Professional Documents

Culture Documents

ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZX

ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZX

Uploaded by

Aditya srivastavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZX

ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZX

Uploaded by

Aditya srivastavaCopyright:

Available Formats

ACCOUNTANCY – Test Paper 07

(Time 90 Mins. - Partnership Retirement) M.M 40

Q1. How do we account for goodwill at the time of retirement of a partner, when it does not appear in balance

sheet. (1)

Q2. A, B and C were sharing profits as 1/2 to A, 1/5 to B and 3/10 to C. C retires and his share is taken up by A

& C equally. Calculate the new profit sharing ratio and gaining ratio of A and B. (2)

Q3. X, Y and Z are sharing profits in the ratio of 9 : 7 : 4. Y retires. Amount due to Y on retirement on account

of goodwill, was calculated to be Rs. 42,000. Calculate new and gaining ratio assuming X contributes Rs.

24,000 and Z Rs. 18,000 to pay out Y. Also pass necessary journal entry. (3)

Q4a. Can the retired partner or the legal representative of a deceased partner claim a share firm the subsequent

profits of the firm?

Q4b. Why is it necessary to revalue the assets and liabilities in case of retirement of a partner?

Q4c. Mention any two circumstances under which the retiring partner’s capital account is debited. (4)

Q5a. Explain the provisions of section 37 of the Indian partnership Act 1932?

Q5b. A, B and C are the partners sharing profits in the ratio of 4 : 3 : 2. B retires and the amount due to him is

valued at Rs. 10,800, whereas it was agreed among the partners to pay him Rs. 16,800. Pass the required

entry. (4)

Q6. Mr. Sushant retired on 31st March 2020 and the amount due to him is Rs. 30,000. It was agreed to pay him

in two equal annual installments together with interest @12% p.a. Prepare Sushant’s loan account until it is

finally paid-off. (4)

Q7.Ram , Shyam & Bharat were partners in a firm sharing profits & losses in the ratio of 3 : 2 : 1.On the date of

Shyam’s retirement the Balance sheet showed workmen compensation reserve at Rs. 50,000, Investment

fluctuation reserve at Rs. 50,000 and Investments valued at Rs. 2,00,000. Pass necessary journal entry in the

following cases:

(a) When investments are valued at Rs. 2,20,000 & Claim towards workmen compensation is estimated to be

Rs. 40,000.

(b) When investments are valued at Rs. 1,80,000 & Claim towards workmen compensation is estimated to be

Rs. 62,000. (6)

Q8. A, B and C are partners sharing profits and losses as 4 : 3 : 2. B retires and A and C carry on in their old

ratio. Their Balance Sheet on the date of retirement is as under

Liabilities Rs. Assets Rs.

Capital Accounts: Land & Buildings 2,50,000

A 2,00,000 Machinery 70,000

B 2,52,000 Stock 3,00,000

C 1,48,000 6,00,000 Debtors 81,000

Sundry Creditors 1,10,000 Less: Provision (1,000) 80,000

Capital Reserve 9,000 Cash at Bank 10,000

Goodwill 9,000

7,19,000 7,19,000

Value of stock and buildings are to be increased by Rs. 30,000 and Rs. 50,000 respectively. Provision for

bad debts is not needed. While appropriating profits for the last year, an amount of Rs. 9,000 was wrongly

credited to Mr. B in excess. Compute new profit sharing ratio, gaining ratio and pass necessary journal

entries. (8)

Q9. The Balance Sheet of Arthur, Baldwin and Curtis who were sharing profits in proportion to their capitals

stood as follows on 31st December, 2019:

Liabilities Rs. Assets Rs.

Sundry creditors 6,900 Cash at bank 5,500

Capital accounts: Sundry debtors 5,000

Arthur 20,000 Less: Reserve 100 4,900

Baldwin 15,000

Curtis 10,000 45,000 Stock 8,000

Plant and machinery 8,500

Factory land & building 25,000

51,900 51,900

Mr. Baldwin retires and the following readjustments of the assets and liabilities have been agreed upon

before ascertainment of the amount payable by the firm to Mr. Baldwin:

(a) That the stock be decapitated by 6%

(b) That the reserve for doubtful debts be brought upto 5% on debtors

(c) That the factory land and building be appreciated by 20%.

(d) That a provision of Rs. 770 be made in respect of outstanding legal charges

(e) That the goodwill of the entire firm be fixed at Rs. 10,800 and Mr. Baldwin's share of the same be adjusted

into the accounts of Arthur and Curtis who are going to share future P/L as 5 : 3.

(f) That the entire capital of the firm as newly constituted be fixed at Rs. 28,000 between Arthur and Curtis in

the proportion of five-eights and three eights (i.e., actual cash to be paid off to or to be brought in by the

continuing partners as the case may be). Prepare revaluation account, capital account & Balance sheet after

retirement of Baldwin. (8)

************

You might also like

- Theory of Interest-Stephen Kellison-Solutions ManualDocument159 pagesTheory of Interest-Stephen Kellison-Solutions ManualGeOrGe GhOsT KoKKiNaKiS84% (43)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- R27 CFA Level 3Document10 pagesR27 CFA Level 3Ashna0188No ratings yet

- Time For Trust: The Trillion-Dollar Reasons To Rethink BlockchainDocument23 pagesTime For Trust: The Trillion-Dollar Reasons To Rethink BlockchainForkLogNo ratings yet

- FinMa PDFDocument86 pagesFinMa PDFJolex Acid0% (1)

- Accountancy Worksheets 4Document15 pagesAccountancy Worksheets 4devanshubhattacharya018No ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- TP 4 Pa 18 JuneDocument2 pagesTP 4 Pa 18 JuneAditya srivastavaNo ratings yet

- 12th Account 12-7-2019Document2 pages12th Account 12-7-2019Ajay GujjarNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Worksheet AdmissionDocument3 pagesWorksheet AdmissionYogesh AdhikariNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- Sample Paper Class XII Subject-Accountancy Part ADocument5 pagesSample Paper Class XII Subject-Accountancy Part AKaran BhatnagarNo ratings yet

- REVISION TEST Admission of A PartnerDocument2 pagesREVISION TEST Admission of A PartnerOshvi Shrivastava100% (1)

- Unit 3 Admission of A Partner QuestionsDocument4 pagesUnit 3 Admission of A Partner QuestionsMitesh SethiNo ratings yet

- SEM III - Advanced Accounting (EM)Document4 pagesSEM III - Advanced Accounting (EM)Abdul MalikNo ratings yet

- AccountsDocument14 pagesAccountsshrutichoudhary436No ratings yet

- Retirement WSDocument2 pagesRetirement WSarhamenterprises5401No ratings yet

- 12 2006 Accountancy 1Document5 pages12 2006 Accountancy 1Akash TamuliNo ratings yet

- Retirement of Partners Cbse Question BankDocument6 pagesRetirement of Partners Cbse Question Bankabhayku1689No ratings yet

- Cbse Questions Adm RetirementDocument19 pagesCbse Questions Adm RetirementDeepanshu kaushikNo ratings yet

- Foundation Practice SumsDocument9 pagesFoundation Practice SumsBRISTI SAHANo ratings yet

- PYQ PartnershipDocument11 pagesPYQ Partnershipa86476007No ratings yet

- Book Keeping and AccountancyDocument9 pagesBook Keeping and AccountancyPriyanka SHELKENo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- XII Acc CW Practice Questions Ch4.4 (Retirement)Document2 pagesXII Acc CW Practice Questions Ch4.4 (Retirement)Vaidehi BagraNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- Admission of A Partner - 1Document2 pagesAdmission of A Partner - 1Tera baapNo ratings yet

- 12th Accounts Partnership Test 15 Sept.Document6 pages12th Accounts Partnership Test 15 Sept.SGEVirtualNo ratings yet

- Assessement Test - Retirment of A PartnerDocument2 pagesAssessement Test - Retirment of A PartnerShreya PushkarnaNo ratings yet

- Test Paper 12Document6 pagesTest Paper 12Sukhjinder SinghNo ratings yet

- New Model Test Paper 1Document8 pagesNew Model Test Paper 1Harry AryanNo ratings yet

- Additional Questions-5Document14 pagesAdditional Questions-5Shivam Kumar JhaNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- Retierment of PartnerDocument4 pagesRetierment of PartnerSaransh GhoshNo ratings yet

- Admission of A Partner - Work Sheet No .4Document12 pagesAdmission of A Partner - Work Sheet No .4Hamza MudassirNo ratings yet

- Retirement Hots and Application Based QuestionsDocument5 pagesRetirement Hots and Application Based Questionspriya longaniNo ratings yet

- Navya and Radhey Were Partners Sharing Profits and Losses in The RatioDocument9 pagesNavya and Radhey Were Partners Sharing Profits and Losses in The RatioMohammad Tariq AnsariNo ratings yet

- Practice Worksheet 2 For Admission: March 2018 Stood As Liabilities Amount Assets AmountDocument3 pagesPractice Worksheet 2 For Admission: March 2018 Stood As Liabilities Amount Assets AmountAaira IbrahimNo ratings yet

- 12 Accountancy Lyp 2015 Foreign Set1Document42 pages12 Accountancy Lyp 2015 Foreign Set1Ashish GangwalNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- 12 2006 Accountancy 2Document5 pages12 2006 Accountancy 2Akash TamuliNo ratings yet

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENANo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- 12 2006 Accountancy 4Document5 pages12 2006 Accountancy 4Akash TamuliNo ratings yet

- Chapter-2: Partnership AccountsDocument6 pagesChapter-2: Partnership Accountsadityatiwari122006No ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- PartnershipDocument10 pagesPartnershipShaz NagaNo ratings yet

- Accountancy TestDocument2 pagesAccountancy Testdixa mathpalNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

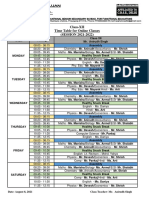

- Class Xii Time TableDocument1 pageClass Xii Time TableAditya srivastavaNo ratings yet

- Pa 1 Class Xii Business StudiesDocument2 pagesPa 1 Class Xii Business StudiesAditya srivastavaNo ratings yet

- Class Xii Time TableDocument1 pageClass Xii Time TableAditya srivastavaNo ratings yet

- TP 4 Pa 18 JuneDocument2 pagesTP 4 Pa 18 JuneAditya srivastavaNo ratings yet

- Aditya Birla Money SWOTDocument9 pagesAditya Birla Money SWOTGaurav SinghNo ratings yet

- Student NameDocument44 pagesStudent Name201930037No ratings yet

- Caf V TemplateDocument5 pagesCaf V Templatetatiana peacock100% (7)

- I Barnes - MIRF-withdrawalretreanchmentretDocument8 pagesI Barnes - MIRF-withdrawalretreanchmentretridbastraNo ratings yet

- Accounting For Government DisbursementsDocument12 pagesAccounting For Government DisbursementsMerlina Cuare100% (1)

- Sovereign Gold Bond - Product Features and FAQ'sDocument3 pagesSovereign Gold Bond - Product Features and FAQ'ssanjithchowdaryNo ratings yet

- Bank Branch Audit Presentation 2Document26 pagesBank Branch Audit Presentation 2karbalsNo ratings yet

- RBL Credit Card Statement - UnlockedDocument2 pagesRBL Credit Card Statement - UnlockedDipra DasNo ratings yet

- Books of Prime Entry and Control Account More Practice From A Level Topical Past PapersDocument21 pagesBooks of Prime Entry and Control Account More Practice From A Level Topical Past PapersJahanzaib ButtNo ratings yet

- Activity 9Document2 pagesActivity 9Kyle Marie PiñeroNo ratings yet

- Study On Call Money & Commercial Paper MarketDocument28 pagesStudy On Call Money & Commercial Paper MarketVarun Puri100% (2)

- Freddie MacDocument12 pagesFreddie Macانيس AnisNo ratings yet

- T Shape Account PreprationDocument5 pagesT Shape Account Preprationrajindere sainiNo ratings yet

- Sraj (Q4 - 2015)Document108 pagesSraj (Q4 - 2015)Wihelmina DeaNo ratings yet

- Financial Wellness Seminar: The Rock Unit Blue Horizon BranchDocument31 pagesFinancial Wellness Seminar: The Rock Unit Blue Horizon BranchKeiWakNo ratings yet

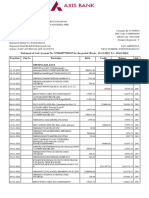

- Account STMT XX6767 20032024Document4 pagesAccount STMT XX6767 20032024jaidev DamarajuNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- Instructions: The Data Needed To Determine Year-End Adjustments Are As FollowsDocument2 pagesInstructions: The Data Needed To Determine Year-End Adjustments Are As FollowsyoantanNo ratings yet

- Secured Promissory Note: This Promissory Note Is Secured by Security Agreement of The Same DateDocument1 pageSecured Promissory Note: This Promissory Note Is Secured by Security Agreement of The Same DateFede CavalliNo ratings yet

- Contract Trade Usage: Cost-Plus or PercentageDocument4 pagesContract Trade Usage: Cost-Plus or Percentageraghav VarmaNo ratings yet

- FIN-AW3 AnswersDocument18 pagesFIN-AW3 AnswersRameesh DeNo ratings yet

- Finance Department PresentationDocument12 pagesFinance Department PresentationKMI7769% (13)

- The Unbanked and Underbanked by StateDocument11 pagesThe Unbanked and Underbanked by StatecaitlynharveyNo ratings yet

- Ratio Anlaysis Written ReportDocument5 pagesRatio Anlaysis Written ReportLyka Mae FajardoNo ratings yet

- Financial Management - Financial Statements, Cash Flow and TaxesDocument16 pagesFinancial Management - Financial Statements, Cash Flow and TaxesDonna ZanduetaNo ratings yet

- Project We LikeDocument45 pagesProject We LikeShashikant GujratiNo ratings yet