Professional Documents

Culture Documents

May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - Ma

Uploaded by

monalika7deshmukhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - Ma

Uploaded by

monalika7deshmukhCopyright:

Available Formats

17

20

ay

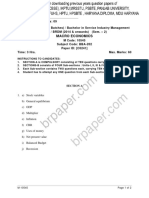

P79/FMG401/EE/20170618

-M

17

Time : 3 Hours Marks : 80

20

Instructions :

ay

1. All Questions are Compulsory.

-M

2. Each Sub-question carry 5 marks.

17

3. Each Sub-question should be answered between 75 to 100 words. Write every questions

answer on separate page.

20

4. Question paper of 80 Marks, it will be converted in to your programme structure marks.

ay

-M

1. Solve any four sub-questions.

17

a) What is Annual value? Explain its factors. 5

20

b) State the conditions for claiming depreciation. 5

ay

-M

c) Write the procedure for registration of an assesse. 5

d) Define capital asset. Explain its types. 5

17

20

e) Discuss the negative list of services. 5

ay

-M

2. Solve any four sub-questions.

17

a) Write the allowances of a salaried person. 5

20

b) Explain the scheme of Taxation under VAT. 5

ay

-M

c) Explain the subtraction method of VAT. 5

d) State the various categories of Income Tax slabs and Rates. 5

17

20

e) Differentiate between deductions and exemptions. 5

ay

7 -M

01

KA17-3030 P79/FMG401/EE/20170618 : 1 (P.T.O.)

y2

Ma

17

20

ay

3. Solve any four sub-questions.

-M

a) Differentiate between Direct Tax and Indirect Tax. 5

17

b) What do you mean by service tax? Explain its approaches. 5

20

ay

c) How to compute the Income from other sources. 5

-M

d) What is Tax abatement? List any three abatement in service tax. 5

17

e) Which documents are required for the purpose of Registration? 5

20

ay

4. Solve any four sub-questions.

-M

a) Which person is not liable to pay advance tax? 5

17

b) Give the advantages of VAT. 20 5

ay

c) Write the deduction for donation towards social causes : Section 80G. 5

-M

d) What is valuation? 5

17

e) Differentiate between gross Annual value and Net annual value. 5

20

ay

sssssss

-M

17

20

ay

-M

17

20

ay

7 -M

01

KA17-3030 P79/FMG401/EE/20170618 : 2

y2

Ma

You might also like

- Reedy Creek BillDocument189 pagesReedy Creek BillSkyler Swisher100% (1)

- 9th Grade Ethnic Studies Curriculum Map 2022-2023Document24 pages9th Grade Ethnic Studies Curriculum Map 2022-2023api-606132036100% (1)

- Order On Motion For Sanctions - RUBY FREEMAN, Et Al., VS. RUDOLPH W. GIULIANNIDocument3 pagesOrder On Motion For Sanctions - RUBY FREEMAN, Et Al., VS. RUDOLPH W. GIULIANNIPatriotTakesNo ratings yet

- Member's Data Form (MDF) PDFDocument5 pagesMember's Data Form (MDF) PDFAngelica BautistaNo ratings yet

- Sendas - La Senda Del Daimyo (Extracto) (Inglés)Document8 pagesSendas - La Senda Del Daimyo (Extracto) (Inglés)juan luis GarciaNo ratings yet

- Terelay v. Yulo: Stockholder's Right to Inspect Corporate RecordsDocument3 pagesTerelay v. Yulo: Stockholder's Right to Inspect Corporate Recordsalexis_beaNo ratings yet

- May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - MaDocument2 pagesMay 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - May 2017 - Mamonalika7deshmukhNo ratings yet

- Explaining key concepts in international financeDocument2 pagesExplaining key concepts in international financemonalika7deshmukhNo ratings yet

- Understanding MIS Components and ProcessesDocument2 pagesUnderstanding MIS Components and Processesmonalika7deshmukhNo ratings yet

- Understanding MIS Components and ProcessesDocument2 pagesUnderstanding MIS Components and Processesmonalika7deshmukhNo ratings yet

- Understanding MIS Components and ProcessesDocument2 pagesUnderstanding MIS Components and Processesmonalika7deshmukhNo ratings yet

- As 123Document2 pagesAs 123ChandrakantBangarNo ratings yet

- MGT 203 Business Economics NotesDocument6 pagesMGT 203 Business Economics NotesSuzain Nath90% (10)

- Operating System QuestionDocument2 pagesOperating System Questiongreatrashidkhan1No ratings yet

- P144 - MCA035 Dec 2019Document3 pagesP144 - MCA035 Dec 2019shivrajchangle00No ratings yet

- Jntuk 2 1 Mefa Nov 2017 Q PDocument5 pagesJntuk 2 1 Mefa Nov 2017 Q PsaiNo ratings yet

- Economics Paper-1Document1 pageEconomics Paper-1Nur QamarinaNo ratings yet

- Opn273 2Document2 pagesOpn273 2Afsana ShaikhNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoDocument3 pagesTime: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoHimanshuNo ratings yet

- BC 303 PI Past PapersDocument15 pagesBC 303 PI Past PapersDucky 6No ratings yet

- Banking Diploma Exam Business Communication QuestionsDocument2 pagesBanking Diploma Exam Business Communication QuestionsAdyanul HoqueNo ratings yet

- UACE Economics 2017 Paper 1Document3 pagesUACE Economics 2017 Paper 1fahrah daudaNo ratings yet

- National Institute of Technology, Rourkela BTech/Dual 7th Sem, Mech Engg (End Sem, Autumn), Nov 2015 ExamDocument4 pagesNational Institute of Technology, Rourkela BTech/Dual 7th Sem, Mech Engg (End Sem, Autumn), Nov 2015 ExamK Pushpendu PrashantNo ratings yet

- CMP516 2Document2 pagesCMP516 2Afsana ShaikhNo ratings yet

- Macro 2020Document2 pagesMacro 2020naturechannel1234No ratings yet

- II Pu Economics QPDocument8 pagesII Pu Economics QPBharathi RNo ratings yet

- Accounting For Management B ComDocument38 pagesAccounting For Management B CommhdxsuhailNo ratings yet

- Answer All QuestionsDocument3 pagesAnswer All QuestionsDisha KothariNo ratings yet

- Computerised Accounting (Theory) Ca-703Document2 pagesComputerised Accounting (Theory) Ca-703blessonpmathew34No ratings yet

- F1 Business Maths AprilDocument12 pagesF1 Business Maths Aprilஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- Key concepts of Operations Research examDocument71 pagesKey concepts of Operations Research examrakhi962No ratings yet

- Core Java exam questionsDocument2 pagesCore Java exam questionsRaj MishraNo ratings yet

- Financial Management and PolicyDocument7 pagesFinancial Management and PolicySåntøsh YådåvNo ratings yet

- Economics 2 Model Question Papers by Tumkur-1 - 240202 - 225656Document6 pagesEconomics 2 Model Question Papers by Tumkur-1 - 240202 - 225656unknown.xyz.qwertNo ratings yet

- PST ECON 2015 2023Document47 pagesPST ECON 2015 2023PhilipNo ratings yet

- Production Planning and Control: Code: ME7T2Document3 pagesProduction Planning and Control: Code: ME7T2Rajyalakshmi MNo ratings yet

- Business Economics-July 2017 PDFDocument2 pagesBusiness Economics-July 2017 PDFgmNo ratings yet

- II B. Tech I Semester Model Question Paper, Sept - 2017 Managerial EconomicsDocument5 pagesII B. Tech I Semester Model Question Paper, Sept - 2017 Managerial EconomicsRashmi SharmaNo ratings yet

- Answer Any TWO Questions. All Questions Carry Equal MarksDocument3 pagesAnswer Any TWO Questions. All Questions Carry Equal MarksdinobalaNo ratings yet

- QP CODE: 19102080: Reg No: NameDocument2 pagesQP CODE: 19102080: Reg No: NameOnline Class, CAS KPLYNo ratings yet

- Corporate Regulations and Administration - 0001 Dec 2018Document2 pagesCorporate Regulations and Administration - 0001 Dec 2018NishaNo ratings yet

- BA Sem IIIDocument2 pagesBA Sem IIISuprio SahaNo ratings yet

- 16mb750-Managerial Economics and Financial AnalysisDocument8 pages16mb750-Managerial Economics and Financial AnalysisKishan KumarNo ratings yet

- Industrial ManAgementDocument3 pagesIndustrial ManAgementSayantan DexNo ratings yet

- MTP Economics 11thDocument4 pagesMTP Economics 11thiamaarushdevsharmaNo ratings yet

- First Term XII (B)Document2 pagesFirst Term XII (B)Kapil KhadkaNo ratings yet

- O Level Econs 2 June 2020Document3 pagesO Level Econs 2 June 2020atabongawungnoelNo ratings yet

- FMP (2nd) May2016Document1 pageFMP (2nd) May2016Vandana AhujaNo ratings yet

- Economics 1, 2023Document4 pagesEconomics 1, 2023pkgxfnmcvtNo ratings yet

- Economics 1, 2023Document4 pagesEconomics 1, 2023Hancy TarimoNo ratings yet

- Bcom 3 Sem Financial Markets and Operations 22100580 Apr 2022Document2 pagesBcom 3 Sem Financial Markets and Operations 22100580 Apr 2022lightpekka2003No ratings yet

- QUESTION PAPER-S4 - Set 2Document3 pagesQUESTION PAPER-S4 - Set 2Titus ClementNo ratings yet

- Lease and Project Finance Exam 2022 S2Document4 pagesLease and Project Finance Exam 2022 S2bonaventure chipetaNo ratings yet

- Css Business Administration 2021Document1 pageCss Business Administration 2021Zahid Shan BughioNo ratings yet

- Maruti Suzuki's effective supply chain managementDocument5 pagesMaruti Suzuki's effective supply chain managementUNik ROnz OFFICIALNo ratings yet

- Business Administration CSS 2000 2020Document32 pagesBusiness Administration CSS 2000 2020Jelly FishNo ratings yet

- G 3568 (Pages: 2) Reg - No ............. Name M.B.A. Degree Examination, August 1996 First SemesterDocument2 pagesG 3568 (Pages: 2) Reg - No ............. Name M.B.A. Degree Examination, August 1996 First Semestersreesajesh100% (1)

- 3rd Sem Bcom 2013Document62 pages3rd Sem Bcom 2013piqueNo ratings yet

- CO3CRT07 - Corporate Accounting I (T)Document5 pagesCO3CRT07 - Corporate Accounting I (T)shemymuhammad289No ratings yet

- Economics 2019Document3 pagesEconomics 2019Amen KhanNo ratings yet

- Page 5 of 8 TOA - January Semester 2020Document4 pagesPage 5 of 8 TOA - January Semester 2020Rama Krishna SaraswatiNo ratings yet

- BEF1312 Final Exam 2022 S1Document4 pagesBEF1312 Final Exam 2022 S1bonaventure chipetaNo ratings yet

- ME (2nd) May2018Document2 pagesME (2nd) May2018Shruti BansalNo ratings yet

- Federal Public Service Commission exam questions on business administrationDocument1 pageFederal Public Service Commission exam questions on business administrationusman aliNo ratings yet

- KASNEB - Aug 2009 To Nov 2010Document13 pagesKASNEB - Aug 2009 To Nov 2010Josephe Mwinizi50% (2)

- P79 Gen204Document2 pagesP79 Gen204monalika7deshmukhNo ratings yet

- P79 MMG301Document2 pagesP79 MMG301monalika7deshmukhNo ratings yet

- P79 Gen121 Gen403Document2 pagesP79 Gen121 Gen403monalika7deshmukhNo ratings yet

- V88/V89/V90/V91/M12/M17/P79/GEN121 TO GEN403/EE/20160523: Time: 3 Hours Marks: 80 InstructionDocument2 pagesV88/V89/V90/V91/M12/M17/P79/GEN121 TO GEN403/EE/20160523: Time: 3 Hours Marks: 80 Instructionmonalika7deshmukhNo ratings yet

- Effective Communication Skills Exam QuestionsDocument2 pagesEffective Communication Skills Exam Questionsmonalika7deshmukhNo ratings yet

- M12/M17/P79/GEN122/EE/20160523: Time: 3 Hours Marks: 80 InstructionDocument2 pagesM12/M17/P79/GEN122/EE/20160523: Time: 3 Hours Marks: 80 Instructionmonalika7deshmukhNo ratings yet

- P79 MKG303Document2 pagesP79 MKG303monalika7deshmukhNo ratings yet

- P79 MKG303Document2 pagesP79 MKG303monalika7deshmukhNo ratings yet

- P79/MMG303/EE/20180113: Time: 3 Hours Marks: 80 InstructionsDocument2 pagesP79/MMG303/EE/20180113: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukhNo ratings yet

- P79/MKG302/EE/20180109: Time: 3 Hours Marks: 80 InstructionsDocument2 pagesP79/MKG302/EE/20180109: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukhNo ratings yet

- P79/MBA202/EE/20160519: Time: 3 Hours Marks: 80 InstructionsDocument4 pagesP79/MBA202/EE/20160519: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukh0% (1)

- P79/MKG304/EE/20180110: Time: 3 Hours Marks: 80 InstructionsDocument2 pagesP79/MKG304/EE/20180110: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukhNo ratings yet

- P79/MBA201/EE/20160518: Time: 3 Hours Marks: 80 InstructionsDocument2 pagesP79/MBA201/EE/20160518: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukhNo ratings yet

- P79/MKG301/EE/20180108: Time: 3 Hours Marks: 80 InstructionsDocument2 pagesP79/MKG301/EE/20180108: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukhNo ratings yet

- P79/MMG301/EE/20180111: Time: 3 Hours Marks: 80 InstructionsDocument2 pagesP79/MMG301/EE/20180111: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukhNo ratings yet

- P79/MBA203/EE/20160520: Time: 3 Hours Marks: 80 InstructionsDocument2 pagesP79/MBA203/EE/20160520: Time: 3 Hours Marks: 80 Instructionsmonalika7deshmukhNo ratings yet

- How I Spent My Time During LockdownDocument2 pagesHow I Spent My Time During Lockdownmonalika7deshmukhNo ratings yet

- Two Ways To Belong in AmericaDocument3 pagesTwo Ways To Belong in AmericaStephanie Sabine Downie100% (1)

- Joselito Peralta Y Zareno, Petitioner, vs. People of The Philippines, Respondent. DecisionDocument5 pagesJoselito Peralta Y Zareno, Petitioner, vs. People of The Philippines, Respondent. DecisionGinn UndarNo ratings yet

- Registered Pharmacist Self DeclarationDocument1 pageRegistered Pharmacist Self DeclarationRathod SirNo ratings yet

- International Journal of Law ISSN: 2455-2194 4-3-51-589Document12 pagesInternational Journal of Law ISSN: 2455-2194 4-3-51-589v123t456No ratings yet

- Custodial ViolenceDocument13 pagesCustodial Violencebhupendra barhatNo ratings yet

- Multicultural Education: A Challenge To Global Teachers: (Reflection)Document3 pagesMulticultural Education: A Challenge To Global Teachers: (Reflection)Florencio Diones Delos Santos Jr.No ratings yet

- InvoiceDocument2 pagesInvoicedevesh6900No ratings yet

- Finance Department: Section Officer AdmnDocument438 pagesFinance Department: Section Officer AdmnRam ReddyNo ratings yet

- Land Bank of The Philippines V Belle CorpDocument2 pagesLand Bank of The Philippines V Belle CorpDan Marco GriarteNo ratings yet

- Construction Arbitration Rules Demand For Arbitration: AAA Case Filing Services Can Be Reached at 877-495-4185Document2 pagesConstruction Arbitration Rules Demand For Arbitration: AAA Case Filing Services Can Be Reached at 877-495-4185kelsey harrisNo ratings yet

- Supreme Court Cases How Do They Apply To YouDocument2 pagesSupreme Court Cases How Do They Apply To Youapi-526843023No ratings yet

- Part5 - Rov Gas - Iss0Document6 pagesPart5 - Rov Gas - Iss0Bong NguyenNo ratings yet

- Pana v. Heirs of Juanite, SR., G.R. No. 164201, Dec. 10, 2012 DIGESTDocument3 pagesPana v. Heirs of Juanite, SR., G.R. No. 164201, Dec. 10, 2012 DIGESTApril100% (1)

- Rules of devolution of undivided coparcenary propertyDocument24 pagesRules of devolution of undivided coparcenary propertyRupeshPandyaNo ratings yet

- Imjin WarDocument5 pagesImjin Warbod8mickNo ratings yet

- Social - Networking - Sites - Are - Used - For - Stalking - Instead - of - Communictaon (Debate Script)Document3 pagesSocial - Networking - Sites - Are - Used - For - Stalking - Instead - of - Communictaon (Debate Script)Jaskeerrat KaurNo ratings yet

- Partnership Formation OperationDocument23 pagesPartnership Formation OperationJonh Carlo ManalansanNo ratings yet

- AP Vcms Test Keys Use Clear Mdk1Document2 pagesAP Vcms Test Keys Use Clear Mdk1Buontee laiyNo ratings yet

- Eric Munchel Pretrial Detention OrderDocument3 pagesEric Munchel Pretrial Detention OrderJonathan RaymondNo ratings yet

- Admit CardDocument2 pagesAdmit CardAyesha KhanNo ratings yet

- Final - Published RFQ For UMRAHDocument7 pagesFinal - Published RFQ For UMRAHAndreas KamasahNo ratings yet

- Who Ate The Cheese LabDocument4 pagesWho Ate The Cheese LabMrc Leogiver MañoscaNo ratings yet

- Shelley Walia: On Rights For AllDocument1 pageShelley Walia: On Rights For AllvishuNo ratings yet

- Assessment Part 1Document5 pagesAssessment Part 1RoNnie RonNieNo ratings yet