Professional Documents

Culture Documents

Exercise 1:: 1) The Objective of TBS Team To Decide On What Competition To Choose in Order To Maximize

Uploaded by

molka ben mahmoudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 1:: 1) The Objective of TBS Team To Decide On What Competition To Choose in Order To Maximize

Uploaded by

molka ben mahmoudCopyright:

Available Formats

Exercise 1

1) In this exercise, we are talking about a job which is a long-term decision, it will not be

repetitive. There are large fluculations and big variations between the alternatives. Thus, the

expected value criterion isn’t appropriate.

2) We have 3 offers :

Alternative1 : Team leader at a reputed company

Alternative2 : Developer at a nely established foreign company.

Alternative3 : establish his own company.

States of nature : product is a breakthrough, product is a success, product is a flop.

We compute the expected value for each alternative :

Alternative1 : 1200*12= 14400

Alternative2 : Breakthrough+ success+ flop= ((400*12)+(3000*7))*0.4 + ((400*12)+

(1000*7))*0.4 + (400*12)*0.2 = 16000

Alternative3 : 9333

The best job offer that offers the best return is the developer position.

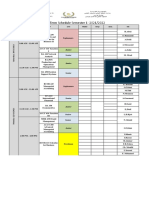

Exercise 2 :

1) The objective of TBS team to decide on what competition to choose in order to maximize

the funding of their project.

2)

Exercise 3 :

1) The decision isn’t repititive, we don’t have significant variations in the outcome.Thus

EMV is not appropriate.

2)

10000

Inv1

22000

Inv2 14000

-10000

Inv3 3200

800

-2000

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Samsung Mobile: Market Share and Profitability in SmartphonesDocument25 pagesSamsung Mobile: Market Share and Profitability in Smartphonesmolka ben mahmoudNo ratings yet

- Operations Planning and LogisticsDocument4 pagesOperations Planning and Logisticsmolka ben mahmoudNo ratings yet

- University of Tunis Fall 2013 Tunis Business School Decision & Game Theory Tutorial 3Document4 pagesUniversity of Tunis Fall 2013 Tunis Business School Decision & Game Theory Tutorial 3molka ben mahmoudNo ratings yet

- Tutorial 1-Solution-2020Document4 pagesTutorial 1-Solution-2020molka ben mahmoudNo ratings yet

- Homework - Study Case Artify - Tbs-ConvertiDocument1 pageHomework - Study Case Artify - Tbs-Convertimolka ben mahmoudNo ratings yet

- Tutorial 2-SolutionsDocument3 pagesTutorial 2-Solutionsmolka ben mahmoudNo ratings yet

- This Study Resource Was: Case Study Samsung Mobile: Market Share andDocument4 pagesThis Study Resource Was: Case Study Samsung Mobile: Market Share andmolka ben mahmoudNo ratings yet

- Celebrating SEWA: Towards Human Development Through Insutitutional Innovation in Women's Livelihood SecurityDocument20 pagesCelebrating SEWA: Towards Human Development Through Insutitutional Innovation in Women's Livelihood Securitymolka ben mahmoudNo ratings yet

- Introduction To Entrepreneurship Summer Course ManualDocument5 pagesIntroduction To Entrepreneurship Summer Course Manualmolka ben mahmoudNo ratings yet

- Samsung Mobile: Market Share and Profitability in SmartphonesDocument6 pagesSamsung Mobile: Market Share and Profitability in Smartphonesmolka ben mahmoudNo ratings yet

- Tutorial 2 Sarra Benslama Decision & Game Theory Tutorial 2: Decision and Game TheoryDocument4 pagesTutorial 2 Sarra Benslama Decision & Game Theory Tutorial 2: Decision and Game Theorymolka ben mahmoudNo ratings yet

- Mid-Term Schedule Semester 1 - 2021/2022: Day Hour Level Nember Group Room ObsDocument3 pagesMid-Term Schedule Semester 1 - 2021/2022: Day Hour Level Nember Group Room Obsmolka ben mahmoudNo ratings yet

- Assignment 1: Brand Elements and Brand Resonance of KFCDocument2 pagesAssignment 1: Brand Elements and Brand Resonance of KFCmolka ben mahmoudNo ratings yet

- Decision and Game Theory ResumeDocument12 pagesDecision and Game Theory Resumemolka ben mahmoudNo ratings yet

- Selling Process Tools/ Documents Needed: Research Conducted On ProspectsDocument3 pagesSelling Process Tools/ Documents Needed: Research Conducted On Prospectsmolka ben mahmoudNo ratings yet