Professional Documents

Culture Documents

TP 4 Pa 18 June

TP 4 Pa 18 June

Uploaded by

Aditya srivastava0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

TP 4 PA 18 JUNE

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesTP 4 Pa 18 June

TP 4 Pa 18 June

Uploaded by

Aditya srivastavaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

ACCOUNTANCY – Test Paper 04

(Time 80 minutes - Partnership Admission) M.M 40

Q1. What is meant by reconstitution of partnership? (2)

Q2. State two differences between dissolution of partnership & dissolution of firm. (2)

Q3a. Can a minor partner be admitted in a partnership firm, State Yes/No, giving reasons for the same.

Q3b. Can a partnership be started with a minor, State Yes/No, giving reasons for the same. (2)

Q4. State one right other than “Right to share profits”. (2)

Q5. Under what circumstances sacrificing ratio can be :

(a) Zero (b) Negative (2)

Q6. State the nature and other name for revaluation account. (2)

Q7. Give journal entries for the following:

(a) Increase in the value of Asset (b) Increase in the value of Liability

(c) Unrecorded asset, now to be recorded (b) Decrease in the value of Debtors (2)

Q8a. What is the need for distribution of Accumulated gains among old partners on admission?

Q8b. State the ratio in which profit / loss on revaluation is distributred. (2)

Q9a. How will you calculate new partner’s share of goodwill, if goodwill of the firm is given?

Q9b. Give one similarity between Revaluation account & P/L appropriation a/c.

Q9c. A and B agree to value goodwill at 2.5 years purchase of average profits of the last four years for admitting

C as a partner.

Profits of the last four years were Rs. 20,000; Rs. 30,000 (Loss); Rs. 50,000 and Rs. 60,000 respectively.

What amount should C contribute towards goodwill in order to get 1/5th share. (4)

Q10a. State any four adjustments made in the books on admission of a partner?

Q10b. State any 4 factors on which goodwill depends.

Q10c. Calculate the sacrifice ratio in the following:

i. X and Y are sharing profits in the ratio of 4 : 3 Z joins and the new ratio is 7 : 4 : 3.

ii. X and Y are old partners sharing profits in the ratio of 3 : 2. Z joins with 1/7 the share of the profit. (6)

Q11. A and B partners sharing profits and losses in the ratio of 3:2. Their Balance Sheet as at 31.03.2020 is given

below:

Rs. Rs.

Creditors 40,000 Freehold premises 3,00,000

General reserve 10,000 Plant 50,000

Capital A/c: Office equipment 40,000

A 2,40,000 Stock 30,000

B 1,70,000 Debtors 25,000

Bank 15,000

4,60,000 4,60,000

On 1.4.2020, they admit C as a partner, who contributes Rs. 1,00,000 as capital. The following were agreed

upon:

1. C is to get 1/5th share in the firm 2. Provision for bad debts is to be made on debtors @2%.

3. Stock to be written down by 10%. 4. Investment to be recorded at Rs. 5,000

5. Freehold premises is to be revalued at Rs. 3,40,000, Plant Rs. 35,000 and office equipment Rs. 42,500.

Calculate new profit sharing ratio, sacrificing ratio, Pass necessary journal entries and prepare revaluation

account only. (6)

Q12. The following is the Balance Sheet of A and B who had been sharing profits in proportion of three-fourth

and one-fourths, on 31st December, 2020.

Liabilities Rs. Assets Rs.

Creditors 30,000 Cash at Bank 22,500

Employees’ Fund 7,500 Bills Receivable 3,000

Workmen Compensation Reserve 6,000 Debtors 16,000

A’s Capital 30,000 Stock 20,000

B’s Capital 16,000 Furniture 1,000

Land & Building 25,000

Advertisement Exp. 2,000

89,500 89,500

They agreed to take C into partnership on 1st January, 2021 on the following terms:

a. That C acquires his share of profit equally from A & B,

b. That C pays Rs. 40,000 as his capital for one-fourth share in the future profits,

c. That a claim on account of Workmen Compensation is estimated to be Rs. 10,000,

d. That stock and furniture be reduced by 20% and 5% provision for doubtful debts be created on debtors,

e. That the value of land and building be appreciated by 30%. Calculate new profit sharing ratio, sacrificing

ratio, Pass necessary journal entries, prepare revaluation account Partner’s Capital Accounts. (8)

************

You might also like

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- Accountancy Worksheets 4Document15 pagesAccountancy Worksheets 4devanshubhattacharya018No ratings yet

- Admission of A Partner PDFDocument8 pagesAdmission of A Partner PDFSpandan DasNo ratings yet

- ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXDocument2 pagesACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXAditya srivastavaNo ratings yet

- Accounts Parntership TestDocument6 pagesAccounts Parntership TestdhruvNo ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- 12 2006 Accountancy 1Document5 pages12 2006 Accountancy 1Akash TamuliNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- Book Keeping and AccountancyDocument9 pagesBook Keeping and AccountancyPriyanka SHELKENo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- Unit 3 Admission of A Partner QuestionsDocument4 pagesUnit 3 Admission of A Partner QuestionsMitesh SethiNo ratings yet

- Cbse Question Bank Admission of PartnersDocument6 pagesCbse Question Bank Admission of Partnersvsy9926No ratings yet

- REVISION TEST Admission of A PartnerDocument2 pagesREVISION TEST Admission of A PartnerOshvi Shrivastava100% (1)

- Retirement Collage SPCC Term 2..Document5 pagesRetirement Collage SPCC Term 2..Taaran ReddyNo ratings yet

- 12th Account - Practice Test 1 - Que - SMJDocument5 pages12th Account - Practice Test 1 - Que - SMJVarun BotharaNo ratings yet

- Partnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 05 (Of Lecture 07) - (Kautilya)DevanshuNo ratings yet

- BK - Board Question Paper - March 2023 - 640c2df6aaec0Document6 pagesBK - Board Question Paper - March 2023 - 640c2df6aaec0Priyansh ShahNo ratings yet

- SEM III - Advanced Accounting (EM)Document4 pagesSEM III - Advanced Accounting (EM)Abdul MalikNo ratings yet

- Admission of A Partner - 1Document2 pagesAdmission of A Partner - 1Tera baapNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- 12 2006 Accountancy 2Document5 pages12 2006 Accountancy 2Akash TamuliNo ratings yet

- PYQ PartnershipDocument11 pagesPYQ Partnershipa86476007No ratings yet

- II Puc Acc Mid Term MQP - 2Document5 pagesII Puc Acc Mid Term MQP - 2parvathis2606No ratings yet

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNo ratings yet

- Retirement of Partners Cbse Question BankDocument6 pagesRetirement of Partners Cbse Question Bankabhayku1689No ratings yet

- Sunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts - Retirement of A PartnerDocument2 pagesSunil Panda Commerce Classes: Before Exam Practice Questions For Term 2 Boards Accounts - Retirement of A PartnerHigi SNo ratings yet

- 1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Document3 pages1st Semi Prelium Chp. 1, 3, 4, 5, 6 (40 Marks) Dt. 07.12.2020 (All Branch)Arthur ShelbyNo ratings yet

- Worksheet 2Document4 pagesWorksheet 2singhharshu3222No ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- Partner Ship - IIDocument6 pagesPartner Ship - IIM JEEVARATHNAM NAIDUNo ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Worksheet AdmissionDocument3 pagesWorksheet AdmissionYogesh AdhikariNo ratings yet

- Chapter-3 Additional and Missing Value QuestionsDocument6 pagesChapter-3 Additional and Missing Value Questionsgoelr1802No ratings yet

- Accountancy TestDocument2 pagesAccountancy Testdixa mathpalNo ratings yet

- II Puc Acc Mid Term MQP - 1Document5 pagesII Puc Acc Mid Term MQP - 1parvathis2606No ratings yet

- Retirement WSDocument2 pagesRetirement WSarhamenterprises5401No ratings yet

- Cheque in Profit Sharing RatioDocument3 pagesCheque in Profit Sharing Ratioxjnk6fwfvhNo ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- Test Paper 12Document6 pagesTest Paper 12Sukhjinder SinghNo ratings yet

- Accountancy: Amount (?)Document4 pagesAccountancy: Amount (?)Thulsi JayadevNo ratings yet

- Admission of A Partner - Work Sheet No .4Document12 pagesAdmission of A Partner - Work Sheet No .4Hamza MudassirNo ratings yet

- Partnership QsDocument3 pagesPartnership QsJAYARAJALAKSHMI IlangoNo ratings yet

- Practice Worksheet 2 For Admission: March 2018 Stood As Liabilities Amount Assets AmountDocument3 pagesPractice Worksheet 2 For Admission: March 2018 Stood As Liabilities Amount Assets AmountAaira IbrahimNo ratings yet

- 12 AccountancyDocument10 pages12 AccountancyBhaswati SurNo ratings yet

- Acc Workshee - Admission of A PartnerDocument2 pagesAcc Workshee - Admission of A PartnerPrithvi RajNo ratings yet

- Class 12 AMU Model PapersDocument77 pagesClass 12 AMU Model PapersMohammad FarazNo ratings yet

- BK Prelims ComDocument6 pagesBK Prelims ComAafreen QureshiNo ratings yet

- FND Partnership QuestionDocument3 pagesFND Partnership QuestionShweta BhadauriaNo ratings yet

- Admission of A Partner - Work Sheet No .3Document9 pagesAdmission of A Partner - Work Sheet No .3Hamza MudassirNo ratings yet

- Chapter-2: Partnership AccountsDocument6 pagesChapter-2: Partnership Accountsadityatiwari122006No ratings yet

- Retierment of PartnerDocument4 pagesRetierment of PartnerSaransh GhoshNo ratings yet

- Prelim PartnershipDissolutionSampleProblemDocument12 pagesPrelim PartnershipDissolutionSampleProblemLee SuarezNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

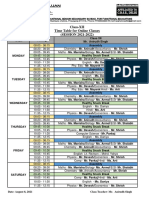

- Class Xii Time TableDocument1 pageClass Xii Time TableAditya srivastavaNo ratings yet

- Pa 1 Class Xii Business StudiesDocument2 pagesPa 1 Class Xii Business StudiesAditya srivastavaNo ratings yet

- Class Xii Time TableDocument1 pageClass Xii Time TableAditya srivastavaNo ratings yet

- ACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXDocument2 pagesACFrOgC2YFRgQqgXGei2VAYXPoowOnZ2mbZMnxvBpiDVpg6usCOgH0 Jt8oFprOsbVV 07 C z432aPTAuHLeuscFZz3Lr7nZzxGlOXkbUF6py8GWKjo5YCkQTYkjM9i66mj0n8EaOUnse7l NZXAditya srivastavaNo ratings yet

- Countries With Visa Requirements For Filipino CitizensDocument4 pagesCountries With Visa Requirements For Filipino CitizensAyenne Yin YangNo ratings yet

- Pobre Vs Mendieta GR 106677Document7 pagesPobre Vs Mendieta GR 106677Judel MatiasNo ratings yet

- Legal Requirement of Auditing and The Professional EthicsDocument16 pagesLegal Requirement of Auditing and The Professional EthicsyebegashetNo ratings yet

- 50MW Wind Farm Facility CEB-ArinmaDocument48 pages50MW Wind Farm Facility CEB-Arinmasaravanan.365mediaNo ratings yet

- Scrip Code: 532371 Scrip Symbol: TTMLDocument3 pagesScrip Code: 532371 Scrip Symbol: TTMLPratibha JassuNo ratings yet

- Anexo I Do Regulamento EU 1831Document26 pagesAnexo I Do Regulamento EU 1831Sistema de Gestão Rio DesertoNo ratings yet

- Alternative Dispute Resolution Barredbear's Lecture Notes Arellano University School of LawDocument5 pagesAlternative Dispute Resolution Barredbear's Lecture Notes Arellano University School of LawEvan TriolNo ratings yet

- Pocurement: 50 Confusing Terms inDocument9 pagesPocurement: 50 Confusing Terms inSyamirNo ratings yet

- DuplicateDocument3 pagesDuplicatemanojkumarcscietNo ratings yet

- Impeachment of Judges A Rigorous Process and A History of Fruitless AttemptsDocument4 pagesImpeachment of Judges A Rigorous Process and A History of Fruitless AttemptsAnonymous 1Ye0Go7KuNo ratings yet

- Compendium of Accounting Classification CodesDocument525 pagesCompendium of Accounting Classification Codeskuththan0% (1)

- ETI Question Bank Unit 4,5,6Document210 pagesETI Question Bank Unit 4,5,6Ashvini shingareNo ratings yet

- July 27, 2020 (Monday) Unit Course Description Section Time ProfessorDocument4 pagesJuly 27, 2020 (Monday) Unit Course Description Section Time ProfessorMichy De GuzmanNo ratings yet

- Letter of Termination Serious Misconduct Summary DismissalDocument4 pagesLetter of Termination Serious Misconduct Summary DismissalEdward AlmazanNo ratings yet

- PakopyaDocument9 pagesPakopyaKate NuevaNo ratings yet

- ANNEX D SEC-elenaDocument4 pagesANNEX D SEC-elenaADG CMFINo ratings yet

- BC 177Document7 pagesBC 177queequeg73No ratings yet

- Financial and Managerial Accounting Principlesinternational Edition 9th Edition Crosson Test BankDocument38 pagesFinancial and Managerial Accounting Principlesinternational Edition 9th Edition Crosson Test BankChristinaMcmahonbiqka100% (10)

- Vat Seatwork - NeDocument3 pagesVat Seatwork - NeMarvin San JuanNo ratings yet

- Monthly Implementation Report: Girl Scouts of The PhilippinesDocument2 pagesMonthly Implementation Report: Girl Scouts of The PhilippinesShane Olen GonzalesNo ratings yet

- Villanueva v. Balaguer DIGESTDocument2 pagesVillanueva v. Balaguer DIGESTkathrynmaydevezaNo ratings yet

- Basileus Training Presentation 2020Document19 pagesBasileus Training Presentation 2020heru nurudinNo ratings yet

- July 15 and 17Document11 pagesJuly 15 and 17NurRjObeidatNo ratings yet

- Partnership Act 1932Document27 pagesPartnership Act 1932ABHISHNo ratings yet

- Recommendation Report - Example 2Document7 pagesRecommendation Report - Example 2haziqNo ratings yet

- Solved According To The Text When One Fortune 500 Company Changed PDFDocument1 pageSolved According To The Text When One Fortune 500 Company Changed PDFAnbu jaromiaNo ratings yet

- Clarke Tech v1.1Document26 pagesClarke Tech v1.1Samuel LeiteNo ratings yet

- All You Need To Know About National Herald CaseDocument2 pagesAll You Need To Know About National Herald CasenishantNo ratings yet

- Unit 8 - Week 7: Assignment 7Document3 pagesUnit 8 - Week 7: Assignment 7Nitin MoreNo ratings yet

- IMI - Purchasing Maintenance Repair and Operations ProcedureDocument23 pagesIMI - Purchasing Maintenance Repair and Operations ProcedureRPM28XINo ratings yet