Professional Documents

Culture Documents

Festive Offer Terms and Conditions

Festive Offer Terms and Conditions

Uploaded by

Raj KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Festive Offer Terms and Conditions

Festive Offer Terms and Conditions

Uploaded by

Raj KumarCopyright:

Available Formats

Millennia

F I R S T

Millennia

F I R S T

IDFC FIRST BANK FAMILY

IDFC FIRST BANK FAMILY

Get

K H U S H

FIRST

I YAN

5%

with IDFC FIRST Bank Credit Cards!

Cashback*

Valid till 10th Nov 2021

This festive season, use your IDFC FIRST Bank Credit Card

and enjoy 5% cashback on EMI and Tap & Pay transactions

Offer Details

5% cashback on 3 or more 5% cashback on EMI transactions

tap & pay transactions.

• Maximum cashback of Rs. 10,000.

• Not applicable on Fuel, Jewellery

• Maximum cashback of Rs. 1,000.

and Gold transactions.

Click Here or Call 1860 500 1111 to avail Easy EMI

What’s More? Offers on more 300+ merchants!

India ka Travel Planner

Click Here to explore these offers now!

*T&C Apply

General Terms & Conditions

EMI Offer Details

5% Cashback up to Rs. 10,000 on all EMI transactions

Offer Period

10th October’21 to 10th November’21

EMI Offer Terms & Conditions:

• Offer is not applicable on EMIs processed for 3-month tenure

• Cashback applicable will be credited within 60 days after the offer end date to the eligible Credit Card

account of the qualified customers only

• Your first EMI transaction within 90 days of card creation will be eligible only for 5% Cashback as per the

welcome offer on your IDFC Bank Credit Card. This welcome offer is independent of above 5% EMI

festive cashback offer and your first EMI transaction within 90 days will not be eligible for festive cas

back offer

• Any merchant offer at Point of Sale is over and above this offer.

• Offer is also applicable on IDFC FIRST Family Credit Cards

• Applicable on transaction value of ₹3,000 & above

• EMI conversion can be done across flexible tenures of 3m,6m,9m,12m,18m,24m & 36m

• Once the EMI tenure has been chosen by the Customer, it cannot be changed

• Transactions converted to EMI are not eligible for Reward Points

• Transactions done on Jewelry and Fuel are not eligible for EMI conversion

• Cash withdrawals cannot be converted into EMIs

• EMI amount will be a part of Minimum Amount Due payable by the customer during EMI tenure.

Customer has to make the payment of MAD to avoid credit card interest charges

• Processing Fee of 1% of transaction Value (Minimum ₹99) plus GST as applicable will be charged on

EMI conversion. This will be added to first instalment and will reflect as part of Minimum Amount Due

(MAD) in Credit Card statement.

• Processing fee will be levied if EMI is booked through any channel except Point-of-Sale terminal o

merchant website/app

• Sum of all EMI’s and Processing Fee (including GST) will be blocked from Credit Card Limit. Every

month once the EMI payment is received, the credit limit equal to the principal repayment of EMI will be

released from the blocked limit

• A fore-closure fee of 3% (GST applicable) will be charged upon EMI cancellation after 7 days of EMI

booking. In this case, entire outstanding principal will be debited to card account and will be due by next

due date

• Cashback will not be applicable for an EMI transaction where a refund is processed.

• Any Customer eligible for the EMI offer shall be deemed to have read, understood and accepted these

terms and conditions, the offer terms and conditions mentioned in the Emailer, SMS, PN and/or banner,

as well as, general terms and conditions of the Bank, before availing the Offer.

• The Bank reserves the right to disqualify any Customer from the benefits of the Offer if any fraudulent

activity is identified as being carried out for the purpose of availing the benefits under the Offer.

• The Bank reserves the right, at any time, without prior notice and without assigning any reason whats

ever, to add/alter/modify/change or vary all or any of these terms and conditions or to replace, wholly or in

part this Offer by another offer whether similar to this Offer or not or to extend or withdraw this Offer

altogether.

• The Bank holds out no warranty and makes no representation about the quality, delivery or otherwise of

the goods and services offered by any merchant with regards to this offer. The Customer is expected to

take any grievance, pertaining to quality, delivery or any other issue of purchased goods and services, to

the respective merchant and not to the Bank.

• The decision of the Bank limited in all matters in connection with and incidental to this Offer is final and

shall be binding on all persons.

• Disputes, if any, arising out of or in connection with or as a result of above Offer or otherwise relating

hereto shall be subject to the exclusive jurisdiction of the competent courts / tribunals in Mumbai.

• All taxes, duties, levies or other statutory dues and charges payable in connection with the offer shall be

borne solely by the Customer and the Bank will not be liable in any manner whatsoever for any such

taxes, duties, levies or other statutory dues and charges.

• The terms and conditions contained in the Card Member Agreement will apply over and above the terms

and condition of this loan.

Tap & Pay Offer Details:

Offer

Get 5% cashback on doing 3 or more tap & pay transactions with

IDFC First Bank Credit Card. Maximum cashback amount is Rs. 1,000.

Limited Period Offer

Valid from 10th October to 10th November 2021

Tap & Pay Offer Terms & Conditions:

1. The Offer is made solely and entirely by IDFC FIRST BANK Limited (“Bank”) to the Bank’s Credit Card

holders (“Customers”).

2. Only spends done on merchants using contactless facility (tap & pay) will be considered for the offer.

3. Non-contactless (dip + PIN) transactions at retail stores, online and ATM withdrawals will not qualify for

the offer. Cancelled and dropped transactions will not qualify for the offer.

4. Minimum number of contactless transactions to be eligible for the offer is three. On eligibility,

Cumulative contactless spends during the offer period will be considered for the cashback.

5. Maximum cashback amount during the offer period per customer is Rs. 1,000 only.

6. A customer will be eligible for the cashback only once during the offer period.

7. Offer is also applicable on IDFC FIRST Family Credit Cards

8. The Offer is non-transferable, non-cashable and non-negotiable.

9. Cashback applicable will be credited within 60 days after the offer end date to the eligible Credit Card

account of the qualified customers only.

10. Any Customer eligible for the offer shall be deemed to have read, understood and accepted these

terms and conditions, the offer terms and conditions mentioned in the communication sent, as well as,

general terms and conditions of the Bank, before availing the Offer.

11. The Bank reserve the right to disqualify any Customer from the benefits of the Offer if any fraudulent

activity is identified as being carried out for the purpose of availing the benefits under the Offer

(including any default in payments).

12. Bank reserves the right, at any time, without prior notice and without assigning any reason whatsoever,

to add/alter/modify/change or vary all or any of these terms and conditions or to replace, wholly or in

part this Offer by another offer whether similar to this Offer or not or to extend or withdraw this Offer

altogether.

13. The Bank holds out no warranty and makes no representation about the quality, delivery or otherwise of

the goods and services offered by any merchant with regards to this offer. Customer is expected to

take any grievance, pertaining to quality, delivery or any other issue of purchased goods and services,

to the respective merchant and not to the Bank.

14. The decision of the Bank limited in all matters in connection with and incidental to this Offer is final and

shall be binding on all persons.

15. Disputes, if any, arising out of or in connection with or as a result of above Offer or otherwise relating

hereto shall be subject to the exclusive jurisdiction of the competent courts / tribunals in Mumbai.

16. All taxes, duties, levies or other statutory dues and charges payable in connection with the offer shall

be borne solely by the Customer and the Bank will not be liable in any manner whatsoever for any such

taxes, duties, levies or other statutory dues and charges.

You might also like

- 12A (Ground Floor), Prakash Deep Building, 7 Tolstoy Marg, New Delhi, INDocument1 page12A (Ground Floor), Prakash Deep Building, 7 Tolstoy Marg, New Delhi, INwdwdwNo ratings yet

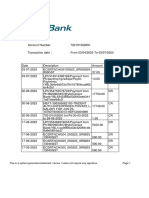

- Your Statement PDFDocument6 pagesYour Statement PDFpattiNo ratings yet

- Fiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATDocument2 pagesFiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATAnna Hofisi100% (1)

- Volvo TicketDocument1 pageVolvo TicketVipin TiwariNo ratings yet

- Up To 10 % Cashback On Yes Bank Credit Card EMI Transactions On Select Whirlpool ProductsDocument3 pagesUp To 10 % Cashback On Yes Bank Credit Card EMI Transactions On Select Whirlpool Productskalpesh thakerNo ratings yet

- Terms & Conditions (Reliance Digital-Black Friday Offer) : WWW - Reliancedigital.inDocument1 pageTerms & Conditions (Reliance Digital-Black Friday Offer) : WWW - Reliancedigital.insujeethsNo ratings yet

- Firstcry TNCDocument4 pagesFirstcry TNCShaurya GuptaNo ratings yet

- MMTDomestic TNCDocument4 pagesMMTDomestic TNCkanoimalNo ratings yet

- Co-Brand Credit Cards Miles Frenzy Offer - Terms & Conditions: 1. Eligible ParticipantsDocument3 pagesCo-Brand Credit Cards Miles Frenzy Offer - Terms & Conditions: 1. Eligible ParticipantsAnkur SarafNo ratings yet

- Summer Dhamaka AprilDocument21 pagesSummer Dhamaka AprilPapia ChandaNo ratings yet

- DownloadDocument2 pagesDownloadTejas appuNo ratings yet

- Insta Loan On Card TCDocument3 pagesInsta Loan On Card TCpavanivinNo ratings yet

- Eazy Diner TN CDocument1 pageEazy Diner TN CLogesh MklyNo ratings yet

- Cashback Offer T&C Feb 15th To March1stDocument8 pagesCashback Offer T&C Feb 15th To March1stShubham PalNo ratings yet

- Terms and Conditions For Emi On Cashback Offer On Flipkart Axis Bank Credit Card NewDocument3 pagesTerms and Conditions For Emi On Cashback Offer On Flipkart Axis Bank Credit Card NewGoffardNo ratings yet

- Terms & Conditions - Smartemi (Dial An Emi) : Please Note ThatDocument2 pagesTerms & Conditions - Smartemi (Dial An Emi) : Please Note ThatSaurabh SharmaNo ratings yet

- (Defined Below) (Defined Below) (Defined Below)Document5 pages(Defined Below) (Defined Below) (Defined Below)GATE FACULTYNo ratings yet

- Cashback: Offer Duration Applicable OnDocument2 pagesCashback: Offer Duration Applicable Ontally3tallyNo ratings yet

- Apple Offer TNCDocument232 pagesApple Offer TNCKamal Kant SainiNo ratings yet

- Terms and ConditionsDocument3 pagesTerms and Conditionsharshmittal.sgmgNo ratings yet

- DownloadDocument3 pagesDownloadRavi Teja GarimellaNo ratings yet

- Terms & Conditions - Smartemi (Dial An Emi) : Please Note ThatDocument2 pagesTerms & Conditions - Smartemi (Dial An Emi) : Please Note ThatSubodh KantNo ratings yet

- Mtes3043 Matematik Kewangan. Report - Loan SelectionDocument5 pagesMtes3043 Matematik Kewangan. Report - Loan SelectionainasafiaNo ratings yet

- Details of The Offer:: "Spend Rs. 1,500 On Domestic E-Commerce Transactions and Get Rs. 250 Cashback" Terms & ConditionsDocument3 pagesDetails of The Offer:: "Spend Rs. 1,500 On Domestic E-Commerce Transactions and Get Rs. 250 Cashback" Terms & ConditionsMohamedNo ratings yet

- PDFDocument3 pagesPDFTaseer PankhawalaNo ratings yet

- Instant EMI - BriefDocument4 pagesInstant EMI - Briefmohit sinhaNo ratings yet

- Terms & Conditions: LG Cashback Offer Offer ConstructDocument2 pagesTerms & Conditions: LG Cashback Offer Offer ConstructMohammed MujahidNo ratings yet

- Apple Buyback Offer Page TNCDocument8 pagesApple Buyback Offer Page TNCPavan MusliNo ratings yet

- IDFC Credit CardSelect-Product-GuideDocument7 pagesIDFC Credit CardSelect-Product-GuidesunmayjioNo ratings yet

- HDFC Insta Loan DetailsDocument3 pagesHDFC Insta Loan DetailsbalaNo ratings yet

- Siganture Plus Brand Gift Vouchers Redemption ProcessDocument2 pagesSiganture Plus Brand Gift Vouchers Redemption Processnikhil gargNo ratings yet

- Yes Bank PolicyDocument4 pagesYes Bank PolicyAman AmickNo ratings yet

- Terms & Conditions: Additional Instant Cashback On ICICI Bank EMI TransactionsDocument2 pagesTerms & Conditions: Additional Instant Cashback On ICICI Bank EMI Transactionsloco webruNo ratings yet

- Ce Emi Pinelab Allbank TNCDocument5 pagesCe Emi Pinelab Allbank TNCaman kumar jhaNo ratings yet

- Insta Loan On CardDocument3 pagesInsta Loan On Cardabhi7744No ratings yet

- Cashback Offer With Lenovo Laptops On YES BANK Credit Cards EMI - Terms & ConditionsDocument1 pageCashback Offer With Lenovo Laptops On YES BANK Credit Cards EMI - Terms & ConditionsPreeya PreeyaNo ratings yet

- Terms & Conditions - Insta Jumbo Loan: Please Note ThatDocument3 pagesTerms & Conditions - Insta Jumbo Loan: Please Note ThatZaed QasmiNo ratings yet

- Terms & Conditions - Insta Jumbo Loan: Please Note ThatDocument3 pagesTerms & Conditions - Insta Jumbo Loan: Please Note ThatDinesh KondaNo ratings yet

- MillenniaCVP 1Document1 pageMillenniaCVP 1Ranjeet KushwahaNo ratings yet

- MillenniaCVP 1Document1 pageMillenniaCVP 1gokek80159No ratings yet

- Terms and Conditions - Super 811Document4 pagesTerms and Conditions - Super 811Pavan KumarNo ratings yet

- Dining Exlusive Program - Web T Cs FinalDocument9 pagesDining Exlusive Program - Web T Cs FinalJerry Muthu RamanNo ratings yet

- MMT TNCDocument3 pagesMMT TNCkaranNo ratings yet

- City Flipkart Sale Terms and ConditionsDocument5 pagesCity Flipkart Sale Terms and ConditionsvenkyNo ratings yet

- Heritage MITCDocument12 pagesHeritage MITCSankalp PatelNo ratings yet

- EazyDiner TnCsDocument3 pagesEazyDiner TnCsHarsh DagaNo ratings yet

- TNC Rent Offer NovemberDocument4 pagesTNC Rent Offer NovemberComputer Hacks By ReeshikeshNo ratings yet

- T&C For One Plus 7T Pro and 7T Cashback OfferDocument4 pagesT&C For One Plus 7T Pro and 7T Cashback OfferbalajiNo ratings yet

- HP TNC PDFDocument2 pagesHP TNC PDFPradeepNo ratings yet

- PDF PriorityDocument4 pagesPDF PriorityNapster KingNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- Amazon TnCs 7pt5KDocument3 pagesAmazon TnCs 7pt5KPoorna ChandranNo ratings yet

- IDBI Bank Credit Cards Terms & Conditions: OfferDocument1 pageIDBI Bank Credit Cards Terms & Conditions: OfferJadeja DevendrasinhNo ratings yet

- Key Facts Statement Home LoanDocument2 pagesKey Facts Statement Home LoananammominNo ratings yet

- Play Credit Card Terms and ConditionsDocument3 pagesPlay Credit Card Terms and ConditionsdepakmunirajNo ratings yet

- NPR Terms and ConditionsDocument2 pagesNPR Terms and Conditionskrishna chaitanyaNo ratings yet

- Personal Loan Apply For A Personal Loan Online - HSBC INDocument1 pagePersonal Loan Apply For A Personal Loan Online - HSBC INshahmananmukeshNo ratings yet

- Offer Terms and Conditions: WWW - Oneplus.inDocument4 pagesOffer Terms and Conditions: WWW - Oneplus.inyogesh jawadwarNo ratings yet

- Eazydiner TNCDocument1 pageEazydiner TNCAnshu kumarNo ratings yet

- "Spend Now To Get A Cashback": Details of The OfferDocument3 pages"Spend Now To Get A Cashback": Details of The Offernakshter.iaNo ratings yet

- WOW Product GuideDocument8 pagesWOW Product GuideDean WinchesterNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Comp ProjectDocument28 pagesComp Projectavram johnNo ratings yet

- Debit Cards User GuideDocument24 pagesDebit Cards User GuideAdeel TahirNo ratings yet

- Wa0003.Document1 pageWa0003.mitricarobert83No ratings yet

- Income Tax 2008-09Document10 pagesIncome Tax 2008-09mohan9813032985@yahoo.com100% (16)

- Himali Akarawita Invoice PDFDocument12 pagesHimali Akarawita Invoice PDFAnura PiyatissaNo ratings yet

- Roop Major Research ProjectDocument97 pagesRoop Major Research Projectshashikant001No ratings yet

- 93x - DISNEY - LOGS - MRCOMBO1 6Document7 pages93x - DISNEY - LOGS - MRCOMBO1 6Darius RaducanuNo ratings yet

- Salisbury Transport Model: NoticeDocument38 pagesSalisbury Transport Model: NoticeManu SudharnanNo ratings yet

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- Credit Cards Best Rewards No Annual FeeDocument1 pageCredit Cards Best Rewards No Annual FeeCarolNo ratings yet

- Z. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofDocument9 pagesZ. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofACCTLVO 35No ratings yet

- InvoiceDocument1 pageInvoicePranjal SharmaNo ratings yet

- What Is Pesonet and Instapay?Document4 pagesWhat Is Pesonet and Instapay?Shie MinimoNo ratings yet

- The Recording Process of The BusinessDocument3 pagesThe Recording Process of The BusinessFrshaa FdzlNo ratings yet

- NF22697110338933 InvoiceDocument2 pagesNF22697110338933 InvoiceVishnu RajNo ratings yet

- Capital District Trails Plan 2018 DraftDocument116 pagesCapital District Trails Plan 2018 DraftalloveralbanyNo ratings yet

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)Ashish KumarNo ratings yet

- Your GIRO Payment Plan For Income Tax: DBS/POSB xxxxxx9205Document2 pagesYour GIRO Payment Plan For Income Tax: DBS/POSB xxxxxx9205Karaoui LaidNo ratings yet

- Disbursement Voucher: Juan Dela CruzDocument9 pagesDisbursement Voucher: Juan Dela CruzJoan Del Castillo NaingNo ratings yet

- Namma Kalvi 11th Accountancy Government Model Question Paper Answer Key emDocument48 pagesNamma Kalvi 11th Accountancy Government Model Question Paper Answer Key emGANAPATHY.SNo ratings yet

- Account Name Level Account Type Balance 1-0000 Aset Asset Debit Header 1 Asset Account Number Account Classificat Ion Norm Al Sign Heade R/detai LDocument6 pagesAccount Name Level Account Type Balance 1-0000 Aset Asset Debit Header 1 Asset Account Number Account Classificat Ion Norm Al Sign Heade R/detai LZanis Al MuradNo ratings yet

- Statement 1688358203630Document3 pagesStatement 1688358203630Chinmay RajNo ratings yet

- AdvanceReceipt2022 03 14 21 10 48Document7 pagesAdvanceReceipt2022 03 14 21 10 48Sanjay VermaNo ratings yet

- Megan Jenkins Gemini StatementDocument2 pagesMegan Jenkins Gemini StatementJonathan Seagull LivingstonNo ratings yet

- HBL IPG FAQs PDFDocument5 pagesHBL IPG FAQs PDFAbbas HussainNo ratings yet

- Circular Fees and Charges External Website v3 10182019Document8 pagesCircular Fees and Charges External Website v3 10182019Kim Orven KhoNo ratings yet