Professional Documents

Culture Documents

Ratio Analysis of Wipro LTD For The Financial Year 2019

Ratio Analysis of Wipro LTD For The Financial Year 2019

Uploaded by

srivin rsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis of Wipro LTD For The Financial Year 2019

Ratio Analysis of Wipro LTD For The Financial Year 2019

Uploaded by

srivin rsCopyright:

Available Formats

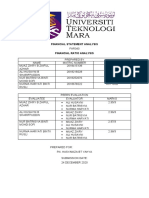

RATIO ANALYSIS OF WIPRO LTD FOR THE FINANCIAL YEAR 2019-20

1. Current ratio = Current assets

Current liablities

31/03/2020 = 45,713.30 = 2.77

16,443.80 1

31/03/2019 = 47,730.40 = 3.56

16,144.60 1

The generally accepted standard is 2:3 i.e. the current assets must be twice that of current liabilities.

Though the current ratio of Asian paints falls below the industry standards, yet it is satisfactory, as there

are enough current assets to cover the current liabilities.

2. Debt to equity ratio = debt

Equity

Debt = Total debt – Current liablities

Equity = Equity share capital + preference share capital + reserves and surplus

31/03/2020 = 2,408.90 - 16,443.80 = 0.302

1,142.70 + 45,311.00 1

31/03/2019 = 1,461.50 - 16,144.60 = 0.3034

1,206.80 + 48,185.20 1

Debt to equity ratio is computed to assess the long term financial soundness of business.

It is the relationship between the long term external equities and aide external debts and

internal debts of the enterprise normally debt to equity to equity ratio 2:3 is considered an

appropriate ratio. However the lower debt to equity ratios means that the company

depends more on shareholders’ funds then external equities in effect, lenders are at lower

risk and high safety.

3. Proprietary Ratio = shareholders’ funds

Total assets

31/03/2020 = 46453.7 = 0.7113

65,306.40

31/03/2019 = 49,392 = 0.7372

66,998.10

Proprietary ratio establishes the relationship between proprietor’s funds and assets. A

high ratio indicates adequate safety for creditors. A low ratio on the other hand indicates

inadequate safety. The company has been maintaining a decent proprietary ratio over the

two years, with more than 50% of the assets been financed with shareholders’ funds.

You might also like

- Microfinance Ass 1Document15 pagesMicrofinance Ass 1Willard MusengeyiNo ratings yet

- UCO BankDocument23 pagesUCO BankUdit AggarwalNo ratings yet

- ANALYSIS OF FINANCIAL STATEMENTS-mix Ratio Approach-Solvency RatiosDocument6 pagesANALYSIS OF FINANCIAL STATEMENTS-mix Ratio Approach-Solvency Ratioslynnrodrigo16No ratings yet

- CAACC224Document11 pagesCAACC224nirmalNo ratings yet

- Debt ManagementDocument5 pagesDebt Managementminhdoworking1811No ratings yet

- Acc Ca2Document10 pagesAcc Ca2nirmalNo ratings yet

- AccountsDocument24 pagesAccountsrahulNo ratings yet

- Baximco RatioDocument9 pagesBaximco RatioAfsana Mimi (211011065)No ratings yet

- Wa0014.Document1 pageWa0014.Pèldêñ SîñgyëNo ratings yet

- Accounts CaDocument14 pagesAccounts CaAvinash BeheraNo ratings yet

- Banna Leisure 111Document2 pagesBanna Leisure 111ravinyseNo ratings yet

- Wa0010.Document15 pagesWa0010.Krishnan 18No ratings yet

- Module 13 Notes PayableDocument9 pagesModule 13 Notes PayableLilyNo ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- Gas PetronasDocument33 pagesGas PetronasNour FaizahNo ratings yet

- Qantus - WACC - Project SolutionDocument11 pagesQantus - WACC - Project SolutionJehanzaibNo ratings yet

- 3 CompaniesreportfinanceDocument45 pages3 CompaniesreportfinanceMarisha RizalNo ratings yet

- Tata Motors AnalysisDocument9 pagesTata Motors AnalysisrastehertaNo ratings yet

- Far340 - Ratio AnalysisDocument13 pagesFar340 - Ratio Analysisnurma haryatiNo ratings yet

- P S O Ratio AnalysisDocument94 pagesP S O Ratio AnalysisMuhammad SeyamNo ratings yet

- 712 Financial Reporting and Controls: Submitted By: Akash Narvaria 687082453Document13 pages712 Financial Reporting and Controls: Submitted By: Akash Narvaria 687082453AnarNo ratings yet

- Ratio Analysis of Asian PaintsDocument19 pagesRatio Analysis of Asian Paintssaran mkNo ratings yet

- Fuad, 7,8,9Document6 pagesFuad, 7,8,9Muhd FiekrieNo ratings yet

- Solvency Position: 1. Debt-Equity RatioDocument5 pagesSolvency Position: 1. Debt-Equity RatioShilpiNo ratings yet

- Ratio Analysis1Document4 pagesRatio Analysis1Bernard MercialesNo ratings yet

- Financial StatementsDocument9 pagesFinancial StatementsVarshini KNo ratings yet

- Assignment 1 FMDocument15 pagesAssignment 1 FMsyazwan AimanNo ratings yet

- Gearing RatiosDocument1 pageGearing Ratiosajao oyindamolaNo ratings yet

- Current RatioDocument13 pagesCurrent RatioAnugya GuptaNo ratings yet

- Common Size Analysis PT Semen IndonesiaDocument7 pagesCommon Size Analysis PT Semen IndonesiaDaniella NataliaNo ratings yet

- Financial Management Assignement: Company Name: Marico LTDDocument14 pagesFinancial Management Assignement: Company Name: Marico LTDAvijit DindaNo ratings yet

- Liquidity RatiosDocument5 pagesLiquidity RatiosPastel Rose CloudNo ratings yet

- Ratio Analysis of HulDocument11 pagesRatio Analysis of HulRohit SanghviNo ratings yet

- Capital Structure: Solvency RatiosDocument3 pagesCapital Structure: Solvency RatiosNimra SiddiqueNo ratings yet

- Financial AccountingDocument11 pagesFinancial AccountingSHIKHA DWIVEDINo ratings yet

- Fin 410Document4 pagesFin 410Emon HossainNo ratings yet

- Ratio Analysis:-Ratio Analysis Is The Process of Determining andDocument19 pagesRatio Analysis:-Ratio Analysis Is The Process of Determining andSam SmartNo ratings yet

- Handout FIN300 Chapter 3 2024Document56 pagesHandout FIN300 Chapter 3 2024Xuân TùngNo ratings yet

- Untitled DocumentDocument4 pagesUntitled DocumentTran Duc Tuan QP2569No ratings yet

- Evaluating The Ability To Pay Long-Term DebtDocument3 pagesEvaluating The Ability To Pay Long-Term DebtIntan HidayahNo ratings yet

- Long Term SolvencyDocument6 pagesLong Term SolvencyHoàng HoàngNo ratings yet

- TCS Advanced Accounting PDFDocument14 pagesTCS Advanced Accounting PDFkanishq.rajendraNo ratings yet

- 202004241009363724jksharma Integrative Problems in Financial DecisionsDocument5 pages202004241009363724jksharma Integrative Problems in Financial Decisionssonamsri76No ratings yet

- BBF201 041220233 Ca1Document9 pagesBBF201 041220233 Ca1SO CreativeNo ratings yet

- FINAL (WCM)Document12 pagesFINAL (WCM)Takibul HasanNo ratings yet

- Senior High SchoolDocument9 pagesSenior High SchoolCharlyn CastroNo ratings yet

- Sunsuria BHD (Written Report)Document6 pagesSunsuria BHD (Written Report)Monoliza PhilipsNo ratings yet

- Financially Yours Induction 2023 Study MaterialDocument12 pagesFinancially Yours Induction 2023 Study MaterialVaishali GargNo ratings yet

- Accounts Specific Project 1Document28 pagesAccounts Specific Project 1sakshi pandey100% (1)

- Ratio AnalysisDocument10 pagesRatio AnalysisShamim IqbalNo ratings yet

- Anisul FDMDocument6 pagesAnisul FDManisul islamNo ratings yet

- Principles of BankingDocument33 pagesPrinciples of BankingMANAN MEHTANo ratings yet

- Finm542 Ca2Document17 pagesFinm542 Ca2vishvjeet singh panwarNo ratings yet

- Module 1 3 Notes PayableDocument8 pagesModule 1 3 Notes PayableFujoshi BeeNo ratings yet

- Financial Analysis of SpicejetDocument6 pagesFinancial Analysis of SpicejetChandan SaigalNo ratings yet

- BDPL4103 Introductory Investment Management - Jan 22Document10 pagesBDPL4103 Introductory Investment Management - Jan 22SOBANAH A/P CHANDRAN STUDENTNo ratings yet

- Financial Statement Analysis of Microsoft: Rania Elhossary Abu Dhabi University, EmailDocument19 pagesFinancial Statement Analysis of Microsoft: Rania Elhossary Abu Dhabi University, EmailvaibhavNo ratings yet

- Analysis of Financial PerformanceDocument33 pagesAnalysis of Financial PerformanceG.KISHORE KUMARNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet