Professional Documents

Culture Documents

How Much Is The Distributable Income of The GPP?

Uploaded by

Katrina Dela CruzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Much Is The Distributable Income of The GPP?

Uploaded by

Katrina Dela CruzCopyright:

Available Formats

Garcia, Ramos, Toribio and Co., CPAS (GRT & Co.), are partners of an accounting firm.

The 2018 financial

records of the firm disclosed the following:

Service Revenue P4,490,000

Cost of Services 1,610,000

Operating expenses 800,000

Rental income 500,000

Interest income from bank deposit 200,000

Interest income from from FCDS deposit 280,000

Ramos is also engaged in business with the following data for the year:

Sales P2,500,000

Cost of Services 1,250,000

Operating 550,000

Expenses

How much is the distributable income of the GPP?

a. P992,667 c. P2,578,000

b. P1,019,333 d. P2,978,000

• Answer: D

Net income of the firm firm (4,490k-1,610k-800k+500) P2,580,000

Interest income from bank deposit, net (P200,000 x 80%) 160,000

Interest income from FCDS transaction, net (P280,000 x 85%) 238,000

Total distributable income of the GPP P2,978,000

Divide 3

Distributive share/partner P992,667

How much is the distributive share of each partner in the total income of the GPP?

a. P992,667 c. P2,578,000

b. P1,019,333 d. P2,976,000

• Answer: A

How much is the taxable income of Ramos in 2018?

a. P860,000 c. P1,560,000 b. P1,510,000 d. P2,580,000

• Answer: C

Solution:

Net income from GPP's operations P2,580,000

Divide by 3

Share in GPP's ordinary income per partner P860,000

Add: Ramos' own net income (2.5M-1.25M-550k) 700,000

Taxable net income of Ramos P1,560,000

• The partners' share in the other income of the GPP (i.e., subj. to FWT and CGTs) are non-returnable

income

of the partners.

How much is the taxable income of Ramos in 2018 assuming GRT & Co. opted to use Optional Standard

deduction?

a. P1,376,000 c. P1,692,000

b. P1,426,000 d. P1,860,600

• Answer: A

Solution:

GPP's Gross Income (4,490K-1,610k+500k) P3,380,000

X 60%

GPP's net income under OSD P2,028,000

Divide 3

Share of Ramos in the ordinary income of the GPP P676,000

Add: Ramos' own net income (2.5M-1.25M-550k) 700,000

Taxable net income of Ramos P1,376,000

• Under the TRAIN Law, the partner may use either itemized deduction or OSD.

• Under the TRAIN Law, apply OSD only if the taxpayer indicated the same in its ITR. Hence, unless clear,

itemized deduction must be applied.

You might also like

- Syllabi HRMA 40023 Project Management 2Document6 pagesSyllabi HRMA 40023 Project Management 2BSMA Third YearNo ratings yet

- Philippine Christian University: Midterm Examination inDocument5 pagesPhilippine Christian University: Midterm Examination inleo pigafetaNo ratings yet

- Business Combination AssignmentDocument5 pagesBusiness Combination AssignmentBienvenido JmNo ratings yet

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- 5Document19 pages5Dawn JessaNo ratings yet

- Valencia Chap 5 Estate TaxDocument11 pagesValencia Chap 5 Estate TaxCha DumpyNo ratings yet

- Bar Exam Taxation Law QuestionsDocument27 pagesBar Exam Taxation Law QuestionsMaris Angelica AyuyaoNo ratings yet

- Identified Weakness / Deficiencies Recommendation For ImprovementsDocument2 pagesIdentified Weakness / Deficiencies Recommendation For ImprovementsSheena ClataNo ratings yet

- Receipt and Disposition of InventoriesDocument5 pagesReceipt and Disposition of InventoriesWawex DavisNo ratings yet

- Activity Task Business CombinationDocument7 pagesActivity Task Business CombinationCasper John Nanas MuñozNo ratings yet

- Rmbe AfarDocument13 pagesRmbe AfarMiss FermiaNo ratings yet

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- Final Income TaxationDocument15 pagesFinal Income TaxationElizalen MacarilayNo ratings yet

- AFARDocument15 pagesAFARBetchelyn Dagwayan BenignosNo ratings yet

- Value Added TaxDocument8 pagesValue Added TaxErica VillaruelNo ratings yet

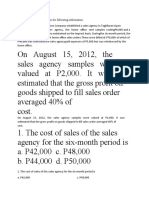

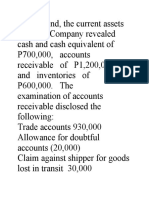

- Finals Exercise 2 - WC Management InventoryDocument3 pagesFinals Exercise 2 - WC Management Inventorywin win0% (1)

- Problem Set For AR (Ctto)Document16 pagesProblem Set For AR (Ctto)Mariane Jean Guerrero100% (1)

- Advanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Document68 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 4 (2022)Mazikeen DeckerNo ratings yet

- This Study Resource Was: Consignment SalesDocument3 pagesThis Study Resource Was: Consignment SalesKez MaxNo ratings yet

- Auditor's Report on Financial StatementsDocument9 pagesAuditor's Report on Financial StatementsEm-em ValNo ratings yet

- Business Tax Semi Finals Quiz 1 AUDocument9 pagesBusiness Tax Semi Finals Quiz 1 AUKeira TanNo ratings yet

- DocumentDocument2 pagesDocumentAisaka Taiga0% (1)

- Estate Tax Assignment 1Document2 pagesEstate Tax Assignment 1Heavenly Joy CuaresmaNo ratings yet

- Understanding Financial Statements /TITLEDocument26 pagesUnderstanding Financial Statements /TITLEMARC BENNETH BERIÑANo ratings yet

- Tax3. Lecture 1 - Value Added Tax SCDocument40 pagesTax3. Lecture 1 - Value Added Tax SCsuzyshii 888No ratings yet

- Answer:: Case 15Document1 pageAnswer:: Case 15exquisiteNo ratings yet

- Discontinued Operation and Noncurrent Asset Held For SaleDocument2 pagesDiscontinued Operation and Noncurrent Asset Held For SaleMary Dale Joie BocalaNo ratings yet

- Chapter 35 001Document8 pagesChapter 35 001Grace Ann Aceveda QuinioNo ratings yet

- Booklet 1 Introduction To Transfer Tax - Estate TaxDocument51 pagesBooklet 1 Introduction To Transfer Tax - Estate Taxsunkist0091No ratings yet

- XBUSTAX Percentage and Other TaxesDocument5 pagesXBUSTAX Percentage and Other TaxesFlorine Fate SalungaNo ratings yet

- Exempt Sale of Goods Properties and Services NotesDocument2 pagesExempt Sale of Goods Properties and Services NotesSelene DimlaNo ratings yet

- Tax MockboardDocument8 pagesTax MockboardJaneNo ratings yet

- MSC-Audited FS With Notes - 2014 - CaseDocument12 pagesMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorNo ratings yet

- Management Services Agamata 2014Document12 pagesManagement Services Agamata 2014NICOLE FAYE SAN MIGUELNo ratings yet

- Acc 30 CorporationDocument8 pagesAcc 30 CorporationGerlie BonleonNo ratings yet

- Adamson University Business Tax Final Exam ReviewDocument7 pagesAdamson University Business Tax Final Exam ReviewMarie Tes LocsinNo ratings yet

- Estimated transaction price methods and entries for consignment salesDocument7 pagesEstimated transaction price methods and entries for consignment salesPaupauNo ratings yet

- Quiz Donor S Tax ACT 193Document14 pagesQuiz Donor S Tax ACT 193Haks MashtiNo ratings yet

- AFAR-07 (Home-Office & Branch Accounting)Document7 pagesAFAR-07 (Home-Office & Branch Accounting)mysweet surrenderNo ratings yet

- Relevant Costing Simulated Exam Ans KeyDocument5 pagesRelevant Costing Simulated Exam Ans KeySarah BalisacanNo ratings yet

- Lesson 7 Joint VenturesDocument9 pagesLesson 7 Joint VenturesheyheyNo ratings yet

- Installment ExercisesDocument2 pagesInstallment ExercisesalyssaNo ratings yet

- Estate Tax Chapter SummaryDocument4 pagesEstate Tax Chapter SummaryPJ PoliranNo ratings yet

- Module 8 AgricultureDocument9 pagesModule 8 AgricultureTrine De LeonNo ratings yet

- Excise TaxDocument15 pagesExcise TaxDaniella MananghayaNo ratings yet

- Estate Tax Guide for PhilippinesDocument50 pagesEstate Tax Guide for PhilippinesLea JoaquinNo ratings yet

- 1.1 MC - Exercises On Estate Tax (PRTC)Document8 pages1.1 MC - Exercises On Estate Tax (PRTC)marco poloNo ratings yet

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- AISDocument11 pagesAISJezeil DimasNo ratings yet

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceJomarNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Discuss The Components and Characteristics of Maximization and Minimization ModelDocument5 pagesDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizNo ratings yet

- Tax Quiz 4Document61 pagesTax Quiz 4Seri CrisologoNo ratings yet

- IM ACCO 20173 Business and Transfer Taxes Module 4 PDFDocument40 pagesIM ACCO 20173 Business and Transfer Taxes Module 4 PDFMakoy BixenmanNo ratings yet

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- Calculate income tax for partnershipsDocument4 pagesCalculate income tax for partnershipsPrince Carl Lepiten SilvaNo ratings yet

- AFAR Test BankDocument57 pagesAFAR Test BankandengNo ratings yet

- PDF Intermediate Accounting Volume 3 ValixDocument4 pagesPDF Intermediate Accounting Volume 3 ValixJosh Cruz CosNo ratings yet

- 02Document1 page02Katrina Dela CruzNo ratings yet

- 1Document1 page1Katrina Dela CruzNo ratings yet

- Partnership Is Formed by Persons For The Sole Purpose of Exercising Their ProfessionDocument2 pagesPartnership Is Formed by Persons For The Sole Purpose of Exercising Their ProfessionKatrina Dela CruzNo ratings yet

- 03Document2 pages03Katrina Dela CruzNo ratings yet

- 01Document1 page01Katrina Dela CruzNo ratings yet

- A Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015Document1 pageA Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015Katrina Dela CruzNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice QuestionsKatrina Dela CruzNo ratings yet

- FloydDocument1 pageFloydKatrina Dela CruzNo ratings yet

- Filipino Immigrant's US Pension Taxation in the PhilippinesDocument1 pageFilipino Immigrant's US Pension Taxation in the PhilippinesKatrina Dela CruzNo ratings yet

- Statement 2Document1 pageStatement 2Katrina Dela CruzNo ratings yet

- These Are Assets Which Are Not Used in TradeDocument2 pagesThese Are Assets Which Are Not Used in TradeKatrina Dela CruzNo ratings yet

- Questions 1Document4 pagesQuestions 1Katrina Dela CruzNo ratings yet

- 4Document1 page4Katrina Dela CruzNo ratings yet

- Fa 1Document2 pagesFa 1Katrina Dela CruzNo ratings yet

- Philippine tax obligations calculation resident citizenDocument3 pagesPhilippine tax obligations calculation resident citizenKatrina Dela CruzNo ratings yet

- Menu Bar: Your AnswerDocument1 pageMenu Bar: Your AnswerKatrina Dela CruzNo ratings yet

- Short ProblemsDocument7 pagesShort ProblemsKatrina Dela CruzNo ratings yet

- Bldgs & Equip. (Net), RR 350,000.00 Bldgs & Equip. (Net), DD 375,000.00 Total Bldgs & EquipmentsDocument1 pageBldgs & Equip. (Net), RR 350,000.00 Bldgs & Equip. (Net), DD 375,000.00 Total Bldgs & EquipmentsKatrina Dela CruzNo ratings yet

- MRDocument2 pagesMRKatrina Dela CruzNo ratings yet

- Bldgs & Equip. (Net), RR 350,000.00 Bldgs & Equip. (Net), DD 375,000.00 Total Bldgs & EquipmentsDocument1 pageBldgs & Equip. (Net), RR 350,000.00 Bldgs & Equip. (Net), DD 375,000.00 Total Bldgs & EquipmentsKatrina Dela CruzNo ratings yet

- Statement 1Document2 pagesStatement 1Katrina Dela CruzNo ratings yet

- MIGUEL Is A Resident CitizenDocument1 pageMIGUEL Is A Resident CitizenKatrina Dela CruzNo ratings yet

- 7Document1 page7Katrina Dela CruzNo ratings yet

- Accounting Information System: Your AnswerDocument1 pageAccounting Information System: Your AnswerKatrina Dela CruzNo ratings yet

- Due To His ExpertiseDocument2 pagesDue To His ExpertiseKatrina Dela CruzNo ratings yet

- What Amount of Pre-Acquisition Earnings Is Eliminated in The Acquisition Date Worksheet Elimination? No Revenues and ExpensesDocument1 pageWhat Amount of Pre-Acquisition Earnings Is Eliminated in The Acquisition Date Worksheet Elimination? No Revenues and ExpensesKatrina Dela CruzNo ratings yet

- This Kind of Tax Is Imposed Primarily For The Regulation of Useful or NonDocument2 pagesThis Kind of Tax Is Imposed Primarily For The Regulation of Useful or NonKatrina Dela CruzNo ratings yet

- At YearDocument3 pagesAt YearKatrina Dela CruzNo ratings yet

- P20,000 P18,000 P2,000 P0: 2 PointsDocument10 pagesP20,000 P18,000 P2,000 P0: 2 PointsKatrina Dela CruzNo ratings yet

- AC 520 3.1 Answer KeyDocument11 pagesAC 520 3.1 Answer KeyMatthew TiuNo ratings yet

- 2.job & Contract CostingDocument38 pages2.job & Contract CostingNaga ChandraNo ratings yet

- 05aug2014 India DailyDocument73 pages05aug2014 India DailyChaitanya JagarlapudiNo ratings yet

- Fundamentals of Cost Accounting 5th Edition by Lanen Anderson Maher ISBN Solution ManualDocument98 pagesFundamentals of Cost Accounting 5th Edition by Lanen Anderson Maher ISBN Solution Manualmatthew100% (25)

- Intermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerDocument27 pagesIntermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerMelissaNo ratings yet

- ACCT 450 - AICPA Questions FlashcardsDocument24 pagesACCT 450 - AICPA Questions FlashcardsdissidentmeNo ratings yet

- Managerial ACCT2 2nd Edition Sawyers Solutions ManualDocument20 pagesManagerial ACCT2 2nd Edition Sawyers Solutions Manuala679213672No ratings yet

- ECO2104 NotesDocument58 pagesECO2104 NotesSindayigaya Aimable BenjaminNo ratings yet

- Fundamentals of Accounting, Business and ManagementDocument27 pagesFundamentals of Accounting, Business and Managementbelle100% (3)

- HBR AccountsDocument37 pagesHBR AccountsR StudienNo ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet

- Marketing Plan: Product & Services: School SuppliesDocument10 pagesMarketing Plan: Product & Services: School SuppliesKayla Dela TorreNo ratings yet

- Term Paper On Investment DecisionDocument6 pagesTerm Paper On Investment Decisioncdkxbcrif100% (1)

- Supersuman FINALDocument50 pagesSupersuman FINALJohnDominicMoralesNo ratings yet

- Tally 6.3Document9 pagesTally 6.3Prasenjit GuhaNo ratings yet

- PROJECT HIGHLIGHTSDocument20 pagesPROJECT HIGHLIGHTSSHRUTI AGRAWAL100% (2)

- Calculating current and deferred taxDocument5 pagesCalculating current and deferred taxKaiWenNgNo ratings yet

- Lone Pine CaféDocument3 pagesLone Pine Caféchan_han123No ratings yet

- 7 Final Accounts of CompaniesDocument15 pages7 Final Accounts of CompaniesAakshi SharmaNo ratings yet

- SAP Certified Application Associate - Financial Accounting With SAP ERP - FullDocument41 pagesSAP Certified Application Associate - Financial Accounting With SAP ERP - FullMohammed Nawaz ShariffNo ratings yet

- CHRLKW FinanceDocument132 pagesCHRLKW FinancenargesNo ratings yet

- Taxation Exam: MidtermDocument33 pagesTaxation Exam: MidtermSim BelsondraNo ratings yet

- Bank of The Philippine IslandsDocument40 pagesBank of The Philippine IslandsRed Christian PalustreNo ratings yet

- Investment Holding Company (IHC): Key AspectsDocument52 pagesInvestment Holding Company (IHC): Key AspectsMin Li67% (3)

- Grade 11 EntrepreneurshipquizDocument7 pagesGrade 11 Entrepreneurshipquizapi-35040061760% (5)

- The Hubbart FormulaDocument1 pageThe Hubbart FormulaCealpahu100% (2)

- Odel Re ReDocument2 pagesOdel Re ReShashika MihiranNo ratings yet

- Steel Fabrication Industry ReportDocument67 pagesSteel Fabrication Industry ReportAnand GanesanNo ratings yet

- Group Assignment Cafes Monte Bianco Final V2Document13 pagesGroup Assignment Cafes Monte Bianco Final V2Linh Chi Trịnh T.No ratings yet

- Comprehensive Example of Interperiod TAX ALLOCATIONDocument9 pagesComprehensive Example of Interperiod TAX ALLOCATIONarsykeiwayNo ratings yet