Professional Documents

Culture Documents

758x 3A

Uploaded by

Nathan WangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

758x 3A

Uploaded by

Nathan WangCopyright:

Available Formats

BUFN758X

Nathan Wang

What is latency? How has it changed in recent years?

Latency is the time it takes to learn about an event, generate a response, and have the

exchange act on the response. Latency especially in trading has been extraordinarily

reduced in recent years.

What are the key drivers of the changes in latency?

One of the most significant driver is the market volatility, as the market event or public

information drives the stock price rapidly. The low latency becomes significantly

important. A millisecond delay make cause exponential loss in large quantity trading. The

other key driver is the high frequency trading strategy that the traders are implementing,

in order to make the high frequency trading, the system must make minimal latency to

execute the orders.

What makes a high frequency trading strategy today different from a typical

market-making strategy in the past?

Typical market-making strategy do not need millisecond response to the changing market

conditions. High frequency trading strategy responds to market event in milliseconds,

which is extremely fast.

Why is trading highly concentrated in a small number of high frequency trading

firms?

Because such algorithms are employed by hedge funds, and only small number of high

frequency trading firms already involves high percentage of the trading volume in

NASDAQ.

What are some examples of HFT firms?

Virtu Financial, IMC, Tower Research Capital, and Citadel LLC.

What does high frequency trading suggest about the trade-offs between private

benefits and social benefits?

The trade-offs between private benefits and social benefits are hard to determine. It

maybe harmful or improve the market quality in aggregate for long-term investors. One

argument is that the HFT aid price discovery by eliminating the price difference, but at

such a short time it is difficult to determine the true value of the security.

For how long do high frequency traders hold inventories?

They usually hold their inventory for a very short time, never longer than a day.

What is a "stale quote" ?

A stale quote is a quote that only reflects the old market event, that is not updated to the

most recent market information.

Do high frequency traders attempt to make money with market orders or limit

orders? Why?

They make more money with limit order, since all submitted orders must be price

contingent. Market order’s executed price is not under control of the high frequency

traders.

(Optional for extra credit; if you do it, please submit it as part of the assignment) Do

high frequency traders prefer a market with a large tick size or a small tick size?

I believe high frequency traders prefer small tick size, because small tick size make their

limit order more flexible, their order price could be more precise to execute the order.

Reference:

Hasbrouck, Joel, and Gideon Saar. 2013. “Low Latency Trading.” Journal of Financial

Markets, Vol. 16, pp. 646–679. Hasbrouck_Saar.pdf

You might also like

- Domeyard Case SolutionDocument4 pagesDomeyard Case SolutionSamet GüçlüNo ratings yet

- Stop-Limit Order: High-Frequency TradingDocument5 pagesStop-Limit Order: High-Frequency TradingPeter KwagalaNo ratings yet

- Swing Trading for Beginners: The Ultimate Trading Guide. Learn Effective Money Management Strategies to Conquer the Market and Become a Successful Swing Trader.From EverandSwing Trading for Beginners: The Ultimate Trading Guide. Learn Effective Money Management Strategies to Conquer the Market and Become a Successful Swing Trader.No ratings yet

- FINC3014 Topic 11 - Solutions: Current issues in Trading & DealingDocument5 pagesFINC3014 Topic 11 - Solutions: Current issues in Trading & Dealingsuitup100No ratings yet

- Trading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsFrom EverandTrading Momentum: Trend Following: An Introductory Guide to Low Risk/High-Return Strategies; Stocks, ETF, Futures, And Forex MarketsRating: 1 out of 5 stars1/5 (1)

- Swing Trading: Guide to Investing in Financial Markets, to Create Passive Income, Secrets and Strategies to ProfitFrom EverandSwing Trading: Guide to Investing in Financial Markets, to Create Passive Income, Secrets and Strategies to ProfitRating: 1 out of 5 stars1/5 (1)

- Anglais PresentationDocument2 pagesAnglais PresentationEl Messaoudi AyaNo ratings yet

- SWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)From EverandSWING TRADING: Maximizing Returns and Minimizing Risk through Time-Tested Techniques and Tactics (2023 Guide for Beginners)No ratings yet

- What Are The Restricted:Prohibited Trading Strategies at FundedNext? - FundedNext Help CenterDocument8 pagesWhat Are The Restricted:Prohibited Trading Strategies at FundedNext? - FundedNext Help CenterEbinbin AjagunNo ratings yet

- SWING TRADING STRATEGIES: Proven Techniques for Capturing Market Swings (2024 Guide for Beginners)From EverandSWING TRADING STRATEGIES: Proven Techniques for Capturing Market Swings (2024 Guide for Beginners)No ratings yet

- HFTDocument18 pagesHFTpankajpandeylkoNo ratings yet

- Day Trading Strategies: Learn The Key Tools and Techniques You Need to Succeed in Trading Stocks, Forex, Options, Futures, Cryptocurrency, and ETFs Using Insider Technical Analysis and Risk ManagementFrom EverandDay Trading Strategies: Learn The Key Tools and Techniques You Need to Succeed in Trading Stocks, Forex, Options, Futures, Cryptocurrency, and ETFs Using Insider Technical Analysis and Risk ManagementRating: 5 out of 5 stars5/5 (44)

- BMO paper examines impact of high frequency trading in CanadaDocument10 pagesBMO paper examines impact of high frequency trading in CanadaRichardYuNo ratings yet

- The Cost of Latency in High-Frequency TradingDocument55 pagesThe Cost of Latency in High-Frequency TradingPopon KangpenkaeNo ratings yet

- DAY TRADING OPTIONS: Strategies and Techniques for Profiting from Short-Term Options Trading (2024 Guide for Beginners)From EverandDAY TRADING OPTIONS: Strategies and Techniques for Profiting from Short-Term Options Trading (2024 Guide for Beginners)No ratings yet

- Day Trading & Options Trading: Trade Like A Pro With Winning Strategies & Precise Technical Analysis to Succeed in Trading Stocks, Commodities, Forex, Futures, Bitcoin and ETFs in Any Market ConditionFrom EverandDay Trading & Options Trading: Trade Like A Pro With Winning Strategies & Precise Technical Analysis to Succeed in Trading Stocks, Commodities, Forex, Futures, Bitcoin and ETFs in Any Market ConditionRating: 5 out of 5 stars5/5 (26)

- A Practical Guide to ETF Trading Systems: A systematic approach to trading exchange-traded fundsFrom EverandA Practical Guide to ETF Trading Systems: A systematic approach to trading exchange-traded fundsRating: 5 out of 5 stars5/5 (1)

- Order BookDocument4 pagesOrder BookMahir MulaomerovićNo ratings yet

- Trading White Paper: Jeff BrownDocument8 pagesTrading White Paper: Jeff BrownChappidiNareshNo ratings yet

- Day Trading for Beginners: The Ultimate Trading Guide. Discover Effective Strategies to Master the Stock Market and Start Making Money Online.From EverandDay Trading for Beginners: The Ultimate Trading Guide. Discover Effective Strategies to Master the Stock Market and Start Making Money Online.No ratings yet

- Swing Trading: A Beginner’s Step by Step Guide to Make Money on the Stock Market With Trend Following StrategiesFrom EverandSwing Trading: A Beginner’s Step by Step Guide to Make Money on the Stock Market With Trend Following StrategiesRating: 4.5 out of 5 stars4.5/5 (39)

- Forex Trading: Part 3: The Relevance of PriceFrom EverandForex Trading: Part 3: The Relevance of PriceRating: 4.5 out of 5 stars4.5/5 (3)

- Quant Book 2022Document117 pagesQuant Book 2022Nikhil SinghalNo ratings yet

- Where Is The Value in High Frequency Trading?Document34 pagesWhere Is The Value in High Frequency Trading?MarketsWikiNo ratings yet

- HFT Client Letter - 7 30 09Document2 pagesHFT Client Letter - 7 30 09ZerohedgeNo ratings yet

- High Frequency FX Trading:: Technology, Techniques and DataDocument4 pagesHigh Frequency FX Trading:: Technology, Techniques and Datakaddour7108No ratings yet

- Trading Types - Day, Swing and Position Strategies ExplainedDocument15 pagesTrading Types - Day, Swing and Position Strategies Explainedhai_sekhNo ratings yet

- SWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)From EverandSWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)No ratings yet

- The Advanced Swing Trading Guide: The Ultimate Beginners Guide for Learning the Best Algorithmic, Swing, and Day Trading Strategies; To Apply to the Options, Forex, and Stock Market in the Modern Age!From EverandThe Advanced Swing Trading Guide: The Ultimate Beginners Guide for Learning the Best Algorithmic, Swing, and Day Trading Strategies; To Apply to the Options, Forex, and Stock Market in the Modern Age!Rating: 4.5 out of 5 stars4.5/5 (12)

- OPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)From EverandOPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)No ratings yet

- What Lurks in Those Dark Pools?Document2 pagesWhat Lurks in Those Dark Pools?Th3.N3w813No ratings yet

- An Introduction to Forex Trading: A Guide for BeginnersFrom EverandAn Introduction to Forex Trading: A Guide for BeginnersRating: 4 out of 5 stars4/5 (6)

- Ultimate Forex Trading Guide: With FX Trading To Passive Income & Financial Freedom Within One Year: (Workbook With Practical Strategies For Trading And Financial Psychology)From EverandUltimate Forex Trading Guide: With FX Trading To Passive Income & Financial Freedom Within One Year: (Workbook With Practical Strategies For Trading And Financial Psychology)No ratings yet

- Day Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingFrom EverandDay Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingRating: 5 out of 5 stars5/5 (9)

- Swing and day trading for beginners: How to Make Money with Trading and Investing in the Currency Market by Managing Risk and Using the Best Strategies to Earn a Real Passive IncomeFrom EverandSwing and day trading for beginners: How to Make Money with Trading and Investing in the Currency Market by Managing Risk and Using the Best Strategies to Earn a Real Passive IncomeNo ratings yet

- Forex Trading: Part 1: Time and Price StrategyFrom EverandForex Trading: Part 1: Time and Price StrategyRating: 4.5 out of 5 stars4.5/5 (6)

- Example of Real Rate of Return FormulaDocument19 pagesExample of Real Rate of Return FormulasahilkuNo ratings yet

- 2022-2023 Price Action Trading Guide for Beginners in 45 MinutesFrom Everand2022-2023 Price Action Trading Guide for Beginners in 45 MinutesRating: 4.5 out of 5 stars4.5/5 (4)

- Literature Review High Frequency TradingDocument8 pagesLiterature Review High Frequency Tradingafdttricd100% (1)

- High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading SystemsFrom EverandHigh-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading SystemsRating: 2 out of 5 stars2/5 (1)

- Investments Workbook: Principles of Portfolio and Equity AnalysisFrom EverandInvestments Workbook: Principles of Portfolio and Equity AnalysisRating: 4 out of 5 stars4/5 (1)

- Momentum Strategy Master ThesisDocument6 pagesMomentum Strategy Master Thesisnancyjarjissterlingheights100% (2)

- Locked-In Range Analysis: Why Most Traders Must Lose Money in the Futures Market (Forex)From EverandLocked-In Range Analysis: Why Most Traders Must Lose Money in the Futures Market (Forex)Rating: 1 out of 5 stars1/5 (1)

- Day Trading: The Ultimate Guide to Start Making Money in the Stock Market. Learn Effective Strategies, Manage Tools and Platforms to Become a Successful TraderFrom EverandDay Trading: The Ultimate Guide to Start Making Money in the Stock Market. Learn Effective Strategies, Manage Tools and Platforms to Become a Successful TraderNo ratings yet

- Short SellingDocument2 pagesShort SellingTayyaba TariqNo ratings yet

- Course Overview: CME Group Courses Module 3Document8 pagesCourse Overview: CME Group Courses Module 3Darren FNo ratings yet

- Day Trading: An Introduction: The ControversyDocument5 pagesDay Trading: An Introduction: The Controversyitika jainNo ratings yet

- The Advanced Day Trader Guide: Follow the Ultimate Step by Step Day Trading Strategies for Learning How to Day Trade Forex, Options, Futures, and Stocks like a Pro for a Living!From EverandThe Advanced Day Trader Guide: Follow the Ultimate Step by Step Day Trading Strategies for Learning How to Day Trade Forex, Options, Futures, and Stocks like a Pro for a Living!Rating: 4.5 out of 5 stars4.5/5 (20)

- Day Trading Guide: Create a Passive Income Stream in 17 Days by Mastering Day Trading. Learn All the Strategies and Tools for Money Management, Discipline, and Trader Psychology (2022 for Beginners)From EverandDay Trading Guide: Create a Passive Income Stream in 17 Days by Mastering Day Trading. Learn All the Strategies and Tools for Money Management, Discipline, and Trader Psychology (2022 for Beginners)Rating: 1 out of 5 stars1/5 (1)

- Ultimate Forex Trading Guide: With Forex Trading To Passive Income And Financial Freedom Within One Year (Workbook With Practical Strategies For Trading Foreign Exchange Including Detailed Chart Analysis And Financial Psychology)From EverandUltimate Forex Trading Guide: With Forex Trading To Passive Income And Financial Freedom Within One Year (Workbook With Practical Strategies For Trading Foreign Exchange Including Detailed Chart Analysis And Financial Psychology)No ratings yet

- HW CH 7Document13 pagesHW CH 7Nathan WangNo ratings yet

- Chapter 25Document63 pagesChapter 25Nathan WangNo ratings yet

- Corporate Valuation Case StudyDocument1 pageCorporate Valuation Case StudyNathan WangNo ratings yet

- Interest Rate ProblemsTITLE Discount Price Calculations TITLE Forward Rate DeterminationTITLE Stock Investment ReturnTITLE Treasury Yield CurveDocument3 pagesInterest Rate ProblemsTITLE Discount Price Calculations TITLE Forward Rate DeterminationTITLE Stock Investment ReturnTITLE Treasury Yield CurveNathan WangNo ratings yet

- History and Definition of ENGRO RUPIYADocument10 pagesHistory and Definition of ENGRO RUPIYAZeeshan MehdiNo ratings yet

- Partnership Formation and Firm AmalgamationDocument22 pagesPartnership Formation and Firm AmalgamationShridhar Kaligotla75% (4)

- Definitions of Key Terms in Anti-Money Laundering ActDocument8 pagesDefinitions of Key Terms in Anti-Money Laundering ActRenz AmonNo ratings yet

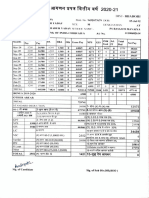

- Income Tax Agadan PrapatraDocument3 pagesIncome Tax Agadan Prapatraat.amitkumarbstNo ratings yet

- Cash Flow Statement Mcqs With AnswerDocument25 pagesCash Flow Statement Mcqs With Answermahesh patilNo ratings yet

- Security List DetailsDocument1,948 pagesSecurity List Detailssriganesh07No ratings yet

- Technical Paper AccrualsDocument33 pagesTechnical Paper AccrualszafernaseerNo ratings yet

- SEC Form 10-Q FilingDocument39 pagesSEC Form 10-Q FilingalexandercuongNo ratings yet

- Examples of Events That Need Adjusting EntriesDocument3 pagesExamples of Events That Need Adjusting EntriesTanbir Ahsan RubelNo ratings yet

- ACCA F9 Study Text EbookDocument138 pagesACCA F9 Study Text EbookShergeel AhmedNo ratings yet

- The Consumer Credit Card Market ReportDocument352 pagesThe Consumer Credit Card Market Reportsiddharth.nt9234No ratings yet

- GCC July 2013Document68 pagesGCC July 2013Manas RawatNo ratings yet

- Bar Graph Unit MonthDocument2 pagesBar Graph Unit MonthshrikantNo ratings yet

- Clerk Competition BoosterDocument70 pagesClerk Competition Boosterdheeru0071No ratings yet

- Adl Pe Primer Fin r2Document24 pagesAdl Pe Primer Fin r2priyankachopraNo ratings yet

- BRI Monthly Oct 2022Document5 pagesBRI Monthly Oct 2022Andri MirzalNo ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- Fintech Glossary 04 23 PDFDocument25 pagesFintech Glossary 04 23 PDFkhrathaNo ratings yet

- Accountancy QPDocument11 pagesAccountancy QPTûshar Thakúr0% (1)

- Managerial Economics MB 0042Document23 pagesManagerial Economics MB 0042Prafull VarshneyNo ratings yet

- Banking & Economy PDF - December 2021 by AffairsCloud 1Document153 pagesBanking & Economy PDF - December 2021 by AffairsCloud 1OK BHaiNo ratings yet

- Five Keys To Investing SuccessDocument12 pagesFive Keys To Investing Successr.jeyashankar9550No ratings yet

- Sop For Industrial Land Allotment PDFDocument32 pagesSop For Industrial Land Allotment PDFSurajPandeyNo ratings yet

- Dintle StatementDocument3 pagesDintle StatementMANDLANo ratings yet

- ATM Claim FormDocument1 pageATM Claim FormJm VenkiNo ratings yet

- Financial Markets and OperationsDocument27 pagesFinancial Markets and OperationsSakshi SharmaNo ratings yet

- Annual General Meeting PresentationDocument23 pagesAnnual General Meeting Presentationtanvi virmaniNo ratings yet

- List of Quesion PapersDocument14 pagesList of Quesion PapersLofidNo ratings yet

- Working Capital Management Sample ProblemsDocument4 pagesWorking Capital Management Sample ProblemsJames InferidoNo ratings yet

- Banking Industry - Key Success Factors: Business Risk Assessment Market PositionDocument2 pagesBanking Industry - Key Success Factors: Business Risk Assessment Market PositionrahidarzooNo ratings yet