Professional Documents

Culture Documents

Solution Zoom 1

Uploaded by

Muhammad Hamza0 ratings0% found this document useful (0 votes)

11 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views3 pagesSolution Zoom 1

Uploaded by

Muhammad HamzaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

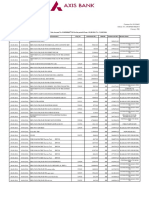

Income from salary (12)

Basic salary 1020000

CLA 100000

Dearness Allowance 60000

Un Approved Gratuity 350,000

75000 or 50 % of 350,000 - 75000 275000

75000 or 175000 (WEL)

Recognined PR

Employee Contribution 180,000

Employer Contribution 180,000

150,000 or 10 % (1020000+60000) - 108000

150,000 or 108000 WEL 72000

Bank Interest 120,000

1/3 of (1020000+60000) = 360000 - 96000

120,000 x 16/20 96000 24000

G.H.S SBI 350,000

Value of Acc

45 % of BS = 459000

30,000 x 12= 360,000 459,000

Value of Conveyance (10 % of 800000) 80,000

Special Allowance 40,000

Total salary 20,90,000

Income from Property (15)

Rent 30,000 x 12= 360,000

UAA (90,000/10) 9000

RCT (SBI) 369,000

Income From Business (18)

Income from wood business 150,000

Income from business at Uk 400,000

Capital Gains (37)

Gain on sale of Public company shares

SBI 180,000

Income from other source (39)

Income from talk on TV 80,000

Total Income 27,20,000

(-) Allowable deductions

Zakat 40,000

Mark Up 115,000

(115,000/20 Lac/ 13,60,000) 155,000 155,000

TAI 25,65,000

Computation of Tax:

1- Tax according to slab

65000+ 10% ( 65,000)

65000+ 6500= 71,500 71,500

2- + Tax on SBI

Property 5 % (396,000-200,000) 9800

GHS 350,000 (20+25+30)/3

350,000@ 25% 87,500

Gain on Publi Shares 180,000@ 12.5% 22500 119800

191300

3- (-) Concession being a teacher

T. Salary 20,90,000

Tax 5% (890,00) 44,500

25% of 44500= 11125 - 11125

180,175

4- (-) Foreign Tax Credit

Foreign Tax= 80,000

(180,175/25,65,000) x 400,000 28097 - 28097

152,078

5- (-) Avergae Relief

Donation to Govt Uni

150,000 Or 30% of 25,65,000

150,000 Or 769,500

Health Ins Premium

5% of 25,65,000 Or 150,000 Or 40,000

128,250/150,000/ 40,000

Formula For Relief:

Current tax / TAI x 190,000

(152078/25,65,000) x 190,000 - 11265

170,813

6- (-) Tax deducted at source

10 % of Talk deliverd on TV show

10% of 80,000 - 8000

162,813

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Document 3Document9 pagesDocument 3La Chavez VlogsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AGICL Axis Bank Statement Aug 2016 PDFDocument7 pagesAGICL Axis Bank Statement Aug 2016 PDFSagar Asati100% (1)

- Merloni Elettrodomestici Spa: The Transit Point Experiment: SCM - 2 Group 12Document8 pagesMerloni Elettrodomestici Spa: The Transit Point Experiment: SCM - 2 Group 12Prasoon SudhakaranNo ratings yet

- Sales TAX FORMATDocument6 pagesSales TAX FORMATMuhammad HamzaNo ratings yet

- Dark Purple and Gold Dots Farewell Party InvitationDocument1 pageDark Purple and Gold Dots Farewell Party InvitationMuhammad HamzaNo ratings yet

- Dark Purple and Gold Dots Farewell Party InvitationDocument1 pageDark Purple and Gold Dots Farewell Party InvitationMuhammad HamzaNo ratings yet

- Answer Chapter 7 8Document3 pagesAnswer Chapter 7 8Muhammad HamzaNo ratings yet

- Use The Following Scale To Respond To The Item BelowDocument3 pagesUse The Following Scale To Respond To The Item BelowMuhammad HamzaNo ratings yet

- Management of Accounts Receivables - ProposalDocument5 pagesManagement of Accounts Receivables - ProposalMuhammad Hamza100% (1)

- Batch-08 QKB101 4Document4 pagesBatch-08 QKB101 4Muhammad HamzaNo ratings yet

- Batch-08 QKB101 3Document4 pagesBatch-08 QKB101 3Muhammad HamzaNo ratings yet

- A Study On Logistics Management at Lintas FreightDocument39 pagesA Study On Logistics Management at Lintas FreightDatta SairamNo ratings yet

- NEW Time SheetDocument13 pagesNEW Time SheetStacey LanghansNo ratings yet

- 8121497951Document40 pages8121497951Sahil JainNo ratings yet

- BIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormDocument1 pageBIR Form 0614-EVAP Payment Form Guidelines and Instructions: Who Shall Use This FormMhel GollenaNo ratings yet

- Istilah Pajak Dalam Bahasa InggrisDocument2 pagesIstilah Pajak Dalam Bahasa Inggrisroida hasugianNo ratings yet

- Value Added TaxDocument2 pagesValue Added TaxBon BonsNo ratings yet

- January 2023 Bank AccountDocument4 pagesJanuary 2023 Bank AccountleratokwNo ratings yet

- 3 Engine FundamentalsDocument2 pages3 Engine FundamentalsAkshay PatelNo ratings yet

- Borderless Accounts and Tax - TransferWise Help CentreDocument4 pagesBorderless Accounts and Tax - TransferWise Help CentreNadi Jothidan KLNo ratings yet

- Previous Bill This Bill: Your Payment HistoryDocument3 pagesPrevious Bill This Bill: Your Payment HistoryFauzan RamliNo ratings yet

- Remittance - Advice Apr 16-30Document2 pagesRemittance - Advice Apr 16-30Nar Je Lyn MatugasNo ratings yet

- Curriculum Vitae: Melissa Juliana Kundap GoniDocument3 pagesCurriculum Vitae: Melissa Juliana Kundap GoniAlvi PolaNo ratings yet

- ECS Mandate Form For StudentsDocument1 pageECS Mandate Form For StudentsrakeshagrawalNo ratings yet

- Export Promotion Council For Handicrafts: Greetings From EPCH Happy New Year 2018!!Document6 pagesExport Promotion Council For Handicrafts: Greetings From EPCH Happy New Year 2018!!Snzy DelNo ratings yet

- List PDFDocument4 pagesList PDFPam Welch HeuleNo ratings yet

- Account Statement-1003711267-9 - 27 - 2021 4-18-11 PMDocument23 pagesAccount Statement-1003711267-9 - 27 - 2021 4-18-11 PMHadi Ul HassanNo ratings yet

- Webbank Klarna Credit Account AgreementDocument7 pagesWebbank Klarna Credit Account AgreementLori Silva MillerNo ratings yet

- Draf BL SampleDocument1 pageDraf BL Samplezueandrew100% (2)

- Your Electricity Bill For: Samir Kumar ChakrabortyDocument2 pagesYour Electricity Bill For: Samir Kumar ChakrabortyscNo ratings yet

- Tiger Airways Booking Confirmation - J39YBHDocument2 pagesTiger Airways Booking Confirmation - J39YBHShawn BoeyNo ratings yet

- Self Declaration For Future ProofDocument1 pageSelf Declaration For Future ProofNikhil RaviNo ratings yet

- Children Education Allowance Claim FormDocument3 pagesChildren Education Allowance Claim FormSUSHIL KUMARNo ratings yet

- Accounting For Accrued ExpensesDocument8 pagesAccounting For Accrued Expenseswalter880No ratings yet

- Contract Rate PT Pramantika Jaya HolidayDocument4 pagesContract Rate PT Pramantika Jaya HolidayRiski W PratamaNo ratings yet

- RMC No. 4-2021 Revised - v2Document6 pagesRMC No. 4-2021 Revised - v2nathalie velasquezNo ratings yet

- SBC To BPL SudhakarDocument2 pagesSBC To BPL SudhakarrajeshNo ratings yet

- OpTransactionHistory (2019 Dec - 2020 Feb)Document6 pagesOpTransactionHistory (2019 Dec - 2020 Feb)Lakshmi Narayana SindiriNo ratings yet