Professional Documents

Culture Documents

What is a Bill of Exchange

Uploaded by

Мария Попович0 ratings0% found this document useful (0 votes)

41 views1 pageOriginal Title

Bill of exchange

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

41 views1 pageWhat is a Bill of Exchange

Uploaded by

Мария ПоповичCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

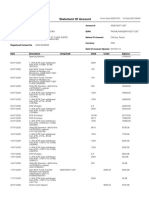

Bill of exchange

What Is a Bill of Exchange?

A bill of exchange is a written order used primarily in international trade that binds one party to pay a fixed sum of money to

another party on demand or at a predetermined date. Bills of exchange are similar to checks and promissory notes—they can be

drawn by individuals or banks and are generally transferable by endorsements. Bills of exchange are sometimes called drafts, but

that term usually applies to domestic transactions only.

History

The bill of exchange originated as a method of settling accounts by Arab merchants. And the bill in its present form attained wide

use during the 13th century among the Lombards of northern Italy, who carried on considerable foreign commerce. Because

merchants (the buyers) usually retained their assets in banks in a number of trading cities, a shipper of goods (the seller) could

obtain immediate payment from a banker by presenting a bill of exchange signed by the buyer.

How a Bill of Exchange Works

A bill of exchange transaction can involve up to three parties. The drawee is the party that pays the sum specified by the bill of

exchange. The payee is the one who receives that sum. The drawer is the party that obliges the drawee to pay the payee. The

drawer and the payee are the same entity unless the drawer transfers the bill of exchange to a third-party payee. While a bill of

exchange is not a contract itself, the involved parties can use it to fulfill the terms of a contract. It can specify that payment is due

on demand or at a specified future date. It's often extended with credit terms, such as 90 days. As well, a bill of exchange must be

accepted by the drawee to be valid.

Bills of exchange are useful in international trade because they help buyers and sellers deal with the risks associated with exchange

rate fluctuations and differences in legal jurisdictions.

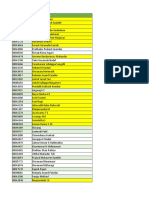

Types of Bills of Exchange:

Bills of exchange are categorized as follows:

Inland Bill: An inland bill is a bill that is made payable in the home country only.

Foreign Bill: The bill made payable in a foreign country is called Foreign Bill.

Usance Bill: This bill covers the period within which the payment is to be made.

Clean Bill: This bill doesn’t include any documents as opposed to the documentary bill. Hence, the interest is higher than the other

bills.

Demand bill: This bill is payable on demand. It has no fixed period of payment.

Accommodation Bill: The bill which is sponsored to help another person in need, drawn and accepted without any condition is

known as an accommodation bill.

Documentary bill: They are very popular in trade circles. These bills are accompanied by a bill of lading, air consignment note,

truck/lorry receipts, railway receipts.

Advantage of Bill of exchange:

1) It is a legal document. If the drawee fails to make payment in due time, the drawer can recover the amount legally.

2)The terms of bills of exchange are certain and can’t be altered.

3)Adequate time for payment: Importer buying goods and services gets sufficient time limit to pay for the purchase by negotiating

in bills of exchange.

4)Clear terms and conditions: The bills of exchange are signed by the acceptor only after accepting and reading the clear terms and

conditions of the bills of exchange.

5) Easy transfer: The bills of exchange can be easily transferred to the third party. By endorsement of the bill, the liability to pay can

be transferred to the third party.

6)Mutual accommodation: Such bills are drawn to meet the financial need of others. In this case, the bill is issued to mutually

accommodate the other party.

So, now you know.

You might also like

- Compute Income TaxDocument24 pagesCompute Income TaxMelody Fabreag76% (25)

- TCS India Process - Separation KitDocument25 pagesTCS India Process - Separation KitSuman Dey33% (6)

- Features of A Negotiable InstrumentDocument4 pagesFeatures of A Negotiable InstrumentAditi100% (7)

- Report IBPMECMCXXXX760BBP - SB 0169-1Document5 pagesReport IBPMECMCXXXX760BBP - SB 0169-1MuhammadAsimNo ratings yet

- Unit 4 - Contracts 2-1Document30 pagesUnit 4 - Contracts 2-1sarthak chughNo ratings yet

- Bill of Excange Book by Chief HashiDocument61 pagesBill of Excange Book by Chief HashiElNo ratings yet

- Real Property TaxDocument5 pagesReal Property TaxRacinef Tee100% (2)

- International Trade and FinanceDocument5 pagesInternational Trade and FinanceHamsa VahiniNo ratings yet

- Bills of Exchange Meaning of Bill of ExchangeDocument4 pagesBills of Exchange Meaning of Bill of ExchangeAnimesh BawejaNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraNo ratings yet

- BILLS OF EXCHANGE TITLEDocument9 pagesBILLS OF EXCHANGE TITLEMariyam MalsaNo ratings yet

- Bills of ExchangeDocument5 pagesBills of Exchangesara24391100% (3)

- Bill of ExchangeDocument5 pagesBill of ExchangeyosephworkuNo ratings yet

- Definition of Bill of ExchangeDocument6 pagesDefinition of Bill of ExchangeJhulan SenguptaNo ratings yet

- Commercial Bill MarketDocument25 pagesCommercial Bill Marketapeksha_606532056No ratings yet

- promissory noteDocument5 pagespromissory notedeepikaNo ratings yet

- Legal and Regulatory LawsDocument110 pagesLegal and Regulatory LawsAniruddha JadhavNo ratings yet

- Bill of ExchangeDocument14 pagesBill of Exchangenakoda121100% (2)

- Rom The Point of View of Transfer of Title To The Mortgaged PropertyDocument4 pagesRom The Point of View of Transfer of Title To The Mortgaged PropertyMonir HossainNo ratings yet

- B.Law Assignment N.IDocument9 pagesB.Law Assignment N.IWazeeer AhmadNo ratings yet

- Negotiable InstrumentDocument7 pagesNegotiable InstrumentNathan NakibingeNo ratings yet

- CHAPTER 3: Financial Documents in The International PaymentDocument33 pagesCHAPTER 3: Financial Documents in The International PaymentVũ Cao Kỳ DuyênNo ratings yet

- Bill of ExchangeDocument4 pagesBill of Exchangemmmprasajanu100% (1)

- Unit-4 Negotiable Instruments ActDocument27 pagesUnit-4 Negotiable Instruments Actfa7041898908100% (1)

- Negotiable InstrumentsDocument2 pagesNegotiable InstrumentsdvvoraniNo ratings yet

- Trade Financing KazakhstanDocument5 pagesTrade Financing KazakhstanAssylaiymYertayevaNo ratings yet

- Bills of ExchangeDocument2 pagesBills of ExchangeSachin TiwariNo ratings yet

- Yg G G Y Y: The Holder in Due CourseDocument10 pagesYg G G Y Y: The Holder in Due CourseMilan JeswaniNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeChetan SapraNo ratings yet

- Negotiable NstrumentsDocument11 pagesNegotiable Nstrumentsevelynberko21No ratings yet

- Bill of Lading (B/L) : What Is Bill of Exchange and State Its Essentials ?Document4 pagesBill of Lading (B/L) : What Is Bill of Exchange and State Its Essentials ?Dhananjay KumarNo ratings yet

- Bills of Exchange ProjectDocument7 pagesBills of Exchange ProjectNishaTambe100% (1)

- International Trade PaymentDocument10 pagesInternational Trade Paymentpooja tripathiNo ratings yet

- NI-Full NotesDocument27 pagesNI-Full NotesArchana PurohitNo ratings yet

- International Bill of Exchange TemplateDocument2 pagesInternational Bill of Exchange TemplateArtur Lupasku0% (3)

- Banking Law - Negotiable Instruments & It's TypesDocument3 pagesBanking Law - Negotiable Instruments & It's TypesAmogha Gadkar100% (1)

- Bankingtheorylawpracticeunitiiippt 240307181015 7e5977faDocument29 pagesBankingtheorylawpracticeunitiiippt 240307181015 7e5977fadharshan0425No ratings yet

- Bill of ExchangeDocument1 pageBill of ExchangeDonita MantuanoNo ratings yet

- Legal Aspects of Banking Bills of ExchangeDocument39 pagesLegal Aspects of Banking Bills of ExchangeKpop BazaarNo ratings yet

- Bills of ExchangeDocument57 pagesBills of Exchangekamalsodhi24100% (5)

- ASSIGNMENTDocument12 pagesASSIGNMENTMindalyn FranciscoNo ratings yet

- Himachal Pradesh National Law University, Shimla.: Assignment OnDocument13 pagesHimachal Pradesh National Law University, Shimla.: Assignment OnShivani ChoudharyNo ratings yet

- Bills of Exchage-Behaviour-Treatment and SystemDocument32 pagesBills of Exchage-Behaviour-Treatment and SystemUsaid Khan67% (15)

- Bills of ExchangeDocument3 pagesBills of ExchangeanshisharmaNo ratings yet

- Bill of Exchange MaybankDocument3 pagesBill of Exchange MaybankBuayaz GamingNo ratings yet

- Negotiable InstrumentsDocument52 pagesNegotiable InstrumentsRoyden Savio AthaideNo ratings yet

- Negotiable Instruments Law Part 1 PDFDocument46 pagesNegotiable Instruments Law Part 1 PDFmajemafae100% (2)

- Bill of ExchangeDocument1 pageBill of ExchangeDonita MantuanoNo ratings yet

- Accountancy Notes PDF Class 11 Chapter 8Document4 pagesAccountancy Notes PDF Class 11 Chapter 8Rishi ShibdatNo ratings yet

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsShamaarajShankerNo ratings yet

- Negotiable Instruments: Chapter - 3Document11 pagesNegotiable Instruments: Chapter - 3Mae CaraigNo ratings yet

- Kinds of Negotiable Instruments (1)Document19 pagesKinds of Negotiable Instruments (1)theashu022No ratings yet

- Unit-Ii Negotiable InstrumentsDocument65 pagesUnit-Ii Negotiable InstrumentsRAYSPEAR0% (1)

- Bill of ExchangeDocument4 pagesBill of ExchangeVadic FactsNo ratings yet

- Governing Law: - The Negotiable Instruments Law (ACT No. 2031)Document7 pagesGoverning Law: - The Negotiable Instruments Law (ACT No. 2031)Leilani WeeNo ratings yet

- ML Unit-3Document11 pagesML Unit-3AkshayNo ratings yet

- Bill of Exchange: Earning BjectivesDocument42 pagesBill of Exchange: Earning BjectivespopushellyNo ratings yet

- Bill of Exchange ExplainedDocument47 pagesBill of Exchange ExplainedPathan KausarNo ratings yet

- Topic 2 - NegoDocument3 pagesTopic 2 - NegoDANICA FLORESNo ratings yet

- Negotiable Instruments ActDocument9 pagesNegotiable Instruments ActJohnson Nu100% (1)

- IBC Mock Test 3Document12 pagesIBC Mock Test 3Hao VinhNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Special JournalsDocument2 pagesSpecial JournalsabsidycoNo ratings yet

- Income Tax Authorities: Roles & PowersDocument28 pagesIncome Tax Authorities: Roles & Powersabhi9998No ratings yet

- Changes On Finance Bill 2023Document16 pagesChanges On Finance Bill 2023Md. Abdullah Al ImranNo ratings yet

- A.p.treasury Code Vol-1 PDFDocument25 pagesA.p.treasury Code Vol-1 PDFChamu Phani0% (1)

- UAE VAT Dual Currency Invoice Template 1Document4 pagesUAE VAT Dual Currency Invoice Template 1Vijay Kumar Reddy ChallaNo ratings yet

- Taxation Semester VI T. Y. B. ComDocument265 pagesTaxation Semester VI T. Y. B. ComSushant kawadeNo ratings yet

- Sad (1X20) PDFDocument3 pagesSad (1X20) PDFHarrenNo ratings yet

- TaxationDocument188 pagesTaxationNikolajay MarrenoNo ratings yet

- Am ExDocument12 pagesAm ExPreeti SinghNo ratings yet

- Annex B-1:: Guide On Filling Up The DocumentDocument9 pagesAnnex B-1:: Guide On Filling Up The DocumentGrace UrbanoNo ratings yet

- CIR v. AICHI FORGING COMPANY OF ASIA, INC. G.R. No. 184823 October 6, 2010Document13 pagesCIR v. AICHI FORGING COMPANY OF ASIA, INC. G.R. No. 184823 October 6, 2010Sarah Jane-Shae O. Semblante100% (1)

- Midterm Examination NegoDocument4 pagesMidterm Examination NegoPrinsesani GiananNo ratings yet

- Camile's Electronics Store Sales and Tax AnalysisDocument2 pagesCamile's Electronics Store Sales and Tax AnalysispshtiwanNo ratings yet

- LT BILL 46429091009 Dec22Document2 pagesLT BILL 46429091009 Dec22Deepak JhaNo ratings yet

- American Bureau of Shipping: Atoh Ntumngia ADocument1 pageAmerican Bureau of Shipping: Atoh Ntumngia AhansNo ratings yet

- Commissioner of Internal Revenue v. E. J. Zongker and Charleen Zongker, 334 F.2d 44, 10th Cir. (1964)Document3 pagesCommissioner of Internal Revenue v. E. J. Zongker and Charleen Zongker, 334 F.2d 44, 10th Cir. (1964)Scribd Government DocsNo ratings yet

- Republic Vs Iac: None of Which Is Present in This CaseDocument11 pagesRepublic Vs Iac: None of Which Is Present in This CaseFrancis Coronel Jr.No ratings yet

- InvoicesDocument2 pagesInvoicesAppu AshokNo ratings yet

- NEGODocument24 pagesNEGOTj AllasNo ratings yet

- 2 - Madrigal Vs RaffertyDocument7 pages2 - Madrigal Vs RaffertyCollen Anne PagaduanNo ratings yet

- BMBE SeminarDocument60 pagesBMBE SeminarBabyGiant LucasNo ratings yet

- PH Taxes Guide: National & Local TaxesDocument2 pagesPH Taxes Guide: National & Local TaxesYzah CariagaNo ratings yet

- View 1-year statement of bank accountDocument23 pagesView 1-year statement of bank accountHadi Ul HassanNo ratings yet

- Book PalnDocument49 pagesBook PalnDeepakNo ratings yet

- Civil List DocumentDocument284 pagesCivil List DocumentmalanarunaNo ratings yet

- Rhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestDocument2 pagesRhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestEmir MendozaNo ratings yet