Professional Documents

Culture Documents

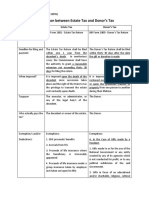

Comparison Between Estate Tax and Donor's Tax

Uploaded by

Imma Therese YuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison Between Estate Tax and Donor's Tax

Uploaded by

Imma Therese YuCopyright:

Available Formats

Yu, Louie Imma-Therese E.

AC 3103 G3 MW (06:00PM-07:30PM)

Comparison between Estate Tax and Donor’s Tax

As to Estate Tax Donor’s Tax

BIR Form BIR Form 1801 - Estate Tax Return BIR Form 1800 - Donor’s Tax Return

Deadline for filing and The Estate Tax Return shall be filed The Donor’s Tax Return shall be filed

payment within one 1 year from the within thirty 30 days after the date

decedent's death. In meritorious the gift or donation is made.

cases, the Commissioner shall have

the authority to grant a reasonable

extension not exceeding thirty 30

days for filing the return.

When imposed? It is imposed upon the death of the It is imposed on annual net gifts

decedent since succession takes reckoned over a calendar year basis

place and the right of the State to tax or upon the gratuitous transfer of

the privilege to transmit the estate property from one person to another

vests instantly upon death. during their lifetime.

Taxpayer The executor, or administrator, or The Donor.

any of the legal heir/s of the

decedent.

Who actually pays the The decedent or owner of the estate. The Donor.

tax?

Exemption/s and/or Exemptions: Exemptions:

Deduction/s 1. GSIS proceeds/ benefits A. In the Case of Gifts made by a

Resident.

2. Accruals from SSS

1. Gifts made to or for the use of the

3. Proceeds of life insurance where

National Government or any entity

the beneficiary is irrevocably

created by any of its agencies which

appointed

is not conducted for profit, or to any

4. Proceeds of life insurance under a political subdivision of the said

group insurance taken by employer Government.

(not taken out upon his life)

2. Gifts in favor of an educational

and/or charitable, religious, cultural

5. War damage payments or social welfare corporation,

institution, accredited non-

6. Transfer by way of bona fide sales

government organization, trust or

7. Transfer of property to the philanthropic organization or

National Government or to any of its research institution or organization:

political subdivisions 8. Separate Provided, however, not more than

property of the surviving spouse 30% of said gifts will be used by such

donee for administration purposes.

9. Merger of usufruct in the owner of For the purpose of this exemption, a

the naked title ‘non-profit educational and/or

10. Properties held in trust by the charitable corporation, institution,

decedent accredited non government

organization, trust or philanthropic

11. Acquisition and/or transfer organization and/or research

expressly declared as not taxable. institution or organization’ is a

school, college or university and/or

charitable corporation, accredited

Deductions: non government organization, trust

or philanthropic organization and/ or

A. Losses, Indebtedness and Taxes

research institution or organization,

(LIT)

incorporated as a non stock entity,

B. Transfer for Public Use paying no dividends, governed by

trustees who receive no

C. Vanishing Deductions

compensation, and devoting all its

D. Special Deductions such as Family income, whether students’ fees or

home, Standard deductions, Benefits gifts, donation, subsidies or other

under RA 4917 forms of philanthropy, to the

accomplishment and promotion of

E. Share of the surviving spouse the purposes enumerated in its

Articles of Incorporation.

B. In the Case of Gifts Made by a

Nonresident not a Citizen of the

Philippines

1. Gifts made to or for the use of the

National Government or any entity

created by any of its agencies which

is not conducted for profit, or to any

political subdivision of the said

Government.

2. Gifts in favor of an educational

and/or charitable, religious, cultural

or social welfare corporation,

institution, foundation, trust or

philanthropic organization or

research institution or organization:

Provided, however, that not more

than thirty percent (30%) of said gifts

shall be used by such donee for

administration purposes.

Tax Rate There shall be an imposed rate of six The donor’s tax for each calendar

percent (6%) based on the value of year shall be six percent 6%

such net estate determined as of the computed on the basis of the total

time of death of decedent composed gifts in excess of Two Hundred Fifty

of all properties, real or personal, Thousand Pesos (P250,000) exempt

tangible or intangible less allowable gifts made during the calendar year.

deductions.

Tax Base Net Taxable Estate determined as of The total gifts in excess of Two

the time of death of the decedent Hundred Fifty Thousand Pesos

and composed of all properties, real (Php250,000) exempt gifts made

or personal, tangible or intangible during the calendar year. If there is

less, allowable deductions. only one gift given during the

calendar year, the tax due shall be

based on the value of the gift

Provided that the minimum Estate donated less allowable deductions.

Amnesty Tax for the transfer of the However, if there are several gifts

estate of each decedent shall be Five made, the tax due shall be computed

Thousand Pesos (P5,000.00). based on the total net gifts made

during the calendar year.

Can you avail of Tax YES NO

Amnesty? How?

Steps:

1. Accomplish the Estate Tax

Amnesty Return (ETAR) and submit,

together with the complete

documentary requirements to the

concerned RDO for computation of

Estate Tax Amnesty due and

endorsement of Acceptance

Payment Form (APF).

2. Present the RDO-endorsed APF to

Authorized Agent Banks (AABs) or

Revenue Collection Officers (RCOs),

whichever is applicable, and pay the

amnesty amount.

3. Submit the validated APF and

proof of payment to the concerned

RDO, which shall not be beyond the

two-year availment period.

4. Receive Certificate of Availment

and Electronic Certificate Authorizing

Registration (eCAR) from the RDO.

Penalties and 1. A surcharge of twenty-five percent Failure to file and pay donor’s tax is

surcharges (25%) in the following violations: subject to 25% surcharge penalty

and/or 50% if fraudulent.

a. Failure to file any return and pay

the amount of tax or installment due

on or before

Also, 20% interest and compromise

the due date; penalties ranging from P200 to

P25,000.

b. Filing a return with a person or

office other than those with whom it

is required to be filed, unless

otherwise authorized by the

Commissioner;

c. Failure to pay the full or part of the

amount of tax shown on the return,

or the full amount of tax due for

which no return is required to be

filed on or before the due date; or

d. Failure to pay the deficiency tax

within the time prescribed for its

payment in the notice of assessment.

2. A surcharge of fifty percent (50%)

of the tax or of the deficiency tax, in

case any payment has been made on

the basis of such return before the

discovery of the falsity or fraud, for

each of the following violations:

a. Willful neglect to file the return

within the period prescribed by the

Code or by the rules and regulations;

or

b. In case a false or fraudulent return

is willfully made.

3. Interest at the rate of double the

legal interest rate for loans or

forbearance of any money

in the absence of an express

stipulation as set by the Bangko

Sentral ng Pilipinas from the date

prescribed for payment until the

amount is fully paid. Provided, that

in no case shall the deficiency and

the delinquency interest prescribed

under Section 249 Subsections (B)

and (C) of the National Internal

Revenue Code, as amended, be

imposed simultaneously.

4. Compromise penalty as provided

under applicable rules and

regulations.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 1st Exam Chapter 11Document9 pages1st Exam Chapter 11Imma Therese YuNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Writing a Thesis ProposalDocument39 pagesWriting a Thesis ProposalImma Therese YuNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Comparison Between Estate Tax and Donor's TaxDocument5 pagesComparison Between Estate Tax and Donor's TaxImma Therese YuNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Business and Transfer Taxation Chapter 13 Discussion Questions and AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13 Discussion Questions and AnswerKarla Faye LagangNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Business and Transfer Taxation Chapter 13 Discussion Questions and AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13 Discussion Questions and AnswerKarla Faye LagangNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Comparison Between Estate Tax and Donor's TaxDocument5 pagesComparison Between Estate Tax and Donor's TaxImma Therese YuNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- NotesDocument15 pagesNotesImma Therese YuNo ratings yet

- Banggawan Answer KeyDocument17 pagesBanggawan Answer Keyvallerie_lumantas76% (42)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Writing a Thesis ProposalDocument39 pagesWriting a Thesis ProposalImma Therese YuNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Intro To FMDocument4 pagesIntro To FMImma Therese YuNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Chapter 27Document8 pagesChapter 27Imma Therese YuNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Chapter 25: Borrowing Costs Borrowing CostDocument3 pagesChapter 25: Borrowing Costs Borrowing CostImma Therese YuNo ratings yet

- Contemporary Arts of The PhilippinesDocument5 pagesContemporary Arts of The PhilippinesImma Therese YuNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Definition: Assistance by Governemnt in The Form of TransferDocument4 pagesDefinition: Assistance by Governemnt in The Form of TransferImma Therese YuNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Fundamentals of AccountingDocument3 pagesFundamentals of AccountingImma Therese YuNo ratings yet

- Taxable Income and Income Tax - Foreign Tax Credit - AdministrDocument52 pagesTaxable Income and Income Tax - Foreign Tax Credit - AdministrCharlotte MalgapoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawTaraChandraChouhanNo ratings yet

- A Project Report On GSTDocument15 pagesA Project Report On GSTAnjali RatudiNo ratings yet

- RQ2019A14 - Online Assignment 1 - BSL301 - ROSHANDocument6 pagesRQ2019A14 - Online Assignment 1 - BSL301 - ROSHANroshan satpathyNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Form No. 12B: Prabhakarappa ShashidharDocument1 pageForm No. 12B: Prabhakarappa ShashidharAmbika BpNo ratings yet

- Qatar Tax Law 2009Document18 pagesQatar Tax Law 2009Jitendra NagvekarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- April Sathish Pay SlipDocument1 pageApril Sathish Pay Slipmsathish7428No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Afroza Sultana RumaDocument1 pageAfroza Sultana RumaImam HasanNo ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- Homework - Income TaxesDocument3 pagesHomework - Income TaxesPeachyNo ratings yet

- Banking Industry Risk ProfilingDocument34 pagesBanking Industry Risk ProfilingGopal SharmaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Tax Notes Section 28Document3 pagesTax Notes Section 28Jacqueline LeonciaNo ratings yet

- Chi MangaDocument3 pagesChi MangaHAbbunoNo ratings yet

- Theory and Basis of TaxationDocument1 pageTheory and Basis of TaxationLaica MontefalcoNo ratings yet

- DTC Bill proposes modest changes to tax slabs and ratesDocument5 pagesDTC Bill proposes modest changes to tax slabs and ratesSumit DaraNo ratings yet

- ECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)Document2 pagesECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)KriszanFrancoManiponNo ratings yet

- Creba Vs Romulo TaxDocument3 pagesCreba Vs Romulo TaxNichole LanuzaNo ratings yet

- Basic Financial Management Booklet For Elementary Community Primary SchoolsDocument42 pagesBasic Financial Management Booklet For Elementary Community Primary SchoolsFrance Bejosa100% (1)

- CPA UGANDA PAPER 11 TAXATION November 20Document4 pagesCPA UGANDA PAPER 11 TAXATION November 20agaba fredNo ratings yet

- Input VAT DeductionsDocument2 pagesInput VAT DeductionsKim Cristian MaañoNo ratings yet

- Payslip Apr2020Document1 pagePayslip Apr2020Pinki Mitra DasNo ratings yet

- Job Work Challan: Aadinath Industries (111341) C-11/2, Wazirpur Industrial Area Delhi DL - Delhi 110052Document1 pageJob Work Challan: Aadinath Industries (111341) C-11/2, Wazirpur Industrial Area Delhi DL - Delhi 110052Anshu SinghNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pay SlipDocument1 pagePay SlipnauvalNo ratings yet

- ACCT 553 Week 7 HW SolutionDocument3 pagesACCT 553 Week 7 HW SolutionMohammad Islam100% (1)

- Cash Budget - Payal Plastics CompanyDocument4 pagesCash Budget - Payal Plastics Companysukesh80% (5)

- Rajkot Airport E and M AMC 1st RADocument2 pagesRajkot Airport E and M AMC 1st RANanu PatelNo ratings yet

- Withholding-Taxes (ZRA)Document2 pagesWithholding-Taxes (ZRA)Noah MwansaNo ratings yet

- CP71ADocument6 pagesCP71AFunny ChunksNo ratings yet

- E-WAY BILL DetailsDocument1 pageE-WAY BILL DetailsrohanNo ratings yet

- How Much Is The Distributable Income of The GPP?Document2 pagesHow Much Is The Distributable Income of The GPP?Katrina Dela CruzNo ratings yet