Professional Documents

Culture Documents

7 Additional Self Test Problems 5

Uploaded by

Pranoy SarkarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 Additional Self Test Problems 5

Uploaded by

Pranoy SarkarCopyright:

Available Formats

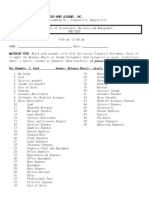

Chapter 7

VALUATION OF BONDS AND STOCKS

1. A Rs. 1000 par value bond, bearing a coupon rate of 12 % payable semi-

annually will mature after 5 years.

(i) If the required rate of return on the bond is 16 % p.a., what is its value?

(ii) If the bond is currently selling at Rs. 965, what is the approximate YTM

per annum?

2. A Rs. 1000 par value bond, bearing a coupon rate of 10 % payable semi-

annually will mature after 4 years.

(i) If the required rate of return on the bond is 8 % p.a., what is its value?

(ii) If the bond is currently selling at Rs. 1100, what is the approximate YTM

per annum?

3. A Rs.100 par bond carrying a coupon rate of 10 percent and maturing

after 4 years is selling for Rs. 102.

(i) What is the approximate YTM?

(ii) What will be the realised yield to maturity if the reinvestment rate is 8

percent?

4. A Rs. 1000 par value bond, bearing a coupon rate of 16 % payable semi-

annually will mature after 3 years.

(i) If the required rate of return on the bond is 12 % p.a., what is its value?

(ii) If the bond is currently selling at Rs. 1050, what is the approximate YTM

per annum?

5. A Rs.1,000 par bond carrying a coupon rate of 8 percent and maturing after

8 years is selling for Rs. 1,100.

What is the approximate YTM?

6. The risk-free rate is 6 percent and the expected return on the market

portfolio is 15%. The beta of a stock is 1.8. Its dividends and earnings are

expected to grow at a constant rate of 10 % per annum forever. The

dividend paid just now is Rs.10.00. What should be the intrinsic value per

share of the stock?

7. The following information is available for a bond.

Face Value Rs. 100

Coupon (interest rate) 12 percent payable annually

Term to maturity 8 years

Redemption value Rs. 100

Current market price Rs. 108

(i) What is the YTM of the bond? Use the approximate formula.

(ii) What is the duration of the bond? Use the approximate formula for

calculating the yield to maturity.

(iii) If the yield on the bond decreases by 50 basis points, what will be the

approximate change in the bond price?

8. The equity stock of a firm is currently selling for Rs. 200 per share. The

expected dividend a year from now is Rs. 15.00. The investors’ required rate

of return on the stock is 25%. If the constant growth model applies to the

firm, what is the expected growth rate?

9. The current dividend on an equity share of Max Limited is Rs. 6.00 on an

earnings per share of Rs. 20.00.

(i) Assume that the dividend per share will grow at the rate of 16 percent per

year for the next 8 years. Thereafter, the growth rate is expected to fall

and stabilise at 9 percent. Investors require a return of 13 percent from

Max’s equity shares. What is the intrinsic value of Max’s equity share?

(ii) Assume that the growth rate of 16 percent will decline linearly over an 8

year period and then stabilise at 9 percent. What is the intrinsic value of

Max’s share if the investors’ required rate of return is 13 percent?

10. The current dividend on an equity share of Zipro Limited is Rs.12.00 on an

earnings per share of Rs. 60.00.

(i) Assume that the dividend per share will grow at the rate of 25 percent per

year for the next 6 years. Thereafter, the growth rate is expected to fall

and stabilise at 15 percent. Investors require a return of 18 percent from

Zipro’s equity shares. What is the intrinsic value of Zipro’s equity share?

(ii) Assume that the growth rate of 25 percent will decline linearly over a six

year period and then stabilise at 15 percent. What is the intrinsic value of

Omega’s share if the investors’ required rate of return is 18 percent?

(iii) Assume that the dividend is expected to grow at a rate of 16 percent

annually forever from now on and investors require a return of 18

percent from Zipro’s equity shares. What will be the retrospective price-

earnings ratio (Po/Eo) for Zipro?

11. The equity stock of a firm is currently selling for Rs. 200 per share. The

expected dividend a year from now is Rs. 15.00. The investors’ required rate

of return on the stock is 25%. If the constant growth model applies to the

firm, what is the expected growth rate?

12. The equity stock of Rajni Ltd. is currently selling for Rs. 280 per share. The

expected dividend a year from now is Rs. 20.00. The investors’ required rate

of return on the stock is 25%. If the constant growth model applies to Rajni

Ltd. what is the expected growth rate?

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Kieso Ifrs Test Bank Ch17Document45 pagesKieso Ifrs Test Bank Ch17FaradibaNo ratings yet

- Production and Operations Management MCQ With Answers1Document6 pagesProduction and Operations Management MCQ With Answers1Pranoy Sarkar0% (1)

- AFM Class Notes PDFDocument154 pagesAFM Class Notes PDFSiddharth NarayananNo ratings yet

- Production and Operations Management MCQ With AnswersDocument7 pagesProduction and Operations Management MCQ With AnswersPranoy SarkarNo ratings yet

- Ratios 9706 Accounting AS & A LevelDocument3 pagesRatios 9706 Accounting AS & A LevelRizwanSial100% (1)

- 7 Additional Solved Problems 6Document14 pages7 Additional Solved Problems 6Pranoy SarkarNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Document15 pagesManila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Bella Choi100% (1)

- Capital Gain Formula Excel TemplateDocument9 pagesCapital Gain Formula Excel TemplatePranoy SarkarNo ratings yet

- Expected Return Formula Excel TemplateDocument4 pagesExpected Return Formula Excel TemplatePranoy SarkarNo ratings yet

- Capital Gains Yield Formula Excel TemplateDocument3 pagesCapital Gains Yield Formula Excel TemplatePranoy SarkarNo ratings yet

- Yield To Maturity Excel TemplateDocument4 pagesYield To Maturity Excel TemplatePranoy SarkarNo ratings yet

- Expected Return Formula Excel TemplateDocument4 pagesExpected Return Formula Excel TemplatePranoy SarkarNo ratings yet

- Yield To Maturity Excel Template: Visit: EmailDocument4 pagesYield To Maturity Excel Template: Visit: EmailPranoy SarkarNo ratings yet

- Operations Management MCQs - Types of Production - MCQs ClubDocument7 pagesOperations Management MCQs - Types of Production - MCQs ClubPranoy SarkarNo ratings yet

- Production and Operations Management MCQ With AnswersDocument7 pagesProduction and Operations Management MCQ With AnswersPranoy SarkarNo ratings yet

- 7excels On Solved ProblemsDocument2 pages7excels On Solved ProblemsPranoy SarkarNo ratings yet

- 300+ TOP Production and Operation Management MCQs & AnswersDocument14 pages300+ TOP Production and Operation Management MCQs & AnswersPranoy SarkarNo ratings yet

- Operations Management MCQs - Types of Production - MCQs ClubDocument7 pagesOperations Management MCQs - Types of Production - MCQs ClubPranoy SarkarNo ratings yet

- Production and Operations Management MCQ With Answers3Document7 pagesProduction and Operations Management MCQ With Answers3Pranoy SarkarNo ratings yet

- MBF Homework 5Document19 pagesMBF Homework 5JerryNo ratings yet

- Chapter 3 What Do Interest Rates Mean and What Is Their Role in ValuationDocument8 pagesChapter 3 What Do Interest Rates Mean and What Is Their Role in Valuation12345No ratings yet

- Sem - V Economics Suggested Questions For Exam 2022-CUDocument1 pageSem - V Economics Suggested Questions For Exam 2022-CUUdittiNo ratings yet

- Cacs Paper 2 Practice Questions PDF FreeDocument16 pagesCacs Paper 2 Practice Questions PDF FreeYufei Chow BooshNo ratings yet

- Uti Mutual Fund Project 2022Document45 pagesUti Mutual Fund Project 2022Anuja DekateNo ratings yet

- Interest and The Time Value of MoneyDocument9 pagesInterest and The Time Value of MoneyRaymond MoscosoNo ratings yet

- Mid-Term Exam. 2022Document3 pagesMid-Term Exam. 2022Trâm AnhNo ratings yet

- Quizesfm 2Document2 pagesQuizesfm 2Prince MalabaNo ratings yet

- Gui Me inDocument30 pagesGui Me inThùy LinhNo ratings yet

- Module in Financial Management V2Document50 pagesModule in Financial Management V2Chocodie cocodieNo ratings yet

- # Solution: 900,000/100,000 9:. 9 16 144Document5 pages# Solution: 900,000/100,000 9:. 9 16 144Joel Christian MascariñaNo ratings yet

- Ce 215 Engineering Econ Module CompilationDocument129 pagesCe 215 Engineering Econ Module CompilationClaudette Lindsay LabagnoyNo ratings yet

- Saunders 8e PPT Chapter10Document32 pagesSaunders 8e PPT Chapter10sdgdfs sdfsfNo ratings yet

- Simple Interest - Exrecise 1Document2 pagesSimple Interest - Exrecise 1Khiks ObiasNo ratings yet

- Strategic Business Analysis (Midterms) : Course Learning OutcomesDocument36 pagesStrategic Business Analysis (Midterms) : Course Learning OutcomesJemimah SerquinaNo ratings yet

- Selected Questions Chapter 30Document12 pagesSelected Questions Chapter 30Pranta SahaNo ratings yet

- Working Lecture 7Document17 pagesWorking Lecture 7Sara KarenNo ratings yet

- FinMan Module 5 Time Value of MoneyDocument9 pagesFinMan Module 5 Time Value of Moneyerickson hernanNo ratings yet

- EE - Midterm Examination - Sample TestDocument7 pagesEE - Midterm Examination - Sample TestDương NgNo ratings yet

- The Time Value of Money Continuous Compounding Discount InflationDocument21 pagesThe Time Value of Money Continuous Compounding Discount InflationSTEVE DOMINIC SISNONo ratings yet

- 4 Basic Concepts of Stocks and Bonds 1Document70 pages4 Basic Concepts of Stocks and Bonds 1Lukas AlexanderNo ratings yet

- Brahmastra 8 Sept 2023 Aman Sharma 1694164009740Document5 pagesBrahmastra 8 Sept 2023 Aman Sharma 1694164009740Saurabh Pandey 19GCEBEC042No ratings yet

- Liabilities, Provisions and Contingent Liabilities & Notes and Bonds PayableDocument5 pagesLiabilities, Provisions and Contingent Liabilities & Notes and Bonds PayableAmanda MarieNo ratings yet

- Imple Nterest: Skezeer John B. PazDocument32 pagesImple Nterest: Skezeer John B. PazMeryl Tumbaga GauranaNo ratings yet

- It Can Be Identified 4 Basic Scenarios When Rescheduling A LoanDocument4 pagesIt Can Be Identified 4 Basic Scenarios When Rescheduling A LoanMd Salah UddinNo ratings yet

- PRE TEST ABM ClassDocument3 pagesPRE TEST ABM ClassGood News Worldwide MissionNo ratings yet