Professional Documents

Culture Documents

Quiz 6.1 Capital Budgeting

Uploaded by

Winoah HubaldeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 6.1 Capital Budgeting

Uploaded by

Winoah HubaldeCopyright:

Available Formats

1.

An actuary has determined that a company should have P90,000,000 accumulated in its pension fund

20 years from now for the fund to be able to meet its obligations. An interest rate of 8% is considered

appropriate for all pension fund calculations. The company wishes to know how much it should

contribute to the pension fund at the end of each of the next 20 years. Which set of instructions

correctly describes the procedures necessary to compute the annual contribution?

Answer: Divide P90 Million by the factor for future value of an ordinary annuity.

2. Snow Company plans to invest P2,000 at the end of the next ten years. Assume that Snow Company

will earn interest at an annual rate of 6% compounded annually. The future amount of an ordinary

annuity of P1 for 10 periods at 6% is 13.181. The present value of P1 for ten periods at 6% is 0.558. The

present value of an ordinary annuity of P1 for ten periods at 6% is 7.360. The investment after the end

of ten years would be:

Answer: 26,362

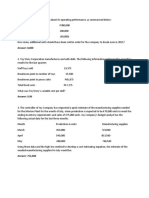

3. Jasper Company has a payback goal of 3 years on new equipment acquisitions. A new sorter is being

evaluated that costs P450,000 and has a 5-year life. Straight-line depreciation will be used; no salvage is

anticipated. Jasper is subject to a 40% income tax rate. To meet the Company's payback goal the sorter

must generate reductions in annual cash operating costs of:

Answer: 190,000

4. Palafox and Company is considering an investment proposal for P10,000,000 yielding a net present

value of P450,000. The project has a life of seven years with salvage value of P200,000. The company

uses a discount rate of 12%. Which of the following would decrease the net present value?

Answer: Increase the discount rate to 15%.

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Mancon Quiz 5Document56 pagesMancon Quiz 5Quendrick SurbanNo ratings yet

- Ex10 - Working Capital Management With SolutionDocument9 pagesEx10 - Working Capital Management With SolutionJonas Mondala80% (5)

- Capital Budgeting Quiz 1: Multiple ChoiceDocument7 pagesCapital Budgeting Quiz 1: Multiple ChoiceMark Jesus Aristo100% (1)

- Endterm ExamDocument6 pagesEndterm ExamMasTer PanDaNo ratings yet

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Capital Investment Factors7to16Document15 pagesCapital Investment Factors7to16Spencer Tañada100% (1)

- (Exercise) WaccDocument3 pages(Exercise) Waccclary frayNo ratings yet

- Diagnostic Examination (Batch 2020)Document71 pagesDiagnostic Examination (Batch 2020)KriztleKateMontealtoGelogo75% (4)

- SFM MaterialDocument106 pagesSFM MaterialAlok67% (3)

- Part 1: Financial ForecastingDocument8 pagesPart 1: Financial ForecastingJustine CruzNo ratings yet

- Engineering Economy Problem1Document11 pagesEngineering Economy Problem1frankRACENo ratings yet

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingYaj CruzadaNo ratings yet

- Universal College of Parañaque: Working Capital ManagementDocument23 pagesUniversal College of Parañaque: Working Capital ManagementEmelita ManlangitNo ratings yet

- Capital BudgetingDocument23 pagesCapital BudgetingNoelJr. Allanaraiz100% (4)

- Operating Cash InflowDocument11 pagesOperating Cash InflowRarajNo ratings yet

- HW5 1Document4 pagesHW5 1Winoah HubaldeNo ratings yet

- Quiz#1 MaDocument5 pagesQuiz#1 Marayjoshua12No ratings yet

- Multiple Choice Questions General ConceptsDocument10 pagesMultiple Choice Questions General ConceptsAzureBlazeNo ratings yet

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNo ratings yet

- FinalsDocument3 pagesFinalsWinoah HubaldeNo ratings yet

- FinalsDocument3 pagesFinalsWinoah HubaldeNo ratings yet

- Capital Budgeting NotesDocument5 pagesCapital Budgeting NotesCris Joy BiabasNo ratings yet

- Capital Budgeting ExercisesDocument4 pagesCapital Budgeting ExercisescrissilleNo ratings yet

- Capital Budgeting ProblemsDocument4 pagesCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Working CapitalDocument3 pagesWorking CapitalSiidolohNo ratings yet

- Management Advisory ServicesDocument18 pagesManagement Advisory ServicesAldrin Arcilla Simeon0% (1)

- Ie151-2x - Eng Eco - PsDocument9 pagesIe151-2x - Eng Eco - Psjac bnvstaNo ratings yet

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesNo ratings yet

- True or FalseDocument3 pagesTrue or FalseKarlo D. ReclaNo ratings yet

- Problems - Capital BudgetingDocument5 pagesProblems - Capital BudgetingDianne TorresNo ratings yet

- Assignment 1 CF Section BDocument2 pagesAssignment 1 CF Section BPoornima SharmaNo ratings yet

- Practice ProblemsDocument4 pagesPractice ProblemsThalia RodriguezNo ratings yet

- Mafin QuizDocument2 pagesMafin QuizNesgie MiclatNo ratings yet

- Cost of CapitalDocument3 pagesCost of Capitalkedar211No ratings yet

- Engineering Economics 2023Document375 pagesEngineering Economics 2023joe marieNo ratings yet

- MAS 3 WC Management Exercises For UploadDocument3 pagesMAS 3 WC Management Exercises For UploadJaiavave LinogonNo ratings yet

- Problemset EconceDocument10 pagesProblemset EconceGerly Joy MaquilingNo ratings yet

- Jpia, SCF, Eps & FsaDocument4 pagesJpia, SCF, Eps & FsaBrian Christian VillaluzNo ratings yet

- Operating Cash InflowDocument11 pagesOperating Cash InflowQuiroann NalzNo ratings yet

- Drill-9 EecoDocument17 pagesDrill-9 EecoTine AbellanosaNo ratings yet

- Fin3n Cap Budgeting Quiz 1Document1 pageFin3n Cap Budgeting Quiz 1Kirsten Marie EximNo ratings yet

- Cash and Marketable Securities Seatworks PDFDocument3 pagesCash and Marketable Securities Seatworks PDFGirl Lang AkoNo ratings yet

- Exercises Capital BudgetingDocument3 pagesExercises Capital BudgetingSwap WerdNo ratings yet

- Take Home QuizDocument5 pagesTake Home QuizMA ValdezNo ratings yet

- Acc 223 CB PS3 QDocument8 pagesAcc 223 CB PS3 QAeyjay ManangaranNo ratings yet

- 11 Dividend Policy ExerciseDocument1 page11 Dividend Policy Exercise马妍菲100% (1)

- Engineering Economy 3 April 2024Document4 pagesEngineering Economy 3 April 2024Craeven AranillaNo ratings yet

- Par CorDocument15 pagesPar CorKim Nayve57% (7)

- Chapter 2 Problems On Capital InvestmentDocument2 pagesChapter 2 Problems On Capital InvestmentamananandxNo ratings yet

- HO No. 3 - Working Capital ManagementDocument2 pagesHO No. 3 - Working Capital ManagementGrace Chavez ManaliliNo ratings yet

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- BBDocument3 pagesBBJoshua WacanganNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Engineering EconomyDocument2 pagesEngineering EconomyMichelle MariposaNo ratings yet

- Non-Discounted Capital Budgeting Techniques: ExampleDocument2 pagesNon-Discounted Capital Budgeting Techniques: ExampleKristineTwo CorporalNo ratings yet

- 14 Working Capital Management 2020Document6 pages14 Working Capital Management 2020JemNo ratings yet

- Acc 223 CB PS1 2021 QDocument8 pagesAcc 223 CB PS1 2021 QAeyjay ManangaranNo ratings yet

- Cash Flow Analysis ReviewerDocument2 pagesCash Flow Analysis ReviewerMae CruzNo ratings yet

- Lesson 1Document30 pagesLesson 1Winoah HubaldeNo ratings yet

- Data of Barbados Company:: Variable Cost Per UnitDocument2 pagesData of Barbados Company:: Variable Cost Per UnitWinoah HubaldeNo ratings yet

- Income Taxation 2Document3 pagesIncome Taxation 2Winoah HubaldeNo ratings yet

- Income Taxation 1Document7 pagesIncome Taxation 1Winoah HubaldeNo ratings yet

- MODULE 5 To Module 6Document10 pagesMODULE 5 To Module 6Winoah HubaldeNo ratings yet

- Lesson 2Document10 pagesLesson 2Winoah HubaldeNo ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- Break-Even Is The Point Where Total Sales Equal To Total CostsDocument5 pagesBreak-Even Is The Point Where Total Sales Equal To Total CostsWinoah HubaldeNo ratings yet

- Answer: 215,000Document2 pagesAnswer: 215,000Winoah HubaldeNo ratings yet

- Answer: 8,000Document2 pagesAnswer: 8,000Winoah HubaldeNo ratings yet

- HW4 1Document2 pagesHW4 1Winoah HubaldeNo ratings yet

- Strategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionDocument9 pagesStrategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionWinoah HubaldeNo ratings yet

- Relevant Costing 3Document1 pageRelevant Costing 3Winoah HubaldeNo ratings yet

- Assignment 1: Variable CostingDocument4 pagesAssignment 1: Variable CostingWinoah HubaldeNo ratings yet

- Assignment 3.2 BudgetingDocument2 pagesAssignment 3.2 BudgetingWinoah HubaldeNo ratings yet

- Segment MarginDocument1 pageSegment MarginWinoah HubaldeNo ratings yet

- Net Operating Income 397800: Members: Consibido, Carmela Marie Hubalde, Winoah Lim, ShairalynDocument2 pagesNet Operating Income 397800: Members: Consibido, Carmela Marie Hubalde, Winoah Lim, ShairalynWinoah HubaldeNo ratings yet

- Answer: 8,000Document2 pagesAnswer: 8,000Winoah HubaldeNo ratings yet

- Decentralization in Operation 4.2Document1 pageDecentralization in Operation 4.2Winoah HubaldeNo ratings yet

- Data of Barbados Company:: Variable Cost Per UnitDocument2 pagesData of Barbados Company:: Variable Cost Per UnitWinoah HubaldeNo ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- Lesson 2Document10 pagesLesson 2Winoah HubaldeNo ratings yet

- Capital BudgetingDocument1 pageCapital BudgetingWinoah HubaldeNo ratings yet

- Answer: 215,000Document2 pagesAnswer: 215,000Winoah HubaldeNo ratings yet

- Lesson 1Document30 pagesLesson 1Winoah HubaldeNo ratings yet