Professional Documents

Culture Documents

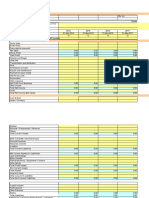

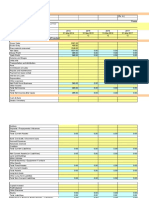

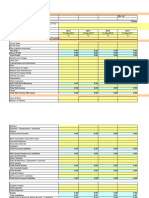

VAT 201 - VAT Returns: Taxable Person Details

Uploaded by

ankit surti0 ratings0% found this document useful (0 votes)

10 views2 pagesThis VAT return document summarizes Daiso Japan LLC's VAT activities for the period of January 1-31, 2021. It shows that the company had 325 AED in standard rated supplies in Dubai with 16.25 AED in VAT. It also lists the company's 17,280 AED in standard rated expenses with 864 AED eligible for VAT recovery. The net VAT due for the period is calculated at -847.75 AED, with the company electing not to request a refund for the excess recoverable tax amount.

Original Description:

Original Title

VAT 201

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis VAT return document summarizes Daiso Japan LLC's VAT activities for the period of January 1-31, 2021. It shows that the company had 325 AED in standard rated supplies in Dubai with 16.25 AED in VAT. It also lists the company's 17,280 AED in standard rated expenses with 864 AED eligible for VAT recovery. The net VAT due for the period is calculated at -847.75 AED, with the company electing not to request a refund for the excess recoverable tax amount.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesVAT 201 - VAT Returns: Taxable Person Details

Uploaded by

ankit surtiThis VAT return document summarizes Daiso Japan LLC's VAT activities for the period of January 1-31, 2021. It shows that the company had 325 AED in standard rated supplies in Dubai with 16.25 AED in VAT. It also lists the company's 17,280 AED in standard rated expenses with 864 AED eligible for VAT recovery. The net VAT due for the period is calculated at -847.75 AED, with the company electing not to request a refund for the excess recoverable tax amount.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

VAT 201 - VAT Returns

Taxable Person details

TRN

123456789012345

Taxable Person Name (English)

Daiso Japan LLC

Taxable Person Address

VAT Return Period

VAT Return Period* VAT Return Due Date

01/01/2021 - 31/01/2021

Tax Year End*

VAT on Sales and all other Outputs

Amount (AED) VAT Amount (AED) Adjustment (AED)

1a Standard rated supplies in Abu Dhabi* 0.00 0.00 0.00

1b Standard rated supplies in Dubai* 325.00 16.25 0.00

1c Standard rated supplies in Sharjah* 0.00 0.00 0.00

1d Standard rated supplies in Ajman* 0.00 0.00 0.00

1e Standard rated supplies in Umm Al Quwain* 0.00 0.00 0.00

1f Standard rated supplies in Ras Al Khaimah* 0.00 0.00 0.00

1g Standard rated supplies in Fujairah* 0.00 0.00 0.00

2 Tax Refunds provided to Tourists under the Tax Refunds 0.00 0.00

for Tourists Scheme*

3 Supplies subject to the reverse charge provisions* 0.00 0.00

4 Zero rated supplies* 0.00

5 Exempt supplies* 0.00

6 Goods imported into the UAE* 0.00 0.00

7 Adjustments to goods imported into the UAE* 0.00 0.00

8 Totals 325.00 16.25 0.00

VAT on Expenses and All Other Inputs

Amount (AED) Recoverable Adjustment (AED)

VAT Amount

(AED)

9 Standard rated expenses* 17,280.00 864.00 0.00

10 Supplies subject to the reverse charge provisions* 0.00 0.00

11 Totals 17,280.00 864.00 0.00

Net VAT Due

12 Total value of due tax for the period

16.25

13 Total value of recoverable tax for the period

864.00

14 Payable tax for the period

(-)847.75

15 Do you wish to request a refund for the above amount of excess recoverable tax

Yes P No

Additional Reporting Requirements

Profit Margin Scheme

Did you apply the profit margin scheme in respect of any supplies made during the tax period?

Yes P No

Declaration and Authorised Signatory

Name in English

Phone/Mobile country code Phone/Mobile Number

Date of submission(dd/mm/yyyy) E-mail address

31/01/2021

P I declare the all information provided is true, accurate and complete to the best of my knowledge and belief.

You might also like

- CMA Data in Excel FormatDocument18 pagesCMA Data in Excel FormatKaushik Chattoraj0% (1)

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationUser 1109No ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationSushil GabaNo ratings yet

- Pay Is inDocument2 pagesPay Is inJo YelleNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationArun KumarNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With Calculationchirag desaiNo ratings yet

- DMCC Approved Auditors List Oct 2018Document2 pagesDMCC Approved Auditors List Oct 2018ankit surti100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Khind IntroductionDocument2 pagesKhind IntroductionainaNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationRajkumar NateshanNo ratings yet

- Ukraine War ImpactDocument8 pagesUkraine War ImpactMehak FatimaNo ratings yet

- Acct Statement-XX7040-30122022Document93 pagesAcct Statement-XX7040-30122022Gaurav KinholkarNo ratings yet

- Vat ReturnDocument2 pagesVat ReturnJyothish KumarNo ratings yet

- VAT Return TemplateDocument6 pagesVAT Return Templatenasar_kottopadamNo ratings yet

- Vat ReportDocument6 pagesVat Reportqeffeq ejffjNo ratings yet

- Vat SummaryDocument2 pagesVat SummaryBridgeway ConsultancyNo ratings yet

- Ashwin Daftary: Units Value (INR) Units Value (INR)Document4 pagesAshwin Daftary: Units Value (INR) Units Value (INR)Shivani raikarNo ratings yet

- HCL Technologies Ltd.Document76 pagesHCL Technologies Ltd.Hemendra GuptaNo ratings yet

- GSTR3B 09hbjps0079a1zi 042022Document3 pagesGSTR3B 09hbjps0079a1zi 042022birpal singhNo ratings yet

- Ashwin Daftary: Units Value (INR) Units Value (INR)Document4 pagesAshwin Daftary: Units Value (INR) Units Value (INR)Shivani raikarNo ratings yet

- Assessment FormatDocument8 pagesAssessment FormatsmilenithyaaNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewvrsapthagiriNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAjit GuptaNo ratings yet

- Axiom Research Labs PVT LTD Profit and Loss: All DatesDocument3 pagesAxiom Research Labs PVT LTD Profit and Loss: All Datesruby ganesh0706No ratings yet

- Profit and Loss by CustomerDocument4 pagesProfit and Loss by CustomerkelehostNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bsiva kumarNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- Summary of Outward Supplies (GSTR-1) : R K Hardware and ElectricalsDocument1 pageSummary of Outward Supplies (GSTR-1) : R K Hardware and ElectricalsAnamikaNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- RPT VATMonthly ReturnnewDocument1 pageRPT VATMonthly ReturnnewchandhiranNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BShorya JainNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- SDN+Company Profit+and+LossDocument1 pageSDN+Company Profit+and+LossDianne PañoNo ratings yet

- GSTR1 03ajdpk8658g1z5 062022Document7 pagesGSTR1 03ajdpk8658g1z5 062022SANJEEV KUMARNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bsiva kumarNo ratings yet

- GSTR9 29aahcv2115k1z5 032020Document8 pagesGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- September 2022 TDS WorksheetDocument4 pagesSeptember 2022 TDS Worksheetsri sainathNo ratings yet

- M Adil-2Document1 pageM Adil-2n4kn9t4f4yNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BShashwat ImfNo ratings yet

- GSTR3B 27aaufr3550j1zn 012018 PDFDocument3 pagesGSTR3B 27aaufr3550j1zn 012018 PDFNiraj KulkarniNo ratings yet

- GSTR3B Report - 12 - 23 - To - 12 - 23Document12 pagesGSTR3B Report - 12 - 23 - To - 12 - 23RAHUL KUMARNo ratings yet

- GSTR9 29aaqfm8617b1zz 032022Document8 pagesGSTR9 29aaqfm8617b1zz 032022helloNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BShorya JainNo ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bsiva kumarNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BTushar Prakash ChaudhariNo ratings yet

- GSTR3B 09hbjps0079a1zi 052022Document3 pagesGSTR3B 09hbjps0079a1zi 052022birpal singhNo ratings yet

- RTB Income Statement 06302022Document2 pagesRTB Income Statement 06302022Norberto F. BarsalNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument25 pagesNumbers Sheet Name Numbers Table NameDARSH SADANI 131-19No ratings yet

- Client Name Nimish - Client ID DN0261 PAN AIWPD1881EDocument8 pagesClient Name Nimish - Client ID DN0261 PAN AIWPD1881EnimishsdllNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BVikram RaiNo ratings yet

- GSTR9 18acvpa7546a1zk 032022Document8 pagesGSTR9 18acvpa7546a1zk 032022SUBHASH MOURNo ratings yet

- GSTR3B 09hbjps0079a1zi 082022Document3 pagesGSTR3B 09hbjps0079a1zi 082022birpal singhNo ratings yet

- Delivery Advice: For The DealerDocument3 pagesDelivery Advice: For The Dealersanjay bindNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDeven PrajapatiNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationMithilesh pandeyNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRahulKumarNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With Calculationshukla.aj.0007No ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With Calculationkhanjishan113No ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRajesh BogulNo ratings yet

- ARR Cost Impact 1702825090Document2 pagesARR Cost Impact 1702825090soringodenotNo ratings yet

- Nesto Mushrif Todbeckar WatchesDocument7 pagesNesto Mushrif Todbeckar Watchesankit surtiNo ratings yet

- 2020 Draft FS FormatDocument26 pages2020 Draft FS Formatankit surtiNo ratings yet

- Tall Erp 9 Notes and Practice BookDocument20 pagesTall Erp 9 Notes and Practice Bookankit surtiNo ratings yet

- 2020 Draft FS FormatDocument43 pages2020 Draft FS Formatankit surtiNo ratings yet

- 2020 Draft FS FormatDocument26 pages2020 Draft FS Formatankit surtiNo ratings yet

- (Company Name) Trial Balance: Emirate: 1-Jan-2020 To 31-Dec-2020Document4 pages(Company Name) Trial Balance: Emirate: 1-Jan-2020 To 31-Dec-2020ankit surtiNo ratings yet

- Economic Performance Report, June 2021Document39 pagesEconomic Performance Report, June 2021African Centre for Media ExcellenceNo ratings yet

- Annexures II Summer Project PresentationDocument12 pagesAnnexures II Summer Project PresentationNoOR SheikhNo ratings yet

- Lagdamin MP5Document4 pagesLagdamin MP5josh lagdaminNo ratings yet

- MFM InggrisDocument5 pagesMFM InggrisZuko RaharjoNo ratings yet

- Public Views On Philippine Mining Service Cooperation in Pugalo, Alcoy, CebuDocument7 pagesPublic Views On Philippine Mining Service Cooperation in Pugalo, Alcoy, CebuKimSon - baby SixteenNo ratings yet

- BIR RMO No. 6-2021Document5 pagesBIR RMO No. 6-2021Earl PatrickNo ratings yet

- The Filipino Youth Nowadays Are Fully Influenced by The Media and Technology in Which Everything That Is in Trend Will Be Fully Adapt by The Filipino YouthDocument2 pagesThe Filipino Youth Nowadays Are Fully Influenced by The Media and Technology in Which Everything That Is in Trend Will Be Fully Adapt by The Filipino YouthChelsa BejasaNo ratings yet

- IE Lecture 1Document58 pagesIE Lecture 1EnjoyNo ratings yet

- Economic Survey: Ruby Anie Philip 2011-31-106 Mba (Abm)Document18 pagesEconomic Survey: Ruby Anie Philip 2011-31-106 Mba (Abm)Swathi AjayNo ratings yet

- Foreign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)Document15 pagesForeign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)TanuNo ratings yet

- Ahmad Riaz 100330070 ACCT 3320 (A10) Assignment #2: CH 3 - Question 1Document3 pagesAhmad Riaz 100330070 ACCT 3320 (A10) Assignment #2: CH 3 - Question 1Ahmad RiazNo ratings yet

- On Indian Economy Features and DevelopmentDocument36 pagesOn Indian Economy Features and DevelopmentSaima Arshad67% (9)

- What Is SME, Sectors Under SMEDocument2 pagesWhat Is SME, Sectors Under SMERohit KarmakarNo ratings yet

- India Money Supply M2 - 1991-2014 - Data - Chart - Calendar - ForecastDocument5 pagesIndia Money Supply M2 - 1991-2014 - Data - Chart - Calendar - ForecastkrazycapricornNo ratings yet

- Adani GreenDocument1 pageAdani GreenKpNo ratings yet

- Ad Code Letter FormatDocument3 pagesAd Code Letter FormatPrashant Baranpurkar50% (4)

- International Adjustment & InterdependenceDocument9 pagesInternational Adjustment & InterdependenceRamagurubaran VenkatNo ratings yet

- World Market TradeDocument56 pagesWorld Market TradeHarigopalakrishna RudraNo ratings yet

- Bescom GSTN No: 29Aaccb1412G1Z5Document2 pagesBescom GSTN No: 29Aaccb1412G1Z5rajendra145No ratings yet

- MNI Foreign Exchange Bullet Points - US English - 1Document1 pageMNI Foreign Exchange Bullet Points - US English - 1rancang empatNo ratings yet

- 2.17d-Fundamentals of F.oreign T.rade and DocumentationDocument21 pages2.17d-Fundamentals of F.oreign T.rade and DocumentationDebapriya PradhanNo ratings yet

- Indian Hotel Industry: Presented by Parul SinghDocument9 pagesIndian Hotel Industry: Presented by Parul Singhvinay_yadav_25No ratings yet

- DISTRICT JalandharDocument5 pagesDISTRICT Jalandharsai pujitha nayakantiNo ratings yet

- Purchase Mangers Index Is Used To Understand The Economic Trends On The Basis of The Analysis of Manufacturing and Services SectorDocument4 pagesPurchase Mangers Index Is Used To Understand The Economic Trends On The Basis of The Analysis of Manufacturing and Services SectorKatta AshishNo ratings yet

- PDFContent 2Document1 pagePDFContent 2savan anvekarNo ratings yet

- Zulfiqar Ali BhuttoDocument2 pagesZulfiqar Ali BhuttoSakina AliNo ratings yet

- The Bank Fight: Free K-12 Worksheets and MoreDocument2 pagesThe Bank Fight: Free K-12 Worksheets and MoreAlex NguyenRodriguezNo ratings yet