Professional Documents

Culture Documents

SPEC 2 - Module 1

Uploaded by

Margie Anne ClaudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SPEC 2 - Module 1

Uploaded by

Margie Anne ClaudCopyright:

Available Formats

1

Aklan Catholic College

Flexible Learning System

SPEC 2

Fundamentals of Accountancy,

Business and Management 2

Learning Module 1

Mr. Aurelio C. Lopez Jr., CPA

Course Instructor

Contact information

Email: aurelio768@gmail.com

Mobile number: 09387770402

Facebook profile: Aurelio Castrence Lopez Jr.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

2

Aklan Catholic College

Archbishop Gabriel M. Reyes St.

5600 Kalibo, Aklan, Philippines

Tel. Nos.: (036)268-4152; 268-9171

Fax No.: (036)268-4010

Website: http://www.acc.edu.ph

E-mail Add: aklancollege@yahoo.com

ACC Flexible Learning System

Learning Module

Fundamentals of Accountancy, Business and

Management 2

Module no.: 1 of 2

FL Design: CorreL (Correspondence Learning)

Course Code & Title: SPEC 2 – Fundamentals of Accountancy, Business and Management 2

Course Description: This is the continuation of the first Fundamentals of Accountancy, Business and

Management 1. It provides the continuation of the accounting cycle from the preparation of adjusting entries,

preparation of financial statements, and up to preparation of closing and reversing entries. It also deals with

transactions, financial statements and problems related to the operations of a merchandising type of business.

Furthermore, it includes an introduction to the financial statements of a manufacturing concern.

Outcomes: At the end of the course the learner should have

1. Solved problems of a merchandising business.

2. Prepared the post-closing trial balance.

3. Analyzed the conceptual framework of accounting.

Introduction to the Module

This is Module 1 of 2 of the course SPEC 2 – Fundamentals of Accountancy, Business and Management 2. This

learner module is developed for the flexible learning program of Aklan Catholic College and programmed to run for at

least a week. This module tackles the first three outcomes of the course:

1. Solved problems of a merchandising business.

This module is primarily used at home and it takes advantage of task-based approach to learning and self-paced

learning. Success of learning would essentially depend on the collaboration between you and your instructor and

your commitment to self-directed learning.

It contains the (a) essential concept notes, (b) instructions to further readings and media, (c) quizzes, (d)

activities, (e) peer work, (f) reflection pages, (f) written test, and (g) task.

How to use this Module

Below is a learning program or sample learning cycle prepared by the module developer to help you navigate

your way through the module works. You are highly encouraged to follow the program to increase the success rate in

using the module.

It is very important that every time you begin work on your module that you begin with a prayer for guidance,

openness, clarity of mind, and wisdom. At the end of each module work, say a prayer of gratitude, guidance, and

passion to put into good use what you have learned. See the prayer page for the prayers we say before and after

each learning session.

As this module comes with reading materials and a dual flash drive containing learning media, you should study

thoroughly all the required readings and other media cited in the concept notes. All readings and media written in

bold in the concept notes can be found in the dual flash drive. If you have any issues in accessing the content of the

dual flash drive, please contact your instructor right away.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

3

You are also encouraged to study supplementary materials provided in the dual flash drive. It is wise that the you

review first the outline of the module and the guide questions in each lesson to get an overview of the module. This

will help you create a focus to facilitate answering the quizzes and written test and performing the activities and the

task in each lesson.

It is recommended that you complete two lessons a day so that you can have ample time to prepare for the

written test and for the task performance.

Sample learning cycle

To keep you on tract of your learning task, you can create a plan or program of your home-based learning.

Creating a routine or learning task will help you create a focus that is essential for your success in this learning

modality.

The table below is a sample of a personal learning plan. You are encouraged to use the same template or

create one that work better for you. It is also important to coordinate this schedule with your instructor and your

assigned peer.

Module 1 – Week 1

Day 1 Day 2 Day 3 Day 4

Course Mon Tue Wed Thu Fri

SPEC 2 • Opening prayer • Opening prayer

• Study all • Study all

8:00 am – 12:00 materials materials

noon • Answer quizzes • Answer quizzes

• Perform • Perform

activities activities

• Work with peer • Work with peer

• Write reflection • Write reflection

• Closing prayer • Closing prayer

Other Subjects • Opening prayer • Opening prayer

• Study all • Study all

materials materials

8:00-12:00 • Answer quizzes • Answer quizzes

• Perform • Perform

activities activities

• Work with peer • Work with peer

• Write reflection • Write reflection

• Closing prayer • Closing prayer

For activities that require writing, write legibly. For Learning Activity Sheets 1 and 3, you should necessarily need

to use an extra clean sheet of paper for your answers. For Learning Activity Sheets 2, you may write the letter of your

answer on the space before the item number. Extra sheets of paper should be inserted between the pages where the

activity can be found. Don’t forget to label these extra sheets with your name and the title of the activity.

Make sure to take all learning activity sheets with care and diligence. Some activities may be performed

individually while some activities may require collaboration with your peer.

For collaborative activities, called Peer work in this module, your instructor will provide the name and mobile

number of the students with whom you will collaborate. The Peer work is one of the most essential feature of this

module and will mean a lot for learning to succeed as we recognized that you can learn better if you share insights

and perspectives with another. The peer work may be done through phone calls or text messaging. If better channels

are accessible at the time of the activity such as chat or forum, make use of better channel. If connecting with your

designated peer through the most basic means is impossible, try your best to solicit ideas from members of your

household on the questions, statements, or instructions contained in the peer work.

Once you have completed this module, place this module and all required outputs for the week in the learning

packet to prepare them for collection. Make sure to recheck your submissions especially soft copies that you have

stored in the dual flash drive. If you are having any trouble in storing the files into your dual flash drive, please contact

your instructor right away.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

4

Course Requirements

1. Peer work (20%)

2. Quizzes (20%)

3. Activities (30%)

4. Written Test (30%)

5. Learning Journal

Other requirements

None

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

5

Table of Contents

Lesson 1: Analyzing the Transactions of a Merchandising Business

Intended Learning Outcomes …………………………………………………………………….. 6

Instructions …………………………………………………………………….. 6

Concept Notes …………………………………………………………………….. 6

Instructions for supplementary …………………………………………………………………….. 8

materials

Learning Activities 1 – Peer Work …………………………………………………………………….. 9

Learning Journal (LA1) …………………………………………………………………….. 11

Learning Activities 2 – Multiple Choice Exercises ……………………………………………………………….. 12

Learning Journal (LA2) …………………………………………………………………….. 15

Learning Activities 3 – Performance Task …... ……………………………………………………………….. 16

Learning Journal (LA3) …………………………………………………………………….. 19

Written Test …………………………………………………………………….. 20

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

6

Lesson 1

Analyzing the Accounting Process

I. Intended Learning Outcomes

At the end of this lesson, the learner will have

1. Reviewed the steps of the accounting process.

2. Solved problems reviewing the steps in the accounting process.

II. General Instructions

1. Read the guide questions

2. Study the concept notes and videos. Refer to materials cited for further understanding.

3. Study supplementary materials for additional information

4. Answer the Peer Work and Quiz. (p. 9/12/16)

5. Fill out the Learning Journal Sheet (p. 11/15/19)

III. Guide questions

Use these guide questions to navigate through the concept notes and additional readings and media.

Keep them in mind while studying. You can use a separate note to pick up answers and ideas from the

materials as you move along them.

1. What are the account titles used in a merchandising business that differ from that of a service-

oriented business?

2. How is the income statement of a merchandising concern presented?

IV. Concept Notes

Additional Account Titles

The account titles used by a merchandising business does not totally differ from that of a service type of

business. Typical account titles used for merchandising, in addition to that which were discussed for a

service type business, are as follows:

Income

a. Sales – revenues earned as a result of sale of merchandise.

b. Sales Returns – a contra account against sales, used when a customer returns goods previously

sold to the customer.

c. Sales Discounts – a contra account against sales, used when a customer pays within the discount

period, wherein this account reduces the amount to be paid by such customer.

Expenses

a. Cost of Sales – the cost incurred to purchase or to produce the products sold to customers during

the period; also called cost of goods sold.

b. Purchases – the cost of the goods acquired for resale from a supplier.

c. Purchase Returns – a contra account against purchases, used when the entity returns goods

previously purchased from a supplier.

d. Purchase Discounts – a contra account against purchases, used when the entity pays within the

discount period, wherein this account reduces the amount to be paid by the entity.

e. Transportation In/Freight In – the cost of transporting/delivering purchased goods from a supplier

to the entity.

f. Transportation Out/Freight Out – the cost of transporting/delivering sold goods from the entity to

the customer.

Asset

a. Merchandise Inventory – these are assets which are held for sale in the ordinary course of the

business. The account pertains to the cost of goods previously acquired/purchased but not yet sold

and still in the possession of the entity.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

7

Pro-forma Income Statement

Net Sales* xx

Cost of Sales** (xx)

Gross Profit xx

Operating Expenses*** (xx)

Operating Profit xx

Finance Costs (Interest Expense) (xx)

Net Income xx

*Net Sales computation

Gross Sales/Sales xx

Sales Returns and Allowance (xx)

Sales Discounts (xx)

Net Sales xx

**Cost of Sales computation

Merchandise Inventory, beg xx

Net Purchases

Purchases xx

Purchase Rets. and Allow. (xx)

Purchase Discounts (xx)

Net Cost of Purchases xx

Transportation In xx xx

Goods Available for Sale xx

Merchandise Inventory, end (xx)

Cost of Sales xx

***Transportation Out is part of Operating Expenses

Terms of Transactions

Merchandise may be purchased and sold either on cash or credit. Goods sold/acquired on credit have

certain credit terms which determines when the transaction should be paid. A credit term would normally

look like this:

“2/10, net/30”

The first part “2/10” determines the discount period (10 days) and the discount rate (2%). It means if we

or the customer pays within 10 days, a 2% discount shall be deducted from the amount to be paid. 2/10

simply means 2% within 10 days.

The second part “net/30” is the credit period. It determines the number of days allowed for payment. It

means that if you fail to pay within the 10 days discount period, you will not avail the discount, and you

need to pay the whole amount 30 days from the transaction date.

Let’s say for example, the entity acquired goods from a supplier on March 1, 2021 with credit terms of

2/10, n/30. If the entity pays within 10 days, on or before March 11, the amount will be deducted with a

2% discount. If the entity pays beyond March 11, the entity pays the gross amount, and the entity is

given up to March 31 (March 1 plus 30 days) to pay for the amount.

The discount found on credit terms is called “cash discounts” or prompt payment discount, which are

recorded as sales discount on the part of the seller and purchase discount on the part of the buyer.

Trade Discounts

Trade discounts are deductions from the list price or catalog price in arriving at the invoice price. Trade

discounts are not recorded on the books, rather the invoice price are directly recorded as

sales/purchases.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

8

List price/catalog price xx – not recorded in the books

Trade discount (xx) – not recorded in the books

Invoice price xx – the amount recorded as sales/purchases

Cash discount, if any (xx) – recorded as sales discount/purchase discount

Amount to be received xx

Freight Terms

Terms normally related to freight includes FOB shipping point, FOB destination, freight collect and freight

prepaid. FOB is short for freight on board.

Under FOB destination, ownership of goods purchased is transferred only upon receipt of the goods by

the buyer at the point of destination. Under FOB destination, the goods in transit are still the property

of the seller.

If the term is FOB shipping point, ownership in transferred upon shipment of the goods and therefore,

the goods in transit are the property of the buyer.

These terms, FOB destination and FOB shipping point, determines who is legally obliged to pay for

the freight and therefore determines who actually records freight in or freight out.

Freight collect – this means that the freight charge on the goods shipped is not yet paid. The common

carrier shall collect the same from the buyer. Thus, under this, the freight charge is actually paid by the

seller.

Freight prepaid – this means that the freight charge on the goods shipped is already paid by the seller.

These terms determine the party who actually pay the freight charges, but not the party who is legally

responsible to pay the freight charge.

Inventory Systems

Merchandise inventory is the key factor in determining cost of sales. Because merchandise inventory

represents goods available for sale, there must be a method of determining both the quantity and the

cost of these goods.

Two Inventory Systems:

a. Perpetual inventory system – under this method, the inventory account is continuously updated.

Purchases are recorded as a debit to the inventory account and a credit to the inventory accounts is

made every time a sale is made. It made possible by maintaining a stock card for each type of

inventory which records in detain every in and out in inventory. A computerized accounting system

makes it easier to maintain a perpetual inventory system.

b. Periodic inventory system – under this method, the inventory accounts is not updated every time

there is a purchase or sale transaction. Purchases are recorded as debit to the purchases account

and no credit to inventory account is made for every sale transaction. This method requires a

physical count of inventory at the end of every accounting period to determine the ending balance of

inventory to appear in the balance sheet and the amount that would be used in computing the cost

of sales using the formula.

For a more detailed discussion, look into Chapter 8_Basic Accounting: Merchandising Operations in

the ebooks folder of your flash drive.

Reference:

1. Ballada, Win, Ballada, Susan, Basic Accounting (2015 Edition), Domdane Publishers & Made Easy

Books

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

9

Learning Activities 1 – Peer Work

Activity no. 1 – Merchandising Income Statement

You are provided with the following information:

Sales (gross) P2,350,000 Purchase Returns and Allowances P 56,400

Sales Returns and Allowance 125,000 Purchase Discounts 21,360

Sales Discounts 32,500 Transportation in 82,360

Merchandise Inventory, beg 528,000 Merchandise Inventory, ending 483,000

Purchases (gross) 1,264,000 Transportation Out 23,550

Salaries Expense 123,560 Depreciation Expense 112,500

Rent Expense 56,770 Supplies Expense 57,970

Insurance Expense 45,870 Repairs and Maintenance Expense 39,080

Utilities Expense 24,600 Interest Expense 60,000

Required:

1. Compute for the following:

a. Net Sales d. Cost of Goods Sold

b. Net Cost of Purchases e. Gross Profit

c. Goods Available for Sale f. Net Profit

2. Prepare a Pro-forma Income Statement for merchandising operations.

Activity no. 2 – Trade and Cash Discounts

On June 1, 2021, Marites De Chavez Forest Products sold merchandise with a P120,000 list price:

Trade Discount Credit Terms Date paid

a. 30% 2/10, n/30 June 8

b. 20% and 10% 1/10, n/30 June 15

c. - 2/10, n/30 June 11

d. 40% 1/15, n/30 June 14

e. 20% and 20% n/30 June 28

Required: For each of the sales terms, determine the following:

1. The amount recorded as sales.

2. The amount of cash received.

Activity no. 3 – Recording Purchases with Freight Terms

Marquez Trading entered into the following transactions for the month of August:

a. On August 1, purchased merchandise with a list price of P120,000. The seller gave a trade discount

of 10% and terms of 2/10, net 30, FOB shipping point. Marquez paid on Aug. 1 the freight for the

said merchandise amounting to 5,000. The account was paid on Aug. 10.

b. On August 2, P245,000 merchandise was purchased with the terms of 2/15, net 60, FOB

destination. The seller paid on Aug. 3 the freight for the said purchase amounting to P10,500. The

account was paid on Aug. 20.

c. On August 5, purchased merchandise with a list price of P100,000. The terms are 15% trade

discount, 3/10, net 20, FOB shipping point. The seller paid on Aug. 5 the freight for the said

merchandise amounting to P4,750. The payable was paid on Aug 15.

d. On August 9, purchased merchandise with a list price of P150,000. The terms provided for a 5%

and 10% deduction in the list price and 2/10, net 30, FOB destination. Marquez paid on Aug. 9 the

freight for the said purchases, P7,600. The payable was paid on August 29.

Required: Prepare the journal entries in relation to the purchase, freight and payment.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

10

Activity no. 4 – Sales with Freight Terms

Duterte Merchandising entered into the following transactions in the month of September 2018:

a. On September 2, sold merchandise on account amounting to P35,000. Terms are 2/10, net 30, FOB

shipping point. The buyer paid for the transportation of the said sale amounting to P1,150. The

account was collected September 12.

b. On September 8, merchandise was sold amounting to P50,000. Terms are 2/15, net 45, FOB

shipping point. Duterte paid P3,000 to the freight company. The sale was collected on September

23.

c. On September 10, merchandise was sold with a list price of P40,000. Duterte gave the buyer a

trade discount of 10% and the terms are 2/10, net 30, FOB destination. The buyer paid the

forwarders for the shipment amounting to P2,250. The said account was collected on September 25.

d. On September 14, sold merchandise amounting to P75,000. Terms are 3/15, net 45 FOB

destination. Duterte paid for the shipment of the said sale amounting to P5,700. The buyer paid the

account on September 30.

Required: Prepare the journal entries in relation to the sale, freight and collection.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

11

Learning Journal (LA1)

Write legibly your reflections in the space provided. You can use extra sheet if you wish to write more.

Label the extra sheet Reflection LA1-M1 and insert between these pages. You can use Microsoft

word if available. Title the file Reflection LA1-M1 and store in the storage device that comes in the

learning journal.

Here are the questions to help you in your reflection.

1. What are the top three things you’ve learned from this lesson.

2. What were your difficulties in this lesson?

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

_____________________________________________________________________

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

12

Learning Activities 2 – Multiple Choice Exercises

Name: ______________________________ Program and year: ____________________________

Score: ______

Instruction: Read each question carefully. Write the letter of your answer on the space provided before

the item number.

MERHANDISE ACCOUNTING BASICS

1. Which account does a merchandiser use, but not a service entity?

a. Sales c. Cost of goods sold

b. Merchandise Inventory d. All of the above

2. The account that appears in the chart of accounts for a merchandising entity but not for a service

entity is

a. Accounts receivable c. Advertising expense

b. Accumulated depreciation d. Sales returns and allowances

3. Two main inventory accounting systems are the following

a. Purchase and sale c. Cash and accrual

b. Returns and allowances d. Perpetual and periodic

4. The journal entry for the purchase of inventory on account is

a. Inventory xx

Accounts payable xx

b. Accounts payable xx

Inventory xx

c. Inventory xx

Accounts receivable xx

d. Inventory xx

Cash xx

5. Each of the following companies is a merchandising entity except a

a. Candy store c. Furniture store

b. Car wash d. Wholesale parts entity

6. An amount deducted from the catalog price for an item of merchandise is called a

a. Customer discount c. Sales discount

b. Purchase Discount d. Trade discount

7. Which of the following is not considered in computing net cost of purchases?

a. Purchases

b. Purchases returns and allowances

c. Transportation paid on goods shipped to customers

d. Transportation paid on purchased goods

8. The amount of cost of goods sold available for sale during the year depends on the amounts of

a. Beginning merchandise inventory and cost of goods sold.

b. Beginning merchandise inventory and net purchases.

c. Beginning merchandise inventory, cost of goods sold and ending merchandise inventory.

d. Beginning merchandise inventory, net purchases and ending merchandise inventory.

9. The excess of net sales over the cost of goods sold is called

a. Gross profit c. Operating profit

b. Merchandising income d. Profit

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

13

10. Which of the following is not considered an operating expense?

a. Administrative expenses c. Cost of goods sold

b. Advertising expense d. Transportation out

MERCHANDISE ACCOUNTING APPLIED

11. A supplier offers the following discounts: Trade discounts of 10% at list price and another cash

discount of 5% if paid in full before the due date. How much is to be paid if a customer pays before

due date at a list price of P16,000?

a. P13,680 c. P14,000

b. P15,520 d. P16,000

12. Assuming that net purchases was P900,000 during the year and that ending merchandise inventory

was P20,000 less than the beginning merchandise inventory of P250,000, how much was cost of

goods sold?

a. P1,130,000 c. P 920,000

b. P 670,000 d. P1,170,000

13. Goods totaling P50,000 were purchased February 2 with terms 2/10, n/30. Returns of P10,000 were

made on February 10. What discounts, if any, can be availed of if the invoice was paid on February

12?

a. None c. P800

b. P1,000 d. P200

14. Grace Ancheta Company which uses the gross price method of recording purchases, and the

periodic inventory system, bought merchandise for P8,000, terms 2/10, n/30. If Ancheta returns

P2,000 of the goods to the vendor, the entry to record the return should include a

a. Credit to purchases returns and allowances of P1,960.

b. Debit to accounts payable to P2,000.

c. Debit to discounts lost of P40.

d. Debit to purchase returns and allowances of P1,960.

15. Olive Valenzuela Traders purchased merchandise from San Jose Suppliers for P3,600 list price,

subject to a trade discount of 25%. The goods were purchased on terms of 2/10, n/30 F.O.B.

destination. Valenzuela paid P100 transportation costs. Valenzuela returned P400 (list price) of the

merchandise to San Jose and later paid the amount due within the discount period. The amount

paid is

a. P2,254 c. P2,246

b. P2,252 d. P2,352

16. The December 31, 2020 trial balance for Aileen Maglana Company included the following

purchases, P40,000; purchases returns and allowances, P2,000; transportation in, P3,000; ending

inventory was P8,000. What was the cost of goods sold for 2020?

a. P39,000 c. P38,000

b. P33,000 d. None of the above

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

14

Use the following information to answer questions 17 to 20:

Debit Credit

Sales 750,000

Sales returns and allowances 15,000

Sales discount 10,000

Purchases 170,000

Purchases returns and allowances 20,000

Transportation in 30,000

Selling expenses 75,000

General and administrative expenses 275,000

In addition, beginning merchandise inventory was P55,000 and ending merchandise inventory was

P35,000.

17. Net sales for the period were

a. P755,000 c. P735,000

b. P725,000 d. P775,000

18. Net purchases for the period were

a. P150,000 c. P210,000

b. P180,000 d. P430,000

19. Cost of goods sold for the period was

a. P235,000 c. P200,000

b. P160,000 d. P170,000

20. Profit for the period was

a. P525,000 c. P250,000

b. P450,000 d. P175,000

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

15

Learning Journal (LA2)

Write legibly your reflections in the space provided. You can use extra sheet if you wish to write more.

Label the extra sheet Reflection LA2-M1 and insert between these pages. You can use Microsoft

word if available. Title the file Reflection LA2-M1 and store in the storage device that comes in the

learning journal.

Here are the questions to help you in your reflection.

1. What are the top three things you’ve learned from this lesson.

2. What were your difficulties in this lesson?

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

_____________________________________________________________________

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

16

Learning Activities 3 – Performance Task

Problem no. 1 Journalizing Merchandising Transactions

Transactions for the Mariano Lerin Bookstore for March 2020 follows:

Mar 2 Purchased merchandise on credit from Digao Publishers, terms 2/10, n/30, FOB

destination, P74,000.

3 Sold merchandise on credit to Detoya Books Shop, terms 1/10. n/30, FOB

shipping point, P10,000.

5 Sold merchandising for cash, P7,000.

6 Purchased and received merchandise on credit from Made Easy Bookstore, terms

2/10, n/30, FOB shipping point, P42,000.

7 Received freight bill from Super Express from shipment received on March 6,

P570.

9 Sold merchandise on credit to Recoletos Books, terms 1/10, n/30, FOB shipping

point, P38,000.

10 Purchased merchandise from Digao Publishers, terms 2/10, n/30, FOB shipping

point, P26,500, including freight cost of P500.

11 Received freight bill from Super Express for sale on March 3.

12 Paid Digao Publishers for purchase of March 2.

13 Received payment in full for Detoya Books Shop’s purchase of March 3.

14 Paid Made Easy Bookstore half the amount owed on the March 6 purchase. A

discount is allowed on partial payment.

15 Returned faulty merchandise worth P3,000 to Digao Publishers for credit against

purchase of March 10.

16 Purchased office supplies from Olamit Supplies for P4,780, terms n/10.

17 Received payment from Recoletos Books for half of the purchase of March 9. A

discount is allowed on partial payment.

18 Paid Digao Publishers in full amount owed on purchase of March 10, less return

on March 15.

19 Sold merchandise to Sir Ed Trading on credit, terms 2/10, n/30, FOB shipping

point, P7,800.

20 Returned for credit several items of office supplies purchased on March 16,

P1,280.

22 Issued a credit memo to Sir Ed Trading for returned merchandise, P1,800.

25 Paid for purchase of March 16, less returns on March 20.

26 Paid freight entity for freight charges for March 7 and 11.

27 Received payment of amount owed by Sir Ed Trading for purchase of March 19

less credits of March 22.

28 Paid Made Easy Bookstore for the balance on the March 6 purchase.

31 Sold merchandise for cash, P9,730.

Required: Prepare journal entries.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

17

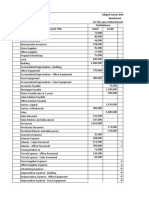

Problem No. 2 – Merchandise Accounting Comprehensive Problem

Listed below are the December 1, 2020 account balances of the Teresita Buenaflor Shoes:

110 Cash P 33,000

120 Accounts Receivable 192,000

130 Merchandise Inventory 413,000

140 Supplies 51,000

150 Prepaid Insurance 48,000

160 Land 460,000

170 Building 1,750,000

175 Accumulated Depreciation - Building P 350,000

180 Equipment 2,310,000

185 Accumulated Depreciation - Equipment 630,000

210 Accounts Payable 108,000

220 Salaries Payable

230 Mortgage Payable 2,600,000

310 Buenaflor, Capital 1,569,000

320 Buenaflor, Withdrawals

330 Income Summary

410 Sales

420 Sales Returns and Allowances

430 Sales Discounts

510 Purchases

520 Purchase Returns and Allowances

530 Purchase Discounts

540 Transportation In

610 Salaries Expense

620 Supplies Expense

630 Insurance Expense

640 Depreciation Expense – Building

650 Depreciation Expense – Equipment

660 Transportation Out

670 Advertising Expense

680 Interest Expense

690 Miscellaneous Expense .

P5,257,000 P5,257,000

The following pertain to transactions for the month of December 2018:

Dec 1 Collected P113,000 from customers n account.

2 Paid P64,000 of accounts due less discounts of 3%.

4 Purchased merchandise, P170,000. Terms: FOB shipping point; 3/10, n/30.

5 Sold merchandise on account to Gonzales Inc., P270,000. Terms: FOB shipping

point; 2/10, n/30.

7 Paid for advertising for the month of December, P6,000.

7 Sold merchandise for cash, P250,000.

8 Paid the amount due from the December 4 transaction.

9 Paid Iloilo Freight P4,000 for delivering merchandise last December 4.

10 Received returns from the Gonzales Inc., P70,000.

12 Received payment from the Gonzales Inc. less returns and discounts.

14 Paid P26,000 interest on the mortgage payable.

15 Paid salaries, P51,000.

16 Sold merchandise on account to Ronzales Corp., P392,000. Terms: FOB

destination; 2/10, n/30.

18 Paid P4,000 freight charges on the sale on December 16.

19 Acquired supplies for cash, P21,000.

20 Purchased P125,000 of merchandise from Lozada Imports on account. Terms:

FOB destination; 3/10, n/30.

22 Paid P7,000 miscellaneous expense.

23 Received payment from Ronzales Corp. less discount.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

18

24 Purchased P373,000 of merchandise on account from Agustin Enterprises. Terms:

FOB shipping point; 3/10, n/30.

24 Paid La Paz Express P9,000 freight for delivering merchandising acquired from

Agustin.

25 Sold merchandise to Ronzales Corp. on account, P420,000. Terms: FOB shipping

point; 2/10, n/30.

26 Received returns from Ronzales Corp., P71,000.

28 Buenaflor withdrew P400,000 from the business.

28 Returned merchandise purchased from Agustin on December 24, P25,000.

Required:

1. Post the beginning balances on the General Ledger.

2. Prepare the journal entries and post the entries for the month of December.

3. Prepare the worksheet using the following information:

a. Salaries in the amount of P51,000 have accrued on December 31.

b. Insurance coverage with premiums of P2,000 has expired at month-end.

c. Depreciation on the building and on the equipment for the month amounted to P9,000 and

P12,000, respectively.

d. Supplies on hand at month-end amounted to P14,000.

e. A count of the merchandise inventory on December 31, 2020 amounted to P397,000.

4. Prepare an Income Statement, Statement of Changes in Equity and Balance Sheet.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

19

Learning Journal (LA3)

Write legibly your reflections in the space provided. You can use extra sheet if you wish to write more.

Label the extra sheet Reflection LA3-M1 and insert between these pages. You can use Microsoft

word if available. Title the file Reflection LA3-M1 and store in the storage device that comes in the

learning journal.

Here are the questions to help you in your reflection.

1. What are the top three things you’ve learned from this lesson.

2. What were your difficulties in this lesson?

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

_____________________________________________________________________

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

20

WRITTEN TEST

This written test covers the underpinning knowledge, concepts and principles learned from Lesson 1 to

Lesson 3 of this module.

Name: ______________________________ Program and year: ___________________________

Date: _______________________ Score: ______ Remark: ________________________

Part I. Straight Problems

Problem 1

Armando Ordinanza Company entered into the following transactions during the month of June 2018:

June 2 Purchased 1,000 tires at a cost of P600 per tire. Terms of payment: 1/10, net 45.

4 Paid trucking firm P8,000 to ship the tires purchased on June 2.

5 Purchased 600 tires at a cost of P600 per tire. Terms of payment: 2/10, net 30.

6 Paid trucking firm P5,000 to ship the tires purchased on June 5.

7 Returned 150 of the tires purchased on June 2 because they were defective.

received a credit on open account from the seller.

11 Paid for tires purchased on June 2.

13 Sold 700 tires from those purchased on June 2. The selling price was P900 per

tire. Terms 1/10, net 30.

22 Received cash from sale of tires on June 13.

30 Paid for tires purchased on June 5.

Required: Prepare journal entries.

Problem 2

The following information pertains to the Leopoldo Valdez School Chairs:

Transportation in P 172,000

Operating Expenses 1,105,000

Merchandise inventory, 1/1/2021 1,200,000

Sales (Gross) 6,250,000

Merchandise inventory, 12/31/2021 1,900,000

Purchases 4,300,000

Purchases Returns and Allowance 129,000

Sales Returns and Allowance 625,000

Purchase Discounts 215,000

Sales Discounts 125,000

Required: Present in good format a computation of the following:

a. Net sales

b. Cost of Sales

c. Gross Profit

d. Net Income

Part II. Multiple Choices (2 points each)

1. The entry to record the return of goods from a customer would include a

a. Credit to Sales

b. Credit to Sales Returns and Allowances

c. Debit to Sales

d. Debit to Sales Returns and Allowances

2. Merchandise inventory becomes part of cost of goods sold when an entity

a. Pays for the inventory.

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

21

b. Purchases the inventory.

c. Receives payment from the customer.

d. Sells the inventory.

3. Which of the following is not considered in computing net cost of purchases?

a. Purchases

b. Purchases returns and allowances

c. Transportation paid on goods shipped to customers

d. Transportation paid on purchased goods

4. The collection of P4,000 account within the 2% discount period would result in a

a. Credit to accounts receivable for P3,920.

b. Credit to cash for P3,920.

c. Debit to accounts receivable for P3,920.

d. Debit to sales discounts for P80.

5. The entry to record payment on a P15,000 account within the 2% discount period would include a

a. Credit to accounts payable for P15,000

b. Credit to purchase discounts for P300.

c. Debit to accounts payable for P14,700.

d. Debit to cash for P15,000.

6. A buyer received an invoice for P6,000 dated June 10. If the terms are 2/10, n/30, and the buyer

paid the invoice within the discount period, what amount will the seller receive?

a. P6,000 c. P4,800

b. P5,880 d. P 120

7. The purchase discount account is a contra account to

a. Accounts payable c. Sales

b. Purchases d. Sales discount

8. When the seller advances the transportation costs and the term of sale are FOB shipping point, the

seller records the payment of the transportation costs by debiting

a. Accounts payable c. Sales

b. Accounts receivable d. Transportation in

9. The excess of net sales over the cost of goods sold is called

a. Gross profit c. Operating profit

b. Merchandising income d. Profit

10. The basic difference between the financial statements of a merchandising entity and a service entity

include the cost of goods sold section of the income statement and the

a. Equity section of the balance sheet.

b. Inclusion of merchandise inventory on the balance sheet as a current asset.

c. Other income section of the income statement.

d. Profit figure.

END OF THE EXAMINATION

- END OF THE MODULE -

Fundamentals of ABM 2 | Module 1 Aklan Catholic College HED

You might also like

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- 600 Assembly Work: 2x + 6y 480Document5 pages600 Assembly Work: 2x + 6y 480John Louie DungcaNo ratings yet

- Assignment Module 1Document4 pagesAssignment Module 1Geo NacionNo ratings yet

- Calculate Depreciation and Net Book Value of BuildingDocument5 pagesCalculate Depreciation and Net Book Value of Buildingangela flores100% (1)

- FAR Chapter4 FinalDocument43 pagesFAR Chapter4 FinalPATRICIA COLINANo ratings yet

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- Bam 040 Sas Period 1Document57 pagesBam 040 Sas Period 1Lily KyuNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Accounting 1Document16 pagesAccounting 1Rommel Angelo AgacitaNo ratings yet

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRDocument5 pagesMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코No ratings yet

- Lesson 7.1 - AJE Accrued ExpensesDocument22 pagesLesson 7.1 - AJE Accrued ExpensesYra Dominique ChuaNo ratings yet

- Caselet 3 Comprehensive Evaluation GamespanelaquitevisrapadasalgadoDocument18 pagesCaselet 3 Comprehensive Evaluation GamespanelaquitevisrapadasalgadoPANELA, Jericho F.No ratings yet

- Far TheoriesDocument6 pagesFar TheoriesallijahNo ratings yet

- IA1 - Quiz#1 (Chapter 1 & 2 - CCE & Bank Recon) Theories and ProblemsDocument27 pagesIA1 - Quiz#1 (Chapter 1 & 2 - CCE & Bank Recon) Theories and ProblemsChristabel Lecita PuigNo ratings yet

- Nfjpia1819 - National Mid Year Convention Non-Academic League - IrrDocument33 pagesNfjpia1819 - National Mid Year Convention Non-Academic League - IrrJohn BryanNo ratings yet

- CHAPTER 6 (Payroll)Document9 pagesCHAPTER 6 (Payroll)lc100% (1)

- Mariano Lerin Bookstore Chart of AccountsDocument44 pagesMariano Lerin Bookstore Chart of AccountsMaria Beatriz Aban Munda100% (2)

- SHS Statement of Financial Position Handout 035Document1 pageSHS Statement of Financial Position Handout 035Severus S Potter0% (1)

- Accounting ProcessDocument6 pagesAccounting ProcessJen NerNo ratings yet

- Accounting Problem 16Document1 pageAccounting Problem 16sabbyveraNo ratings yet

- Chap 6 Notes AFMDocument30 pagesChap 6 Notes AFMAngel RubiosNo ratings yet

- General Leger Cleaning Business FinancialsDocument3 pagesGeneral Leger Cleaning Business FinancialsAriel Palay100% (1)

- Depreciation Calculation for MachineryDocument1 pageDepreciation Calculation for MachineryKate Iannel VicenteNo ratings yet

- Key To Correction Seatwork#5Document11 pagesKey To Correction Seatwork#5Shiela Mae CalangiNo ratings yet

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- Cost Acc Chapter 8Document11 pagesCost Acc Chapter 8ElleNo ratings yet

- AtelengDocument2 pagesAtelengGarp BarrocaNo ratings yet

- Philippine Accounting Standard (PAS) 1: Presentation of Financial StatementsDocument30 pagesPhilippine Accounting Standard (PAS) 1: Presentation of Financial StatementsJhon Cydric TiosaycoNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Accounting Tutorials Day 1Document8 pagesAccounting Tutorials Day 1Richboy Jude VillenaNo ratings yet

- Eac Integ AcctgnfinalsDocument6 pagesEac Integ AcctgnfinalsDave C PeraltaNo ratings yet

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoNo ratings yet

- Classification of PartnersDocument2 pagesClassification of Partnersarnel barawedNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- Laurente Cleaning Services LedgerDocument3 pagesLaurente Cleaning Services LedgerAriel PalayNo ratings yet

- Sol. Man. - Chapter 3 - The Accounting EquationDocument8 pagesSol. Man. - Chapter 3 - The Accounting EquationMae Ann Tomimbang MaglinteNo ratings yet

- Activity No. 3 - Principles of Accounting: AnswersDocument2 pagesActivity No. 3 - Principles of Accounting: AnswersLagasca Iris100% (1)

- How to Write a Position PaperDocument9 pagesHow to Write a Position PaperKen CruzNo ratings yet

- Exercise Workbook: Smartbooks BasicDocument21 pagesExercise Workbook: Smartbooks BasicAngelica TuazonNo ratings yet

- Management Science - HomeworkDocument15 pagesManagement Science - HomeworkVinaNo ratings yet

- Double Entry Bookkeeping Guide for Service ProvidersDocument8 pagesDouble Entry Bookkeeping Guide for Service ProvidersPaw Verdillo100% (1)

- Review Questions, Exercises and ProblemsDocument5 pagesReview Questions, Exercises and ProblemsChen HaoNo ratings yet

- Preparation of Financial StatementsDocument13 pagesPreparation of Financial StatementsSharina Mhyca SamonteNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Receivables Discussion QuestionDocument17 pagesReceivables Discussion QuestionAngelica TalledoNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1a - 2020 EditionDocument14 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Partnership Dissolution: Admission of New PartnerDocument3 pagesPartnership Dissolution: Admission of New PartnerAlarich CatayocNo ratings yet

- Classifications of PartnershipDocument3 pagesClassifications of PartnershipFely MaataNo ratings yet

- Santos Pays 80,000 For 1/2 Share of Hernandez InterestDocument9 pagesSantos Pays 80,000 For 1/2 Share of Hernandez InterestGvm Joy MagalingNo ratings yet

- FABM ActivityDocument3 pagesFABM ActivityRey VillaNo ratings yet

- Darantan, KC T. - FAR Module 6Document3 pagesDarantan, KC T. - FAR Module 6Li LiNo ratings yet

- Both Statements Are FalseDocument26 pagesBoth Statements Are FalseBanana QNo ratings yet

- ACCO 2026 2nd Sem 2011 Finals SW2016 BlankDocument5 pagesACCO 2026 2nd Sem 2011 Finals SW2016 BlankSarah Quijan BoneoNo ratings yet

- Prelims Managerial EconDocument4 pagesPrelims Managerial EconALMA MORENANo ratings yet

- Book 1Document4 pagesBook 1Sly BlueNo ratings yet

- CFAS Notes Chapter 2 ObjectivesDocument5 pagesCFAS Notes Chapter 2 ObjectivesKhey KheyNo ratings yet

- Solving Systems of Equations and InequalitiesDocument6 pagesSolving Systems of Equations and InequalitiesAngela Ricaplaza ReveralNo ratings yet

- Abigail Santos Boutique, Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- PROF-4 Module-1 F2FDocument18 pagesPROF-4 Module-1 F2FShanne YvonneNo ratings yet

- Prof Ed 10 Module 1Document18 pagesProf Ed 10 Module 1Emely RebloraNo ratings yet

- Antipasto Appetizer SaladDocument5 pagesAntipasto Appetizer SaladMargie Anne ClaudNo ratings yet

- Math 6: Colonial School DistrictDocument39 pagesMath 6: Colonial School DistrictNightmare GamingNo ratings yet

- Math 6: Colonial School DistrictDocument39 pagesMath 6: Colonial School DistrictNightmare GamingNo ratings yet

- Math 6: Colonial School DistrictDocument39 pagesMath 6: Colonial School DistrictNightmare GamingNo ratings yet

- Survey results on outreach program destinationsDocument2 pagesSurvey results on outreach program destinationsMargie Anne ClaudNo ratings yet

- Survey results on outreach program destinationsDocument2 pagesSurvey results on outreach program destinationsMargie Anne ClaudNo ratings yet

- Survey results on outreach program destinationsDocument2 pagesSurvey results on outreach program destinationsMargie Anne ClaudNo ratings yet

- STS Act 1Document1 pageSTS Act 1Margie Anne ClaudNo ratings yet

- National Community-Driven Development Project (NCDDP) - (Philippines)Document1 pageNational Community-Driven Development Project (NCDDP) - (Philippines)Margie Anne ClaudNo ratings yet

- NSTP Naplor PTDocument1 pageNSTP Naplor PTMargie Anne ClaudNo ratings yet

- Trac Nghiem TTQT Dai Hoc Ngan HangDocument19 pagesTrac Nghiem TTQT Dai Hoc Ngan Hang31 Trà Thị Hoàng NhưNo ratings yet

- 3.08 Free Trade and Barriers Honors AssignmentDocument2 pages3.08 Free Trade and Barriers Honors AssignmentAnna LambertNo ratings yet

- Incoterms 2010 Quick Reference Chart 120610Document1 pageIncoterms 2010 Quick Reference Chart 120610Muhammad ShahbazNo ratings yet

- Evaluate Effectiveness of Zimbabwe's Foreign Auction SystemDocument4 pagesEvaluate Effectiveness of Zimbabwe's Foreign Auction Systemnever nyatsineNo ratings yet

- 22 2 HooperDocument28 pages22 2 HooperBahuvirupakshaNo ratings yet

- Vietnam Local Charges Service Fees May2023Document2 pagesVietnam Local Charges Service Fees May2023Mỹ Nhật NguyễnNo ratings yet

- Dissertation Report ON " GST and GST Suvidha Kendra " (Research Work)Document57 pagesDissertation Report ON " GST and GST Suvidha Kendra " (Research Work)Pinkey KumariNo ratings yet

- PorscheCroatia 2017 0109Document5,256 pagesPorscheCroatia 2017 0109Mihael CigićNo ratings yet

- LY2020031 Homework AwaisDastgeerDocument5 pagesLY2020031 Homework AwaisDastgeerAwais Khan100% (1)

- Assignment 9Document3 pagesAssignment 9nina0301No ratings yet

- Kennedy Balance of PaymentDocument5 pagesKennedy Balance of PaymentKinza ZaheerNo ratings yet

- AIG Malaysia CovernoteDocument2 pagesAIG Malaysia CovernoteKelly ObrienNo ratings yet

- MM Module 3 NotesDocument9 pagesMM Module 3 NotesJase JbmNo ratings yet

- 6 Major Modes of Financing in Islamic BankDocument2 pages6 Major Modes of Financing in Islamic BankAbdullahNo ratings yet

- Data Analysis.1669623881614Document50 pagesData Analysis.1669623881614BARTOLOME, JARAINE P.No ratings yet

- MATH-REVIEW-10%-2022Document1 pageMATH-REVIEW-10%-2022Bui VyNo ratings yet

- Bangladesh Economic Review - Chapter 5Document20 pagesBangladesh Economic Review - Chapter 5Md. Abdur RakibNo ratings yet

- Market MasteryDocument79 pagesMarket MasteryFrancis Ejike100% (3)

- Bhagwat Group CorporationDocument10 pagesBhagwat Group CorporationPrabin KumarNo ratings yet

- Arthur Lewis and Industrial Development in The Caribbean: An AssessmentDocument32 pagesArthur Lewis and Industrial Development in The Caribbean: An AssessmentRichardson HolderNo ratings yet

- International Sponsoring GuideDocument246 pagesInternational Sponsoring Guidegustave baka100% (1)

- 10A. HDFC Jan 2021 EstatementDocument10 pages10A. HDFC Jan 2021 EstatementNanu PatelNo ratings yet

- HyperFund Standard Presentation 1 Oct 2021 Final-1Document35 pagesHyperFund Standard Presentation 1 Oct 2021 Final-1Rb BNo ratings yet

- Balance Cash Holding Teaching MaterialDocument18 pagesBalance Cash Holding Teaching MaterialAbdi Mucee TubeNo ratings yet

- Worksheet For A Course Industrial Management and Engineering EconomyDocument2 pagesWorksheet For A Course Industrial Management and Engineering Economysolomonlemma14No ratings yet

- India International Trade - ppt-SYLDocument12 pagesIndia International Trade - ppt-SYLsinghgajendra654100% (1)

- International Economics 9th Edition Appleyard Test BankDocument15 pagesInternational Economics 9th Edition Appleyard Test Bankcalanthalovelloa5100% (30)

- Argus: PotashDocument12 pagesArgus: PotashSamia NajeebNo ratings yet

- Shree Samarth Tax InvoiceDocument3 pagesShree Samarth Tax InvoicePAVAN YADAVNo ratings yet

- 8 VatDocument11 pages8 VatRiyo Mae MagnoNo ratings yet