - 4Document2 pagesDelsan Transport Lines vs. CA (G.R. No. 127897 November 15, 2001) - 4eunice demaclidNo ratings yet

- Filipino Merchants Insurance vs. CA (G.R. No. 85141 November 28, 1989) - 5Document2 pagesFilipino Merchants Insurance vs. CA (G.R. No. 85141 November 28, 1989) - 5eunice demaclidNo ratings yet

- Roque vs. IAC (G.R. No. L-66935 November 11, 1985) - 5Document2 pagesRoque vs. IAC (G.R. No. L-66935 November 11, 1985) - 5eunice demaclidNo ratings yet

- Oriental Assurance Corp vs. CA (G.R. No. 94052 August 9, 1991) - 4Document1 pageOriental Assurance Corp vs. CA (G.R. No. 94052 August 9, 1991) - 4eunice demaclidNo ratings yet

- Republic Bank vs. Philippine Guaranty (G.R. No. L-27932 October 30, 1972) - 2Document1 pageRepublic Bank vs. Philippine Guaranty (G.R. No. L-27932 October 30, 1972) - 2eunice demaclidNo ratings yet

- 46 Philam Care Health vs. CA (G.R. No. 125678 March 18, 2002) - 4Document2 pages46 Philam Care Health vs. CA (G.R. No. 125678 March 18, 2002) - 4eunice demaclidNo ratings yet

- Cz-50 CDC Declaration FormDocument1 pageCz-50 CDC Declaration FormSyeda Hiba AffanNo ratings yet

- Allstate Insurance Company Plan of DivisionDocument121 pagesAllstate Insurance Company Plan of DivisionTom WilsonNo ratings yet

- GKToday JulyDocument80 pagesGKToday Julygajendra singh RathoreNo ratings yet

- Customer Perception Towards Idbi Federal Life InsuranceDocument83 pagesCustomer Perception Towards Idbi Federal Life InsuranceSanket Sood88% (8)

- GIS Quotation FinalDocument12 pagesGIS Quotation FinalAshish MahapatraNo ratings yet

- Calvin Brown Résumé, Cover Letter, and References PDFDocument3 pagesCalvin Brown Résumé, Cover Letter, and References PDFCalvin BrownNo ratings yet

- Dear Gaurav Kadam,: Policy DetailsDocument10 pagesDear Gaurav Kadam,: Policy DetailsGaurav KadamNo ratings yet

- (Word) Revised TranspoLaw Outline 2017Document12 pages(Word) Revised TranspoLaw Outline 2017Rhows BuergoNo ratings yet

- Welcome To Trawelltag Cover-More.: Contact Name: AddressDocument2 pagesWelcome To Trawelltag Cover-More.: Contact Name: AddressAbhishek SinghNo ratings yet

- Motor Insurance - Two Wheeler Package Policy ScheduleDocument1 pageMotor Insurance - Two Wheeler Package Policy SchedulePriya RNo ratings yet

- Fortune Medicare V Amorin (2014)Document5 pagesFortune Medicare V Amorin (2014)Reyna RemultaNo ratings yet

- 15th Global Ceo Survey InsuranceDocument8 pages15th Global Ceo Survey InsuranceVe SusiraniNo ratings yet

- Ansonia Power Purchase Agreement 9 05 11 (700413263 - 3)Document27 pagesAnsonia Power Purchase Agreement 9 05 11 (700413263 - 3)The Valley IndyNo ratings yet

- Deposit Insurance and Credit Guarantee CorporationDocument78 pagesDeposit Insurance and Credit Guarantee CorporationarunohriNo ratings yet

- ASHOKDocument3 pagesASHOKSonu the devotional boyNo ratings yet

- Bike LoanDocument1 pageBike LoanKrishna KumarNo ratings yet

- Câu Hỏi quizz 11Document6 pagesCâu Hỏi quizz 11Nguyên ChiNo ratings yet

- The Demand and Supply of Health InsuranceDocument6 pagesThe Demand and Supply of Health Insuranceannie:XNo ratings yet

- Final - Commercial & SOR-Vol IDocument86 pagesFinal - Commercial & SOR-Vol IengharshNo ratings yet

- Insurance 8892Document5 pagesInsurance 8892Vivek Kumar sharmaNo ratings yet

- Pursuit of Excellence-Catalog Web.2018 PDFDocument104 pagesPursuit of Excellence-Catalog Web.2018 PDFHolstein PlazaNo ratings yet

- Savings Quotient 2023Document13 pagesSavings Quotient 2023malvikasinghalNo ratings yet

- Brief History of Scotia Bank Group ProjectDocument11 pagesBrief History of Scotia Bank Group ProjectDane BrissettNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)commission sompoNo ratings yet