Professional Documents

Culture Documents

Activity Jenny Light Accountant Problem 1.1

Uploaded by

Atasha Xd6700 ratings0% found this document useful (0 votes)

20 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views2 pagesActivity Jenny Light Accountant Problem 1.1

Uploaded by

Atasha Xd670Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

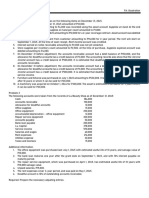

DOMINICAN COLLEGE OF TARLAC

FINAL EXAMINATION 1ST SEM 2019-2020

FUNDAMENTALS OF ACCOUNTING

Problem:

Jenny Light completed these transactions during December:

Dec. 2 Invested P120,000 to start an accounting practice , Jenny Light, Accountant.

2 Paid monthly office rent, P5,000.

3 Paid cash for an Acer computer, P30,000. The computer is expected to remain in

service for 5 years.

4 Purchased office furniture on account, P36,000. The furniture should last for 5 years.

5 Purchased supplies on account, P3,000.

9 Performed tax services for a client and received cash for the full amount of P8,000.

12 Paid utility expenses, P2,000.

18 Performed consulting service for a client on account, P17,000.

21 Received P9,000 in advance for tax work to be performed evenly over the next 30

days.

21 Hired a secretary to be paid P15,000 on the 20th day of each month.

26 Paid for the supplies purchased on December 5.

28 Collected P6,000 from the consulting client on December 18.

30 Withdrew P16,000 for personal use.

Here are the account titles used by Jenny Light, Accountant.

Cash Rent Expense

Accounts Receivable Utilities Expense

Supplies Salary Expense

Equipment Accumulated Depreciation- Equipment

Furniture Accumulated Depreciation- Furniture

Accounts Payable Salary Payable

Jenny Light, Capital Unearned Service Revenue

Jenny Light, Drawing Depreciation Expense- Equipment

Service Revenue Depreciation Expense- Furniture

Supplies Expense

Requirements:

1. Journalize the transactions. Use 2 Column Journal.

2. Post to the T-Accounts (General Ledger), keying all items by date. Indicate account balance.

3. Unadjusted Trial Balance

You might also like

- Emotional Maturity: A Hogg Foundation ReprintDocument12 pagesEmotional Maturity: A Hogg Foundation ReprintOana_Dana_Bala_8888No ratings yet

- Business Finance: A Pictorial Guide for ManagersFrom EverandBusiness Finance: A Pictorial Guide for ManagersRating: 4 out of 5 stars4/5 (1)

- Accounting Problem SetDocument22 pagesAccounting Problem SetJill SolisNo ratings yet

- 6 ProblemsDocument6 pages6 ProblemsAzelAnnAlibinNo ratings yet

- Acctg 311 Prelim ExamDocument8 pagesAcctg 311 Prelim ExamJaycie EscuadroNo ratings yet

- Mastering Adjusting Entries Homework..Document32 pagesMastering Adjusting Entries Homework..lea100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- Creed Article 2.ppsxDocument18 pagesCreed Article 2.ppsxDryxlyn Myrns Ortega67% (3)

- Accounting Cycle of A Service BusinessDocument8 pagesAccounting Cycle of A Service BusinessNiziU MaraNo ratings yet

- Exercise 3 Adjusting Entries - Service BusinessDocument2 pagesExercise 3 Adjusting Entries - Service BusinessMarc Viduya75% (4)

- Journalizing TransactionsDocument24 pagesJournalizing TransactionsManuel Panotes Reantazo50% (2)

- Exercises For Adjusting EntriesDocument3 pagesExercises For Adjusting EntriesJunmirMalicVillanuevaNo ratings yet

- 3 Adjusting Entries HandoutsDocument10 pages3 Adjusting Entries HandoutsJuan Dela CruzNo ratings yet

- Accounting For Sole Proprietorship Problem1-5Document8 pagesAccounting For Sole Proprietorship Problem1-5Rocel Domingo100% (1)

- Practice Problem Jenny Light AccountantDocument17 pagesPractice Problem Jenny Light AccountantFranco James SanpedroNo ratings yet

- Terrific Temps Fills Temporary Employment Positions For Local Businesses SomeDocument2 pagesTerrific Temps Fills Temporary Employment Positions For Local Businesses SomeAmit PandeyNo ratings yet

- HO Branch Accounting MC ProblemsDocument4 pagesHO Branch Accounting MC ProblemsDivine CuasayNo ratings yet

- Final Examination 1St Sem 2019-2020Document2 pagesFinal Examination 1St Sem 2019-2020Franco James SanpedroNo ratings yet

- Activity 2 - Emily CruzDocument1 pageActivity 2 - Emily Cruzelriatagat85No ratings yet

- Performance TasksDocument3 pagesPerformance TasksJebEscuetaAriolaNo ratings yet

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- AIS Manual Accounting CycleDocument1 pageAIS Manual Accounting Cyclejapvivi ceceNo ratings yet

- Final RequirementsDocument1 pageFinal RequirementsJohn Lester SuarezNo ratings yet

- T AccountsDocument3 pagesT AccountsEdizon De Andres JaoNo ratings yet

- Additional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TDocument4 pagesAdditional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TRenalyn Ps MewagNo ratings yet

- Orca Share Media1674449949770 7023152122120546859Document6 pagesOrca Share Media1674449949770 7023152122120546859Only JesusNo ratings yet

- Journaling ExerciseDocument2 pagesJournaling ExerciseSammy Marquez100% (1)

- I. Problem Solving. Journal, Ledger & Trial BalanceDocument1 pageI. Problem Solving. Journal, Ledger & Trial BalanceMarcel VelascoNo ratings yet

- Topic 6 Sample ProblemsDocument1 pageTopic 6 Sample ProblemsMary Jane Pedere VeranoNo ratings yet

- Adjusting Entries: Anne Angelie C. Gomez San Isidro College School of AccountancyDocument36 pagesAdjusting Entries: Anne Angelie C. Gomez San Isidro College School of AccountancyPamela SantosNo ratings yet

- FINAL Exam BACC 1 Answer SheetDocument1 pageFINAL Exam BACC 1 Answer Sheetivyortizdalida2004No ratings yet

- Acctng Mod 2Document6 pagesAcctng Mod 2viaishere4uNo ratings yet

- Lesson 3: Worksheet 3: Remedial Lesson 3: Adjusting EntriesDocument2 pagesLesson 3: Worksheet 3: Remedial Lesson 3: Adjusting EntriesAleana joy PabelicNo ratings yet

- NC Bacctg1 Final Exam Part 1Document3 pagesNC Bacctg1 Final Exam Part 1Danica Onte0% (1)

- Fundamentals of Accountancy, Business, and Management Final Assessment ActivityDocument6 pagesFundamentals of Accountancy, Business, and Management Final Assessment ActivityWerNo ratings yet

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- Exercises Reversing EntriesDocument2 pagesExercises Reversing EntriesAndrea Bercy CoballesNo ratings yet

- Problem No. 8Document1 pageProblem No. 8Lailanie BrionesNo ratings yet

- Activity #1 Journalizing and Posting To T Accounts (1) 1Document1 pageActivity #1 Journalizing and Posting To T Accounts (1) 1Kil ZoldyckNo ratings yet

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1Kathleen MaynigoNo ratings yet

- Accounting Level IV Coc: Project OneDocument5 pagesAccounting Level IV Coc: Project OneTewodros BekeleNo ratings yet

- Funac MidtermsDocument20 pagesFunac MidtermstyramanankilNo ratings yet

- Journal Entries To FSDocument3 pagesJournal Entries To FSJadon MejiaNo ratings yet

- Afar Construction Franchise and Hoba Q3Document5 pagesAfar Construction Franchise and Hoba Q3Heinie Joy PauleNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- FAR 01C Review of Accounting Cycle IllustrationsDocument2 pagesFAR 01C Review of Accounting Cycle Illustrationsbyunb3617No ratings yet

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- Accounting With SolutionsDocument8 pagesAccounting With Solutions26 Athira S Nair CS1No ratings yet

- Prob 3Document1 pageProb 3por wansNo ratings yet

- Exercises For Midterm PDFDocument10 pagesExercises For Midterm PDFThanh HằngNo ratings yet

- Practice Set 2Document4 pagesPractice Set 2Mylene CandidoNo ratings yet

- CH 2 Service BusinessDocument10 pagesCH 2 Service BusinessNicole AshleyNo ratings yet

- CB Chap 3Document39 pagesCB Chap 3Christianne Joyse MerreraNo ratings yet

- 01 Quiz 1Document2 pages01 Quiz 1Laisan SantosNo ratings yet

- Simplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDocument4 pagesSimplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDarwin Dionisio ClementeNo ratings yet

- Tugas 2 Latihan Jurnal Perusahaan Jasa2Document4 pagesTugas 2 Latihan Jurnal Perusahaan Jasa2SupriadiNo ratings yet

- Bookkeeping Challenge 2019Document2 pagesBookkeeping Challenge 2019Anthony Tunying MantuhacNo ratings yet

- ACCO 20033 - Quiz 2Document2 pagesACCO 20033 - Quiz 2DRUMMER DROIDNo ratings yet

- Fundamentals of Accounting 2 - PrefinalsDocument3 pagesFundamentals of Accounting 2 - PrefinalsCary JaucianNo ratings yet

- ABM2 - 1st Semester - 1st Quarter - Accounting Practice SetDocument7 pagesABM2 - 1st Semester - 1st Quarter - Accounting Practice SetROWELL SALAPARE100% (2)

- Pauleen's JournalDocument3 pagesPauleen's Journalshaneemacasi100% (1)

- Unit II Lesson 5 and 6 ADJUSTING ENTRIES and FSDocument25 pagesUnit II Lesson 5 and 6 ADJUSTING ENTRIES and FSAlezandra SantelicesNo ratings yet

- ScienceDocument30 pagesScienceAtasha Xd670No ratings yet

- ScienceDocument64 pagesScienceAtasha Xd670No ratings yet

- Lesson 2:: Reason and ImpartialityDocument34 pagesLesson 2:: Reason and ImpartialityAtasha Xd670No ratings yet

- Laws Regulating Accomodation Establishments - 230411 - 175756 (1) - 060348Document22 pagesLaws Regulating Accomodation Establishments - 230411 - 175756 (1) - 060348Atasha Xd670No ratings yet

- Speech Style Ppt.Document17 pagesSpeech Style Ppt.Atasha Xd670No ratings yet

- Speech Style Ppt.Document17 pagesSpeech Style Ppt.Atasha Xd670No ratings yet

- Types of Speech ContextDocument14 pagesTypes of Speech ContextAtasha Xd670No ratings yet

- Inspecting A Vacant Room, Check Out Room: Franco James T. San Pedro BSHM - 1A Hpc2Document4 pagesInspecting A Vacant Room, Check Out Room: Franco James T. San Pedro BSHM - 1A Hpc2Atasha Xd670No ratings yet

- Group 7Document1 pageGroup 7Atasha Xd670No ratings yet

- Public Speaking 1-MergedDocument69 pagesPublic Speaking 1-MergedAtasha Xd670No ratings yet

- P.E 1 Traditional GamesDocument84 pagesP.E 1 Traditional GamesAtasha Xd670No ratings yet

- Ge-5 ReviewerDocument4 pagesGe-5 ReviewerAtasha Xd670No ratings yet

- Sanpedro La7Document5 pagesSanpedro La7Atasha Xd670No ratings yet

- Group1 TypesofmenuDocument15 pagesGroup1 TypesofmenuAtasha Xd670No ratings yet

- Formerly: San Nicolas Academy / Dominican School - Founded 1946Document8 pagesFormerly: San Nicolas Academy / Dominican School - Founded 1946Atasha Xd670No ratings yet

- St. Dominic de GuzmanDocument16 pagesSt. Dominic de GuzmanAtasha Xd670No ratings yet

- Group 5Document1 pageGroup 5Atasha Xd670No ratings yet

- T. Bshm1aDocument6 pagesT. Bshm1aAtasha Xd670No ratings yet

- T. Bshm1aDocument6 pagesT. Bshm1aAtasha Xd670No ratings yet

- Lesson 3.1 PDFDocument16 pagesLesson 3.1 PDFKrizia May AguirreNo ratings yet

- ShortstoryDocument14 pagesShortstoryAtasha Xd670No ratings yet