Professional Documents

Culture Documents

Jurnal Artikel IJEMS Determinants of Indonesian Share Price

Uploaded by

FpFMaster Mmorpg0 ratings0% found this document useful (0 votes)

14 views8 pagesOriginal Title

11.-Jurnal-Artikel-IJEMS-Determinants-of-Indonesian-Share-Price

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views8 pagesJurnal Artikel IJEMS Determinants of Indonesian Share Price

Uploaded by

FpFMaster MmorpgCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – Volume 7 Issue 1 – Jan 2020

Determinants of Indonesian Share Price: Do

Capital Structure, Sales Growth, and

Profitability Matter?

Nicodemus Simu and Anneke Margaret Pangaribuan

Asian Banking Finance and Informatics Institute Perbanas, Jakarta, Indonesia

Abstract Conversely, when the company’s financial performance

This research is aiming at discovering the direct and is not good, the investors’ expectation becomes low,

indirect effects of capital structure and sales growth and investors are not attracted to invest in the shares. In

on share price with profitability as the mediating a nutshell,share price becomes an indicator of investors’

variable. This research studied 26 companies listed in expectation of a company’s performance and its

LQ45 index from 2016–2017. They were selected by potential improvement in the future.Generally, there are

using purposive sampling method. Fifty-two some internal and external factors which affect the tug

observation data were analyzed using path analysis. of war over the (potential) investors’ supplies and

The hypothesis testing on the first substructure demands which influence the share price. The internal

equation results in the conclusion that both capital factors are the price influencing factors source from

structure and sales growth have no significant effects within a company, whereas the external factors are

on profitability. On the second substructure equation, those price influencing factors originating from outside

capital structure and sales growth also have no the company.

significant effects on share price. However,

This present research focuses on the effects of the

profitability has significant positive effects on share

internal factors on the dynamics of share price

price. By using Sobel test, the mediating effects of

movements which are directly and indirectly mediated

profitability on the effects of capital structure and

by other internal factors. The internal factors are

sales growth on share price could not be confirmed.

capital structure, sales growth, dan profitability level.

Capital structure shows the financing sources of a

Keywords:capital structure,sales growth,profitability,

company. A company which use borrowed capital to

share price

fund its productive investments can have positive

outcomes because the company’s leverage can

I. INTRODUCTION multiply their income to a higher level in comparison

Share price is an indicator to measure the corporate with the incurred fixed cost from the borrowed capital

management performance. The pricereflects the tug of (Tally, 2014). The positive outcomes arethe increase

war between investors in their bids and asks for the of earnings and the rise of the share price. These

share price. In general, a company’s share price outcomes also signify an increase in the shareholders’

reflects investors’ perception of the company’s value. well-being (Tanni, 2012). On the other hand, negative

The higher a company’s share price is, the better the outcomes are inevitable when the company cannot

investors’ perception of the company is. On the other balance the increasing debts with productive

hand, a low share price which tends to decrease investment, or, worse still, the increasing debts

reflects the poor performance or imperfect reputation becomes counterproductive burden on the company’s

of the company.A shareholder who is dissatisfied with finance. Previous research by Onyema and Oji (2018)

the company’s performance can sell his shares and concluded that financial leverage has no significant

invest the money to another company. This condition effects on profitability. In addition, high leverage

may be communicable to other shareholders which reflects higher risks to the company itself; thus,

cumulatively can put selling pressure to the company’s investors tend to avoid investing in companies with

shares, and eventually it causes the share price to fall. high financial leverage (Bailia, Tommy, &Baramuli,

2016).

Share price becomes important to investors as it has

economic consequences. Changes in share price can Sales growth, an output of a company’s performance

alter the market value which also change the investors’ in the past, can be in the forms of investment in fixed

opportunities in the future. Share price is set based on assets and sales capacity. Therefore, sales growth data

the supplies and demandsin the market. Demands of can be used to predict sales growth in the future

shares are influenced by investors’ expectation of the (Clarensia, Rahayu, &Azizah, 2012; Chandra &

share issuer (the company). The better the performance Veronica, 2018). A constant increase of sales growth

of the share issuer, the higher the expectation of the is an indicator that a company still has the opportunity

investors is. This causes the company’s share to be to achieve higher performance level and better

attractive, and its price become increasingly high. prospects (Hayati, Simbolon, Situmorang, Haloho,

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 174

&Tafonao, 2019). A high level of sales is a basic (Carvalho& Costa, 2014). High sales level is basically

indicator that a company can increase its profitability a metric to indicate market penetration level of the

which can motivate the investors’ interests in buying company’s products, and it is usually followed by

the company’s shares (Chandra & Veronica, 2018). significant sales growth. Therefore, sales growth

reflects the company’s success in its investment in

Profitability indicates whether a company’s

previous period, and it can be used to predict the

performance is good or bad (Utami&Prasetiono,

company’s growth in the future (Sambharakreshna,

2016). A good performance of a company can attract

2010; Clarensiaet al., 2012; Chandra & Veronica,

investors to invest their money (Alipudin&Oktaviani,

2018).

2016), and this can affect the fluctuation of the

company’s share price (Vonna, Islahudin, &Musnadi, By identifying the sales growth quantity, a company

2016). can predict the amount of earnings it willhave. A good

sales growth can stimulateimprovement ofthe

II. LITERATURE REVIEW & HYPOTHESIS company’s profitability. Previous research by Ali,

Hussin, andGhani (2019) concluded that an increase of

A. Capital Structure and Profitability

sales growth can moderately increase profitability

Capital structure of a company is related to the measured by ROA, and, in general, continuous sales

decisions to develop its policies on sources of capital growth can affect return on equity. This conclusion is

funding. Kipesha and Moshi (2014) are of the opinion in line with those of Shintya, Situmorang, and Iryani

that the decision on using a particular source of (2017) and Suryaputra and Christiawan (2016) which

funding can have different effects on the company’s state that sales growth has a significant positive effect

performance. Thus, the company must try to formulate on profitability. Thus, the hypothesis is formulated as

the best combination of debt and equity to maximize follows.

the company’s market value (Voulgaris, Asteriou,

H2: Sales growth has a significant positive effect on

&Agiomirgianakis, 2002). In other words, capital

profitability.

structure involves an important funding policy which

generally can affect the earnings performance or can C. Capital Structure and Share Price

be used to maximize the shareholders’ well-being

Capital structure is basically a company’s financial

(Onyema& Oji, 2018). A company uses debts to

framework which combines debt and equity capital of

finance its investment, its expenses, and its efforts to

the company (Uwalomwa&Uadiale, 2012). The capital

increase sales. The financing policy of a company

structure of a company is shown by comparing its total

manifested in the amount of DER implicitly indicates

debts to the total shareholders’ equity or commonly

the amount of the company’s liabilities in terms of

known as the debt to equity ratio (DER).

principal payment and interest expenses which

cumulatively becomes financial liabilities and affects A company has the freedom of choosing the most

the amounts of the company’s earnings. suitable capital structure which can increase its share

price (Andow&Wetsi, 2018). However, it is important

Previous research has confirmed that a financing

to note that capital structure is also an indicator of a

policy which is suitable for a company may not be

company’s financial risks. When a company uses

suitable for others (Onyema& Oji, 2018). For a

bigger amount of borrowed capital for its

company, a higher debt ratio in its capital structure can

operationswhich means it has a higher capital structure

yield profitable results when the company gains

ratio, it faces higher financial risks because of the

positive difference because the economic rentability

intensity of cash outflow for loan principal payment

level of the company is higher than the interest level of

and for interest expense payment.

its debts. In this case, using borrowed capital is more

favorable and can give more value added which is When a company’s long-term loan is getting bigger,

more profitable for the shareholders. In other words, the company may face potential liquidity disruptions

when the economic situation is good, a greater use of in the future. The disruptions emerge because the

debtscan increase profitability, and the increase of company places a higher priority on using its earnings

capital structure can affect a company’s financing to pay the loan and its interests, rather than using the

performance which increases the company’s earnings to pay dividends (Alipudin&Oktaviani,

earnings(Felany&Worokinasih, 2018). Based on the 2016). When this happens, the share price of the

opinion, the following hypothesis needs to be tested: company may come under pressure, and, eventually, it

will have an effect on the investors’ lack of interests to

H1: Capital structure has a significant positive

buy the shares.This statement is confirmed by

effecton profitability.

Widayanti and Colline (2017) and Andow and Wetsi

B. Sales Growth and Profitability (2018). Thus, the hypothesis to be tested is as follows.

Sales is the main operation and source of income for a

company which relies on the sales to generate

earnings. Sales growth is the increase of current sales

from the previous year’s sales stated in percentage

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 175

H3 : Capital Structure has a significant the increase of profitability indicates the company’s

negative effect on share price financial performance is good, and its share price will

also increase. Based on this explanation, the

D. Sales Growth and Share Price

hypothesis to be tested can be formulated as follow.

A company with high sales growth will be able to

H5: Profitability has a significant positive effect on

fulfill its financial obligations (Clarensia et al., 2012).

share price

It is generally accepted that high sales growth affects

the increase of the company’s earnings which can F. Profitability Mediates the Effect of Capital

motivate the investors’ intention to buy the company’s Structure on Share Price

shares. In other words, the company’s growth

Capital structure of a company influences its

measured by the sales growth can affect the

profitability. An increase in capital debts followed by

company’s value or its share price because the

returns which are higher than the incurring interest

company’s growth indicated positive improvement of

expenses will directly increase the company’s net

the company which will receivepositive responses

income and, of course, its earnings. High earnings

from the investors (Bailia et al., 2016).

indicate the company is efficiently well-managed. This

A company’s sales growth shows the company’s will be the reason why (potential) investors are

condition externally. The rise of a company’s sales attracted to invest their money in the company, and,

growth indicates the company runs its operation this interests in buying the shares can boost the share

properly. The company’s ability to run a business price.From the brief explanation, it is suggested that

properly gives a positive signal to the investors that it profitability can mediate the influence of capital

has good prospects in the future (Chandra & Veronica, structure on share price. Thus, the hypothesis to be

2018). If the company’s sales growth keeps on tested is as follows.

increasing annually, the company has the prospects of

surviving and successful because sales growth affects H6: Profitability mediates the effect of capital

structure on share price

the increase of earnings and will draw the investors’

interests to buy its shares (Clarensia et al., 2012). G. Profitability Mediates the Effect of Sales Growth

Thus, the hypothesis to be tested is as follows. on Share Price

H4: Sales growth has a significant positive effect on Sales growth reflects the investment success in the

share price. previous period, and it can be used to predict the sales

growth in the next period. The high level of sales

E. Profitability and Share Price

growth reached by a company is one of the indicators

Profitability is a company’s ability to generate that the company is able to run its operations properly.

earnings. Profitability is also a measurement of The increase in sales growth of a company which is

efficiency because the higher the profitability of a balanced with the increase of current year earningsis a

company is, the more efficient the company uses its positive indicator which can motivate the investors to

assets (Alipudin&Oktaviani, 2016). Profitability is the buy the company’s shares which, eventually, increases

company’s main appeal in order to attract potential the share price.Based on the brief explanation, the

investors who are ultimately concerned about current hypothesis to be tested is formulated as follows.

earnings, future earnings, and earnings stability. In this

H7: Profitability mediates the effect of sales growth

case, investors must really take profitability into

on share price

consideration because it determines the company’s

prospects.Every company will always try to increase

III. RESEARCH METHOD

its performance and generate great earnings which

The research populations were companies listed in

enable the company to continue its operations and to

LQ45 index of Indonesia Stock Exchange from 2016–

grow. For investors, high profitability of a companyis

2017 (four publication periods). The purposive sampling

a signalthat the company’s operations, investments,

method was used to select the samples with five criteria:

and financing are well-managed. This will eventually

companies which were consistently listed in LQ45 stock

increase the company’s share price, and directly

category from 2016–2017; companies which were

increase the company’s value (Barakat, 2014).

regularly published their audited financial statements

Consistent reports on high earnings for some periods from 2016–2017; companies which did not perform

can attract investors to buy the company’s shares. That corporate action of stock repurchase from 2016–2017;

is why profitability is considered as one of the internal companies which did not belong to the category of the

factors which affects the level of attractiveness of service companies or banking companies; and

certain shares because their profitability indicates the companies which did not generate negative earnings

productivity of the company’s assets to generate from 2016–2017. Based on the sampling criteria, there

earnings (Chandra & Veronica, 2018). When some were 26 companies selected as the samples. The data

investors think that a share is attractive and worthy to were collected annually; thus, it created 52 observation

be invested in, there will be buying pressure which data.

eventually can increase the share price. In other words,

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 176

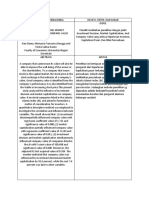

The present research is a quantitative research using Figure 1: Conceptual Framework

secondary data from the companies’ stock reports and

annual reports. The data were analyzed by using the

multiple linear regression statistical technique to test Debt to

Equity Ratio

the influence significance of the independent

(X1)

variableson the dependent variable. In addition, the

data were also analyzed using the path analysis to test Return Share

the direct and indirect influence of the exogenous on Asset Price(

variable on the endogenous variable through the (X3) Y)

endogenous mediating variable. The path analysis was

also used to measure the direct and indirect

relationships between variables in the model. Sales

Growth

Based on the hypothesis development, Figure 1 (X2)

illustrates the conceptual framework of this present

research.

Table 1 summarizes the variables used in this present

research, their operational definitions, types, and the

measuring indicators.

Table 1: Operational Variables

Variables Operational Definitions Types of Variables Measuring Indicators

Share Share market price during the closing Endogenous Variable Indonesian Rupiah (Rp)

Price of semester 1 and 2 from 2016–2017. or IDR

(SP)

Return on Description of the company’s ability Endogenous Net income

ROA

Assets to generating profits with its available mediating variable Total asset

(ROA) assets.

Capital The relative proportion of total Exogenous variable Total Debts

DER

Structure liabilities and common stock equity Total Equity

(DER) used to finance the firm’s total assets.

Sales The increased sales and services Exogenous variable

SG Sales

Salesit - Salesit -1

Growth between the current and previous year it -1

(SG) in percentage.

The present research used path analysis which is an The second substructure equation is as follows.

extension of multiple linear regression analysis used to

SP = β0 + β₁ DER + β₂ SG + β₃ ROA + ∊₂

predict the causality relationship between the variables

which had been determined based on the theory. The Where:

data were processed using Eviews 9. SP = Share Price

DER = Capital Structure

The first substructure equation is presented as follows.

SG = Sales Growth

ROA = β0 + β₁ DER + β₂ SG + ∊₁ ROA = Profitability

β0 = Constant term

Where:

β₁ , β₂ , β₃ = are slope to be estimated

ROA = Profitability

∊₂ = Component unobserved error term

DER = Capital Structure

SG = Sales Growth

IV. RESULTS AND DISCUSSION

β0 = Constant term

The descriptive statistics of the first and second

β₁ , β₂ = are slope to be estimated

substructures are summarized in Table 2.

∊₁ = Component unobserved error term

Table 2:Descriptive Statistics

Share Price DER SG ROA

Mean 8.1572 46.4734 19.9634 10.4875

Median 7.8709 37.5300 9.9000 7.4750

Maximum 10.9313 188.2200 110.6000 46.1700

Minimum 6.1903 0.0000 -23.0000 1.2000

Std. Dev. 1.0787 44.4566 27.0501 10.5936

Observations 52 52 52 52

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 177

The results of descriptive statistics of the 52 sufficient to generate regression equations with fairly

observation data as shown in Table 2 describe the accurate estimation, unbiased, and consistent.

movements of each variable which becomes the

The use of E-views in processing data requires that

subject of this present research. The summary of each

Chow test, Hausman test, and Lagrange Multipllier test

variable is explained briefly as follows.

were undergone to determine the accuracy of one of

First, the share price mean of the observed companies the models, i.e. common effect (CE), fixed effect (FE),

from 2016–2016 is 8.1572, and the price range is or random effect (RE), which would be used. The

between 6.1903 (minimum price) and 10.9313 results show that the fixed effect model is more

(maximum price). The standard deviation is suitable to be used for the first substructure equation,

1.078705. By examining the movements of price whereas the random effect model is more suitable to be

which is rather tight, and the standard deviation used for the second substructure equation.

which is close to 0, it can be concluded that the

The results of the data processing are shown in Table 3

observed shares had not been confirmed as shares

and Table 4 to create regression equation in

with high liquidity. The shares are supposed to be

accordance with path analysis.

listed in LQ45 which is an index of 45 shares which

meet several criteria, two of which are the intensityof Table 3:Panel Data Regression of the First

the trading days and/or the frequency of transactions. Substructure

Second, the mean of DER is 46.4734, and the standard Std. t-

Variable Coefficient Prob.

deviation is 44.4566. The maximum DER is 188.2200 Error Statistic

as attained by PT WaskitaKarya in 2017. The C 1.8261 0.1916 9.5295 0.0000

minimum DER is 0.0000 which was attained by PT DER 0.0018 0.0039 0.4740 0.6398

MatahariDepartemen Store in 2016 and PT PP London SG 0.0028 0.0026 1.0906 0.2862

Sumatra Indonesia in 2017. This minimum DER at

0.0000 indicates that both companies did not use any The regression equation for the first substructure is

borrowed capital in financing their operations. formulated as follows.

Third, the sales growth of the observed companies ROA = 1.8261 + 0.0018 DER + 0.0028 SG

range from -23.0000 to 110.6000, and the mean of

growth is 9.96346%. The highest sales growth was The first hypothesis states that capital structure has a

booked by PT JasaMargaPersero in 2017. The data significant positive effect on profitability. Some

also shows a company, PT AKR Corporindo, which studies suggest that when DER value increases, ROA

gained negative growth in 2016. However, with also increases. Thismeans that the companies with

standard deviation at 27.0501, it is normally massive borrowed capitals are able to manage their

considered that the entire sales growth is in positive business properly so that they can yield great earnings

level. In other words, even though the sales growth as shown by the increase of their ROA. In Table 3,

shows very high variations, the 26 observed companies DER coefficient is .0018, and the Prob. is 0.6398. This

still demonstrate the performance of companies with indicates that although the coefficient value is positive,

big capitalization which can still maintain positive the first hypothesis is rejected because Prob. > 0.05.

sales growth. This means capital structure has no significant effect

on profitability.

Fourth, the mean of ROA is 10.4875, and the standard

deviation is 10.5936. The maximum ROA is 46.1700 Companies’ financing policies which are reflected in

which was booked by PT MatahariDepartemen Store their debt equity to ratio (DER) can influence the

in 2016 which also reported 0% debts in its capital amount of earnings gained by the companies. The

structure in the same year. This means the lower debts companies which become the objects of this research

(0%) might cause the company to gain the highest belong to several sectors, one of which is property

ROA in that period. On the other hand, the minimum sector whichhas a typical of an industry thatuses debts

ROA of 1.2000 was attained by PT LippoKarawaci in as the major source of its capital. The use of debts

2017. This result is relevant because the company had which incur higher expenses than the cost of equity

big capitalization. In general, it is proved that allthe will motivate the increase in weighted average cost of

observed companies’ sharesare still valid to be used as capital. If this happens, a company will have to pay

investment instruments as they can still generate much bigger expenses to cover the company’s

earnings. liabilities, particularly the long-term debts. The

condition becomes the burden for the company and

The assumption generated bymultiple linear regression reduces its profitability.

analysis must be tested by usingthe Jarque-Bera test to

test the data normality, centered VIF to test The second hypothesis states thatsales growth has a

multicollinearity, Glejser test to test heteroscedasticity, significant positive effect on profitability. The data in

and Durbin-Watson test to test the autocorrelation. Table 3 shows SG coefficient is 0.0028, and the Prob.

Using E-views, the test results show the data are quite is 0.2862 which is > 0.05. This indicates that the

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 178

effect of SG on profitability is positive but by investors because of the incurring interest expenses

insignificant. Thus, the second hypothesis is rejected. which have to be paid by the company. The risks

reduce the investors’ interests to invest, and they

Sales growth, basically, can be used as the basisfor a

maycause the fall of the share price.

projection of the total of profits that will be gained in

current year earnings with an assumption that good Once again, it appears that there is a tug of war

sales growth can boost an increase in between factors which can increase the share price and

earnings.Nonetheless, sales growth is not an factors which can decrease the share price. This

independent variable as it may influence or be present research also shows that there is a balance of

influenced by other factors. In general, the perceptions between investors who believe that the

consequence of sales growth is an increase of company is still in the stage of business development

expenses used to achieve the sales growth, such as and those who believe that an increase in debts can put

development costs, promotion costs, or distribution a burden on the company in the long run, and,

costs, not to mention the possible costs for therefore, the investors are not interested in buying the

purchasing certain assets driven by necessity. shares. Worse still, they may even sell their current

shares instead.

This present research shows that sales growth is not

the main factor for the increase in profitability. On The fourth hypothesis states that sales growth has a

one side, sales growth can boost an increase in significant positive effect on share price. Sales growth

profitability. On the other hand, the increase in reflects the investment success in the previous period,

profitability is proved to be achieved by paying for and it can be used to predict the sales growth in the

all the incurring expenses. In the end, the projected next period. The high level of a company’s sales

potential profitability decreases to a lower level. growth is an indicator that the company is able to run

the business properly, and this positive indicator

Table 4: Panel Data Regression of the Second

becomes the basis of investors’ argumentation to buy

Substructure

the company’s shares.

Variable Coefficient Std. t-Statistic Prob.

Error Table 4 shows the sales growth coefficient is -0.0018

C 7.8102 0.2630 29.6859 0.0000 in a negative number. This shows that the higher the

DER 0.0016 0.0023 0.6914 0.4926 sales is, the lower the share price is. The prob. is

SG -0.0018 0.0017 -1.0306 0.3079 0.3079 which is > 0.05. This fact proves that sales

ROA 0.0293 0.0115 2.5354 0.0145 growth has no significant effect on share price; thus,

the fourth hypothesis is rejected. The result of this

present research also confirm the assumption that high

The regression equation for the second substructure is

sales growth is considered as a burden for the

as follows.

company. Essentially, high sales growth is not

identical with high income. For new products or

Share Price = 7.8102 + 0.0016 DER – 0.0018 SG +

products with low market attractiveness, it would take

00293 ROA

tremendous efforts to make the products be recognized

and demanded by the market. One of the common

In Table 4, DER is 0.0016 with Prob. 0.4926. The third

efforts is to apply certain promotion strategies which,

hypothesis states that DER (capital structure) has a

significant negative effect on share price. The Prob. of course, need a lot of money. Another way to boost

0.4926 is much higher than the 0.05 parameter. This sales growth is by giving discounts. This is commonly

indicates that capital structure has no significant effect used by companies to reach the short term objectives,

on share price. Thus, the third hypothesis is rejected i.e. to meet the sales target. However, Jackson &

because it is proved that investors did not use capital Wilcox (2000) assert that this discount policy will

structure as one of the determinants of the decision to result in negative long-term effects to the company

invest in certain companies’ shares. because by giving discounts, the buyers get higher

A company’s DER is a comparison of its leverage bargaining power. They will be accustomed to this

discount policy, and they will buy the products only if

level (total debts use) with its total equity (its own

capital). When DER is higher than 1.00, it indicates the they are sold at a discount. Furthermore, by applying

total debts is higher than the equity. In general, DER this discount policy, the company is led into a price

competition with other similar companies. In the long

value can indicate the extent of efforts done by the

company management to develop its business in order run, the discount policy will inevitably entrap the

to increase earnings or to maximize the company’s company further into a financial problem as the policy

value. If investors believe in this perception, their will reduce its earnings. From this perspective, it is

interests to invest will become higher. This will reasonable that some investors do not consider sales

increase their buying transactions which eventually growth as one of the determinants of their investment

decisions.

increase the share price. On the other hand, a high

DER value also reflects the amount of the company’s The fifth hypothesis states that profitability has a

liabilities and shows that the company relies on significant positive effect on share price. The higher

external capital sources. This increases the risks faced the earnings of a company are, the more obvious it is

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 179

that the company is well-managed and efficient. It is therole of profitability as the mediator of capital

also obvious that the company has the potential for structure and sales growth effects on the share price.

reaping high earnings in the future. This kind of The values are below 1.98 with significance level at

perception becomes the basic motivation for the 5%. Thus, it can be concluded that profitability and

investors to buy the shares, and this will cause an sales growth do not mediate the effects of capital

increase in the share price. structure on share price. This means hypothesis six

and hypothesis seven are rejected.

In Table 4, the ROA coefficient is 0.0293 which

indicates that profitability has positive effect on share

V. CONCLUSION

price. The Prob, is 0.0145 which is lower than 0.05

Based on the discussion, an empirical conclusion

parameter. Thus, it can be concluded that profitability

which can be drawn from this present research is that,

has a significant positive effect on share price, and the

partially, capital structure and sales growth have no

fifth hypothesis is accepted. A company with higher

significance effects on profitability and share price.

ROA indicates that the company is able to utilize its

However, the findings confirmed that profitability

assets to generate earnings which means high ROA can

has significant effects on share price. The present

increase profitability or the company’s earnings.

research also studied profitability as the mediating

Companies with high ROA will increase the investors’

variable between capital structure and sales growth

trust and attract investors to invest money in the

on share price.The findings show that profitability

companies’ shares. The more investors make

does not mediate the effects of capital structure and

investments in a company, the higher the share price of

sales growth on share price.

the company will be.

The findings confirm the indication that the earnings

To test the role of profitability as the intermediating

variable or profit is an important variable which

variable of share price dynamics, this present research

needs to be taken into consideration when investors

used Sobel test. The standard formulation of the Sobel

want to invest in certain shares. Companies should

test is as follows.

take specific measures to increase their abilities to

ab generate earnings because earnings affect the increase

Z= of the companies’ value and the shareholders’ well-

(b SE ) (a 2 SE 2b )

2 2

a being. Therefore, the companies should apply

suitable strategies to control various internal factors

Where: which can affect the companies’ abilities to generate

a = regression coefficient of the independent earnings, including the ability to control costs (e.g.

variable against the mediating variable interest expenses).

b = regression coefficient of the mediating

REFERENCES

variable against the independent variable [1] Alipudin, A., &Oktaviani, R. (2016). Pengaruh EPS, ROE,

SEa= standard error of estimate from the effect of ROA dan DER terhadap harga saham pada perusahaan

the independent variable on the mediating variable subsektor semen yang terdaftar di BEI. Jurnal Ilmiah

SEb= standard error of estimate from the effect of Akuntansi Fakultas Ekonomi (JIAFE), 2(1), 1–22

[2] Ali, M. M., Hussin, N. N. A. N., &Ghani, E. K. (2019).

the mediating variable on the dependent variable Liquidity, growth and profitability of non-financial public

listed Malaysia: A Malaysian evidence [Special issue].

The first test placed the profitability variable as the International Journal of Financial Research, 10(3), 194–202.

mediating variable on the effects of capital structure [3] Andow, H. A., &Wetsi, S. Y. (2018). Capital structure and

share price: Empirical evidence from listed deposit money

on the share price. The results is as follows. banks (DMB) in Nigeria. International Journal of New

Technology and Research (IJNTR). 4(2), 95–99.

0.0018 x 0.0293 [4] Bailia, F. F.W., Tommy, P., &Baramuli, D. N. (2016).

Z= Pengaruh pertumbuhan penjualan, dividend payout ratio dan

(0.02932 x 0.00392 ) (0.00182 x 0.01152 ) debt to equity ratio terhadap harga sahampa daperusahaan

property di Bursa Efek Indonesia. Jurnal Berkala Ilmiah

Efisiensi, 16(03), 270–278.

Z = 0.4541 [5] Barakat, A. (2014). The impact of financial structure,

financial leverage, and profitability on industrial companies

Using the same equation, Z value is estimated to test shares value: Applied study on a sample of Saudi industrial

the effect of sales growth on the share price with companies. Research Journal of Finance and Accounting,

5(1), 55–66.

profitability as the mediating variable. The result is [6] Carvalho, L., &Costa, T. (2014). Small and medium

shown as follows. enterprises (SMEs) and competitiveness: An empirical study.

Journal of Management Studies, 2(2), 88–95.

0.0028 x 0.0293 [7] Chandra, S., & Veronica, S. (2018). The effect of CR, DER,

Z= EPS, ROA, and sales growth on stock prices of

(0.0293 2 x 0.0026 2 ) (0.0028 2 x 0.01152 ) manufacturing companies. Bilancia, 2(3), 343–354.

[8] Clarensia, J., Rahayu, S.,&Azizah, N. (2012). Pengaruh

Z = 0.9920 likuiditas, profitabilitas, pertumbuhan penjualan, dan

kebijakan dividen terhadap harga saham: Studi empirik pada

From the Sobel test, the Z from each test is 0.4541 perusahaan manufaktur yang terdaftar di Bursa Efek

and 0.9920 respectively as they are used to test Indonesia tahun 2007–2010. Jurnal Akuntansidan Keuangan,

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 180

1(1), 72–88.

[9] Felany, I. A.,&Worokinasih, S. (2018). Pengaruh perputaran

modal kerja, leverage dan likuiditas terhadap profitabilitas.

Jurnal Administrasi Bisnis (JAB), 58(2), 119–128.

[10] Hayati, K., Simbolon, A. K. A. P.,Situmorang, S., Haloho, I.,

&Tafonao, I.K. (2019). Pengaruhnet profit margin, likuiditas

dan pertumbuhan penjualan terhadap harga saham pada

perusahaan manufaktur yang terdaftar di Bursa Efek

Indonesia Periode 2013–2017. Owner:Riset&Jurnal

Akuntansi, 3(1), 133–139.

[11] Jackson, S. B., & Wilcox, W. E. (2000). Do managers grant

sales price reductions to avoid losses and declines in earnings

and sales? Quarterly Journal of Business and

Economics, 39(4), 3–20. Retrieved November 11, 2019, from

http://www.jstor.org/stable/40473306

[12] Kipesha, E. F., & Moshi, J. J. (2014). Capital structure and

firm performance: Evidences from commercial banks in

Tanzania. Research Journal of Finance and Accounting,

5(14), 168–178.

[13] Onyema, J. I., &Oji, J. U. (2018). Financial leverage and

profitability of quoted food and beverage companies in

Nigeria. International Journal of Research in Economics and

Social Sciences (IJRESS), 8(9), 46–60.

[14] Sambharakreshna, Y. (2010). Pengaruh size of firm, growth

dan profitabilitas terhadap struktur modal perusahaan. Jurnal

Akuntansi, Manajemen Bisnisdan Sektor Publik

(JAMBSP),6( 2), 197–216.

[15] Shintya, M. N., Situmorang, M.,&Iryani, L. D. (2017).

Analisis pengaruh leverage dan pertumbuhan penjualan

terhadap profitabilitas pada perusahaan subsector kosmetik

yang terdaftar di Bursa Efek Indonesia. Jurnal Online

Mahasiswa (JOM) Bidang Akuntansi, 2( 2),1–11.

[16] Suryaputra, G.,&Christiawan, Y. J. (2016). Pengaruh

manajemen modal kerja, pertumbuhan penjualan danukuran

perusahaan terhadap profitabilitas pada perusahaan property

dan real estate yang terdaftar di Bursa Efek Indonesia (BEI)

tahun 2010–2014, Business Accounting Review, 4(1), 493–

504.

[17] Taani, K., (2012). Impact of working capital management

policy and financial leverage on financial performance:

Empirical evidence from Amman Stock Exchange–listed

companies. International Journal of management sciences

and Business Research,1(8), 10–17.

[18] Tally, H., (2014). An investigation of the effect of financial

leverage on firm financial performance in Saudi Arabia’s

publiclisted companies. Unpublisheddoctoral thesis. Victoria

Graduate School of Business, Victoria University,

Melbourne.

[19] Utami, R. B., & Prasetiono, P. (2016). Analisispengaruh

TATO, WCTO, dan DER terhadap nilai perusahaan dengan

ROA sebagai variabel intervening. Jurnal Studi Manajemen

& Organisasi, 13, 28–43.

[20] Uwalomwa, U., &Uadiale, O. M. (2012). An empirical

examination of the relationship between capital structure and

the financial performance of firms in Nigeria.

Euroeconomica, 1(31), 57–65.

[21] Vonna, S. M., Islahuddin, I., &Musnadi, S. (2016).Pengaruh

profitabilitas, asset tetap, dan pertumbuhan penjualan

terhadap financial leverage serta dampaknya terhadap harga

saham pada perusahaan yang terdaftar di Bursa Efek

Indonesia. Jurnal Magister Akuntansi, 5(1), 21–31.

[22] Voulgaris, F., Asteriou, D., &Agiomirgianakis, G. M. (2002).

Capital structure, asset utilization, profitability and growth in

the Greek manufacturing sector. Applied Economics, 34,

1379–1388. Retrieved November 2, 2019, from

http://www.tandf.co.uk/journals

[23] Widayanti, R., &Colline, F. (2017). Pengaruh rasio keuangan

terhadap harga saham perusahaan LQ45 Periode 2011–2015.

BinaEkonomi, 21(1), 35–49.

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 181

You might also like

- Cebu PacificDocument13 pagesCebu PacificAce Peralta100% (2)

- BUSS 207 - Fall 2021: Quiz 5 (Chapter 5) Solution: Investment Rate CompoundingDocument3 pagesBUSS 207 - Fall 2021: Quiz 5 (Chapter 5) Solution: Investment Rate Compoundingtom dussekNo ratings yet

- Small Account Strategy DecisionDocument2 pagesSmall Account Strategy DecisionSinagaNo ratings yet

- INDO WIND POWER - INFORMATION MEMORANDUM (March 2014) (Contractors)Document85 pagesINDO WIND POWER - INFORMATION MEMORANDUM (March 2014) (Contractors)Ronny FitriadiNo ratings yet

- The Effect of Company Size, Sales Growth, Current Ratio (CR), Net Profit Margin (NPM) and Return On Equity (Roe) On Stock PricesDocument9 pagesThe Effect of Company Size, Sales Growth, Current Ratio (CR), Net Profit Margin (NPM) and Return On Equity (Roe) On Stock PricesNouf ANo ratings yet

- The Effect of Capital Expenditure Company Growth ADocument9 pagesThe Effect of Capital Expenditure Company Growth AVira FernandaNo ratings yet

- 50744-Article Text-156349-1-10-20220217Document8 pages50744-Article Text-156349-1-10-20220217Vira FernandaNo ratings yet

- The Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableDocument8 pagesThe Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Artikel 2015030013Document14 pagesArtikel 2015030013Machine LaundryNo ratings yet

- NI LUH 2021 Company Value Profitability ROADocument11 pagesNI LUH 2021 Company Value Profitability ROAFitra Ramadhana AsfriantoNo ratings yet

- Capital Structure and Firm Size On Firm Value Moderated by ProfitabilityDocument18 pagesCapital Structure and Firm Size On Firm Value Moderated by Profitabilityrahmat fajarNo ratings yet

- Andy,+Journal+Manager,+Jurnal+ +Mario+HasangaponDocument15 pagesAndy,+Journal+Manager,+Jurnal+ +Mario+HasangaponDiendra Lintang MahersiNo ratings yet

- Jurnal Pendukung 13 (LN)Document16 pagesJurnal Pendukung 13 (LN)Natanael PranataNo ratings yet

- Jurnal ProfitabilitasDocument15 pagesJurnal ProfitabilitasDiah UtianiNo ratings yet

- Jurnal Inter (CZ) 2Document5 pagesJurnal Inter (CZ) 2Siwi SariNo ratings yet

- 677 1861 1 PBDocument13 pages677 1861 1 PBAulia Rachmadhini FaizNo ratings yet

- E-Jurnal Rya Adi AstutiDocument10 pagesE-Jurnal Rya Adi AstutiryadiasNo ratings yet

- The Effect of Profitability, Firm Size, Leverage and Firm Value On Income SmoothingDocument6 pagesThe Effect of Profitability, Firm Size, Leverage and Firm Value On Income SmoothingAJHSSR JournalNo ratings yet

- Jurnal Inter 6Document7 pagesJurnal Inter 6STEFFANINo ratings yet

- Rachmi - DividenDocument11 pagesRachmi - DividenFita Dwi LestariNo ratings yet

- Profitability, Capital Structure, Managerial Ownership and Firm Value (Empirical Study of Manufacturing Companies in Indonesia 2016 - 2020)Document7 pagesProfitability, Capital Structure, Managerial Ownership and Firm Value (Empirical Study of Manufacturing Companies in Indonesia 2016 - 2020)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Investment Decisions Funding Decisions and ActivitDocument16 pagesInvestment Decisions Funding Decisions and ActivitGONZALO ANDRE RIVERO MALATESTANo ratings yet

- Management Analysis JournalDocument12 pagesManagement Analysis JournalN NurilNo ratings yet

- The Effect of Capital Structure, Dividend PolicyDocument18 pagesThe Effect of Capital Structure, Dividend PolicyAmal MobarakiNo ratings yet

- The Effect of Debt Equity Ratio, Dividend Payout Ratio, and Profitability On The Firm ValueDocument6 pagesThe Effect of Debt Equity Ratio, Dividend Payout Ratio, and Profitability On The Firm ValueThe IjbmtNo ratings yet

- What's The Best Factor To Determining Firm Value?: Neneng Susanti (Indonesia), Nanda Gyska Restiana (Indonesia)Document9 pagesWhat's The Best Factor To Determining Firm Value?: Neneng Susanti (Indonesia), Nanda Gyska Restiana (Indonesia)Haibara Novelia PuspitaNo ratings yet

- Capital StuctureDocument9 pagesCapital StuctureSyahrial SarafuddinNo ratings yet

- The Effect of Institutional Ownership, Capital Structure, Dividend Policy, and Company's Growth On Firm ValueDocument9 pagesThe Effect of Institutional Ownership, Capital Structure, Dividend Policy, and Company's Growth On Firm ValueRinanti DANo ratings yet

- Analysis of The Effect of Profitability, Solvability, and Dividend Policy On Banking Firm ValueDocument10 pagesAnalysis of The Effect of Profitability, Solvability, and Dividend Policy On Banking Firm ValueverenNo ratings yet

- Jurnal Inter 2 DerDocument28 pagesJurnal Inter 2 DerHengky JunnawanNo ratings yet

- Analisis Pengaruh Profitabilitas, Strategi Diversifikasi, Dan Good Corporate Governance Terhadap Nilai PerusahaanDocument16 pagesAnalisis Pengaruh Profitabilitas, Strategi Diversifikasi, Dan Good Corporate Governance Terhadap Nilai PerusahaanEra ZsannabelaNo ratings yet

- Sigma: Journal of Economic and BusinessDocument8 pagesSigma: Journal of Economic and BusinessafrilianiNo ratings yet

- 1 SMDocument8 pages1 SMJonathan SangimpianNo ratings yet

- Ijebmr 847Document16 pagesIjebmr 847Amal MobarakiNo ratings yet

- 1326-Article Text-1446-1-10-20160730 PDFDocument5 pages1326-Article Text-1446-1-10-20160730 PDFbare fruitNo ratings yet

- Ni Putu Ayu Yuniastri I Dewa Made Endiana Putu Diah KumalasariDocument11 pagesNi Putu Ayu Yuniastri I Dewa Made Endiana Putu Diah KumalasariYunik ArsariNo ratings yet

- 3366 6773 3 PBDocument23 pages3366 6773 3 PBJepri SantosaNo ratings yet

- 01 Penelitian Bu Rina-Fithri (Inggris)Document17 pages01 Penelitian Bu Rina-Fithri (Inggris)kaka adikNo ratings yet

- Jurnal Dian Dan John EDocument14 pagesJurnal Dian Dan John EAdelyana MSNo ratings yet

- Effect of Firm Size and Capital Structure On The Value of The Company With Profitability As An Intervening VariableDocument11 pagesEffect of Firm Size and Capital Structure On The Value of The Company With Profitability As An Intervening VariableAJHSSR JournalNo ratings yet

- 1.yulius - Kurnia - Susanto With Cover Page v2Document8 pages1.yulius - Kurnia - Susanto With Cover Page v2dudung masterNo ratings yet

- The Influence of Financial Ratios and Firm Size On Firm ValueDocument6 pagesThe Influence of Financial Ratios and Firm Size On Firm ValueArif RahmanNo ratings yet

- Kinerja Keuangan Dan Ukuran PerusahaanDocument14 pagesKinerja Keuangan Dan Ukuran Perusahaanmelly nkmlsrNo ratings yet

- ManurungDocument6 pagesManurungMelvi FitriNo ratings yet

- 1 PBDocument6 pages1 PBverenNo ratings yet

- International Journal of Humanities and Social Science Invention (IJHSSI)Document6 pagesInternational Journal of Humanities and Social Science Invention (IJHSSI)inventionjournalsNo ratings yet

- Ijsred V2i1p36Document14 pagesIjsred V2i1p36IJSREDNo ratings yet

- CR Der Roa Dividend PolicyDocument12 pagesCR Der Roa Dividend Policyumar YPUNo ratings yet

- The Influence of Leverage Sales Growth A Fae2c17bDocument14 pagesThe Influence of Leverage Sales Growth A Fae2c17bRicalyn VillaneaNo ratings yet

- Nisasmara (CG)Document12 pagesNisasmara (CG)Gracia Pulcheria ValentinaNo ratings yet

- Jurnal 1-Article Text-5525-1-10-20201214Document10 pagesJurnal 1-Article Text-5525-1-10-20201214Diah ayu ristiningsihNo ratings yet

- Analysis of Factors Affecting Voluntary Disclosure and Company Value in Financial CompaniesDocument9 pagesAnalysis of Factors Affecting Voluntary Disclosure and Company Value in Financial CompaniesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effect of Profitability, Leverage, and Liquidity To The Firm ValueDocument12 pagesEffect of Profitability, Leverage, and Liquidity To The Firm Valueteuku masnur ramadhanNo ratings yet

- Iriena Maharani LaksitaputriDocument26 pagesIriena Maharani LaksitaputriBrillianNo ratings yet

- Analysis of Liquidity, Activity, LeverageDocument7 pagesAnalysis of Liquidity, Activity, Leveragetareq nikzadNo ratings yet

- Jurnal Ilmiah Internasional Etika BisnisDocument7 pagesJurnal Ilmiah Internasional Etika BisnisgempitaNo ratings yet

- Iriena Maharani Laksitaputri: JURNAL BISNIS STRATEGI L Vol. 21 No. 2 Desember 2012 1Document17 pagesIriena Maharani Laksitaputri: JURNAL BISNIS STRATEGI L Vol. 21 No. 2 Desember 2012 1AschanNo ratings yet

- Inter 1 PDFDocument12 pagesInter 1 PDFrizki efendiNo ratings yet

- Profitability, Growth Opportunity, Capital Structure and The Firm ValueDocument22 pagesProfitability, Growth Opportunity, Capital Structure and The Firm ValueYohanes Danang PramonoNo ratings yet

- 66 105 1 SMDocument9 pages66 105 1 SMs3979517No ratings yet

- CSR Negative Effect On Firm ValueDocument14 pagesCSR Negative Effect On Firm ValueLydia limNo ratings yet

- THE MEDIATING ROLE OF PROFITABILITY ON THE RELATIONSHIP FREE CASH FLOWANDLEVERAGE ON STOCK PRICING (Case Study On Manufacture Company, SubSectorsofConsumer in 2016 - 2019)Document15 pagesTHE MEDIATING ROLE OF PROFITABILITY ON THE RELATIONSHIP FREE CASH FLOWANDLEVERAGE ON STOCK PRICING (Case Study On Manufacture Company, SubSectorsofConsumer in 2016 - 2019)AJHSSR JournalNo ratings yet

- K. Naskah Publikasi PDFDocument23 pagesK. Naskah Publikasi PDFDwi NvcantikaNo ratings yet

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- Secrecy in Bank DEPOSITS (R.A. 1405) : One of The Most StrictDocument48 pagesSecrecy in Bank DEPOSITS (R.A. 1405) : One of The Most StrictAleah Jehan AbuatNo ratings yet

- Microfinance Report in MaharashtraDocument96 pagesMicrofinance Report in MaharashtraJugal Taneja100% (1)

- Gopal Krishna GokhaleDocument11 pagesGopal Krishna GokhalenaviNo ratings yet

- ValuationDocument20 pagesValuationNirmal ShresthaNo ratings yet

- Local Budget Circular No. 111 - Manual On The Setting Up and Operation of Local Economic Enterprises (Lees)Document3 pagesLocal Budget Circular No. 111 - Manual On The Setting Up and Operation of Local Economic Enterprises (Lees)Glaiza RafaNo ratings yet

- Big Secret of Intermarket TradingDocument7 pagesBig Secret of Intermarket TradingadolfinoNo ratings yet

- Tender Documents PKG 4 Shaheed Benazir Bhutto BridgeDocument133 pagesTender Documents PKG 4 Shaheed Benazir Bhutto BridgeAbn e MaqsoodNo ratings yet

- 05-30-15 SatDocument32 pages05-30-15 SatSan Mateo Daily JournalNo ratings yet

- Balance Sheet: (Company Name)Document2 pagesBalance Sheet: (Company Name)Bleep NewsNo ratings yet

- Contracts Outline - Siegelman - Fall 2011Document71 pagesContracts Outline - Siegelman - Fall 2011diemericNo ratings yet

- P.F. Nomination 2 (1) - SignedDocument2 pagesP.F. Nomination 2 (1) - Signedvijaybhaskar damireddyNo ratings yet

- Step by Step Sap GL User ManualDocument109 pagesStep by Step Sap GL User Manualkapil_73No ratings yet

- Chapter4 IA Midterm BuenaventuraDocument10 pagesChapter4 IA Midterm BuenaventuraAnonnNo ratings yet

- Review On Financial Statement AnalysisDocument6 pagesReview On Financial Statement AnalysisDanica VetuzNo ratings yet

- WSP Fulcrum Security Exercises VFDocument4 pagesWSP Fulcrum Security Exercises VFManeeshNo ratings yet

- Case Study of CM On BAHLDocument12 pagesCase Study of CM On BAHLMohsin RazaNo ratings yet

- RayeesDocument52 pagesRayeesAnshid ElamaramNo ratings yet

- Management AccountingDocument2 pagesManagement AccountingkabilanNo ratings yet

- Delpher Trades Corp v. IACDocument2 pagesDelpher Trades Corp v. IACkfv05100% (3)

- Comp-XM Basix Guide PDFDocument6 pagesComp-XM Basix Guide PDFJai PhookanNo ratings yet

- Testimony of Brian MoynihanDocument5 pagesTestimony of Brian MoynihanDealBookNo ratings yet

- Pradhan Mantri Kaushal Vikas YojanaDocument32 pagesPradhan Mantri Kaushal Vikas YojanaPreet SasanNo ratings yet

- 3 Firm Portfolio ExampleDocument12 pages3 Firm Portfolio ExampleRudy Martin Bada AlayoNo ratings yet

- Busoni Company Is A Wholesaler During One Accounting Period ItDocument1 pageBusoni Company Is A Wholesaler During One Accounting Period ItTaimour HassanNo ratings yet

- Graduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeDocument9 pagesGraduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeFrancis Kyle Cagalingan SubidoNo ratings yet

- Candle TradingDocument2 pagesCandle Tradingkaushikpoojari1012No ratings yet