Professional Documents

Culture Documents

A Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015

Uploaded by

Katrina Dela Cruz0 ratings0% found this document useful (0 votes)

25 views1 pageA Malaysian bank manager in the Philippines had various sources of income in 2015, including salaries, bonuses, interest income, dividends, and capital gains. His total income tax expense was 83,000 pesos. As a special Filipino employee, his tax expense would be 57,000 pesos. Beginning in 2018, interest income from bank deposits and yield from deposit substitutes will be subject to a 20% final tax, while small prizes of 10,000 pesos or less will be subject to basic tax.

Original Description:

Original Title

A Malaysian occupying a managerial position in an Offshore Banking Unit located in Taguig had the following data for taxable year 2015

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA Malaysian bank manager in the Philippines had various sources of income in 2015, including salaries, bonuses, interest income, dividends, and capital gains. His total income tax expense was 83,000 pesos. As a special Filipino employee, his tax expense would be 57,000 pesos. Beginning in 2018, interest income from bank deposits and yield from deposit substitutes will be subject to a 20% final tax, while small prizes of 10,000 pesos or less will be subject to basic tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views1 pageA Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015

Uploaded by

Katrina Dela CruzA Malaysian bank manager in the Philippines had various sources of income in 2015, including salaries, bonuses, interest income, dividends, and capital gains. His total income tax expense was 83,000 pesos. As a special Filipino employee, his tax expense would be 57,000 pesos. Beginning in 2018, interest income from bank deposits and yield from deposit substitutes will be subject to a 20% final tax, while small prizes of 10,000 pesos or less will be subject to basic tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

A Malaysian occupying a managerial position in an Offshore Banking Unit located in Taguig had the

following data for taxable year 2015.

Salaries received P120,000

Other emoluments 50,000

De minimis benefits 5,000

Interest income from deposit substitutes 20,000

Interest income from long-term Philippine Bank Deposit 10,000

Dividend income from a domestic corporation 150,000

Gain from sale of shares of stock of a domestic corporation

held as investment sold outside of the local stock exchange 175,000

The total income tax expense of the taxpayer is:

a. P73,000 c. P63,000

b. P70,500 d. P83,000

• Answer: D

. Assuming the taxpayer is a Special Filipino employee, his total income tax expense is:

a. P56,500 c. P57,000

b. P58,500 d. P83,000

• Answer: C

Which of the following shall not be subject to the 20% final tax beginning January 1, 2018?

a. Amount of interest from any currency bank deposit and yield or any other monetary benefit from

deposit substitutes and from trust funds and similar arrangements

b. Winnings other than Philippine Charity Sweepstakes and Lotto winnings, regardless of amount

c. Philippine Charity Sweepstakes and Lotto winnings exceeding P10,000

d. Prizes amounting to ten thousand pesos (P10,000) or less

• Answer: D

• “D” is subject to basic tax

You might also like

- Week 6 - Deduction From Gross IncomeDocument5 pagesWeek 6 - Deduction From Gross IncomeJuan FrivaldoNo ratings yet

- Cash FlowDocument15 pagesCash FlowCandy BayonaNo ratings yet

- Chris Is A Filipino Immigrant Living in The United States For More Than 15 YearsDocument1 pageChris Is A Filipino Immigrant Living in The United States For More Than 15 YearsKatrina Dela CruzNo ratings yet

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Taxation SituationalDocument113 pagesTaxation SituationalDaryl Mae Mansay100% (1)

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Corporation Quiz PDFDocument8 pagesCorporation Quiz PDFangelo vasquezNo ratings yet

- Income Taxation 1Document4 pagesIncome Taxation 1nicole bancoroNo ratings yet

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Document3 pagesName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- Final Exam Tax - SpecialDocument9 pagesFinal Exam Tax - SpecialKenneth Bryan Tegerero Tegio100% (5)

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Income Tax ProblemsDocument1 pageIncome Tax ProblemsPam Otic-ReyesNo ratings yet

- Find Study Resources: Answered Step-By-StepDocument12 pagesFind Study Resources: Answered Step-By-StepBisag AsaNo ratings yet

- Topic 5 - Final Income TaxationDocument12 pagesTopic 5 - Final Income TaxationNicol Jay Duriguez100% (3)

- IncomeTaxation Banggawan2019 Ch13BDocument9 pagesIncomeTaxation Banggawan2019 Ch13BNoreen Ledda0% (2)

- Midterm Exam Principles of Taxation and Income TaxationDocument6 pagesMidterm Exam Principles of Taxation and Income TaxationKitagawa, Misia Sophia Jan B.No ratings yet

- Dynasty Corporation 2019 2019 2019 Phils. China TotalDocument17 pagesDynasty Corporation 2019 2019 2019 Phils. China TotalAngela RuedasNo ratings yet

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- Chapter 8 v2 RevisedDocument13 pagesChapter 8 v2 RevisedSheilamae Sernadilla GregorioNo ratings yet

- Tax Pre TestDocument4 pagesTax Pre TestSebastian GarciaNo ratings yet

- Answer: ADocument3 pagesAnswer: ARosemarie CruzNo ratings yet

- Corporation As A TaxpayerDocument27 pagesCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- Taxation SituationalDocument113 pagesTaxation SituationalMartin GragasinNo ratings yet

- Team PRTC Far-Finpb - 5.21Document19 pagesTeam PRTC Far-Finpb - 5.21NananananaNo ratings yet

- Rules in Holding Period in Capital GainsDocument39 pagesRules in Holding Period in Capital GainsTrine De LeonNo ratings yet

- Yellow - Not Sure, Green - CorrectDocument7 pagesYellow - Not Sure, Green - CorrectIsaiah John Domenic M. CantaneroNo ratings yet

- Question 2: FeedbackDocument43 pagesQuestion 2: FeedbackIris FenelleNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- BAM 031 Income Taxation 2nd Periodical Exam With AKDocument8 pagesBAM 031 Income Taxation 2nd Periodical Exam With AKbrmo.amatorio.uiNo ratings yet

- Arcebal QuizonFITDocument4 pagesArcebal QuizonFITVheia ArcebalNo ratings yet

- Ea - TaxDocument8 pagesEa - TaxKc SevillaNo ratings yet

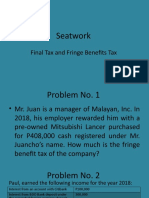

- Seatwork: Final Tax and Fringe Benefits TaxDocument6 pagesSeatwork: Final Tax and Fringe Benefits TaxVergel MartinezNo ratings yet

- Exercise - FinmarDocument8 pagesExercise - FinmarRed VelvetNo ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Chapter 13B - Special Allowable Itemized Deductions and NolcoDocument7 pagesChapter 13B - Special Allowable Itemized Deductions and NolcoprestinejanepanganNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- Taxation Situational ProblemsDocument32 pagesTaxation Situational ProblemsMilo MilkNo ratings yet

- PRe Departmental ReviwersDocument7 pagesPRe Departmental ReviwersCañon, Lorenz GeneNo ratings yet

- Tax Revenue Regulation Illustrative Problems Compilation iCPA NotesDocument13 pagesTax Revenue Regulation Illustrative Problems Compilation iCPA Notesmendoza.adrianeNo ratings yet

- 09tp TaxationDocument3 pages09tp TaxationKatelyn Mae SungcangNo ratings yet

- 1007 (RA, SR and TP)Document6 pages1007 (RA, SR and TP)Neil Ryan CatagaNo ratings yet

- Prefinals Exam in Income TaxationDocument3 pagesPrefinals Exam in Income TaxationYen YenNo ratings yet

- Taxation Review Final Income TaxDocument4 pagesTaxation Review Final Income TaxGendyBocoNo ratings yet

- ACC 311 Income Taxation QuizDocument3 pagesACC 311 Income Taxation QuizHilarie JeanNo ratings yet

- Tax Pre TestDocument40 pagesTax Pre TestjohnlerrysilvaNo ratings yet

- Tax On Individuals - QuizDocument3 pagesTax On Individuals - QuizJM NoynayNo ratings yet

- Nasa Coursehero Exam NG FEUDocument9 pagesNasa Coursehero Exam NG FEUZedie Leigh VioletaNo ratings yet

- TAXDocument20 pagesTAXkate trishaNo ratings yet

- Income Tax For IndividualsDocument37 pagesIncome Tax For IndividualsKristine Aubrey AlvarezNo ratings yet

- Tax1 DeductionsDocument45 pagesTax1 DeductionsjoNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Final Income TaxationDocument86 pagesFinal Income TaxationKil ZoldyckNo ratings yet

- KF Eliminations For RMYCDocument8 pagesKF Eliminations For RMYCFranz Josef De GuzmanNo ratings yet

- Gross IncomeDocument21 pagesGross IncomeRey ViloriaNo ratings yet

- Tax1 DeductionsDocument43 pagesTax1 DeductionsAlliah Mae ArbastoNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Salary As Accountant P450Document1 pageSalary As Accountant P450TOMAS, JACKY LOU C.No ratings yet

- Income Taxation Problem 1Document3 pagesIncome Taxation Problem 1Darlyn Joyce OrdoñezNo ratings yet

- These Are Assets Which Are Not Used in TradeDocument2 pagesThese Are Assets Which Are Not Used in TradeKatrina Dela CruzNo ratings yet

- FloydDocument1 pageFloydKatrina Dela CruzNo ratings yet

- Short ProblemsDocument7 pagesShort ProblemsKatrina Dela CruzNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice QuestionsKatrina Dela CruzNo ratings yet

- Taxpayer Is A Resident CitizenDocument3 pagesTaxpayer Is A Resident CitizenKatrina Dela CruzNo ratings yet

- Ventura Was On His Way To Deliver Merchandise Ordered by His Customer When Another Driver LostDocument2 pagesVentura Was On His Way To Deliver Merchandise Ordered by His Customer When Another Driver LostKatrina Dela CruzNo ratings yet

- Due To His ExpertiseDocument2 pagesDue To His ExpertiseKatrina Dela CruzNo ratings yet

- How Much Is The Distributable Income of The GPP?Document2 pagesHow Much Is The Distributable Income of The GPP?Katrina Dela CruzNo ratings yet

- P20,000 P18,000 P2,000 P0: 2 PointsDocument10 pagesP20,000 P18,000 P2,000 P0: 2 PointsKatrina Dela CruzNo ratings yet

- This Kind of Tax Is Imposed Primarily For The Regulation of Useful or NonDocument2 pagesThis Kind of Tax Is Imposed Primarily For The Regulation of Useful or NonKatrina Dela CruzNo ratings yet

- Cruz Was An Employee of ABC TradingDocument2 pagesCruz Was An Employee of ABC TradingKatrina Dela CruzNo ratings yet

- A Has Been Assessed Deficiency Income Tax P1Document2 pagesA Has Been Assessed Deficiency Income Tax P1Katrina Dela CruzNo ratings yet

- Which of The Following Does Not Meet The Definition of A LiabilityDocument4 pagesWhich of The Following Does Not Meet The Definition of A LiabilityKatrina Dela CruzNo ratings yet

- It Means All Income Derived From Whatever SourceDocument2 pagesIt Means All Income Derived From Whatever SourceKatrina Dela CruzNo ratings yet