Professional Documents

Culture Documents

Writeup Ulip

Writeup Ulip

Uploaded by

Anjali AllureOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Writeup Ulip

Writeup Ulip

Uploaded by

Anjali AllureCopyright:

Available Formats

Except the premium Allocation charge, Accelerated Total and Permanent Disability Benefit charge

and the mortality charges, all other charges would be subject to revision with prior approval of the

IRDAI. The premium Allocation charge, Accelerated Total and Permanent Disability Benefit charge

and the mortality charges are guaranteed throughout the policy term.

PremiumAllocationCharge: This charge shall be deducted from Premiums as they are paid,

before allocation of units each time a Premium is received,and shall be as follows: ) Year 1

5.75% Years 2 - 5 4.00% Years 6 - 7 3.50% Year 8 2.50% Year 9 2.00% Year 10 onwards 1.50%

• PolicyAdministrationCharge: Policy Administration Charge of `33.33 per month will be deducted

throughout the term of the policy. Policy Administration Charges will be recovered by way of

cancellation of units at the prevailing unit price on the first business day of each Policy Month .

FundManagementCharges(FMC):A certain fixed percentage of the relevant fund before

calculating the NAV on a daily basis will be charged as per the rates below:

Equity Fund 1.35% p.a. Top 300 Fund 1.35% p.a. Equity Optimiser Fund 1.35% p.a. Growth Fund

1.35% p.a. Pure Fund 1.35% p.a. Balanced Fund 1.25% p.a. Bond Optimiser Fund 1.15% p.a.

Corporate Bond Fund 1.15% p.a. Bond Fund 1.00% p.a. Money Market Fund 0.25% p.a.

The FMC for all funds except Discontinued Policy Fund would be subject to a cap of 1.35%.

However,revision of charges would be subject to prior approval of IRDAI.

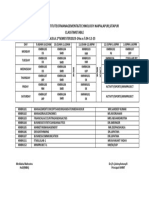

DiscontinuanceCharge: Discontinuance charges are expressed as a percentage of Annual

Premium or Fund Value. The year of discontinuance is the policy year in which the date of

discontinuance falls

Wherethepolicyis discontinuedduring thepolicyyear** 1 2 3 4 5 onwards

DiscontinuanceChargeforthepolicies havingannualizedpremium above`50,000 Lower of 6% X

(Annualized Premium or Fund Value) subject to maximum of `6,000 Lower of 4% X

(Annualized Premium or Fund Value) subject to maximum of `5,000 Lower of 3% X

(Annualized Premium or Fund Value) subject to maximum of `4,000 Lower of 2% X

(Annualized Premium or Fund Value) subject to maximum of `2,000 Nil

DiscontinuanceChargeforthepolicies havingannualizedpremium upto`50,000 Lower of 20% X

(Annualized Premium or Fund Value) subject to maximum of `3,000 Lower of 15% X

(Annualized Premium or Fund Value) subject to maximum of `2,000 Lower of 10% X

(Annualized Premium or Fund Value) subject to maximum of `1,500 Lower of 5% X

(Annualized Premium or Fund Value) subject to maximum of `1,0

MortalityCharge: Mortality charge are deducted on the first business day of each policy

month from Fund Value by way of cancellation of units.

Accelerated Total & Permanent Disability(TPD)Charge: Accelerated TPD charges of`

0.40p.a.per1000Sum Assured will be deducted on a monthly basis on the first business day

of each policy month from FundValue,by cancellation of units.

Switching Charge:A charge of `100 is applicable for every switch , in excess of two free

switches in the same policy year during the policy term or settlement period.The switching

charge would be subject to a cap of` 500per switch.

Premium Redirection Charge:A charge of ` 100 is applicable for everyredirection in excess of

one free redirection in same policy year. The Premium redirection charge would be subject

to a cap ofRs. 500 per transaction .However ,revision of charges would be subject to prior

approval of IRDA

Partial Withdrawal Charge: A charge of` 100 is applicable for every partial withdrawa in

excess of two free partial withdrawal in same policy year.The Partial withdrawal charge

would be subject to a cap of` 500per transaction.

Medical Expenses on Revival: Cost of medical expenses incurred (ifany) will be borne by the

policyholder through cancellation of units subject to maximum of` 3,000.

Additional allocation as below would be applicable for staff cases Year 1 5.00% Years 2 -5

3.00% Years 6 - 8 2.00% Years 9 1.50%

Staff cases are defined as all employees, retired employees, VRS holders, minor children and

spouse of employees of SBI Life Insurance Co. Ltd. and State Bank of India (SBI),RRBs

sponsored by SBI and subsidiaries of State Bank Group.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Bill#468411356914Document2 pagesBill#468411356914dylanmore1223No ratings yet

- The 5Document8 pagesThe 5kskhushbu1275% (8)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Pet Food Shop Business Plan TemplateDocument23 pagesPet Food Shop Business Plan TemplateSuleman100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Agents: Lrgi Group PresentationDocument10 pagesCorporate Agents: Lrgi Group PresentationAnjali AllureNo ratings yet

- 1 MR For MBA Doss Sir (6 Files Merged)Document100 pages1 MR For MBA Doss Sir (6 Files Merged)Anjali AllureNo ratings yet

- (Protection of Policyholders' Interests) Regulations, 2017Document13 pages(Protection of Policyholders' Interests) Regulations, 2017Anjali AllureNo ratings yet

- A Breif Summary On Delivery Duty Paid (DDP) : MCI Asignment#2 Group 4Document3 pagesA Breif Summary On Delivery Duty Paid (DDP) : MCI Asignment#2 Group 4Anjali AllureNo ratings yet

- 02 - 12 - 20 #1 PmexerciseDocument2 pages02 - 12 - 20 #1 PmexerciseAnjali AllureNo ratings yet

- Answer 3 AedaDocument3 pagesAnswer 3 AedaAnjali AllureNo ratings yet

- Answer 2 AedaDocument2 pagesAnswer 2 AedaAnjali AllureNo ratings yet

- Points To Work OnDocument2 pagesPoints To Work OnAnjali AllureNo ratings yet

- Recruitment of Junior Assistants, Senior Assistants and Junior Executives in Various DisciplinesDocument3 pagesRecruitment of Junior Assistants, Senior Assistants and Junior Executives in Various DisciplinesAnjali AllureNo ratings yet

- HttpsDocument2 pagesHttpsAnjali AllureNo ratings yet

- Policy Coverage Premium Inclusion Exclusio N How Good in ComparisonDocument5 pagesPolicy Coverage Premium Inclusion Exclusio N How Good in ComparisonAnjali AllureNo ratings yet

- Tata Aig Cyber Shield: AssignmentDocument7 pagesTata Aig Cyber Shield: AssignmentAnjali AllureNo ratings yet

- Debate NDocument2 pagesDebate NAnjali AllureNo ratings yet

- Exhibit 3.1 Articles of Incorporation of Merchandise Creations, IncDocument4 pagesExhibit 3.1 Articles of Incorporation of Merchandise Creations, IncJazcel GalsimNo ratings yet

- Marketing Project OpusDocument16 pagesMarketing Project OpusAnimesh Kr SinghNo ratings yet

- Anchored VWAP-Take Your Swing Trading To The Next LevelDocument7 pagesAnchored VWAP-Take Your Swing Trading To The Next Leveldjoiner45No ratings yet

- Request For Proposal: SECTION I - BackgroundDocument5 pagesRequest For Proposal: SECTION I - Backgroundsemhal gebremedhinNo ratings yet

- Akun 2 BenerDocument2 pagesAkun 2 BenerLatifah KhalisyahNo ratings yet

- Petissu (Final)Document51 pagesPetissu (Final)Patricia SantosNo ratings yet

- L4 UK Regulation and Professional Integrity Ed9Document522 pagesL4 UK Regulation and Professional Integrity Ed9MsT MogaeNo ratings yet

- GE Ecomagination Strategic InitiativeDocument1 pageGE Ecomagination Strategic InitiativeDaniella Dhanice CanoNo ratings yet

- MKT521, Final, Md. Zayedul Haque, 2020-3-95-027Document5 pagesMKT521, Final, Md. Zayedul Haque, 2020-3-95-027Zayedul Haque ZayedNo ratings yet

- Construction Cost Template in ExcelDocument1 pageConstruction Cost Template in ExcelFrancisco SalazarNo ratings yet

- Determinants of Customer Retention in FiDocument109 pagesDeterminants of Customer Retention in FiAschalew HabteNo ratings yet

- Everbrite, LLC Names New PresidentDocument2 pagesEverbrite, LLC Names New PresidentPR.comNo ratings yet

- Operations Management: William J. StevensonDocument16 pagesOperations Management: William J. StevensonPatrice ScottNo ratings yet

- 408 Tax Case BriefDocument256 pages408 Tax Case BriefIsabel Luchie GuimaryNo ratings yet

- How To Capitalise On Tourism in Local Revitalisation Schemes - Case Study CollectionDocument25 pagesHow To Capitalise On Tourism in Local Revitalisation Schemes - Case Study CollectionDavid DragosNo ratings yet

- Iso13485 QOP4201 DocumentControl PDFDocument9 pagesIso13485 QOP4201 DocumentControl PDFQuality and Safety Consultants Co.No ratings yet

- Perfectly Competitive MarketsDocument36 pagesPerfectly Competitive MarketsSaurabh SharmaNo ratings yet

- Theories of ProfitDocument5 pagesTheories of ProfitKavyanjali SinghNo ratings yet

- Time Table MBA 1st SEM 2023-24Document1 pageTime Table MBA 1st SEM 2023-24Jatin SinghalNo ratings yet

- Assignment - Legal Environment of BusinessDocument6 pagesAssignment - Legal Environment of BusinessShakeeb Hashmi100% (1)

- Definition of Executive SummaryDocument4 pagesDefinition of Executive SummaryKen Kou WangNo ratings yet

- Rate ConDocument4 pagesRate ConRana Ali.08No ratings yet

- Marc Gian Talisic-Activity-2-JournalizingDocument8 pagesMarc Gian Talisic-Activity-2-JournalizingArien Evangelista TalisicNo ratings yet

- Graduation Project 2019 - Nidhin Kumar - 170061Document89 pagesGraduation Project 2019 - Nidhin Kumar - 170061NidhinKumar SikhivahanakumarNo ratings yet

- Pub - Wall Street A History PDFDocument449 pagesPub - Wall Street A History PDFBhavik Gandhi100% (3)

- Documentation: Manufacture, Control and DistributionDocument10 pagesDocumentation: Manufacture, Control and DistributionAyalew DesyeNo ratings yet

- b2b AssignmentDocument3 pagesb2b AssignmentAparna SinghNo ratings yet