Professional Documents

Culture Documents

True or False 1

Uploaded by

kessa thea salvatoreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

True or False 1

Uploaded by

kessa thea salvatoreCopyright:

Available Formats

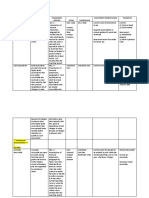

TRUE OR FALSE 1.

Section 406 requires a US issuer to disclose whether it has a Code of Ethics for its

senior financial officers and, if not, why not. Any changes to the Code of Ethics must be disclosed. True

2. The Sarbanes-Oxley Act (sometimes referred to as the SOA, Sarbox, or SOX) is a U.S. law to protect

investors by preventing fraudulent accounting and financial practices at privately traded companies.

False 3. Section 206 Conflicts of interest of the act states that it shall be lawful for a registered public

accounting firm to perform for an issuer any audit service required by this title, if a chief executive

officer, controller, chief financial officer, chief accounting officer, or any person serving in an equivalent

position for the issuer, was employed by that registered independent public accounting firm and

participated in any capacity in the audit of that issuer during the one year period preceding the date of

the initiation of the audit. False 4. Based on the officer’s knowledge, the report does not contain any

untrue statement of an immaterial fact or omit to state an immaterial fact necessary in order to make

the statements made, in light of the circumstances under which such statements were made, not

misleading. False 5. According to PCAOB Auditing Standard No. 5 (2007), a significant deficiency should

be classified as a material weakness if, by itself or in combination with other control deficiencies, it

results in more than a remote likelihood that a material misstatement in the company’s annual or

interim financial statements will be prevented or detected. False 6. Each audit committee shall have the

authority to engage independent counsel and other advisers, as it determines necessary to carry out its

duties. True 7. The SOX LITE was made to lessen the cost of complying for SOX Act and amend the sec.

404. True 8. Section 906 (Corporate responsibility for financial statements) introduces severe criminal

sanctions for breaches of s. 302 and s. 404 up to a maximum of a $ 5 000 000 fine and imprisonment for

not more than 10 years for knowingly breaching s. 302 or s. 404 or $ 1 000 000 and as much as 20 years’

imprisonment for wilful breach False 9. The costliest part of the Sarbanes-Oxley Act is Section 404 True

10. A registered public accounting firm may engage in any non-audit service, including tax services, that

is not described in any of paragraphs (1) through (9) of section 201 for an audit client, only if the activity

is approved in advance by the audit committee of the issuer True

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Identification 1Document1 pageIdentification 1kessa thea salvatoreNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Q1 Activity 3Document1 pageQ1 Activity 3kessa thea salvatoreNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Obligations and ContractsDocument2 pagesObligations and Contractskessa thea salvatoreNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Executive SummaryDocument1 pageExecutive Summarykessa thea salvatoreNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Creditor MayDocument1 pageThe Creditor Maykessa thea salvatoreNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Chapter 7Document1 pageChapter 7kessa thea salvatoreNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Multiple ChoiceDocument1 pageMultiple Choicekessa thea salvatoreNo ratings yet

- For The Purpose of Title IV of The Sarbane1Document1 pageFor The Purpose of Title IV of The Sarbane1kessa thea salvatoreNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Theoritical Vs ConceptualDocument4 pagesTheoritical Vs Conceptualkessa thea salvatoreNo ratings yet

- Effect of Accounting Ethics On The Quality of Financial ReportsDocument1 pageEffect of Accounting Ethics On The Quality of Financial Reportskessa thea salvatoreNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Attendance - August 28 2021Document1 pageAttendance - August 28 2021kessa thea salvatoreNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Accounting 22-24Document4 pagesAccounting 22-24ShairaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Post, or Distribute: Conceptual and Theoretical Frameworks in ResearchDocument14 pagesPost, or Distribute: Conceptual and Theoretical Frameworks in ResearchMelodia Turqueza GandezaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Assets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial StatementsDocument13 pagesAssets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial Statementskessa thea salvatoreNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Effect of Accounting Ethics On The Quality of Financial ReportsDocument1 pageEffect of Accounting Ethics On The Quality of Financial Reportskessa thea salvatoreNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Acctg 121N Chapters 1-4: Public AccountantsDocument4 pagesAcctg 121N Chapters 1-4: Public Accountantskessa thea salvatoreNo ratings yet

- Orca Share Media1583151851134Document2 pagesOrca Share Media1583151851134kessa thea salvatoreNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Orca Share Media1583151851134Document2 pagesOrca Share Media1583151851134kessa thea salvatoreNo ratings yet

- Advance Accounting 2 by GuerreroDocument14 pagesAdvance Accounting 2 by Guerreromarycayton83% (6)

- Linso, Hazraphine S.: LibraryDocument3 pagesLinso, Hazraphine S.: Librarykessa thea salvatoreNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Accounting Chapters 12-15Document5 pagesAccounting Chapters 12-15ShairaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Orca Share Media1583151851134Document2 pagesOrca Share Media1583151851134kessa thea salvatoreNo ratings yet

- Orca Share Media1583151851134Document2 pagesOrca Share Media1583151851134kessa thea salvatoreNo ratings yet

- McDonald's Case StudyDocument20 pagesMcDonald's Case StudyFathi Salem Mohammed Abdullah95% (59)

- STSDocument1 pageSTSkessa thea salvatoreNo ratings yet

- Assets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial StatementsDocument6 pagesAssets Description Standards Applied Intial Subsequent Statement Presentation Examples PAS 1 - Presentation of Financial Statementskessa thea salvatoreNo ratings yet

- Orca Share Media1583151851134Document2 pagesOrca Share Media1583151851134kessa thea salvatoreNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Total Male 6 Female 20 Total Students 26Document6 pagesTotal Male 6 Female 20 Total Students 26kessa thea salvatoreNo ratings yet

- Science As An IdeaDocument1 pageScience As An Ideakessa thea salvatoreNo ratings yet

- Far510 Dec2015 q2 (Aisyah, Farhana, Ayuni, Farah)Document5 pagesFar510 Dec2015 q2 (Aisyah, Farhana, Ayuni, Farah)Aisyah Hassim100% (1)

- Khuseland Lehman Bothers CaseDocument9 pagesKhuseland Lehman Bothers Caserangga agungNo ratings yet

- AsdasdDocument3 pagesAsdasdMark Domingo MendozaNo ratings yet

- General Ledger Accounting:: SAP FICO Course ContentDocument10 pagesGeneral Ledger Accounting:: SAP FICO Course ContentsrinivasNo ratings yet

- AAT Advanced Diploma in Accounting Level 3 Qualification Specification 0Document88 pagesAAT Advanced Diploma in Accounting Level 3 Qualification Specification 0h21048666100% (1)

- Shinnecock Nation and Gateway Casino Resorts - DRAFT Non-Interference and Enabling AgreementDocument18 pagesShinnecock Nation and Gateway Casino Resorts - DRAFT Non-Interference and Enabling AgreementArchive ItNo ratings yet

- Week 1 IntroDocument33 pagesWeek 1 IntroRhinndhi SakthyvelNo ratings yet

- Lesson 3Document42 pagesLesson 3angel caoNo ratings yet

- Ap104 Inventories PDFDocument6 pagesAp104 Inventories PDFMicaela Betis100% (1)

- Annexure 6Document32 pagesAnnexure 6Dhvani PanchalNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Haig Company Maintains A Petty Cash Fund For Small ExpendituresDocument1 pageHaig Company Maintains A Petty Cash Fund For Small ExpendituresAmit PandeyNo ratings yet

- Ais Word 1Document6 pagesAis Word 1Nur Adilah DilaNo ratings yet

- Kelompok 2 Analisis RasioDocument10 pagesKelompok 2 Analisis Rasio12A4-29-Yulita Fatma SariNo ratings yet

- Basic AccountingDocument1 pageBasic AccountingJassenNo ratings yet

- PurchaseOrder PO-TSI-Proc-V-2020-524Document2 pagesPurchaseOrder PO-TSI-Proc-V-2020-524Saifu RamdhaniNo ratings yet

- Encumbrance Final Edited1Document41 pagesEncumbrance Final Edited1MokhtarMCINo ratings yet

- Gul Ahmed 2009Document125 pagesGul Ahmed 2009Qoumal HashmiNo ratings yet

- Adjusting Entries With AnswersDocument7 pagesAdjusting Entries With AnswersMichael Magdaog100% (1)

- Internal Audit Manual Title PageDocument155 pagesInternal Audit Manual Title PageYunita Sari AdhaniNo ratings yet

- Job Order CostingDocument18 pagesJob Order CostingDan RyanNo ratings yet

- Andi Woodworks Pvt. Ltd. - 14-15Document17 pagesAndi Woodworks Pvt. Ltd. - 14-15Aayush agarwalNo ratings yet

- Tensei - BPO (Company Profile)Document15 pagesTensei - BPO (Company Profile)Mandy OsiasNo ratings yet

- Accounting Cycle of A Service BusinessDocument3 pagesAccounting Cycle of A Service BusinessAnne AlagNo ratings yet

- Final Output: Case 1: Quarantina Catering Services (QCS)Document3 pagesFinal Output: Case 1: Quarantina Catering Services (QCS)Jillian Mae Sobrino Belegorio100% (1)

- CPA Review Auditing Theory Answer SheetDocument2 pagesCPA Review Auditing Theory Answer SheetMellinia MantesNo ratings yet

- NAFASI ZA KAZI Tanzania Revenue Authority (TRA) (July 3, 2017)Document10 pagesNAFASI ZA KAZI Tanzania Revenue Authority (TRA) (July 3, 2017)Juma MpangaNo ratings yet

- A2.1 Roe 1Document14 pagesA2.1 Roe 1monemNo ratings yet

- 1prem Kumar BudhathokiDocument4 pages1prem Kumar BudhathokigpdharanNo ratings yet

- BP Op Entpr S4hana2022 09 Process-Steps en XXDocument4,205 pagesBP Op Entpr S4hana2022 09 Process-Steps en XXVinay KumarNo ratings yet

- Who Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionDocument46 pagesWho Uses Fair Value Accounting For Non Financial Assets After Ifrs AdoptionVincent S Vincent0% (1)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)