Professional Documents

Culture Documents

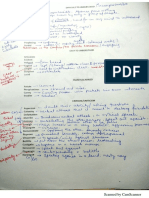

What Is Tunneling?: Tunneling Process Involves Following Steps

Uploaded by

Madhur AggarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Tunneling?: Tunneling Process Involves Following Steps

Uploaded by

Madhur AggarwalCopyright:

Available Formats

What is Tunneling?

Tunneling is the unethical and illegal practice where a majority shareholder directs assets or

future business to themselves for personal gain

A controlling shareholder can simply transfer resources from the firm for his/her

own benefit through self-dealing transaction

The controlling shareholder can increase his/her share of the firm without

transferring any assets through dilutive share issues, minority freeze outs, insider

trading etc.

Tunneling process involves following steps:

Identify and incentivise a trusted company 'insider', usually in the finance dept, that

will be willing to trample over company compliance and authorisations—and enter

secretly into a loan/loans—with a person 'outside' of the company. 'Granting' a

partial or a full 'security' over some of, or over the assets, or over the entire business

and all of its assets.

Rapidly run down the cash in the company, usually by buying and holding in

inventory equipment and stock—that is unnecessary at that time.

At short (sometimes only 24–48 hours) notice, announce that the company is

'insolvent'—and have the company immediately forced into a bankruptcy process.

The 'only'/'main creditor' is of course the local 'outsider'—and so it is THEY that

dominates a rapidly assembled 'creditors committee'—which similarly rapidly agrees

to sell some or all of the company assets.... to a holding company that THEY already

control.

Knowing that the original owners are eventually likely to seek justice and also the re-

establishment of ownership of their assets, the 'tunnelers' next typically pay a local

Police Dept officer, to file (knowingly false) 'charges'—against the original owner of

the company—usually by claiming that a 'loan' or 'loans' (which the original owners

were entirely unaware of!) were 'taken, with no intention of repaying them'.

The 'tunnelers' typically pay a local Local/Regional Court official

What is Money Laundering?

Money laundering is concealing or disguising the identity of illegally obtained

proceeds so that they appear to have originated from legitimate sources. It is

frequently a component of other, much more serious, crimes such as drug

trafficking, robbery or extortion.

According to the IMF, global Money Laundering is estimated between 2 to 5% of

World GDP.

How Money Laundering works?

It involves three steps: placement, layering and integration.

Placement puts the "dirty money" into the legitimate financial system.

Layering conceals the source of the money through a series of transactions and

bookkeeping tricks.

In the case of integration, the now-laundered money is withdrawn from the

legitimate account to be used for criminal activities.

Money Laundering can take several forms, some of them are:

Structuring also called as Smurfing

Bulk Cash Smuggling

Cash intensive Businesses

Trade based Laundering

Shell companies

Round tripping

Economic Impacts:

Undermines legitimacy of private sector

Undermines integrity of financial markets

Loss of control of economic policy

Economic distortion and instability

Loss of revenue

Declines the moral and social position of the society by exposing it to activities such

as drug trafficking, smuggling, corruption and other criminal activities

Political Impacts:

1. Initiates political distrust and instability

2. Criminalisation of politics

Steps Taken by Government of India to Prevent Money Laundering

1. Criminal Law Amendment Ordinance (XXXVIII of 1944): It covers proceeds of only

certain crimes such corruption, breach of trust and cheating and not all the crimes

under the Indian Penal Code.

2. The Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act,

1976: It covers penalty of illegally acquired properties of smugglers and foreign

exchange manipulators and for matters connected therewith and incidental thereto.

3. Narcotic Drugs and Psychotropic Substances Act, 1985: It provides for the penalty of

property derived from, or used in illegal traffic in narcotic drugs.

4. Prevention of Money-Laundering Act, 2002 (PMLA)

It forms the core of the legal framework put in place by India to combat Money Laundering.

The provisions of this act are applicable to all financial institutions, banks(Including RBI),

mutual funds, insurance companies, and their financial intermediaries.

How to Deal with Tunneling

Better board procedures and a better compensation policy

Insider trading legislation should be strengthened.

Introduce new auditing procedures.

Don't invest all of your money into a corporation's shares if you work for one.

Satyam employees earned a significant amount of their pay in the form of stock

options. Some folks even used their retirement assets to increase their stock

portfolio.

Establish a code of ethics for all publicly traded corporations.

External Auditor Rotation in Non-Financial Institutions

If you hold shares in the company, pay attention to the behaviour of the founders

and directors. If they don't own a large portion of the firm or are actively selling it.

Establish that the audit committee is totally self-contained.

Set up a method for reporting wrongdoings.

Describe what a class action lawsuit is and how it works to employees

Appointment of Independent directors

Prevent the collusion between the rating agencies and companies

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Laws Essentials of Financial Management v7Document186 pagesLaws Essentials of Financial Management v7hshshdhd100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Proj. Proposal Community Garden FINALDocument16 pagesProj. Proposal Community Garden FINALRicca Joy Torre100% (2)

- Load BalancingDocument29 pagesLoad BalancingKishore KumarNo ratings yet

- Maths Class X Sample Paper 03 For Board Exam 2019 PDFDocument4 pagesMaths Class X Sample Paper 03 For Board Exam 2019 PDFApex Institute100% (1)

- Indigo PDFDocument4 pagesIndigo PDFMadhur AggarwalNo ratings yet

- 3 Types of Emergency Shutdown and Emergency Isolation ValvesDocument4 pages3 Types of Emergency Shutdown and Emergency Isolation ValvesMateusz KonopnickiNo ratings yet

- Indian Partnership ActDocument43 pagesIndian Partnership ActMadhur AggarwalNo ratings yet

- Indian Partnership ActDocument44 pagesIndian Partnership ActMadhur AggarwalNo ratings yet

- FM 1 MergedDocument90 pagesFM 1 MergedMadhur AggarwalNo ratings yet

- Practice Question 1 With AnswersDocument8 pagesPractice Question 1 With AnswersMadhur AggarwalNo ratings yet

- Tunnelling As A Means of Money Laundering: Lessons Learnt From Recent CasesDocument9 pagesTunnelling As A Means of Money Laundering: Lessons Learnt From Recent CasesMadhur AggarwalNo ratings yet

- OR MergedDocument560 pagesOR MergedMadhur Aggarwal100% (1)

- BRM MergedDocument969 pagesBRM MergedMadhur AggarwalNo ratings yet

- Aravinda Halvi: Lorem IpsumDocument4 pagesAravinda Halvi: Lorem IpsumMadhur AggarwalNo ratings yet

- New BELDocument1 pageNew BELMadhur AggarwalNo ratings yet

- Case - Costing in Pepe Denim PDFDocument5 pagesCase - Costing in Pepe Denim PDFMadhur AggarwalNo ratings yet

- Socrates The Consulting & Strategy Club of IiftDocument4 pagesSocrates The Consulting & Strategy Club of IiftMadhur AggarwalNo ratings yet

- Pepe Denim PDFDocument5 pagesPepe Denim PDFMadhur AggarwalNo ratings yet

- Vocab 5 PDFDocument6 pagesVocab 5 PDFMadhur AggarwalNo ratings yet

- International Business Cell (IBC) : "Sultan-E-Afrique"Document2 pagesInternational Business Cell (IBC) : "Sultan-E-Afrique"Madhur AggarwalNo ratings yet

- IBC - Madhur AggarwalDocument5 pagesIBC - Madhur AggarwalMadhur AggarwalNo ratings yet

- PPC The Public Policy Club of IIFTDocument1 pagePPC The Public Policy Club of IIFTMadhur AggarwalNo ratings yet

- Role of A Pharmacist in Health Care SystemDocument7 pagesRole of A Pharmacist in Health Care SystemAnna KhalidNo ratings yet

- Request For Proposal Entrepreneur/Small Business Outreach ServicesDocument8 pagesRequest For Proposal Entrepreneur/Small Business Outreach ServiceshNo ratings yet

- Subject CT1 - Financial Mathematics. Core Technical.: Xaminers EportDocument11 pagesSubject CT1 - Financial Mathematics. Core Technical.: Xaminers EportfeererereNo ratings yet

- ATX MYS D23 To Sep 24 - FINALDocument22 pagesATX MYS D23 To Sep 24 - FINALfengfa2000No ratings yet

- Agreement On Rescue of AstronountsDocument4 pagesAgreement On Rescue of AstronountsDATIUS DIDACE(Amicus Curiae)⚖️No ratings yet

- FAQs On Exit Process For eNPS SubscribersDocument6 pagesFAQs On Exit Process For eNPS Subscriberspawan kumar raiNo ratings yet

- Anilox QC Application Quality Control Qcpdfquality Control Applications AniloxDocument4 pagesAnilox QC Application Quality Control Qcpdfquality Control Applications AniloxHữu QuangNo ratings yet

- Final Report U-Sec 173 CRPC, in NSEL Default CaseDocument76 pagesFinal Report U-Sec 173 CRPC, in NSEL Default CaseAmit SarafNo ratings yet

- Sess13 Trace IdentifierDocument30 pagesSess13 Trace IdentifierRajiv RanjanNo ratings yet

- 02 Response To Harmonic & Impulsive LoadingDocument14 pages02 Response To Harmonic & Impulsive LoadingMar MartillanoNo ratings yet

- Tanaka 1995Document18 pagesTanaka 1995Jairo CGNo ratings yet

- Contact - AnonTex GroupDocument2 pagesContact - AnonTex GroupshoyebNo ratings yet

- Cat 2022 Score Card: Common Admission Test 2022 (Cat 2022) Indian Institutes of ManagementDocument1 pageCat 2022 Score Card: Common Admission Test 2022 (Cat 2022) Indian Institutes of ManagementPiyush KhareNo ratings yet

- The Southern European Social ModelDocument50 pagesThe Southern European Social ModelIgnacio PHNo ratings yet

- RISE With SAP S - 4HANA Cloud Service Use DescriptionDocument22 pagesRISE With SAP S - 4HANA Cloud Service Use DescriptionMahendranathNo ratings yet

- Beasiswa TaiwanDocument5 pagesBeasiswa TaiwanANDRE ALHIDAYAT -No ratings yet

- Historical Record of Iso Membership 1947 To 2015Document4 pagesHistorical Record of Iso Membership 1947 To 2015leovenceNo ratings yet

- Country Profile RomainaDocument15 pagesCountry Profile RomainastarzgazerNo ratings yet

- Motherboard D946GZIS SpecificationDocument88 pagesMotherboard D946GZIS Specification154475828No ratings yet

- CV 02 17Document3 pagesCV 02 17api-347572218No ratings yet

- Selection Ms Project 2016Document19 pagesSelection Ms Project 2016bayu_lukitoNo ratings yet

- GL552VW DM643TDocument3 pagesGL552VW DM643TGerman CastañedaNo ratings yet

- EUR Account StatementDocument4 pagesEUR Account StatementuzdbobpasnlruzkeorNo ratings yet