Professional Documents

Culture Documents

20/7 A / R - Saudi Co. Sales - Foreign Currency 2. Collecting First Installment: 20/7 Cash A / R - Saudi Co

Uploaded by

mohamed abbasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

20/7 A / R - Saudi Co. Sales - Foreign Currency 2. Collecting First Installment: 20/7 Cash A / R - Saudi Co

Uploaded by

mohamed abbasCopyright:

Available Formats

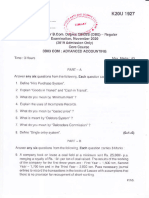

Ex.

8:

On 20/5/2019 An Egyptian company exported goods to a Saudi company for

$ 3,000,000. The Saudi importer will pay for these goods on three equal installments ,

every two months. The accounting period of both the exporter and the importer ended

31/12, and the exchange rate of the American dollar for both the Egyptian pound and the

Saudi riyal was as follows :

Date Egyptian Pound Saudi riyal

20/5/2019 16.50 3.70

20/7/2019 16.60 3.75

20/9/2019 16.65 3.77

20/11/2019 16.40 3.79

Required :

Journal entries in the records of both the exporter and the importer , and show the

A/R a/c , A/P a/c , and the P.-L. change in exchange rate a/c .

Answer

Exporter: Egyptian co.

Importer: Saudi co.

Goods: 3,000,000

Journal entries in exporter record:

1. Exporting goods at 16.60:

3,000,000 x 16.60 = 49,800,000

Value of installment = 1,000,000 x 16.60 = 16,600,000

20/7 A / R – Saudi Co. 49,800,000

Sales – Foreign currency 49,800,000

2. Collecting first installment:

20/7 cash 16,600,000

A / R – Saudi Co. 16,600,000

3. Collecting second installment :

1,000,000 x 16.65 = 16,650,000

20/9 Cash 16,650,000

A / R Saudi Co. 16,600,000

P – L change in exchange

rate 50,000

4. Collecting third installment at 16.40

1,000,000 x 16.40 = 16,400,000

20/11 Cash 16,400,000

P – L change in exchange rate 200,000

A / R Saudi Co. 16,600,000

5. Closing

31/12 income summary 150,000

P – L change in exchange rate 150,000

----------------------------------------------------------------------------------

-Journal entries in the importer's records:

1. Importing goods at 3.75:

3,000,000 x 3.75 = 11,250,000

1.Value of installment = 1000,000 × 3.75 = 3,750,000

20/7 purchases - foreign currency 11,250,000

A / P – Egyptian Co. 11,250,000

2. Paying first installment :

20/7 A / P – Egyptian Co. 3,750,000

Cash 3,750,000

3. paying second installment:

20/9 A / P – Egyptian Co. 3,750,000

P – L change in exchange rate 20,000

Cash 3,770,000

4. paying third installment :

1,000,000 x 3.79 = 3,790,000

20/11 A / P – Egyptian Co. 3,750,000

P – L change in exchange rate 40,000

Cash 3,790,000

5 closing entry

31/12 income summary 60,000

P – L change in exchange rate 60,000

You might also like

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Forex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David CDocument74 pagesForex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David Capi-3748231No ratings yet

- Test Bank For International Economics 9th Edition by Krugman Chapter 3Document6 pagesTest Bank For International Economics 9th Edition by Krugman Chapter 3dxc12670100% (1)

- Toaz - Info Partnership Dissolution PRDocument16 pagesToaz - Info Partnership Dissolution PRNil Justeen GarciaNo ratings yet

- Investment Accounts PDFDocument35 pagesInvestment Accounts PDFRam Iyer80% (10)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Quizzer - PREFINALDocument19 pagesQuizzer - PREFINALrav dano0% (1)

- Book-Keeping Form TwoDocument109 pagesBook-Keeping Form TwoChizani Mnyifuna100% (1)

- Chapter 10-1Document34 pagesChapter 10-1Nguyen MinhhieuNo ratings yet

- Midterms Advanced Finac Acctg Set ADocument9 pagesMidterms Advanced Finac Acctg Set ALuisitoNo ratings yet

- ACTIVITY 1 Capital BudgetingDocument12 pagesACTIVITY 1 Capital BudgetingkmarisseeNo ratings yet

- The Philippine Peso and The Foreign CurrencyDocument36 pagesThe Philippine Peso and The Foreign CurrencyKRISP ABEARNo ratings yet

- Solution Adv. Accounting Test-2 CH-3Document13 pagesSolution Adv. Accounting Test-2 CH-3NITIN JAINNo ratings yet

- Amalgamation Accounting Cp6 3Document28 pagesAmalgamation Accounting Cp6 3Divakara ReddyNo ratings yet

- Habib MD Martujaq3 - CopDocument29 pagesHabib MD Martujaq3 - CopArman AhmedNo ratings yet

- Joint Venture Accounts Hr-4Document11 pagesJoint Venture Accounts Hr-4meenasarathaNo ratings yet

- Accounting Final Project Bsaf-2.0Document47 pagesAccounting Final Project Bsaf-2.0Uzair QayyumNo ratings yet

- 1 Investment F PDFDocument35 pages1 Investment F PDFShrikant Mahajan100% (2)

- Audit of Ppe PDFDocument35 pagesAudit of Ppe PDFJoshua LapinidNo ratings yet

- Test - AccountingDocument7 pagesTest - AccountingSoumyadip DasNo ratings yet

- Chapter 11Document10 pagesChapter 11Ms VampireNo ratings yet

- Joint Venture Accounts Hr-7Document8 pagesJoint Venture Accounts Hr-7meenasarathaNo ratings yet

- XI Accountancy Model Set 2078Document38 pagesXI Accountancy Model Set 2078kevin bhattaraiNo ratings yet

- Hire Purchase Notes 10 YrDocument80 pagesHire Purchase Notes 10 YrLalitKukreja100% (2)

- Format: The Format/specimen of A Double Column Cash Book Is Given BelowDocument7 pagesFormat: The Format/specimen of A Double Column Cash Book Is Given Belowjoshua stevenNo ratings yet

- Partnership ExercisesDocument17 pagesPartnership ExercisesDan RyanNo ratings yet

- Q.1 Record This Transactions in Cash Book and Other LedgersDocument7 pagesQ.1 Record This Transactions in Cash Book and Other LedgersAnuj GohainNo ratings yet

- Adobe Scan Aug 19, 2022Document11 pagesAdobe Scan Aug 19, 2022Purushottam YadhuvanshiNo ratings yet

- Statement of Liability of B List Contributories P Q Date Rs. Rs. Rs. Rs. Creditors Outstanding On The Date of Such TransferDocument27 pagesStatement of Liability of B List Contributories P Q Date Rs. Rs. Rs. Rs. Creditors Outstanding On The Date of Such TransferAnanya ChoudharyNo ratings yet

- Hsslive Xii Acc 4 Retiremnet and Death of A Partner KeyDocument6 pagesHsslive Xii Acc 4 Retiremnet and Death of A Partner Keypirated wallahNo ratings yet

- HahahahaDocument3 pagesHahahahaTyrelle Dela Cruz100% (1)

- 1223 Financial Accounting Sep Oct 2022Document4 pages1223 Financial Accounting Sep Oct 2022supritha724No ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- FinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFDocument10 pagesFinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFSherona ReidNo ratings yet

- Taxation Review Final Income TaxDocument4 pagesTaxation Review Final Income TaxGendyBocoNo ratings yet

- DK Goel Solutions Class 11 Accountancy Chapter 11 - Books of Original Entry - Cash BookDocument43 pagesDK Goel Solutions Class 11 Accountancy Chapter 11 - Books of Original Entry - Cash BookAkash SahNo ratings yet

- BalanceDocument2 pagesBalanceAnonymous 9xKDY2G27QNo ratings yet

- CCP102Document12 pagesCCP102api-3849444No ratings yet

- 15-Mca-Or-Accounting and Financial ManagementDocument4 pages15-Mca-Or-Accounting and Financial ManagementSRINIVASA RAO GANTANo ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- FOREX Part2Document9 pagesFOREX Part2misonim.eNo ratings yet

- TS Grewal Class 11 Accountancy Solutions Chapter 7Document10 pagesTS Grewal Class 11 Accountancy Solutions Chapter 7Vishek kashyap 10 A1 22No ratings yet

- Working Papers Presentation-Ap-NpDocument6 pagesWorking Papers Presentation-Ap-NpAngelica Mae MarquezNo ratings yet

- Commerce Paathshaala: Pu-Ii Annual Examination April-May-2022 Accountancy Key Answers Section A (1 Mark Answers)Document12 pagesCommerce Paathshaala: Pu-Ii Annual Examination April-May-2022 Accountancy Key Answers Section A (1 Mark Answers)Ashok dore Ashok doreNo ratings yet

- Problem 2: Liabilities AMT Assets AMT Capitals A B C CreditorsDocument6 pagesProblem 2: Liabilities AMT Assets AMT Capitals A B C CreditorsHaji HalviNo ratings yet

- Business AccountingDocument3 pagesBusiness AccountingMaha RachithaNo ratings yet

- Cash Book Ak 2023-24Document8 pagesCash Book Ak 2023-24Aaryan JainNo ratings yet

- Accounting 2Document4 pagesAccounting 2aromalsolteroNo ratings yet

- Mudio Islamic Examination Board (Mieb) : InstructionsDocument2 pagesMudio Islamic Examination Board (Mieb) : InstructionsMmaryNo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- IFRS 15 - RevenueDocument15 pagesIFRS 15 - RevenueDawar Hussain (WT)No ratings yet

- Hssreporter Xi Acc Afs Anskey Ramesh VP 2023 March UnofficialDocument5 pagesHssreporter Xi Acc Afs Anskey Ramesh VP 2023 March Unofficialmuhammedmuhtharmuhthar52No ratings yet

- Problem 1 #1-2.: Total Cash ReceivedDocument8 pagesProblem 1 #1-2.: Total Cash ReceivedAlizah BucotNo ratings yet

- IPFMPSFR - Solutions 3 2023 Final - AADocument31 pagesIPFMPSFR - Solutions 3 2023 Final - AASabNo ratings yet

- Untitled FgapqDocument5 pagesUntitled FgapqSusovan SirNo ratings yet

- Homework Week 10Document13 pagesHomework Week 10LNo ratings yet

- BookDocument1 pageBookSwati SinhaNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationRyou ShinodaNo ratings yet

- The Schram Academy: Accounts ProjectDocument17 pagesThe Schram Academy: Accounts ProjectVarshini KNo ratings yet

- Assignement No 4Document5 pagesAssignement No 4Elina aliNo ratings yet

- Assignement No 4Document5 pagesAssignement No 4Elina aliNo ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- Incoterms - Wikipedia, The Free EncyclopediaDocument4 pagesIncoterms - Wikipedia, The Free EncyclopediaChhomNo ratings yet

- Economic GlobalizationDocument22 pagesEconomic GlobalizationMelo fi6No ratings yet

- Exam 6 March 2018 Questions and AnswersDocument10 pagesExam 6 March 2018 Questions and AnswersErika May RamirezNo ratings yet

- The Niche-Regime Transition in Fair Trade, Contributions From MexicoDocument13 pagesThe Niche-Regime Transition in Fair Trade, Contributions From MexicoCristina GuerreroNo ratings yet

- Class 12 Economic Reforms 1991Document4 pagesClass 12 Economic Reforms 1991Aryan ph vlogsNo ratings yet

- Summary MKI Chapter 7Document5 pagesSummary MKI Chapter 7DeviNo ratings yet

- Forex Market SessionsDocument9 pagesForex Market Sessionsmythicgc8No ratings yet

- Internatiuonal Business Unit 2Document17 pagesInternatiuonal Business Unit 2Janardhan VNo ratings yet

- Easy Way To Remember CurrenciesDocument5 pagesEasy Way To Remember Currenciesjyottsna100% (2)

- Mongolia's Trade AnalysisDocument3 pagesMongolia's Trade AnalysisSeren TsekiNo ratings yet

- Proclamation 859 2014Document89 pagesProclamation 859 2014Kassim FiteNo ratings yet

- Banknotes Featuring Scientists and Mathematicians - Part 4Document5 pagesBanknotes Featuring Scientists and Mathematicians - Part 4Antonio BordalloNo ratings yet

- GATT and WTO Trade RoundsDocument2 pagesGATT and WTO Trade RoundsNeelesh BhandariNo ratings yet

- The US China Trade WarDocument12 pagesThe US China Trade WarNGUYET NGUYEN NGOC NHUNo ratings yet

- Correction Blend 2Document20 pagesCorrection Blend 2Trần Đức TàiNo ratings yet

- Trade AgreementDocument6 pagesTrade AgreementSoumyajit KaramNo ratings yet

- EC - Bananas III (Guatemala and Honduras) PDFDocument383 pagesEC - Bananas III (Guatemala and Honduras) PDFAndrés PaniaguaNo ratings yet

- Group3 Ecn2a Contemporary WorldDocument61 pagesGroup3 Ecn2a Contemporary WorldAnna Rose T. MarcelinoNo ratings yet

- IFM CHDocument43 pagesIFM CHMarIam AnsariNo ratings yet

- Daniels IBT 16e Final PPT 01Document48 pagesDaniels IBT 16e Final PPT 01rola mohammadNo ratings yet

- International Financial Management 11 Edition: by Jeff MaduraDocument25 pagesInternational Financial Management 11 Edition: by Jeff MaduraJON snowNo ratings yet

- Currency Exchange RateDocument8 pagesCurrency Exchange RateMohammed HussainNo ratings yet

- International Trading Systems CworldDocument30 pagesInternational Trading Systems CworldDennis Raymundo100% (1)

- Final Assignment: Course: International Finance (INE 3001 E)Document15 pagesFinal Assignment: Course: International Finance (INE 3001 E)Yến Bạc HàNo ratings yet

- Expense Report 60017 Sergio Gonzalez 2Q Febrero 20210221120000 - 20210221110342Document22 pagesExpense Report 60017 Sergio Gonzalez 2Q Febrero 20210221120000 - 20210221110342Sergio glezNo ratings yet

- Day1 S2 Gravity IntroDocument21 pagesDay1 S2 Gravity IntroPedro Hortua SeguraNo ratings yet